How Do You Calculate Interest On A Credit Card

To calculate your interest charges, you need to figure out what your APR is, how much your average daily balance is, and how many days are in your billing cycle. You should be able to find most of this information by logging into your account.

If youre carrying a credit card balance, youll likely be charged interest. Credit card companies may differ in the time frame they give you to pay for new purchases before they charge interest, though they typically give you about a month to do so.

Early Mortgage Payoff Calculator

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

What You Should Know About Loan Payoffs

As I demonstrated with the loan examples above, loan payoffs are something of a trade-off between the monthly payment and the total cost of the loan. The lower the monthly payment you choose, the longer the loan term will be, and the more interest youll pay over the life of the loan. That will increase the total cost of the loan.

Youll need to decide whats more important a low monthly payment, or getting the loan paid off as soon as possible and saving money on the total cost.

Theres one other factor you should be aware of, especially when it comes to personal loans. Some personal loan lenders charge origination fees equal to between 1% and 6% of the amount you borrow. That means you may pay between $100 and $600 on a $10,000 loan.

But an origination fee shouldnt discourage you from considering a personal loan. For example, lets say you have $10,000 in with an average interest rate of 23%. That means youre paying $2,300 per year in interest.

You have an opportunity to get a personal loan at 12% over 60 months with a 6% origination fee. Even though youll pay $600 for the origination fee, youll still save hundreds of dollars compared to your current credit card debt.

And since the origination fee applies only when you accept the loan, the savings each year thereafter will be even higher. And equally important, the debt will be completely paid off in five years. Thats unlikely to happen with credit card debt.

Don’t Miss: Usaa Refinance Auto

Federal Housing Administration Loan

FHA loans are another popular mortgage option, designed specifically for first-time home buyers. FHA loans make it easier for first-time buyers to make the leap to home ownership by requiring as little as 3.5% down. Plus, these loans are backed by the government, which means the government insures the bank so it wont lose its money if you dont make your payments. Whats the downside? New regulations require you to keep private mortgage insurance for the life of the loan. PMI can cost around $100 a month per $100,000 borrowed, and it doesnt go toward paying off your mortgage. Thats a cost you can do without!

What Youll Need To Calculate Your Mortgage Payments

To get started, youll need a regular calculator, since well be crunching numbers. Also, have three pieces key of information ready, since youll need to plug them into the mortgage payment formula . Keep in mind that this formula will only calculate your monthlymortgage paymentbi-weekly or accelerated bi-weekly payments, for example, would be calculated differently. The three pieces of info youll need to know are:

Recommended Reading: Leads For Loan Officers

What Is My Loan Payment Formula

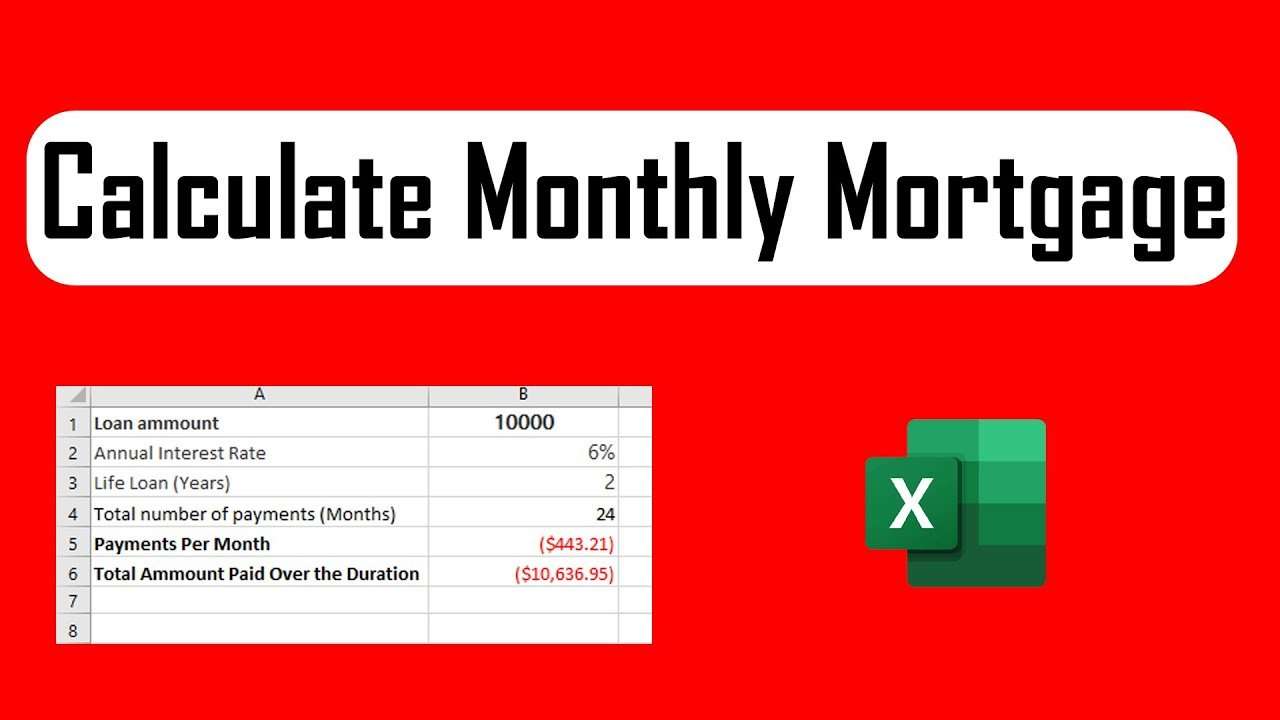

Now that you have identified the type of loan you have, the second step is plugging numbers into a loan payment formula based on your loan type.

If you have an amortized loan, calculating your loan payment can get a little hairy and potentially bring back not-so-fond memories of high school math, but stick with us and we’ll help you with the numbers.

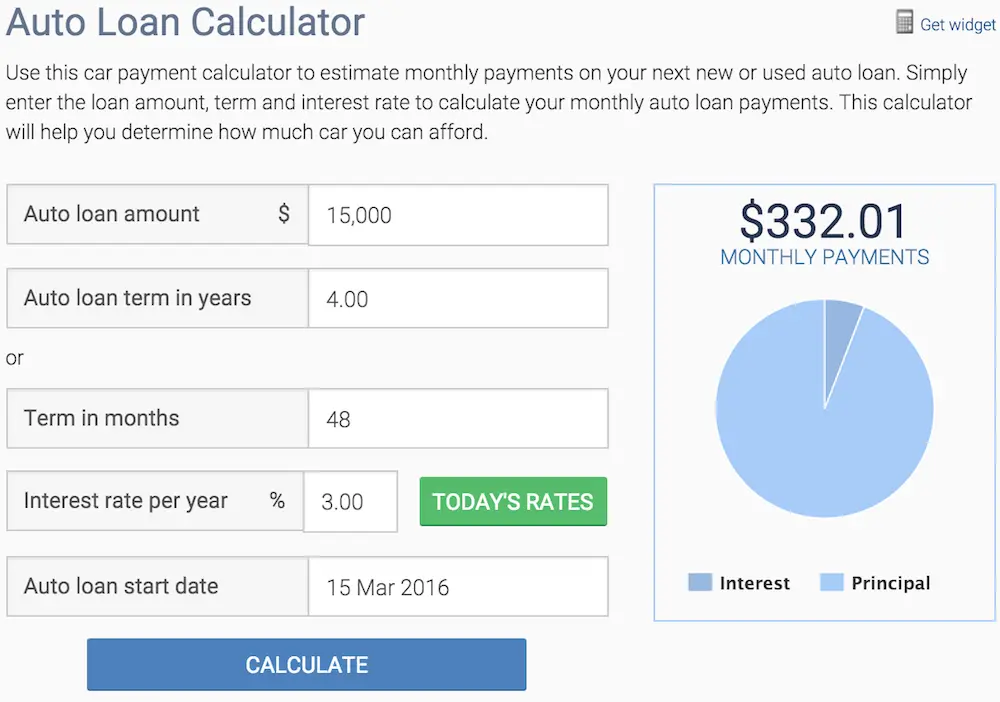

Here’s an example: let’s say you get an auto loan for $10,000 at a 7.5% annual interest rate for 5 years after making a $1,000 down payment. To solve the equation, you’ll need to find the numbers for these values:

-

A = Payment amount per period

-

P = Initial principal or loan amount

-

r = Interest rate per period

-

n = Total number of payments or periods

The formula for calculating your monthly payment is:

A = P ^n) / ^n -1 )

When you plug in your numbers, it would shake out as this:

-

P = $10,000

-

r = 7.5% per year / 12 months = 0.625% per period

-

n = 5 years x 12 months = 60 total periods

So, when we follow through on the arithmetic you find your monthly payment:

10,000 / – 1)

10,000 /

10,000

10,000 = $200.38

In this case, your monthly payment for your cars loan term would be $200.38.

If you have an interest-only loan, calculating the monthly payment is exponentially easier . Here is the formula the lender uses to calculate your monthly payment:

loan payment = loan balance x

In this case, your monthly interest-only payment for the loan above would be $62.50.

What The Mortgage Payoff Calculator Tells You

The Summary Results section has two subheadings:

How to reach your goal describes how much you would have to pay in principal and interest every month to meet the payoff goal. It lists the original principal-and-interest payment, and how much you would have to add to the minimum monthly payment to meet your goal.

Loan comparison summary describes the total cost of the mortgage in principal and interest payments, the original monthly principal-and-interest payment, the total cost in principal and interest if you pay it off early, and the new monthly principal-and-interest payment to reach your payoff goal.

“New monthly P& I” and “Original monthly P& I” comprise only the principal and interest portions of your monthly payments. Your full monthly payment will include principal and interest, plus the other monthly costs, such as taxes, homeowners insurance and mortgage insurance .

The early mortgage payoff calculator also lets you enter different numbers into the “In how many years from now do you want to payoff your mortgage?” box to see how those changes affect your total savings.

For more information about how the process of gradually paying off a mortgage works, see this explanation of mortgage amortization.

Also Check: Specialized Loan Servicing Payoff Request Form

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Are Points On A Mortgage

Before we get into the pros and cons of paying points, lets define what a point is: A mortgage point is an optional fee you can pay upfront to reduce the interest rate on your home loan.

Each point costs 1% of your loan amount. But heres the tricky part: theres no concrete answer to how much each point will reduce your rate. That depends on the current market, the starting rate, the lender, and even the very day and hour you lock.

In some cases, a point might reduce your rate by 0.50% and in others, it wont even reduce your rate by 0.125%.

This is where your math skills come in. You have to calculate how much youre saving by paying points and when you recover that cost.

Well get into how to figure out whether paying points is worth it.

But back to the definition of a point: It is considered prepaid interest and is titled a discount fee on your final closing statement. No, its not because you get a discount necessarily, its just mortgage-speak meaning your rate is being lowered from the market rate thanks to your upfront payment.

Why? Well, if you pay a lower interest rate, your lender will earn less money on the loan. The discount points compensate them for the reduced rate while also allowing you to save on interest long-term.

And if they can afford their monthly payment, they see no reason to pay points if they dont have to. But is a zero points mortgage really the best deal? The answer may surprise you.

You May Like: How Big Of An Auto Loan Can I Get

Refinanceor Pretend You Did

Another way to pay off your mortgage early is to trade it in for a better loan with a shorter termlike a 15-year fixed-rate mortgage. Lets see how this would impact our earlier example. If you keep the 30-year mortgage, youll pay more than $158,000 in total interest over the life of the loan. But if you switch to a 15-year mortgage, youll save over $85,000and youll pay off your home in half the time!

Sure, a 15-year mortgage will probably come with a bigger monthly payment. But if it fits within your housing budget, itll totally be worth it! And hey, maybe youve boosted your income or lowered your cost of living since when you first took out your mortgagethen youd definitely be able to handle the bigger payment.

You can refinance a longer-term mortgage into a 15-year loan. Or if you already have a low interest rate, save on the closing costs of a refinance and simply pay on your 30-year mortgage like its a 15-year mortgage. What if you already have a 15-year mortgage? If you can swing it, imagine increasing your payments to pay it off in 10 years!

How To Use Credit Karmas Debt Repayment Calculator

If youre trying to get out of debt, Credit Karmas debt repayment calculator can help you figure out how long it could take.

Our calculator can help you estimate when youll pay off your credit card debt or other debt such as auto loans, student loans or personal loans and how much youll need to pay each month, based on how much you owe and your interest rate. Youll also be able to see how much principal versus interest youll pay over the lifetime of the debt.

Of course, its important to keep in mind that these are only estimates based on the info you provide. This debt payoff calculator can help give you a sense of timing and monthly payments as you put together a repayment plan, but it doesnt consider other factors such as your cards annual fee , late-payment fees or any other fees you might incur. It also assumes you wont use the card to make any new purchases.

Here are some details on the information youll need to use this debt calculator.

Read Also: Va Handbook Manufactured Homes

Mortgage Loan Do’s And Don’ts

5 Min Read | Sep 24, 2021

Feeling overwhelmed about your mortgage options? No wonder! Youve got plenty of choices when it comes to financing the purchase of your home, and it can be hard to know which one is best.

Daves favorite way to pay for a home is with cash. It may sound crazy, but people like you do it every day! If thats not feasible for you, the next best thing is a smart home mortgage loan. It may be easy to dive headfirst into the mortgage option that will allow you to buy a home with next to nothing down. But a bad mortgage product can be a liability in your financial portfolio. A home should be a blessing to your family, not a financial nightmare!

Thats why its a good idea to know whats out there and why you need to avoid some of the more popular mortgage options.

If you need help with mortgages, we recommend talking with Churchill Mortgage. They can answer any mortgage questions you have.

Make Extra House Payments

Lets say you have a $220,000, 30-year mortgage with a 4% interest rate. Our mortgage payoff calculator can show you how making an extra house payment every quarter will get your mortgage paid off 11 years early, and save you more than $65,000 in interestcha-ching!

But before you start making extra payments, lets go over some ground rules:

- Check with your mortgage company first. Some companies only accept extra payments at specific times or may charge prepayment penalties.

- Include a note on your extra payment that you want it applied to the principal balancenot to the following months payment.

- Dont shell out your hard-earned cash for a fancy-schmancy mortgage accelerator program. You can accomplish the same goal all by yourself.

What Does Paying Your Mortgage Biweekly Do?

Some mortgage lenders allow you to sign up for biweekly mortgage payments. This means you can make half of your mortgage payment every two weeks. That results in 26 half-payments, which equals 13 full monthly payments each year. Based on our example above, that extra payment can knock four years off the 30-year mortgage and save you over $25,000 in interest.

Are Biweekly Mortgage Payments a Good Idea?

Don’t Miss: 1-800-689-1789

Using The Mortgage Payoff Calculator

To use this calculator, begin by entering the years remaining on your mortgage, the length of your mortgage, the full amount you originally borrowed, the additional amount you’d like to pay each month and your mortgage rate.

For purposes of the amortization report, check whether you wish to see it displayed as a month-by-month or year by-year breakdown.

The length by which your mortgage will be shortened will be seen in the blue box above the imputs and your total interest savings will appear to the right. You can use the green triangles to adjust any of the figures you enter and the results will update automatically.

A few things to note: It’s important to enter the original amount of your mortgage and not your current mortgage balance. The calculator will figure where you currently stand based on how long you’ve been making payments.

Include any closing costs that were rolled into the original mortgage you want to enter the total amount you borrowed. Likewise, be sure to enter your mortgage rate and not the APR in the interest rate box to get a correct report.

The “Mortgage Balances and Interest” section is a graph that compares how your mortgage principle balance will decline over time with making additional monthly payments compared to making just your regular monthly payments. It also shows how your accumulated interest costs will accumulate over time as well for both options.

Alternative Methods Of Managing Mounting Debt

Sometimes, individual borrowers may struggle in situations where they simply cannot repay their mounting debts. A lack of financial means, serious illness, and a poor mindset are some of the reasons this occurs.

In the U.S., borrowers have alternative methods that can salvage their situations. They should carefully weigh these options and assess in detail whether they should use them or not, as many of these methods may potentially leave borrowers worse off than before. Higher costs, lower credit scores, and additional debt are some of the possible consequences. For these reasons, some personal financial advisors suggest avoiding the options listed below at any cost.

Debt Management

Debt management first involves consulting with a credit counselor from a credit counseling agency. The U.S. Department of Justice contains a list of approved credit counseling agencies by state.

Suppose they deem a debt management plan viable. In that case, the credit counselor will extend an offer to the debtor. The agency will take responsibility for all their debts every month and pay each of the creditors individually. In turn, the agency requires the debtor to make one monthly payment to the credit counseling agency and possibly other fees. Usually, credit counselors will also require debtors to avoid opening new lines of credit and close their credit cards to avoid accruing new debt.

Debt Settlement

Bankruptcy

Also Check: Cars You Can Afford Based On Salary

Ready To Refinance Your Mortgage

If you want to refinance to a mortgage you can pay off fast, talk to our friends at Churchill Mortgage. The home loan specialists at Churchill Mortgage show you the true costand savingsof each loan option. They coach you to make the best decision based on your budget and goals.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

How To Pay Off A Loan Faster

The first rule of overpaying is to speak to the lender to ensure that any extra money you send comes off the principal debt, and not the interest. Paying off the principal is key to shortening a loan. Our Loan Payoff Calculator shows you how much you might save if you increased your monthly payments by 20%.

You May Like: Texas Fha Loan Limits 2020