Finding Your Federal Student Loan Balances

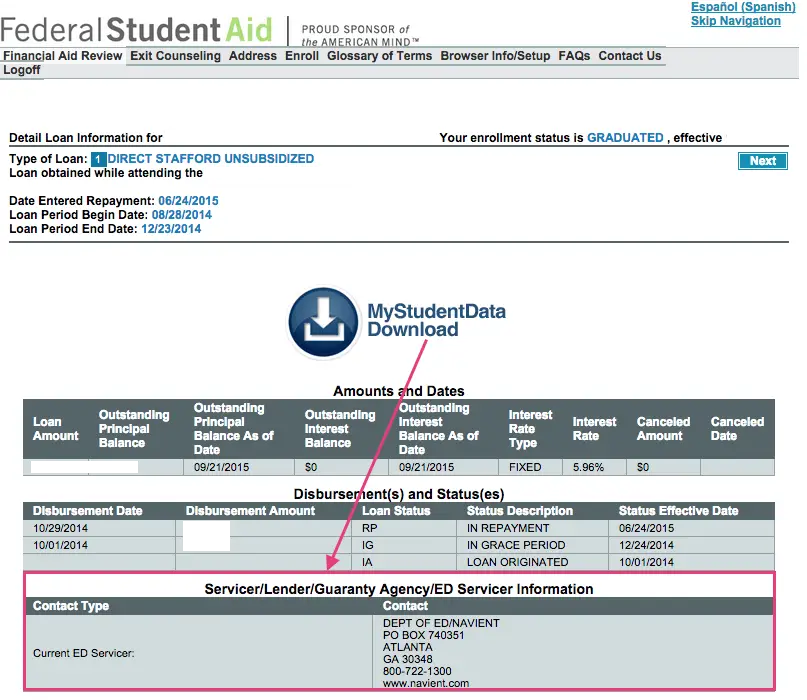

You can always access student loan information through your My Federal Student Aid account, where you can find your federal student loan balances under the National Student Loan Data System . This is the U.S. Department of Education’s central database for student aid, and it keeps track of all your federal student loans.

You’ll need a Federal Student Aid ID username and password to log in to the site. The ID serves as your legal signature, and you can’t have someonewhether an employer, family member, or third partycreate an account for you, nor can you create an account for someone else. The NSLDS stores information so you can quickly check it whenever you need to, and it will tell you which loans are subsidized or unsubsidized, which is important because it can determine how much you end up paying after graduation.

If your loans are subsidized, the U.S. Department of Education pays the interest while you’re enrolled in school interest accrues during that time with unsubsidized loans. To qualify for a subsidized loan, you must be an undergraduate student who has demonstrated financial need. Unsubsidized loans are available to undergraduate, graduate, and professional degree students, and there are no financial qualifications in place.

Most Frequently Asked Questions

How do I find out which companies are servicing my federal student loans?

You may have federal loans in addition to those serviced by Granite State Management & Resources. Get the details on all of your student loans and student loan servicers online through the Department of Education’s National Student Loan Data System at nslds.ed.gov. Youll need the same Federal Student Aid ID used to file FAFSA® to access your Federal Student Aid records online.

How do I access my account online?

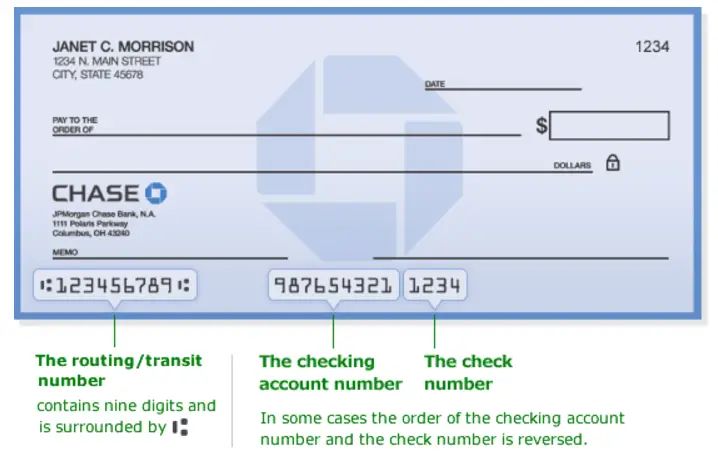

Access your account by clicking Manage My Account from the homepage. If you are a first time visitor to our site, please complete the steps for online account access. You will need to have your nine-digit account number to create your account your nine-digit account number can be found on your monthly statement.

Through Manage My Account you can:

- Apply online for deferments or forbearances.

- Reset your own password.

- Access our convenient and secure online message system for monthly statements and correspondence.

- Access real-time information easily while logged into your account with the confidence of knowing it is password-protected and confidential.

How do I make that loan payment on behalf of a child/friend/spouse?

A parent or other third party can quickly and easily make a payment on an account online once they have been established as an . The Borrower must follow these quick steps to establish an authorized payer:

How do I request a pay-off statement?

How do I change my payment due date?

How Do I Find My Student Loans

The process for finding your loan servicer will be different depending on whether you have federal or private student loans.

If you have federal student loans, you can find your loan servicer by signing into your Federal Student Aid account. Youll log in with your FSA ID. Once youve accessed your dashboard, youll see your student loan servicer and other details about your loans.

Alternatively, you can find your federal student loan servicer by calling 1-800-4-FED-AID .

Along with identifying your loan servicer, you will also find other information on your student loans, including the type of student loans you have, the loan amounts, interest accrued and outstanding balances.

You May Like: Va Loan Manufactured Home With Land

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Student Loan Billing Statement

Every month that you owe a payment, youll receive an official billing statement to repay your student loan.

Your account number will be plainly listed as account number, on your billing statement.

Think of a credit card billing statement. Your account number is plainly identifiable on it.

Your student loan account number should be plainly noticeable near the top of your billing statement.

Corporate lending and facilitation services like Fannie Mae and various other federal student loan services feature plainly distinguishable account numbers on their billing statements.

Don’t Miss: How To Get An Aer Loan

What Do I Do With My 1098

You’ll have one 1098-E for each account listed on your Account Summary.

To file your taxes, you don’t need a physical copy of your 1098-E. Check with a tax advisor to determine how much of the interest paid on your student loans in the previous year is tax deductible. If you have more than one account, you’ll need to look at multiple statements and add the numbers together for your total deduction. Enter the amount from box 1 into the student loan interest deduction portion of your tax return.

If you want a physical copy of your 1098-E for your records, just print it out from our website. It’s as easy as that!

Change Or Cancel Auto Pay

You May Like: Minimum Credit Score For Rv Loan

Student Loan Stats At A Glance

Do you know what is the best way to bog yourself down in a quagmire of debt?

Get yourself a college degree.

The second highest consumer debt category is student loan debt, preceded by mortgages.

Student loan debt in the United States is higher than both auto loans and credit card debt as well.

The average student loan borrower owes $33,000. About 3 million students owe over $100,000. To put that in context, an average new car costs $36,700. You can get a small starter house in most small or mid-sized cities for $100,000.

When its time to start making repayments, shortly after graduation, the average monthly repayment is $300.

Imagine making monthly $300 payments for 6, 10, 15, or 20 years.

Over 45 million Americans dont have to imagine it. Its their everyday reality.

A student loan is a lifelong investment for many. Its as vital a bill payment as rent, a mortgage, or car loans.

If youre embarking on a decades-long journey of monthly student loan repayments, you must know how to find the student loan account information.

Wells Fargo Private Student Loans

Wells Fargo has exited the student loan business. Our private student loans are being transitioned to a new loan holder and repayment will be managed by a new loan servicer, Firstmark Services, a division of Nelnet.

For assistance:

- Visit Firstmark Services online

Avoid processing delays: After your student loan has transferred to Firstmark Services, please ensure that payments are being sent using your new Firstmark Services account number and payment address. Wells Fargo will only forward misdirected payments for 120 days after transfer. After that 120-day period has passed, misdirected payments will be returned.

Alert: If you need assistance or services related to COVID-19, learn more about how we can help.

General student loan questions?Visit CollegeSTEPS® for guidance to help you manage your money confidently during college.

After your student loan is transferred, your student loan will no longer appear on Wells Fargo Online. If your student loan is your only account with Wells Fargo, you will no longer have access to Well Fargo Online after this transfer is complete. Firstmark Services will mail you written instructions describing how to set up online access using your new account number.

If you are a borrower or cosigner with a pending disbursement, please call us at Monday to Friday: 9 am to 5 pm Central Time, or login to check your loan status.

If your student loan payments are made by someone other than you, please advise them of these changes.

Read Also: Does Va Loan Work For Manufactured Homes

How To Find Your Student Loan Account Number

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey. Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

What exactly is a student loan account number? And, more importantly, why do you need to know it?

Your student loan account number is a unique 10-digit number that is given to you by your student loan provider and is used for identifying your federal student loan.

Students can use their student loan account number to look up their payments and see how much of their balance is left. This number is also used to verify a students identity when they are using services offered by the loan provider, such as mobile banking or trying to obtain previous statements.

Some financial institutions and banks may ask you for your student loan account number before allowing you to borrow money or approve a new credit card. Youll also need to know this number if you are considering refinancing those loans.

In addition, your student loan account number is used for tax purposes in order to verify that the student loan on a tax return is yours.

So, how do you find your student loan account number for federal loans?

Review Free Annual Credit Reports

The FSA website is the best way to see all your federal student loans, but it wont list any private student debt you might have. To see these student loans, you can request your free annual credit report.

Your credit report will include the following information:

- All the student loans you have, including both private and federal student loans.

- The lender or student loan servicer that holds each loan. You should also be able to see if a student loan was transferred or sold to a new servicer.

- The student loans initial balance and most recent balance.

- Payment history, including any missed payments and the date of the most recent payment on the loan.

While a credit report will likely list all your student loans, there are no guarantees. You might want to pull reports from all three major credit bureaus to be sure no loans are missed.

You May Like: How Can I Get An Rv Loan With Bad Credit

If You Dont Repay Your Loans

If you don’t make your loan payments, you will be in default.

An OSAP loan is considered to be in default when no required payments have been made for 270 days.

Being in default means:

- your debt will be turned over to a collection agency

- you will be reported to a credit bureau

- you could be ineligible for further OSAP until the default is cleared

- your ability to get a car loan, mortgage or credit card can be affected

- your income tax refund and HST rebate can be withheld

- interest will continue to build up on the unpaid balance of your loan

Your OSAP debt will only be erased when you have paid it off in full.

Manage Your Student Loan Balance

Sign in to your student loan repayment account to:

- check your balance

- see how much youve repaid towards your loan

- see how much interest has been applied to your loan so far

- make a one-off repayment

- set up and amend Direct Debits

- tell the Student Loans Company if youve changed your contact details

- tell SLC if youre going overseas for more than 3 months

This service is also available in Welsh .

You can also make one-off repayments towards your student loan, or towards someone elses loan, without signing in.

To sign in youll need your:

- customer reference number or email address

- password

- secret answer, for example your mothers maiden name

If you do not know these, you can reset them using the email address you had when you applied for your loan. Contact SLC if youve changed your email address.

Recommended Reading: How To Transfer Car Loan To Another Person

Pay Attention To Notifications From Servicers

Closely watch your email and mail for notifications from student loan servicers. They will reach out to you with updates.

For instance, they should contact you to let you know when your post-college student loan grace period is up and when you should begin making payments.

If you lose track of even one student loan, it could go into default which can add big fees to your student loan debt and destroy your credit.

If youre not receiving correspondence from your lender or loan servicer, electronic or otherwise, they may not have your up-to-date contact information. To find your loan holder and correct this error, try the following step.

Why You Should Track Your Student Loans

While it might seem complicated, it is essential to keep track of your student loans and the amount of debt you owe, including knowing how much you borrowed and how much you owe once you add interest. This can be helpful while you are in college, and as you start your budgeting process after graduation. Many options exist for repayment plans, including the following:

- Standard plans: Payments are calculated to guarantee loans are paid off within 1030 years.

- Graduated plans: These are designed to ensure loans will be repaid within a certain amount of time, but payments will increase gradually over time.

- Income-based: These repayment plans calculate your monthly payments based on how much you earn, with higher wages equaling higher payments.

Once you have a solid number to start with, you can begin to create a repayment plan to get rid of that debt as quickly as possible. You can develop a repayment plan that works for your salary and lifestyle and pays down the debt quickly to save you money over time. You can always contact your loan servicer to update your payment plan if your situation changes. This does not have a negative impact on your credit.

Also Check: How To Find Student Loan Number

How To Find Your Student Loan Balance

The dreaded question of every college graduate: How much do I owe in student loans?

Kat TretinaUpdated April 30, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

With the typical graduate having up to 12 different federal and private student loans, it can be difficult to keep track of them all. But finding out exactly how much you owe is essential for managing and paying off your debt.

In this post:

Rehabilitate Your Canada Student Loan

If your loan is in collection, Contact the CRA to:

- see if you qualify to have your federal student loan brought up to date

- make payments equal to 2 regular monthly payments and choose one of the following options:

- pay off all outstanding interest on your loan, or

- add all unpaid interest to the balance of your loan

Once you make your payments, contact the NSLSC. You should receive a new repayment schedule within 1 month.

Recommended Reading: How Long For Sba Loan Approval

Find Out How Much You Owe In Student Loans

When you took out your student loans, you agreed to borrow a set amount and to repay it with interest. Your interest rate can cause your loan balance to grow over time, so you could end up owing thousands more than you originally borrowed.

To make things even more confusing, your loans can sometimes change hands. Some lenders will sell your loans or transfer them to other loan servicers, so who you originally had as a loan servicer may no longer be the right one. Your loan servicer is who you make payments to and go to for questions, so its important to figure out who your current servicer is to repay your debt.

So if you know you have student loans, but arent sure who your loan servicer is or how much your balance is, heres what you need to know about finding both federal and private student loan balances.