If You Go Back To School

Once the Governments have contributed to your principal payment, you cannot receive additional student loans or grants until your existing loans are paid in full. However, you can still get interest-free status for your existing student loans if you return to school.

Once you have received a RAP-PD benefit and 5 years have passed since you have left school, you may not be eligible to receive further provincial loans and grants from some provinces until your loan from that jurisdiction is paid in full. Please contact your province for more information. This does not apply to the federal part of your loan.

Factors That Can Affect The Amount Of Aid Offered

When applying for a student loan its important to remember that not all students are eligible for the same amount. There are a number of factors considered when determining how much aid you are eligible for.

- Your enrollment status: part-time or full-time student

- The amount of time passed since your high school graduation

- Your parents income

- Your income

- Your field of study

- Cost of housing

All of these factors can affect the amount of aid youre eligible for, so be sure to do your research before applying.

Taking Out Federal Student Loans Vs Taking Out Private Student Loans

There are two kinds of student loans you can get, federal and private. Federal loans are underwritten by the U.S. government and private loans are offered by private entities, such as a bank.

- To take out a federal student loan, you file the FAFSA, or the Free Application for Federal Student Aid.

- To take out a private student loan, you have to choose a lender and complete their application process.

Consider federal loan options in the students name first since they tend to have low fixed interest rates and special benefits only available on federal loans. Then use a private loan to help fill the gap.

Lets take a closer look at how the process works for each.

Don’t Miss: Usaa 84 Month Auto Loan

You Can Still Apply For Student Loans After School Has Started

While federal student loans have rigid deadlines, you can apply for private student loans at any time of the year, even mid-semester.

For example, if you took out enough in federal loans to cover tuition but are running low on funds for room and board, you might consider applying for a private student loan to cover your living expenses.

If you havent already, you can apply for federal student loans until the deadline at the end of June. Applying late can limit your options depending on your state or schools deadlines. If you need federal student loans, its best to apply as soon as possible.

What Type Of Federal Student Loans Can I Get

There are several types of federal student loans:

-

Direct subsidized loans are earmarked for undergraduate borrowers with a financial need. If you qualify, you wont be responsible for any interest that accrues while youre in school.

-

Direct unsubsidized loans are the most common type of federal student loan. Unlike subsidized loans, theyre available to both undergraduate and graduate borrowers and they do accrue interest while youre in school. The interest is capitalized at the end of your grace period.

» MORE:Federal Student Loans Review

-

Grad PLUS loans are for graduate and professional students and dont have borrowing limits. Unlike undergraduate loans, which dont consider borrower credit, you need decent credit to qualify for a grad PLUS loan. The government wants to make sure your credit report is free of negative marks like bankruptcies, charge-offs or past-due debt, says Karen McCarthy, director of policy analysis at the National Association of Student Financial Aid Administrators.

-

Parent PLUS loans are for parents with dependent undergraduate students. Parents credit histories must be tarnish-free to qualify. They can borrow as much as they need to cover their students college costs.

» MORE: Compare parent loans for college: PLUS and private

Also Check: Usaa Approved Car Dealerships

Student Loan Process Basics

There are two types of student loans: federal and private. Federal student loans are administered by the government. They can have more forgiving student loans interest terms and they usually dont require a credit check. So, with federal loans, your credit history shouldnt matter as much. This makes it easier to get federal student loans without needing a cosigner.

Private student loans are managed by private lenders such as banks, credit unions, or institutions and require you to pay back your loan. Private student loans can be more versatile than federal student loans, depending on your situation. They require a credit check, which can work to your advantage if you have a strong credit score.

When Youre Eligible For Full Support

You can apply for full support if all the following apply:

- youre a UK national or Irish citizen or have settled status

- you normally live in England

- youve been living legally in the UK, the Channel Islands or the Isle of Man for 3 continuous years before the first day of your course, apart from temporary absences such as going on holiday

You may be eligible for full support if youre a UK national who both:

- was living in the EU, Switzerland, Norway, Iceland or Liechtenstein on 31 December 2021, or returned to the UK by 31 December 2020 after living in the EU, Switzerland, Norway, Iceland or Liechtenstein

- has been living in the UK, the EU, Gibraltar, Switzerland, Norway, Iceland or Liechtenstein for the past 3 years

You may also be eligible if your residency status is one of the following:

You could also be eligible if youre not a UK national and are either:

- under 18 and have lived in the UK for at least 7 years

- 18 or over and have lived in the UK for at least 20 years

You must have been living in the UK, the Channel Islands or the Isle of Man for 3 continuous years before the first day of your course.

You May Like: How Many Aer Loans Can I Have

Understand What Student Aid Is

Student Aid is a government service that provides student loans, grants, scholarships, and awards to help you pay for your post-secondary education. Student aid may not cover all of your costs, so youll need to plan to make up the difference.

You only have to submit one application to be considered for loans and grants from both Albertas government and Canadas government. Most students get money from both, which means you may get two smaller loans instead of one big one. Learn more about scholarships and awards.

You should:

- Apply early. The only way to know for sure how much money youll get is to apply and wait for your award letter. You should apply at least 60 days before your classes start so that you have time to figure out your finances.

- Apply every year. You can apply for student aid for up to 12 months at a time. If your period of study is longer, you need to submit another application.

| Student loans are interest-free while you study. You dont make any payments while youre a student, and they wont acquire interest until 6 months after you leave school. |

A Variety Of Repayment Options

In addition to these inherent advantages of federal student loans, borrowers also have the ability to select from a number of repayment plans other than the standard 10-year plan.

There are income-driven repayment plans that allow for lower or no monthly payments while earnings are low, graduated repayment programs that start low and then increase every few years, and extended repayment plans that can as long as 25 years.

Some borrowers may also qualify for student loan forgiveness after a set number of monthly payments are made.

Read Also: Sss Loan Eligibility

What Can You Pay For With Student Loans

Your total college costs will include much more than just tuition. Room and board alone could easily cost over $10,000, and that doesnt include transportation, books and fun money. But, can you use your student loans to pay for housing and living expenses?

You can use your student loans to pay for school-certified education expenses, which includes most living expenses. This includes tuition, fees, books, room and board, study abroad and computers. Costs of food, transportation, health care and child care are also eligible. Its important to stick to these essentials so that you dont end up taking on excessive debt.

If you end up borrowing more than you need, you can return your unused student loans. Remember, every dollar you borrow will likely cost about two dollars once you pay it back.

How Do You Borrow College Money Under Federal Loan Programs

There are five letters to remember: FAFSA. To qualify for a federal loan, you will need to complete and submit the Free Application for Federal Student Aid, aka FAFSA. Borrowers must answer questions about the student’s and parents’ income and investments, as well as other relevant matters, such as whether the family has other children in college. Using that information, the FAFSA determines Expected Family Contribution, which is being rebranded as the Student Aid Index . That figure is used to calculate how much assistance you’re eligible to receive.

Also Check: Does A Loan Processor Have To Be Licensed In California

How Much Can I Borrow

There are limits on the amount in subsidized and unsubsidized loans that you may be eligible to receive each academic year and the total amounts you may borrow for undergraduate and graduate study . The actual loan amount you are eligible to receive each academic year may be less than the annual loan limit. These limits vary depending on your grade level and your dependency status.

Ways To Lower College Costs

You might find that the only way to make college affordable is to reduce the cost. Start by filing the Free Application for Federal Student Aid . The federal government uses the FAFSA to determine your eligibility for need-based federal aid.

You can file the FAFSA as early as October 1 of the year before you enter college. Some financial aid is awarded on a first-come, first served basis, so its important to file as soon as possible.

The FAFSA will determine your how much financial aid you are eligible for an academic year. This includes need-based aid, like grants and federal student aid. Colleges also use information from the FAFSA to award institutional scholarships. Students should file a FAFSA for every year they attend college.

In addition to the FAFSA, be sure to apply for as many scholarships as you can. There are many free tools online that can help match you with possible opportunities.

Recommended Reading: Usaa Auto Calculator

Use These Forms To Apply For Student Loans And Free Aid

As you can probably already see, the FAFSA is your only path to applying for federal student loans. If you dont fill out your FAFSA, you cant get federal student aid for college.

However, theres a lesser-known form that might be of use to you. Its called the CSS Profile, and it helps you obtain institutional aid from specific colleges. You can fill this out to see if some of the colleges on your wish list offer aid to supplement what you get from the federal government.

The CSS Profile also unlocks access not just to loans, but also to grants. That means you might be able to take out even fewer loans for college, reducing the amount of debt you have to pay back.

But the CSS Profile isnt free theres an initial $25 fee, plus an additional $16 for every school you add to the list .

An advantage of the CSS Profile is that colleges you thought were out of your reach financially could suddenly become a real option if you qualify for their aid. In that case, the small fee for the application might be worth it in the end.

How To Get Student Loans For Bad Credit Approved In Canada

Home \ Loans \ How To Get Student Loans For Bad Credit Approved In Canada

Join millions of Canadians who have already trusted Loans Canada

Post-secondary education in Canada can be extremely expensive, costing students well over $50,000. This is a significant amount of money and many students, even those whose family wants to help cover the cost dont have the necessary funds to afford that kind of expense. Most full-time students dont have time to attend classes while holding down a job, even a part-time one. This is often even more true for students in highly competitive and demanding programs. With pressure to excel in school, keep up with extracurricular activities, continue with everyday activities, and have a social life it can be overwhelming and sometimes impossible to maintain a job while in school. This makes financing a necessity for most students.

Thankfully, the Canadian Government provides students with loans and bursaries to help them get through financially difficult times. For those students who are unable to get approved for a private student loan on their own because of bad credit or other financial issues, weve compiled all the information you need to find an alternative way to help pay for post-secondary schooling. Depending on where you reside, the federal and provincial governments each have their own unique student loan programs to financially help students so they can academically succeed.

Recommended Reading: Capitol One Car Loans

Find Another Adult To Co

If you need to borrow for school and are considering federal vs. private student loans, keep in mind that its usually best to rely on federal student loans first. Federal loans come with major benefits and protections, such as access to income-driven repayment plans and student loan forgiveness programs. But if youve exhausted your federal loan options, private student loans could help fill any financial gaps left over.

You typically need good to excellent credit as well as sufficient income to qualify for a private student loanwhich is why most undergraduate private student loans are co-signed. However, if you want to take out a private student loan and arent eligible on your own, you dont need a parent to co-sign. A co-signer can be anyone with good creditsuch as another relative or trusted adultwho is willing to share responsibility for the loan.

Even if you dont need a co-signer to qualify, having one could get you a lower interest rate than youd get on your own. Just keep in mind that because your co-signer is equally liable for the loan, theyll be on the hook if you dont make your payments.

Fill Out The Fafsa And Css Profile Online

When it comes time to fill out your FAFSA and if you so choose your CSS Profile, it might be easiest to do so electronically.

You or your parents can register for access to the FAFSA through fafsa.gov. After youre registered, the entire FAFSA can be filled out online, and even edited later if necessary. You can also apply via the FAFSA mobile app.

While youre at it, you can skip some of the steps above by using the IRS Data Retrieval Tool to autofill much of the necessary financial information. However, it cant hurt to gather the paperwork in advance anyway, just in case you run into issues using this tool.

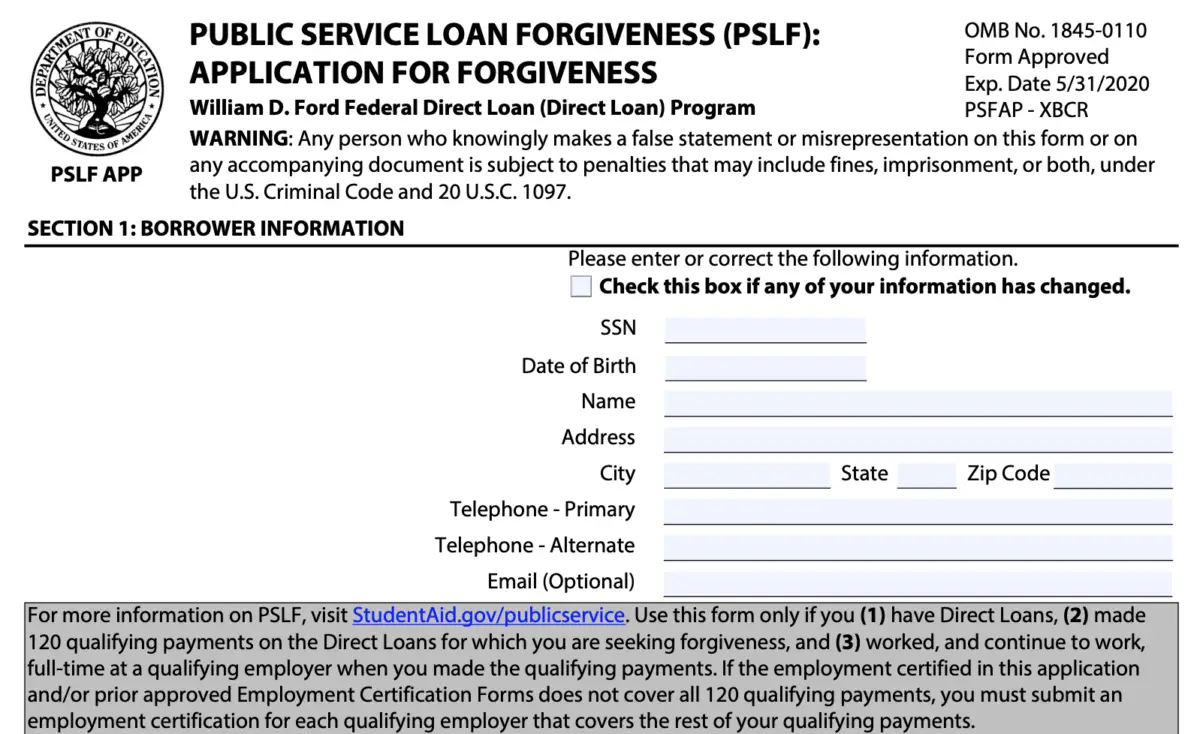

Image: Federal Student Aid

And if you choose to fill out the CSS Profile, you can do so via College Board. To make sure your desired colleges are included, review the list of participating schools before you pay to fill out an application.

Read Also: Auto Loan With 650 Credit Score

Review Your Student Aid Report

After you fill out your FAFSA, youll receive whats called a Student Aid Report, showing you a summary of all the information youve entered. It can take from three days to three weeks to get this report. Its important to review it for accuracy as soon as possible and edit your FAFSA if necessary.

Remember, aid is first-come, first-served dont delay on fixing any errors that might exist on your FAFSA.

There might also be times when the school you included on your FAFSA selects you for verification. If that happens, you might simply need to provide extra documentation to confirm what you entered on your FAFSA. According to Federal Student Aid, this isnt something to worry about some schools might do this randomly, while others require it for everyone.

The most important thing is to provide whatever documentation youre being asked for on time, as missing the deadline could mean not getting any federal financial aid.

Repaying Federal And Private Student Loans

- Federal student loans: Following a six-month grace period, you generally begin to make payments.

- Private student loans: Youll generally have a six-month grace period. If you elected to make in-school fixed or interest payments with our , youll continue to make those payments during your grace period. After that, youll begin to make principal and interest payments.

Don’t Miss: Max Fha Loan Amount Texas 2021

Failure To Pay Your Tuition Payment Plan

- Tuition Payment Plan is an approved loan for education, which is non-dischargeable in a bankruptcy court.

- If you fail to fully pay your Tuition Payment Plan, SLCC pursues all financial obligations to the fullest extent of the law.

- SLCC may place holds on your student account, which may include registration, transcripts, grades, and graduation.

- SLCC may also pursue liens against Utah State Income Tax Returns, referrals to collection agencies, and litigation.

- Interest will be charged at the rate of 1.5 percent per month on any amount over 30 days past due.

For more information on Tuition Payment Plan, contact 801-957-4480 during business hours or .