Personal Line Of Credit:

A personal line of credit is a type of revolving credit account that allows you to borrow a sum of money and pay it off over time. Unlike a loan, you do not have to borrow the entire lump sum all at once. You can choose how much you want to borrow at a given time and interest will only be charged on the amount of money you borrow. A personal line of credit does not come with fixed rates like personal loans do, so your payments may vary month to month.

What Interest Rate Can I Expect If I Have Bad Credit

When you have a FICO score under 670, you’re considered a subprime borrower. If your FICO score is less than 580, your credit falls into the “Poor” range.

Every lender sets its own criteria for loan approval and pricing. That makes it difficult to predict precisely what APR you’ll be offered for a personal loan if you have bad credit. Interest rates on personal loans can range from roughly 4.99% to 36%. If your credit rating is poor, youll probably be offered rates on the higher end of that scale.

Is A Title Loan A Good Idea

With a title loan, you can receive cash in exchange for the title of your vehicle, so long as the car is paid off and the title has your name on it. After your car gets appraised, you may get approved to borrow anywhere between 25% and 50% of its value. Youll be able to continue driving your car while you repay your loan.

While title loans have lenient requirements and may not require a credit check or proof of income, they arent always a smart choice. The interest rates are almost always very high and can easily steer you into a cycle of debt. Not to mention you risk losing your vehicle if you dont repay the debt.

Read Also: What Mortgage Loan Fees Are Negotiable

What Do I Do If Need Money On Weekends Or Holidays

Installment loans in Canada are provided by online direct lenders. If you are in an emergency or are in urgent need of money then online installment loans guaranteed approval 24/7 are perfect for you. Whether it’s a weekend or a holiday in your provinces, direct online lenders process your application for possible solutions.

Note: Our all trusted landers are Canadians, they also celebrate National Holidays and Christmas.

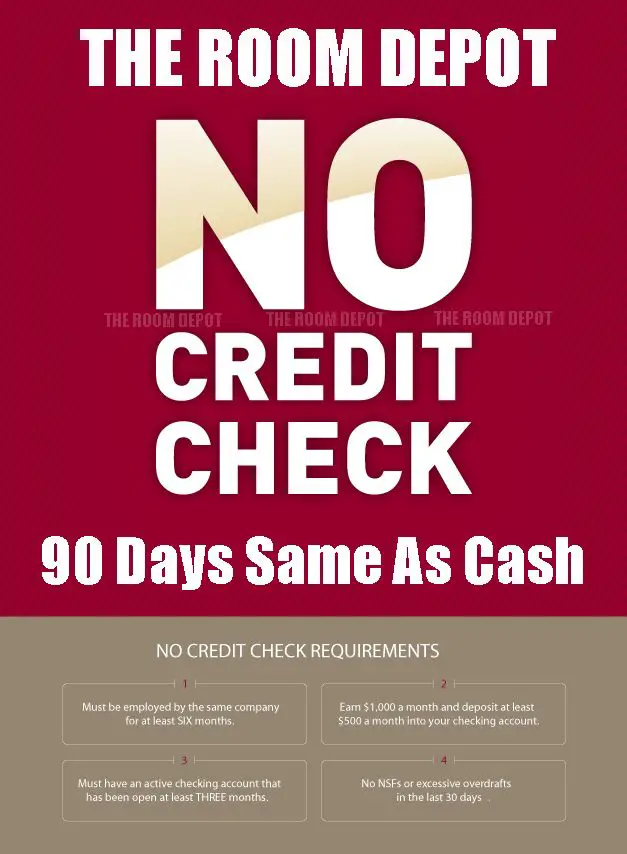

Get A No Credit Check Loan With Kallyss

No credit check loans are great for when you need to secure funds fast as they are hassle-free. We work with many different lenders across the USA, from Texas to California and more, to help you find the loan you need when you are looking for loans with no credit check online. You can easily get started with a loan application online at Kallyss by filling in our quick and easy online form. When you need to find a no credit check loan when you are facing a financial emergency, you may feel like there is nowhere to turn, but we work with lenders that will consider all loan applications, even if you have bad or poor credit.

Once we have received your application for a no credit check loan, we will check your eligibility against our strict borrowing criteria and the lenders we work with will assess each application on its merit. If you meet the requirements, we will be able to put you in contact with a lender who could offer you a loan, when you are looking for a no credit check options.

Recommended Reading: Can My S Corp Pay My Student Loan

How Do I Build Or Repair My Credit

If you have poor or fair creditor youre starting to build credit from scratchthe most important action you can take is to pay all your bills on time. Payment history accounts for the largest share of your score. You also can look into credit-building strategies like becoming an on another persons credit card, which will let you add positive payment history to your credit file without requiring you to take on responsibility for all payments.

You may also consider taking out a credit-builder loan, typically available at credit unions and online lenders. The lender will place the money youve borrowed in a savings account that accrues interest. Youll make payments toward the account each month and have access to the funds when your loan term is over.

What Do I Need For Instant Approval Of Online Installment Loans In Canada

Online Installment Loans have a simple process. Most direct lenders in Canada don’t check credit scores and provide instant & guaranteed responses.

If you are in financial trouble and looking for some quick cash, you can consider bad credit installment loans guaranteed approval in Canada.

Installment loan you’re looking for! How can you get instant approval for that? What you will need:

- Personal ID

- Proof of income

- Social Security Number

- Personal banking information

Keep in mind that all these things also can’t get you approved for a guaranteed loan. The next step is to carefully fill up an online form and provide all the needed information to your lender. Then the lender will review all the information provided and decide whether you are eligible for the loan or not. If your credit score is good, enough regular income, and all other required data, then your chances of getting approved.

Recommended Reading: How Much Down Payment For Small Business Loan

What Makes Your Loans So Different

GreendayOnline installment loans can be a great way for many to borrow money in varying amountsSelect your terms: Once you have been approved for a loan amount, tell us how much money you would like to borrowDepending on where you live, our loan amounts can range from $500up to $5,000.Get funds quickly: Most applications that are processed before 5 p.m. will be funded electronically within the next business day.

Loans In Canada With No Credit Check

Join millions of Canadians who have already trusted Loans Canada

While you might think that its impossible for someone in Canada to get approved for a loan with no credit check, this is in fact not the case. No credit check loans in Canada are a great substitute for more traditional loans from banks and other big financial institutions. No credit check lenders wont pull your in order to assess your creditworthiness instead, youll need to provide an alternative way to verify that your current financial situation can support additional financing.

Also Check: How To Lower Your Monthly Student Loan Payments

How Can I Get An Instant No Credit Check Loan Online

The United States is a major market for payday loans online because of the quick availability of funds. Other loan approvals may take weeks or months while obtaining a payday loan typically does not take longer than a single day. Upon approval, the funds are deposited directly into your bank account.

What Is A Non

Before lending you the required amount, a non-credit loan does not ask for a hard inquiry into your credit report. Instead, these loans depend on your lending history and a monthly income as factors for approval.

These loans are quick solutions for bad-credit borrowers in need since they offer request approvals within the next business day. Credit-builder loans, payday loans, and most federal student loans are examples of non-credit loans.

Instant Loans With MoneyMutual

Also Check: How To Get Loan Officer License In California

Applying For A Personal Loan With Bad Credit

Applying for a personal loan with bad credit is similar to whats required for any other type of loan, and it’s a fairly simple process. You’ll need to fill out an application, review the loan offers, accept the terms, and receive funding. You might need to set up an online account, depending on the lender you choose.

You might be required to provide documentation such as a driver’s license or other government-issued ID or proof of address or financial details such as your income or monthly housing payment. Most lenders will perform a soft credit check, which doesn’t affect your credit score, to see if you prequalify for a loan. Once all of that is complete and your application is approved, you’ll receive the terms and conditions of the loan.

Make sure you review those carefully so you know exactly what’s required, including monthly payments, what the loan can and can’t be used for, and your interest rate.

How Can I Get Emergency Money Fast

The lending networks above know that their customers sometimes need an emergency loan fast. These customers probably wouldnt be applying for an emergency payday loan if they didnt need to.

Many of the companies weve recommended work with lenders that provide loan funds in as few as 24 hours. Most lenders make the application process easy, requiring five minutes or less to fill out an online form that can lead to loan preapproval.

Though the interest rates youre offered may be high, these loans are often a superior option to a secured loan, which requires using collateral such as your car or home to secure a loan.

To help make your loan approval from a direct lender more likely and fast, read each lending networks minimum requirements on its website. For example, you may need to have a cellphone number, been employed at the same job for at least three months, and have $1,000 in monthly income. If you cant meet those minimum requirements, then you may want to look elsewhere for a loan.

Fill out the form completely and truthfully. Some lenders may later require proof of employment, and you dont want to be denied an emergency loan at the last minute because you lied about your income.

Another way to get an emergency loan fast is to use your credit card. If the emergency bill can be paid with a credit card and you can afford to pay off the credit card in full when the credit card bill comes due, then charging the cost may be worthwhile.

Also Check: Paying Off Personal Loan Early

Is This A Payday Loan

No. Unless you decide to work with CashAdvance, all the other lending networks we recommend work with lenders that have interest rates as high as 36% and can allow years to repay.

CashAdvance works with lenders that provide payday loans that must be repaid in 15 to 30 days, and at interest rates that start at 400% and go as high as 2,290%.

These loans use your next paycheck as collateral if you dont pay. Almost half of these loans end up in default, some studies show. That means your next paycheck will be swallowed up whole by the payday lender, and your debt will increase.

These should be your last loan option for small emergency loans. Theyre high-interest loans due quickly, and since half of such borrowers default on the loans, its a clear sign that theyre difficult to afford.

Though the other lending networks we recommend dont offer such loans, the small loans that they connect borrowers with should still be paid on time and not skipped entirely.

Only paying part of the loan, having a late payment, or not paying the loan back at all can cost you additional fees and you could face collections from your lender. If you think you may miss a payment, you should immediately contact your lender and discuss your options. Most lenders are often willing to work with you if you need help.

Do You Need Cash Urgently But Have A Bad Credit Score Here Youll Find The Top 5 Companies Offering Bad Credit Loans With Guaranteed Approvals Click For More

loanbest bad credit loansTop bad credit loans with guaranteed approval

Overall best platform for bad credit loans Spotlight Wire FeaturesEasy eligibilityGreat websiteLimits and loan terms are reasonablePositive feedbackPros

- There are more than 60 different lenders available through MoneyMutual

- Your private details are not in danger because the website is secure

- MoneyMutual does not ask for any fees for the services it provides

- The application process is straightforward

- The official website is simple to use

Cons#2. Bad Credit Loans: Popular lenders offering high interest loans Spotlight Wire Pros

- Maintains strong privacy and security standards

- The funds are made available in the next 24 hours

- It’s simple to use and just requires three steps

Cons

- Not accessible in all states

#3. RadCred: Online lenders for bad credit personal loans Spotlight Wire Pros

- Some lenders will deposit the money immediately after you sign the contract

- A completely free service

- You don’t have to explain why you need the money, and you can use the loan for anything you want

- Rapid service with no additional fees

Cons

- RadCred is not involved in the loan agreement or borrowing process

FAQs on online loans for bad credit

Recommended Reading: How Long Before You Can Refinance An Fha Loan

Do Student Loans Require A Credit Check

Most federal student loans that are provided by the U.S. government do not require a credit check. To apply for a federal student loan, youll be asked to fill out a Free Application for Federal Student Aid .

Private student loans differ from federal student loans in that they do require a credit check. This is because they are administered by a bank, credit union, or similar financial institution instead of the government.

A private student loan may be difficult to obtain if you have limited or poor credit. You may have to stick to federal student loans unless youre able to improve your low credit score.

Is It Easy To Get A Personal Loan With Bad Credit

Getting a loan with bad credit tends to be harder than getting a loan with excellent credit, but there are still many lenders offering bad credit loans. Even if you have bad credit, it could be relatively easy to get a personal loan as long as you can afford the payment and youre not currently delinquent on your existing debt.

However, if you have active credit issues, like delinquent loans or accounts in collections, you may need to work on getting these problems fixed before you can qualify for a personal loan. There are many places you can go to get help resolving credit issues is a good place to start.

Read Also: What Type Of Loan Is Best For Home Improvements

Personal Online Loans With No Credit Checks

If you have poor credit you will also be concerned about having a credit check whilst applying for a loan. Our lenders specialize in offering loans for fair credit to people in tight financial situations.

That is why online lenders perform no hard credit checks on personal loans. This means that this process can spare your credit score from being damaged even further by the main credit bureaus accessing this data.

Applying for a personal installment loan is a great option for those who are building credit and need money quickly. An unsecured loan has a higher interest rate compared to a secured loan.

To get loans funded with the lowest rates and favorable repayment terms you should have collateral.

How Can I Borrow Money Without A Credit Check

A soft credit check is done during the initial application process with the lending networks we recommend. This wont affect your credit score because its not an official credit check.

However, each lender may have its own underwriting rules after your initial application is approved by the lending network. This next step with the actual lenders may require having a credit check, also called a hard pull, which may affect your credit score.

If you have bad credit, you may be worried about such a credit check. Since youve already been prequalified by a lending network, there shouldnt be much to worry about because it has referred you to the lenders that have indicated theyre willing to work with you, so being approved for a loan even if you have a bad credit score shouldnt be a problem.

Lenders may require more information from you to help determine whether youre eligible for a loan and which interest rate and other terms will be offered to you. You may need to supply your:

- drivers license

And youll need to be:

- age 18 or older

- a U.S. citizen or permanent resident

- employed, self-employed, or receiving benefits

Recommended Reading: How To Increase Loan Amount

Does A No Credit Check Loan Involve A Soft Credit Check

A hard credit check occurs when an online lender checks your credit report to help them make an approval decision. If you have a low credit score, a hard credit check can be nerve-wracking. Fortunately, a no credit check loan may only involve a soft credit check rather than a hard credit check.

A soft credit check will not be reported to a credit bureau or harm your credit score. Instead, it can help you get an idea of your approval chances before formally applying for the loan.

Q2 What Are No Credit Checks Loans

Loans for bad credit mean the lender won’t look at your credit report before approving your loan application. People with poor credit or no credit history may benefit from this.

If you need the money immediately and don’t want to deal with the inconvenience of applying for a regular loan, you might still want to get a no credit check loan, even if you have decent credit.

Payday loans, title loans, and installment loans are a few of the several varieties of loans with no credit checks.

Also Check: How Much Do Mortgage Loan Officers Make