Factors That Can Influence The Home Loan Rate

When learning about the current home loan interest rates, you must also know about the following factors as they can greatly influence the EMI.

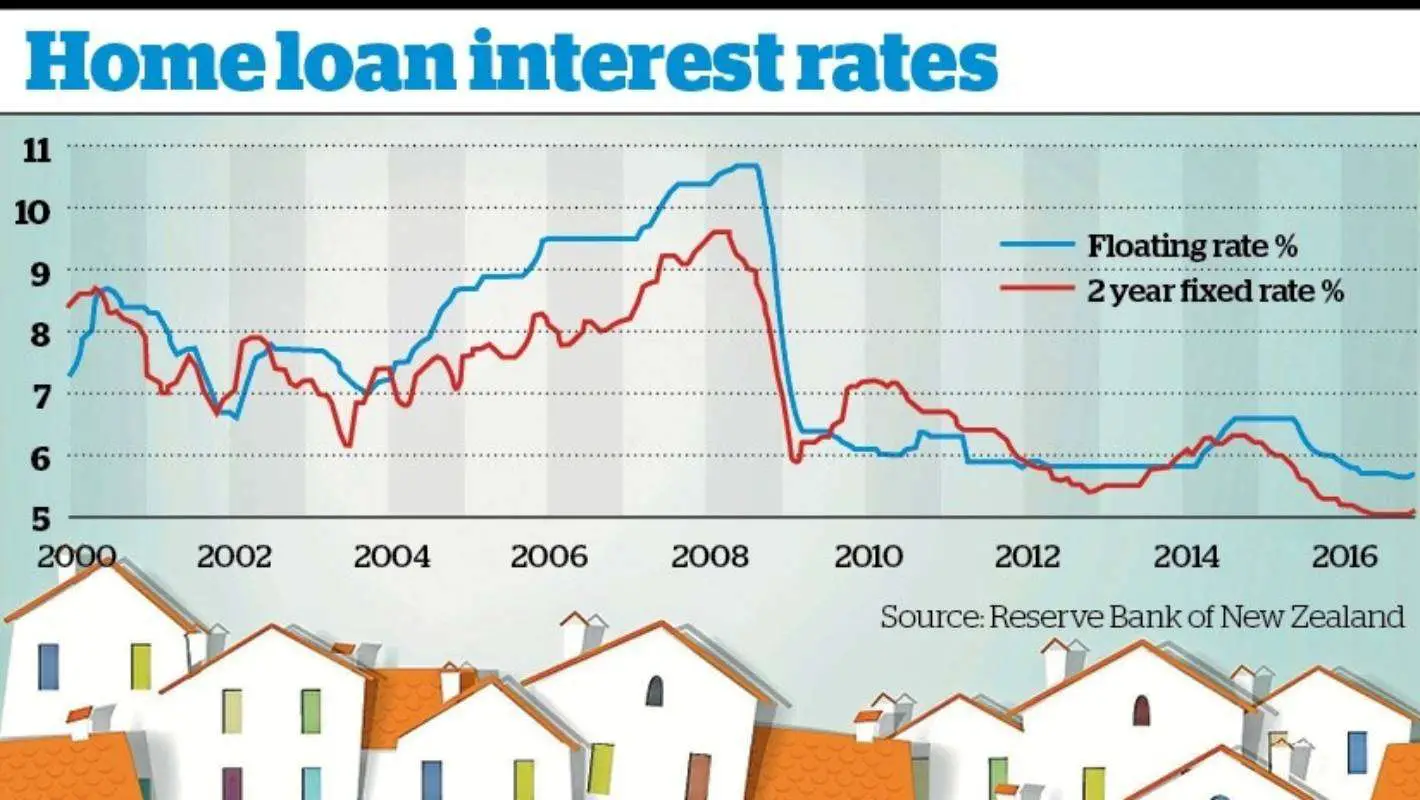

- Type of Interest

While the fixed rates will not change, the floating rates would be influenced when the RBI brings in any modifications.

- The ratio between loan and value

The loan to value ratio, better known as LTV, is the maximum limit that the lender can extend. It is a percentage of the propertyâs present market value. In order to decrease the loan quantum, you can increase the down payment.

- The Property

The resale value of the property depends on factors such as its location, its condition and also its age. Any property with a high resale value becomes a lucrative opportunity for the lender, who would attract the borrower with low-interest home loans.

- The Term of the Loan

There is a direct relationship between the loan term and the home loan interest rate that you pay. The longer the tenure, the lower would be the EMI.

- The Borrowerâs Gender

Most financial institutes offer a much better deal to women borrowers.

- The Borrowerâs Profile

In most cases, salaried employees are considered to be a safe bet as they have a stable income. Also, maintaining a good financial profile can help you in attracting competitive interest rates.

Factors That Can Affect Your Personal Interest Rate

Itâs important to understand that the best mortgage rate you qualify for may change depending on your unique borrowing profile. Here are some of the factors that influence what mortgage rate you qualify for:

The type of mortgage: If your mortgage is for a refinance, rather than a purchase or renewal, youâll be eligible for higher rates. For individuals with an existing mortgage who have good credit and more than 20% equity in their homes, in addition to refinancing, you can also explore a home equity line of credit .

Your down payment: If youâre purchasing a home andyour down payment is less than 20% of the purchase price and the value of the home you are purchasing is less than $1 million, youâll be required to purchase mortgage default insurance . This insurance is added to your mortgage amount and, while it will cost you money, it will result in a lower mortgage rate as your mortgage is less risky for your lender. If youâre renewing your mortgage, in order to be eligible for the lowest mortgage rates you would have needed to purchase CMHC insurance on the original mortgage.

Your intended use of the property: Your mortgage rate will be higher if you plan to rent your property out vs. live in it as your primary residence.

What Is Lenders Mortgage Insurance

Lenders mortgage insurance is a type of insurance that a lender takes out to protect itself in case of default from the borrower, but which the borrower must pay for.

It usually applies to home loans with a high LVR , or in other words when the borrower has a deposit of less than 20% of the propertys value.

Read Also: Usaa Mortgage Credit Score Requirements

Calculating A Home Equity Line Of Credit

As per the Office of the Superintendent of Financial Institutions , a HELOC can give you access to no more than 65% of the value of your home. It’s also important to remember that your mortgage loan balance + your HELOC cannot equal more than 80% of your home’s value.

To see how this works, let’s look at an example:

The maximum amount of equity you could pull from your home through a HELOC is $105,000.

Now, you still need to make sure that $105,000 doesn’t exceed 65% of your home’s value. To be sure, simply divide the HELOC amount by the value of your home:

In this example, you could access $105,000 through a HELOC, which only amounts to 30% of your home’s value.

Prime Interest Rates: How Are They Determined

The SARB controls the repo rate the interest rate at which SARB lends to South African banks. This determines the prime interest rate, and in turn the rate at which banks will lend to their customers.

The prime interest rate is the repo rate plus the amount added by the bank in order to ensure they make a profit on their loans.

From thereon, your risk worthiness will determine the amount added by the bank to their prime interest rate when calculating your home loan interest rates.

And if the prime interest rate falls, so will your home loan interest rate, by the same amount.

For example if the prime interest rate is 7% and the bank grants you an 11% interest rate, your rate is prime + 4%. If the prime interest rate drops to 6%, your rate will still be prime + 4%, meaning your rate now drops to 10%.

Of course, youd need an exceptionally high and a solid deposit for the bank to offer you an interest rate below the prime rate.

Read Also: Upstart Early Payoff Penalty

Home Loan Interest Rate Comparison On Loan Schemes

While all banks and HFCs in India offer multiple home loan schemes, some new schemes like Pradhan Mantri Awas Yojana and DDA are quite popular in India due to their unique features and special discounted rates. Banks like SBI, Axis Bank, Citibank, ICICI Bank, PNB and HDFC have many popular schemes for women loan borrowers, businessmen and existing bank customers. Some of the popular housing loan schemes have been captured in the table below:

| Bank |

|---|

Basic Home Loan Sensational Rate

- 2.19% p.a.Variable rate

- 2.21% p.a.Comparison rate1

Including 1.72% p.a. discount off our Basic Home Loan Variable Rate with no package fee. For new Owner Occupier . LVR+ above 60% up to 80%.

T& C’s apply. See comparison rate warning.

Fixed rate home loans have an interest rate that is fixed for a set period of time . At the end of the fixed rate term, the loan will usually switch to a variable rate.

Variable rate home loans have an interest rate that can fluctuate it can go both up and down and this can affect your repayments.

Read Also: Usaa Home Loans Credit Score

Your Rights And Responsibilities As A Borrower

Its important to know your rights as a mortgage borrower. When applying for a mortgage, your lender must provide information such as your mortgage principal amount, your mortgage interest rate, your annual percentage rate , term, payments, amortization, prepayment privileges and charges, and other fees. This can be provided in an information box in your mortgage agreement.

Changes to your mortgage agreement will need to be made in writing within 30 days, or it can be disclosed electronically. Your lender must also give you a renewal statement at least 21 days before the end of your term, or let you know if they will not be renewing your mortgage. If your lender is a member of the Canadian Banking Association, which includes most major banks operating in Canada, your lender may have agreed to provide additional information, such asonline financial calculatorsor other information that can be used to calculate mortgage prepayment charges.

Your lender also has rights, such as the right to inspect your title or the right to sell your home if you dont make your mortgage payments.

You also have responsibilities as a mortgage borrower. It’s important to carefully read your mortgage agreement and ask your lender questions if you don’t fully understand any terms or conditions.

Mortgage Interest Rates As Of Dec : Rates Ease

A variety of important mortgage rates sunk lower today. The average interest rates for both 15-year fixed and 30-year fixed mortgages dropped. The average rate of the most common type of variable-rate mortgage, the 5/1 adjustable-rate mortgage, also fell. Although mortgage rates are always moving, they are quite low right now. Because of this, right now is a great time for prospective homebuyers to get a fixed rate. Before you buy a house, remember to think about your personal needs and financial situation and shop around for multiple lenders to find the best one for you.

You May Like: Can You Do A Va Loan On A Second Home

What About My Other Borrowing

Most personal loans are taken on fixed rates, so if you have unsecured borrowing you should continue to repay it as agreed. The Finance and Leasing Association does not have figures for what percentage of car loans and other consumer finance is on a variable rate, but says that most borrowing is done on a fixed interest rate.

Credit card rates are variable, but not typically explicitly linked to the base rate, so wont automatically go up. Card providers can usually change rates as and when they want recently, for example, American Express announced it would be charging its cardholders more, blaming the rising cost of offering rewards. They are already at a 23-year high.

Better Mortgage Company: Best Online Lender

Better.com is an online mortgage lender offering a range of loan products in the majority of states in the U.S, and one of Bankrates best mortgage lenders overall.

Strengths: Better.com can save you time and money with three-minute preapprovals and 21-day closings, on average, and no lender fees. If you get a more competitive mortgage rate from another lender, you can also take advantage of the Better Price Guarantee, in which Better.com either matches that rate or gives you $100. The lender offers seven-days-a-week support by phone, as well, if you need it.

Weaknesses: If youre looking for a VA loan or USDA loan, youll have to search elsewhere Better.com currently doesnt offer these loan types. Although the Better Price Guarantee can help you get a lower rate, its only available if you apply online directly through the lender.

> > Read Bankrate’s full Better Mortgage review

Don’t Miss: Max Fha Loan Amount Texas 2021

Tata Housing Offers Fixed Home Loan Rates For Buyers For A Year

Tata Housing Development Company has announced ‘Wow is Now’ scheme for homebuyers under which they will pay only 3.99% interest rate for a period of 12 months and the rest would be taken care of by the company. The scheme is applicable to ten projects until November 20.

The scheme has been launched after taking into consideration 7% rate of interest per annum from the bank as the maximum limit.

As per the scheme, the borrower will also receive a gift voucher ranging from Rs.25,000 to Rs.8 lakh depending on the property, after the booking. The voucher would be issued after the payment of 10% of the amount and the registration of property.

The campaign is extended across 10 Tata Housing projects.

22 October 2020

Mortgage Interest Rates Explained

A mortgage interest rate a percentage of your total loan balance. It’s paid on a monthly basis, along with your principal payment, until your loan is paid off. It’s a component in determining the annual cost to borrow money from a lender to purchase a home or other property.

Investors require higher interest rates to make back money when the economy, stock market, and foreign markets are strong. This causes lenders to raise their rates. Bond investment activity can also impact mortgage rates, as well as your personal financial situation. Nonetheless, you might have some options to reduce your lender’s quoted interest rate when you’re looking to buy a home.

Recommended Reading: Co Applicant For Home Loan

Interest Rates And Discrimination

Despite laws, such as the Equal Credit Opportunity Act , that prohibit discriminatory lending practices, systemic racism prevails in the U.S. Homebuyers in predominantly Black communities are offered mortgages with higher rates than homebuyers in white communities, according to a Realtor.com report published in July 2020. Its analysis of 2018 and 2019 mortgage data found that the higher rates added almost $10,000 of interest over the life of a typical 30-year fixed-rate loan.

In July 2020, the Consumer Financial Protection Bureau , which enforces the ECOA, issued a Request for Information seeking public comments to identify opportunities for improving what ECOA does to ensure nondiscriminatory access to credit. Clear standards help protect African Americans and other minorities, but the CFPB must back them up with action to make sure lenders and others follow the law, stated Kathleen L. Kraninger, director of the agency.

Factors Affecting Interest Rates

In addition to your and other personal eligibility parameters, here are factors that affect your home loans interest.

- Repo rate: The repo rate is the rate at which the RBI lends money to banks and financial institutions. Therefore, if the repo rate is high, then a lender is likely to have high home loan interest rates too.

- Cash reserve ratio: Financial institutions have to deposit a certain amount of funds with the RBI. This stipulated amount is known as the cash reserve ratio. If the CRR rises, lenders have limited reserves to offer as loans. This results in an increase in home loan interest rates.

- Demand for funds: If the demand for home loans is high, banks will have lesser funds available to lend. As a result, they will levy a higher interest rate on home loans.

Now that you know what affects a home loans interest rate, pick one that has nominal interest, such as the Bajaj Finserv Home Loan. Additionally, enjoy beneficial features such as a flexi home loan facility and handy top-up loan.

Don’t Miss: Usaa Personal Loan With Cosigner

**new**home Loan Festive Offer

| Loan Bracket | ||

|---|---|---|

| No Change in present terms applicable for Card Interest rate | NA | |

| > 800 | 6.70% | No further concessions/ additional Premium would be applicable during the festive offer These concessions are not applicable to CRE Home loans and Maxgain |

| Above 30 lacs |

| **Home Loan Festive Offer: Processing Fee |

|---|

| Approved Projects |

| Full waiver subject to recovery of actual expenses |

| *Out of pocket expenses/Actual charges if any to be recovered |

Interest Rates

Upto 1 lakh

What Is A Heloc

A home equity line of credit is a revolving line of credit that is secured by the equity that you’ve built up in your home. A HELOC allows you to borrow against that equity at a much lower interest rate than a traditional line of credit. By taking out a mortgage with a HELOC feature, youll have access to a pre-approved amount of cash within your mortgage. When you use the money from a HELOC, youll have to pay the interest on it on top of your regular mortgage payments.

Read Also: Is It Better To Get A Fixed Or Variable Student Loan

Sbi Home Loan Customers To Enjoy Lower Interest Rates Frequently

According to reports, SBI has reduced its MCLR reset frequency. Earlier, the bank used to reset its MCLR annually. However, SBI recently tweeted saying that the bank has slashed its MCLR reset frequency from 1 year to 6 months.

This move will help SBI home loan customers reap benefits of lower home loan interest rates. However, it should be noted that customers whose home loans are linked to the banks MCLR are eligible to enjoy the benefits.

The announcement was made to initiate faster transmission of rate cuts to the borrowers whose loans are linked to MCLR.

8 September 2020

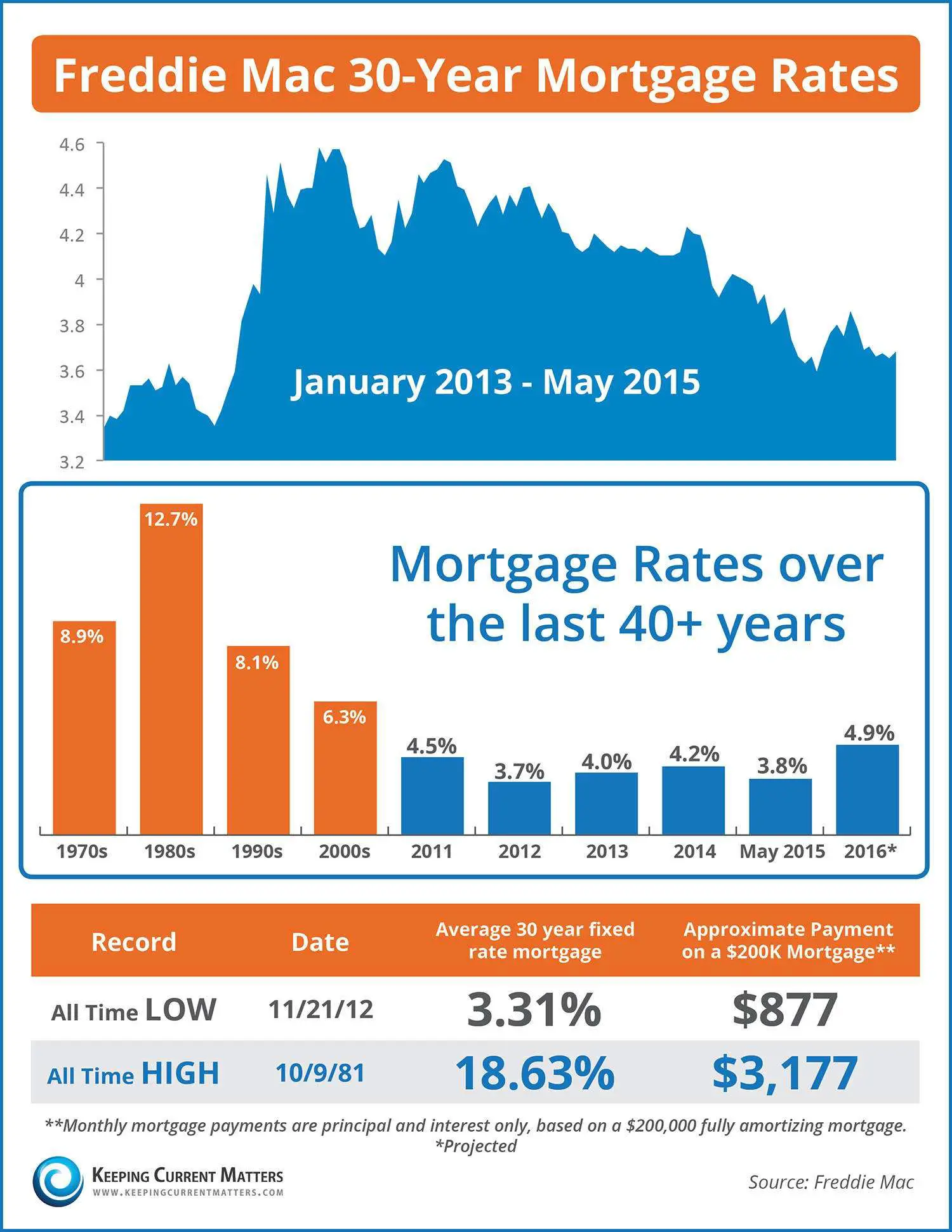

Mortgage Rate Predictions For Late 2021

Most industry pros expect mortgage rates to rise modestly through December 2021 and into 2022.

Fannie Mae, NAR, and the Mortgage Bankers Association all agree 30-year fixed mortgage rates should average around 3.10% in the fourth quarter of 2021.

Others, like Freddie Mac and the National Association of Home Builders, think mortgage rates will continue to rise, hitting averages of 3.20% or higher by the end of December.

| Housing Authority |

Mortgage rates are moving away from the record-low territory seen in 2020 and 2021.

But keep in mind that rates are still ultra-low from a historical perspective.

Just three years ago, in November 2018, 30-year rates were at nearly 5 percent . And in November of 2019 they were averaging between 3.5 and 4.0%.

So if you havent locked a rate yet, dont lose too much sleep over it. There are still great deals to be had especially for borrowers with strong credit.

Just make sure you shop around to find the best lender and lowest rate for your unique situation.

Recommended Reading: Mlo License Ca

What Controls A Variable Interest Rate

Your variable interest rate is directly controlled by your lender via theirPrime Rate. Each lender can choose to increase or decrease their own prime rate, in turn increasing or decreasing your variable interest rate.

Lenders will usually adjust their prime rate to reflect changes in theBank of Canadas Policy Interest Rate. This means that lenders will tend to have similar or identical prime rates. All major Canadian banks currently have a prime rate of 2.45%.

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Also Check: Refinance Auto Usaa