Conforming Loan Limits By County

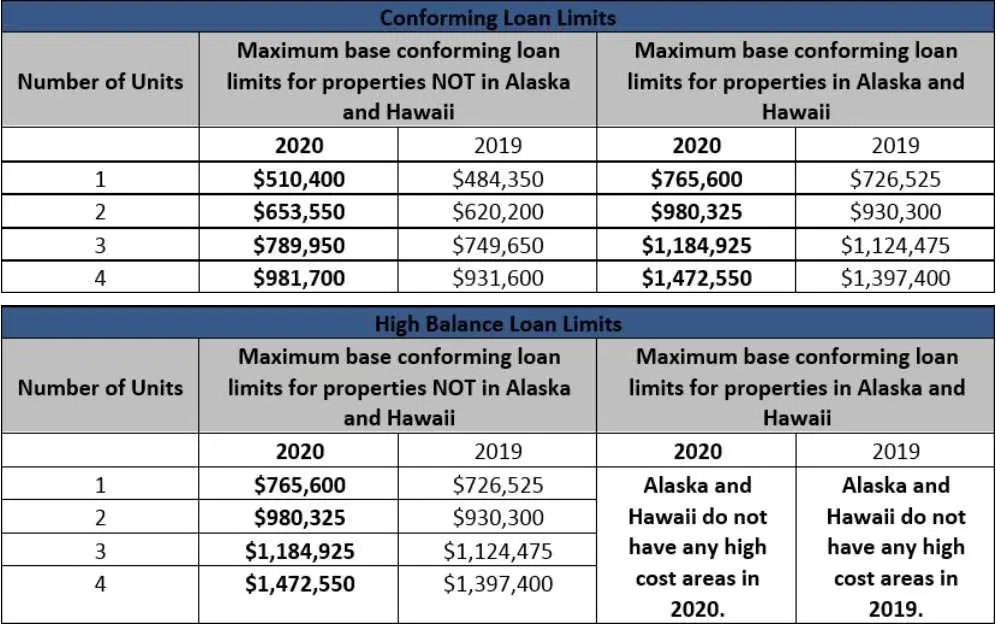

Update: We updated this page on November 30 to include the revised conforming loan limits for 2022. Federal housing officials have increased the limits for most U.S. counties in response to rising home prices. Refer to the spreadsheet below for the new figures.

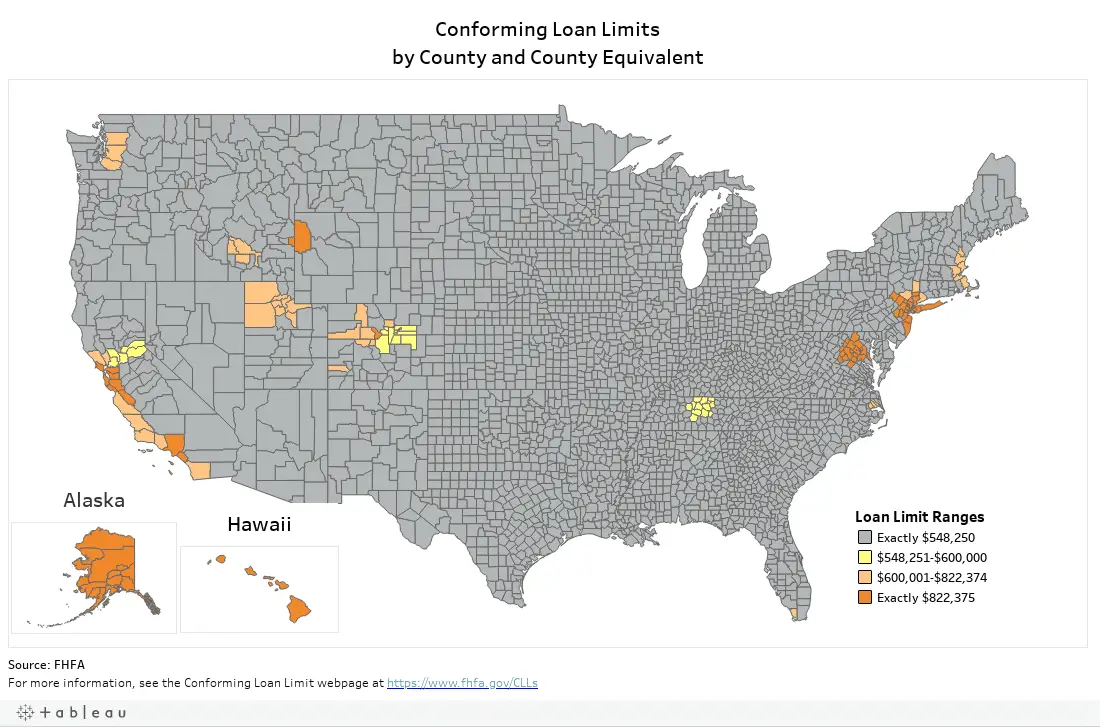

This website provides 2022 conforming loan limits by county, as well as FHA limits. In 2022, the baseline loan limit for most counties across the U.S. will be $647,200. Thats an increase of nearly $100,000 from the 2021 cap of $548,250.

More expensive real estate markets, such as New York City and San Francisco, have conforming loan limits as high as $970,800. Remote housing markets like Alaska, Hawaii and Guam also fall into this high-cost category.

Anything above these maximum amounts would be considered a jumbo mortgage.

The PDF and Excel spreadsheet files above were obtained from FHFA.gov. They are offered here as a convenience to our visitors. You can download them to your computer, in either format, and refer to them as needed.

What Are Todays Conentional Mortgage Rates

Mortgage rates for conventional conforming loans are stellar, which is why so many buyers consider a conforming loan before using jumbo financing.

Get a rate quote for your standard or extended-limit conforming loan. Compare to jumbo rates and piggyback mortgage rates to make sure youre getting the best value.

Is A Conforming Loan The Same Thing As Conventional

The terms conforming and conventional are sometimes used interchangeably. But these two adjectives mean different things, and sometimes they overlap. A conventional mortgage loan is one that does not receive any kind of government insurance, guarantee or backing. This distinguishes them from the government-backed home loan programs like FHA, VA and USDA.

A conforming loan is simply a conventional mortgage product that meets or conforms to the size limits and other criteria used by Freddie Mac and Fannie Mae . Learn more about the distinction between conventional and conforming.

Don’t Miss: How To Calculate Home Loan Amount

We Have Some Wonderful News For Our Home Buyers The Conventional Loan Limit For 2022 Has Been Announced The Conventional Loan Limit For 2021 Was $548250 The New Conventional Loan Limit Has Been Increased To $625000 That Is Roughly A $76000 Increase

So in plain English, what does that mean? Lets say that you wanted to purchase a home for $600,000. Currently, you would have to put almost 10% down in order to keep your loan amount under the $548,250 Conventional loan limit. If you borrowed more than that $548,250 number, you would have to go with a Jumbo loan. Higher rate, higher fees, and more headaches! However, now you would be able to put the minimum down on that same $600,000 property without having to go with a Jumbo loan product. Great stuff!

Here is more great news! Typically, these loan limit changes do not take effect until January 1st of the next year. However, being mortgage brokers at Chissell Mortgage Group, we have some lenders who are already honoring this loan limit change, effectively immediately!

Now, only certain lenders will be accepting these loan limit changes effective immediately, so if you know someone looking to purchase a home, or have any questions regarding the home buying process, please contact us atorStart Your Application.

If you don’t need a conventional loan, you can check out our other loan options.

Qualifications For New Conforming Loan Limits

Thinking of taking advantage of these new conforming loan limits to buy a house? Heres what loans will qualify for these new limits:

- Of course, these limits apply only to GSE purchase transactions

- The property you purchase can be a one-unit, owner-occupied house, a second home, or an investment property

- The new limits apply to new submissions only

Thats pretty much it! Theyre called conventional loans because theyre, well, pretty conventional, and generally most home buyers will qualify.

Read Also: What Is Best Loan For Home Improvement

How Are They Determined

The methodology for creating these limits is outlined within the Housing and Economic Recovery Act of 2008, or HERA. This act requires the Federal Housing Finance Agency to establish and maintain an index for tracking average home prices in counties across the country. In short, HERA ties loan limits to median home values.

In most cases, the conforming loan limit for a particular county is set at 115% of the median home value for the area. It cannot, however, be more than 50% above the baseline mentioned at the top of this page.

Conventional Loan Limits In 2022

In 2022, the baseline loan limit is $647,200. So you should be able to borrow at least that providing your credit and personal financial situation is strong enough to justify such a loan.

That figure is for buying a single-family home in an area with average or lower-than-average home prices. If youre looking to buy multi-family housing in such an area, the maximum loan limits are higher depending on the number of units:

- Two units: $647,200

- Three units: $647,200

- Four units: $647,200

But its not just the number of units that can increase these loan limits. If youre buying in a county where home prices are expensive, you may be eligible for a higher limit.

Read Also: Are Fha Loan Rates Higher Than Conventional

How Do You Qualify For A Conventional Loan

A lot of home shoppers think its too hard to qualify for a conventional mortgage, especially if their financial situations arent perfect. But thats not really the case.

Just like with a government-backed loan, qualifying for a conventional loan requires you to prove:

- You make enough money to cover monthly payments

- Your income is expected to continue

- You have funds to cover the required down payment

- You have a good credit history and decent score

True, the standards to qualify for a conventional loan are slightly higher than for an FHA or VA loan. But theyre still flexible enough that most homebuyers are able to qualify.

Other Advantages Of Conforming Loans Versus Jumbo Mortgages

Conventional Loans offer much looser credit requirements than Jumbo Mortgages. Conventional Loans are called Conforming Loans. This is because they need to conform to Fannie Mae and Freddie Mac mortgage lending guidelines. Although Conventional Loans are private loans originated and funded by banks and private mortgage lenders, these lenders do not want to hold them in house.

Read Also: What’s The Lowest Auto Loan Rates

The 20% Down Payment Myth

Where does the myth about the 20% down payment requirement come from? Probably from shoppers who want to avoid paying private mortgage insurance premiums.

When you put less than 20% down on a conventional loan, your lender will require private mortgage insurance . This coverage helps protect the lender if you default on the loan.

PMI does increase monthly mortgage payments. But thats OK if it allows you to get a conventional loan with a down payment you can afford.

Also note that conventional PMI can be canceled later on, once your home reaches at least 20% equity. So youre not stuck with it forever.

Conforming Versus Jumbo Mortgages

Lenders are stuck holding these loans in their portfolios. Fannie Mae and Freddie Mac are private corporations owned by shareholders but are backed by the federal government. This is the reason they call Fannie Mae and Freddie Mac government-sponsored enterprises, or GSEs. Jumbo Mortgages do not have set Lending Guidelines. Each Jumbo Mortgage Lenders have their own Lending Requirements, unlike Conforming Loans.

Recommended Reading: How Does An Auto Loan Affect Your Credit Score

When Should I Start Preparing To Qualify For A Mortgage With A Lender

Applying for a mortgage with the 2022 mortgage limits and Gustan Cho Associates is an easy process. Technology is a huge factor in the mortgage industry and has simplified mortgage applications. We are here to assist you seven days a week. The first step to applying for a mortgage is to call Mike Gracz on 630-659-7644 and have a one-on-one customized mortgage consultation. You and Mike will go over everything from your credit profile, available down payment, monthly budget, and the timeline for closing on your new home.

Why Understanding Conforming Loan Limits Is Important

As a real estate investor, understanding the conforming loan limits each year may help you allocate capital more strategically. To make the most amount of money, you want to invest in real estate where there is the most demand. Therefore, the most amount of real estate demand should be up to the conforming loan limits plus a down payment percentage.

In other words, given the baseline conforming loan limit for 2022 is $647,200, we can assume with high certainty that single-family homes priced up to $647,200 will get the most favorable mortgage rates. If we assume a 20 percent down payment, we can estimate that almost all homes priced up to $809,000 will receive the most favorable mortgage rates.

For higher-cost areas, the most amount of demand will be for homes between $970,800 to $1,213,500. Of course, as we get to the upper bands of $809,000 and $1,213,500, demand will decline slightly as not everybody is able to put down 20%.

Strategically, for 2022, you would then peruse Zillow or Redfin or the various real estate crowdfunding platforms for opportunities up to $809,000 and up to $1,213,500, depending on the area.

Don’t Miss: What To Do If Your Home Loan Is Denied

Is A Jumbo Loan Right For You

Now that you know more about jumbo loan limits, you can begin to determine if its your best choice for a mortgage. Youll want to consider whether you will meet the requirements for a jumbo loan and if you will be able to handle the larger costs associated with a bigger mortgage.

If you are in the market for a bigger home, you might also be in the market for a jumbo mortgage. So, as you conduct your home search, keep an eye on current jumbo loan limits and possible changes to jumbo loan limits for 2023. Talking to a jumbo loan expert can help you decide if you should go big with your mortgage in order to go home.

Interested in a jumbo loan with Ally Home? Well walk you through everything you need to know.

This chart below shows 2022 jumbo loan limits in U.S. counties and territories with conforming loan limits above the standard $647,200.

| State/Territory |

|---|

What Could This Mean For Borrowers

An increase in conforming loan limits will enable more homebuyers purchasing homes with a higher sale price to enjoy the benefits of a conforming mortgage loan without needing a jumbo loan.

While jumbo loans can be adapted to meet your financing needs, they often require stricter qualifying information, such as higher credit scores, higher interest rates and are beyond traditional funding limits as they arent currently backed by Fannie and Freddie.

Potential benefits of qualifying for traditional, conventional loan programs include access to financing at lower rates, lower down payments and lower credit score requirements.

Why apply with WCM?

At Wyndham Capital Mortgage, were tuned in to the needs of our borrowers during this time and welcome the increase in loan limits as an opportunity to better serve our homebuyers while rates are still at historic lows.

With more than 20 years of tenure, we understand that when it comes to purchasing a home, youre making one of the biggest purchases of your life and you deserve a transparent, trustworthy and unique mortgage experience that could save you both time and money.

At WCM, were built and equipped to take on different experiences and different mortgages, so customers can be certain they will get the top-notch customer service they deserve.

Don’t Miss: How Much Interest Will I Pay For Student Loan

How To Start The Mortgage Qualification And Pre

After your one on one mortgage consultation, Mike will pair you with a licensed loan officer in your state. Your loan officer will send you an application link to start the process. That loan officer will request the required documentation based on your sources of income and loan product. Once you send in the required documentation and your loan officer has your credit report verified, you will then be able to go over specific qualifications. Based on your debt to income ratio, credit score, and down payment available, a preapproval letter will be issued. If for some reason you do not qualify today, your loan officer will come up with a customized financial plan to qualify for a home as soon as possible. Buying a home is a big step and we want to make sure you buy the home of your dreams and not settle for anything less. The team at Gustan Cho Associates has worked with many clients for well over a year before they buy the right home for them.

Rising Home Prices Push Limits Higher

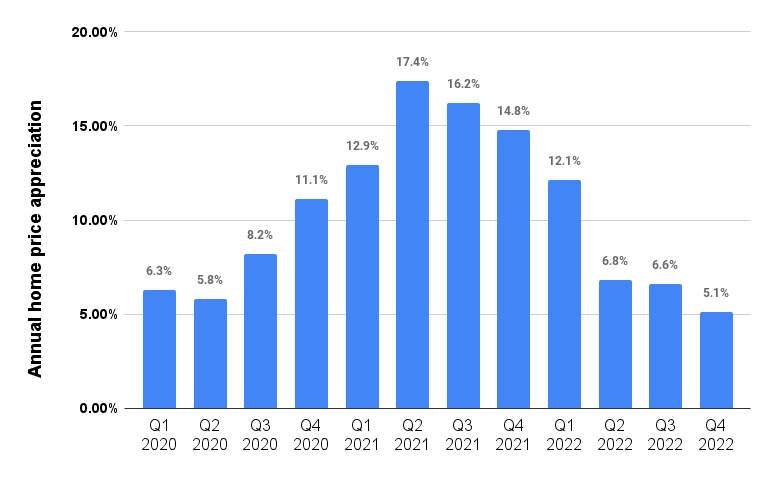

Each year, the FHFA uses its House Price Index report to determine how much to raise conforming loan limits. This year, the agency found that home prices rose 18.05% annually from the third quarter of 2020 to the third quarter of 2021, according to its expanded-data HPI.

This led to an unprecedented increase in conforming loan limits. The FHFA increased the limits by 7.5% for 2021 and had previously only raised the ceiling by a total of $131,250 for all years combined since 2017, which was when the FHFA raised limits for the first time since the Great Recession.

“Earlier today, FHFA announced the Conforming Loan Limits for 2022,” FHFA Acting Director Sandra Thompson said on Tuesday. “Compared to previous years, the 2022 Conforming Loan Limits represent a significant increase due to the historic house price appreciation over the last year. While 95% of U.S. counties will be subject to the new baseline limit of $647,200, approximately 100 counties will have conforming loan limits approaching $1 million.

“FHFA is actively evaluating the relationship between house price growth and conforming loan limits, particularly as they relate to creating affordable and sustainable homeownership opportunities across all communities,” Thompson said.

You May Like: Where Can You Get An Fha Loan

Loan Limits On Government And Conventional Loans: 2022 Mortgage Limits On Fha Loans Take Effect January 1st 2022

If you already have a mortgage loan in process that could be outside of the 2021 loan limit but inside of the 2022 limit, you will need to start the transaction over. A new loan file must be disclosed to you. As mentioned above, if this is an FHA mortgage loan, you will need to apply after the new year to utilize the higher limits. The case number cannot be assigned down the road.

Shop Around With At Least Three Different Lenders

When youre shopping for a mortgage, its important to get personalized rate quotes.

Published rate averages are often based on the perfect applicant one with great credit and a large down payment. Your rate might be higher or lower.

It pays to get at least three written quotes from different lenders, no matter which loan term or loan type you choose. According to one government study, applicants who shopped around receive rates up to 0.50% lower than non-shopping.

Get a conventional rate quote based on your information not on the information of an average buyer.

Don’t Miss: Is It Easy To Get Loan From Credit Union

Fha Announces New Single Family Title Ii Forward And Home Equity Conversion Mortgage Loan Limits For 2022

WASHINGTON – The Federal Housing Administration on Tuesday announced new loan limits for calendar year 2022 for its Single Family Title II forward and Home Equity Conversion Mortgage insurance programs. Loan limits for most of the country will increase in the coming year resulting from robust house price appreciation, which is factored into the statutorily mandated calculations FHA uses as part of its methodology for determining the limits each year. The new loan limits are effective for FHA case numbers assigned on or after January 1, 2022.

The increase in loan limits, commensurate with the increase in home prices, will allow qualified individuals and families to continue to access FHA-insured mortgages to achieve affordable home financing, said Principal Deputy Assistant Secretary for Housing and FHA Lopa Kolluri.

FHA is required by the National Housing Act , as amended by the Housing and Economic Recovery Act of 2008 , to set Single Family forward mortgage loan limits at 115 percent of area median house prices, subject to a floor and a ceiling on the limits. In accordance with the NHA, FHA calculates forward mortgage limits by Metropolitan Statistical Area and county.

To find a complete list of FHA loan limits, areas at the FHA ceiling, and areas between the floor and the ceiling, visit FHA’s Loan Limits Page.

Loan Limits On Government And Conventional Loans: No Maximum Loan Limit Cap On Va Loans

As most veterans are aware, there are no longer mortgage limits for VA mortgage lending. Blue Water Navy Vietnam Veterans Act of 2019got rid of loan limits at the beginning of 2020. President Donald Trump signed this act into law in July 2019. However, VA entitlement is still important for VA mortgage lending. New loan limits for each county will go into effect after January 1, 2021. Entitlement is calculated based on the county limits which will go into effect on this date. Although the VA has not officially announced the maximum guarantee amount for these transactions, any loan needing to use the new loan limits must close on or after January 1, 2021. For more information on entitlement and VA mortgage lending, please call Mike Gracz at 630-659-7644.

Also Check: What Can I Use Ppp Loan For