Va Loan Limits By County

Some mortgages backed by the VA no longer have caps on size after Congress passed a law in 2019 law abolishing loan limits. However, many lenders have what the industry calls overlays, meaning eligibility rules that exceed the qualifications set by the VA.

Also, the loan limits remain a factor for veterans with diminished VA loan entitlement who want to use a VA mortgage without a down payment. That includes veterans wanting to hold multiple VA mortgages at the same time or those whove lost a previous VA loan to default.

In those cases, lenders typically follow the conforming loan limits for mortgages acquired by Fannie Mae and Freddie Mac, set each year by their watchdog, the Federal Housing Finance Agency. So, while VA-backed mortgages are securitized meaning packaged into bonds that are sold to investors by Ginnie Mae, not Fannie Mae or Freddie Mac, some of the rules can be the same.

In most of the U.S., the 2022 maximum conforming loan limits for single unit properties is $647,200, an 18.05% increase from $548,250 in 2021. The ceiling loan limit for single-unit properties in most high-cost areas is $970,800 or 150% of the $647,200 loan limit for most single-unit properties.

Cons Of Choosing A Va Mortgage

- They come with a funding fee, which is paid to support the program.

- The funding fee increases after every subsequent use of VA loan benefits. You will pay more in funding fees the second time you borrow a loan.

- The loans could exceed market value.

- The loans are provided only by VA-approved private lenders.

- You cannot purchase a vacation home or an investment property with these loans.

Why Va Loan Limits Dont Restrict How Much You Can Borrow

The Blue Water Navy Vietnam Veterans Act of 2019 eliminated loan limits for VA loans in order to give military veterans more buying power regardless of home prices. The new law also helps military borrowers avoid jumbo loans, which often require higher down payments and more stringent approval guidelines.

Recommended Reading: Interest Rate For Car Loan With 650 Credit Score

Close Your Loan In Under 30 Days

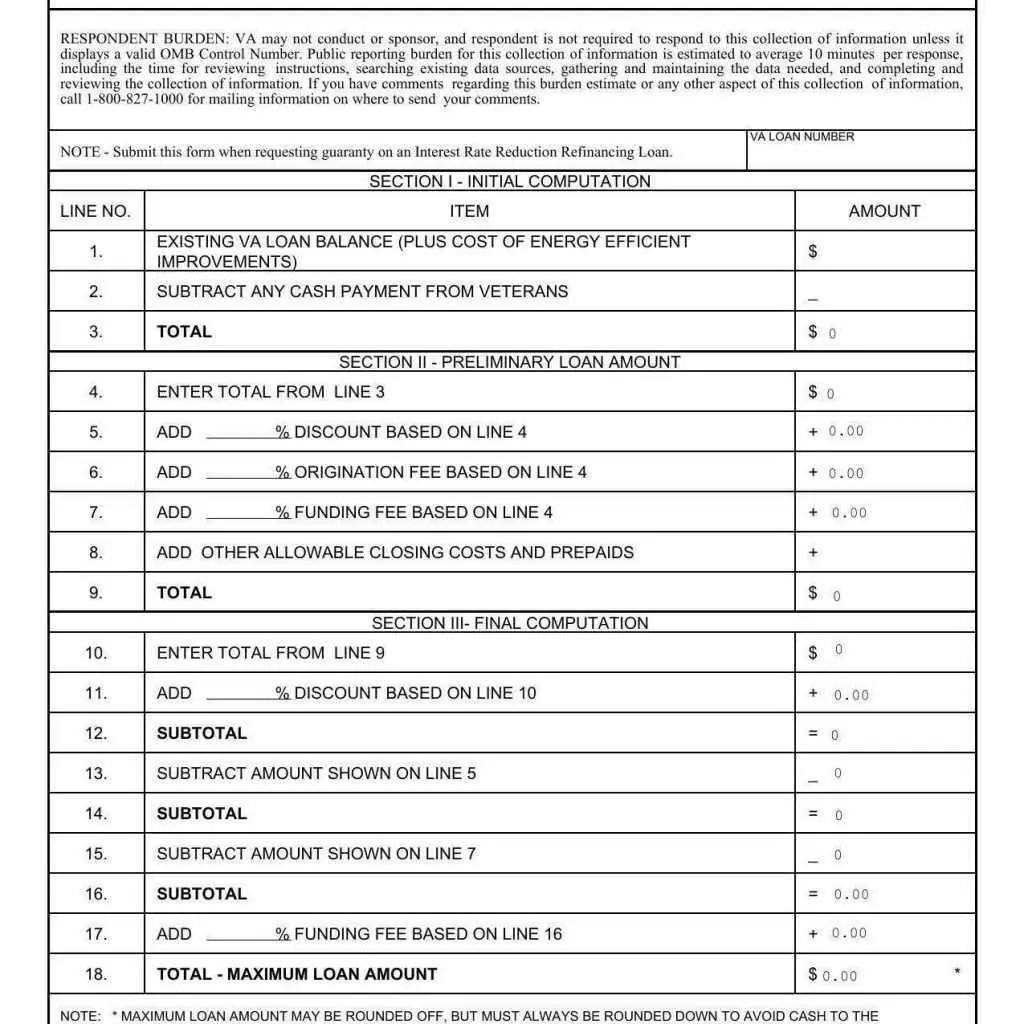

How to calculate VA High Balance Down Payment requirements:

To figure out how much of a VA loan you qualify for, the VA publishes a list of county loan limits every year.

If the Purchase price of your home is under the VA county loan limit, ZERO down payment is required.

Is it possible to go over the VA County Loan Limit?

YES, it is possible to go over the county limit, BUT there will be a down payment requirement.

You will be required to put down 25 cents for every dollar over the VA Loan Limit.

Say you want to buy a home for $650,000 but the VA Loan limit for the county where your home is located is $425,000. That is $225,000 over your county limit. Your down payment would only be 25% of the difference between the two or $225000*.25= $56,250. In this example, that is only 8.6% down. Way less than you will find with any other loan products out there.

A Va Home Loan Is A Benefit Provided By The Department Of Veteran Affairs To Help Service Members And Veterans Build Purchase Or Refinance A Home If You Currently Serve Or Have Served In The Military Its Smart To Find Out If You Qualify For A Va Loan In Washington State Before Moving Forward With Your Purchase Or Refinance Va Home Loans Are Backed By The Department Of Veteran Affairs Meaning That The Loan Is Guaranteed If You Default However The Va Does Not Administer These Loans Mortgage Lenders Do The Main Advantage Of A Va Home Loan Is You Can Put Zero Down And Qualify For Lower Rates Because There Is Less Risk To The Lender With A Va Loan Learn More About Va Loans In Washington State And Find Out If You Qualify By Applying With Griffin Funding

At Griffin Funding, we provide VA loans throughout the state of Washington, including:

- Seattle

- Renton

- Federal Way

Whether you are drawn to Washington State by your love for the outdoors or are relocating for service at one of the local air force bases or naval bases , we can help you find the right VA home loan for your needs. At Griffin Funding, we take pride in helping veterans and their families secure a mortgage for their home.

Recommended Reading: Stilt Personal Loans

Can You Reject A Va Loan

VA lenders make money by approving loans, not denying them, so they will do what they can to get your approval. When they can not, they send what is called an alert for unwanted action. To see also : Why do sellers hate VA loans?. This is an official form and required by law to give you a written explanation of why your loan was not approved.

Can you discriminate against a VA loan?

If you want to buy a home with a VA loan, you can not be discriminated against because of your disabilities at any stage of the process, including viewing, inspecting or otherwise having access to the property as a potential buyer or tenant.

Why would a VA home loan be denied?

The most common reason why VA applications for mortgages are rejected is due to errors in the application itself. Lenders cannot issue loans unless they are sure that your personal and financial details are correct. Before submitting your application, take the time to review each claim you make and the numbers you enter.

Will I Have To Pay The Va Funding Fee

If youre using a VA home loan to buy, build, improve, or repair a home or to refinance a mortgage, youll need to pay the VA funding fee unless you meet certain requirements.

You wont have to pay a VA funding fee if any of the below descriptions is true. Youre:

- Receiving VA compensation for a service-connected disability, or

- Eligible to receive VA compensation for a service-connected disability, but youre receiving retirement or active-duty pay instead, or

- The surviving spouse of a Veteran who died in service or from a service-connected disability, or who was totally disabled, and you’re receiving Dependency and Indemnity Compensation , or

- A service member with a proposed or memorandum rating, before the loan closing date, saying you’re eligible to get compensation because of a pre-discharge claim, or

- A service member on active duty who before or on the loan closing date provides evidence of having received the Purple Heart

You may be eligible for a refund of the VA funding fee if you’re later awarded VA compensation for a service-connected disability. The effective date of your VA compensation must be retroactive to before the date of your loan closing.

If you think you’re eligible for a refund, please call your VA regional loan center at . Were here Monday through Friday, 8:00 a.m. to 6:00 p.m. ET.

You May Like: Usaa Auto Loan Refinance

May I Borrow Extra To Make Home Improvements

Yes. If you have some equity in your home, says Alexandra Hopkin. To fund the improvements, Hopkin advises veterans to explore a VA Cash-Out Refinance Loan. If a home is valued at $250,000 and you owe $200,000 on your mortgage, for example, you can refinance your loan for the full amount of the home’s value, and subtract what you owe to pay off the previous loan. Keep in mind you’ll need to account for any closing costs associated with the refinance loan, but the remainder between your home value and what you owe can go to home improvements. With that in mind, Hopkins does offer this cautionary note. Make sure the transaction doesn’t cost more than it delivers in benefits: “The VA will charge a new funding fee of up to 3.3 percent of the loan this may end up being more costly than necessary to fund improvements,” Hopkin said.

Va Loan Limits Dont Restrict How Much You Can Borrow

If you’re subject to VA loan limits and have found a property you really love and can afford you can still get a VA loan if it’s over the county limit. Its just a matter of coming up with a down payment. The required down payment will be subject to a formula based on your entitlement and home price.

You May Like: Usaa Interest Rates Auto

What Is The Current Va Loan Rate

Loan rates can significantly impact the cost of your loan, especially over the course of 15 to 30 years, so its understandable why you would want to find a set loan rate to compare mortgage costs. However, the VA loan rates in Washington State are constantly changing based on current market conditions. This means that they can vary significantly day-to-day.

Even if you can find generalized mortgage rate listings, that does not always mean that they are indicative of the interest rate you will receive on your VA loan in Washington State. This is because loan rates are also based on personal factors like your FICO score and income.

At Griffin Funding, we aim to offer competitive interest rates that allow you to spend less over the course of your home loan.

May I Have More Than One Va Loan At A Time

No. You can only have one outstanding VA loan at a time, and your VA loan must finance your primary residence not investment property, a business facility or a vacation home. “But once that loan is paid off and the home sold, a new VA loan may be taken out,” Hopkin said. You may also be able to leverage any remaining VA loan entitlement to obtain a new VA loan. Hopkins adds that there is no limit to how many times you can get a VA loan, provided you use the loan to finance the purchase of your primary residence, and you have no outstanding VA loans in your name.

About the Author

Stephanie Taylor Christensen is a freelance writer with more than a decade of experience in the financial services industry. Her work is frequently syndicated on national media outlets including USAToday, Fast Company, Real Simple and Forbes.

Recommended Reading: Is Carmax Pre Approval A Hard Inquiry

The Bottom Line: Entitlement Helps You Understand How Much You Can Borrow With Zero Down

Your VA loan entitlement amount tells you how much of your loan the VA will guarantee.

If youre a first-time VA borrower or youve paid off a previous VA loan and sold the property you used the loan to purchase, you should have full entitlement, which means that the VA will guarantee up to 25% of your loan, with no loan limit.

If you have entitlement tied up in another loan, your entitlement amount will be limited by your countys loan limit and how much of your entitlement has already been used. If you want to borrow beyond this, youll need to bring a down payment to the closing table.

No matter how much entitlement you have available, youll ultimately only be able to borrow as much as a lender is willing to give you. Plus, you want to ensure youre getting a loan your budget can comfortably handle. Rocket Mortgage® has a few different tools you can use to get an idea of how much you can afford.

Ready to start the home buying process? You can apply online with Rocket Mortgage.

Get approved to refinance.

When Do Va Loan Limits Apply

VA loan limits are applied to those with no or partial VA loan entitlement.

How do you know if someone has full or partial entitlement? Luckily, we have the answer to this frequently asked question.

You have full entitlement if any one of the following is true.

- You have never used your VA loan benefits before.

- You have paid the previous VA loan fully and have sold the property.

- You borrowed a VA loan and had a foreclosure but repaid the amount in full.

An applicant will be subject to loan limits if any one of the following is true.

- Your VA loan is still active, and youre paying it back.

- You have paid the previous loan amount in full but still, own the house.

- You refinanced a non-VA loan into a VA loan and still own the home.

- You had a short sale on your previous VA loan and didnt repay it completely.

- There was a foreclosure on a previous VA loan you failed to repay.

- You filed a deed in place of foreclosure for an earlier VA loan.

You May Like: Can I Refinance My Upstart Loan

Va Loan Limits In Washington State

The VA loan limits for 2020 range based on location, however, the standard loan limit is $510,400. The loan limit may extend up to $741,750 in certain areas of Washington State. There are various factors that will impact which loan limits apply to you including where you are buying or refinancing, the cost of the home, and your entitlement status.

Its important to clarify that the Department of Veteran Affairs does not limit how much you can borrow for a home loan. Instead, it regulates the amount you can qualify for without providing money up-front for a down payment.

Does The Va Have Special Requirements For Credit Scores

No. As stated above, it is not necessary to have an excellent score to qualify for VA loans. Instead, different lenders have different requirements for credit scores.

Besides having a minimum score of 620, you must also have enough residual income, an appropriate debt-to-income ratio, and a fair credit history to satisfy the lenders requirements.

Here is how to improve your credit score.

- Pay your bills on time to have a good payment history.

- Do not max out your credit cards.

- Repay any existing debt.

Read Also: How Long Does Sba Loan Take

Apply For A Va Home Loan In Wa

If you are ready to purchase or refinance a home, we can help you secure a VA loan that is optimized for your circumstances. Whether you need a purchase, refinance, or VA construction loan in Washington State, Griffin Funding is here to provide you with competitive loan terms and a streamlined and efficient application process, so you move forward as quickly as possible.

How Can I Restore My Full Entitlement And Avoid Va Loan Limits

If you have partial entitlement because of an existing or previous VA loan, you can restore your full entitlement by settling up with the VA.

Restoring full VA entitlement means restoring your ability to borrow with no money down and without VA loan limits.

To restore your full entitlement, youll need to:

Pay off your previous VA mortgage in full: Then youll need to request a restoration of entitlement. Your lender can do this for you through the VAs online application system, or you can submit the form yourself. But you can only request entitlement restoration once if you keep the house. If you sell the house each time, the VA can restore entitlement again and again.

Repay the VA for its losses: If your previous VA loan ended in foreclosure or a short sale, you must repay the VA for the money it lost on your previous loan.

Read Also: 600 Fico Score Auto Loan

Why Pay Va Funding Fees At All

The VA home loan program is self-sustaining meaning it doesnt use taxpayer dollars or funds from other VA benefit programs. Charging the VA funding fee ensures that the program is maintained for future Veterans and active-duty servicemembers to take advantage of a zero down payment home loan.

This one-time, upfront fee is also relatively small when compared to other zero-down or low-down payment home loans. Those other loan types require mortgage insurance premiums every month for some over the entire life of the loan. This route costs borrowers thousands of dollars more than the typical VA funding fee amount.

What If I Cant Get A Va Loan Right Now

If you had a previous VA loan that ended in foreclosure or a short sale and you cant afford to repay the funds at this time, you wont be able to get a new VA loan right now. However, you may qualify for another government-backed mortgage with 0% or low money down:

- USDA loans: USDA loans are 0% down payment mortgages. Theyre available to low- and moderate-income borrowers in qualifying rural and suburban areas.

- FHA loans: The Federal Housing Administration backs mortgages for borrowers with credit scores as low as 580 and down payments of 3.5%. These mortgages are subject to FHA loan limits, but they are available nationwide and there are no income restrictions, as there are with USDA loans.

Keep in mind that the government keeps record of defaults on any federal debt. That includes other government-backed mortgages and even student loans. Your lender may inform you that you have a CAIVRS alert and youre not eligible for any government loan. If this is the case, check with your lender how long you have to wait to apply.

Read Also: Chfa Loan Colorado

What Does Full Entitlement To A Va Loan Mean

Full entitlement means you do not have an active VA loan and can use your full benefits when applying for a mortgage. You can have full entitlement if youve never used your loan benefit before, if youve paid off a previous VA loan and sold the house, or youve repaid the VA in full after a foreclosure or short sale.

When you have your full entitlement, your Certificate of Eligibility will say âThis Veterans basic entitlement is $36,000.â When you have used your full entitlement, your COE will say âThis Veterans basic entitlement is $0.â

Also Check: How To File Bankruptcy On Car Loan

What Is The Maximum Va For 100% Financing

The current VA loan limit is set at $ 548,250, but may be higher in high-cost areas determined by the VA.

What is the maximum VA loan entitlement?

VA loans are available in most regions up to $ 548,250, but can exceed $ 800,000 for single-family homes in expensive counties. Loan limits do not apply to all borrowers. Your VA loan limit â or how much you can borrow without making a down payment â depends directly on your borrowing rights.

Can you get a 100% VA loan?

VA loans are an exception. Instead of a down payment, VA can finance up to 100 percent of the purchase price of the home you want to buy. And you never have to pay for mortgage insurance.

You May Like: Car Loan Balance Transfer