How Does The Ppp Loan Program Work

The Paycheck Protection Programs main objective is to keep employees on the payroll and provide cover for utilities, rent, supplier expenses, mortgage interest, and other necessary business expenditures.

The borrower can spend the loan paying any allowable costs obtained during their covered time. A financial organization can ensure that the borrower was operational as of Feb. 15, 2020. The Paycheck Protection Program has been responsible for offering forgiven loans to small-scale businesses.

At first, the loan plan had assigned $350 million in March and $320 billion in April. In December 2020, Congress allocated $284 million for new and second-time loan withdrawal for small businesses. Private lenders offer these loans, and the Small Business Administration supports them.

Loan Proceeds Are Not Included As Taxable Income

There is a lot of confusion about this with PPP loans, especially since they are not income when received, especially since they are expected to repay them. If a taxpayer repays the PPP loan, nothing to report as income will be nothing.

For this reason, it should not include that income from this type of loan will not be included in income for federal income tax purposes. However, it should consider that if the loans are forgiven, the rules will be different, even though these types of loans are tax exempt.

PPP loans were originally designed to be used as loan funds and were relieved of the obligation to repay. For this reason, if this type of tax is properly used and forgiven, the taxpayer will not need to report the forgiveness as gross income.

It is considered proper use of this type of loan if at least 60% of the funds are used to pay payroll. For this reason, if properly used, this income is exempt from taxation.

When Do You Report Ppp Forgiveness On Tax Return

You dont report forgiveness until you actually receive it. If the loan isnt forgiven until 2021, then you dont report it until 2021. The PPP forgiven amount is excludable on both the CA and federal return. On the federal return you can fully deduct the expenses that were paid with the PPP forgiven loan amount.

You May Like: How To Cancel Zoca Loan

Why Did Ppp Close Down Early

The original deadline to apply for a PPP loan was May 31, 2021, but it winded down on May 28 instead. There was a high volume of applications and there weren’t enough remaining funds. The PPP quickly ran out of funds for both the First Draw and Second Draw.

PPP loans are low-interest, with a 1 percent interest rate, but many loan recipients are eligible for full PPP loan forgiveness. The PPP program provided almost $800 billion of forgivable loans to small businesses.

Are Expenses Paid With Ppp Loan Proceeds Deductible On My Tax Return

Yes. Expenses paid with PPP loan proceeds are deductible on your tax return, regardless if the loan was forgiven or not. With the passing of the Consolidated Appropriations Act of 2021, Congress made it clear that these expenses are deductible. Originally, the IRS ruled that expenses paid with forgiven PPP loan proceeds would not be deductible. After passage of the Consolidated Appropriations Act of 2021, the IRS issued Revenue Ruling 2021-2, which made obsolete prior rulings that these expenses were non-deductible.

Many taxpayers may see this as a “double dip” benefit, which is exactly what it is. Not only do taxpayers get tax free treatment of the forgiven PPP loan proceeds, but they are also allowed to deduct expenses paid with the loan proceeds. Some accounting professionals were somewhat surprised by this provision, but Congress stated that it was intended to maximize the benefits of those businesses hit the hardest by the COVID-19 pandemic.

In the TaxAct program, you should enter your expenses as you normally would. You will not be required to enter expenses paid with PPP loans, as the IRS is not requiring nor requesting this information.

Also Check: How To Find Out Apr On Car Loan

Other Covid Tax Relief Options For Small Business Owners

Receiving PPP and/or EIDL funds isnt the only way small business owners have been able to weather the COVID-19 storm. There are additional relief options out there in the form of small business deductions and tax credits that can help lower your tax liability and ease some of the financial burdens of the pandemic. COVID tax relief options for small business owners include:

- Writing off expenses paid for with PPP loan funds

- Writing off expenses paid for with EIDL loan and/or grant funds

- Claiming tax credits for required paid leave provided by small and midsize businesses

The Claim: Ppp Loans Must Be Reported On Tax Returns

It’s tax season, and thanks to the COVID-19 pandemic, thousands of businesses have a new type of loan to consider while filing.

The Paycheck Protection Program, a cornerstone of the CARES Act, provided loans to small businesses to help them stay afloat during the first year of the COVID-19 pandemic. But some social media posts imply the loans came with a cost.

“PPP LOANS MUST BE REPORTED ON THE TAX RETURN,” reads a , shared more than 350 times in four days.”smh the GAME just changed.”

“Report it you want and if you dont gone to jail,” one commenter wrote.

Another commenter wrote, “If u got one it better be included with dem w2s.”

But experts told USA TODAY it’s not that simple. No loans need to be reported as income, because there is an expectation they will be paid back. Though forgiven or canceled loans are typically taxable, PPP loans are federally tax-exempt if used properly. However, some states may tax forgiven PPP loans.

In response to USA TODAY’S request for comment, the post’s creator, Kristie Fuller, reiterated the claim made in the post and said her post was misunderstood by other social media users.

“A lot of people were in a uproar claiming it was false claim however I never said it was apart of the income you report,” she said.

Follow us on Facebook! Like our page to get updates throughout the day on our latest debunks

Read Also: Can Student Loan Interest Be Reduced

Can My S Corp Pay My Mortgage

A corporation cannot pay an employees mortgage as a fringe benefit because it is not a typical business deduction the employee would incur on his own, according to the IRS. This means the company would report payments on the employees W-2 form and withhold state and federal taxes.

What Is The Impact On Ppp Loan Repayments

It should note that Paycheck Protection Program loans have no impact on federal refunds within certain limitations. The loans have undergone many revisions and amendments, so the reporting of any forgiveness as income has been eliminated.

In addition, expenses can be reported as deductions on the tax return. For this reason, it is taken as a double bonus for companies that can claim a tax deduction for expenses that have been paid with PPP funds.

However, if a company meets the requirements for remission, the portion that is not remitted must be refunded. The interest rate is assessed at that time, and any interest will be tax-deductible. The loan will represent a cash inflow and a liability on the companys balance sheet.

A PPP loan itself does not generate any income tax consequences, and in some cases, it will be necessary to include a statement on the tax return about the forgiven loan. Also, if a loan is forgiven, the company will not receive a 1099-C. Now you know all the information regarding the PPP tax and how it can affect your tax return.

Also Check: Can You Have More Than One Consolidation Loan

What Payroll Taxes Are Included In The Ppp Loan Forgiveness

Payments for employer state and local taxes paid by the borrower and assessed on S corporation owner-employee compensation is eligible for loan forgiveness as are employer retirement contributions to owner-employee retirement plans, capped at the amount of 2.5/12 of the 2019 employer retirement contribution.

Eligible Paycheck Protection Program Expenses Now Deductible

IR-2021-04, January 6, 2021

WASHINGTON The Treasury Department and the Internal Revenue Service issued guidancePDF today allowing deductions for the payments of eligible expenses when such payments would result in the forgiveness of a loan under the Paycheck Protection Program .

Today’s guidance, Revenue Ruling 2021-02PDF, reflects changes to law contained in the COVID-related Tax Relief Act of 2020, enacted as part of the Consolidated Appropriations Act, 2021, Public Law 116-260,which was signed into law on December 27, 2020.

The COVID-related Tax Relief Act of 2020 amended the Coronavirus Aid, Relief, and Economic Security Act to say that no deduction is denied, no tax attribute is reduced, and no basis increase is denied by reason of the exclusion from gross income of the forgiveness of an eligible recipient’s covered loan. This change applies for taxable years ending after March 27, 2020.

Revenue Ruling 2021-02 obsoletes Notice 2020-32 and Revenue Ruling 2020-27. This obsoleted guidance disallowed deductions for the payment of eligible expenses when the payments resulted in forgiveness of a covered loan.

For more information about this, the COVID-related Tax Relief Act of 2020, and other tax changes, visit IRS.gov.

Don’t Miss: How Much Down Payment For Small Business Loan

How To Generate A Ppp Forgiveness Statement

If you do not know how to generate a forgiveness statement for PPP loans, you should follow these steps:

- From the menu on the left side, you should select the General option.

- Then click on Misc. Info/Direct Deposit.

- You should go to the Miscellaneous section at the top of the entry.

- The appropriate fields in the PPP Loan Forgiveness Statement section should be completed.

This statement must be included in the electronically filed federal return. This is because the program will generate a form with this statement.

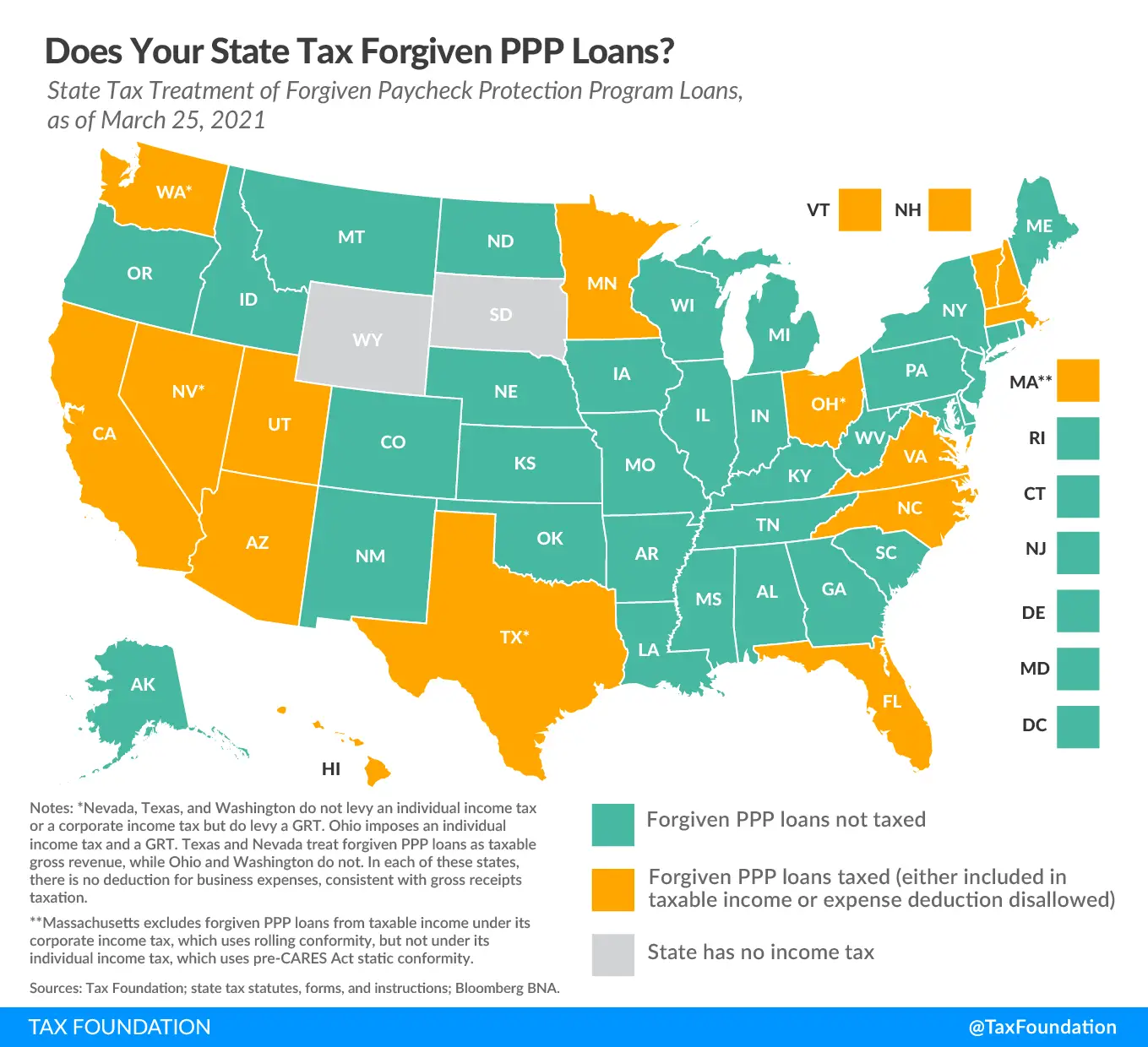

Some States May Tax Forgiven Ppp Loans

A number of states may require income tax payments on forgiven PPP loan amounts, despite the fact that the federal government won’t.

For example, Nevada, Utah, North Carolina and Florida taxed all forgiven PPP loans in 2020, according to the tax policy nonprofit Tax Foundation. California, Rhode Island and Virginia taxed some businesses’ forgiven PPP loans, and both Washington and Ohio taxed forgiven PPP loans in some instances.

The reason some states will tax forgiven PPP loans while the federal government won’t is because of state income tax laws, according to Forbes.

PolitiFact first reported on the claim.

USA TODAY reached out to the IRS for comment.

Recommended Reading: How To Lower The Interest Rate On Your Car Loan

Is There Any Special Process Or Form For Amending Returns To Claim The Newly

No, taxpayers should follow FTBs normal amended return procedures. However, if a taxpayer makes an election under Rev. Proc. 2021-20 for federal purposes, California will follow the federal treatment for California tax purposes.

Additionally, FTB does not anticipate creating any new forms to implement AB 80, but we are in the process of updating line item instructions.

If You Received A Ppp Loan Expect A Tax Audit

The SBA and the US Treasury have announced that all PPP loans in excess of $2 million will be audited. Loans that are less than $2 million are subject to an audit, and it has been reported that much lower loans have been scrutinized. What does this mean for you? In short, all recipients of the PPP loan should expect to be audited, as there is a higher probability that the IRS will audit you.

Audit is a pretty scary word, especially if youve never faced one before. However, the audit process should be pretty painless as long as you have your records in order and you used funds appropriately. Heres how to make the process go as smoothly as possible:

- Dont Procrastinate: Sure, an audit can be scary but ignoring it wont make it go away. Read over your notice carefully and begin compiling your documentation as soon as possible.

- Keep All Records: Receipts, statements, payroll records, and PPP documentation should be kept on file for at least six years after your PPP loan is fully repaid or forgiven.

- Make Copies: If youre sending off documentation, make sure to send copies. Always retain your original documentation in case you need it at a later time.

- Hire A CPA: A CPA, unlike a regular accountant, will be able to represent and defend your business against the IRS, if necessary. A CPA can also offer important advice for tax preparation and future audits.

You May Like: How To Get Personal Loan With Fair Credit

Is Ppp Loan Forgiveness Taxable

For federal tax purposes, PPP loan funds that have been forgiven are excluded from your businesss gross income. That also includes anyone self-employed that received a PPP loan. In other words, any portion of your PPP loan that has been forgiven will not be included as part of your companys taxable income.

Our Rating: Missing Context

Based on our research, we rate MISSING CONTEXT the claim that PPP loans must be reported on tax returns, because without further context it could be misleading. Loans don’t need to be reported as income when received, because there is an expectation they will be paid back. PPP loans are federally tax-exempt if used properly, but some states may tax forgiven PPP loans.

Read Also: Can I Apply For Another Student Loan

Federal And State Tax Consequences Of Ppp Loan Forgiveness

During 2020 many small, and even not-so small, businesses applied for and received Paycheck Protection Program loans which, if spent on certain permitted expenditures, are forgivable and essentially become a form of government grant.

Under the PPP law, loan forgiveness is not automatic. A borrower who wants to have their loan forgiven must apply for forgiveness within 10 months of the end of their loans covered period, which is generally no more than 24 weeks after their loan was funded. Therefore, most borrowers PPP loans will not be officially forgiven until 2021. Loans of more than $2 million received by some borrowers may not be forgiven until 2022, as the SBA will be auditing the loans to ensure that the borrowers qualified for a loan to begin with and spent the loan proceeds on permitted expenditures.

Although in March 2020 Congress stated in the CARES Act that PPP loan forgiveness income was not subject to federal income tax, the IRS took the position that since PPP loan forgiveness income was not taxable, expenses paid with a PPP loan were not deductible, essentially making the PPP loan forgiveness taxable income. Congress eventually made its original intentions abundantly clear and in December of last year passed the Consolidated Appropriations Act , which provides that PPP loan forgiveness is not taxable and that PPP-funded expenses are also deductible.

Timing of PPP Loan Forgiveness Reporting for Passthrough Entity Owners

Summary:

Is The Ppp Forgiveness Loan Taxable

According to Coronavirus Aid, Relief, and Economic Security Act, there have been debates on if PPP is taxable or not. Despite arguments from IRS regarding taxable expenses, congress has shed light stating that only income will be liable for tax charges. In view of this, small businesses do not pay tax on the money received.

The sole purpose of the money disbursed to businesses is to keep them up and running. To do that easily, taxes are removed to avoid putting extra burdens on such businesses.

Keep in mind that based on initial understanding, the expenses covered by the PPP loan are not tax-deductible. But with clarifications as of December 2020, the stimulus act changes occurred. Now, expenses carted to by PPP loan are eligible for tax deductions much to the relief of businesses.

Further, the clarification translates to relief for small businesses. The PPP loan would in no way affect the tax filling procedure of businesses.

Smart Note:

Failure to comply with the PPP loan requirements disqualifies a business from enjoying the loan forgiveness option. Compliance with the spending percentage on the specified aspects guarantees loan forgiveness. For businesses unable to comply they miss out on loan forgiveness.

You May Like: How To Find Interest Rate On Car Loan

Can Ppp Loans Be Used To Pay Business Taxes

Although the Small Business Administration offered an extensive array of uses for PPP loans, they can not be used to pay business taxes. Small businesses not eligible for the PPP can still use other financing methods and carefully consider all logical sources.

The recent round of the CARES Act provides more room for small businesses to use PPP loans. Protective equipment, asset deterioration, and business software are among the latest costs covered in the PPP loan program. However, business taxes are still not included in that list. Business owners cannot pay income tax, sales tax, or any other tax with the PPP loan funds. Hence, the amount of PPP loan being used for paying business taxes will not be forgiven.

Business owners can opt for the Employee Retention Tax Credit if they fulfil the criteria. But they can not claim salaries paid with a PPP forgiven loan. To be eligible for the tax credit, a business must pay wages to workers regardless of a temporary halt due to the coronavirus lockdown or going through a 20% reduction in total receipts compared to the last year.

Expenses Deducted Under A Forgiven Ppp Loan

The 2020 General Assembly enacted G.S. 105-153.5 and G.S. 105-130.5 requiring North Carolina taxpayers to addback the amount of expenses deducted under the Code to the extent that expenses were paid with forgiven PPP loan proceeds. Importantly, the 2021 General Assembly retroactively amended G.S. 105-130.5 and G.S. 105-153.5, delaying the States decoupling adjustment. As amended, a taxpayer is not required to add to federal income the amount of otherwise deductible expenses paid with forgiven PPP loan proceeds until tax years beginning on or after January 1, 2023. Because the General Assembly chose to suspend the State-level PPP addback until 2023, North Carolina conforms to the federal treatment of expenses paid by PPP loans for tax years 2020 and 2021.

Recommended Reading: Who Can Cosign My Student Loan