Things To Consider When Shopping For A Vehicle

When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. Most drivers intend to own the car for a long while. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans.

| Borrower |

|---|

How Much Will My Loan Payments Be

Many factors go into determining the final loan amount for the purchase of a new or used vehicle. These factors include any manufacturer’s rebate, the trade-in value of your old vehicle less any outstanding balance, your down payment, etc. Once the loan amount is determined the interest rate and the term of the loan will be used to estimate your vehicle payment.

220 Donald Lynch Boulevard

How To Calculate Loan Payments In 3 Easy Steps

Making a big purchase, consolidating debt, or covering emergency expenses with the help of financing feels great in the moment – until that first loan payment is due. Suddenly, all that feeling of financial flexibility goes out the window as you factor a new bill into your budget. No matter the dollar amount, it’s an adjustment, but don’t panic. Maybe it’s as simple as reducing your dining out expenses or picking up;a side hustle. Let’s focus on your ability to make that new payment on time and in full.

Of course, before you take out a personal loan, it’s important to know what that new payment will be, and yes, what you’ll have to do to pay your debt back. Whether you’re a math whiz or you slept through Algebra I, it’s good to have at least a basic idea of how your repayment options are calculated. Doing so will ensure that you borrow what you can afford on a month-to-month basis without surprises or penny-scrounging moments. So let’s crunch numbers and dive into the finances of your repayment options to be sure you know what you’re borrowing.

Don’t worry – we’re not just going to give you a formula and wish you well. Ahead, we’ll break down the steps you need to learn how to calculate your loan’s monthly payment with confidence.

Read Also: Can You Pay Off Mortgage With Home Equity Loan

Calculating Auto Loan Payments

Early Auto Loan Payoff Calculator

Have an auto loan that you want to pay off sooner? Wondering how much faster you could pay it off by paying a bit more each month? And how much interest you could save in the process?

This Early Auto Loan Payoff Calculator has the answers.

Enter how much extra you want to pay each month, and the calculator will immediately tell you how many months you’ll shave off your loan and your total savings in interest. It can also show how quickly you’re paying down the loan, with the balance remaining for each month until the vehicle is paid off.

This is good information to have if you’re thinking of trading in the vehicle before it’s paid off and wondering how much to knock off the anticipated trade-in value.

You May Like: Can I Pay Off Personal Loan Early

How To Get A Lower Car Payment

If it looks like you wont be able to afford the monthly payment for your dream car, dont worry. You can lower your car payment by making a few changes. Check out the following list for tips on how to lower your car payment:

- Pick a cheaper car. One easy way to lower your payment is by reducing the cost of the car, which will lower your loan amount. The lower your loan amount, the less youll have to pay each monthand the less youll pay overall in interest.

- Save for a larger down payment. Your down payment is the money you pay upfront when you purchase the car. If you aren’t in a rush to get a new car, saving for a bigger down payment will reduce your loan amount and could help you lower your monthly payment. Furthermore, reducing the size of your loan with a big down payment may help you lock in other favorable loan terms.

- Shop around for a lower interest rate. When you take out an auto loan, youll be assigned an interest rate that represents the cost to borrow money to pay for your car. Interest is paid as part of your monthly payment, and the lender determines your rate based on your creditworthiness and other factors. If you can lock in a lower interest rate, your monthly payment should be lower as a result. Rates vary by lender, and an improved credit score could help you land a lower one.

If you don’t know your credit score, you can get a free copy of your credit report and FICO® Score from Experian to get an updated view of where your credit stands.

Early Auto Loan Payoff Calculator Faqs

What is a pay-off car loan early calculator?

A pay-off car loan early calculator is a calculator that helps you know how much time you can shave-off from your car payment and the interest you can save by increasing your monthly car payments.

How will an auto loan calculator help me with extra payments?

Auto loans that span for a long period are great, but they accrue a lot of interest to be paid over time. Our auto loan calculator will show you just how much you can save on these interests by making extra monthly payments.

Also Check: How Long Until You Can Refinance An Fha Loan

Why Take Out A Car Loan

When it comes to financing a new car, there are a number of options available to you: outright purchase, personal loan, leasing, hire purchase or dealer financing. It’s advisable to read up on the pros and cons of each of these before deciding upon the best one for you. Should you be considering taking out a different type of loan, give our standard loan calculator a try.

How To Get The Best Deal On A Loan

This one is simple: get a loan that helps you manage your monthly payments.

Now that you know how to calculate your monthly payment, and understand how much loan you can afford, it’s crucial you have a game plan for paying off your loan. Making an extra payment on your loan is the best way to save on interest . But it can be scary to do that. What if unexpected costs come up like;car repairs or vet visits?

The Kasasa Loans® is the only loan available that lets you pay ahead and access those funds if you need them later, with a feature called Take-BacksTM. They also make managing repayments easy with a mobile-ready, personalized dashboard. Ask your local, community financial institution or credit union if they offer Kasasa Loans®.

Taking out a loan can feel overwhelming given all the facts and figures , but being armed with useful information and a clear handle on your monthly payment options can ease you into the process. In fact, many of the big-ticket items like homes or cars just wouldn’t be possible to purchase without the flexibility of a monthly loanpayment. As long as you budget carefully and understand what you’re getting into, this credit-building undertaking isn’t hard to manage – or calculate – especially if you keep a calculator handy.

Also Check: What’s Better Refinance Or Home Equity Loan

Use The Edmunds Auto Loan Calculator To Determine Or Verify Your Payment

You’re gearing up to buy your next car but aren’t sure what the monthly car payment will look like. Getting to a monthly payment usually involves some math, but the good news is that the Edmunds auto loan calculator will do the heavy lifting for you.

Let’s say you have your eye on a compact car or SUV. Choose the make and model you want, or alternatively enter the vehicle’s price into the auto loan calculator. It will ask for a few other details such as the down payment, the loan term, the trade-in value and the interest rate. After that, it will calculate the compound interest, estimate tax and title fees, and display the monthly payment.

This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. Take some time to experiment with different values to find an auto loan setup that works best for your budget.

Process To Use Bankbazaars Car Loan Emi Calculator

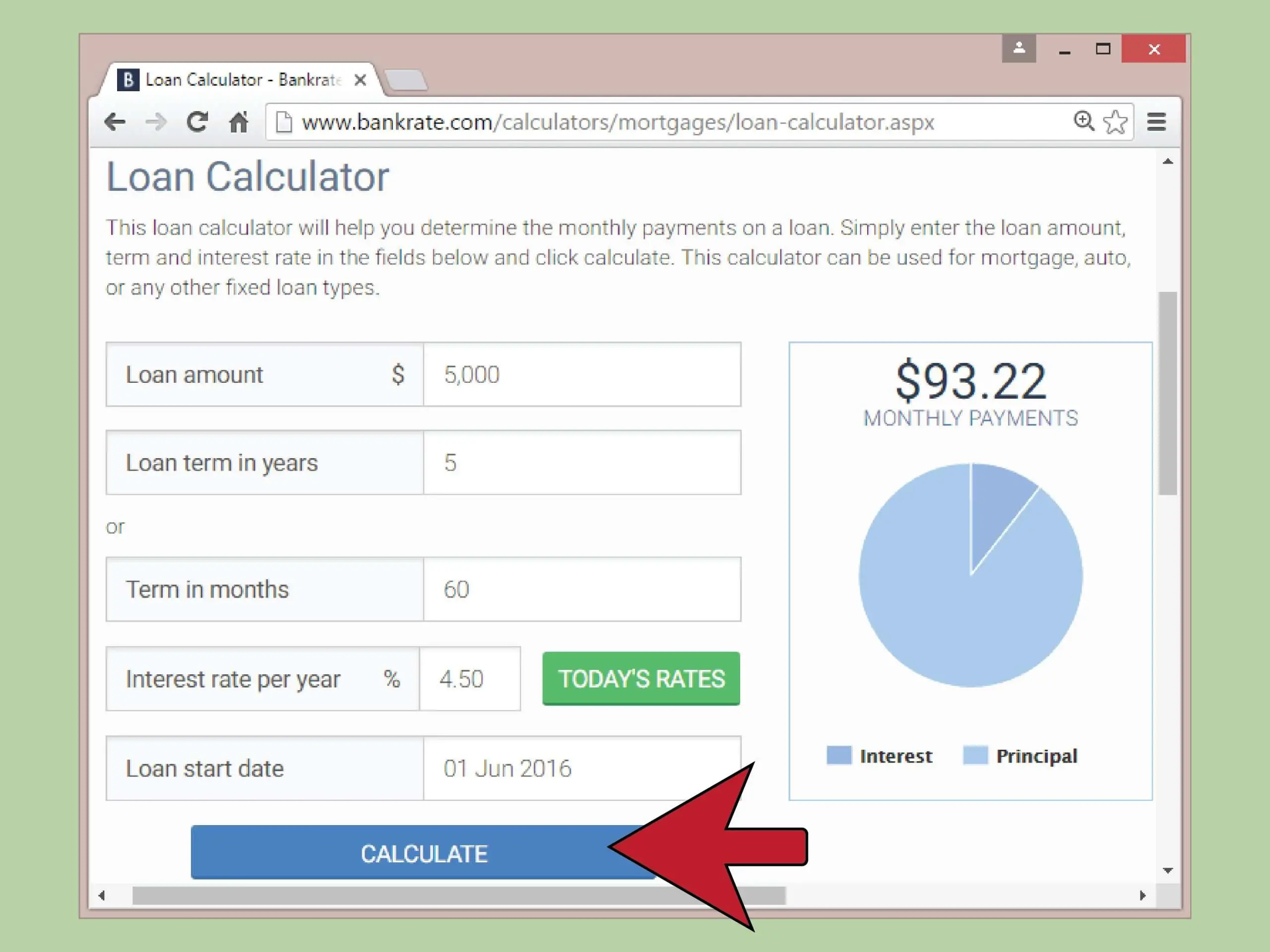

The step-by-step procedure to use the Car Loan EMI calculator offered by BankBazaar is mentioned below:

1. The calculator can be found on the top of this page. The first step would be to select the loan amount.

2. Next, select the repayment tenure.

3. Enter the rate of interest and the processing fee.

4. Click on Calculate. The results will be displayed immediately.

You can check the principal amount and the interest that is being paid every year. The calculator also provides the outstanding balance at the end of every year.

Read Also: How To Calculate Bank Loan

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

Read Also: What Credit Score Is Needed For Conventional Loan

Using Microsoft Excel To Calculate Auto Loan Payments

How To Get The Best Deals On Your Loan Payments

Your monthly loan payment is just a result of the loan amount, the interest rate, and the length of your loan. Salespeople and lenders can make a low monthly payment seem like youre getting a good dealeven when youre not.

For example, some auto dealers want you to focus solely on your monthly payment, which is why they often ask how much you can afford each month. With that information, they can sell you almost anything and fit it into your monthly budget by extending the life of the loan.

It is better to negotiate a lower purchase price than a lower monthly payment. Lowering the sales price decreases one of the three components of the total loan cost.

Stretching out your loan means youll pay more in interest over the life of the loan, increasing the total cost of the loan. Plus, longer-term loans might be riskier: When they’re used by buyers with lower credit to finance larger amounts, there’s a greater risk of default.

You May Like: Can You Pay Off Sofi Loan Early

What Are Loan Payment Calculations

The type of calculation you use will vary based on the type of loan. Here are three helpful calculations to know about when considering borrowing money:

- Interest-only loans: With interest-only loans, you dont pay down any of the principal in the early yearsonly interest.

- Amortizing loans: On the other hand, amortizing loans involve paying toward both principal and interest over a set period of time, such as with a five-year auto loan.

- When using a credit card, you’re given a line of credit that acts as a reusable loan so long as you pay it off in time. If you’re late on making monthly payments and begin to carry a balance, you’ll likely be charged interest.

Production Of The Nissan Magnite Suv Started In India

The Nissan Magnite SUV was revealed last month in India and the prices are expected to be announced soon. The Magnite is expected to rival the likes of the Maruti Suzuki Vitara Brezza, Hyundai Venue, and Kia Sonet. Nissan has started manufacturing the car in its Chennai plant and orders are expected to start soon. The car is expected to be available in 4 variants and two engine options. The compact-SUV will be available in both manual and automatic transmissions. Some of the main features that the Magnite comes with are power steering, AC, power windows, steering mounted controls, and an integrated music system.

3 November 2020

Also Check: When Do Student Loan Payments Start After Graduation

How To Calculate A Car Loan In Excel

wikiHow is a wiki, similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 9 people, some anonymous, worked to edit and improve it over time. This article has been viewed 193,709 times.Learn more…

Microsoft’s Excel spreadsheet program can be used for many different types of business and personal applications. For instance, you can use Excel to calculate car loan transactions and payment amounts as well as the total interest paid over the life of a loan. In addition, you can use Excel to compare multiple scenarios in order to make sound financial decisions. Here’s how to calculate a car loan in Excel before you make a commitment.

What Is An Auto Refinance Calculator And How Does It Work

An auto refinance calculator is a tool to help you figure out how much money you can save every month with a given interest rate. It works by giving you an idea of how much you can save every month, which will consequently help you determine the right plan.

All you have to do is follow the instructions on the calculator, input the required information and get an estimate of your monthly savings. Typically, youre supposed to input details of your existing loan such as:

- The amount you currently pay every month

- The remaining balance on your loan

- The remaining loan term

- The existing rate of interest

Also Check: What Is The Best Student Loan Servicer

Auto Loan Amortization Calculator Arbor Financial

Auto loan amortization calculators outline your payment schedule and show the reduction of debt over time. Click to use our auto loan calculator and learn;

Interest is what the auto loan company charges you to borrow the money. With that in mind, its easy to see why your monthly car payment may matter more to you;

Looking to buy a new car? Well do the math for you. Scotiabank free auto loan calculator gives you estimate for car loan, monthly payment, interest rate,;