Buying A New Or Used Car May Be One Of The Biggest Purchases You Make In Your Lifetime With All The Moving Parts That Come With A Car Loan Figuring Out How To Pay For Your Ride Can Send You For A Spin

With the average price of a new car hovering around $35,000, according to a Consumer Financial Protection Bureau blog post published in 2018, chances are youll have to take out a car loan.

But before you pick out your next set of wheels, its a good idea to do a little homework on auto financing first. In this article, well take a closer look at the most common types of car loans, auto loan lenders, important key terms to know and how to prepare to apply.

I Was Behind On My Payments What Are My Options

Theres good news for delinquent borrowers, too: You get a fresh start.

You will be current, said Scott Buchanan, executive director of the Student Loan Servicing Alliance, an industry trade group. Their delinquency was removed.

That should remove the pressure for borrowers who were in danger of falling into default, which happens if youre 270 days behind. If you had been delinquent, find out what your payment is expected to be, and if you cannot afford it, consider enrolling in a different repayment plan that will lower your bill.

Is It Better To Get A 30

Refinancing from a 30-year, fixed-rate mortgage into a 15-year fixed-rate note can help you pay down your mortgage faster and save lots of money on interest, especially if rates have fallen since you bought your home. Shorter mortgages also tend to have lower interest rates, resulting in even more savings.

Also Check: How Long For Sba Loan Approval

How Does Student Loan Interest Work: Federal Rates Fees

Interest rates for loans disbursed on or after July 1, 2021, and before July 1, 2022, are:

- Direct unsubsidized loans: 3.73% for undergrads and 5.28% for graduate and professional students

- Direct subsidized loans: 3.73% for undergrads

- Direct PLUS loans: 6.28% for parents, graduates and professional students

Congress determines student loan interest rates and sets them each year according to a formula. Federal student loan interest rates are fixed for the life of the loan, meaning the interest rate you initially received wont change throughout your loan term.

Origination fees for loans disbursed on or after Oct. 1, 2020, and before Oct. 1, 2022, are:

- Direct unsubsidized and subsidized loans: 1.057%

- Direct PLUS loans:4.228%

These fees are calculated as a percentage of your total loan amount. They are subtracted from your balance when you receive your loan money.

For even more detail, check out our guide to how student loan interest works.

What Help Is Out There For First

GETTING on the property ladder can feel like a daunting task but there are schemes out there to help first-time buyers have their own home.

Lifetime Isa – This is Government scheme gives anyone aged 18 to 39 the chance to save tax-free and get a bonus of up to £32,000 towards their first home. You can save up to £4,000 a year and the Government will add 25% on top.

– Co-owning with a housing association means you can buy a part of the property and pay rent on the remaining amount. You can buy anything from 25% to 75% of the property but you’re restricted to specific ones.

Mortgage guarantee scheme – The scheme opened to new 95% mortgages from April 19 2021. Applicants can buy their first home with a 5% deposit, it’s eligible for homes up to £600,000.

Recommended Reading: Usaa 84 Month Auto Loan

Review The Terms Of Your Agreement

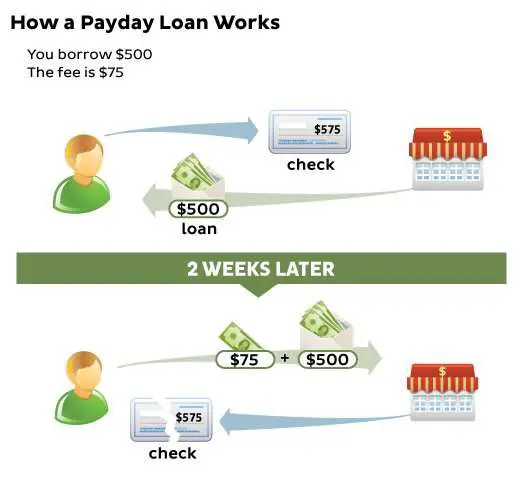

The company must give you a copy of the terms of your payment authorization. The payment authorization is your agreement to allow the company to debit your bank account for payment. The terms of your authorization must be laid out in a clear and understandable way. Its important to review the copy of your authorization and keep a copy for your records. Make sure you understand how much and how often money will be taken out of your account. Monitor your account to make sure the amount and timing of the transfers are what you agreed to.

You also have the right to stop automatic payments.

Types Of Personal Loans

While all personal loans are in the same general category, there are some sub-categories you should know:

- Personal loans for good credit — Many personal lenders focus specifically on “prime” borrowers — that is, consumers with strong credit histories.

- Personal loans for bad credit — There are some companies that have personal loan products designed for borrowers with sub-optimal credit.

- Personal loans for debt consolidation — These loans allow you to combine multiple debt payments into one simple payment. A debt consolidation loan usually has a lower interest rate, too, which means you’ll probably have a lower monthly payment.

- Medical loans — A medical loan is generally used to pay for healthcare costs.

- Renovation loans — These types of loans can help fund home improvements, like installing a pool, redoing a bathroom or kitchen, or finishing a basement.

- Coronavirus hardship loans — If your income was cut by COVID-19, you may qualify for a coronavirus hardship loan. These loans are smaller and meant to help you pay the bills during a short period of unemployment.

Also Check: Can You Refinance Fha Loan

Qualifying For A Loan

To get a loan youll have to qualify. Lenders only make loans when they believe theyll be repaid. There are a few factors that lenders use to determine whether you are eligible for a loan or not.

Your is a key factor in helping you qualify since it shows how youve used loans in the past. If you have a higher credit score, then youre more likely to get a loan at a reasonable interest rate.

You’ll likely also need to show that you have enough income to repay the loan. Lenders will often look at your debt-to-income ratiothe amount of money you have borrowed compared to the amount you earn.

If you dont have strong credit, or if youre borrowing a lot of money, you may also have to secure the loan with collateralotherwise known as a secured loan. This allows the lender to take something and sell it if youre unable to repay the loan. You might even need to have someone with good credit co-sign on the loan, which means they take responsibility to pay it if you cant.

Rate Terms And Repayment Of A Traditional Home Equity Loan

A traditional home equity loan carries a fixed interest rate for the life of the loan. This means your interest rate will stay the same from your first payment until your last payment. The interest rate for a traditional home equity loan is based on several factors, including your existing mortgage balance, the value of your home, the term of the loan, the loan amount, your credit history and your income.

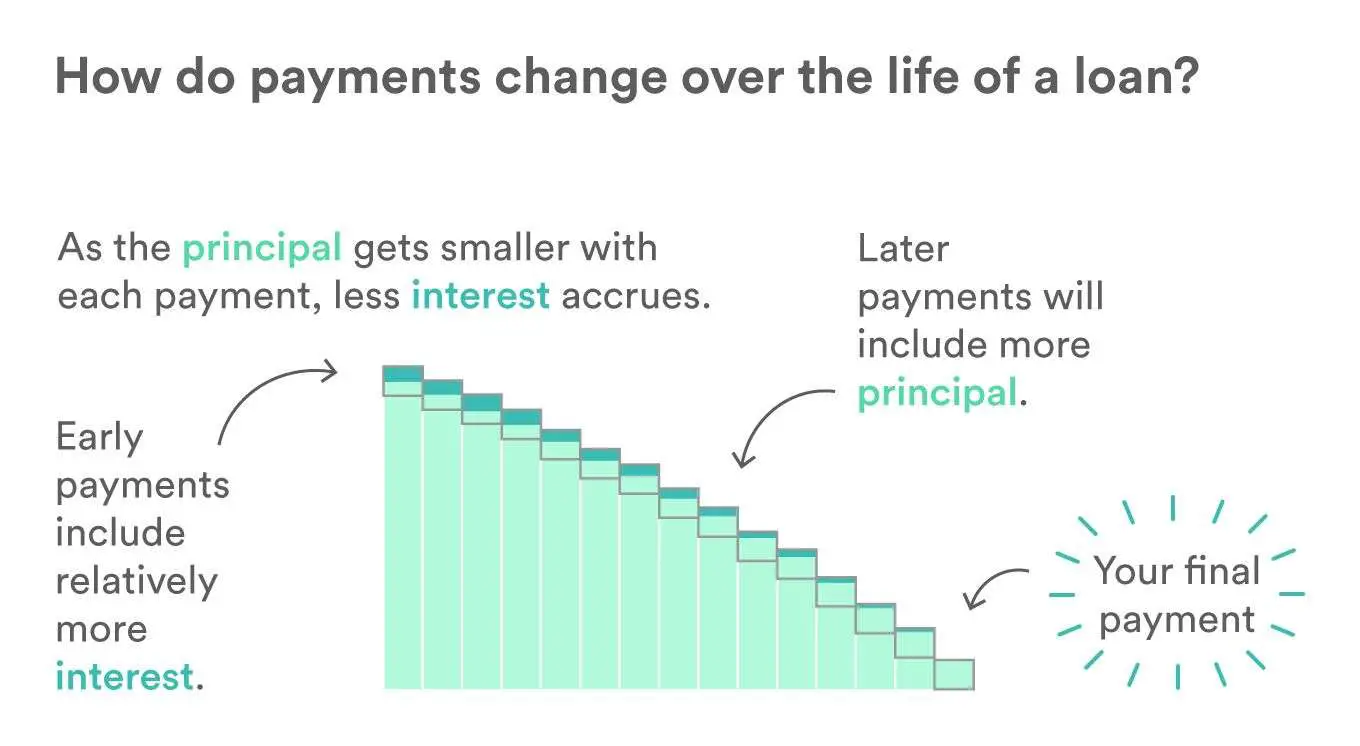

When you make payments on a traditional home equity loan, you are paying both the principal and interest on the loan with every payment.

Don’t Miss: How Much Of A Loan Can I Get For A Car

Can I Reduce My Mortgage Repayments

You may be able to extend your mortgage term in order to lower your monthly mortgage repayments.

For example, if your mortgage is currently on a 25-year term and you move it to a 30-year term, your monthly repayments will fall as you are taking longer in order to clear the capital youve borrowed.

While this will reduce your monthly outgoings, it will increase the overall amount you repay. Because you are taking longer to clear the capital youve borrowed, youll also be charged interest for longer, meaning a larger total repayment.

Let’s look at an example. If you borrowed £200,000 over 25 years at an interest rate of 3%, you’d repay £948 and repay £284,478 in total.

Extending your term to 30 years will reduce your monthly repayments to £843, but you’ll repay 303,495 – an extra £19,000.

You may also be able to switch part or all of your mortgage debt onto an interest-only mortgage. Lenders may offer this as an option if you are experiencing some financial difficulties to help you avoid falling into arrears.

Remember, while this will mean lower monthly payments, you will still need to find a way to repay the capital you borrowed at the end of your mortgage term.

Can I Overpay On My Mortgage

Most mortgages will allow you to overpay a certain amount, usually around 10% per year, without incurring any additional charges.

If you can afford to do so, it makes sense to overpay as you will clear the mortgage more quickly, saving money on interest payments in the process.

Lets go back to our example above of a £200,000 mortgage on a 25-year term with a 3% interest rate. If you overpaid by £90 a month, you would clear the debt in just 22 years, saving you three years worth of interest payments on the loan. This would mean a saving of £11,358.

- Find out more: mortgage overpayment calculator

Recommended Reading: Mlo Average Salary

Payments Made After 120 Days

You make a payment after 120 days from the disbursement date on any of your loans.

Auto Pay, Pay Online, U.S. Mail, or Bill Payment Service

Your payment will be applied in this order:

* For loans in forbearance, any amount that goes to principal will be applied to the highest interest rate loans, beginning with unsubsidized loans.

** For PLUS loans that are in repayment, have an active Payment Schedule and Disclosure, and have disbursements within 120 days, the payments will automatically be applied to interest and principal. If you want payments during this time to be applied as a refund, please send a written request asking for it to be treated as a refund. Keep in mind that the refund will not be considered a monthly payment so upcoming monthly payments will still be due.

For a Direct subsidized loan taken out after July 1, 2012 and before July 1, 2014, interest is not subsidized during the loan’s grace period. You’re responsible for interest that accrues during your grace period. If you make payments during your grace period, any paid interest will not be capitalized.

Your student loan agreement requires us to follow federal rules on how we apply payments. The rules require that a payment be applied first to outstanding interest, and any remaining amount is applied to the principal balance.

$100

What Happens If I Pay An Extra $1000 A Month On My Mortgage

Paying an extra $1,000 per month would save a homeowner a staggering $320,000 in interest and nearly cut the mortgage term in half. To be more precise, it’d shave nearly 12 and a half years off the loan term. The result is a home that is free and clear much faster, and tremendous savings that can rarely be beat.

Also Check: How To Get Out Of Auto Loan

Types Of Private Student Lenders

Theres a variety of private student lenders, including:

- Major banks, such as PNC

- Online lenders, such as CommonBond and Earnest

- Credit unions, many of which offer student loans through the LendKey marketplace

The bank with which you have a checking account may not offer student loans. As such, you should widen your search, comparing loan interest rates and features across several different lender types.

Take a look, too, at the protections lenders offer:

- Is deferment or forbearance an option?

- Is it possible to release your cosigner after a certain number of payments?

Pay As You Earn Repayment Plan

With the PAYE Plan, your monthly payment is 10% of your discretionary income, and youll never pay more than you would on the Standard Repayment Plan. The PAYE Plan caps your monthly payment at the Standard Repayment Plan level, even if your income increases.

- Eligible loans Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans made to students, Direct Consolidation Loans that dont include PLUS Loans made to parents

- Repayment terms 20 years

- Pro Payment will never exceed the amount youd pay on the Standard Repayment Plan

- Con Can only qualify if your monthly payment is lower than what youd pay under the Standard Repayment Plan

Don’t Miss: Marcus Goldman Sachs Loan Reviews

Who Issues Car Loans

Generally speaking, there are two ways that you can borrow money to buy a car direct lending or dealer financing.

- Direct lending Direct lenders include banks, and other financial institutions like online lenders. Borrowing from one of these lenders can give you the opportunity to comparison shop for the best loan terms for you and may give you the option to get preapproved for a specific loan before you shop. And when youre ready to buy, youll use this loan to pay for the car.

- Dealership financing This option, which is handled by your dealers finance department, makes it convenient to shop for your vehicle and auto loan in one place. Dealers generally have relationships with multiple lenders, so you may be able to compare terms and may even qualify for manufacturer-sponsored low rate or incentive programs. But be on the lookout for buy here, pay here dealers offering high-interest in-house auto loans to buyers who dont have great credit.

If you dont want to take out a traditional auto loan or dont qualify for approval, consider asking a family member to help you out or waiting until youve saved up enough cash. You can also look into an alternative loan option, like a personal loan from a peer-to-peer lender.

What Is A Personal Loan And How Does It Work

A personal loan is a lump sum lent to you by a credit union, bank, or online lender. Then, you pay back the loan — plus interest fees — in monthly installments over a predetermined period of time. Unlike other loans for a specific type of purchase, such as a home or car loan, personal loans can be used for almost any purpose.

For example, you can use a personal loan to:

- Buy a car

- Cover rent and groceries while you’re unemployed

- Pay off credit card debt

- Pay for medical bills

- Get braces for yourself or your child

- Cover other expenses, bills, or purchases

Recommended Reading: Refinance My Fha Loan

Figure Out If You Have A Cosigner

If your credit report turns out to not be that great, lenders may require that you have a cosigner on the lease agreement or loan agreement. Lenders require cosigners as they absorb some of the risks in lending you money. As the cosigner is equally responsible for paying any amounts due, lenders can claim outstanding payments from the cosigner.

Even if your lender doesnt require a cosigner, having a cosigner might be beneficial if you dont have a good credit score. As cosigners lessen the risk for lenders, you might be able to get a more favorable rate if you make use of a cosigner.

How Do Mortgages Work In Canada

30 May, 2018 / by

Before you execute your plans to buy a new home, you must take the time to ask and learn the answer to this question: How do mortgages work?

Not all aspiring homeowners in Canada have the extra money to pay up front the full purchase price of their dream home. And so, to be able to afford the cost of buying a new property, they take out loans, or more particularly, mortgages.

This entails borrowing money from banks and other financial institutions and slowly paying off the amount loaned with interest. This sounds simple enough, but there are many considerations to think about before a potential homebuyer should apply for a mortgage.

There different types of mortgages and each has key features which may or may not suit you. Moreover, although mortgages are common across the globe, the rules which govern them have key differences in every country.

To help you navigate this aspect of the real estate world, here is a guide to understanding how mortgages work in Canada.

Also Check: Loan Processor License California

Fixed Vs Variable Rate Loan

A fixed-rate loan has an interest rate that remains constant throughout your loan term. Most loans have a fixed rate, and if you prefer predictability, this is the best option. Variable rate loans may offer lower interest rates, but the rates fluctuate with the market over the lifetime of your loan, making them less predictable for you as the borrower. They can still be an option to consider if the lower starting rate is attractive to you and you can afford to take the risk.

How An Extra Payment Is Applied To Your Loan

What happens if you want to make an extra bonus payment to lower your loan balance outside of your scheduled payment? Depending on the type of loan, this can work a little differently. Typically, mortgages have strict rules about one payment per month while student and auto loans allow payments at any time.

In the case of a mortgage, any extra payment you make outside of your regular payment schedule goes straight to the principle. This lowers your overall balance and interest due, but does not impact your regularly scheduled payments. Even if you pay extra, you have to pay your regular payment on schedule in the future.

With student and auto loans, an extra payment can push your due date out into the future. This means you can pay double one month and may be able to skip a payment the next month. However, skipping payments does the opposite of what you want: getting you out of debt faster while saving money. So even if you get ahead on your loan, keep making at least the minimum payment every month. This will help you stay ahead of schedule.

When I was paying off those student loans, I started small. I decided to split my payment up to a half payment every payday. But as my budget allowed more, I ended up making full payments. I did this twice a month and then eventually double payments twice a month. This was like rocket fuel for my loan payoff.

Read Also: Gustan Cho Mortgage Reviews