Millions Of Student Loan Borrowers Will Continue To Get Student Loan Forgiveness

President Joe Biden isnt done cancelling student loan debt. Its clear from this major announcement that Biden is committed to fixing a broken student loan repayment system. This includes increasing the amount of student loan cancellation and fixing administrative errors that have hurt student loan borrowers. The result is that more student loan borrowers will have access to student loan forgiveness. Plus, student loan forgiveness should happen sooner and more efficiently for borrowers with reduced bureaucratic roadblocks. This includes more automatic student loan forgiveness through data sharing with other federal agencies, reduced paperwork and easing of rules to be eligible for student loan forgiveness.

My Loans Were In Default What Happens To Me

Its still not entirely clear.

An Education Department spokeswoman said the department was working to finalize plans that would help defaulted borrowers when the pause ended.Before the extension of the pause, the department said policies that were under consideration would allow such borrowers to avoid having their tax refunds or child tax credits garnished.

Loans fall into default after roughly nine months of nonpayment, though it often takes a year or more for an account to move into collections. At that point, the federal government can take your tax refund, up to 15 percent of your paycheck or part of your Social Security benefits.

Borrowers generally have a few ways to emerge from default, which they must do before they can enter an income-driven repayment plan. Paying the loans off completely is an option, but usually not feasible. Loan consolidation is another option, or, alternatively borrowers can rehabilitate their loans. That involves making nine out of 10 consecutive reasonable payments, which your loan holder determines using a formula.

Advocates for student borrowers hope that the Biden administration will provide them with a fresh start by wiping away their defaulted status and making their loans current. That would allow them to avoid the often cumbersome hurdles required to get out of default at a time when loan servicers are likely to be inundated.

When Are Plan 4 Student Loans Written Off

If you started studying in the 2006/07 academic year or earlier, there are two possible dates on which your Plan 4 loan could be written off it will be whichever comes first between:

- You turning 65 years old

- Reaching 30 years after you first become eligible to repay .

If you started studying in the 2007/08 academic year or later, things are a little more simple your loan will be written off 30 years after the first April following your graduation.

In either case, your loan may be written off earlier than this if you receive a disability-related benefit and can no longer work .

And to clarify, if the loan is ‘written off’, that means you no longer have to make payments towards it even if you haven’t repaid it in full.

Find out how much of your loan youre in line to repay with our Student Loan repayment calculator.

Recommended Reading: Usaa Rv Loan Reviews

How The Module Works

The interactive module contains short, self-study sections with information you must read before you start your OSAP or OSAP for Micro-credentials application. At the end of each section, you will be asked to answer a question about what youve just read.

Correct answers let you move to the next section of the module. When youve finished the information module, your OSAP or OSAP for Micro-credentials application will open.

You can log in and out of the module at any time, and your progress will be saved.

If you choose to complete the module in one sitting, it will take you approximately 15 minutes.

Only full-time students making their first OSAP application for the 2020-21 or 2021-22 school year need to complete this module. If you choose to reapply to OSAP for the 2020-21 or 2021-22 school year, you will not need to complete this module again.

Complete And Submit The Fafsa

Timeline: Less than one hour

Filling out the FAFSA is the first step in applying for federal aid like scholarships and grants, and it also determines whether youre eligible for federal student loans.

The application process can take less than one hour to complete. To complete it, youll need a Federal Student Aid ID, which will also be used later in the student loan process. Its also helpful to gather the essential documents youll need to reference, including tax returns, Social Security numbers and other financial documents.

Once youve completed the form, submit it electronically or by mail . Applications for the upcoming academic year are available each year starting on October 1 of the preceding year. For example, the 2022-23 FAFSA became available on Oct. 1, 2021.

States and schools each have their own FAFSA submission deadlines. State deadlines are available on the Student Aid website ask your school about its deadline for student aid. While the application window for the FAFSA is often quite long, it pays to submit it as close to the Oct. 1 opening date as possible. Some aid is awarded on a first-come, first-served basis, so you could miss out on some forms of aid if you delay.

Recommended Reading: Silt Loan

Reservist Status In The Canadian Forces

If you are a reservist in the Canadian Forces on a designated operation you can delay repayment and interest on your student loan.

Complete the Confirmation of Posting Assignment for Full-Time Students form and submit it with your loan application to maintain your interest-free status. Make sure you attach a copy of your notification of posting instructions that you received from the Department of National Defence.

If you need help with this, contact your provincial or territorial student aid office.

Find Out How Much You Owe Even If You Forgot Your Lenders

It can be easy to lose track of all of your student loans and your total balance, especially when you’re busy in college. Many students receive multiple small loans per semester, which can be a mixture of federal student loanssuch as Perkins, Stafford, and PLUSand private student loans. While your school financial aid office may be able to help you find some basic facts and figures, there are other effective ways to find out your total student loan balance.

You May Like: Usaa Rv Loan Terms

How Can I Clear My Student Loan Balance More Quickly

If you want to clear your student loan balance more quickly, you can make single extra payments directly to the SLC on top of the standard repayments you must make when your income is over the threshold amount for your repayment plan.

You can make these extra repayments at any time using your online account, by cheque or by bank transfer.

You also have the right to pay off your outstanding student loan balance in full at any time.

However, before choosing this route, make sure you have first considered how this will affect your financial wellbeing and whether there is another way to make better use of your money.

Compare Your Actual Prequalified Rates In 2 Minutes

SOC 2 Compliant

**************

At Purefy, we do our best to keep all information, including rates, as up to date as possible. Keep in mind that each private student loan refinancing lender has different eligibility criteria. Your actual rate, payment and savings may be different based on credit history, actual interest rate, loan amount, and term, including your co-signer . If applying with a co-signer, lenders typically use the higher credit score between the borrower and the co-signer for approval purposes. All loans are subject to credit approval by the lender.

Purefys comparison platform is not offered or endorsed by any college or university. Purefy is not affiliated with and does not endorse any college or university listed on this website.

You should review the benefits of your federal student loan it may offer specific benefits that a private refinance/consolidation loan may not offer. If you work in the private sector, are in the military or taking advantage of a federal department of relief program, such as income based repayment or public service forgiveness, you may not want to refinance, as these benefits do not transfer to private refinance/consolidation loans.

Purefy reserves the right to modify or discontinue products and benefits at any time without notice.

Also Check: Usaa Personal Loan Credit Requirements

How To Find Your Private Student Loan Balance

Because the NSLDS is only for federal loans, your private student loans wont show up in the database. If you refinanced any federal loans, those wont show up either because once you refinance your student loans, they become private loans.

To find any private student loan balances :

Check Out: The Best Student Loan Refinancing Companies

How Do I Repay My Student Loan Balance

The earliest youll have to start repaying your loan is 6 April in the year after you finish your course.

If you are employed, repayments are typically taken from your monthly pay at source. They only start once youve started earning above a certain salary threshold. This threshold depends on which repayment plan you are on.

The actual amount you pay will depend on the amount you earn over the threshold during any given pay period. If your income falls below the threshold at any point, then your repayments will pause.

If you are self-employed, HMRC will calculate what you owe each year in repayments once you file your tax return.

Recommended Reading: Do Loan Originators Make Commission

Thats A Lot To Consider How Do I Choose The Best Plan

Analyzing the plans is an agonizing exercise, which is why you should visit the loan simulator tool at StudentAid.gov. It will guide you through the options and help you decide which plan best fits your goals finding the lowest-payment plan, for example, versus paying loans off as soon as possible.

It is, fortunately, easy to use: When you sign in, it should automatically use your loans in its calculations. You can also compare plans side by side how much theyll cost over time, both monthly and in total, and if any debt would be forgiven.

For most borrowers, income-driven or extended plans will yield the lowest monthly payment, experts said.

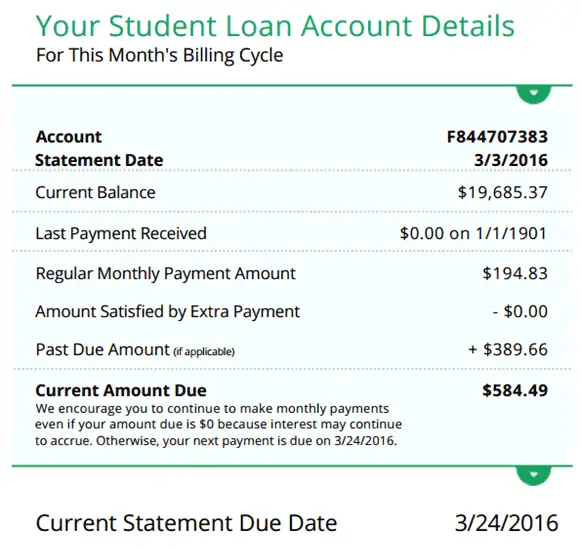

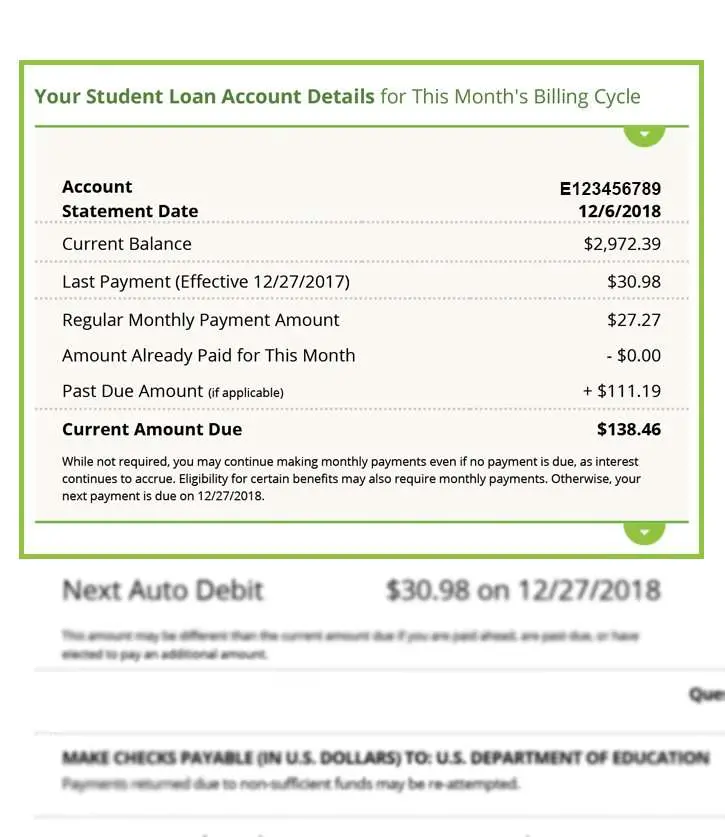

Understanding Your Statement And Payments

Knowing how to read your monthly billing statement is important in helping you responsibly manage your student loan debt. Review the sample statement below to understand the key elements of our standard billing statement.

Knowing how your payments are applied is important when trying to determine your overall cost of borrowing.

If you have any specific questions about your particular statement, please call us at 1-800-STUDENT anytime 24/7.

Don’t Miss: Signing Loan Agent

How To Find Your Student Loan Balance

The dreaded question of every college graduate: How much do I owe in student loans?

Edited byAshley HarrisonUpdated October 29, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

With the typical graduate having up to 12 different federal and private student loans, it can be difficult to keep track of them all. But finding out exactly how much you owe is essential for managing and paying off your debt.

In this post:

When Should I Apply For Student Loans

Since student loan applications take time to processand delays can happenits best to start the process early. For federal student loans, this means completing and submitting your FAFSA as close to the Oct. 1 opening date as possible.

For private student loans, consider applying after youve received your financial aid award packages from the schools youre considering. This will help you better understand any funding gaps and how much money you might need to borrow from private lenders. Based on the application and funding timeline discussed above, consider applying for private loans at least two months before tuition is due.

Recommended Reading: Bayview Home Loans

Finding Your Student Loan Balance Or Lender

Private student loan borrowers do not have as many options for viewing their balance, says Van Ostern. The easiest way to do this is to log in to your lender website or app, where you should be able to see all of the details of your loan. If youre not sure who your lender is, you can also check your credit report to gain access to all of the loans that are issued in your name. You can currently access each of your credit reports for free, weekly, through AnnualCreditReport.com.

If you do decide to check your credit report, keep in mind that the credit report wont note any deferment, forbearance or hardship payment options, and it could be a few months behind in showing the total balance due, Van Ostern says.

What Is The Interest Rate On Plan 4 Student Loans

As we explained above, Scottish students used to repay their Student Loans under Plan 1. As part of the move to Plan 4, most of the key components were retained including the way interest is calculated.

This means that, like Plan 1, the rate at which Plan 4 Student Loans accrue interest is usually set in September of each year, and is determined by whichever is lowest between:

- The RPI rate from March of the same year

- The Bank of England base rate plus 1%.

You can to jump back to Plan 1 for a more detailed explanation of how the interest works, but the key point to bear in mind is that the Bank of England base rate plus 1% is currently lower than the RPI rate from March 2021 .

Therefore, the interest rate on Plan 4 Student Loans is 1.1% and that applies whether you’re still studying or have graduated.

Recommended Reading: Usaa 84 Month Auto Loan

Student Loan Forgiveness After 20 Years Will Become The Norm

If youre still paying student loans after 20 years, the Biden administration wants you to know that help is on the way. Student loans arent meant to be a financial death sentence. Therefore, the Biden administration is focused on enrolling more student loan borrowers in income-driven repayment. With income-driven repayment plans such as IBR, PAYE, REPAYE and ICR, student loan borrowers pay their federal student loans based on their family size and discretionary income. As such, borrowers could pay as low as $0 a month. After 20 years, student loan borrowers can get student loan forgiveness for their college student loans.

Why You Should Track Your Student Loans

While it might seem complicated, it is essential to keep track of your student loans and the amount of debt you owe, including knowing how much you borrowed and how much you owe once you add interest. This can be helpful while you are in college, and as you start your budgeting process after graduation. Many options exist for repayment plans, including the following:

- Standard plans: Payments are calculated to guarantee loans are paid off within 1030 years.

- Graduated plans: These are designed to ensure loans will be repaid within a certain amount of time, but payments will increase gradually over time.

- Income-based: These repayment plans calculate your monthly payments based on how much you earn, with higher wages equaling higher payments.

Once you have a solid number to start with, you can begin to create a repayment plan to get rid of that debt as quickly as possible. You can develop a repayment plan that works for your salary and lifestyle and pays down the debt quickly to save you money over time. You can always contact your loan servicer to update your payment plan if your situation changes. This does not have a negative impact on your credit.

Read Also: How Does Capital One Auto Loan Work

Student Loan Repayment Terms Arent Set In Stone

We keep banging on about this, but it bears repeating: Student Finance terms arent set in stone.

This is pretty much the only argument in favour of making additional Student Loan repayments, as while the terms are decent enough right now, they can change at any time and should they change for the worse, you could later regret not clearing your debt earlier.

No Mention Of Student Loan Cancellation Raises Eyebrows

There was one major thing missing from this major announcement: any mention of wide-scale student loan cancellation. The announcement included Bidens accomplishments on student loan forgiveness and his proposal to double the size of Pell Grants. However, the Biden administration remained silent on any plans for wide-scale student loan cancellation, just as it excluded student loan cancellation from its annual budget proposal. Instead, the Biden administration continues to focus on targeted student loan relief. .

Its clear that Biden is focused on improving student loan repayment, increasing access to student loan forgiveness, and directing more student loan relief for millions of student loan borrowers. For student loan borrowers who wont qualify, however, its essential to know that student loan payments are scheduled to restart beginning on September 1, 2022if the Biden Administration doesnt extend the current payment moratorium again. Here are some of the most popular ways to pay off student loans:

You May Like: Bayview Loan Servicing Tucson

Contact Your Schools Financial Aid Office

If you have federal loans that dont show up on the NSLDS, another option is to contact your schools financial aid office. The staff there can look up your past loan information, including what you originally borrowed and who the loan servicer was. With that information, you can contact the servicer to get your current loan balance.