Usda Singlefamily Housing Repair Grant

The U.S. Department of Agriculture offers a Housing Repair Grant meant to help lowincome families repair, improve or modernize homes or remove health and safety hazards.

For eligible homeowners, this program can offer a grant up to $7,500 or a loan up to $20,000 to pay for repairs and upgrades to make a home more accessible.

Loans are repayable over 20 years and have a fixed interest rate of just 1%.

To qualify, the borrower must:

- Be the homeowner and occupy the house

- Be unable to obtain affordable credit elsewhere

- Have a family income below 50 percent of the area median income

- For grants, be age 62 or older and not be able to repay a repair loan

Three national programs help lowincome families and disabled people become homeowners.

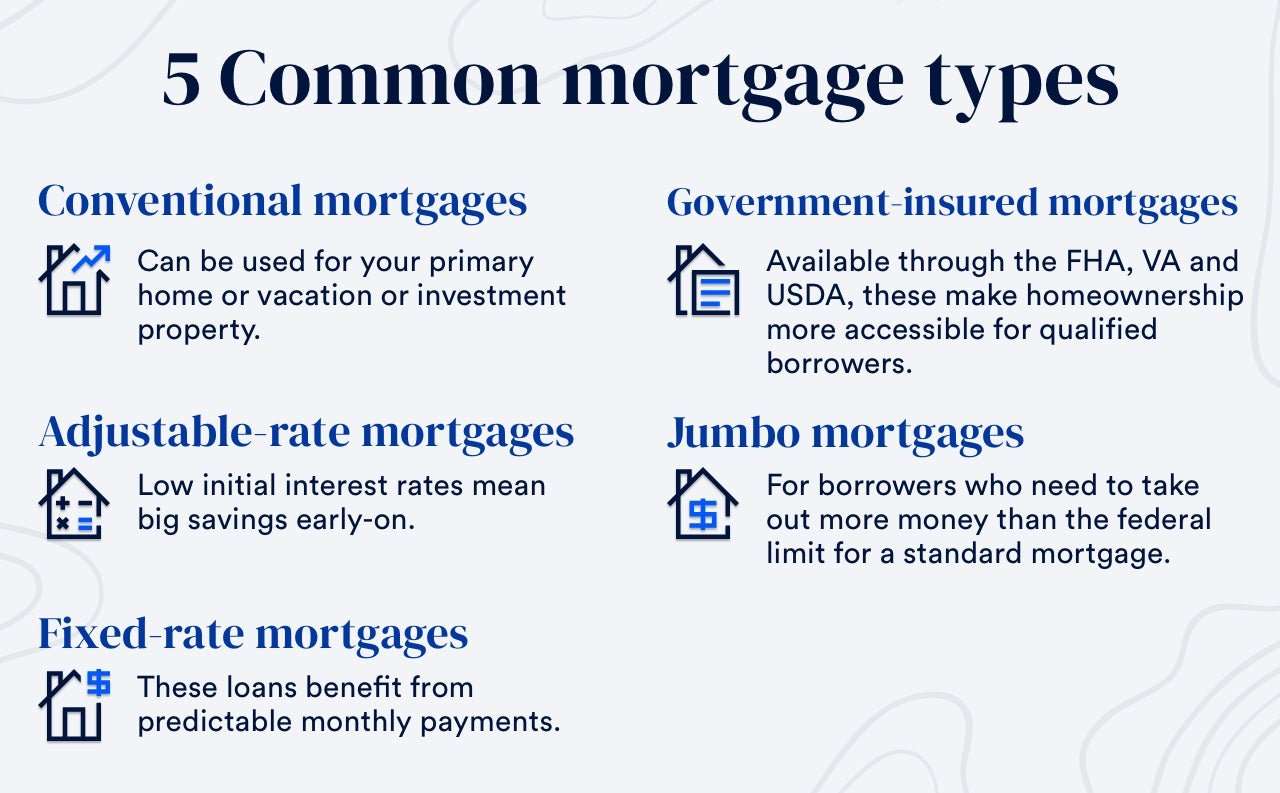

Figure Out How Much Of A Mortgage You Can Afford

The last thing you want to do is get in over your head and take on a mortgage that’s too high. Look at your budget and figure out what you can afford — use our monthly mortgage payment calculator to estimate the cost of different types of mortgages. You can also consult our beginner’s guide to home loans, which not only reviews different mortgage types, but also explains what goes into a mortgage payment.

USDA mortgages don’t require a down payment. Still, if you receive a down payment gift from a generous friend or family member, you’re welcome to use it for up to 100% of your down payment.

Where Can I Learn More

You can start with our VA Loan Guide. This explains the VA Loan, lists pros and cons, and discusses how to use the VA Loan to buy your next home.

If you are ready to buy a home, you can work with your real estate agent to find the right match for you. Just be sure to pay attention to the types of properties listed in this article to ensure your home will qualify for a VA Loan.

Finally, many lenders are qualified to process VA Loans, so you can work with your current bank or lender to buy a home using a VA Loan. However, I strongly recommend getting at least 5-7 quotes before buying your home. Interest rates origination fees, and other terms will vary based on the lender, your location, the homes purchase price, and your financial details, such as credit score, credit history, debt to income ratio, and other factors.

Here are some lenders you can start with :

- Veterans United Most Popular .

- Quicken Loans All Online Process Easy to Use.

- NASB Top 10 VA Lender they do not charge an origination or application fee for VA loans.

- J.G. Wentworth Great for refinancing a VA Loan.

Read Also: Why Isn T My Car Loan On My Credit Report

How Much Should You Be Spending On A Mortgage

According to Brown, you should spend between 28% to 36% of your take-home income on your housing payment. If you make $70,000 a year, your monthly take-home pay, including tax deductions, will be approximately $4,328. So, ideally, if we round that 28%-to-36% rule to one-third of your take-home income, you wouldnt be spending more than $1,442 on your housing payment dont forget, that should include your principal and interest payment, taxes and insurance, any HOA fees, plus PMI or mortgage insurance if you have it.

But if you have no debt, you can stretch up to 40% of your take-home income, which will be devoting about $1,731.20 to your mortgage payment.

Properties That Are Not Eligible For Va Loans

Naturally, there are a handful of housing types that will be outright rejected for VA Loans if you try to finance them using your loan. Anything that could be used for commercial gain is out of the question. As a basic rule of thumb, remember that VA Loans are intended to be used for the purchase of primary residences only.

Vacant land: Regardless of whether or not you intend to build a primary residence on a plot of land, VA Loans cannot be used to buy vacant land. There needs to be a home on the property already that you can use as a primary residence. For example, you can buy a farmhouse and the attached farmland with your loan as long as the farmhouse serves as your primary residence.

Multi-family homes larger than four units: When it comes to multi-family dwellings, four units is the maximum that you are allowed to finance with a VA Loan. The reason is that multi-family homes of this size are considered to be more of an investment property than a primary residence.

Vacation properties: Even though you might plan to use a vacation property exclusively for personal use rather than renting it for commercial gain, the VA will undoubtedly deny the purchase. While it may serve as your vacation residence, you can only use VA Loans toward financing your primary home.

Recommended Reading: Va Requirements For Manufactured Homes

Can I Get A Mortgage With No Money Down

In a word, yes. There are mortgages available where the required down payment is zero. These are often referred to as 100% loans loans in which the money lent comprises 100% of a particular homes market value.

Mortgages with no down payment are usually available only through certain government-sponsored programs.

To help people become homeowners, the government insures lenders if the borrower defaults on the loan. This enables banks and mortgage companies to issue favorable loans, even for first-time buyers with little credit and no money down.

Following are three governmental programs that are known to insure 100% loans.

USDA A USDA loan is a no-down-payment loan backed by the United States Department of Agriculture. These loans are often provided to low-to-moderate income borrowers who cant afford a traditional mortgage and want to live in a rural or suburban setting.

FHA FHA loans are insured by the Federal Housing Administration. These loans are designed for low-to-moderate income buyers and those with less-than-perfect credit. First-time and repeat buyers are eligible, and buyers can receive gift funds to cover the 3.5% down payment requirement.

VA VA loans are zero-down loans that are guaranteed by the U.S Department Of Veterans Affairs. To qualify for a VA loan, you must be a current or past service member. Those with eligible service get ultra-low mortgage rates and dont have to pay monthly mortgage insurance.

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

You May Like: Refinance Fha Loan

Its Not What You Can Borrow Its What You Can Afford

In some respects, the mortgage lending industry is working against your best interest. If you are deemed a qualified borrower, a lender is prone to approve you for the maximum it believes you can afford. But in some cases, that amount may be too generous.

Buying a home always means dealing with big numbers. And the impact to your budget may seem to be a stretch, particularly in the beginning. The challenge is buying a home that meets your current and future needs, without feeling like all of your money is in your home leaving you without the financial freedom to travel, save for other priorities and have a cash flow cushion.

Now that the NerdWallet How much can I borrow calculator has given you an idea of your buying power, you may want to gut-check the number by:

-

Run affordability scenarios. You can get another view of your home-buying budget by running some what-ifs through the NerdWallet home affordability calculator.

-

Talk to more than one lender. You are more likely to get a better interest rate by comparing terms offered by multiple lenders, and it might be illuminating to see the loan amounts different lenders will qualify you for.

-

Consider all homeownership expenses. Its not just whats built into your monthly payment such as insurance, taxes and the rest but the other having-a-home expenses, like structural upkeep, new furniture, maybe even yard maintenance equipment.

What Kind Of Home Loan Can I Get With A 650 Credit Score

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

A credit score of 650 leaves considerable room for improvementit’s regarded as a “fair” score by credit scoring model FICO®. A FICO® Score of 650 meets some lenders’ minimum requirements for a mortgage loanbut credit scores aren’t all mortgage lenders look for when deciding how much to lend you or what interest rates they’ll charge.

Don’t Miss: Fha Loan Limits In Texas

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.

What Are The Most Common Home Loan Payment Options

Nowadays, as technology is used to speed things up, its common loan installments be deducted from bank accounts. Specially if we talk about home loans because we assume those installments will be high. So instead of having to take much money from one place to another, you can be calm knowing it will be taken from your bank account without risking losing it or being stolen on the way. Just remember to have the amount of money available in your account on the date it should be debited.

You May Like: Refinance Auto Loan With Usaa

Where Do You Want To Live

}, }

! Your browser does not support geolocation. Consider using another browser.

How much mortgage can I afford?

The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Knowing your total household income, how much youâve saved for a down payment, and your monthly expenses , plus new expenses youâd take on , you can get a reasonable estimate. Learn more about factors that can affect your mortgage affordability.

How to estimate affordability

To estimate mortgage affordability, lenders will use two standard debt service ratios: Gross Debt Service and Total Debt Service . According to the Canadian Mortgage and Housing Corporation¹Note 1:

-

– GDS is the percentage of your monthly household income that covers your housing costs . It should be at or under 35% of your pre-tax household income.

-

– TDS is the percentage of your monthly household income that covers your housing costs and any other debts . It should be at or under 42% of your pre-tax income.

How your down payment affects affordability

The amount you have saved for a down payment is also another important piece of information to help determine affordability. Depending on the purchase price of a home, there are minimum amounts required for your down payment²Note 2:

Step 2 of 6

What Is Mortgage Affordability

Mortgage affordability refers to how much youâre able to borrow, based on your current income, debt, and living expenses. Itâs essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term âaffordabilityâ is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but itâs important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

Recommended Reading: How Do You Find Student Loan Account Number

Find Your Home Buying Budget

Its definitely possible to buy a house on $50K a year. For many borrowers, lowdownpayment loans and down payment assistance programs are making homeownership more accessible than ever.

But everyones budget is different. Even people who make the same annual salary can have different price ranges when they shop for a new home.

Thats because your budget doesnt just depend on your annual salary, but also on your mortgage rate, down payment, loan term, and more. Heres how to find out what you can afford.

> Related:How to buy a house with $0 down: Firsttime home buyer

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Read Also: Car Refinance Rates Usaa

Will I Qualify For A Mortgage +

To know if you will qualify for a mortgage based on your current income, try our Mortgage Required Income Calculator. You will need to supply information about the cost of the Mortgage, down-payment, interest rates, and other liabilities, after which the calculator responds with the required minimum income to qualify for the loan.

The Home Must Be Livable & Safe

In terms of livability, your home needs to be deemed as having adequate space to comfortably accommodate all day-to-day living activities, including eating, sleeping, cooking, etc. All mechanical systems also need to be approved for both safety and quality, and that includes your furnace, water heater, and any other home system. These requirements are put in place for the general safety of the tenant as well as the well-being of the property itself.

Another requirement concerning safety is that the property has to be structurally sound and free of any hazardous defects such as leaking, rotting, and faulty construction. Direct access to the property is also necessary, and that means that both pedestrians and vehicles need to be able to get to the property in question without passing through another property. These parameters further serve to guarantee the safety and well-being of the property owner as well as their neighbors.

Read Also: Usaa Car Loan Bad Credit

% Financing: The Va Home Loan

Another mortgage loan that allows you to finance 100% of the homes cost is the VA home loan. This loan is available to applicants typically with at least two years of former military experience, or 90 days if still serving.

The Veterans Administration estimates that 23 million people in the U.S. are eligible for the VA home loan. Thats about one in every 13 people, and many dont even know theyre eligible.

Anyone who is eligible should take advantage of this zero-down home loan program. VA loans have very low rates usually even lower than conventional loans. And they dont require a monthly mortgage insurance fee like USDA, FHA, or conventional loans.

When compared to any other low down payment mortgage, VA home loans are the most affordable in upfront as well as monthly costs.

Youll need to pay an upfront VA funding fee but it will almost always be less than the cost of private mortgage insurance or a down payment.

With a VA loan, you can buy a home with zero down and have the seller pay some or all of your closing costs, meaning you could own a home with no money out-of-pocket.

Lenders typically allow lower credit scores on VA loans as well. While most mortgage lenders require just a 640 score, some allow you to have a score as low as 620.

The VA home loan is the easiest 100% home financing option available. If you have served in the military, the VA home loan is worth checking into.