If You Decide To Cancel

If you decide to cancel, you must tell the lender in writing. You may not cancel by phone or in a face-to-face conversation with the lender. Your written notice must be mailed, filed electronically, or delivered, before midnight of the third business day.

If you cancel the contract, the security interest in your home also is cancelled, and you are not liable for any amount, including the finance charge. The lender has 20 days to return all money or property you paid as part of the transaction and to release any security interest in your home. If you received money or property from the creditor, you may keep it until the lender shows that your home is no longer being used as collateral and returns any money you have paid. Then, you must offer to return the lenders money or property. If the lender does not claim the money or property within 20 days, you may keep it.

If you have a bona fide personal financial emergency like damage to your home from a storm or other natural disaster you can waive your right to cancel and eliminate the three-day period. To waive your right, you must give the lender a written statement describing the emergency and stating that you are waiving your right to cancel. The statement must be dated and signed by you and anyone else who shares ownership of the home.

The federal three day cancellation rule doesnt apply in all situations when you are using your home for collateral. Exceptions include when:

What Is A Home Equity Loan

A home equity loan allows you to borrow money against the equity in your home. Home equity is the value of the home less the amount or any mortgage debt outstanding. With a home equity loan you receive a lump sum payment and then repay the loan over a set period of time at a fixed interest rate. A home equity loan is typically a loan for a fixed amount. These loans generally have a fixed rate of interest and are paid over a fixed term, just like your original mortgage.

A home equity loan differs from a home equity line of credit or HELOC. A HELOC is a line of credit against the equity in your home that you tap as needed. Repayment terms can vary and in some cases there can be a balloon payment due at the end of the loan term. The interest rate might also be variable.

The current tax rules based on the tax reform passed at the end of 2017 no longer allow the interest paid on home equity loans or HELOCs to be deducted for tax purposes unless the money is specifically used for home improvements or related items as specified by the IRS.

Requirements To Apply For A Home Equity Loan Or Heloc

If you know exactly how much you need to borrow and know you can repay that amount over a number of years, then a home equity loan is likely the right choice for you. However, if you’re unsure how much you’ll actually need to borrow or for how long you’ll need to keep taking money out, then you should consider a HELOC instead.

When you’ve made that determination and want to move forward, there are some things you’ll need to have in line before a lender will approve you. Typically, both options have similar requirements, although each lender is different and may require something that their competitors do not. Laws can also differ from state to state. These are some of the requirements you’re likely to encounter:

Also Check: Usaa Refinance Car Loan

Finding The Right Mortgage

As we said, if your credit score is below your lenders standards, its possible that your first mortgage application wont be approved but, dont give up right away. If everyone with a score under 680 got rejected for mortgages, the population of homeowners in most cities would be sparse, to say the least. That being said, before applying for a mortgage with any lender, its best to improve your credit score as much as you can, since doing so will help you gain access to better interest rates.

Remember, applying for a mortgage is the same as for any other credit product, in the sense that the lender will have to make a hard inquiry on your credit report, causing your score to drop a few points. So, when youre starting to get serious about buying a house, make sure to do some research in advance to find the best lender for your specific financial needs. Loans Canada can help match you with a third-party licenced mortgage specialist that meets your needs, regardless of your credit.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 87 votes.

What Is A Home Equity Loan And A Home Equity Line Of Credit

Even though both are similar, there are some differences. Do keep in mind that both can leave you at risk of foreclosure if you fail to pay back your lender.

Home equity loans are distributed as a single lump sum that you pay back to the lender with interest in fixed monthly payments. Think of it like a second mortgage on your home. Home equity loans have fixed interest rates, which means the rate doesnt change. They can also be tax-deductible, depending on how you use them.

A HELOC acts like a credit card, so you can tap into the funds whenever needed. As you pay the balance back, the available balance is replenished. There is a draw period where you can withdraw funds, followed by a repayment period where you no longer have access to the funds.

Read Also: How To Get Loan Officer License In California

Advantages And Disadvantages Of Home Equity Loans

The primary advantage of home equity loans is that they have lower interest rates than personal loans and credit cards. In fact, many borrowers use home equity loans to pay off their credit card debts.

On the other hand, a primary disadvantage of a home equity loan is that you are increasing the debt on your home, which adds to your financial risks. For example, if you were to lose your job or incur unexpected medical bills, you might have difficulty making your monthly payments on time. If that happened, you might default on your loans, and you could face foreclosure by the lender.

This means that before you take on the additional payment for a home equity loan, you should consider carefully your financial situation. Do you have sufficient cash flow to make the loan payments in the event of a loss of income? Are you comfortable risking the equity in your home? Or would it make more sense to do a cash-out refinance of your first mortgage?

Home equity loans are an effective way to manage large expenses as long as they are kept in proportion to your financial resources you are aware of the importance of timely repayment.

References

Which Home Equity Loan Is Better For You

The right home equity financing for you depends entirely on your situation. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. If you are trying to decide, think about the purpose of the loan. Are you borrowing so youll have funds available as spending needs arise over time or do you need a lump sum now to pay for something like a kitchen renovation?

A home equity loan offers borrowers a lump sum with an interest rate that is fixed but tends to be higher. HELOC, on the other hand, offers access to cash on an as-needed basis, but often comes with an interest rate that can fluctuate.

As a borrower, it pays to shop around and ask a lot of questions to ensure that you are getting the right financing for you at the best rate possible.

You May Like: What Is The Maximum Fha Loan Amount In Texas

Why Is A Home Equity Loan An Attractive Option For Financing

Home equity loans usually come with lower interest rates than you would otherwise find with a traditional loan or other form of credit. Plus, it is a secured loan and your home is the collateral, so the bank sees the loan as less of a risk. Plus, it is a tax-deductible financing option as already mentioned above.

How Can I Determine How Much Equity I Have In My Home

To determine how much equity you have in your home, you’ll need two numbers.

The first is how much you still owe on your mortgage. That number may be on your monthly mortgage statement or the mortgage amortization table provided by your lender. Or, you can simply call your lender and ask.

The second number is how much your home is currently worth. You can get a ballpark estimate by asking a local real estate agent or checking what homes comparable to yours have sold for recently. For a more precise estimate, you can hire a professional real estate appraiser.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Why Your Credit Score Matters

Your credit score is a reflection of how you handle credit and debt. An exceptional credit score is a sign to prospective lenders that they can trust you to repay your loan on time. A score in the good range might be enough to get approved for a home equity loan, as long as you’re working with the right lender and your overall financial profile is satisfactory. However, the lender may still view you as a risk and charge a higher interest rate.

But if your credit score is in the poor to fair ranges, it may signify that you’re new to credit or have made credit missteps in the past.

Before you apply for a home equity loan, check your credit score to see where you stand. If it needs work, get a copy of your credit report to see where you can improve.

If there are any errors, report them to Experian and the other credit bureaus as soon as possible. If not, focus on areas of weakness.

For example, if you have outstanding delinquencies, get current on your payments quickly. If your credit card balances are high, create a strategy to pay them down. With each issue you find, work on a solution sooner than later.

Compare Our Top Lenders

- About Us

- Advertising Disclosure

This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which impacts the location and order in which brands are presented, and also impacts the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Close

You May Like: Usaa Auto Loan Bad Credit

Should I Be Borrowing Against The Equity In My Home

That depends entirely on your financial scenario. If youve built up a great deal of home equity, enjoy a relatively stable fiscal situation, and are confident in your ability to pay back a HELOC, theres nothing inherently concerning about this common and routine real estate practice.

In fact, millions of homeowners who need ongoing or extensive access to capital do it every day. The key is to plan ahead and not overextend yourself if you have questions, be sure to consult with a qualified financial professional.

How Do I Qualify For A Home Equity Loan

Generally speaking, lenders will require you to have at least an 80% loan-to-value ratio remaining after the home equity loan in order to be approved. That means youll need to own more than 20% of your home before you can even qualify for a home equity loan.

If you have a $250,000 home, youd need at least 30% equitya mortgage loan balance of no more than $175,000in order to qualify for a $25,000 home equity loan or line of credit.

Don’t Miss: Usaa Car Loan Pre Approval

Other Requirements For Getting A Heloc

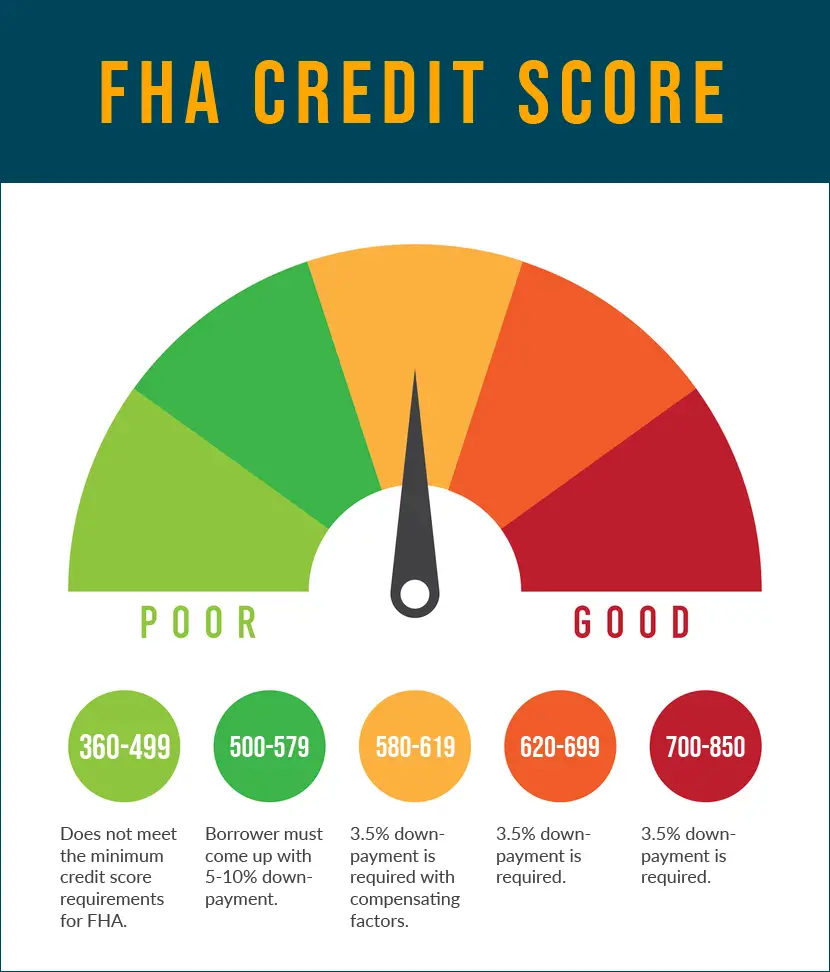

The lenders also run a financial background check on the homeowner to assess his/her capability to repay the loan withdrawn from the home equity line of credit. The plays a role in getting a HELOC approved and in deciding your interest rate. Your debt to income ratio also has a part to play in assessing your risk as a borrower.

The homes value is appraised to determine the equity value and all owner documents are verified to ascertain ownership and the mortgage position on the property. Proof of steady income and ability to repay the loan is also assessed. If you are a self employed person or have an unsteady or fluctuating income, you may have to convince the lender of your ability to repay the loan liability. The lender will also seek documentation regarding previous second mortgages on the property and their repayment history.

All these requirements including the minimum equity requirements for HELOC have been put in place to ensure that the lender and borrowers risk is minimized. Its to protect you and the lender!

What Are The Different Types Of Home Equity Financing

Reading time: 3 minutes

Paying for college, financing home renovations and consolidating debt are just a few of the reasons that homeowners take out home equity loans or lines of credit. Whether you need a one-time lump sum of money or access to cash on an as-needed basis, these types of financing provide flexible and accessible options.

There are two main ways a homeowner can borrow against the equity in their home: a home equity loan and a home equity line of credit .

Recommended Reading: Autosmart Becu

How To Qualify For A Home Equity Loan

Follow these steps to determine if you’re eligible for a home equity loan:

Pros Of A Home Equity Loan

Low interest rates: While a lower credit score could give you a higher interest rate, you’ll likely still get a lower rate than you would with a personal loan. That’s because the collateralâyour home’s equityâlowers the risk to the lender.

Interest may be tax-deductible: If you use your loan to buy, build or substantially improve the home you use to secure the loan, you may be able to deduct the interest you pay. The deduction is available for qualified mortgage loans up to $750,000.

No restrictions for how you use the money: Home equity loans function similarly to personal loans in that they don’t require that you use the loan for a specific purpose. This means you can use a home equity loan to consolidate other debt, pay for home improvements or cover the cost of tuition for one of your children.

Also Check: Usaa Auto Loan Approval Odds

How Do You Pay Back A Home Equity Line Of Credit

A HELOC has two phases: the draw period and the repayment period.

During the draw period, you can borrow from the credit line by check, transfer or a credit card linked to the account. Monthly minimum payments often are interest-only during the draw period, but you can pay principal if you wish. The length of the draw period varies its often 10 years.

During the repayment period, you can no longer borrow against the credit line. Instead, you pay it back in monthly installments that include principal and interest. With the addition of principal, the monthly payments can rise sharply compared with the draw period. The length of the repayment period varies its often 20 years.

At the end of the loan, you could owe a large lump sum or balloon payment that covers any principal not paid during the life of the loan. Before you close on a HELOC, consider negotiating a term extension or refinance option so that you’re covered if you can’t afford the lump sum payment.

Choose Your Debt Amount

Home> Real Estate> How to Get a Mortgage> Home Equity Loans

Need some extra cash? Home equity loans are a convenient, low-cost way to borrow large sums at favorable rates.

Home equity loans for debt consolidation will have a much lower interest rate than credit cards, but you can also use the equity in your home for large home improvement projects like a kitchen remodel or even a down payment for another property.

Whats not to love about that?

The equity figure in home equity loans is a simple math equation: Homes value minus amount owed = home equity. So, if your home is worth $200,000 and you owe $125,000, you have $75,000 worth of equity.

Most lenders offer an 80% loan-to-value rate based on your equity. With the $75,000 equity example, you could qualify for up to a $60,000 loan .

You would receive the $60,000 in a lump sum, then begin a monthly repayment schedule at a fixed rate for anywhere from 5-to-15 years, though most are 5-year loans.

And now that often-asked question: Can I get a home equity loan for anything?

The answer is YES! Anything your heart desires. Lenders wont follow you around to see how the money is spent.

If you qualify for a home equity loan, the cash can be used for financing your daughters wedding, taking a family vacation to Europe, getting some front-row Broadway tickets to Hamilton, purchasing season tickets for your favorite sports teams, paying off your student loan or even making home improvements.

Read Also: What Do Loan Officers Look For In Bank Statements