Equity And Home Appraisals

To determine whether you qualify and how much money you can borrow, a lender will have your home appraised. The home appraisal will tell the lender how much your home is worth.

Rocket Mortgage will allow you to borrow around 90% of the equity in your home. To figure out the amount you could obtain through a home equity loan, youd determine your loan-to-value ratio. To do this, subtract the remaining balance of your primary mortgage from 90% of the appraised value of your home. For example, if your home is appraised at $400,000 and the remaining balance of your mortgage is $100,000, heres how you would calculate the potential loan amount:

$400,000 x .9 = $360,000

This means you could secure up to $260,000 if you obtained a home equity loan.

What Are Current Home Equity Interest Rates

Home equity interest rates vary widely by lender and the type of product. Generally speaking, home equity lines of credit have lower starting interest rates than home equity loans, although the rates are variable. Home equity loans have fixed interest rates, which means the rate you receive will be the rate you pay for the entirety of the loan term.

As of Sep. 7, 2022, the current average home equity loan interest rate is 6.98 percent. The current average HELOC interest rate is 6.51 percent.

| LOAN TYPE | |

|---|---|

| 6.51% | 5.27%-9.14%% |

Best Home Equity Loan Lenders And Rates Of October 2022

Here are the best home equity loan rates of October 2022:

| LENDER | |

|---|---|

| 5 to 20 years | 89.99% |

The APRs shown above are accurate as of October 3, 2022. They are the only APRs openly available among the lenders we assessed. The NextAdvisor editorial team updates this information regularly, although it is possible APRs have changed since they were last updated.

As with any type of lending, your interest rate will depend on multiple factors, including your , income, desired loan amount and term, how much equity you have in your home, and more. To know your exact rate from a particular lender, youll need to pre-qualify or submit an application with the lender.

Also Check: How Fast Can I Get Student Loan Money

How To Qualify For A Home Equity Loan

The basic requirement of a home equity loan is that you own your home. At most, lenders permit homeowners to borrow up to a combined loan-to-value ratio of 90% . In other words, a lender will not approve you for a home equity loan if it means your home equity drops below 10% of your homes current appraised value. Generally, home equity loans can only be taken on owner-occupied properties, although in some cases it may be possible to use a rental or investment property as collateral.

Aside from CLTV, all the other minimum requirements of mortgage or loan eligibility apply. You will need to be a U.S. citizen or resident aged 18 years or more. The lender will run a credit check, which will affect your credit score. And you will need to provide certain financial documentation, although less than for a traditional mortgage application.

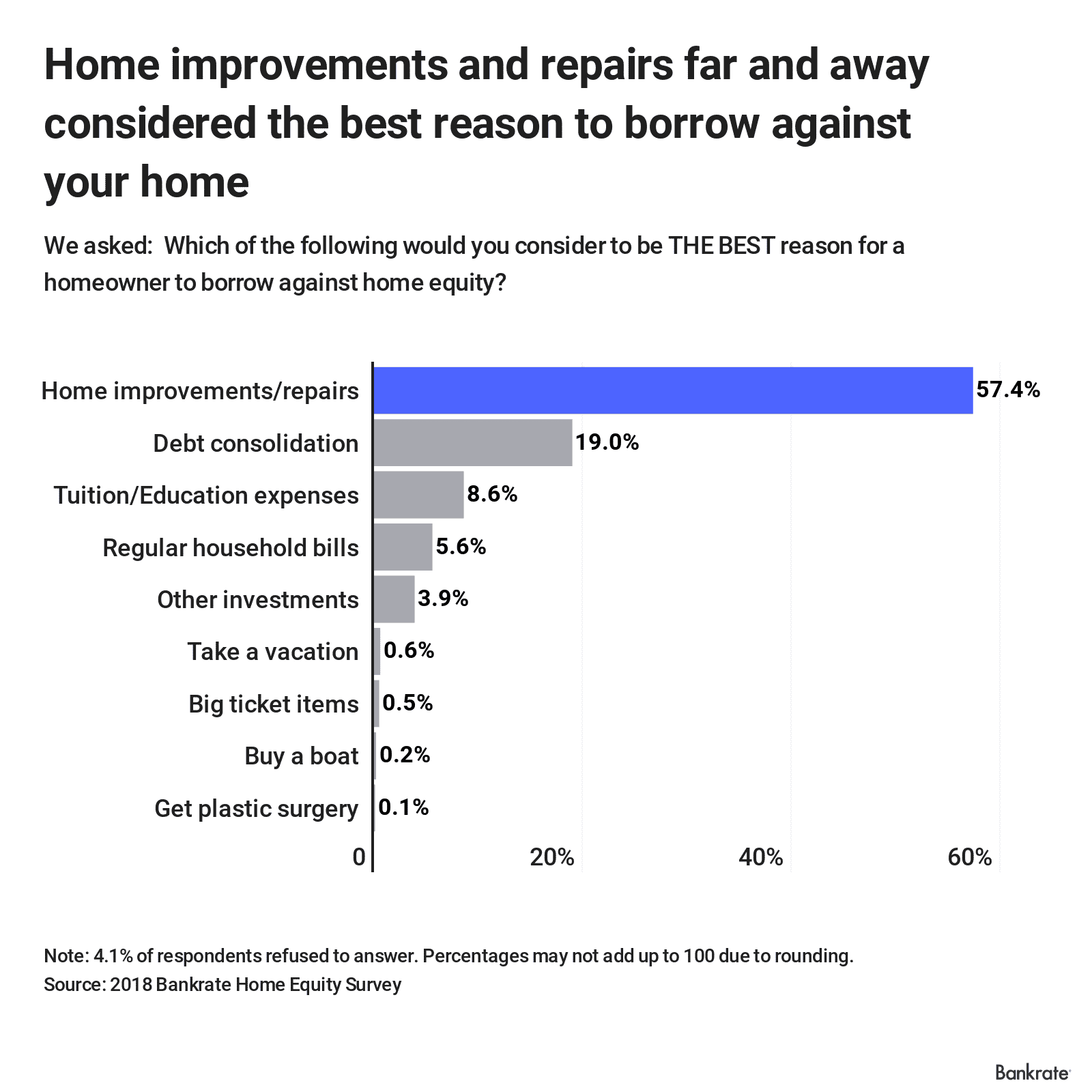

Why Do I Need A Home Equity Loan

You might need a home equity loan to refinance a home improvement, to pay down other higher cost debt, to cover major unexpected medical bills, to pay the costs of college for your children or other major expenditures.

A home equity loan may be a less expensive option than an unsecured personal loan. This is due to the added security having your home as collateral offers to lenders. The secured nature of the loan may offer an opportunity for borrowers with lower credit scores.

On the other hand, it is important for borrowers to understand the fact that they are using the equity in their home as collateral for this loan. If they run into financial difficulties that prevent them from making the required payments they may be putting their home at risk. They should also look at the useful life of what they are using the money for versus the time horizon over which they will need to make payments on the home equity loan to fully evaluate the economics of using this type of loan.

Recommended Reading: Small Business Loans From Government

Legal Information And Disclosures:

Terms and Fees: Home Equity Lines of Credit are subject to credit qualification and collateral valuation. Fees, conditions, and restrictions apply. Product details can be found in our Important Terms Brochure ask for a copy. Rate and offer subject to change without notice. Evidence of adequate property insurance required. Fees: an annual fee up to $75 applies subject to state law limitations a fee of $100 may apply each time a Fixed Rate Loan Option is elected or reversed. Ask a Bank of the West representative for details.

1All HELOCs feature a 10-year variable rate draw period requiring a monthly interest-only payment subject to a $100 minimum. Annual Percentage Rate during the draw period may change as often as monthly. The draw period is followed by a fixed-rate fully-amortizing repayment period of 120, 180, or 240 months, depending on the balance at the end of the draw period. APR during the repayment period will be fixed, based on the Prime Rate in effect at the end of the draw period, plus a margin and other factors. The APR will not exceed 18.00% and will not go below 3.00% regardless of your qualifying margin or applicable discounts.

2Major US bank defined as US banks with excess of $90B in assets. Read more about our restrictive fossil fuel policies here.

3Combine a Bank of the West first mortgage with a loan-to-value up to 80% and a HELOC in second position up to 9.90% LTV for a maximum combined LTV of 89.9%. Ask a mortgage banker for more information.

A Home Equity Loan Is Better If:

- You want a fixed-rate payment: Your monthly payment will never change even if interest rates rise.

- You want one lump sum of money: You receive the entire loan upfront with a home equity loan.

- You know the exact amount of money you need: If you know the amount you need and don’t expect it to change, a home equity loan likely makes more sense than a HELOC.

Recommended Reading: What Is The Lowest Home Loan You Can Get

How Does A Home Equity Loan Differ From A Home Equity Line Of Credit

Home equity loans and HELOCs are both technically second mortgages on your home. A home equity loan allows you to get a lump sum of money all at once and then repay it over time, while a line of credit gives you access to a revolving credit line that you can tap into, repay and tap again over a period of years.

Home equity loans are often a better option if you know the amount you need alreadysay for a childs education or a home construction project. Thats because when you get the money all at once, you repay it according to a fixed interest rate. In contrast, a home equity line of credit offers a lot more flexibility and the ability to take some or all of the money over timebut you pay for that flexibility by agreeing to a variable interest rate that could rise, in some cases substantially, over the life of the credit line.

How Do Home Equity Loans Differ From Mortgages

Both home equity loans and cash-out refinance loans use your home as collateral. But there are some major differences to keep in mind:

- Terms: A cash-out refinance loan is a type of mortgage. Like conventional mortgages, they usually have terms of 15 or 30 years.

- Closing costs: Although home equity loans tend to be more expensive than mortgages, they usually have lower closing costs.

- Home equity loans usually have fixed interest rates. Cash-out refinance loans, like other mortgages, can be fixed- or adjustable-rate mortgages.

You May Like: Do Fha Loans Require Inspections

Our Top Mortgage Lenders

Pros Of A Home Equity Loan

- Fixed-rate payments: Your monthly payment will never change even if interest rates rise.

- One lump sum of cash: You receive the entire loan upfront in one disbursement.

- Low interest rates: It has a lower interest rate than other types of personal loans or credit cards.

- Tax deductible interest: If you use it for home renovations, you can deduct the interest from your taxes.

Don’t Miss: What Are Home Loan Rates At

What Is Home Equity

Home equity is the difference between the balance owed on your mortgage and your homes current market value. Simply put, its the share of your house that you own because youve paid down your mortgage balance and/or your propertys value has increased over time.

As you pay down your loan balance, the equity in your home grows. Even though your home belongs to you, your lender secures the loan against the property until youve repaid in full.

A home equity loan allows a homeowner to borrow against the equity in their home and take the cash in a lump sum. The loan is often used to make major home improvements or to consolidate credit card debt. A home equity loan, unlike a home equity line of credit , has a fixed interest rate, so the borrower’s monthly payments stay the same during the term, which can be up to 30 years.

The lender determines the interest rate for a home equity loan based on several factors, such as:

- The amount of the loan

- The borrower’s credit score, credit history, debt-to-income ratio and income

- Loan-to-value ratio, or how much the borrower owes on the home compared to the home’s value

Which Is Better A Home Equity Loan Or A Line Of Credit

The choice between a home equity loan and a HELOC will depend on your financial needs, the equity in your property and your ability to repay debt.

If you’re looking for a lump sum amount of cash, home equity loans could give you access to more money than a HELOC would. On the other hand, HELOCs can give you borrowing flexibility and you would only pay interest on the funds you draw, much like a credit card.

You May Like: How Many Years Of Service To Qualify For Va Loan

Comparing Va Refinance Loans

VA refinance loans are backed by the federal governments Department of Veterans Affairs but provided by private lenders. Here are the top five things to look for when comparing VA refinance loan providers.

The monthly payments on a mortgage comprise principal, as in the amount remaining on your loan, and interest, as in the money the lender collects for providing the loan. Your APR, or annual percentage rate, consists of the interest rate plus other lender fees. The lower the interest rate / APR, the lower your monthly payments to the lender.

Terms. Like other mortgages, the typical VA refinance loan has a 15-30-year repayment term. There is no right or wrong when it comes to repayment terms whats best for you depends largely on how much you can afford to pay each month. The shorter the term, the higher your monthly payments but the less youll pay in interest over the life of the loan. The longer the term, the lower your monthly payments but the more youll pay your lender in the long run.

Closing costs. Closing costs are the fees and charges owed to the lender when the loan begins and usually range from 3-5% of the loan value. Closing costs for a VA refinance may include origination fees, property appraisal, title fees and insurance, state and local taxes, and various other costs some of which go directly to the lender and some which the lender collects on behalf of third parties. The VA funding fee is a separate fee and isnt impacted by the lender you choose.

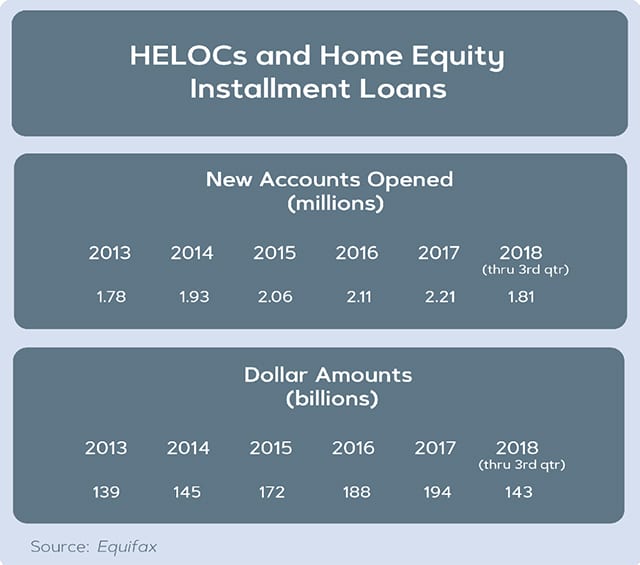

What Are Home Equity Loans And Helocs

The difference between what you owe on mortgages and other home loans is called equity. With a home equity loan or HELOC, you use that as collateral to borrow money. Heres how they work:

Home equity loans involve borrowing a lump sum of cash and paying it back with fixed payments over a certain number of years at a certain interest rate, usually fixed.

HELOCs are somewhat like , in that the bank gives you a limit of how much you can borrow at once a line of credit and you pay interest only on what you borrowed. The interest rate is often variable, changing over time with the market, typically based on a benchmark like the prime rate.

Interest rates for home equity loans and HELOCs are expected to continue increasing during the rest of 2022. The prime rate, which is the benchmark for many HELOCs, tends to track increases in short-term interest rates by the Federal Reserve. The Fed has so far raised its rate four times, most recently at the end of July. For home equity loans, rates are also likely to keep climbing as banks borrowing costs rise, experts say.

Read Also: How To Find The Best Debt Consolidation Loan

How Does A Home Equity Loan Work

A home equity loan is a fixed-rate installment loansecured by your home. Youll get a lump sum payment upfront and then repay the loan in equal monthly payments over a period of time. Because your house is used as collateral, the lender can seize it if you default.

Home equity is the difference between the value of your home and what you owe on the mortgage. A home equity loan lets you borrow against that equity. The more equity you have, the more you can borrow. Lenders typically allow a maximum loan-to-value ratio of 80% to 85%. This means that the combined value of your home equity loan and primary mortgage balance cannot exceed 80% to 85% of your homes appraised value.

Home equity loans usually have anywhere from five- to 30-year terms and come with a fixed interest rate, meaning whatever rate you lock in at the beginning of the loan term will remain throughout its duration. Thats a positive in an environment where interest rates continue to rise.

Fixed Vs Adjustable Rates

Home equity loans are just like a traditional conforming fixed-rate mortgage. They require a set monthly payments for a fixed period of time where a borrower is lent a set amount of money upfront and then pays back a specific amount each month for the remainder of the loan. Equity loans typically charge a slightly higher initial rate than HELOC do, but they are fixed loans rather than adjustable loans. If you are replacing your roof and fixing your plumbing and know exactly what they will cost upfront, then a home equity loan is likely a good fit.

Home equity loans are typically available in fixed-rate formats whereas HELOCs typically charge adjustable rates.

Generally during periods with low interest rates most homeowners choose fixed-rate loans. If you know you will pay your loan off quickly – before rates reset – then it may make sense to choose an adjustable rate option.

On fixed-rate loans lenders typically charge a higher interest rate for longer duration loans. For example, a lender might charge 5.09% for a 10-year fixed rate loan, or 5.75% for a 15-year fixed rate loan.

You May Like: How Do You Get An Equity Loan

How To Apply For A Home Equity Loan

Prepare for a home equity loan application by checking your credit, calculating your home equity and taking stock of how much other debt you already have. Many lenders let you start the application process online by entering your personal and financial information.

The documents and information youll typically need to apply for a home equity loan include:

- Identification or Social Security Number

- Employment history and employers contact information

- Evidence of your income for the past two years, typically through your tax returns

- Last two W-2 statements

- Appraisal or valuation of your home

- Evidence of existing liens on your home

- Amount you pay in child support or alimony

Example Of A Home Equity Loan

Say you have an auto loan with a balance of $10,000 at an interest rate of 9% with two years remaining on the term. Consolidating that debt to a home equity loan at a rate of 4% with a term of five years would actually cost you more money if you took all five years to pay off the home equity loan. Also, remember that your home is now collateral for the loan instead of your car. Defaulting could result in its loss, and losing your home would be significantly more catastrophic than surrendering a car.

Also Check: What To Do If Upside Down On Car Loan

How Does A Home Equity Line Of Credit Work

HELOCs are lines of credit based on your property’s equity and your FICO score. Once approved, you may draw from that line of credit during a draw period, usually 10 years, after which you’ll have to repay the withdrawn amount, plus interest.

Contrary to home equity loans, which give you a one-time lump sum payout, HELOCS allow you to draw funds as needed.

Say you take out a $40,000 HELOC and use $10,000 for a home repair. You’ll pay interest only on the $10,000 and keep $30,000 available. Once you pay down the $10,000, you’ll again have $40,000 available.