Why Your Credit Score Is Important When Applying For A Loan

A credit score is a three-digit number that lenders use to assess the risk of lending money to a borrower. A high credit score indicates a low risk, while a low credit score indicates a high risk. For most personal loans, lenders will require a credit score of 660 or higher. However, some lenders may be willing to work with borrowers who have lower credit scores. In general, the higher the credit score, the lower the interest rate on the loan. For borrowers with excellent credit, it is possible to get a personal loan with an interest rate as low as 5%. Borrowers with poor credit may be charged an interest rate of 20% or more. In addition to credit score, lenders will also consider factors such as income, employment history, and debts when making a decision about whether to approve a loan.

Personal Loan Alternatives For Fair Or Bad Credit

Personal loans arent the right choice for all borrowers. If you have bad or fair credit, consider an alternative borrowing option like the ones listed below:

Secured personal loans401 loans

Secured personal loans are personal loans backed by collateral or property such as a vehicle that a lender can seize if you are unable to pay back a loan. These loans typically offer lower interest rates and higher loan amounts than unsecured loans, as lenders have an assurance they will be able to recover some or all of the value of the loan.

Home equity loans allow homeowners to borrow from the equity they have in their home at a lower interest rate than whats offered by unsecured loans such as personal loans. If you default on the loan, though, you risk losing your home.

401 loans allow you to borrow from your own retirement savings. Since youre borrowing money from yourself, youre also paying back interest to yourself. However, you may face tax penalties if you dont repay the loan on time. Also, carefully consider whether the money you borrow is worth the lost potential earnings.

How Does The Fico Credit Score Rating Work

The FICO credit score rating gives lenders information about how borrowers have managed their credit in the past. It is a three-digit score created from the data drawn from the three main credit bureaus: Equifax, Experian, and Transunion.

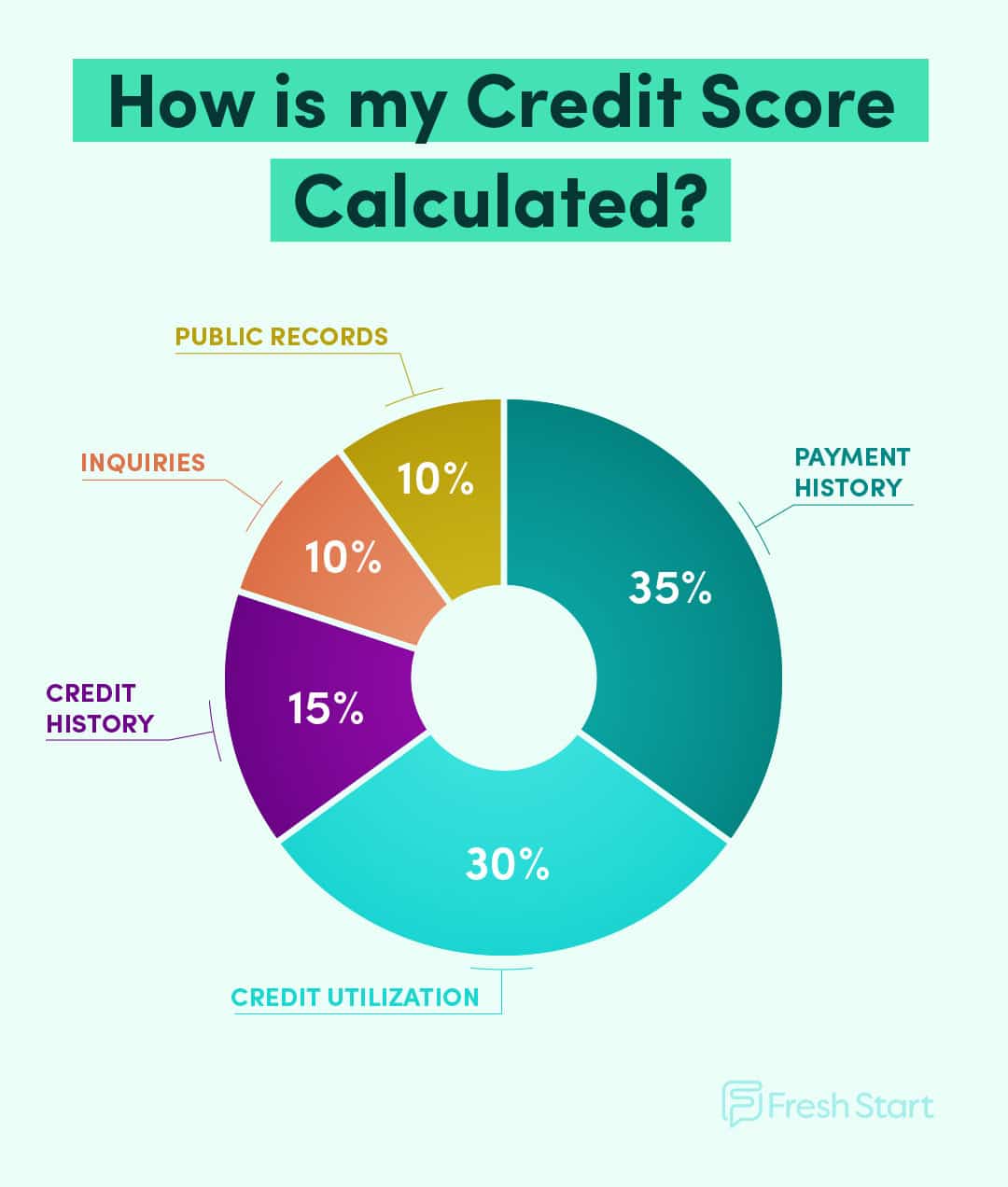

Five main factors determine a borrowers credit score. The most significant is the borrowers payment history. A borrower who makes all their payments on time and has no late payments or payments in arrears will have a higher credit score than a borrower who has late payments.

The second major component is how much a borrower owes. If a borrower owes more than 30% of their credit limits, their score will be lower than those who keep their balances low.

The third factor is how long a borrower has had a credit report. A more extended history can generate a higher credit score because more information is drawn on. For example, having a record of 72 monthly payments gives lenders a more accurate picture of how borrowers manage their credit than someone who only has nine payments on their credit report.

The last two components are the credit mix and if there have been any new accounts opened. These two data pieces have the most negligible impact on the borrowers credit score but are still relevant. The credit mix refers to the types of credit a borrower has, such as loans, credit cards, and mortgages. New accounts can reduce a credit score in the short term.

Read Also: How To Take Loan From 401k To Buy House

Title Loans To Pay For An Hourly Attorney

If your credit isnt where it needs to be for an unsecured loan, a title loan is a great option. A title loan uses your vehicles title as collateral. This secures the loan and helps to minimize the lending risk if you do not have a strong credit history. It is quick and simple to apply for an online loan. You just have to input some information about yourself and your vehicle.

The amount youll get for the loan depends on how much your vehicle is worth and your ability to pay back the loan. To establish how much your vehicle is currently worth, youll need to know this about your car:

How Do I Get A Personal Loan

Once you have a handle on your FICO score, you can focus on the specifics of your loan and start deciding what kind of lending path you want to take.

The most important thing to consider is deciding how much money you want to borrow. When determining your loan amount, youll need to do a little bit of time traveling.

And no, we dont mean in a tricked-out DeLorean with Michael J. Fox. Yes, we know how cool that would be.

Securing a personal loan is not just about paying back the loan amount. Every loan will come with some form of interest attached to it, which means that you will always pay back more than you borrowed in the futureit depends on your interest rate. So think about where you will be financially in the middle of paying back your loan. Will you be able to make the payments on time every month? Can you afford these payments along with all your other bills?

Keeping your loan amount limited to only what you need is a smart move that way, you arent paying interest on money that you dont need. But, if you dont borrow enough, you may have to get another loan with a higher interest rate to cover you. Youre going to live with this debt for a while, so make sure you can do so as comfortably as possible by borrowing only what you can repay.

Other things that you need to consider when choosing a loan are:

You May Like: Should I Refinance My Auto Loan

What Are The Causes Of A Credit Score Under 600

There can be several reasons for a credit score under 600. For example, there might be multiple late payments, accounts in arrears, collections, or judgments on the credit report. It could also result from a borrower having too much credit relative to their income or having a very limited credit history because they have just started borrowing.

How Do I Check My Credit Score

You can use one of the following services or methods to check your credit score. Typically, the score you receive is based on a soft credit inquiry, which doesnt affect your credit rating but isnt as accurate as a hard credit pull. Some lenders warn that soft credit inquiries give higher scores than hard credit checks.

- Online services. Sites like Credit Sesame allow anyone to check their credit score by filling out a quick online form with basic personal information like your name and birth date, as well as your Social Security number.

- Budgeting apps. Many apps like Mint regularly check and update your credit score once you sign up.

- If you have an app for your bank or credit card, you can often sign up to check your credit score and get alerts when it changes.

- Account statements. Your credit score might appear on some statements for loans, checking accounts or other financial products.

- Major credit bureaus. You can also check your credit score with Experian, TransUnion or Equifax.

Recommended Reading: Can I File Bankruptcy On Sallie Mae Student Loan

Does Applying For Loans Affect Your Credit Score

As you can see, obtaining a new personal loan could affect your credit rating. Your outstanding debt has increased, and you have acquired new debt.

The take note of new financial activity. If, for example, you tried to arrange for a new car loan shortly after taking out a personal loan, your application for a car loan might be rejected on the basis that you already have as much debt as you can handle.

Your overall credit history has more impact on your credit score than a single new loan. If you have a long history of managing debt and making timely payments, the impact on your credit score from a new loan is likely to be lessened. The easiest and best way to keep a personal loan from lowering your credit score is to make your payments on time and within the terms of the loan agreement.

Our Standards For Debt

Once youve calculated your DTI ratio, youll want to understand how lenders review it when they’re considering your application. Take a look at the guidelines we use:

35% or less: Looking Good – Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

Youre managing your debt adequately, but you may want to consider lowering your DTI. This may put you in a better position to handle unforeseen expenses. If youre looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action – You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

Recommended Reading: Can You Pay Off Mortgage With Home Equity Loan

Personal Loans For Good Credit

Finally, for borrowers with strong credit profiles, terms can be even better. Lenders offering loans to good credit borrowers typically offer the lowest rates and friendliest repayment terms.

Two Lenders Offering Personal Loans for Good Credit

| Minimum Credit Score |

To compare other options, you can check out our guide to the best good credit loans.

What Credit Score Do I Need To Get Approved For A Personal Loan

Minimum credit score for personal loans varies from lender to lender. Major financial institutions like banks and credit unions will want to see good to excellent credit , while online lenders can approve personal loans even if you have fair credit or bad credit .

Minimum credit score to qualify for personal loans

Below is a breakdown of different lenders with their minimum credit score requirements for personal loans.

| Lender |

|---|

| Bank loans |

You May Like: Is Interest Paid On Home Equity Loan Deductible

Why Your Credit Score Is So Important For A Personal Loan

You dont need to build perfect credit to get a good personal loan. But the higher your credit score is, the more options youll have, and the lower your interest rate will be.

That last point is particularly important. As we saw earlier, with the credit score ranges from various lenders being anywhere from 5.99% to 35.99%, exactly where youll fall on that scale will determine whether getting a personal loan is even desirable.

For example, lets say you have $20,000 in high-interest credit cards, with an average interest rate of 22%. A personal loan will be the perfect way to not only lower your interest rate, but also to get into a fixed rate, fixed-term loan that will completely extinguish your plastic in just a few years. In that way, a personal loan is one of the best ways to make a chronic credit card problem go away.

Now the whole strategy will work beautifully if you can get a personal loan rate of say, 8%. At that rate, a five-year loan of $20,000 will carry a monthly payment of $359. Thats lower than the $400+ youre likely currently paying on your credit card balances. But the biggest advantage is that youll go from variable rates to fixed, and the debt will be completely gone in five years.

Getting that 8% rate will almost certainly require a credit score something well above 700. If you dont have it, the interest rate youll be charged will make the personal loan debt consolidation less attractive.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

You May Like: How To Apply For Federal Student Loan Forgiveness

How Hard Is It To Get A Loan With A 600 Credit Score

Modern credit scores range anywhere from 300 to 850. Obviously, the higher your score is, the easier it will be for you to secure a loan or financing deal for whatever you need. However, qualifying for a loan with a 600 credit score is possible. The difficulty may depend on the type of loan that you are applying for. For example, if you are applying for an unsecured personal loan with a 600 credit score, you may qualify, but you may only qualify for a small low amount with a high interest rate. If you are applying for an auto loan, again you may qualify, but they may require a large down payment and yet again, a high interest rate. An auto loan is secured by collateral , while an unsecured personal loan is not secured by collateral.Therefore, lending companies rely more heavily on your credit to determine loan eligibility. You have to understand that they are taking a risk giving customers money and they need to be certain they will get a return on their investment and the funds will be paid back to them.

If you have a credit score of 600 or less but need a personal loan, you may still have options but the loans may come with stricter rules for you to follow.

What Your Credit Score Means

Your credit score reflects how well you’ve managed your credit. The 3-digit score, sometimes referred to as a FICO® Score, typically ranges from 300-850. Each of the 3 credit reporting agencies use different scoring systems, so the score you receive from each agency may differ. To understand how scores may vary, see how to understand credit scores.

Don’t Miss: What Is The Va Loan Limit In Florida

What Does It Mean To Prequalify For A Personal Loan With A 600 Credit Score

If prequalifying for a personal loan, it does not mean the lender is guaranteed to fund the loan. But rather, it means that you qualify. A little confusing, right? Lets help you understand. If you submit a personal loan application and ask to borrow $5,000, stating that you make $12,000 gross monthly income and own your home, the lender may come back and say you are prequalified for the loan at a certain interest rate and term. However, they may also ask for proof of income or residency. If your income does not match what you submitted or perhaps you rent rather than own, the lender may choose to revoke their offer. If you want to guarantee that a lender will honor their offer, you will want to get pre-approved status.

Other Factors That Affect Personal Loan Eligibility

While your credit score plays a significant role in determining whether you will qualify for a personal loan, lenders also will take into account other factors, including:

- Collateral, if any

Your DTI ratio measures how much of your income goes toward paying debts each month. Lenders calculate this ratio by adding up your monthly debt payments and dividing that number by your gross monthly income. In general, financial institutions prefer to lend to applicants with a lower DTI ratio, as it can signal to lenders whether youd be able to manage your new debt.

Debts such as student loan payments, auto loans, mortgages and child support payments are included in your DTI ratio. Lenders prefer to see a ratio of 35% or lower.

Also Check: What Is An Asset Based Loan

Increase Your Credit Score

If your credit score is lower than 630, focus on increasing it. Do this by making at least the minimum payment on all your bills on time and make sure your credit report is free of any errors that might be affecting your score. If you do find errors, file a dispute with the credit bureau immediately.

Comparing Personal Loan Lenders For Fair Credit

When comparing personal loans for fair credit, its important to consider the qualifications, APR, repayment terms, and funding speed.

- Qualifications: Its harder for people with fair credit to get loans, so what it takes to qualify for a personal loan is important. Not only will most lenders evaluate your credit score, but theyll also consider such things as your income, ability to repay the loan, and credit history. To improve your odds of qualifying, make sure you can afford the loan and you dont have any actively delinquent accounts.

- Annual percentage rate : When comparing loans, make sure you compare the rather than the interest rate. Unlike the interest rate, the APR also includes the fees youll be required to pay. For instance, many lenders charge origination fees, which are often reflected in the APR. By comparing APRs across different loans, the effect of these fees is taken into consideration.

- Repayment terms: Ensure that the lender you select offers the repayment term length you want. Many lenders offer limited repayment terms of 36 or 60 months. However, if you need more or less time to repay your loan, you may be able to find a lender that offers a shorter term of a year or less or a longer term of up to 180 months.

- Funding speed: If you need money quickly, look for a lender that can get you funded in a matter of days. Many of the best personal loan providers can get you funded as quickly as the next business day after your loan is approved.

Read Also: Unsecured Loan Vs Secured Loan