Get The Status Of A Recent Payment

Department Of Education’s Federal Student Aid Information Center

For help accessing the National Student Loan Data System and to find information about the holder of your loan, as well as other information on your loans, call the Department of Education’s Federal Student Aid Information Center at 800-433-3243 or 800-730-8913 . For loans in default, contact the Department of Education’s Default Resolution Group at 800-621-3115 or 877-825-9923 .

Is The Amount Of Interest Higher Than You Expected

Capitalized interest may be counted as interest paid on the 1098E. That capitalized interest and your origination fees may be tax deductible. If you have more questions on your 1098-E, please contact a tax advisor.

Please note: Because fewer loan payments were required and interest rates were at 0% for much of 2020, your interest paid was likely lower than in previous years.

You May Like: Can You Ask For More Federal Student Loan

Can I Make Payments While Im In School

Yes. While you arent required to make payments while youre in school, youll save money on interest in the long run if you do. To learn more about how making payments while you are in school helps you pay less interest over the life of your loan, see What Does It Mean That Interest Is Capitalized?.

If you make a payment within 120 days after the date your school disbursed your loan funds , your payment is first applied to the original principal balance of that disbursement. This reduces the amount of your loan. For more information about payments made within 120 days of disbursement, see How Are Payments Allocated? Please note: this excludes loans that are already in repayment status and consolidation loans.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Is Bayview Loan Servicing Legitimate

My Parent Or Another Third Party Is Making Payments On My Account How Can Third Parties Continue Making Payments On My Account If They Dont Receive A Statement

Your parent, co-signer, endorser, or other third parties can quickly and easily make payments by logging in to a free online authorized payer account at Nelnet.com. First, you need to set up the third party as an authorized payer. Remember that authorized payers have access to your account details, including account number, due date, amount due , payment amount, payoff amount, accrued interest, account balance, interest rate, loan type, and payment history.

Follow these easy steps one time to set up an authorized payer:

If you would like to give copies of your Nelnet statements and correspondence to a third party, print or save the documents from your Nelnet.com account inbox and send them by email or post office mail.

Can I View My Previous Correspondence Online

When you sign up for electronic correspondence, your messages are stored for 12 months. After 12 months, they are deleted. If you want to keep messages longer than 12 months, you can save them to your own computer, a computer disc, or a flash drive before they are deleted by the system. Note: If you delete a message from your inbox, there is no way to restore it.

Don’t Miss: How To Pay Home Loan Faster

Supports For Students Affected By Wildfires

Are you affected by the current wildfire situation? Do you need help with your student loan payments?

- If you have Canada loans, or Canada and Alberta loans, contact the National Student Loans Service Centre to fast track your application for the Repayment Assistance Plan.

- For Alberta Student Loans, call 1-855-606-2096

Currently in School

If your studies have been disrupted as a result of the wildfires, and you have:

- Extended your study period

- Withdrawn from studies, or

- Your financial circumstances have changed.

Notify the Alberta Student Aid Service Centre, or login to your;Student Aid Account and submit a Request for Reconsideration. Eligible students may receive up to $7,500 in Alberta Student loan funding to help cover unexpected costs relating to the wildfire. Supporting documentation may be required to verify the costs.

Finding Your Loan Information

If you are unsure which agency is servicing your defaulted student loan, you may retrieve your loan information from the National Student Loan Data System . This system contains financial aid information collected from schools, agencies, and other educational institutions. You will need your Federal Student Aid ID information to access your account. Or, you may contact the;Federal Student Aid Information Center .

Recommended Reading: What Is The Current Sba Loan Interest Rate

When Should I Apply For A Deferment Or Forbearance

If you have any trouble making your payments, please contact us immediately to explore your options. We can help. Also, learn more about other Repayment Plans.

To learn more about deferments and forbearances, click here.

To apply for a deferment or forbearance, log in to your Nelnet.com account, and then click Repayment Options.

Who Is My Student Loan Servicer

Your student loan servicer is the company that manages your student loans. Essentially, its a third party that acts as a middleman between you and your lender. When you make a payment toward your student loan, it is managed by your loan servicer.

Student loan servicers work with borrowers to help manage their student loan repayment. If borrowers would like to change their repayment plan or apply for deferment or forbearance, they should discuss their options with their loan servicer first.

Borrowers do not choose their loan servicer, but rather, are assigned one. If you have federal student loans, your loan servicer is assigned by the Department of Education.

Below are nine loan servicers that currently manage federal loans, plus an additional loan servicer that deals with default resolution though be aware that this list may soon change.

Originally, the Department of Education had planned to change its roster of servicers in 2020, but while some new contracts have been announced, the only change as of December 2020 has been the departure of former servicer CornerStone.

| Loan servicer | |

|---|---|

| Default Resolution Group | 1-800-621-3115 |

If you have federal student loans, your answer to, Who is my student loan servicer? will be one of the companies on the list above. Note also that your loan servicer can change during the life of your loan, so make sure to check your student loan accounts for the most current information.

You May Like: How To Calculate Loan Installment

What If I Need Another Copy Of My Irs Form 1098

To file your taxes, you are not required to include a copy of your IRS Form 1098-E. However, you do need the amount from the form to know how much paid interest to deduct. To access the form electronically, log in to your Nelnet.com account. Once youre logged in, click Documents and select Tax Info.

How Is Student Loan Interest Calculated

Federal student loans use a method of interest accrual known as “simple interest. Simple interest is calculated only on the principal balance. The principal balance may include previously capitalized interest.

To calculate your daily interest accrual, use the following formula: ÷ 365.25

With this equation, your current principal balance is multiplied by the interest rate. Then that product is divided by 365.25 . The result then can be multiplied by a specific number of days to determine how much interest would accrue in a specific time frame .

Example:

- Number of days of interest: 30

x 30 = 47.22780, or approximately $47.23 in monthly accrued interest.

Read Also: How To Apply For Fha Loan In Illinois

I Am A Member Of The Us Military Am I Eligible For Any Special Federal Student Loan Benefits

Nelnet is grateful to those who serve or have served our country, and we recognize the sacrifices you have made. As a member of the U.S. military, youre entitled to special benefits provided by the U.S. Department of Education and the U.S. Department of Defense. To learn more about these benefits, see Resources for Servicemembers.

What Is A Deferment

A deferment is an authorized temporary suspension of repayment that can be granted under certain circumstances. To get a deferment, you must apply for it, meet the qualifications, and make arrangements with the servicer of your loan. Depending on your loan type, interest may continue to accrue during a deferment, and any unpaid interest will be capitalized at the end of the deferment. While not required, you can continue making payments without penalty even if no payment is due, which will reduce your total cost of borrowing and save you money in the long run.

Recommended Reading: When Do I Pay Back Student Loan

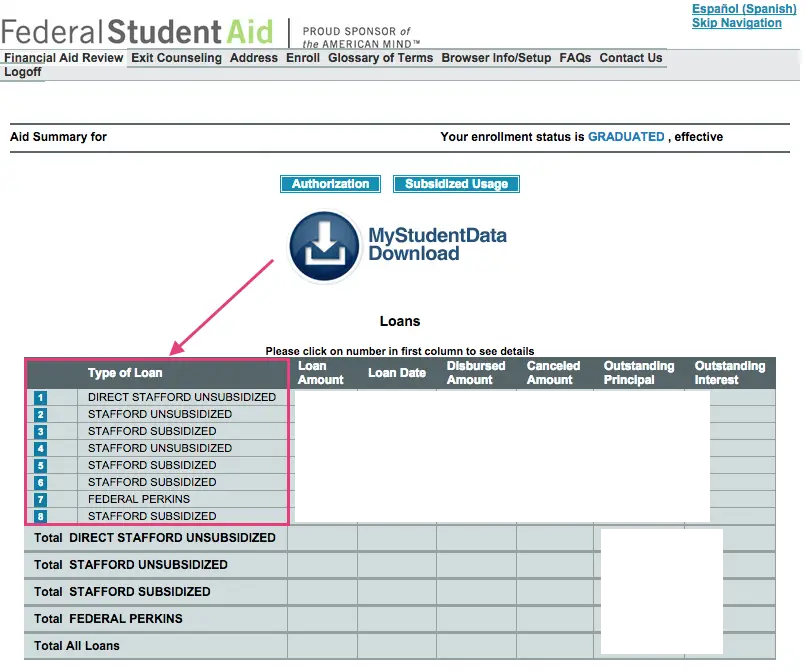

Keep Track Of Your Loans

The National Student Loan Data System is the U.S. Department of Educations comprehensive database that helps federal student loan borrowers find information about their loans including:

- Loan amounts disbursed and current balances

- Schools attended and their contact information

- Your student loan holder and contact information

- Grace period details

- Loan interest rate

To access the NSLDS, youll need your federal FSA ID, the same ID you used when completing the FAFSA.

Lost your FSA ID? If youve forgotten your FSA ID username or password, you can retrieve it from the Federal Student Aid;FSA ID website. You can retrieve the FSA ID using the email or phone number you provided when creating the FSA ID or answering the Challenge Questions.

Print the Loan Tracking Worksheet to record details of your loans. If you don’t know who the lender or servicer is and you don’t have a coupon book or bill for these loans, access your to see who is reporting outstanding loans in your name.

How Long Does It Take For My Deferment Or Forbearance Application To Be Reviewed

It typically takes about three business days from the day we receive your application. To potentially reduce this time, apply online: log in to Nelnet.com and click Repayment Options. Many deferments and forbearances requested online are processed within 24 hours. If we need additional information from you to fully process your application, we’ll let you know and then process the deferment or forbearance once you have provided what we need.

Don’t Miss: What Credit Score Do You Need For An Fha Loan

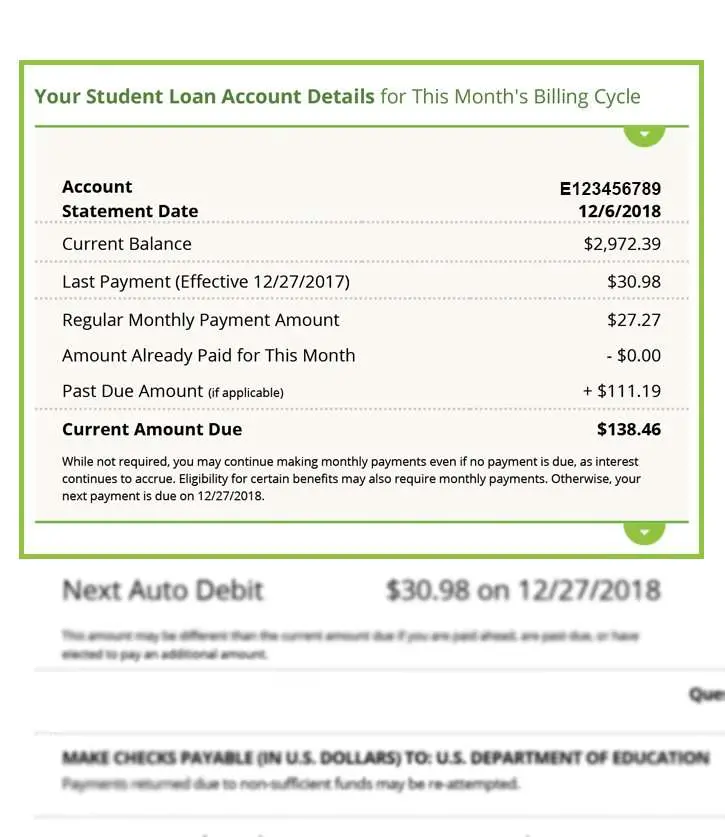

What Is My Nelnetcom Account

Your Nelnet.com account is a secure section of the Nelnet website where you can view your account and loan details, make payments, ask to lower or postpone your payments, sign up for auto debit, and more. To access your account, log in with your username and password. If you havent created your online account, you can create one by clicking the Register button at Nelnet.com.

We Protect Your Online Account

Account Access is only intended for our borrowers. To protect personal information, we will block or delete an online account if we suspect a third party has accessed it or if we suspect fraudulent activity is taking place on the online account. If you are not the borrower and need assistance or have questions about their account, for assistance. We’ll do everything we can to help.

You May Like: Can You Get An Fha Loan To Buy Land

What Do I Do With My 1098

You’ll have one 1098-E for each account listed on your Account Summary.

To file your taxes, you don’t need a physical copy of your 1098-E. Check with a tax advisor to determine how much of the interest paid on your student loans in the previous year is tax deductible. If you have more than one account, you’ll need to look at multiple statements and add the numbers together for your total deduction. Enter the amount from box 1 into the student loan interest deduction portion of your tax return.

If you want a physical copy of your 1098-E for your records, just print it out from our website. It’s as easy as that!

Federal Student Aid Ombudsman Office

If you’ve tried all of these places and are still in need of help, consider contacting the Federal Student Aid Ombudsman office. The Department of Education’s student loan ombudsman helps borrowers with student loan problems. The ombudsman is a last resource; usually, it will help you only after you’ve tried to resolve your issue yourself. You can contact the student loan ombudsman office at 877-557-2575.

You May Like: When To Apply For Ppp Loan Forgiveness

Pay Attention To Notifications From Servicers

Closely watch your email and mail for notifications from student loan servicers. They will reach out to you with updates.

For instance, they should contact you to let you know when your post-college student loan grace period is up and when you should begin making payments.

If you lose track of even one student loan, it could go into default which can add big fees to your student loan debt and destroy your credit.

If youre not receiving correspondence from your lender or loan servicer, electronic or otherwise, they may not have your up-to-date contact information. To find your loan holder and correct this error, try the following step.

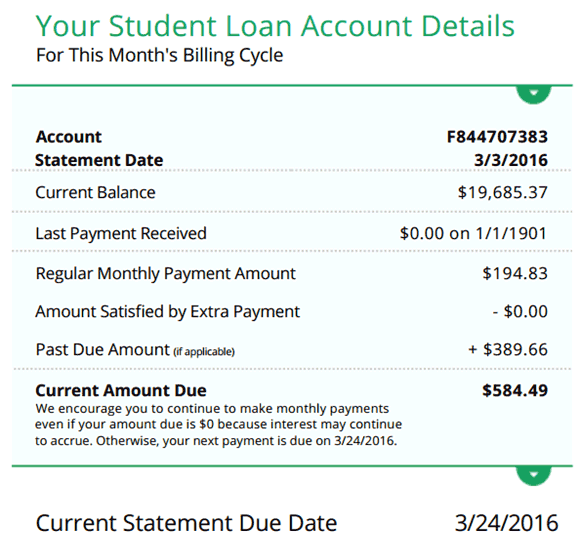

Are There Any Fees Associated With Repaying A Federal Student Loan

If you are late on a payment or your payment is returned, your lender has the discretion to charge you a fee. * Your lender may charge other fees related to collecting a defaulted loan. Below is a list of possible fees. If you have specific questions regarding fees, contact us.

* The U.S. Department of Education does not assess late or returned payment fees. back

- Late fee: Any payment not received within 15 or more days after the due date may incur a late fee of up to six cents for each late dollar as determined by your lender and described in the terms of your promissory note. Your late fee is calculated based on the unpaid portion of your regular monthly payment amount. You can find information about late fees in the account snapshot on your monthly billing statement.

- Returned payment fee: A payment returned due to non-sufficient funds may be reattempted a maximum of one time. A returned payment may be assessed a $5 fee.

- Miscellaneous fees: You may be charged certain reasonable costs incurred in collecting your loan. Costs can include, but are not limited to, attorney fees and court costs.

You may reduce this extra cost by paying more than your current amount due to cover the amount of your fee. If a fee is charged to your account, we will include detailed information about the fee on your monthly billing statement.

Recommended Reading: What Do Mortgage Loan Officers Do

Granite State To Stop Servicing Federal Student Loans When Current Contract Ends

In the next few months, Granite State will be working closely with the U.S. Department of Education to transfer all federal student loans currently held by Granite State to Edfinancial Services.

Please note that this change will not affect the existing terms, programs, or available repayment plans on your loans, nor will it affect the temporary suspension of payments and 0% interest benefits applied for the COVID-19 emergency. Auto-debit information will be transferred to Edfinancial Services; however, borrowers should contact Edfinancial Services to verify information once the transfer is complete.

Affected borrowers can expect to receive more information about this transfer from ED and Granite State, and once the transfer is complete borrowers can expect to receive additional information from Edfinancial Services. Be sure to read these notices fully. You can also visit StudentAid.gov/granitestate for the latest updates and information on loan transfers.

You can check your current balance online, and if you have questions, please contact Granite State at 1-888-556-0022.