Can I Use My Va Entitlement For The Construction Of A New Home

Although the primary purpose of a VA home loan is to assist a Veteran with purchasing a pre-built residence, the VA also offers its guaranty for construction loans for those looking to build a home for themselves. This means that you can put your Veteran entitlement toward building your new house. Although many lenders do not support VA construction loans, SoCal VA Homes enables you to buy your land and build your home with zero down and zero closing costs. Find out more about our VA home construction loans.

Is My Credit Score Affected By Entitlement

Your VA loan entitlement does not affect your credit score. When lenders run a credit check as a part of the VA loan pre-approval process, the hard inquiry may or may not affect your credit score, but if it does, it may only adjust by a few points. If several inquiries are made in the same two-week time frame, such as when you are shopping around for rates, the formulas which produce your credit scores will recognize that you are shopping around and will not ding you multiple times. Additionally, making consistent, on-time payments of your VA home loan is a great way to build up your credit.

What Is The Minimum Amount Of Va Guarantee For Irrrl Lenders

January 22, 2018 By JMcHood

The VA guarantees the loans written in their name. This is how the lenders are able to write loans for riskier borrowers and require no down payment. Today, the VA guarantee is equal to the lesser of 25% of the conforming loan limit or 25% of the loan amount you require.

In 2018, this means the VA will guarantee 25% of $453,100 or 25% of the loan amount you need. The maximum amount the VA will guarantee is $113,275 unless you live in a high-cost area. If you do, the maximum guarantee is 25% of the maximum conforming limit for that area.

Also Check: When Do I Pay Back Student Loan

Do Va Loans Come With Income Requirements

Not exactly. The VA doesnt care what you make overall, but they do care that you have enough income to cover your housing costs plus the necessities. Thats where the VA loan residual income requirement comes in. The residual income requirement is the VAs way of making sure you dont max out your budget on housing costs. When you get a VA loan, youll have to prove that you have enough money left over each month after your bills to pay for basics like food and gas.

Residual income requirements are calculated based on a few factors: the size of your VA loan, the size of your family, your debt-to-income ratio and your location. A single veteran in an inexpensive part of the country who took out a modest loan would need to provide proof of less money in residual income than a big family living someplace fancy.

Calculating The Va Entitlement Amount

If you have full entitlement, you dont have a loan limit, so you dont need to worry about calculating how much entitlement you have. You can borrow as much as a lender will give you with no down payment.

If you have reduced entitlement and want to know how much you have left, youll need to figure out how much of it youre currently using.

Remember that the VA guarantees up to 25% of your loan. To find out how much of your entitlement youve used, simply multiply your loan amount by 0.25.

Loan amount × 0.25 = entitlement youve already used

Youll also need to determine your countys conforming loan limit. In 2021, the baseline conforming loan limit is $548,250. In high-cost areas, it may be higher than this.

The maximum entitlement is equal to 25% of the conforming loan limit for your county.

County conforming loan limit × 0.25 = maximum entitlement

However, if you have a reduced entitlement, you likely wont be able to borrow up to the maximum with no down payment. You can determine your remaining entitlement by subtracting the entitlement youve already used from the maximum entitlement amount.

Maximum entitlement entitlement youve already used = remaining entitlement

Your remaining entitlement is the maximum amount the VA will guarantee on your loan. Since the VA guarantees 25% of the loan, you can multiply your remaining entitlement by 4 to see the maximum amount you can borrow without having to make a down payment.

Recommended Reading: What Is Fha And Conventional Loan

What Is A Va Loan

A VA loan is a type of loan backed by the U.S. Department of Veterans Affairs that helps veterans, service members and some eligible surviving spouses become homeowners. Although these loans are generally provided by private lenders like mortgage companies and banks, the VA guarantees a portion of the loan so that lenders can offer those who are eligible more favorable terms.

So How Many Times Can You Use A Va Loan

Eligible veterans and military service members are able to use there VA home loan benefits over and over again.; There is no limit on how many times you can use your VA loan benefit. This is a benefit you have earned for serving our country, and once you have earned it, it is a life long benefit you can use over and over again.; You can restore your entitlement as often as you need as long as you sell the previous property and pay the prior loan in full. In some cases you can even keep your first home and buy a second primary residence if you are required to move for a job or a PCS situation. Everyones circumstances are unique, so give one of our VA home loan specialists a call at 855-956-4040 to find out more. We are here to serve you!

You May Like: How Much Can I Borrow Personal Loan Calculator

What Is Va Entitlement

Veterans who are eligible for VA loans will have VA loan entitlement. This is a dollar amount that the VA has agreed to pay back to the lender should the borrower default on the mortgage. Although it is simple in theory, the concept of VA entitlement can be rather complex.

For those who meet the minimum loan requirements, most lenders will provide a loan of up to four times the amount of the basic entitlement before requiring a down payment.

VA entitlement is linked to the VA guaranty. This works like mortgage insurance on other types of loans and sees the lender repaid for a portion of the loan in the event that they need to foreclose on the property. However, the VA guaranty is not charged to the borrower as a lump sum or monthly payment. Instead, it is covered by the VA based on the borrowers available VA entitlement and the amount of the loan.

To be eligible for VA entitlement, you must have served at least 90 consecutive days during wartime, 181 days during peacetime, or have more than six years of service in the Reserve or National Guard. In addition, the spouses of veterans who died in the line of duty or due to a service-connected disability may also be eligible.

What Does Full Entitlement To A Va Loan Mean

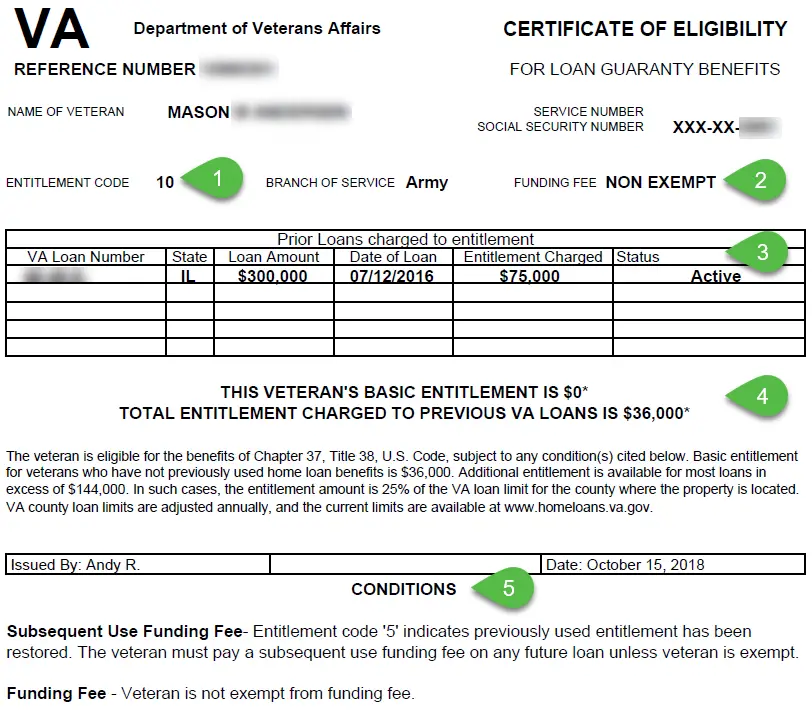

Full entitlement means you do not have an active VA loan and can use your full benefits when applying for a mortgage. You can have full entitlement if youve never used your loan benefit before, if youve paid off a previous VA loan and sold the house, or youve repaid the VA in full after a foreclosure or short sale.

When you have your full entitlement, your Certificate of Eligibility will say “This Veterans basic entitlement is $36,000.” When you have used your full entitlement, your COE will say “This Veterans basic entitlement is $0.”

Also Check: How To File Bankruptcy On Car Loan

Example Va Loan Limit Calculation

VA loan limits and entitlements are pretty confusing topics, so lets look at a real-life example. Lets say Sam is already using $50,000 of his VA loan entitlement but wants to use the remaining entitlement to purchase another property. In his county, the conforming loan limit is $548,250. Since the VA will guarantee a quarter of that amount , he has a maximum entitlement of $137,062.

When you subtract the amount Sam has already used , you get $87,062, giving him a VA loan limit of $348,248 .

If he were to purchase a home priced higher than that $348,248, he would need to make a down payment worth at least a quarter of the difference. On a $400,000 home, for example, that would mean a down payment of $12,938 .

Our LenderVeterans United Home Loans is a VA approved lender; Mortgage Research Center, LLC NMLS #1907 . Not affiliated with the Dept. of Veterans Affairs or any government agency. Not available in NV. 1400 Veterans United Dr., Columbia, MO 65203. Equal Housing Lender

What Is Va Loan Entitlement

VA loan entitlement is the dollar amount the Department of Veterans Affairs will guarantee on each VA home loan and helps determine how much a veteran can borrow before needing a down payment. VA loan entitlement is typically either $36,000 or 25% of the loan amount up to the conforming loan limit.

» Eligibility: Do you meet VA loan guidelines?

You May Like: Is Homeowners Insurance Included In Fha Loan

Does The Va Limit The Quality Of Homes That Qualify For Va Loans

This is the other kind of VA loan limit, the kind that doesnt have to do with dollars and cents. The VA likes to make sure that the homes people finance with their loans arent too run down. Homes financed with a VA loan need to be safe, structurally sound and sanitary. Youll be hard-pressed to get a VA loan on a tear-down, in other words.

Restoring Your Va Loan Entitlement

If youve previously taken out a VA loan, you can have your entitlement fully restored by paying back the loan and selling the property attached to the loan. You may also qualify for a one-time entitlement restoration if youve paid back your loan but havent sold the property attached to the loan.

If you dont have full entitlement and dont qualify for a one-time restoration, you can figure out how much remaining entitlement you have by using the formulas we discussed above.

Essentially, you cant use entitlement thats already tied up in an active loan, but once your entitlement has been restored, typically by repaying your loan and selling your home, youre free to reuse your full entitlement benefit.

Recommended Reading: How To Transfer Car Loan To Another Person

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Does My County Loan Limit Affect Me

You may need to make a down payment if youre using remaining entitlement and your loan amount is over $144,000. This is because most lenders require that your entitlement, down payment, or a combination of both covers at least 25% of your total loan amount.

So if youre able and willing to make a down payment, you may be able to borrow more than the county loan limit with a VA-backed loan. Remember, your lender will still need to approve you for a loan. The lender will determine the size of loan you can afford based on your:;;;Credit history;;;Income;;;Assets

We dont require a minimum credit score, but some lenders may have different credit score requirements. Be sure to contact more than one lender to compare.

Note: You may have heard the terms additional entitlement, bonus entitlement, or tier 2 entitlement. We use these terms when we communicate with lenders about VA-backed loans over $144,000. You wont need to use these terms when applying for a loan.

Recommended Reading: What Are Assets For Home Loan

Va Loan Limits: No Maximum Loan Amounts In 2021

If youre a military servicemember or veteran, you may have access to a zero-down loan with no limit, as long as you qualify for the payment.

The Department of Veterans Affairs eliminated VA loan limits for most borrowers in 2020. That means first-time VA homebuyers, and others with their full entitlements, can borrow as much as lenders are willing to approve.

So the size of your VA loan now depends more on your financial credentials than on the local housing market.

VA loan limits still come into play for homebuyers who currently have VA loans and have partial entitlement available.

If youre a qualifying veteran, active-duty military servicemember, or an eligible surviving military spouse, now may be a great time to buy, with a shot at a 0% down mortgage and no loan limit on the type of home you can buy.

Does The Va Entitlement Benefit Last Forever

That would be nice. Unfortunately, its possible to permanently lose your VA loan entitlement. For example, if the homeowner defaults on the VA loan and the lender forecloses on the property and sells it for less than what was owed, the VA has to reimburse the lender the full 25% initially guaranteed.

The VAs payment to the lender would be deducted from the homeowners total entitlement. This portion of the entitlement would no longer be accessible unless the homeowner repaid the VA the losses. And that aforementioned one-time restoration of entitlement benefit? Not applicable in this scenario.

Read Also: What Is Certificate Of Eligibility Va Home Loan

Loan Limits: Before And After

As Military Benefits points out, January 1, 2020, brought major changes for VA loan limits, and those changes had many borrowers scrutinizing their VA loan entitlement amounts. Why? Borrowers who had their full entitlement at the beginning of 2020 are no longer subject to loan limits. While they must have sufficient income and resources to secure the loan that theyre seeking, borrowers with full entitlements no longer have to worry about staying below conforming loan limits. The VA will provide a 25-percent guarantee for these loans. However, borrowers who have already used part of their entitlement must play by the old rules. Anyone without full entitlement who takes out a VA loan must stay below the conforming loan limits or make up the difference with a down payment.

_____

What is my VA loan entitlement amount? Whats the best way to secure my Certificate of Eligibility? Can you buy a fixer-upper with a VA loan? Does the VA offer a way to refinance my existing property? When you have questions about the VA loan program, the team at PrimeLending: Manhattan, KS, is happy to help you find the clear, useful answers that you need to make smart decisions. We listen carefully, offer personalized guidance, and use our expertise to ensure that the process moves as smoothly as possible. To learn more about our services, contact us today.

Can Entitlement Be Reused Or Restored

The VA loan program is not a one-time benefit. You can use it multiple times throughout your life, but there is a limit.;

Entitlement can be used a second time when a VA homeowner sells his/her home and pays off the mortgage entirely, putting the full entitlement amount back into play. This is called entitlement restoration.;

However, if the homeowner pays off the loan but still retains ownership of the house or if the home is refinanced by VA loan refinancing the entitlement amount attached to the home remains off-limits. Its not available for use at this time.

Like everything else, there is an exception to this must-sell rule. Its a complicated procedure, but you can request a one-time entitlement benefit restoration from the Veterans Association. Well get into that in more detail in a future blog post.

Recommended Reading: Will Refinancing My Auto Loan Help My Credit

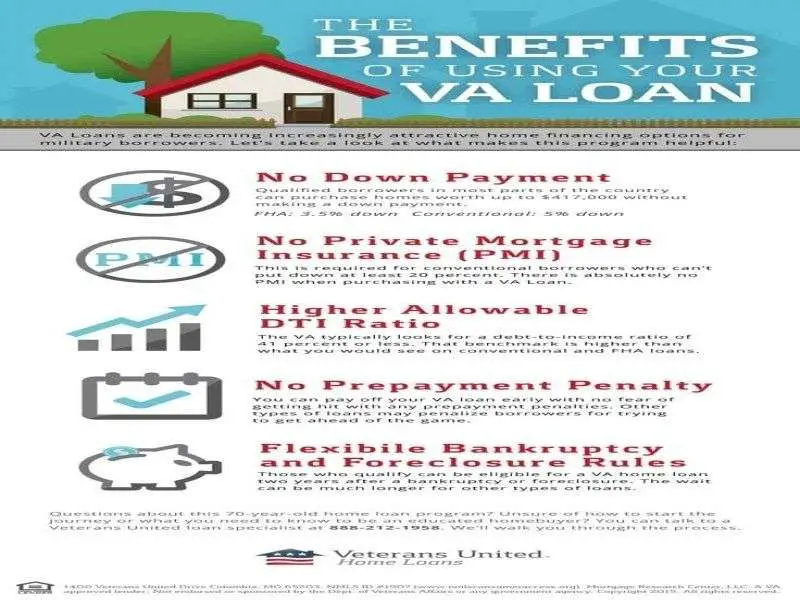

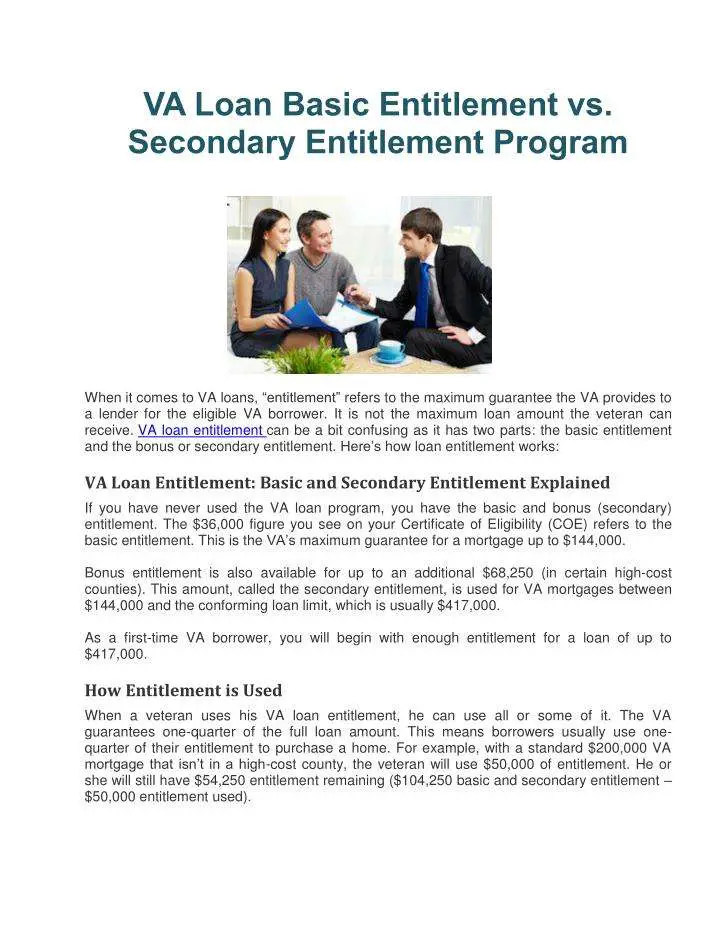

Va Entitlement Has Two Parts: Basic And Bonus

If youre eligible for the VA home loan program, and have never used the program, then you have basic and bonus VA entitlement. The $36,000 figure many see on their Certificate of Eligibility refers to a portion of entitlement known as basic. This is the VAs maximum guarantee for loans up to $144,000. Many veterans are surprised to hear, after speaking with an experienced loan officer, that they have additional entitlement to use for loans over $144,000. Bonus entitlement is up to an additional $68,250, and in certain counties, described below, even more. This amount, sometimes referred to as Tier 2 or Additional entitlement, is only used for VA loans between $144,000 and the conforming limit, which is generally $417,000. In certain high-cost counties the conforming limit is higher, and the amount of bonus entitlement is higher as well.

Va Loan Basic Entitlement

There are two types, or tiers, of entitlement. The first is known as basic entitlement. Basic entitlement for a VA loan is $36,000.

However, you’re probably wondering how the math adds up. If the VA guarantees a quarter of each loan at $36,000, does that mean you can only get a $144,000 home ? Thankfully, that’s not what it means and is where the following type of entitlement comes into play.

Also Check: Are There Student Loan Forgiveness Programs