How To Apply For A Personal Loan With A 600 Credit Score

If youre ready to apply for a fair-credit personal loan, follow these four steps:

Its also a good idea to consider how much a low interest personal loan will cost you over time. You can estimate how much youll pay for a loan using our personal loan calculator below.

Enter your loan information to calculate how much you could pay

Check Out: Installment Loans

Disadvantages Of Avant Personal Loans

- High origination fees

- Higher-than-average interest rates

- No co-signers allowed

Through Avant, just like with any personal loan platform, consumers will be charged an origination fee, which is something like an administrative expense. If you miss a monthly payment, those fees can also really add up: $25 for each payment missed, and $15 for every dishonored payment, like a bounced check or an overdrawn account.

At roughly 4.75%, Avant is certainly not the most expensive out there some lenders charge as much as 10% but it could still tack on quite a bit on to your final bill, depending on the amount borrowed. Its also important to note that some personal loan platforms charge no origination fees at all.

Avant is certainly a great source of funding for those with poor to fair credit, which is an advantage of the service, but for this reason, personal loans from Avant can sometimes be quite high, as much as 35.99% depending on the borrowers credit score.

For a fair credit score, though, interest rates from Avant typically hover right around 10%. With less than stellar credit, its difficult to get a loan in the first place, but its important to be aware that for what you lack in a credit score, Avant makes up for in their interest rates

Thats pretty typical for most personal loan platforms, though.

So whats the bottom line: is Avant good for personal loans?

That answer is coming up next.

Where Can I Get An Installment Loan With Bad Credit

Some lenders will provide installment loans for bad credit. Some banks and credit unions can approve loans for customers or members with bad credit. One of the more common ways is to apply for installment loans with bad credit is online. Online lenders usually have less strict requirements compared to traditional banks and credit unions. Some online lenders can consider borrowers with lower credit scores. Some lenders that have minimum credit scores as low as 560 are LendingPoint, Upstart, Upgrade, and Universal. Other lenders like OneMain and Oportun dont have a minimum credit score.

If you have bad credit and need an installment loan, it is important that you research companies before accepting loans. You will want to make sure they have reasonable rates, fees and are legitimate lenders.

Don’t Miss: Can I Refinance My Car Loan With The Same Lender

What Are The Minimum Credit Requirements To Receive A Loan

Borrowers on Upstart must have a minimum FICO or Vantage score of 600 as reported by a consumer reporting agency. Note, we do accept applicants with insufficient credit history to produce a FICO score.

In addition, there cannot be any material adverse change in your credit report from the time the loan was offered to you and your funding. Material changes include significant drops in your credit score or additional debt obligations. If this occurs, your loan approval will be withdrawn.

Meets the minimum debt to income requirement that total monthly debt payments listed each of the consumers credit report not including rent or mortgage must not exceed 45% if the applicant resides in Connecticut, Maryland, New York or Vermont, and 50% in all other states, of projected pre-tax income except that such requirement will not apply to applicants that have been accepted to one of our partner institutions that provides vocational training

No bankruptcies on any of their consumer reports within the last 12 months

No public records on any of their consumer reports within the last 12 months, unless the public records consist only of paid civil judgments or paid tax liens

You must also not have on your report any accounts that are currently delinquent.

You must have fewer than 6 inquiries on your credit report in the last 6 months, not including any inquiries related to student loans, vehicle loans, or mortgages.

Name: TransUnion

Address: P.O. Box 2000, Chester, PA. 19022

We’ve Got An App For That

Manage your personal loan account right from your phone with the Avant mobile app.

Google Play and the Google Play logo are trademarks of Google LLC.Apple, the Apple logo, iPhone, and iPad are trademarks of Apple Inc., registered in the U.S. and other countries and regions. App Store is a service mark of Apple Inc.

You May Like: How To Refinance An Avant Loan

Avant Personal Loans: 2021 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Who Should Get An Avant Loan

Although Avant loans have a relatively high APR and charges fees, it does have three big points in its favor: relatively low credit score requirements, the ability to check your rate without a hard credit inquiry, and fast funding.

Avants typical minimum credit score requirement of 580 is at the very bottom of the fair range, according to Experian. But the company may also provide products for people with credit scores as low as 500, which is solidly in the poor credit score range. If your credit score keeps you from qualifying for a loan with other lenders, Avant might be able to help. And the ability to check your rate online without your credit score being affected by a hard credit inquiry makes looking into an Avant loan risk-free, whether or not you ultimately decide to use them. However, be aware that even though Avants minimum credit score requirements are relatively low, having a lower credit score will likely mean having a higher interest rate.

Avant also offers fast funding, with loans typically being funded within one business day after the loan is approved. Because of this, Avant loans can be a good option for emergencies if you need to cover an unexpected expense like urgent repairs or medical expenses quickly. But if you need a personal loan for something that can wait, like debt consolidation or planned expenses, you may find lower rates and fewer fees with other lenders.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Borrowers Are Saying About Avant

Avant reviews on LendingTree reveal that the lenders personal loan borrowers are pleased with their experience. The loan servicer has received 4.6/5 stars across more than 2,600 reviews. Further, 95% of reviewers would recommend the product to others.

Although a few customers said that they were displeased about their interest rate or encountered a service issue, most Avant personal loan reviews are extremely positive. Many borrowers praised Avant for its quick application process and loan funding, good customer support and overall transparency regarding loan terms.

Andrea from Fort Atkinson, Wis., had this to say about her experience with Avant personal loans: Easy, fair, fast, and most important very clear in communication of terms and rates. Fee is not insignificant but the disbursement only took two days. Customer service was pleasant and knowledgeable.

Due to their convenience, the company is getting repeat business. Marsha from Roanoke, Va., said, This is my second loan with Avant and this go around was even easier than the first time. I highly recommend Avant.

How Do You Get A $5000 Personal Loan With Bad Credit

Before you apply for credit, you should check your credit score. This will give you an idea of what you can expect in terms of the possibility of approval and the interest rate. If you decide to proceed, you should make sure you have proof of your identity such as a drivers license or passport, proof of your address like a lease agreement or utility bill, and proof of your income and employment. When people have bad credit, lenders will often do a thorough credit check before extending a loan.

Also Check: Becu Lienholder Address

Avant Review: Personal Loans For People With Low Credit Scores But You’ll Pay A High Interest Rate

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective.

- Avant for emergency expenses, car repairs, vacations, and more.

- Avant loan amounts range from $2,000 to $35,000, but exact limits vary by state.

- You have a good chance of qualifying for an Avant personal loan

The Lender Doesnt Have A Secure Website

Some scammers may attempt to steal your information through their website. When researching bad-credit loans, be sure to check that a websites URL has the letter s following http, as well as a padlock icon on pages that ask you for your financial information. If these safety indicators are not in place, a scammer may be attempting to take advantage of you.

Don’t Miss: Drb Student Loan Refinancing Review

How Can I Get An Installment Loan With Terrible Credit

Getting an installment loan when you have terrible credit can be difficult. Knowing your credit score should help you look for lenders that can be willing to work with you. If you cant qualify for a loan on your own, there are some things you might be able to do to help you qualify. If you can secure the loan with an asset, the lender may approve your request. Adding a cosigner can help, too, since the lender will have another borrower to make loan payments if necessary. Getting someone to guarantee the loan can also help. Many lenders will approve guaranteed installment loans for bad credit.

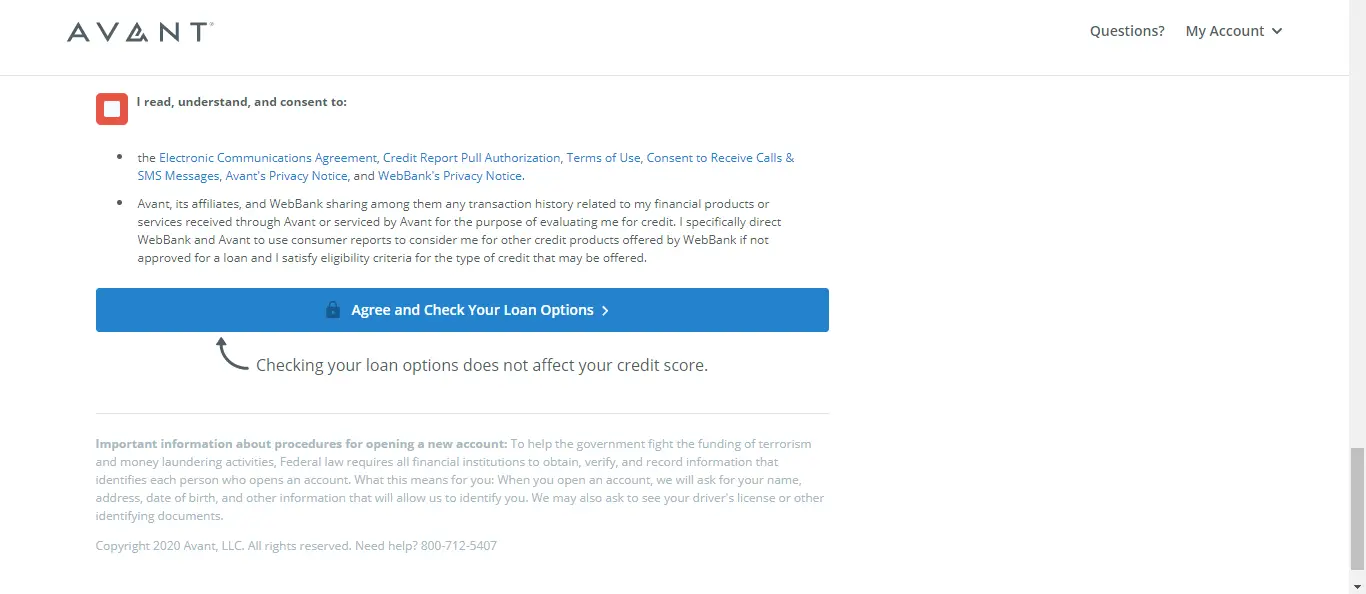

Applying For A Personal Loan From Avant

Avant prides itself on having a simple and fast online personal loan application process. To begin, fill out a short form on the Avant website to view your loan options. Youll need to provide basic information, such as:

- Self-identifying information, like your Social Security number

- Information on your personal financial situation

- How much you need to borrow and why

Avant will perform a Soft Pull on your credit, which doesnt impact your credit score. Afterward, it will present you with loan options for which you may qualify, if any.

Next, youll choose the option that best fits your situation and will formally apply for that specific loan. Avant will run a hard credit check at this time to assess your creditworthiness and may require you to submit documentation to verify statements made in the application.

Though Avants goal is to render the fastest decision possible, the speed of the loan application process can vary. If you need to provide additional information to Avant, you can upload the required documents to their online dashboard or send them via email. You can also track the status of your application on the dashboard. If your application is approved, you could receive your funds as soon as the following business day.

Don’t Miss: How Can I Get An Rv Loan With Bad Credit

How Are Installment Loans Different From Payday Loans

Installment loans are larger amounts, are repaid over many months or years with scheduled payments, and the interest rate doesnt usually exceed 35.99%.

Payday loans typically dont exceed a few hundred dollars. The payday lender expects the loan plus interest and fees to be repaid within a couple of weeks. However, interest rates on payday loans can easily exceed three digits-some are as high as 400% APR.

How does a bad credit loan work?Bad credit loans usually dont work differently than good credit loans, but more documentation may be required. Lenders may request proof of income, employment, residency, and so forth. In addition, bad credit loans may vary in the following ways:

The rate will likely be higherThe amount approved might be lessThe amortization period might be shorterThere can be origination fees The lender might require security or a cosigner

Avant Loans Review: My Experience Using Avant Loans

Ranking

7.3/10

Avant is an online loan servicer catering to borrowers with fair credit. They deliver funds quickly, but high interest rates and mixed customer reviews might make borrowers think twice.

Review of: Avant| Reviewed by: Amy Bergen| Publish date: Oct. 6, 2020

Editor’s Note –

If you need a quick loan to fix up your car, a loan to fix the leak in your bathroom, or some extra cash to pay some unexpected medical debt, a personal loan is likely what youll want to look for.

Personal loans are easy to qualify for if you have stellar credit. But borrowers with okay, but not great credit scores have an increasing number of options, too.

Avant is one online loan servicer catering specifically to lower-credit borrowers, with fast funding for all.

Recommended Reading: Where To Refinance Auto Loan

Avant Vs Best Egg Personal Loans

You’ll pay a late fee with both loan providers Avant’s late fee depends on which state you live in, while Best Egg’s late fee is $15. Both have additional fees baked into the cost of the loan. Avant charges an administration fee of up to 4.75% of your loan amount, while Best Egg’s has an origination fee ranging from 0.99% to 5.99%.

Avant also has a lower minimum credit score guideline than Best Egg though both companies have relatively low minimums. As a result, Avant might be the better choice if your credit is toward the lower side of “fair.”

You’ll receive your funds roughly in the same amount of time with both companies. Avant claims most customers will receive their funds the next business day, and Best Egg says the majority of customers will get their money within one to three business days.

Can You Get A $5000 Loan Online

Most lenders will offer an online application process. In some cases, you can complete the entire process from start to finish online. Shopping online for a $5,000 personal loan online can be a smart idea, especially if you use a platform like Acorn Finance. Acorn Finance allows consumers to check personal loan offers from several top national lenders with no impact to their credit score.

Having that kind of access is beneficial for borrowers because it allows them to review many offers at the same time to see which loans come with the best terms, interest rates, and monthly payments for their financial situation.

Don’t Miss: Can You Transfer Car Payments To Another Person

How Can I Get A $5000 Loan

There are several ways to get a $5,000 loan including a personal loan or a cash advance on your credit card. If you are deciding between these two options, then almost always it is better to secure a personal loan than to take a cash advance on your credit cards.

If you are looking to get a $5,000 personal loan, you should check offers at Acorn Finance. Personal loans can be used for just about anything from debt consolidation to home improvements. You will soon discover that most lenders can offer personal loans, especially for $5,000. This means you should compare offers before signing the dotted line. Acorn Finance makes comparing personal loan offers hassle-free. You can check offers with no impact to your credit score at Acorn Finance.

Avant Vs Other Personal Loan Lenders

Avant isn’t your only source for a personal loan. There are a number of other lenders that offer loans with similar terms.

Doing some comparison shopping is always important to make sure you find a loan that’s going to be the best fit for you.

Here are other lenders to consider as you conduct your personal loan search:

Read Also: Can I Refinance My Car Loan With The Same Lender

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.