Personal Guarantees For Business Loans

Even if your business structureâlike an LLCâtypically shields you from liability, you will likely need to put your personal assets on the line if you qualify for an SBA loan.

If youâre approved for a loan, and you control 20% or more of your business, youâll need to sign a guaranty. In the event that youâre unable to make loan payments, you become personally liable.

Not sure an SBA loan is right for you? Thereâs a variety of small business loans you can apply forâas well as alternative financing options, like lines of credit and merchant cash advances. Make the right choice for your business with our guide to getting a small business loan.

Write A Great Business Plan

Lenders want to see that your business will be successful, so you can pay them back. When you provide a comprehensive business plan, you prove to them that youâve got your eyes set on the future, and any loan youâre approved for will be put to good work.

Any good business plan needs to include:

- An explanation of your product or service, as well as your value proposition

- A thorough analysis of your competition

- An outline of your marketing strategy

- Three to five years of financial projections

- A detailed explanation of how you plan to use your loan, should you be approved

Ask yourself:

- Why is your business unique?

- What makes your business important?

- Where do you see yourself growing?

- Whatâs the most exciting thing about your business?

The business plan is your chance to show off to lenders. The better you can communicate your value, the more likely you are to be approved.

Basic Sba Loan Requirements

For the most part, youll find that SBA loan requirements are going to be similar across the spectrum of loan products. There are certain umbrella guidelines that cover most SBA loans for example, most SBA loan products will require businesses to be for-profit, and meet certain size requirements . Below are some notes to keep in mind when it comes to navigating the different types of SBA loan options.

|

You May Like: What The Highest Apr For Car Loan

Who Sba Loans Are Right For

Whether your business needs working capital, real estate, or equipment, an SBA loan can provide the financing you need. One caveat to SBA loans is that you must not be able to obtain financing through other conventional lending sources.

Businesses that may benefit from an SBA loan include:

- Businesses unable to obtain credit elsewhere: Your lender is required to certify to the SBA that you cannot get some or all of the funds youve requested from other nongovernment sources under reasonable terms without assistance from the SBA.

- Companies in need of working capital: SBA loans can be used to finance the working capital needs of small businesses.

- Businesses making a commercial real estate purchase: SBA 7 and SBA 504 loans can be used to finance owner-occupied commercial real estate.

- Small businesses needing equipment financing: For businesses in need of equipment, an SBA loan can be an affordable means of financing.

Navs Final Word: Sba Loan Requirements

As a small business owner, you need to stay apprised of financing options so that, should the day come that you want to grow your business, you know the best financing solution for your needs.;

Even if right now you dont plan to apply for an SBA loan program, its still a wise idea to work on building your credit and organizing your finances so that, down the road, if you decide to apply, you are a shoo-in for a loan with a great rate.

This article was originally written on July 2, 2019 and updated on January 27, 2021.

You May Like: What’s The Smallest Car Loan You Can Get

How To Apply For An Sba Real Estate Loan

Several SBA programs offer real estate loans, most commonly through the 7 and 504 programs. While the application is similar to other 7 loan applications, your business needs to take some extra steps to get all of the documentation together like getting the property appraised and evaluated for potential environmental issues. On top of the other eligibility requirements, youll also need to:

- Make a minimum down payment of 10%

- Have plans to occupy at least 51% of the property

When it comes to documents, lenders typically ask for the following:

- Real estate purchase agreement

- Rent rolls for the new property

- Leases for tenants of the new property

- Remodeling or construction plans

- A report on the propertys condition

Your Business Must Meet The Basic Requirements

You must know SBA does not give out a loan. Strange, but true! What they do is collaborate with Individual Lendersto distribute loans to small businesses by setting guidelines in line with the guidelines of its partnering lenders and community development organizations.

Now you know how it works. That is why our first recommendation is for you as a small business owner to meet these guidelines so that you can qualify for an SBA loan. Other requirements include businesses should be for-profit, a business must be based in the United States, and importantly it must be a smallbusiness to start.

Business ownersare expected to have invested their resources and time into the business. Also, theymust have exhausted other lending options, as well asestablished the ability to repay the loan over a reasonable period.

In addition, a business owner must have invested time and money into the business, exhausted other lending options, and demonstrates the ability to repay the loan over a reasonable period.

You May Like: How To Take Loan From 401k To Buy House

The Sba 7 Loan Program

What itâs for: General financing to expand your working capital.

Amount: Up to $5 million

2019 Rate: 7.75%â10.25%

Term: Up to 10 years or 25 years

Think of the SBA 7 as the Swiss Army knife of loans. It covers just about any need a small business owner might have. That includes hiring new employees, investing in marketing, expanding to new locations, developing new products and services, making renovations, and more. It can also be used to refinance debt, so you make lower monthly debt payments.

Personal Character And Background

To qualify for an SBA loan, youâll need to provide information about your personal background, including previous addresses, your citizenship status, and your criminal record.

Having a criminal record doesnât automatically disqualify you from SBA financing, unless the crime is a felony of âmoral turpitudeâ . However, the lender will evaluate your application with more scrutiny. The SBA asks for your citizenship status because only U.S. citizens and permanent residents can qualify.

For SBA 7 loans, microloans, and CAPLines, youâll provide this information using SBA form 1919 or SBA form 912. Lenders usually supply their own forms for 504 loans.

Don’t Miss: What Credit Score Is Needed For Best Auto Loan Rates

Targeted Eidl Program With The Coronavirus Relief Bill

A new sub-section of the SBA Disaster Loans program was created by the Coronavirus Relief Bill, which was signed by President Trump on December 27, 2020. The bill targets small businesses in areas that have been particularly hard-hit by the pandemic, aiming to get funds to those who need them most.;

|

Coronavirus Relief Bill Programs |

|

|

|

| Funding; |

|

| Tax-free and does not reduce PPP loan forgiveness eligibility | Tax-free and does not reduce PPP loan forgiveness eligibility |

Are You Eligible For A Sba Loan

SBA loans are a great source of funding for startups. Yet, they arent designed for any startup either.

Why? SBA loans are a form of debt like any other. This means that you will have to repay it in the future. As most startups are loss-making in their early years, most startups cannot really raise debt but instead equity.

If you need a refresher on debt vs. equity for startups, and which one is best for you, make sure to read our article here.

So, before you apply for one of the the different SBA loans out there for your startup, make sure you are eligible. First, you will need to show your startup generates positive cash flows, or will do so soon in the future .

Recommended Reading: Can You Add Onto An Existing Loan

How Can You Improve Your Credit

If youre trying to improve your credit to qualify for an SBA loan, you should seek to optimize both your business and your personal credit. Because your SBSS score factors in your personal credit, start there.;

You can improve your personal credit score by:

- Paying all bills on time

- Keeping your balances on your credit cards low, ideally aiming for no more than 10% to 20% of your credit limits

- Maintaining credit accounts for as long as possible rather than closing them

- Applying for a diverse mix of credit which includes installment loans

- Avoiding applying for credit too frequently

- Following cybersecurity best practices to protect yourself from identity theft

- Monitoring your credit report for negative items or signs of identity theft

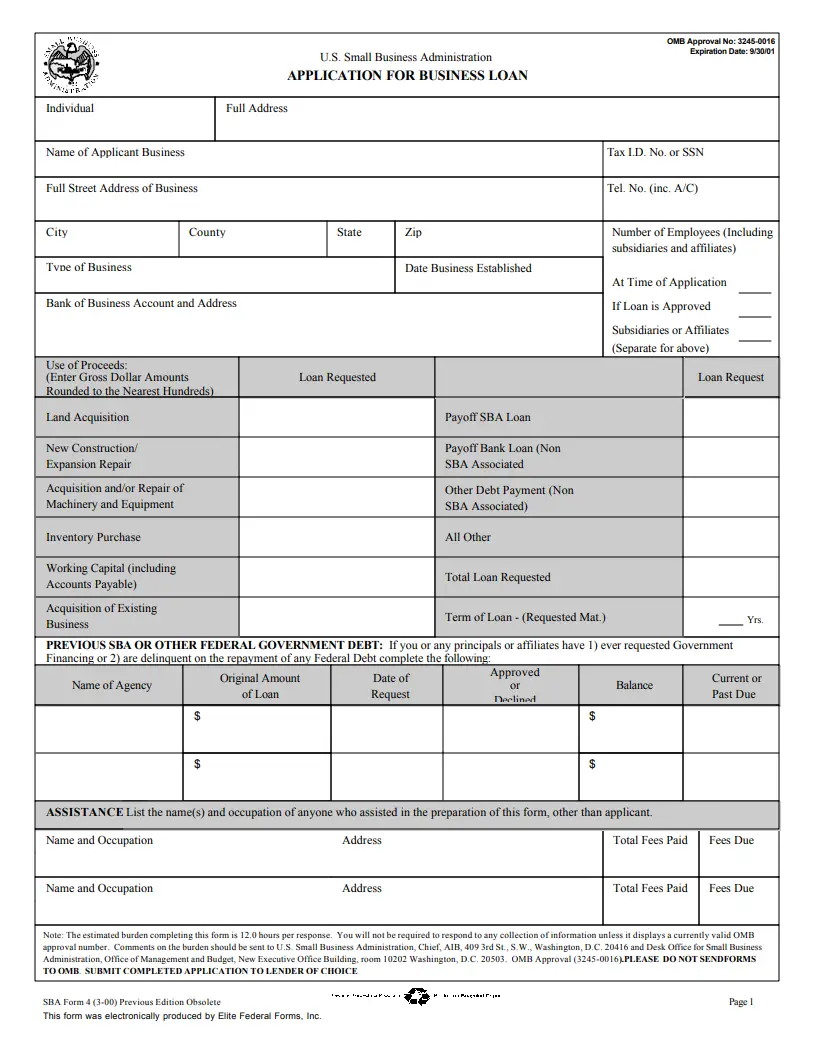

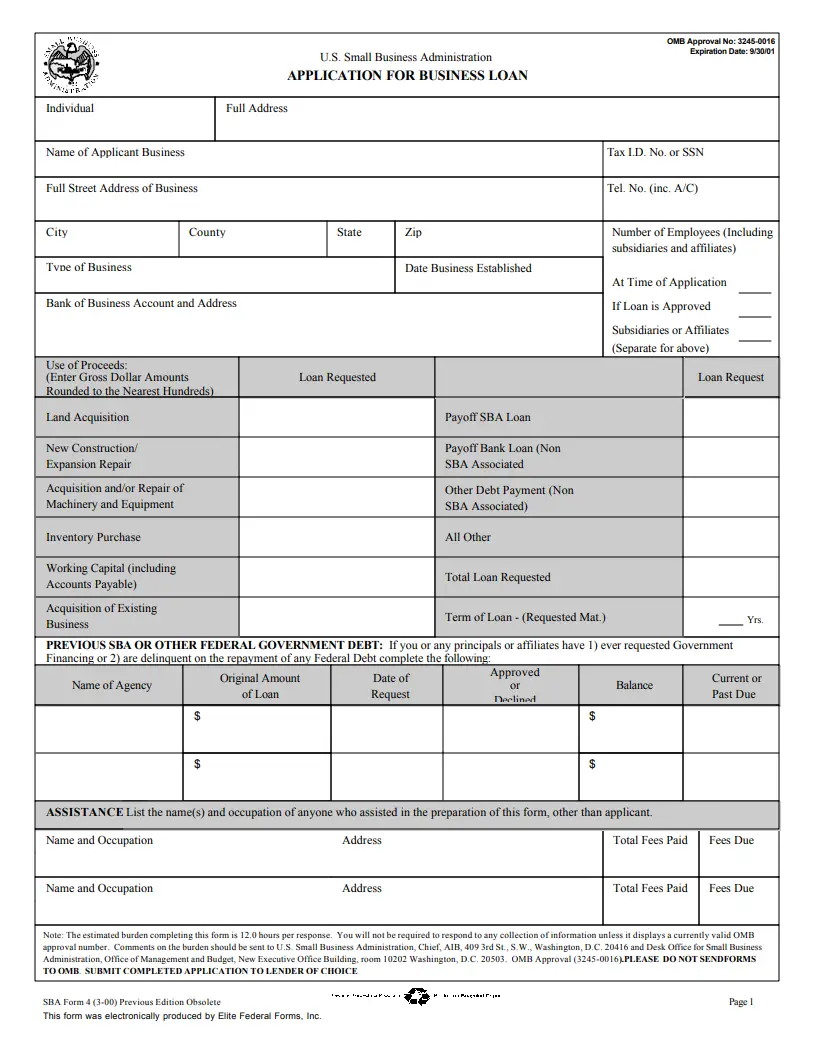

Small Business Loan Application Requirements

- Personal and business tax returns

- Business financial statements for three past years

- Current business financial statement

- Report showing age of unpaid invoices

- Articles of Incorporation and Bylaws

- Personal tax returns from prior three years

- Current personal financial statements from key people in the company

- Collateral information i.e. valuation

Don’t Miss: Can You Pay Off Your Car Loan Early

Get An Sba Loan For Your Business

If you want to start or grow your business, an SBA loan can help you do that. You need to know what the different loans are and choose the one thats right for your business.

You can leverage these funds to hire employees, invest in better equipment, or take care of operating expenses as youre building up the business.

Be sure to visit this site again for more business news and articles.

Sba 7 Eligibility Requirements

If youre looking for support from the SBA, theyve got some requirements youll need to make sure you meet:

-

You must be officially registered as a for-profit business, and you must be operating legally.

-

As the business owner, you cant be on parole.

-

Your business must have fewer than 500 employees, and less than $7.5 million revenue on average each year for the past three years

-

Your net income must be under $5 million , and your tangible net worth must be less than $15 million.

-

You must show youre investing your own time and money into the business, having invested equity.

-

Your business must be physically based in the United States, and you must be doing business with the U.S. and its territories.

-

Your small business must be in an SBA-eligible industry . Learn more about Eligible and Ineligible Industries for SBA 7 Loans

-

Youll need to show that youve already tried and failed get funds from other financial lenders, fully exhausting non-SBA loan options.

-

Youll need to prove youve got a sound business purpose for the loan youre requesting, and that your intended funds usage is approved by the SBA.

-

Youll need to prove youre not delinquent on any existing debts to the U.S. government .

Read Also: How To Get Car Loan When Self Employed

Sba 504/cdc Loan Requirements

Generally, SBA 7 loan requirements, as well as microloan requirements, will end here. With SBA 504/CDC loans, however, youâll also need to submit the following:

- Environment impact statement, if applicable

- Evidence of meeting public policy or job creation goals

- Proof that any real estate youâll buy with the loan proceeds is at least 51% owner-occupied

Use our SBA 504/CDC loans guide to learn more about these loans and their requirements.

Are Sba Loans Hard To Get

Yes and no. Compared to some other business financing options, SBA loans usually have somewhat higher standards. They are often available to small businesses who are profitable, have Good to Excellent credit, and who can demonstrate the ability to pay the loan back.;

SBA loans are generally not an option for someone who cant manage his credit well or who has a business that is considered failing. An alternative lender might provide more suitable, short-term loans for various types of borrowers.;

At the same time, these loans are designed to help businesses that cant get similar credit elsewhere, so you may have more luck getting an SBA loan than a comparable traditional loan from a financial institution. But you have to be willing to put in the effort.;

Recommended Reading: Is It Easy To Get Loan From Credit Union

Certified Development Company Loan Program

For the business owner who has trouble obtaining traditional mortgage financing, the 504 Certified Development Company Loan Program offers a beacon of hope. You can still enjoy a competitive, fixed-rate mortgage financing option with the help of an SBA lender and a certified development company. A 504 Loan allows you to not only buy the land you need;but also renovate real estate and purchase needed heavy equipment for your operations. You can get a loan amount of up to 40% of the total project cost, with a cap of $5 to $5.5 million, depending on your business type.

Qualifying For An Sba Loan: What Small Businesses Need To Know

Listen To This Article

Throughout the Covid-19 pandemic, the Small Business Administration supported small businesses with government-backed Paycheck Protection Program loans and forgiveness programs.;

As vaccines become increasingly widespread and government lockdowns ease, businesses should expect this type of support to wane. The window for PPP loans is set to close on May 31st, 2020.;

Even if you havent had the chance to secure a PPP loan, qualifying for an SBA loan is still a possibility.;

SBA loans come with a number of benefits, such as lower interest rates, longer repayment terms, and smaller down payments. You can use SBA money to refinance debt or tackle new growth opportunities.;

That said, qualifying for an SBA loan isnt as easy as it may seem. Requirements are rigid and there is little flexibility or room for errors.;

If youre wondering whether SBA loans are a possibility for your business, youve come to the right place. Well go over everything youll need to know about qualifying for an SBA loan as well as other solid financing options.

You May Like: What Is The Commitment Fee On Mortgage Loan

Sba Loan Qualifications & Requirements

The most popular type of SBA loan is the SBA 7 loan, and most SBA loan requirements are based on those for this program. In general, to qualify for an SBA loan, you will need to have good credit and an established business or management experience in the industry. You must also be able to demonstrate your businesss ability to repay the loan, and you will need to provide collateral and a personal guarantee.

Eligible Use Of Sba Loan Proceeds

| Use of SBA Loan Proceeds | SBA 504 Loan |

|---|---|

| ; |

Further detail on the use of SBA loan proceeds for some items footnoted in the table are:

Recommended Reading: Can You Pay Off Mortgage With Home Equity Loan

Qualifying For An Sba Loan With Collateral

In some cases, lenders may ask you to put up collateral for your SBA loan. Collateral is any asset with significant value and can include inventory, equipment, real estate, invoices, and more.;

Collateral gives lenders additional security and peace of mind. In case you cant repay your loan, the lender has the right to seize your asset.

Unfortunately, collateral loans can put borrowers at a disadvantage. Youll have to forfeit the asset youve used as collateral if youre unable to make payments.;

What Are The Different Types Of Sba Loans

There are several different kinds of SBA loans, so choosing the one that works best for your business can be a bit tricky. How do you find the right loan for your specific situation? Youll want to understand the options before you decide whats right for you.

Small businesses seeking financing should speak with their lender about their individual needs, Manger advises. The SBA provides guarantees on loans that lenders would not make on a conventional basis.”

To help make your decision easier, weve put together a list of eight of the more common forms of SBA loans at the time of this writing. That said, the SBA does change its offerings from time to time as the market dictates, so always check with them to be sure.

The SBA modernizes its loan program periodically to reflect the current market, Manger says.

When offerings change, the SBA provides updated information to lenders, who then provide it to the applicants, according to Manger.

Applicants can reach out directly to one of our 68 field offices or find information available on the SBA.gov website, which has the standard operating procedures for our loan programs, Manger explains.

To expedite your loan application, start with a look at the list of SBA-approved lendershere. For the fastest results, be sure to have all of the necessary documentation on hand before you apply.

Also Check: Is My Loan Fannie Mae