What Type Of Mortgage Do You Need

First-time homebuyers can walk into a mortgage brokerage office or visit an online lender without knowing what kind of mortgage they need. But it’s always better to have an idea of what you’re shopping for, especially since you can’t control other factors such as home prices and current rates.

Mortgage loan types include:

How To Shop For Mortgage Rates

There are a few things to keep in mind when shopping for mortgage rates:

- Make sure you look at national and local lenders to find the best possible rates.

- Avoid applying for mortgages in multiple places as this can hurt your credit score. Instead, pull your credit report and get a keen picture of your credit history that you can share with potential lenders. Ask them to provide you with the rates based on that information. This way you preserve your credit score while getting the most accurate information for your credit profile.

- Use our rate table to help you identify whether lenders are offering you a competitive rate based on your credit profile.

What Are The Benefits Of Refinancing To A Lower Mortgage Rate

Some of the key benefits of refinancing to a lower mortgage rate are that you can:

- Pay less interest over time: If youre able to refinance to a lower mortgage rate, youll end up paying less interest over time than if you kept your old rate. For example, if you have a $250,000 mortgage with a 30-year fixed-rate term, you would pay $289,595.47 in interest over the 30-year term. The same mortgage with a rate of 3% would only have $129,443.63 in total interest over 30 years.

- Lower your payment: If you want to lower your P& I payment, getting a lower mortgage rate might help. The monthly P& I payment for a $250,000 loan with a fixed rate of 6% and a 30-year term would be $1,498.88. If you refinance the loan after five years to a 25-year fixed-rate loan with a 3% rate, your P& I payment would be reduced to $1,103.19, and you would still pay off the loan in the same amount of time.

- Potentially pay your loan off more quickly: Using the same example, lets say you decide to shorten your originally $250,000 mortgage to a 15-year term after paying on it for five years. The original P& I payment on your 30-year 6% fixed-rate mortgage was $1,498.88. If you were to refinance the balance into a 15-year 2.5% fixed-rate mortgage, your P& I payment would increase to $1.551.19, but it would be paid off 10 years sooner.

You May Like: Usaa Pre Approved Car Loan

Are Mortgage Rates Impacting Home Sales

The number of mortgage applications ticked up 0.3% for the week ending September 10, according to the Mortgage Bankers Association. The increase takes an adjustment for the Labor Day holiday into consideration.

- Purchase applications were up a seasonally adjusted 8% from the previous week and 12% lower than the same week last year. On an unadjusted basis, purchase loan volume was 5% lower week-over-week.

- Refinance applications also ticked lower, decreasing 3% from the week prior and 3% lower than the same week last year. Refinancing continued to slow as the share of refi applications dropped to 65% of all applications, the lowest total since July.

Make sure we land in your inbox, not your spam folder.

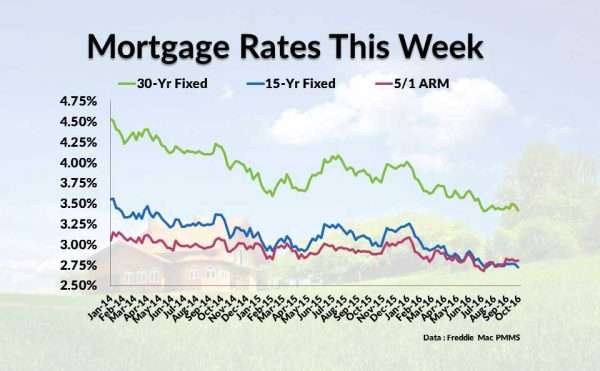

Current Mortgage Interest Rate Trends

Mortgage rates were up slightly this last week. The average 30-year fixed rate is 2.88%, up from 2.87% the week prior, according to Freddie Macs weekly rate survey.

Per the survey, 15-year fixed rates increased slightly from 2.18% to 2.19%. And the average rate for a 5/1 ARM moved slightly down from 2.43% to 2.42%.

Overall, mortgage rates are still close to their lowest levels in history.

The lowest 30-year mortgage rate ever was just 2.65%, recorded by Freddie Mac in January 2021. So anyone who can lock in at or near todays mortgage rates is getting a fantastic deal on their home loan.

Also keep in mind that average rates are just that averages. Prime borrowers with great credit and large down payments often get lower interest rates than the ones shown here. And borrowers with lower credit or fewer assets may get higher rates.

You May Like: How To Get Loan Officer License In California

Is It A Good Idea To Lock In My Mortgage Rate Right Now

Mortgage rates move up and down on a daily basis, and its impossible to time the market. So locking in your interest rate right now is a good idea because overall, rates are exceptionally low.

A rate lock will only last for a set amount of time, typically 30-60 days. If you hit a snag during closing and it looks like your rate lock will expire you should talk with your lender. It may offer an extension of the lock, however, you might have to pay a fee for that privilege.

What To Know About The Above Purchase Mortgage Rates:

Rates shown are based on a conforming, first-lien purchase mortgage loan amount of $250,000 for a single-family, owner-occupied residence with a maximum loan-to-value ratio of 75%, a 0.25% interest rate discount,1 2 for a qualified client with eligible KeyBank checking and savings or investment accounts, mortgage rate lock period of 60 days, an excellent credit profile including a FICO score of 740 or higher, and a debt-to-income ratio of 36% or lower. Your actual rate may be higher or lower than those shown based on information relating to these factors as determined after you apply.

For your personalized rate quote, contact a Mortgage Loan Officer today.

*Adjustable Rate Mortgage interest rates and payments are subject to increase after the initial fixed-rate period and assume a 30-year repayment term.

FHA, VA and other mortgage loan terms and programs are available.

Learn more about estimated mortgage payments.

Interested in refinancing your home? View our refinance rates.

Todays purchase mortgage interest rates for KeyBank clients in ColoradoRates effective as of 10:00 AM ET on Friday, October 22, 2021

| Mortgage Type |

|---|

| 2.660% |

You May Like: How Do I Refinance An Auto Loan

How Do I Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youâre paying for.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

To calculate your monthly mortgage payment, hereâs what youâll need:

- The home price

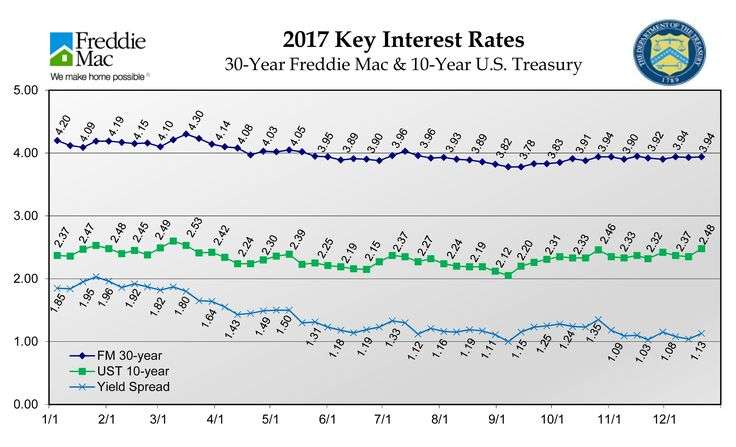

Where Is The Market Headed

Expert economists predicted the economy would rebound in 2010. However, the economy was sluggish with slow growth rates for many years beyond that. The economy contracted in the first quarter of 2014, but in the second half of 2014 economic growth picked up. The Federal Reserve tapered their quantitative easing asset purchase program & the price of oil fell sharply. Consumer perception of inflation and inflation expectations are set largely by the price they pay at the pump when they refill their gas.

Two year Treasury yield keeps marching higher. Today cleared pivot dating back years. Coast seems clear for rise to continue significantly.

â Jeffrey Gundlach

With growth picking up the consensus view is interest rates will continue to head higher for the next couple years into 2020, or until a recession happens. The following table highlights 2018 rate predictions from influential organizations in the real estate & mortgage markets.

Recommended Reading: Can You Transfer Car Payments To Another Person

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How Do Jumbo Mortgage Rates Compare To Conforming Loan Rates

It makes sense that lenders might charge higher interest rates on jumbo loans because, as mentioned before, theres so much risk involved. However, market data suggests that interest rates on jumbo loans are very competitive with market rates.

At todays rates, the difference between conforming and nonconforming loans ranges from just 0.25% to 1%. In fact, some jumbo loans have rates that are lower than other mortgage loans.

Read Also: Va Home Loan For Manufactured Home

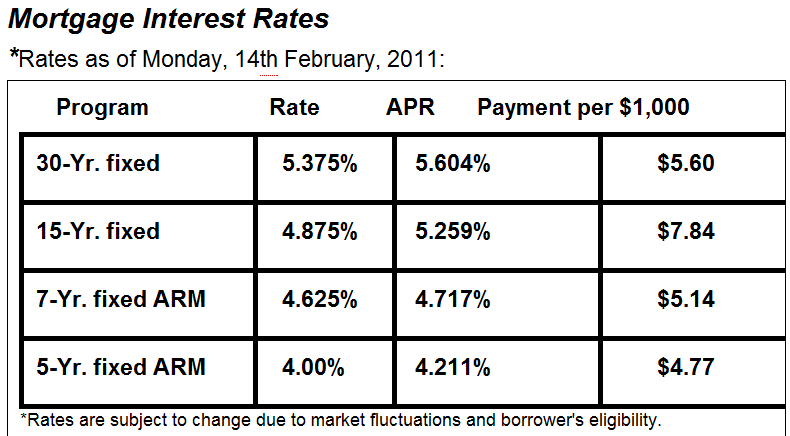

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youâre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youâll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

Those Who Owned No Financial Assets Were Left Behind

While people who are priced out of hot areas, some of the cold areas have remained exceptionally cold nearly a decade after the crisis. According to the Financial Times the recovery has simply passed by many Americans.

More than 50m Americans live in districts that are mired in a âdeep ongoing recessionâ, with falling employment and a shrinking business base, according to a report that highlights the fractured nature of the US recovery.⦠The problems in distressed communities have not developed overnight: most have seen zero net gains in employment and business creation over the whole of this century so far.”

Increasing inequality – rather than an increase in poverty – often leads to a rise in crime. Areas with an elevated GINI coefficient see higher violent crime & this is one of the most robust relationships in the social sciences.

Citigroup ran the Obama cabinet& ensured their own bailout, while the costs of their shady loan practices were passed onto the rest of society.

Now even Citi is warning against rising income inequality.

Recommended Reading: Drb Student Loan Refinancing Review

Tips For Getting The Lowest Mortgage Rate Possible

There is no universal mortgage rate that all borrowers receive. Qualifying for the lowest mortgage rates takes a little bit of work and will depend on both personal financial factors and market conditions.

Check your credit score and credit report. Errors or other red flags may be dragging your credit score down. Borrowers with the highest credit scores are the ones who will get the best rates, so checking your credit report before you start the house-hunting process is key. Taking steps to fix errors will help you raise your score. If you have high credit card balances, paying them down can also provide a quick boost.

Save up money for a sizeable down payment. This will lower your loan-to-value ratio, which means how much of the homes price the lender has to finance. A lower LTV usually translates to a lower mortgage rate. Lenders also like to see money that has been saved in an account for at least 60 days. It tells the lender you have the money to finance the home purchase.

Shop around for the best rate. Dont settle for the first interest rate that a lender offers you. Check with at least three different lenders to see who offers the lowest interest. Also consider different types of lenders, such as credit unions and online lenders in addition to traditional banks.

Finally, lock in your rate. Locking your rate once youve found the right rate, loan product and lender will help guarantee your mortgage rate wont increase before you close on the loan.

What Is A Jumbo Loan

A jumbo loan is one that exceeds the limits for conforming loans set by the Federal Housing Finance Agency . These conforming loans are those that can be serviced by Fannie Mae and Freddie Mac. Because a jumbo loan exceeds these limits, it’s also called a non-conforming loan.

When you get a jumbo mortgage, your lender cant rely on federally-backed insurance from Freddie and Fannie to reduce some of their risks. Many of the home loan programs provided by the government operate under the principle that lenders will be able to recoup some of their losses if a borrower defaults. At the very least, lenders know they can sell their loans to these government-sponsored enterprises, in part, to promote liquidity in the home loan market.

You May Like: Usaa Refinance Auto

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenâor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisorâs mortgage rate tables to get the latest information.

The lower the rate, the less youâll pay on a mortgage. Todayâs rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youâre offered might be higher than what lenders advertise or what you see on rate tables.

If youâre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

First Mortgage Direct Best No

First Mortgage Direct, the online division of First Mortgage Solutions, offers both purchase loans and refinancing.

Strengths: First Mortgage Direct has no hidden fees or limited-time offers, and you can receive a personalized rate within seconds through its website. Borrowers are also able to close in 30 days, which is in line with many other lenders timelines.

Weaknesses: First Mortgage Direct is available only in 19 states .

You May Like: How To Get Loan Originator License

How To Calculate Mortgage Payments

Mortgages and mortgage lenders are often a necessary part of purchasing a home, but it can be difficult to understand what youre paying forand what you can actually afford.

You can use a mortgage calculator to estimate your monthly mortgage payment based on factors including your interest rate, purchase price and down payment.

To calculate your monthly mortgage payment, heres what youll need:

- The home price

Where Are Mortgage Rates Headed In 2021

This summer, mortgage rates have been extremely favorable for borrowers and have rarely topped 3%. Inflation and the economy both are looking stronger, which normally would push rates up. But the uncertainty surrounding the Delta variant has acted as a counterbalance. However, by the end of 2021 some experts see mortgage rates rising slightly.

Looking at the early fall, there is still too much uncertainty to reasonably expect rates to spike. But if the rate of inflation starts to look like it is more than just temporary and the economy really starts to take off, then the Federal Reserve will likely take action. In that scenario, we could see rates start to rise.

Recommended Reading: Avant Refinance

Today’s National Mortgage Rate Averages

The dip seen in mortgage rates this week after they bolted dramatically upwards Monday was short-lived, with averages back to Monday’s levelor higheron Thursday. This returns several of the averages to their highest level in seven months, and approaching their most expensive territory of the calendar year.

The 30-year fixed-rate average rose three points to 3.28%. Compared to early August’s major rate dip, when the 30-year rate sank to 2.89%, today’s average is now almost four-tenths of a percentage point higher.

Meanwhile, the 15-year and Jumbo 30-year fixed averages each climbed a single point Thursday, to 2.51% and 3.43%, respectively. These rates are now 0.30 to 0.37 percentage points above their early-August lows.

Refinance rates also saw a moderate boost Thursday, with the 30-year refinance rate rising three points to 3.39%. Rates to refinance 30-year and 15-year loans are currently priced 10 to 15 basis points more expensive than new purchase rates.

Daily Mortgage Rates Move Higher Today

The average rate for a 30-year fixed-rate mortgage is back on the rise, moving up to 3.541%. Thats an increase of 0.038 percentage points from yesterday. The rate for a 30-year refinance loan also increased to 3.664%.

Despite todays increase, mortgage rates are still historically low. For well-qualified buyers thinking of buying a new home or refinancing, low rates and comfortable monthly payments can still be found.

-

The latest rate on a 30-year fixed-rate mortgage is 3.541%.

-

The latest rate on a 15-year fixed-rate mortgage is 2.571%.

-

The latest rate on a 5/1 jumbo ARM is 2.48%.

-

The latest rate on a 7/1 conforming ARM is 3.438%.

-

The latest rate on a 10/1 conforming ARM is 4.013%.

Moneys daily mortgage rates reflect what a borrower with a 20% down payment and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each days rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Freddie Macs weekly rates will generally be lower, since they measure rates offered to borrowers with higher credit scores.

You May Like: Drb Refinance Review