When Is The Limit Reached

If you are a new borrower as defined above, once you take out your first subsidized loan, you can continue to take out subsidized loans for 150% of your published program length. This means that the actual time limit on your borrowing of subsidized loans varies based on the length of your program. If you don’t know how long your program is, talk to your school for more information.

Direct Subsidized And Unsubsidized Loan Limits

Your school’s financial aid office determines how much you will be able to borrow each year. This amount might be less than the annual loan limit.

When it comes to the Direct Stafford Loan program, it’s important to remember there are two types of loans in the this loan program: Direct Subsidized Loans and Direct Unsubsidized loans. Although these loans are part of the same program, Direct Subsidized Loans have their own limits.

Eligibility for Direct Subsidized Loans is based on demonstrated financial need, up to the annual and aggregate loan limits.

One more thing to keep in mind, beyond annual and aggregate loan limits, there is a maximum eligibility period for you to receive Direct Subsidized Loans. For first-time borrowers whose first loan was obtained on or after July 1, 2013, there is a maximum eligibility period of time that you can receive Direct Subsidized loan funds.You are only able to receive Direct Subsidized loans for no more than 150% of the published length of your program.

For example, if you are enrolled in a four-year degree program, the maximum amount of time you can receive Direct Subsidized loan funds is 150% of four years, which is six years.

Eligibility for Direct Unsubsidized Loans does not depend on demonstrated financial need.

The aggregate loan limits for students attending graduate school or professional school students include any undergraduate federal student loan debt.

Bbay Where Say Contains 2 Semesters

Examples 1a through 1c illustrate the optional use of BBAY 1 for a program that is offered in an SAY consisting of two semesters, fall and spring, each 15 weeks of instructional time in length.

In example 1a, the initial fall and spring terms could be considered either an SAY or BBAY. If the student attends the summer session at the school, the aid administrator can elect to treat the summer term and the next fall as a BBAY for the student. In that case, the following spring and summer would also constitute a BBAY. The maximum loan limit for an academic year applies to each BBAY. If these were the first three years of study for a dependent student who progressed a grade level each academic year, the student would be eligible for up to the applicable annual loan limit each academic year.

A student doesnt have to attend all of the terms in a BBAY, but the BBAY cannot begin with a term that the student doesnt attend. In example 1b, the student is not enrolled in the second term of year 2.

In example 1c, if the student does not attend a term that otherwise would have been the beginning of a BBAY , then the students next BBAY cannot begin until the next term that the student attends. As with example 1a, the annual loan limit applies to each BBAY.

Read Also: How To Get Loan Originator License

Remaining Period Of Study = Two Quarters Separated By A Period Of Non

McNutt Institute has an academic year that covers three quarters: fall, winter, and spring. Bob, an independent fourth-year undergraduate, will be enrolling at least half-time in the fall and spring quarters, but will not be enrolled in the winter quarter, and will graduate at the end of the spring quarter. Because the fall quarter is in the same academic year as Bobs final quarter, it is part of the final period of study, even though there is a term between the final quarter and the fall quarter in which he will not enroll. McNutt Institute must award Bob separate loans for fall and spring.

Bobs final period of study is shorter than an academic year, so the annual loan limit for each loan must be prorated based on the number of hours for which Bob is enrolled in each term.

In this example, Bob will be enrolled for 12 hours in each of the two quarters . The prorated loan limit is determined separately for each term by converting the fraction based on the number of hours in each term to a decimal . Multiply this decimal by the combined Direct Subsidized Loan/Direct Unsubsidized Loan annual loan limit for an independent fourth-year undergraduate :

$12,500 x 0.33 = $4,125 combined subsidized/unsubsidized prorated annual loan limit for a single term

To determine the maximum portion of the $4,125 prorated annual loan limit that Bob may receive in subsidized loan funds for a single term, multiply the maximum subsidized annual loan limit of $5,500 by the same decimal :

Resolving Conflicting Information In Nslds

If you can document that the student is eligible for FSA funds despite the information shown on NSLDS, you may award and disburse aid. An example would be if the NSLDS Financial Aid History page of the SAR or ISIR shows that the student has a defaulted loan, but you have obtained documentation from the holder of the loan that the borrower had made satisfactory arrangements to repay.

Don’t Miss: How To Get An Aer Loan

Talk To Your Financial Aid Office

The federal government isnt the only place that offers aid states and colleges have programs, too.

So talk to your financial aid office and ask if theres anything it can do. Perhaps it can offer some need- or merit-based aid or recommend a local scholarship program. It also might be able to help you find aid from your state.

Additional Loan Funds For Preparatory Coursework

- All students: Up to $2,625 for coursework required for enrollment in an undergraduate degree or certificate program

- Bachelors degree recipients: Up to $5,500 for coursework required for enrollment in a graduate or professional degree or certificate program

- Bachelors degree recipients: Up to $5,500 for state-required teacher certification coursework

These loan funds are limited to a period of 12 consecutive months. Any loans received for preparatory coursework will be counted towards your Direct Loan aggregate loan limits.

Don’t Miss: How To Find Student Loan Number

Visit Your Colleges Financial Aid Office

For students or parents who are facing educational costs they cant cover or are nearing either annual or aggregate student loan limits, there is help.

If they suspect the loan amount will not cover all costs, they should reach out to the colleges office of financial aid to discuss this, Moon said. If the loan amount does not cover the cost of attending the university, then there are options the university can offer.

For instance, Moon said, a university might be able to offer institutional need- or merit-based aid. Students or families might also be able to get on a payment plan for tuition or college costs and avoid a loan.

Even if you dont think you qualify for more aid, you should make the effort. Make an appointment, meet in person and be prepared to describe your situation and any extenuating circumstances.

Explain why you need and should receive additional aid. The human element can make all the difference.

How A Direct Unsubsidized Loan Works

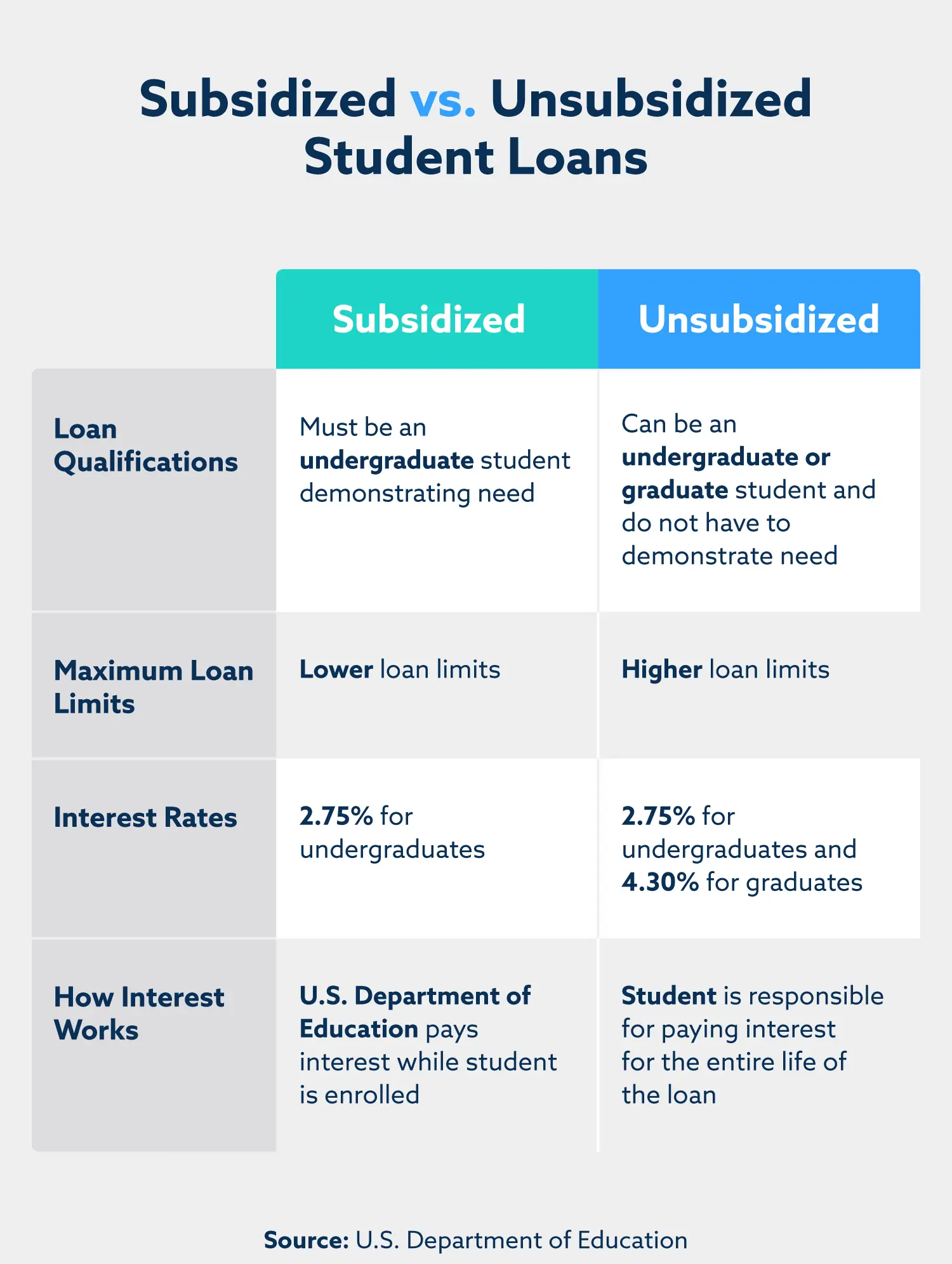

The key differences between an unsubsidized loan and a subsidized loan are the interest, loan limit and eligibility.

Unsubsidized student loans are more expensive than subsidized loans because interest starts accruing sooner on unsubsidized loans. The borrower is responsible for the interest that accrues on unsubsidized student loans during in-school and grace periods, as well as deferments and forbearances. Borrowers can choose to pay the interest as it accrues or to defer paying the interest until the student loans enter repayment. All federal student loans have a fixed interest rate.

If the borrower does not pay the interest as it accrues, the interest will capitalize and be added to the principal loan balance when the loan enters repayment. This can increase the size of the loan by as much as a tenth to a quarter. It also leads to interest compounding, since interest will be charged on the capitalized interest.

Read Also: How To Get An Aer Loan

Annual Loan Limit Increase Based On Grade Level Progression

The annual loan limit for Direct Subsidized and Unsubsidized Loans increases as a student progresses in grade level. Generally, a students grade level for loan limit purposes is set according to the schools academic standards.

While the law defines minimum coursework for an academic year, it doesnt define how much coursework a student must complete to progress from one grade level to another. Unless a students program of study or a schools academic standards clearly specify when this grade-level progression takes place, a reasonable approach would be to base grade levels on the number of credits required for the program, divided by the number of academic years it takes a typical student to earn that number of credits. For instance, if your school has a baccalaureate program that requires 120 semester hours of work and is typically completed in four academic years, then you might use a standard of 30 hours completed at each grade level.

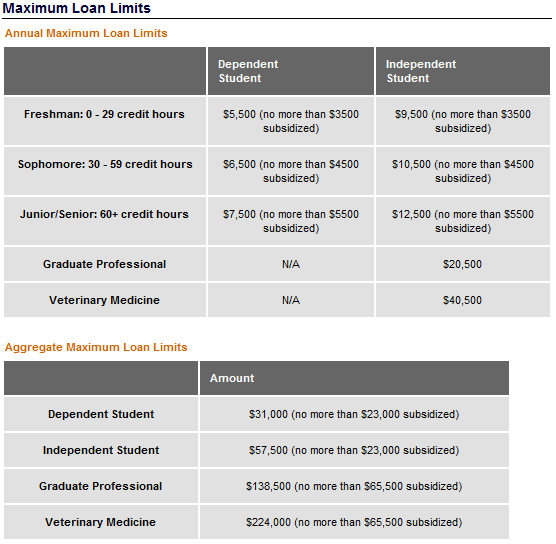

How Much Can I Borrow

The maximum amount you can borrow each academic year depends on your grade level and dependency status. See the chart below for annual and aggregate borrowing limits. You may not be eligible to borrow the full annual loan amount because of your expected family contribution or the amount of other financial aid you are receiving. To see examples of how your Subsidized or Unsubsidized award amount will be determined. Direct loan eligibility and loan request amount must be greater than $200 for a loan to be processed.

If you are a first-time borrower on or after July 1, 2013, there is a limit on the maximum period of time that you can receive Direct Subsidized Loans. This time limit does not apply to Direct Unsubsidized Loans or Direct PLUS Loans. If this limit applies to you, you may not receive Direct Subsidized Loans for more than 150 percent of the published length of your program. See your financial aid adviser or for more information.

Read Also: How To Get An Aer Loan

Direct Subsidized Loans Vs Direct Unsubsidized Loans

Only students who have financial need may receive Direct Subsidized Loans. The federal government does not charge interest on Direct Subsidized Loans while the borrower is enrolled on at least a half-time basis, during the grace and deferment periods, and during certain other periods .

If a student has received a determination of need for a Direct Subsidized Loan in an amount of $200 or less, the school may choose not to originate a Direct Subsidized Loan and may instead include that amount as part of a Direct Unsubsidized Loan.

Financial need is not an eligibility requirement to receive a Direct Unsubsidized Loan. The federal government generally charges interest on Direct Unsubsidized Loans during all periods, with limited exceptions .

Direct Plus Loan Amounts For Parents & Graduate/professional Students

There are no fixed annual or aggregate loan limits for Direct PLUS Loans. A graduate or professional student may be awarded a Direct PLUS Loan for up to the students COA minus other EFA . Therefore, a graduate/professional student who has received the maximum Direct Unsubsidized Loan amount for an academic year may have additional Direct PLUS Loan eligibility. Similarly, the total Direct PLUS Loan amount borrowed by a parent on behalf of a dependent student may not exceed the students estimated COA minus other EFA the student receives for the period of enrollment. This is the only borrowing limit for Direct PLUS Loans.

Also Check: Can You Transfer Car Payments To Another Person

What Is The Stafford Loan Interest Rate & How Do Stafford Loans Work

The main difference between the types of Federal Stafford Loans is how interest is handled.

The interest on a subsidized Stafford loan will be paid by the government while students are in school or while loans are in deferment.

Meanwhile, the interest on an unsubsidized Stafford loan will be paid by the student and is added to the loan balance.

Federal student loan interest rates reset for new loans on July 1 each year.

As an example, undergraduate students who took out loans for the 2019-2020 school year received a 4.53% interest rate. Graduate students received a 6.08% interest rate. These are fixed interest rates that don’t change for the life of the loan.

Stafford Loans are daily interest loans. This means interest accumulates each day.

For more information about interest capitalization for Stafford Loans, visit studentaid.gov/understand-aid/types/loans/subsidized-unsubsidized

Reporting Loan Information Changes

The requirements of the subsidized loan eligibility time limit make it particularly important for schools to accurately report academic year dates and loan period dates for all types of Direct Loans to COD. You must also update a loans previously reported loan period dates or academic year dates if the borrowers actual attendance is different from the anticipated dates that were the basis for an initial reporting to COD. Some examples of when you must update loan data in COD include:

-

If the borrower requests that a loan, or a disbursement of a loan, be cancelled

-

When the borrower does not begin attendance, or does not begin attendance on at least a half-time basis, in a payment period that was included in the originally reported loan period and you did not make any disbursements for that payment period

-

When you determine that the borrower is not eligible to receive a Direct Loan for a payment period that was part of the originally reported loan period

-

When the borrower withdraws during a payment period that was included in the originally reported loan period, and as a result, the entire amount of the loan that was intended for that payment period is returned under the Return of Title IV Funds calculation

-

For clock-hour programs, non-term credit-hour programs, and certain types of nonstandard term credit-hour program, the borrower fails to progress to the next payment period or academic year as scheduled.

Also Check: Genisys Loan Calculator

Figure Out Your Financial Need With The Fafsa

The point of the FAFSA is to help schools figure out your financial need. Thats right: The school determines what kind of federal financial aid package you get.

How much you need is decided by comparing your Expected Family Contribution with the cost of attendance at your school. Heres what you should know about it, along with some other key points:

Eligibility For Direct Stafford Loans

In order to receive either a Direct Subsidized Loan or Direct Unsubsidized Loan, you will need to be enrolled at least half-time in a school that participates in the Direct Loan Program. Generally speaking, you must also be enrolled in a program that will lead to a degree or certificate awarded by the school. Your school will determine the type of loan, if any, and the loan amount you are eligible to receive each academic year.

There are limits on the amount in both subsidized and unsubsidized loans that you are eligible to receive each academic year and the total amounts that you are allowed to borrow for undergraduate and graduate study . The loan amount you are eligible to receive each academic year may be less than the annual loan limit. These limits vary depending on:

- What year you are in school

- Whether you are a dependent or independent student

Recommended Reading: Va Manufactured Home 1976

Grade Level Progression: Clock

In contrast to standard term and SE9W nonstandard term program, progression to a higher grade level and the beginning of a new BBAY for loan limit purposes always happens at the same time for a student in a clock-hour program, non-term program, or non-SE9W nonstandard- term program. In order to advance to the next grade level for annual loan limit purposes, a student must successfully complete both the weeks and hours in the programs Title IV academic year. That is, the student must complete at least 30 weeks of instructional time and the number of credit or clock-hours in the academic year, whichever comes later. For instance, a first-year student in a 2-year non-term program with a defined academic year of 36 quarter hours and 30 weeks of instructional time who earns 36 quarter-credits over 24 weeks of instructional time cannot progress to the next grade level until another 6 weeks of instructional time are completed.

There are two options for awarding an additional loan amount when a student progresses to a grade level with a higher annual loan limit during an academic year:

Adjust the amount of the current loan. Change the grade level in the loan record and increase the amount of the existing loan to the new amount.

With either option, the students remaining loan eligibility must be calculated using only the costs and estimated financial assistance for the term during which the student qualifies for the higher loan limit.

What Is An Unsubsidized Loan

A Direct Unsubsidized Loan is a type of federal student loan that starts accruing interest as soon as money is disbursed to your school. You may choose not to pay this interest while youre in school and during your six-month grace period, but any unpaid interest that accumulates during this time will be added to your total balance.

Also Check: Nslds Ed Gov Legit

Rules For Abbreviated Loan Periods:

The abbreviated loan period begins when the student starts at the new school.

The abbreviated loan period ends when the academic year would have ended at the old school, without regard to how many hours or weeks of instructional time the student has completed at the new school during the abbreviated loan period.

Generally, the maximum loan amount that the student can receive for the abbreviated loan period is the difference between the full annual loan limit applicable to the student at the new school and theloan amount that was disbursed at the prior school during the overlapping academic year .

The first disbursement of the loan for the abbreviated loan period at the new school is made at the beginning of the abbreviated loan period. Unless the school qualifies based on its cohort default rate for the exemption from the multiple disbursement requirement, the loan must be disbursed in at least two installments, with the second disbursement made at the calendar midpoint of the abbreviated loan period regardless of how many clock/credit-hours or weeks of instructional time have been completed. The normal payment period disbursement rules do not apply in this situation.

The next loan period and a new BBAY 3 at the new school would begin the day after the last day of the abbreviated loan period.

Once the new loan period and BBAY 3 begin, all of the normal rules for the timing of disbursements and annual loan limit progression apply.