Four Ways To Get Rid Of Pmi

Understandably, most homeowners would rather not pay for private mortgage insurance .

Luckily, there are multiple ways to get rid of PMI if youre eligible. Not all homeowners have to refinance to get rid of mortgage insurance.

Homeowners with conventional loans have the easiest way to get rid of PMI. This mortgage insurance coverage will automatically fall off once the loan reaches 78% loantovalue ratio .

Or, the homeowner can request that PMI be removed at 80% LTV instead of waiting for it to be taken off automatically when home equity reaches 22% .

When requesting PMI removal, the loantovalue ratio may be calculated based on your homes original purchase price or based on your original home appraisal .

Or, if your homes value has risen, you may be able to order another appraisal and remove PMI based on your homes current value.

How To Cancel An Fha Mortgage Insurance Premium

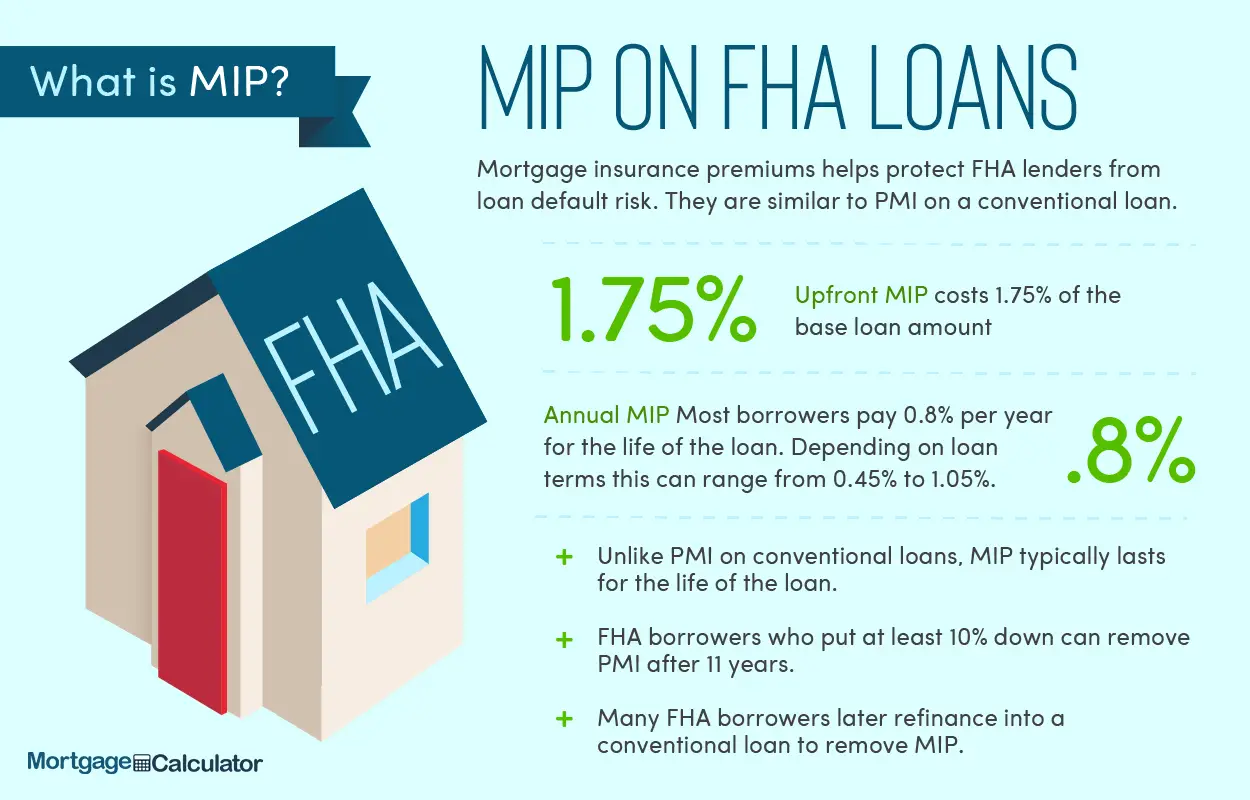

In 2013, the Department of Housing and Urban Development issued a press release that outlined the steps the FHA would take to increase its capital reserves. Among other things, HUD announced they would charge annual mortgage insurance for the life of the loan, in most cases.

Here iss an excerpt from that press release:

FHA will also require most borrowers to continue paying annual premiums for the life of their mortgage loan. This will permit FHA to retain significant revenue that is currently being forfeited prematurely.

And here is a direct quote from the policy letter sent to lenders:

For any mortgage involving an original principal obligation with a loan-to-value ratio greater than 90%, FHA will assess the annual MIP until the end of the mortgage term or for the first 30 years of the term, whichever occurs first.

So, for borrowers who use the customary 3.5% down payment option in 2017, the only way to cancel the annual MIP is to either pay off the loan or refinance. Otherwise, the mortgage insurance premium will stick with the loan for its full term, or at least up to 30 years.

The Hybrid Adjustable Rate

FHA administers a number of programs, based on Section 203, that have special features. One of these programs, Section 251, insures adjustable rate mortgages which, particularly during periods when interest rates are low, enable borrowers to obtain mortgage financing that is more affordable by virtue of its lower initial interest rate. This interest rate is adjusted annually, based on market indices approved by FHA, and thus may increase or decrease over the term of the loan. In 2006 FHA received approval to allow hybrid ARMs, in which the interest is fixed for the first 3 or 5 years, and is then adjusted annually according to market conditions and indices.

The FHA Hybrid provides for an initial fixed interest rate for a period of three or five years, and then adjusts annually after the initial fixed period. The 3/1 and 5/1 FHA Hybrid products allow up to a 1% annual interest rate adjustment after the initial fixed interest rate period, and a 5% interest rate cap over the life of the loan. The new payment after an adjustment will be calculated on the current principal balance at the time of the adjustment. This insures that the payment adjustment will be minimal even on a worst case rate change.

You May Like: 18009460332

Making A Plan To Get Rid Of Fha Mortgage Insurance Is A Great Financial Decision

When youre youre making a home purchase, youre mainly focused on getting into a place where you can set down roots and build a solid future. The down payment can be a big hurdle so high FHA PMI costs can be a worthwhile trade-off.

But now youre settled in, its time to think about getting rid of FHA mortgage insurance. These high monthly PMI payment costs could and should be going into savings, a childs college fund, or toward loan principal.

Dont delay. Even if youre not able to cancel your mortgage insurance now, make a plan for how youre going to do it.

Ten or twenty years down the road, youll be glad you did.

Paying Pmi On A Conventional Loan

The good news is that even if you take a conventional loan and need to borrow more than 80% of the homes value, you will only pay PMI for a short while. Conventional loans allow you to cancel PMI as soon as you owe 80% or less of the homes value.

Once you reach the required threshold, you can request cancellation of the PMI in writing. The lender must evaluate your request by determining the value of the home and how it compares to the outstanding balance of your loan. If you do owe less than 80%, the lender will cancel the insurance. If you dont request cancellation, the lender must cancel it by law, once you owe less than 78% of the homes value.

While FHA loans dont allow you to avoid PMI altogether, there is a way around it. If you take advantage of the FHA streamline refinance to secure a lower interest rate you will still pay the MIP. The only way to get rid of PMI once and for all is to secure a conventional loan once you are able to improve your credit and/or lower your debt ratio.

You May Like: Va Business Loan For Rental Property

Refinance To Get Rid Of Pmi

Another option is to refinance to get rid of PMI. Unlike requesting a cancellation, which is free, refinancing requires you to pay closing costs and provide documentation of your homes value and your income, assets and credit. Consult a lender to decide if you should refinance to remove PMI and compare the costs to refinance, your new monthly payments and your current payment.

Refinancing is usually the only option for FHA loan PMI removal, so a consultation with a lender is valuable. If you have good credit you may qualify for the lowest interest rates on a conventional loan. If you have at least 20% in home equity, you can avoid PMI payments on the new loan.

Also Check: What Is Mortgage Rate Vs Apr

Refinance To A Conventional Loan

You may be able to refinance your FHA loan to a conventional loan once you build up 20% equity in your home.

Conventional loans require monthly private mortgage insurance when borrowers put down less than 20%. By refinancing to a conventional loan once you have 20% equity, you can eliminate FHA MIP and you wont be subject to PMI.

Or, you could refinance into a conventional loan with PMI now. Why would you do this?

If you have great credit, conventional PMI might actually be cheaper than your FHA mortgage insurance. Additionally, conventional PMI automatically falls off when you reach about 22% equity in the home.

But with rising rates, theres a good chance you wont save money by refinancing into a conventional loan with PMI. Still, its a good option to explore. Have your lender run the numbers to see if it makes sense.

Keep in mind that you will pay closing costs on a refinance loan, which are typically 2-5% of the loan amount including things like an appraisal, new title insurance, and lender fees.

But the fees could be worth it if you significantly save money by eliminating FHAs mortgage insurance.

Recommended Reading: Is Prosper A Legit Company

How Do You Get Rid Of Pmi On Fha Loans

Most homeowners who took out a mortgage had to purchase private mortgage insurance. Thats a requirement from most lenders, even for FHA loans. Its not required when you pay more than 20% of the cost of the house in your down payment, but that doesnt happen very often. This insurance can be incredibly expensive, and it may benefit you to get rid of it, but its not a simple as you might like. There are some conditions you will have to meet first before you can drop the PMI.

Refinance Your Home To Remove Pmi

With interest rates at historical lows, theres never been a better time to refinance your mortgage than now. Since many FHA loan borrowers are first-time homebuyers, they find that in the years since they first purchased their home, their incomes have increased. If this sounds like you, then refinancing from an FHA loan to a conventional loan will automatically drop PMI. And since youre used to sending the bank PMI every month, you may find that the slightly higher principal payment your making doesnt change your monthly mortgage obligation much, if at all.

You May Like: Refinance Student Loans Usaa

Lower Your Monthly Costs

While paying PMI can allow you to buy a home with a lower down payment, it also costs you money. The sooner you can get rid of PMI, the better off youll be.

To lower your costs further, make sure to shop around for refinance rates. Credible lets you easily compare real, prequalified rates from all of our partner lenders in the table below.

Miranda Marquit is a mortgage, investing, and business authority. Her work has appeared on NPR, Marketwatch, FOX Business, The Hill, U.S. News & World Report, Forbes, and more.

How Long Will You Pay Fha Mip

While the law has changed more than once on this issue, current guidance states that borrowers who put down less than 10 percent on an FHA loan must pay for FHA mortgage insurance until the entire loan term is over. If you put down at least 10 percent, however, you can have FHA MIP removed after 11 years of payments.

The length of time that a borrower pays the monthly mortgage insurance premium varies depending upon the original loan terms, Boomer says.

PMI on a conventional loan, on the other hand, can typically be cancelled once a homeowner has 20 percent equity in their home.

Recommended Reading: Can You Use A Va Loan For Land

Conventional Pmi Vs Fha Mip

FHA loan borrowers arent the only borrowers who have to pay mortgage insurance. Borrowers with a conventional loan who made a down payment of less than 20 percent typically have to pay private mortgage insurance premiums, which currently range from 0.58 percent to 1.86 percent of the loan principal.

Getting rid of PMI is fairly straightforward: Once you accrue 20 percent equity in your home, either by making payments to reach that level or by increasing your homes value, you can request to have PMI removed.

Cost Of Private Mortgage Insurance

The cost of your PMI premiums will depend on several factors.

- Which premium plan you choose

- Whether your interest rate is fixed or adjustable

- Your loan term

- Your down payment or loan-to-value ratio

- The amount of mortgage insurance coverage required by the lender or investor

- Whether the premium is refundable or not

- Your credit score

- Any additional risk factors, such as the loan being for a jumbo mortgage, investment property, cash-out refinance, or second home

In general, the riskier you look according to any of these factors , the higher your premiums will be. For example, the lower your credit score and the lower your down payment, the higher your premiums will be.

According to data from Ginnie Mae and the Urban Institute, the average annual PMI typically ranges from .55% to 2.25% of the original loan amount each year. Here are some scenarios: If you put down 15% on a 15-year fixed-rate mortgage and have a credit score of 760 or higher, for example, youâd pay 0.17% because youâd likely be considered a low-risk borrower. If you put down 3% on a 30-year adjustable-rate mortgage for which the introductory rate is fixed for only three years and you have a credit score of 630, your rate will be 2.81%. That happens because youâd be considered a high-risk borrower at most financial institutions.

Read Also: Pre Approved Capital One Auto Loan

Can I Waive My Fha Mip

The good news about taking out an FHA mortgage is that you dont have to pay for private mortgage insurance, so you dont have to worry about getting PMI dropped. The bad news is that you do have to pay for mortgage insurance premiums, which you can get dropped after youve paid down your mortgage and built equity in your home.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Calculate Your Equity To Get Rid Of Pmi

I’ll be right up front with it. PMI is the biggest ripoff in real estate… but not necessarily for the reason you’d think. PMI itself makes sense. If you can’t pay for a standard 20% down payment, your bank will make you pay for PMI to insure their loan against default. So, PMI is a reasonable concept overall, but it’s still a huge ripoff.

After the price appreciation since 2012, millions of homeowners have more than 20% equity in their home and could have their PMI removed or refinance into a new loan without PMI. But… they’re still paying it. Use this PMI removal calculator to see if you can remove yours.

If one of the bars turns green and says “Yes”, you should be able to remove your PMI. If they are both red, you’ll see how much more equity you have to build before it can be removed. Here it is, the remove PMI calculator, or more accurately, the “When can I get rid of PMI calculator”.

Hopefully, you can remove your private mortgage insurance PMI? Or, refinance into a loan without PMI? Or, at least you have some better context for when does PMI go away? Or, when PMI will be eliminated based on the current value of your home. I’ll let you know how to actually go about removing your mortgage insurance premiums below, but I wanted to add a little context from my mortgage insurance experience first.

Don’t Miss: Usaa 84 Month Auto Loan

Is Refinancing To End Pmi A Smart Choice For Homeowners

Generally, yes. But like most major financial decisions, refinancing to get rid of PMI depends on your situation.

If you’re able to get rid of PMI by refinancing , refinancing can certainly be a smart choice.

Be sure to consider how long you plan to stay in the home, the fees and other costs of refinancing, and other relevant factors before making your decision.

Ways To Get Rid Of Pmi

On most loans, you actually have to have the ability, as the buyer, to get rid of PMI. This right came as a result of the Homeowner’s Protection Act which was passed into law back in 1998. However, these rules don’t apply to all mortgages, including those backed by the Federal Housing Administration .

How to get rid of PMI on an FHA loan? You can still get rid of PMI on an FHA loan. Its just a bit more complicated. Well talk about that in a bit.

You can get rid of PMI in one of several ways. The Facebook question-writer asks about just one of the ways to remove PMI. This option is using an appraisal to show that the mortgage is now worth 80% or less of the home’s current value.

But before we get into the specifics of how to determine the current value of your home before spending the money for an appraisal, let’s review the different ways that you can have PMI removed from your mortgage.

Recommended Reading: Usaa Auto Financing

Looking To Remove Pmi On Your Fha Loan

Need more advice on how to eliminate mortgage insurance from your monthly budget for good? Were on standby. Learn more about how you may be able to replace your existing FHA loan with a new loan from Union Home Mortgage that aligns with your specific goals or contact us today.

Get a mortgage you can rave about.

How To Get Rid Of Pmi On Fha Usda & Conventional Loans

If mortgage comes up as a topic, eventually the term PMI is mentioned. PMI stands for private mortgage insurance and most want to avoid it at all costs if possible. However, once the benefits of mortgage insuranceare explained correctly, the potential borrower warms up to the idea of it allowing low to no down payment. Although at some point, a couple comments come up: Tell me how to get rid of PMI. and When does PMI go away?

Even though many believe all PMI is the same, it is not. The amounts are different and the ability to cancel vary as well. If a loan with PMI is in place already, this information is worth knowing. If looking to buy a home, this is excellent information to understand up-front. Understanding how each form of PMI works could play an important role in the mortgage decision. So, lets explain how to get rid of PMI for each loan type.

Dont Miss: What Credit Score Is Needed For Usaa Auto Loan

Recommended Reading: Restoring Va Entitlement After Foreclosure