Judge Dismisses Effort To Halt Student Loan Forgiveness Plan

ST. LOUIS A federal judge on Thursday dismissed an effort by six Republican-led states to block the Biden administrations plan to forgive student loan debt for tens of millions of Americans.

U.S. District Judge Henry Autrey in St. Louis wrote that because the six states Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina failed to establish they had standing, the Court lacks jurisdiction to hear this case.

Suzanne Gage, spokeswoman for Nebraska Attorney General Doug Peterson, said the states will appeal. She said in a statement that the states continue to believe that they do in fact have standing to raise their important legal challenges.

Democratic President Joe Biden announced in August that his administration would cancel up to $20,000 in education debt for huge numbers of borrowers. The announcement immediately became a major political issue ahead of the November midterm elections.

The states lawsuit is among a few that have been filed. Earlier Thursday, Supreme Court Justice Amy Coney Barrett rejected an appeal from a Wisconsin taxpayers group seeking to stop the debt cancellation program.

Barrett, who oversees emergency appeals from Wisconsin and neighboring states, did not comment in turning away the appeal from the Brown County Taxpayers Association. The group wrote in its Supreme Court filing that it needed an emergency order because the administration could begin canceling outstanding student debt as soon as Sunday.

Most Read

One Of The Nation’s Largest Student Loan Service Providers Will Cancel The Balance Of More Than $17 Billion In Private Students Loans

TALLAHASSEE, FL Following an agreement with a coalition of 39 attorneys general around the country, one of the nation’s largest student loan service providers will cancel the remaining balance of more than $1.7 billion in subprime private student loan balances owed by about 66,000 former college students and their parents nationwide.

On Thursday, Florida Attorney General Ashley Moody secured $1.85 billion from student loan servicer, Navient, for misrepresenting to borrowers the best repayment options available.

In the proposed consent judgment, Navient, which formerly did business as Sallie Mae, will provide relief totaling $1.85 billion to resolve allegations of widespread unfair and deceptive student loan-servicing practices and abuses in originating predatory student loans.

Florida Loan Forgiveness Programs

Program: Nursing Student Loan Forgiveness Program

- Amount: Up to $4,000 per year for 4 years

- Description: The Florida Legislature established the Nursing Student Loan Forgiveness Program in 1989 to encourage qualified personnel to seek employment in areas of the state where critical nursing shortages exist.

- Requirements:

§ Be licensed as an LPN, RN, or ARNP in the state of Florida

§ Have loans incurred toward a nursing education

§ Work full-time at one of the designated employment sites established in Section 1009.66, Florida Statutes

Program: Loan Repayment Assistance Programs for Lawyers

- Amount: Up to $5,000 per year

You May Like: What Credit Score For Va Home Loan

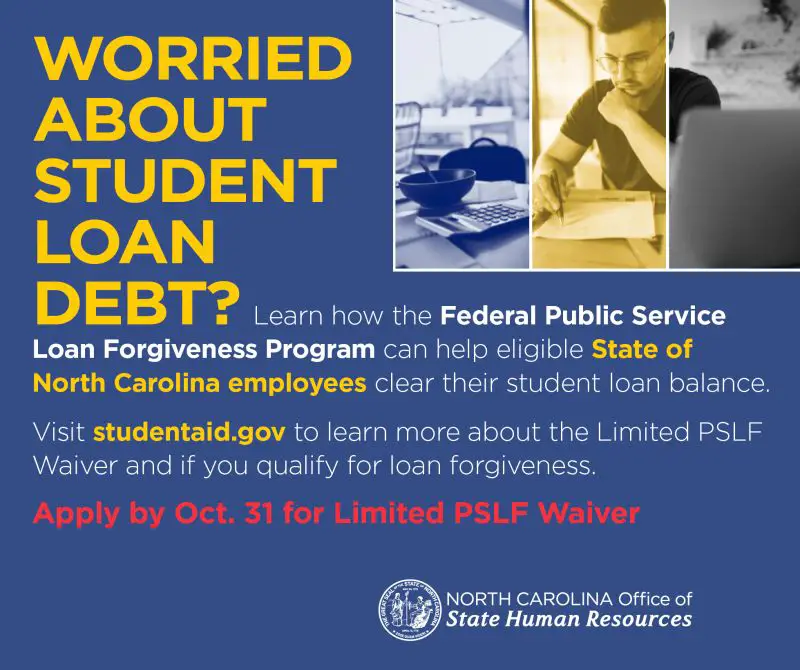

What Counts As A Government Employer For The Pslf Program

Any U.S. federal, state, local, or tribal government agency is considered a government employer for the PSLF Program. This includes employers such as the U.S. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts .

A government contractor isnt considered a government employer.

You can visit our Public Service Loan Forgiveness Help Tool, which will help you determine if an employer is considered a qualifying employer under the PSLF Program.

Iii Public Service Loan Forgiveness

The PSLF Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

To download the PSLF Form:

Please visit the Federal Student Aid PSLF Website to review the eligibility requirements and qualifications.

To request completion of Page 2:

- Email your request and blank Page 2 to with your name and Employee ID

- If sending completed forms with SSN, submit your form to via Noles Files Transfer for secure file submission.

- Do Not Include your SSN in any Emails For Security Purposes

Recommended Reading: How To Select Student Loan Repayment Plan

The Company Promises Immediate Loan Forgiveness

Be wary of companies that claim to help you get loan forgiveness. There are legitimate government programs, such as Public Service Loan Forgiveness, that can reduce or eliminate federal student loans after a certain amount of time. However, only some individuals qualify for the programs.

» MORE:How to avoid COVID-19 student loan forgiveness scams

For instance, borrowers must work full-time for the government or a 501 nonprofit organization and make full monthly payments for at least 10 years before earning forgiveness through PSLF. Borrowers on income-driven repayment plans can get their remaining loans forgiven after they make payments for 20 or 25 years, depending on the plan.

What to do instead: Use Federal Student Aids Repayment Estimator to see your monthly payment and projected loan forgiveness on various plans based on your income and family size.

If you work in public service, make sure you understand the details of Public Service Loan Forgiveness. If you decide to pursue it, begin by submitting a PSLF employment certification form to confirm your employment qualifies.

Worried You’re Being Scammed

I hope this helps you navigate the world of student loans a little better and avoid getting played. If you want to know more, don’t forget to check out my Definitive Guide to Student Loan Debt.

Are you worried that you could be dealing with a scammer? Stop by our new Student Loan Forum and post about it in the Student Loan Scams section. Protect yourself and protect others as well!

Readers, have you ever been the victim of a student loan scam?

Robert Farrington is Americas Millennial Money Expert® and Americas Student Loan Debt Expert, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page, or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications including the New York Times, Washington Post, Fox, ABC, NBC, and more. He is also a regular contributor to Forbes.

Also Check: Can You Wrap Closing Costs Into Loan

You Have To Pay Upfront Or Monthly Fees To Get Help

Theres nothing a debt relief company can do that you cant do on your own. And its not illegal for companies to charge for services you could do for free. Some people compare student debt relief services with tax preparation.

» MORE:Are student loan debt relief services legit?

But it is illegal for companies offering student debt relief to collect fees over the phone before they lower or settle a customers loans.

What to do instead: Go to studentaid.gov to apply for an income-driven repayment plan, learn about government forgiveness plans or consolidate your federal loans all for free. If you have private loans, contact your lender or servicer to discuss alternative repayment plans. Borrowers with federal or private loans can request a temporary pause on payments by asking for deferment or forbearance. If you take this route, though, interest will continue to accrue, increasing your loan balance.

If you want expert help in navigating your options, contact a student loan counselor certified by the National Foundation for Credit Counseling. Some nonprofit credit counseling agencies charge a one-time fee ranging from $50 to $200, but they offer trustworthy advice for a fraction of what youd pay to a for-profit company.

Borrower Defense To Repayment Or Closed School Discharge

- Borrowers who qualify: 690,000

- Total debt forgiveness: $7.9 billion

The borrower defense to repayment program is available to students who were misled by a school involved in misconduct while they were enrolled. Separately, students who attended a school that closed while they were enrolled or shortly after they graduated may qualify to have their federal student loans forgiven under the closed school discharge program.

Borrowers who qualify for these two programs may at times overlap. In some circumstances, borrowers who received a closed school discharge also qualified for student loan forgiveness under the borrower defense to repayment program.

Instances of forgiveness through the borrower defense to repayment program include when the Education Department announced in June 2021 that 18,000 borrowers who attended the now-defunct ITT Technical Institute would have $500 million worth of student loans discharged.

The Biden administration approved an additional 1,800 borrower defense claims in July 2021 for students of Westwood College, Marinello Schools of Beauty and the Court Reporting Institute. An additional 16,000 borrowers were approved for the program in February.

The department is currently reviewing future rulemaking regarding borrower defense, holding public hearings to receive feedback in June 2021. You can apply for borrower defense on the FSA website.

Don’t Miss: How Do I Refinance An Auto Loan

Total And Permanent Disability Discharge

- Borrowers who qualify: 400,000+

- Total debt forgiveness: More than $8.5 billion

The total and permanent disability discharge program offers student debt relief for borrowers who are totally and permanently disabled.

Qualified borrowers no longer have to repay their federal student debt, including Direct Loan Program loans, Federal Family Education Loan Program loans and Federal Perkins Loans. They also are not required to complete a TEACH Grant service obligation to have their loans forgiven.

Previously, borrowers had to apply for a TPD discharge, but the Education Department announced in August 2021 that these borrowers would automatically qualify for relief through an existing data match with the Social Security Administration . This resulted in about $5.8 billion in automatic student loan discharges during that time.

The Biden administration also reinstated $1.3 billion in TPD discharges in March 2021 for 41,000 borrowers who had not reported earnings information as part of this program.

If you have a total and permanent disability but haven’t qualified for a TPD discharge, you may be able to apply for the program on the Federal Student Aid website by providing documentation from your physician. And if you still don’t qualify for a TPD discharge, visit Credible to compare alternative student loan repayment programs like refinancing. You can browse estimated student loan rates from private lenders in the table below.

Youre Asked To Share Sensitive Personal Information

Some companies may ask for borrowers to provide Federal Student Aid IDs or Social Security numbers. The data give the businesses the ability to sign into your account and make decisions on your behalf. Legitimate sources of student loan help, such as NFCC-affiliated nonprofit credit counseling agencies, do not ask for such information.

Additionally, some debt relief companies may ask borrowers to sign power of attorney agreements, which would allow the businesses to communicate with your loan servicer in your name. Youre not obligated to sign such documents in fact, doing so may cause you to lose access to your student loan account.

What to do instead: Dont reveal your FSA ID or Social Security number, or sign a power of attorney agreement. If youve already done so, contact your loan servicer, explain the situation and regain control of your account. Resume making payments directly to your loan servicer if you stopped doing so.

Read Also: How To Get Small Business Loan To Start Business

What To Do If You Think Youve Been A Victim Of A Student Loan Relief Scam

The first thing you need to do if you think youve fallen for one of these scams is to contact your bank or your credit card company to stop any payments going toward that company. Latreille also says to keep an eye on your credit report to see if theres some unusual activity. If there is, contact the places where those transactions took place to dispute them immediately, so it doesnt damage your credit.

Then, the next step is to contact your federal student loan servicer to explain what happened, as they usually have procedures in place to help borrowers in these situations.

A lot of people feel ashamed or embarrassed,” Mayotte says. “They don’t want to report it because they feel like it makes them look like they weren’t that smart, and that’s not the case at all.

If you signed a power of attorney, make sure you tell your servicer, bank and credit card company about this, so they can have it revoked immediately.

Once youve done all of that, you should also report the incident to the Federal Trade Commission, the CFPB or your district attorney, so they can look into it and hopefully prevent this company from scamming other consumers.

How To Get Student Loan Forgiveness In Florida

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Bottom line: Were here for you. So please learn all you can, email us with any questions, and feel free to visit or not visit any of the loan providers on our site. Read less

* * *

Don’t Miss: Is Interest Paid On Home Equity Loan Deductible

Changes To Student Loan Servicers

Adding to potential confusion is that student loan servicers are set to change for some 16 million borrowers in the coming years.

“The uncertainty around who is my loan servicer does leave a bit of a scary gap in terms of scammers trying to take advantage,” said Bridget Haile, head of borrower success at Summer, a company that helps borrowers simplify and save on their student debt.

Three companies Navient, the Pennsylvania Higher Education Assistance Agency and Granite State all announced that they would no longer service loans with the federal government.

Borrowers who worked with those servicers will be transferred, but the timeline isn’t the same for everyone.

For example, FedLoan will continue to service some federal student loans through 2022 and will still administer the Public Service Loan Forgiveness program. Other borrowers who were repaying loans through the program may have already been transferred to MOHELA, another government-contracted loan servicer.

Navient will also transfer borrowers, but over time. Its contract with the government was extended through December of 2023. Granite State’s contract, meanwhile, ended in December, and the agency began transferring borrowers earlier in the year.

If you think your loan may be transferred, make sure you check in with your servicer now, said Haile.

The Benefits Of Paying For Student Loan Consultations

Theres no magic wand to get rid of student loans quickly. Instead, youll need to think carefully through your options to find the best repayment strategy.

You can go at it alone for free through the Federal Student Aid website, the reality is that figuring out which repayment option is best for you is complicated. If you find yourself feeling over your head with your options, it might make sense for you to invest in one of our one-on-one student loan consultations.

Thats why Student Loan Planner® offers a paid service for advice related to your student loan debt repayment. We wouldnt have a business if the federal government could solve every borrowers debt problems. The reality is if you have six-figure student loan debt, your situation is very different from someone who has $20,000 in student loans.

We dont have the answers to wipe away your debt in one fell swoop. Nor do we claim to provide immediate loan forgiveness. Were also not a document preparation company. We purposely dont fill out any paperwork for clients. The more involved and educated you are in your own repayment decisions, the more focused youll be at eliminating your student loan debt the right way.

You can now better identify student loan forgiveness scams!

Read Also: What Is The Loan To Value Ratio For Refinance

What You Need To Know About Student Loan Debt Help

Before we dive into different types of student loan scams, its important that we talk about getting help for your student loan debt.

There are a lot of companies that advertise that they can help you with your loans you might see the ads on Facebook, on Google, or even in the mail . And these companies might promise you things or advertise some type of help for your student loan debt which might entice you to call or sign up.

Before you take any action with these companies, remember this: you dont ever have to pay someone to get help with your Federal student loans if you dont want to. Not that help is not available, but its up to you to decide if you want to do it on your own, or hire a professional organization to handle it for you.

Here’s why:

- Enrollment in repayment programs is available at no cost to Federal student loan borrowers and can be done for free at StudentAid.gov

- Debt relief companies do not have the ability to negotiate with your Federal student loan creditors in order to get you a better deal.

- Payment amounts, qualifiers, requirements under IBR, PAYE, and other repayment programs are set by Federal law

But that doesnt automatically mean paying someone for help is a scam. While these programs are free, signing up can be confusing for some people. Or they may have complex situations and want someone to help them. Just like some people do their taxes themselves, while others hire a CPA, the same applies to student loan debt help.