How Exactly Do Home Loans Work A Rookies Guide To Mortgages

At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

There are several major milestones in life: graduating from college, getting married or committing to a long-term partner, having children, and, of course, buying a home. Settling down in a residence you own is exciting, but taking out a home loan is not a light undertaking, and it may, for a first-time buyer, even be a bit intimidating theres a lot of jargon and a very specific process to understand and follow. These arent loans like any other loan!

We created this quintessential guide to walk you through what we think you should know as you apply for your first home loan .

How To Keep Affording Your Mortgage

Aim to have six months worth of mortgage payments, as well as basic household expenses such as bills and food – set aside in a savings account that can be accessed in an emergency.

Even having a couple of months worth of expenses in savings can give you breathing space in case you lose your job or your circumstances change.

Here are some more tips on how to manage your mortgage so you can keep up with your repayments and make sure you are always on the best deal.

If you’re a first-time buyer or looking to move home or remortgage, we can help you find the best mortgage deal to suit your needs.

If you’re a first time buyer or looking to move house or remortgage, we can help you find the best mortgage deal to suit your needs.

How To Qualify For A Construction Loan

There’s a limited number of lenders that do custom construction, because it is a niche product, said Fred Bolstad, who leads retail lending for U.S. Bank.

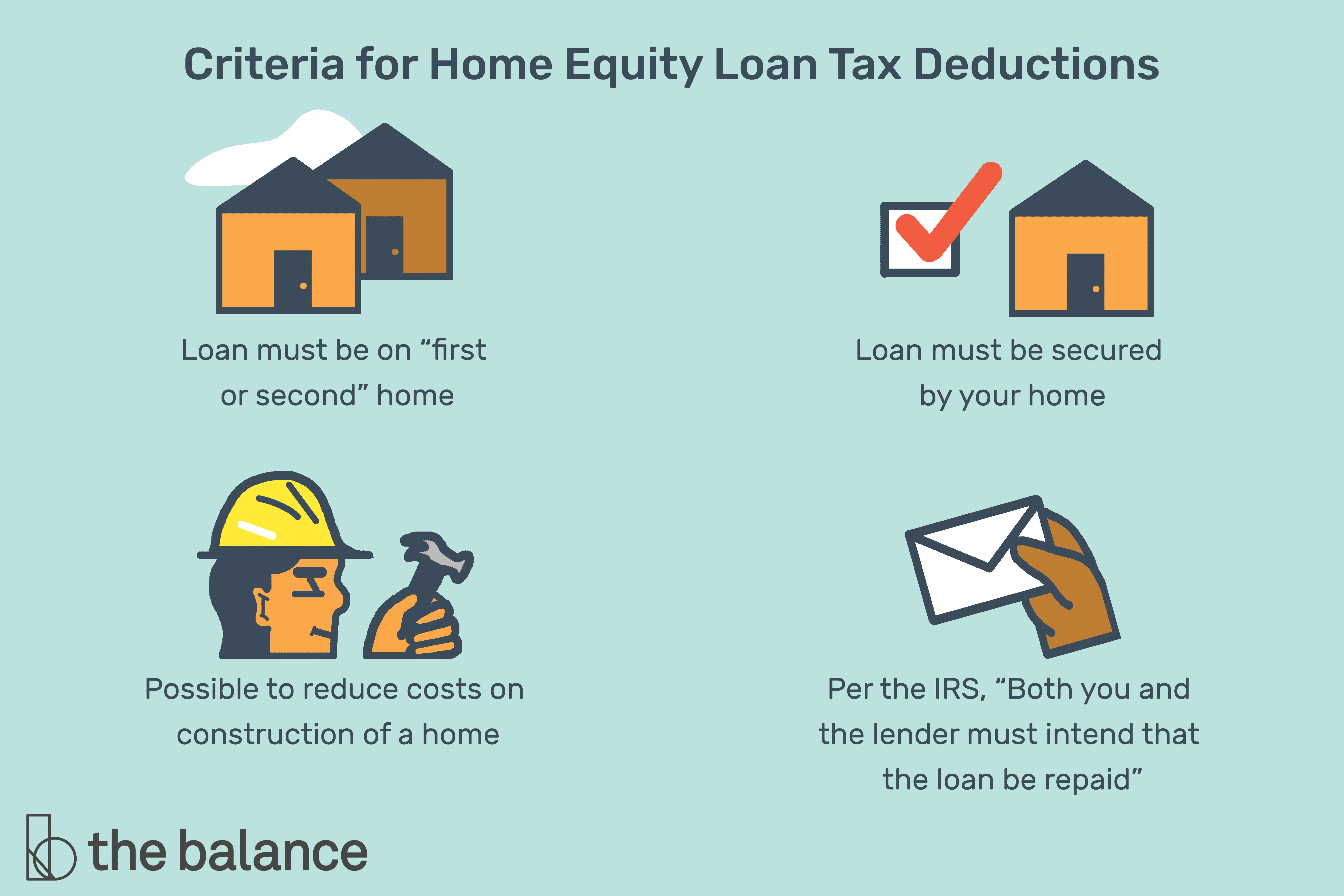

From the lenders perspective, a construction loan is riskier than a mortgage because there is no collateral no actual home to secure it. Because of that, lenders impose stringent qualification requirements. To sign off on a construction loan, most banks ask for a credit score of at least 680 at least 50 points higher than what is typically needed for a conventional mortgage. Construction lenders also seek low debt-to-income ratio and cushier cash reserves.

For example, Citizens Bank customers may require a borrower to maintain a stash of cash large enough to cover the interest on their construction loan for up to a year. While borrowers pay off only interest during the building phase, the rate on a construction loan can be up to a whole percentage point higher than that on a mortgage.

Because it’s interest only, the rate is a little bit higher, but the payment is very low because you’re not paying principal, said Bolstad.

Along with paying higher interest rates, construction-loan borrowers have larger down payment requirements, amounting to at least 10% of the homes estimated value. To appraise homes that are yet to materialize, lenders rely on builders construction plans including cost breakdowns and specifications of home features and any recent sales of comparable existing homes nearby.

You May Like: Which Is The Best Loan Company

The Bottom Line: Theres A Lot To Learn When You Decide You Want To Own A Home

Becoming a homeowner isnt easy and its certainly not cheap but its worth the effort. Its important to take the time to familiarize yourself with what a mortgage is before you plunge into the market. Ready to take the first step in your home buying journey? Get started on your mortgage approval today! You can also give us a call at 326-6018.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Property Loan Fact Sheet

Before you sign up for a home loan with a bank, the bank must provide you with a property loan fact sheet.

It highlights how possible increases in interest rates will affect your monthly instalments, and contains the key features of the loan, including:

- Loan amount and tenure

- Effective interest rate

- Penalty fees

Ask your bank to take you through the fact sheet so that you know what you are committing to when you take up the loan.

See also:Comparing HDB loans and bank housing loans

Also Check: What Is The Best Loan Repayment Plan

Mortgage Terminology To Know

There’s a lot of vocab to learn when you’re looking for a home loan. To make things even trickier, in many cases these are specialized uses of everyday words. Here are some terms you might come across.

. APR is short for annual percentage rate. This number represents the total cost of borrowing money to buy a home because it combines your interest rate with fees, points and other lender charges. Looking at the APR different lenders offer gives you another way to compare costs.

Appraisal. After you have applied for a mortgage, the lender has an appraiser compare the details of the home you want to buy with similar properties that have recently sold in your area. This tells the lender the property’s value, which is important because it won’t let you borrow more than the home is worth.

Closing. Closing has two different but related meanings when it comes to buying a home. It can refer to the time between applying for a mortgage and actually signing the paperwork and receiving the keys, or it can refer to that last day when the loan “closes.”

Loan Estimate. The Loan Estimate is a document that you’ll get when you are preapproved for a mortgage. It shows all the costs related to getting a home loan, including rates and fees. The Loan Estimate also shows which costs are set in stone and which you can shop around for. All lenders have to use the same format, which makes Loan Estimates easy to compare.

» MORE FOR CANADIAN READERS:How does a mortgage work?

Are These Types Of Loans Widely Available

Since so many borrowers got in trouble with interest-only loans during the housing bubble years, banks are hesitant to offer the product today, says Yael Ishakis, vice president of FM Home Loans in Brooklyn, N.Y., and author of “The Complete Guide to Purchasing a Home.”

Fleming says most are jumbo, variable-rate loans with a fixed period of five, seven, or 10 years. A jumbo loan is a type of nonconforming loan. Unlike conforming loans, nonconforming loans arent usually eligible to be sold to government-sponsored enterprises, Fannie Mae and Freddie Macthe largest purchasers of conforming mortgages and a reason why conforming loans are so widely available.

When Fannie and Freddie buy loans from mortgage lenders, they make more money available for lenders to issue additional loans. Nonconforming loans like interest-only loans have a limited secondary mortgage market, so its harder to find an investor who wants to buy them. More lenders hang on to these loans and service them in-house, which means they have less money to make additional loans. Interest-only loans are therefore not as widely available. Even if an interest-only loan is not a jumbo loan, it is still considered nonconforming.

Because interest-only loans arent as widely available as, say, 30-year fixed-rate loans, the best way to find a good interest-only lender is through a reputable broker with a good network, because it will take some serious shopping to find and compare offers, Fleming says.

Don’t Miss: Do You Have To Be Married To Use Va Loan

Transitioning To A Mortgage

Construction loans can either be one-close or two-close . The main difference between the two is how the short-term construction loan becomes a long-term mortgage.

With a one-close construction loan, the borrower commits to a mortgage upfront, agreeing to a bundle the two financial products. They go through a single application and approval process before construction begins. Once the home is ready, the construction loan rolls into a mortgage with a principal amount equivalent to the cost of building. Both U.S. Bank and Citizens Bank only offer this type of construction loan. It’s the simplest, easiest way to do it, said Bolstad.

However, because the borrower agrees to a particular mortgage rate in advance, at the time of conversion, interest rates may have dropped. In that situation, homeowners can immediately apply to refinance their new mortgage in order to take advantage of the lower rates.

With a two-close construction loan, borrowers apply for a construction-loan and, later, for a mortgage. By applying for the two independently, borrowers can shop around for a mortgage or repay their construction debt through other means, such as the proceeds from an existing home sale. But, two-close loans can also mean that homeowners will have to qualify twice first for the construction loan and afterwards for the mortgage and pay twice the usual loan fees.

How Do Mortgage Deposits Work

A deposit is a down payment, and its the amount you have to put towards the cost of the property youre buying. The more you can put down as a deposit, the less youll need to borrow as a mortgage and the better the mortgage rate youll be offered.

A deposit is a percentage of the property’s value, so if you bought a house for £200,000, a 10% deposit would come to £20,000.

Your mortgage provider will lend you the remaining 90% of the purchase price.

This is what is known as the Loan-to-Value .

It measures the percentage of the property price that you will need to borrow to make the purchase.

In the above example, a 90% LTV mortgage would cover the remaining £180,000, which would be the amount you owe your lender.

A 95% mortgage would mean you would put down a 5% deposit or £10,000, meaning you would borrow a mortgage of £190,000 in the above example.

Don’t Miss: Bad Credit Refinancing Auto Loans

Dont Forget Closing Costs

The down payment isnt your only out-of-pocket expense when you buy a house. You also need to pay for closing costs.

Closing costs include all the various fees to set up your mortgage and officially transfer ownership of the home from the seller to you. These are additional charges on top of your down payment.

On average, closing costs come out to about 3% to 5% of the loan amount. So on a $300,000 mortgage, closing costs could easily be $9,000 or more.

This is a hefty amount of money that many first-time home buyers overlook when theyre just starting to think about a mortgage.

You should estimate closing costs for the home you want and include them in your budget, as theyll have a big impact on the amount of money you need to save.

Mortgage Loans Provide Flexibility

In addition, home loans are flexible, so you have a lot of control over your mortgage terms and your monthly costs.

For example, you could choose to save up and make a big down payment. This would lower your monthly housing payments and reduce the amount of interest you pay in the long term.

Or, if you dont have a lot of savings and want to buy a home soon, you could make a small down payment. Most home buyers can qualify with just 3% to 3.5% down.

Your loan amount and payments would be a bit bigger in this case, but you can get into your home and start paying it off sooner.

Each home buyer can explore their mortgage options and find a unique loan structure that best fits their needs.

You May Like: What Do Underwriters Look For Va Loan Approval

How The Loan Works

FHA loans are available for one- to four-unit properties and require a down payment as low as 3.5% of the purchase price. Loan limits differ depending on where you’re shopping for a home, so proactively checking them may be helpful.

FHA loans entail paying for FHA mortgage insurance, which adds 1.75% to the upfront costs plus annual premiums.

An FHA-approved lender can provide more information on loan terms and qualification requirements, which include a minimum credit score, debt-to-income ratio guidelines, and time elapsed after any previous bankruptcy and foreclosure events.

Submit Your Application For Review

Once youve provided all the required information, youll submit it for verification and review. At this point, the lender will usually check your credit. From there, youll be able to review your loan options.

Once you decide to go ahead with a particular HELOC, the lender will verify your income by reviewing bank accounts, pay stubs, and/or tax returns. Further, theyll appraise the current value of your home, which may or may not require a visit from an appraiser.

Also Check: Why Is My Auto Loan Not On My Credit Report

How Do Home Construction Loans Work

The average cost to build a single-family home in the U.S. came close to $300,000 in 2019, according to the National Association of Home Builders. Many of us, of course, don’t have that much money to plunk down on a new home. That’s why many prospective home builders borrow money to build a new home through what’s known as a home construction loan.

Simply put, a home construction loan covers the costs of building a new home, including materials and labor. The proceeds of a construction loan also can be put toward renovating a home. However, construction loans typically come with one big drawback that mortgage loans don’t have: a higher interest rate.

Follow along to build your knowledge of construction loans.

How Do Mortgages Work

Once you get a mortgage, you pay back the amount you have borrowed, plus interest, in monthly instalments over a set period, usually around 25 years. Some mortgages in the UK have longer or shorter terms.

The mortgage is secured against your property until you have paid it off in full. This means the lender could repossess your home if you fail to repay it.

In the UK, you can get a mortgage on your own or take out a joint mortgage with one or more people.

Whats the difference between a loan and a mortgage?

A mortgage is a type of loan thats secured against your property.

A loan is a financial agreement between two parties. A lender or creditor loans money to the borrower and the borrower agrees to repay this amount, plus interest, in a series of monthly instalments over a set term.

There are several types of loans. Some are secured, such as a mortgage, but others are unsecured. This means you do not need to use an asset as collateral. However, the amounts borrowed with unsecured loans are usually smaller with higher interest rates.

Read Also: Who To Call About Student Loan Garnishment

How Do You Use A Heloc To Pay Off Your Mortgage

If you can qualify for a HELOC thats large enough, you could use it to pay off your mortgage. To do so, transfer the funds from your credit line to your checking account, ask your mortgage lender for a pay-off letter that shows the amount owed, and make the payment to your mortgage lender.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

How Much Does A Mortgage Cost

The amount you have to pay each month and in total over the life of your mortgage depends on the deal you get and the cost of the property.

Here are the costs of a mortgage explained in detail and how to work out if you can afford one. The main costs are:

Interest

The interest rate will affect how much you have to repay overall and what you pay each month.

It is accrued across the lifetime of the mortgage and is charged as a percentage rate on the amount you owe.

For example, if you took out a £200,000 mortgage with an interest of 4% over 25 years, you could pay interest of £116,702 and repay a total of £316,702.

The mortgage in the above example could cost around:

-

£1,056 per month with an interest rate of 4%

-

£1,289 per month at 5%

You can work out how much interest would cost on a mortgage for the amount you need. HSBC’s interest calculator shows the amount you would have to pay each month, the total interest amount and an illustration of how much of the balance you would pay off each year.

Mortgage fees

-

Product fees are charged for taking out the mortgage

You may also have to pay fees on your old mortgage:

-

Early repayments charges if you pay it off before the end of its term

-

Exit fees are charged on some mortgages when you move to a new lender

Also Check: How To Check If Car Has Loan

How Second Mortgages Work

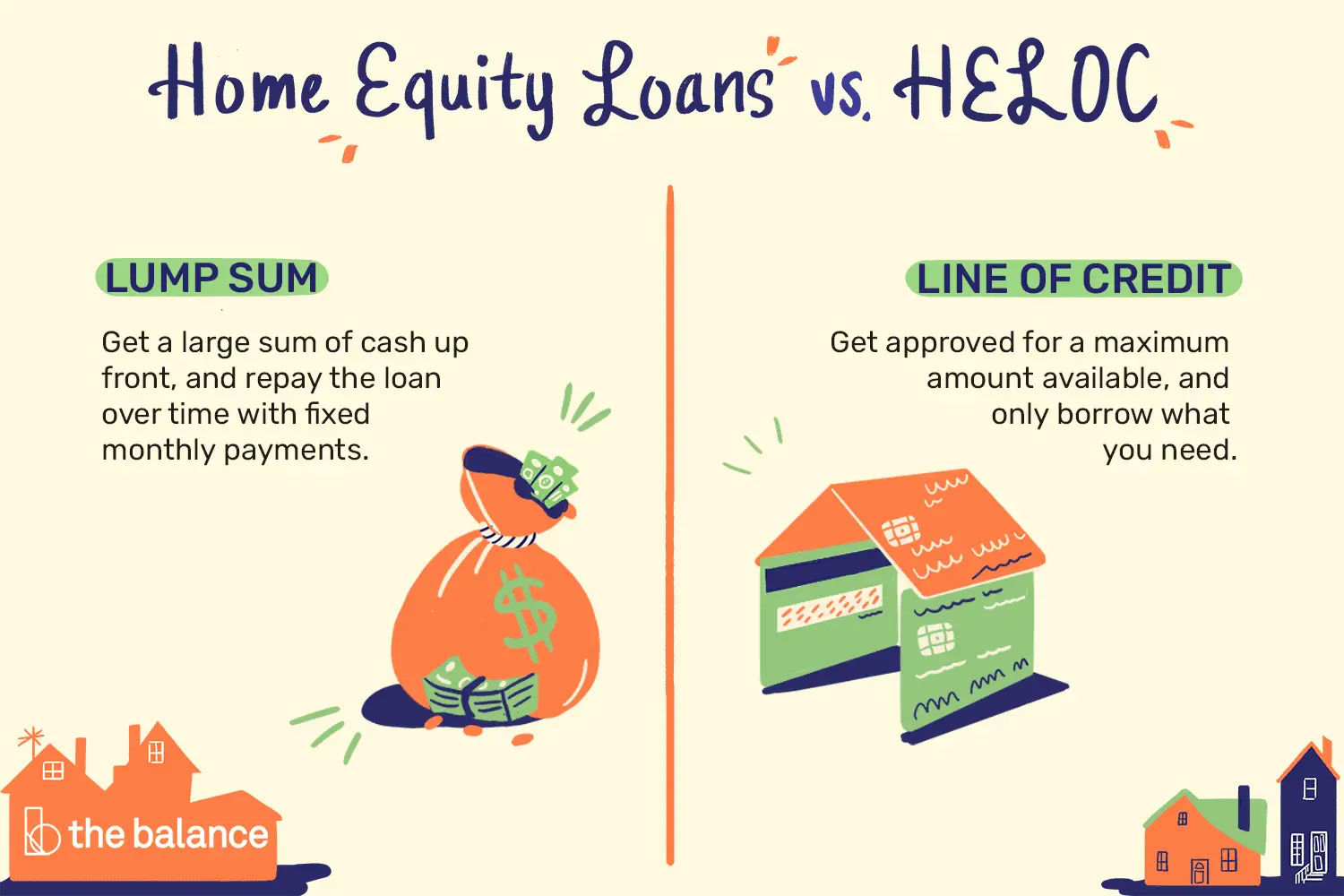

If youre considering a home equity loan or home equity line of credit, its important to understand how these second mortgages work.

One important point is that you keep your existing mortgage intact. You continue making payments on it as youve always done.

The home equity loan or HELOC is a second, separate loan with additional payments due each month. So youd have two lenders and two loans to make payments on.

Do I Have To Keep My Mortgage For All 30 Years

One important thing to note is that taking out a 30-year mortgage does not mean youre committing to living in your home for 30 years.

You dont have to keep the loan until its end date and pay it off in full. In fact, most homeowners dont. They either sell or refinance the home before their mortgage term is up.

- If you move and sell your home before its paid off, part of the proceeds from the home sale will be used to pay off any remaining loan amount due to your mortgage lender

- If you decide you want a different type of loan or a lower interest rate later on, you can refinance your mortgage. This involves replacing your existing mortgage with a new loan that benefits you financially

You dont need to worry too much about selling or refinancing right now.

Just know that taking out a mortgage doesnt mean youre stuck with the same loan for a 15 to 30 year period of time.

You can reevaluate your finances at any point down the road, and if your home or your mortgage no longer meet your needs, youll be able to move or get a new loan that suits you better.

You May Like: Is Va Loan Worth It