A Construction Loan Backed By The Government

The FHA One-Time Close Loan is a secure, government-backed mortgage program available for one-unit, stick-built primary residences, new manufactured housing for primary residences , and modular homes. It allows borrowers to finance for the construction, lot purchase and permanent loan into one loan and a single closing all at once with a minimum down payment of 3.5 percent .

Most construction loans require two separate closingsonce to qualify for the construction itself, and again when converting into a permanent mortgage. When the builder gives the clear to close on a home and its time to move in, the buyer has to pay off the construction loan and apply for a new mortgage. These regular construction loans come with two closing dates, and require the homebuyer to requalify with credit checks, verification of employment, additional closing costs, etc.

The One-Time Close Loan gives buyers a new option. The FHA handbook, HUD 4000.1, refers to this as a construction-to-permanent mortgage. This is a single loan, with one single closing date, and a defined set of parameters for how the loan is to proceed during the construction phase and beyond. An escrow account is required to pay the expenses of construction and related fees, and the borrower will not be obligated to make mortgage payments until a specified time after the final inspection of the completed work .

Additional Costs That Can Be Financed With Your Fha Construction Loan

These additional costs related to your entire construction or build can be financed into your loan.

- Construction closing coordination fees

- Title changes and updates

- Construction draws to pay your contractor during the process

The ability to roll these costs into your loan is an added benefit of the FHA one time close construction loan.

Single Close Construction Loan Program Options

We offer specialized loan programs to meet various borrower needs. Each loan program is government-backed, meaning we follow standard rules for fees, interest rates, and how funds are used.

Government backing allows borrowers to secure financing with low or no down payments and even low credit scores, as long as you meet standard eligibility requirements.

All of our available loan programs can be used to finance new home construction. We also work with homebuyers to finance land if you dont already have a lot to build on.

Learn more about each of our single close construction loans available.

U.S. Department of Agriculture Single Close Construction Loans

A USDA single close construction loan, also known as a rural development loan, is available in certain rural and suburban areas. These 30-year fixed-rate mortgage loans dont require a down payment. Buyers can even finance their closing costs, minimizing additional expenses beyond the homes upfront cost.

Veterans Administration Single Close Construction Loans

Available to qualified veterans, active military, and their eligible surviving spouses, a VA single close construction loan equips you to build, buy, repair, retain, or adapt a home. No down payment is required, closing costs are limited, and you arent charged a penalty for paying the loan in advance.

Federal Housing Administration Single Close Construction Loans

Fannie Mae Single Close Construction Loans

Read Also: How Long Does It Take To Get Sallie Mae Loan

Other Programs To Explore

If the FHA One-Time Close Construction Loan program does not work for a scenario, perhaps one of these programs will better suit your borrowers needs:

- VA One-Time Close, for eligible veterans and active duty military who are interested in building a new home

- Fannie Mae HomeReady, designed to help low- to moderate-income borrowers achieve homeownership for as little as 3% down

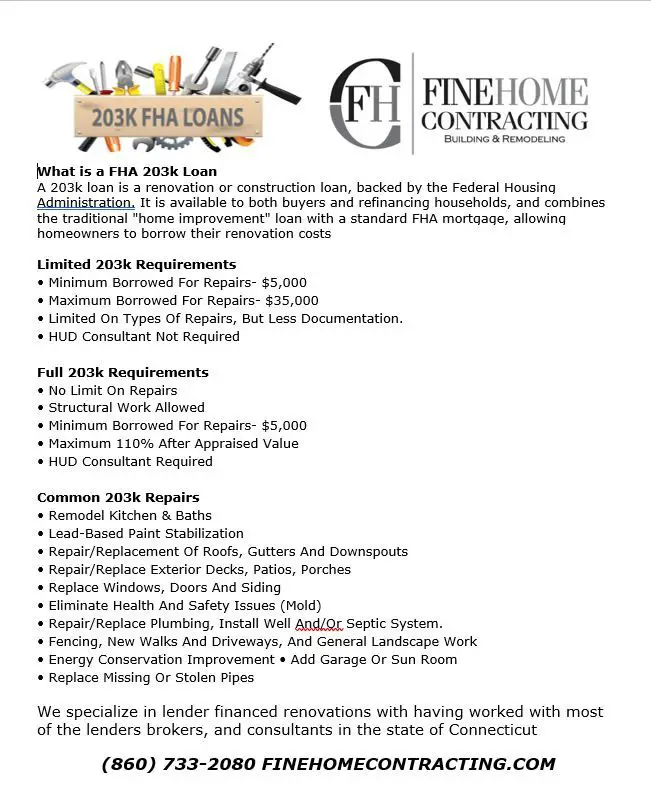

- To purchase a home or take cash out through a refinance: FHA 203

Your Loan Request Is Higher Than $17500000

This requirement is due to the time, fees, and costs involved with OTC construction loans. On RARE occasions, we’ll make an exception to this rule, but for the most part, low loan amounts usually only apply when purchasing a manufactured home due to the lower construction costs. To get to this amount, you can include the purchase price of the land, the construction set-up, and all fees and expenses associated with the one-time close construction loan.

Great, if you answered YES to each of these, you passed the first part of our pre-qual quiz. If you have a NO somewhere, call us now, or take our eligibility checker to discuss your situation. Answering NO doesnt mean you wont qualify it just means we need to find out which area impacts your request. Keep scrolling to the next section to learn more about the BuildBuyRefi OTC loan.

Recommended Reading: How Much Will The Va Home Loan Cover

Understand Your New Home

Building a new home to your exact specifications is one of the most exciting and rewarding projects you could ever undertake. We offer a number of construction loans designed to fit nearly every new home construction need. If youre currently a homeowner, you could also consider using the equity in your existing home to finance your new home construction project. Contact our experienced mortgage loan officers for help choosing the path thats best for your specific needs.

Obtain A Certificate Of Eligibility

Your certificate of eligibility proves that you meet all of the requirements necessary to qualify for the VA construction loan program. You can obtain your certificate of eligibility by submitting your statement of service, which should detail the length of your service and your service status.

You may be required to provide additional information based on your service status and the organization you were enrolled in. You can apply for a certificate of eligibility online or via mail.

Or, you can apply for a certificate of eligibility through your lender. At Security America, we would be happy to help you get your certificate of eligibility and get the ball rolling with your application process!

Also Check: How To Estimate Car Loan Payments

Fha Construction Loan One Time Close

The FHA Construction Loan is a one time close construction loan that allows home buyers to finance the purchase of the lot, the construction costs, and their permanent mortgage after the construction is completed. All of these aspects of your home construction project are financed with just one mortgage that is FHA insured.

Fha Construction Loan Requirements

Several rules apply to FHA construction-to-permanent loans, including requirements for the borrower, the property, and the contractor.

Borrower eligibility:

- Down payment of at least 3.5%. This is the minimum for FHA financing

- Technically, you only need a 580 FICO score to qualify with FHA. However, Mushlin says that in his experience, a higher credit score of at least 640 is usually needed for the FHA construction program

- Clean credit history. You must not have experienced bankruptcy in the last two years

- Debt-to-income ratio below 43%. That means your monthly debts including future mortgage payments dont take up more than 43% of your monthly pre-tax income

- You will need to verify two years of employment and income. For W-2 borrowers, that means the last 60 days of pay stubs, the last two years of W-2s, and your last two annual tax returns. Self-employed borrowers will need to provide the last two years of full personal and business tax returns as well as all tax schedules involved

In addition, all FHA borrowers are required to pay mortgage insurance premium , which protects the lender in case of foreclosure.

FHA MIP has an upfront cost equal to 1.75% of the loan amount as well as an annual charge typically equal to 0.85% of the loan amount and paid monthly.

MIP is usually required for the life of the loan. However, homeowners can often refinance to cancel mortgage insurance and lower their monthly payments once they have 20% home equity.

Property requirements:

Also Check: Loans You Don’t Have To Pay Back

Can You Use A Construction Loan To Buy Land

An FHA construction loan covers all of the costs associated with the build, including the land, plans, permits, fees, labor, and materials. This is good news for FHA borrowers who may not have the financial means to purchase the land or take on an additional loan.

An FHA construction loan may be used to purchase the land so long as the property is going to have a home built on it, said Eric Nerhood, owner of Premier Property Buyers, a company that buys, repairs, and sells homes. Once the home is built, the construction loan will roll into a traditional mortgage.

What Are Alternative Options To Usda Construction Loans

USDA construction loans are an excellent way for rural buyers to find their dream homes. But there are several other loan options for building a house, which may be easier to find than USDA construction loans. Buyers should consider how these options fit their budget and needs.

Rocket Mortgage doesnt offer construction loans. The home must be completed first.

Also Check: What Is The Best Debt Consolidation Loan Company

Property Construction On A Va Otc Loan

The VA OTC construction loan is designed to help veterans build single-family homes. Suppose you wish to develop an alternate property type, such as a condominium. In that case, it is recommended that you finance the project using a traditional construction phase loan modification and then refinance using a VA loan.

This type of construction loan covers purchasing land and construction costs. You will need to hire a VA-approved builder in the VA OTC loan process. You are not required to make any repayments on your VA construction loan until the construction process is finished.

Conventional One Time Close Construction Loan

The Conventional One Time Close Construction Loan is a home mortgage that allows borrowers to purchase a lot, build a home and obtain a permanent mortgage all combined into one first mortgage loan with one closing. It is a great option for borrowers wishing to build their own home with a private builder. If you are interested in a conventional OTC construction loan, then give the John Thomas Team a call at 302-703-0727 or APPLY ONLINE

Don’t Miss: How To Get My Student Loans Forgiven

Borrow For Single Family Home Loans In California Counties

The FHA has a maximum construction loan amount that it will insure, which is known as the FHA lending limit. These loan limits are calculated and updated annually, and are influenced by the conventional loan limits set by Fannie Mae and Freddie Mac. The type of home, such as single-family or duplex, can also affect these numbers.

Construction loan limits no longer apply to new VA Loans. The Department of Veterans Affairs can now back larger loans than previous allowed. This change doesn’t mean that you have unlimited borrowing power. Your lender will still have credit requirements that you need to meet as well as maximum loan amounts based on their own standards. VA lenders establish their own limits based on company policies. The amount we generally see is shown below, labeled as the VA Lender Limit.

58 match found

What Are The Benefits Of Otc Construction Loan

Single Closing = Saves Time & Money

The Conventional OTC Construction Loan is designed to simplify your mortgage process by giving you only one closing date rather than two. You can secure purchase of the land and the construction of the home as well as the permanent loan all in a single closing.

Reduces the Risk to the Borrower

The OTC means the borrower doesnt have to qualify twice as in a traditional two time close construction loan. Once the construction phase is complete, the borrowers do not have to re-qualify for a permanent mortgage since the permanent loan is closed before construction begins.

Low Down Payment Options

The Conventional One Time Close Construction Loans maximum loan to value ratio is 95% for borrowers who will live in the property as their primary residence. So you only need a minimum of 5% down and the closing costs can be financed into the loan so you truly only have to come out of pocket for the 5%.

Fixed Interest Rates

Since the permanent mortgage is closed before construction begins, the fixed rates on Conventional OTC loans will not be subject to change during the construction phase.

Single Appraisal Requirement

The OTC construction loan only requires one appraisal done prior to closing on the loan. A two time close construction loan requires two appraisals to be done and both are required to be paid by the borrower.

Read Also: What Are Payments On 30000 Car Loan

Learn The 4 Most Important Reasons To Light The Fire And Take Fast Action On Your Otc Construction Loan Pre

Rate Locks Expire: Most loans are locked for 30 days because the shorter term allows you to get the lowest rate possible. If you lose your rate lock by letting it expire or needing to extend it because you took weeks getting the items back, it will cost you more money or a higher rate. With rates recently on the rise, a higher price could even make you no longer eligible for the loan you wanted. A long delay could require you to re-qualify for the loan again.

Programs Could Disappear: Its happened before weve witnessed a whole host of loan programs get wiped out overnight. Investors can choose to change their risk portfolio and stop offering programs altogether that is why moving fast on the approval you have in your hand means taking action.

Your Job or Income Status Could Change: What if you lost your job, your income was reduced, or you wanted to take a new job, but it put your loan closing in jeopardy because you took too long? Any of these changes in your employment status could come back with more unfavorable terms, or worse, a complete loan denial.

Your Credit Score Could Dramatically Change: Weve seen this happen so many times before, a borrower maxes out their credit card for business, or they miss a payment because they werent paying attention, or judgment/collection was filed for any number of reasons. Not closing quickly under the same credit terms is another reason for underwriters to require you to re-qualify or cancel the loan.

Loan Requirements For One

Below, you will find expandable sections that give you information on the loan requirements for One-Time-Close Construction Loans. If you are ready to apply for a loan, click here and it will take you to our secure online application. If you still have questions, our loan officers are just a phone call away

Also Check: How To Get Federal Student Loans

Experienced Professional Va One

Security America Mortgage is a company that specializes in offering VA mortgages to veterans with more lenient credit requirements and more competitive interest rates. We take pride in providing 0 down payment loans to veterans that give them the chance to build or purchase their own homes regardless of their financial situation. We serve those who have served us.

Security America Mortgage offers a hands-on and personalized experience, and we have a team of experts to guide you through every step in your loan process. Our expert team has experience in helping countless veterans to get their dream homes, and we offer a variety of services to bring you the help you need.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Read Also: Does Va Loan Require Termite Inspection

Nationwide Home Loans Group Is Providing Fha & Va Construction & Renovation Loans For The Following Properties In All 50 States

YES, Use the One-Time Close for On-Site, Stick-Built Homes: Get Up To 100% For Veterans & Up To 96.5% FHA Purchase. These consist of wood, frame, brick, more traditional construction styles that are acceptable under our version of this program. Build a ranch slab, starter home, ranch walkout, ½ story, or two-story home with or without a walkout, but stay on the more traditional side of this property. Find a great piece of land and start building your dream home for you and your family.

YES, One-Time Close – True Prefabricated Modular Homes: Viewed the same as a stick build traditional homes by lenders around the country, this property style could allow you to save money, decrease build time, and get a great house at a cheaper rate than Manufactured Homes. Eligible on our FHA & VA Construction Loan Program. Prefab Modular Homes are typically designed with more than 4-10 sections built inside a factory. Modular homes do not come attached to an axle and tongue. They are not issued a VIN # like a Manufactured Single, Double, or Triple-wide. Youre able to choose builders from across the country, order your home, and have it delivered, installed, set up all under this program.

YES, Construction Loans For Manufactured Homes:

YES, JUST ADDED: Jumbo Home Financing, Steel/Metal Homes, Barndominiums, Log Cabins, Concrete Block Homes, SIP Panel Homes, ICF Insulated Concrete Foam Homes, Log Cabin Style Homes, Multi-Family, 2nd Homes, Investment Homes, ADU Accessory Dwelling Units.

Fees The Builder Must Pay

- On a VA construction / permanent home loan, the builder is responsible for:

- Interest payments during the construction period

- All Fees normally paid by a builder who obtains an interim construction loan. This includes, but is not limited to:

- Inspection fees and re-inspection fees

- Title update fees

- Construction loan fees

Read Also: Apply Online For Personal Loans