Are Closing Costs Tax Deductible

Can you deduct these closing costs on your federal income taxes? In most cases, the answer is no. The only mortgage closing costs you can claim on your tax return for the tax year in which you buy a home are any points you pay to reduce your interest rate and the real estate taxes you might pay upfront.

No Down Payment No Closing Cost Home Loans

A qualified veteran typically can get 100% financing to purchase a home. A no closing cost VA home loan enables the home buyer to receive lender credit to cover all closing costs and pre-paids and get into their home with no money out of pocket. The VA finding fee is added to the loan amount or waived if the veteran has more than 10% disability to be exempt for the VA funding fee.

How Can I Avoid Closing Costs

While closing costs are usually unavoidable there are parts of those closing costs and fees that are normally negotiable. Through these negotiations, you may be able to vastly reduce the amount that you are called to pay for closing on the property. For example, negotiating with your lender, attorney, and real estate agent each of their respective fees could ultimately help save you thousands of dollars. You may also be able to reduce and negotiate your recording costs. All of these will help bring the number of your closing costs down and could potentially allow you to be in the lower end of that average closing costs percentage spectrum.

Don’t Miss: Do Loan Companies Verify Bank Statements

Negotiating Your Interest Rate

Both lender credits and discount points involve negotiating with your mortgage lender for the deal you want.

Youll be in a better position to negotiate low closing costs and a low rate if lenders want your business. That means presenting yourself as a creditworthy borrower in as many areas as you can.

Lenders typically give the best rates to borrowers with a:

- Loan amount within conforming loan limits

Of course, you dont need to be perfect in all these areas to qualify for a mortgage. For instance, FHA loans allow credit scores as low as 580. And if you qualify for a USDA or VA loan, you can buy with 0% down.

But making improvements where you can for instance, by raising your credit score or paying down debts before applying can make a big difference in the rate youre offered.

How Much Do I Need To Close On A House

The amount that you will need to be able to close on a house will differ depending on the house and your situation. Normally, once you have your mortgage set in place, closing on the house requires you to pay a 20% deposit payment and any closing fees required. As the buyer, those fees will normally range from 2 to 5% of the total price of the property. Once you can cover both of those costs you are able to close on a house.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Fha Loan Closing Costs: What Youll Pay And How To Save

For many cash-strapped homebuyers, FHA loans* are a godsend. The low down payment requirement of 3.5% allows you to purchase a home for less money out of pocket, even with a low credit score.

But the down payment isnt the only expense to consider. FHA loans, like all mortgages, also have closing costs. Typically, those costs total between 2-5% of the loan.

The great thing about FHA closing costs, however, is that you can use gift funds or an assistance program to pay for them.

That means its possible to buy a home without paying for closing costs out of your own pocket. And that option makes FHA loans one of the most affordable mortgage programs out there.

Can You Use Gift Money For Closing Costs

If you are able to get Gift Funds to help with your closing costs, consider using this money to either pay the Upfront Mortgage Insurance Premium or to buy down the interest rate to permanently reduce your mortgage payments and save thousands of dollars of interest over the term of the loan.

Also, can you use gift funds for closing costs?

Using Gifts with Conventional FinancingConventional loans backed by Fannie Mae and Freddie Mac allow the borrower to apply financial gifts to the down payment, fees, and closing costs. The gift amount is less than 20% of the purchase price, and the property is 2-4 unit or a second home.

Likewise, how can I get money for closing costs? Cash-to-close fees may also be paid at the time of closing, and would include things like homeowners insurance and property taxes, also called your escrow account.

Here’s a look at closing costs and where the money can come from:

In this way, do you need a gift letter for closing costs?

If you‘re gifted money for a down payment or other closing costs associated with the mortgage, your donor needs to send a gift letter to your mortgage company. When you buy a home, your mortgage company will require you to make a down payment before lending you money.

Who can gift money for down payment?

You May Like Also

Don’t Miss: Usaa Rv Loan Calculator

Rolling The Closing Costs Into An Fha Refinance

If you are refinancing your home, a popular option is the FHA streamline refinance which does not require a new appraisal. However, if you want to include your closing costs, then a new appraisal will be required. Read our article on FHA streamline refinances.

For a standard FHA refinance, you can refinance your existing mortgage up to 85% of the homes value today. This value will be determined by a new appraisal and the closing costs can be added into the loan amount.

What Is The 5 Cs Of Credit

To get the best mortgage deal, you must first understand the five Cs of mortgage qualification.

The first C is for Character. This is a measure of your tendency to borrow credit and how responsible you are for paying down the debt on time every time. This is affected by payments you made on time and it proves that you are worthy of getting a steady flow of credit.

The second C is for Capacity. The second component of determining your credit rating will be your capacity â This focuses on your ability to pay back the loan, and factors in things like accounts, cash flow, rounded up against your debt outstanding.

The third C is for Capital. Capital is the amount of money that a borrower puts towards a potential loan. In the case of mortgages, the starting capital can be your down payment or any savings you might have accumulated over time in your personal savings account. A larger contribution often results in better rates and, in some cases, better mortgage terms. For instance, making a 20% down payment does not require default insurance .

The fourth C is Collateral. Collateral is a form of security for repayment in loans. Lenders are able to charge lower interest rates because the borrowerâs property or other asset is attached to the loan as protection in case of default by the borrower. In most cases,

Overall, loans with collateral backing are typically more secure and generally result in lower interest rates and better terms.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Why Mortgage Is Important

A mortgage is a type of loan in which a property is used as collateral. Most mortgages are given to individuals to purchase homes.

The process of mortgage is quite complex and requires a lot of paperwork. It involves a lender, a borrower, a title company, an attorney, an appraiser, and usually a mortgage broker to be the mediator among all parties.

Every party involved in the mortgage process has a role to play in successfully closing the mortgage deal. A borrower has to put a lot of effort into obtaining a mortgage. The borrower should understand the mortgage process, especially the financial cycle of a mortgage. This financial cycle of mortgage includes a number of important steps.

For the lender, it is a liability that should be repaid with interest. To the buyer, it is an asset that should be paid off with a monthly payment. The mortgage loan is an agreement between the buyer, the lender, and the seller.

The buyer agrees to purchase the home and make monthly payments on the loan to the lender until the loan is fully paid. The seller agrees to sell the home to the buyer for a price less than the total value of the home. The seller also agrees to transfer ownership of the home to the buyer at closing.

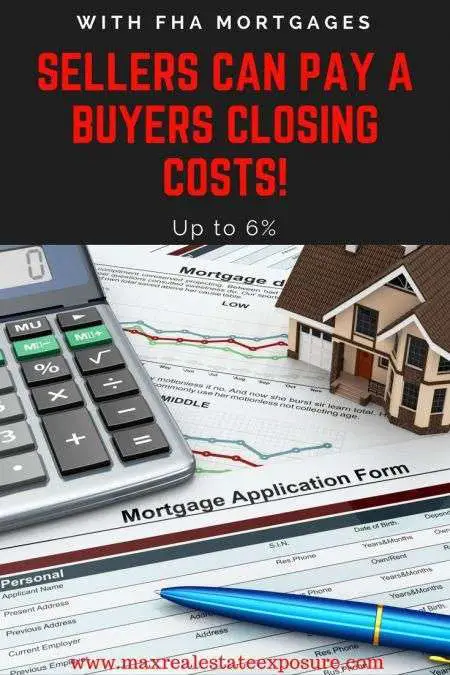

What Closing Costs Does The Seller Have To Pay On Fha Loans

One benefit of an FHA loan is that it allows the seller totake on some or all of the costs. The FHA home loan program limits the buyer’s closingcosts only to the costs that are considered “allowable”, these are parts of theclosing costs that are considered “customary and necessary”. This definitionmay vary with different local FHA offices.

These costs can range from 2 to 7% of the property’s sellingprice. And, if you use an agent or broker, it may even go higher since you willalso pay the commissions.

Other costs that may be expected to be paid by the sellerinclude association reserves, special assessments to associations and creditsthat are given to the buyer.

The seller is also expected to pay off all mortgages, lineof credit or home equity loan so that any interest that is charged and relatedto the period before the closing date will not be charged to the new owner.

The same goes for taxes for “upside down loans” – thishappens when the proceeds of the sale of the property is not enough to pay offyour loans . The lender may agreeto condone these accounts, but the IRS will credit this condonation and willcharge for this.

| Not a bit |

You May Like: Usaa Certified Auto Dealers

Who Pays The Closing Cost

Both the buyer and the seller are responsible for different aspects of the closing costs for the purchase of your home. This means that as the seller there is a list of things including fees, taxes, and other payments to ensure that you can sell your property. Similarly, the closing costs for the buyer will include fees to the lender, insurance fees, property taxes, and other fees necessary for closing on the house.

Extra Tips Just For Refinancers

If youre refinancing a home loan, youll have to pay closing costs all over again. But you do have some special money-saving opportunities. Here are two:

If your home has been appraised recently, you can probably skip the cost of having it appraised again as part of the closing process. Ask your lender for an appraisal waiver. If you cant waive the appraisal altogether, you may be able to save money by opting for an automated appraisal instead of a full appraisal.

Ask for a re-issue rate when you re-up your title insurance for a refinance.

You May Like: Drb Refinance Reviews

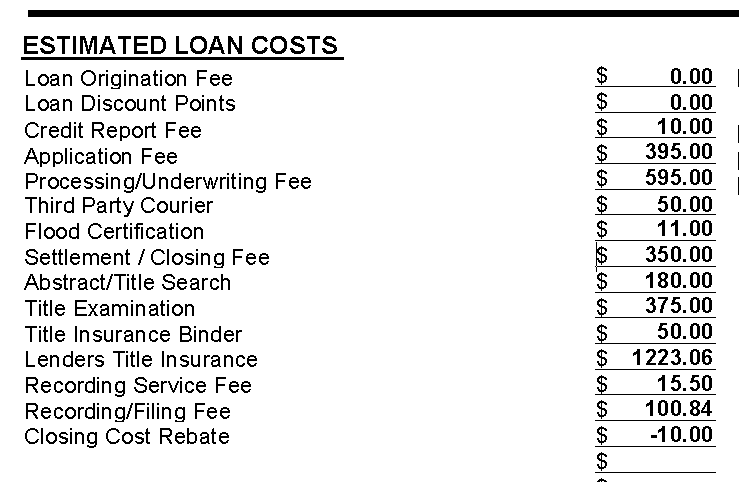

Other Fha Loan Closing Costs

UFMIP is not the only closing cost that comes with an FHA loan. Federal Housing Administration mortgages can also have many of the same closing costs as other loans. These include

- Discount pointsDiscount points are a way of buying a lower interest rate on your mortgage. One discount point is equal to 1% of the loan amount. Some FHA mortgages come with discount points you need to pay and some don’t.

- Appraisal fees and title searchesA home appraisal is an estimate of the value of the house, performed by a professional who charges a fee for this service. A title search makes sure there are no liens against the house and confirms the seller is the legal owner of the property. Title searches are also done by a professional who charges a fee for the work. These fees can be included in your FHA closing costs.

- Application, origination, and attorney fees Getting an FHA loan can include application and origination fees charged by the lender, and potentially fees for an attorney to review the mortgage documents.

- Homeowners insurance and property taxesYou may be required to pay your property taxes and homeowners insurance premiums at closing.

Phew Thats A Lot Of Potential Fees And Charges

Dont despair. Now that weve talked about some of the closing costs youre likely to face, we have six tips for cutting those costs down to size. Heres our guide on how to reduce closing costs:

With closing costs, a lot of money is on the line. Thats a good reason to shop around for the lender who offers the lowest closing costs. You can also ask a lender to match low closing costs offered elsewhere. Besides getting quotes from multiple lenders, you can get quotes for some services as well. There are some services included in the closing costs that you are allowed to shop around for. In other words, you dont have to go with the provider your lender suggests and you can try to find a lower price elsewhere. The closing cost services you can shop for will be listed as such on your Loan Estimate. Do some research, make some calls and see if you can find cheaper options.

When you get the Loan Estimate, dont just glance at it. Take the time to go through each item with the lender, questioning what each fee coversand why it costs as much as it does. This is a good way to identify padded or unnecessary fees. Also, keep an eye out for fees with similar names, as they may mean the lender is charging twice for doing the same thing. A common example: processing fees and underwriting fees. Closing costs have gotten clearer since the Loan Estimate replaced the GFE, but its still worth reviewing your Loan Estimate carefully.

Recommended Reading: Becu Car Loans

No Closing Cost Va Home Loan Options

The only no down payment no closing cost mortgage available in the current market is a VA loan for qualified veterans. All other home buyers applying for a conventional or an FHA loan will need to put the minimum required down payment of 3.5% for FHA loans and 3% for conventional first time home buyers.

What Happens If You Dont Have Enough Money At Closing

If you are not able to budget for the closing costs in time for the home purchase you could potentially ask the seller for a concession, and then take the missing amount out as part of your mortgage. The lender will need to agree that after the appraisal of your new home, the amount that you are requesting does not exceed the value of the house that you are buying, so it can oftentimes be hard to convince the lender of adding that extra amount to your mortgage.

You May Like: Can I Buy A Manufactured Home With A Va Loan

Shop Around For Lenders

As the buyer, you get to choose which mortgage company you want to work with. Dont be afraid to take some time to shop around for lenders.

Contact a few competing loan providers and ask what types of fees they charge. Choose a lender that offers low fees and competitive interest rates for lower overall closing costs.

How To Reduce Or Avoid Closing Costs

When youve spent months or even years saving for a down payment, searching for a property, negotiating a purchase price, going through due diligence and securing financing, paying closing costs can be an unwanted surpriseand they can make it that much harder to afford your new property.

With that in mind, a lot of people want to try to reduce or avoid closing costs. While its impossible to eliminate closing costs entirely, there are some things you can do to reduce your expenses, including:

Additionally, certain closing costs can sometimes be added to a buyers loan amount, rather than paying it in cash at closing. What costs can be rolled into your loan vary by lender, but may include origination fees, appraisal and inspection fees or title fees. While this can lead to some initial cost savings, it will actually increase the total mortgage cost, as youll pay interest on these expenses over the life of the loan.

Recommended Reading: Vehicle Loan Calculator Usaa

Cash Back Closing Costs And Fha Streamline Loans

- You must have a current FHA loan with no late payments or delinquency notices for at least 12 months.

- Your refinancing should be accomplished to get lower mortgage and interest payments.

- The refinancing process requires verification of employment, but proof of income is not required.

- To be approved for an FHA Streamline loan, your original mortgage must be at least six months old.

FHA STEAMLINE LOANS CASH BACK?CLOSING COSTS

Fha Loan Closing Costs Faqs

FHA loan closing costs be included in the loan?

You can include the FHA upfront mortgage insurance fee of 1.75% in your loan if you dont want to pay it at closing. Other costs cannot be financed, such as your prepaid property taxes, homeowners insurance, and daily interest charge.If youre worried about being able to afford your closing costs on an FHA loan, you can use gift funds or closing cost assistance to cover those expenses.

What are the typical FHA closing costs?

Closing costs usually total between 2-5% of the loan, on the higher end of that range for less expensive homes and lower percentages on high-cost homes. On a $200,000 loan, your closing costs might be around $6,000 , and on a $400,000 home, perhaps around $8,000 . Your upfront costs will vary based on your lender and where you live. Lender fees are different company to company. Additionally, local property taxes can significantly affect the amount of money youll need to close. You need to prepay around 6 months of taxes when you buy a home. So if taxes are $150 per month, prepaid taxes are not as big a deal as if the homes property taxes are $700 per month. FHA loans also carry an upfront mortgage insurance fee of 1.75% of the loan, though this can be rolled into your mortgage.

What is the maximum closing costs on an FHA loan?

Recommended Reading: Which Fico Score Is Used For Rv Loans