Is Student Loan Relief Really Ending In January

Yes, student loan relief is expected to end January 31, 2022. Biden has extended student loan relief twice, which follows two extensions from President Donald Trump, after Congress passed the Cares Act, a $2.2 trillion stimulus package, in March 2020. During this period, which will total more than 22 months, student loan borrowers have not been required to pay federal student loans, no new interest has accrued on their federal student loans, and there has been no collection of student loans in default. Effective February 1, this temporary student loan forbearance will end, and student loan borrowers will begin to make federal student loan payments at their regular interest rate. If you include the $60 billion of student loan cancellation from Covid-19 student loan relief, then Biden has cancelled nearly $70 billion of student loans.

Will your student loans get cancelled? There are many ways to get student loan forgiveness, but its more challenging to get any upfront student loan cancellation unless you qualify under an existing federal program. Immediate student loan cancellation likely wont be available to all or even most student loan borrowers. If you have student loans, here are some popular ways to save money:

Student Loan Repayment Options For Lawyers

Going to professional school isnt cheap but there are many loan repayment programs available for lawyers. You may be able to find a local or state assistance program. And some law schools will even help their alumni repay their student loans.

The Department of Justice Attorney Student Loan Repayment Program is a good option for lawyers who want to work at the Department of Justice. If you work there for at least three years, youll receive up to $60,000 in loan forgiveness. You must have at least $10,000 in federal loans to qualify, though thats a pretty low bar for most lawyers to meet.

The John R. Justice Student Loan Repayment Program was designed for lawyers who work in the public sector. For instance, public defenders could earn $10,000 in loan forgiveness a year for a maximum of six years.

Submit Your First Pslf Form

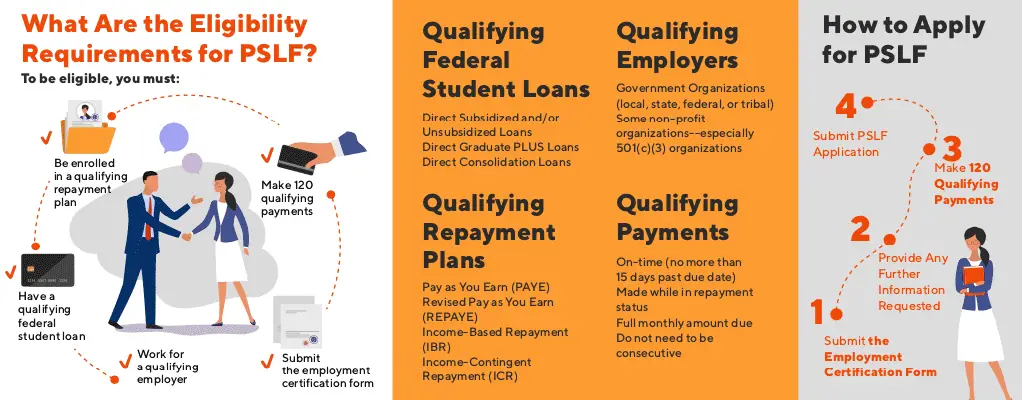

The PSLF form is a form both you and your employer must complete for us to verify that your loan payments were eligible and that you made the payments during periods of qualifying employment. We recommend you submit your first PSLF form after you are confident you:

- Have qualifying loans

- Work full-time for a qualifying employer

- Have made some qualifying payments

Once your qualifying employment is approved, we will begin tracking your progress towards completing the 120 qualifying payments each time you submit a new PSLF form. All PSLF forms will be reviewed for eligibility under both the PSLF/TEPSLF programs.

We recommend that you submit a PSLF form annually. This will help you track your progress in the PSLF/TEPSLF program, and ensure that any repayment or employment missteps are caught sooner rather than later.

Read Also: Can You Pay Off Sofi Loan Early

Watch Out For Federal Student Loan Forgiveness Scams

One quick word of warning: scam artists have long been aware of all these amazing student loan forgiveness programs, and theyre doing everything they can to try and trick borrowers out of their hard-earned money.

If anyone contacts you via the phone, email, or even with a written letter, attempting to get you to sign up for one of their forgiveness programs, you should be extremely cautious before providing them with any personal information.

To find out how to sniff out a scam, and to protect yourself and your family from these con artists, please visit my page about Student Loan Debt Forgiveness Scams.

Forgiveness With Pay As You Earn

Pay As You Earn is similar to Income-Based Repayment, in that it isnt a typical forgiveness program. However, you could be eligible for forgiveness after a certain period of time.

The PAYE plan caps your monthly payment at 10% of your discretionary income. After borrowers make payments for 20 years, any remaining balance becomes eligible for forgiveness.

As with IBR, your forgiven balance might be treated as taxable income.

You May Like: Can You Take Out More Than One Student Loan

What Is A Ffelp Loan How To Get Student Loan Forgiveness

Stanley tate

Federal Family Education Loan Program Loans are federal student loans. Undergraduate students and parents could borrow FFELP loans through June 2010.

The federal government replaced the FFELP Program with the Federal Direct Loan program.

Although new loans are no longer being made under the FFEL Program, many borrowers still owe balances on FFEL Loans. Here’s a guide to your FFEL Loan repayment and forgiveness options.

+ Student Loan Forgiveness Programs That Discharge Loans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Find the latest

-

Help for current students: Emergency COVID-19 relief for students

Student loan forgiveness might seem too good to be true, but there are legitimate ways to get it through free government programs.

The following options are available only to borrowers with federal student loans. Some programs have very specific requirements that make them difficult to qualify for, but income-driven repayment plans are open to most borrowers.

» MORE:What are the odds Ill get student loan forgiveness?

The information below is about existing student loan forgiveness programs. Learn more about the potential for Biden Student Loan Forgiveness.

Youre not eligible for federal student loan forgiveness programs if you have private loans, but there are other strategies for managing private loan debt.

Also Check: How To Stop Loan Payments

Submit Your Pslf Form For Forgiveness

Once you have made your 120th payment, submit a PSLF form to count your qualifying payments and apply for forgiveness.

After we receive your PSLF form, your loans will be reviewed for eligibility for forgiveness. If it appears you are eligible for PSLF/TEPSLF, your employer may be contacted before granting loan forgiveness. Additionally, the amount to be forgiven will be the principal and interest that was due on your eligible loan.

While your loans are being reviewed for loan forgiveness you have two options:

KEEP IN MIND

Contact a PSLF Specialist

We are here to help you with every step of the process. Contact one of our Public Service Loan Forgiveness specialists at 855-265-4038 for more information.

Learn More About PSLF

Learn More About the Qualifications

If you get a job at a government or eligible not-for-profit organization and repay your loans based on your income, you may qualify for forgiveness of your Direct Loans after 120 qualifying payments and employment. See StudentAid.gov/publicservice for more information and for a form you can fill out when you start working to receive confirmation that your employment qualifies for the program.

Student Loan Cancellation Programs

Perkins loan cancellation.;Borrowers with federal Perkins loans can have up to 100% of their loans canceled if they work in a public service job for five years. In many cases, approved borrowers will see a percentage of their loans discharged incrementally for each year worked. The Perkins loan teacher benefit is for teachers who work full time in a low-income public school or who teach qualifying subjects, such as special education, math, science or a foreign language.

Recommended Reading: Who Do I Talk To About An Fha Loan

Who Can Qualify For The Fslrp

Most employees of federal agencies can qualify for student loan repayment. However, some employees may not be eligible because of the confidential or policy-related nature of their job. Other individuals might not qualify if theyre working under a time-limited appointment. If youre interviewing with a government agency, make sure to ask whether your position would disqualify you from taking advantage of the FSLRP.;

Additionally, agencies have service requirements they only agree to start making loan payments after youve worked with the agency for a certain amount of time. Service periods are typically at least three years. During the service period, employees must maintain an adequate level of performance to receive their student loan repayments. Periods when the individual is on leave do not count toward the fulfillment of the service requirement.;

Even if a government agency offers student loan repayment, they may reserve the benefit for high-qualified employees. Youre not entitled to the FSLRP just because you work for an agency that has paid down loans for other workers.;

Are Ffelp Loan Payments Suspended

Borrowers with FFELP loans owned by the Department of Education are eligible for the COVID-19 related payment suspension and interest waiver. However, borrowers with FFELP Loans that are owned by a guaranty agency and in good standing are not eligible for the suspension or interest waiver. The federal government did not include that subset of FFELP Loans when it passed the CARES Act.

However, as the coronavirus/COVID-19 pandemic has continued, the Department of Education has extended those protections through September 2021 for FFEL Loans that are in default. As a result, no collection activity can occur on defaulted FFELP Loans until October.

In addition, FFEL Loans that went into default on or after March 13, 2020, will:

- be returned to good standing

- be assigned to the Department of Education

- have the default status removed from the credit report bureaus.

Also Check: Will Refinancing My Auto Loan Help My Credit

Bidens Student Loan Forgiveness Plan

The U.S. Department of Education has canceled approximately $3 billion in student loans since President Joe Biden entered office in January 2021. The agency first forgave $1 billion in March for 72,000 borrowers with approved fraud claims against colleges, universities and career schools. Another $500 million was forgiven in June for 18,000 loan holders under the same borrower defense rule. And $1.3 billion was also canceled in March for 41,000 borrowers with total and permanent disabilities. Now, as almost one in eight Americans owe a record high of $1.73 trillion in college loans, many are hoping to get broader loan forgiveness to help manage or eliminate debt. Lets break down what a Biden loan forgiveness plan could look like, and how it could benefit you.

Consider working with a financial advisor to ensure that financing college or paying off college debt is handled in the best possible way.

Who Owes Americas Second-Largest Debt Category?

The $1.73 trillion student loan debt held by roughly 43 million borrowers is now the second-largest debt category in the U.S. after mortgage debt . And the average student loan debt is over $39,300 for each borrower in 2021.

The Federal Reserves Report on the Economic Well-Being of U.S. Households says that over four in 10 adults who went to college took on some debt to pay for their education, and those who were under 30 were more likely to take out college loans than older adults.

Inside Bidens Student Loan Forgiveness Plan

Repayment Plans With Loan Forgiveness

If you arent working in a public service position, you may still be able to get a portion of your student debt forgivenbut it will take longer. Federal income-driven repayment plans, which are designed to help graduates who would have trouble making payments within the standard 10-year time frame, also allow for some debt forgiveness after a certain period.

These plans include:

- Income-Based Repayment . Maximum monthly payments will be 10% to 15% of discretionary income. Forgiveness eligibility comes after 20 or 25 years of qualifying payments.

- Income-Contingent Repayment . Payments are recalculated each year based on gross income, family size, and outstanding federal loan balance; generally, they’re 20% of discretionary income. Forgiveness eligibility is after 25 years of qualifying payments.

- Pay As You Earn and Revised Pay As You Earn . Maximum monthly payments will be 10% of discretionary income. Forgiveness eligibility is after 20 years of qualifying payments. The government may even pay part of the interest on the loan.

In addition, if you work for a federal agency, your employer may repay up to $10,000 of your loans per year, with a maximum of $60,000, through the Federal student loan repayment program.

Your student loan servicer handles the repayment of your federal student loans, so work with the servicer to enroll in a repayment plan or change your current plan. You can usually do this online at the servicers website.

Read Also: What Loan Can I Afford Calculator

Submit Your Pslf Form Annually

Because you have to make 120 qualifying monthly payments, it will take at least 10 years for you to become eligible for PSLF/TEPSLF. We recommend that you submit a new PSLF form annually. This will help you track your progress in the program. Each time we approve qualifying employment, we will update your count of qualifying payments.

KEEP IN MIND

- We encourage you to submit the PSLF form whenever you change jobs to ensure your employment is still eligible.

- If you do not periodically submit the PSLF form, then at the time you apply for forgiveness you will be required to submit a PSLF form for each employer where you worked while making the required 120 qualifying monthly payments.

Should I Still Make Payments

Most federal student loan borrowers don’t have to pay their bills until January, and during that time interest is suspended.

Since $10,000 in student loan forgiveness is the proposal most likely to turn into reality, Mayotte said she sees nothing wrong with people who owe under that amount redirecting their usual payments to savings, “earning a little interest on them, then seeing which way the wind is blowing” as we near closer to the winter.

“If it looks like we’re no closer to forgiveness, pay the funds then,” she said.

Even if you owe more than $10,000, it can still be wise to take advantage of the government’s pause on student loan payments.

You can use the extra cash to wipe out high-interest credit card debt, for example, or to build up your emergency savings.

Also Check: How Much Credit Score Required For Car Loan

Will Biden Cancel More Student Loans

Yes, the expectation is that Biden will continue to cancel more student loan debt. Expect Biden to enact more student loan forgiveness under existing law such as for student loan borrowers with total and permanent disabilities and student loan borrowers under the borrower defense to repayment rule. Biden also may help improve student loan repayment and student loan forgiveness through income-driven repayment and the Public Service Loan Forgiveness program, for example, so that more student loan borrowers have access to student loan cancellation. .

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: What Is Fast Cash Loan

Request A Temporary Qualifying Enrollment Suspension

1.Sign in to Account Access and take the TEACH Grant Certification Quiz to complete a TEACH Grant Suspension/Military Discharge Request Form with your answers or .

2. Have an authorized official complete Section 4 of the form, confirming that you are enrolled in an eligible program of study at your institution, and indicate the dates of enrollment.

Are My Loans Ffel Loans

Chances are that if you borrowed federal student loan debt before 2011, you might have FFEL Loans. You can find out the type of federal student loans you have by visiting the Federal Student Aid website, studentaid.gov.

The current FSA website has replaced the National Student Loan Data System, nslds.ed.gov.

You can also call your current student loan servicer.

Note. If your loan servicer says that your loan is a commercial loan, they likely are referring to an FFEL Loan, which was made by a commercial lender.

You May Like: How To Negotiate Home Loan Interest Rate

What Is Temporary Expanded Public Service Loan Forgiveness

The Temporary Expanded Public Service Loan Forgiveness program, or TEPSLF, was an expansion program created in 2018 by Congress in response to the low acceptance rates for the program. Thousands of borrowers complained that they were ineligible for loan forgiveness due to the complex requirements associated with the program. Congress heard these complaints and designed an expansion program that was intended to ensure more people were eligible for the program. The TEPSLF program expands the list of repayment plans that students can use to make the requisite 120 payments to qualify for loan forgiveness. The PSLF program only accepts students who are enrolled in a form of income-based repayment , whereas the TEPSLF program allows borrowers enrolled in the following payment plans to request loan forgiveness:

- Graduated repayment plan

- Consolidation graduated repayment plan

- Consolidation standard repayment plan

Those who apply for TEPSLF must meet the other requirements for the PSLF program, such as working in a full-time public service position and making 120 qualified payments toward their loan .

In order to qualify for TEPSLF, borrowers should also first apply for the PSLF program, even if they are not eligible for the plan. While this is not a requirement set out by Congress, the Education Department has denied applications on the grounds that borrowers have not applied for PSLF.