Home Equity Loans And Helocs Not The Same Thing

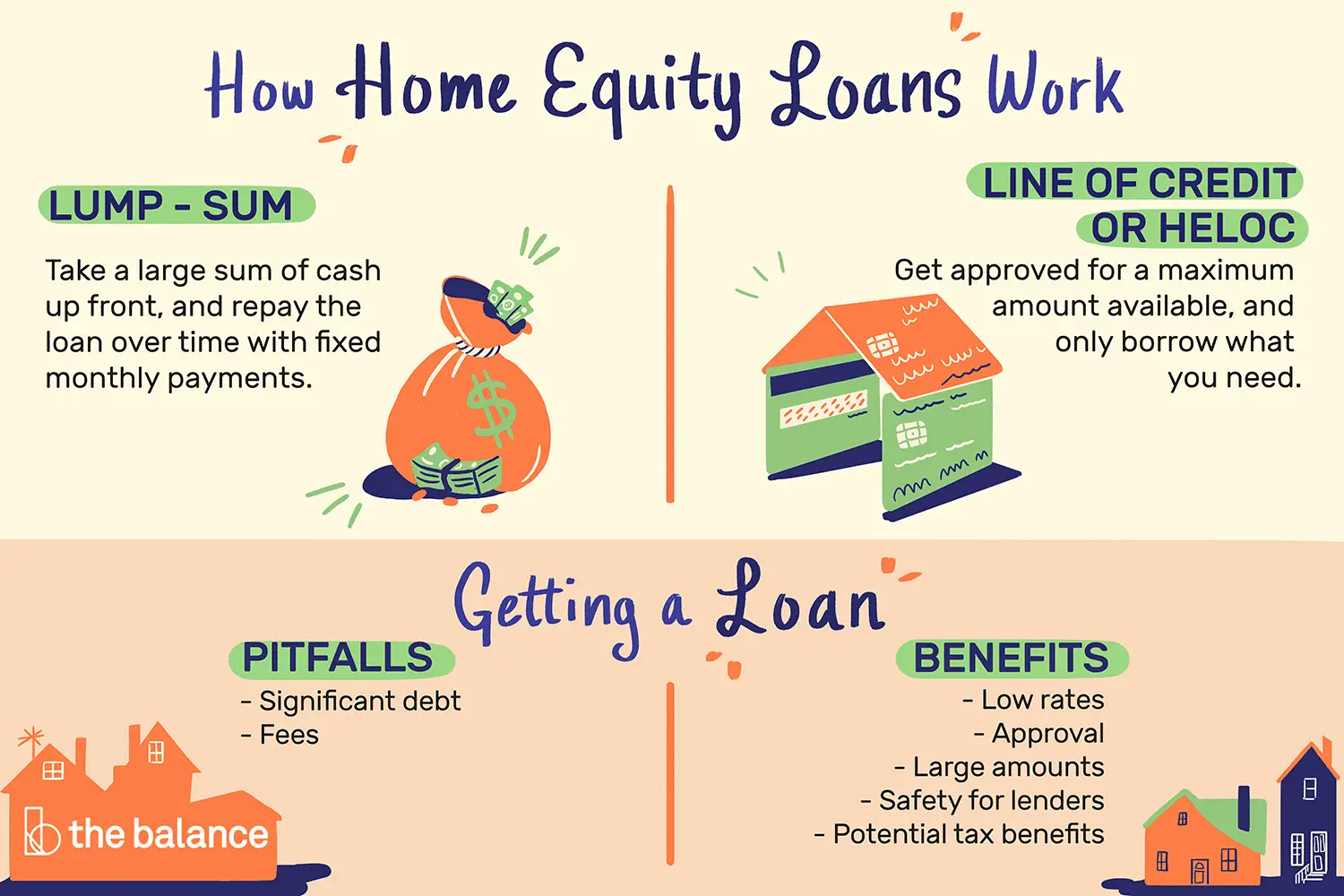

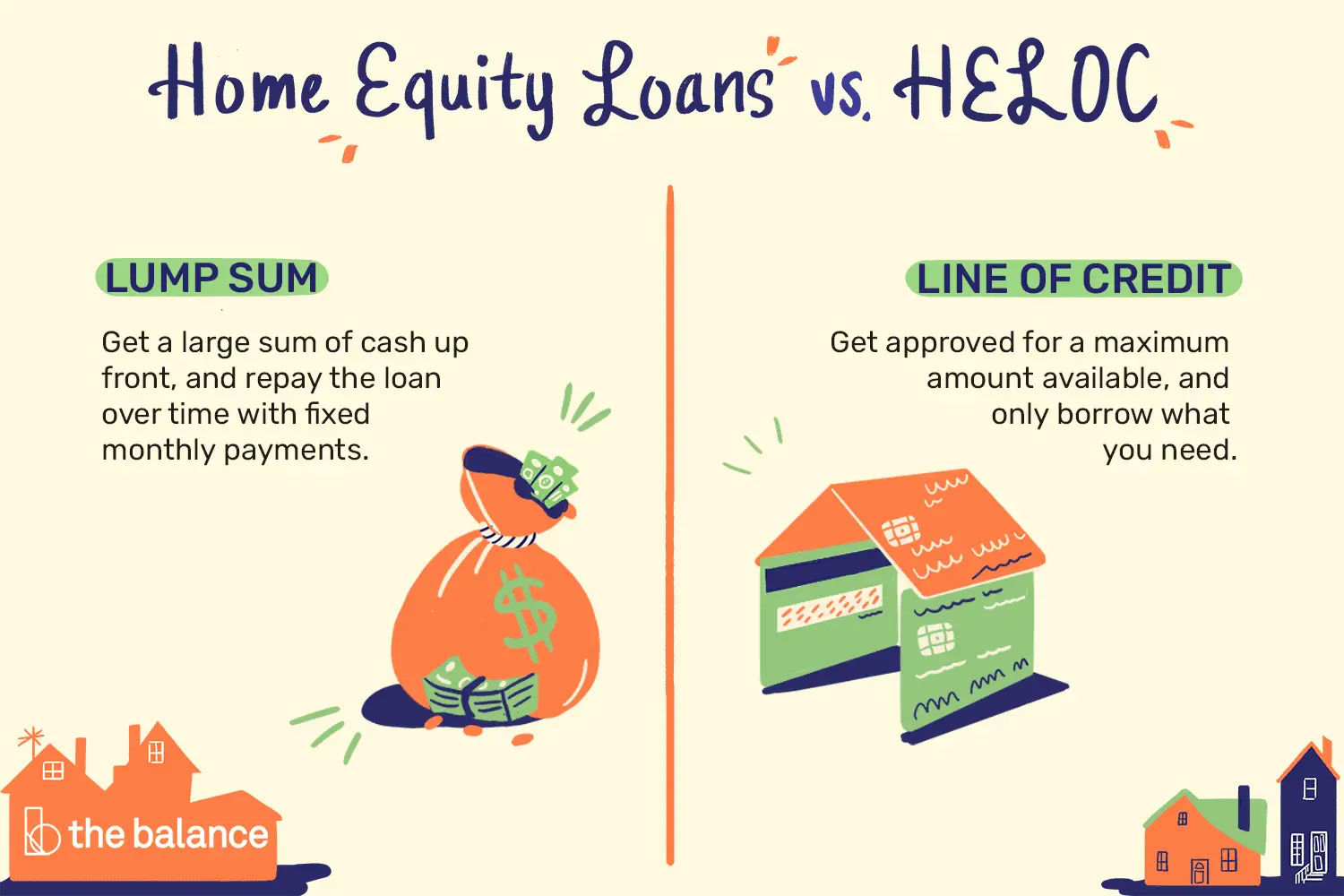

Its important to distinguish between home equity loans and home equity lines of credit .

The home equity loan is a lump sum of money given to the qualified homeowner. It is repaid over time with fixed monthly payments. Each payment reduces the loan balance and covers interest costs on a familiar amortization schedule.

With a HELOC, you receive a line of credit for an approved amount and borrow against that amount as needed. You can withdraw from the line of credit multiple times and make smaller payments for several years before a fully amortized schedule kicks in.

HELOCs are flexible. You pay interest only on the amount of money that is drawn out. The interest rates are variable, so the costs can change over time. Another factor: the lender can cancel the line of credit, possibly before youve had a chance to use all the money, so there is some risk.

A History Of Paying Your Bills On Time

Lenders will also pull your credit report and evaluate your payment history. They want to see that youre paying your bills consistently and on time .

A history of spotty or late payments is a big red flag to a lender, even if your score is fairly high. Because of this, its important to stay on top of your bills especially in the months leading up to your loan application.

Why it matters:

Requirements To Borrow From Home Equity

Home equity loans and HELOCs have their own sets of pros and cons, so consider your needs and how each option would fit your budget and lifestyle. Regardless of which type of loan you choose, home equity loan requirements and HELOC requirements are typically the same.

The requirements vary by lender, but you generally need:

- A certain percentage of equity in your home

- Good credit

- Reliable payment history

Don’t Miss: How Long Does An Sba Loan Take To Get Approved

Are Home Equity Loans And Home Equity Lines Of Credit Safe

Remember that taking out a home equity loan or HELOC increases the amount of debt you have on your home. Lenders on these products typically take a second lien position, behind your first mortgage. If you cannot pay, you can be foreclosed on.

If home values fall, so does your equity. Dont take out more than you could realistically pay back .

Bad Credit Home Equity Loans

Lenders are looking for good to excellent credit when considering a home equity loan. You can find some with credit scores in the 620 range, but thats pushing it. Normally, lenders like to see something above 670.

Of course, every situation is different. Home equity loans could become available for borrowers who have lots of equity or a low debt-to-income ratio.

There are also scenarios where it pays to do whatever it takes to boost your credit score in the short term whether its opening a secured credit card, clearing up your collection history and getting on a schedule to avoid late payments so you can qualify for the home equity loan.

Recommended Reading: Credit Score Usaa

A Credit Score In The Mid

Exact vary by lender, but you generally need a score in the mid-to-high 600s to qualify for a home equity loan or HELOC. A high score typically makes for the easiest qualification process and gives you access to the lowest interest rates.

If your score is in the low 600s or below, you may have trouble securing a home equity product, though its not impossible. If youre less risky in other areas you have a low LTV or DTI, for example then you may still be able to qualify. Just be sure to shop around and consider a number of lenders if you fall into this low-score category.

Why it matters:

Learn More:

Should You Get A Home Equity Loan Or Heloc

If you need money to fund a home improvement project or consolidate high-interest debt, taking out a home equity loan or HELOC can be a wise decision. Since the loans are secured by your home, the interest rate is usually lower compared to unsecured loan products such as credit cards or personal loans. For example, home equity loan rates range between 3 percent and 12 percent, depending on the lender, loan amount and the creditworthiness of the borrower, while the average credit card rate is above 16 percent.

In addition, if you use the money from a home equity loan to buy, build or substantially improve your home, you may be able to deduct the interest on the loan from your taxes.

However, one major downside to consider is that if you default on the home equity loan, the lender can foreclose on your home. Before you get a loan that uses your home as collateral, make sure you have a solid repayment plan.

Recommended Reading: Fha Loan Limit Texas

Applying For A Home Equity Loan

Home equity loans are available to most individuals. In order to take out a home equity loan, you usually need excellent credit and a great amount of equity. To consider your application, lenders typically require a FICO score of 720 to 740. Some lenders are willing to consider borrowers with a credit score of 620 or higher if they have a verifiable income history for two or more years.

In many ways, applying for a home equity loan is like applying for a mortgage. A credit check, proof of income, an estimated value of your property, the amount you owe to your mortgage lender, recent pay stubs, latest tax return and bank statements will all be necessary. Depending on your lender’s policies, you also might need to pay for a title search and an appraisal. To obtain your credit score, the bank will ask for a Social Security number. If you have investment income or self-employment income that you’d like the lender to consider, you’ll need to document that as well as home-related expenses such as property taxes, homeowners association dues, insurance premiums and monthly mortgage payments.

There are two main reasons a lender rejects an application for a home equity loan: less-than-stellar credit and too little home equity. Johnna Camarillo, manager of equity lending at Navy Federal Credit Union, offers these tips for making sure your application sails through:

Can I Use A Home Equity Loan For Debt Consolidation

Yes, you can consolidate your debts and pay them off with a home equity loan. Most lenders wont ask what youre using the money for, but some may require that it only be used for certain expenses, such as home renovations. If thats the case, then youll have to find another way to consolidate your debts, such as through a personal loan.

If it is allowed, youre in luck. Home equity loans often have lower interest rates than other types of debt consolidation, which will make monthly payments easier.

Paying off your credit cards and other debts by merging them into a single debt thats paid off by a loan or debt management program is an effective way to avoid high-interest credit card debt. Debt consolidation lowers the interest rate on your bills and is something you can do yourself with a large enough loan to pay off the cards with the highest interest rates first.

You can use a home equity loan to consolidate multiple credit card balances into one monthly payment with a lower APR for long-term savings.

Just be sure you want to do it with a home equity loan. The loan will increase your debt and requires making monthly payments. If you cant limit your spending and rack up more debt, you could be in a worse position than you were before taking out the loan.

Your home is also the collateral for the loan. This is good news in one sense: a secured loan often has a lower interest rate than other types of loans, including credit cards.

You May Like: When To Refinance Fha Mortgage

Funding A Home Improvement Project

Home improvements are one of the most common uses for home equity loans and home equity lines of credit. Home improvements can help boost the value of your current home. Home equity loans are one of the most affordable ways to remodel your home, but keep in the mind the renovation costs they may surpass the amount of the loan.

How Home Equity Loans Work

Home equity loans can provide access to large amounts of money and be a little easier to qualify for than other types of loans because you’re putting up your home as collateral.

-

You can claim a tax deduction for the interest you pay if you use the loan to buy, build, or substantially improve your home, according to the IRS.

-

Youll probably pay less interest than you would on a personal loan, because a home equity loan is secured by your home.

-

You can borrow a fair bit of money if you have enough equity in your home to cover it.

-

You risk losing your home to foreclosure if you fail to make loan payments.

-

Youll have to pay this debt off immediately and in its entirety if you sell your home, just as you would with your first mortgage.

-

You may have to pay closing costs, unlike if you were to take out a personal loan.

Read Also: Credit Score For Usaa Auto Loan

Which One Is Right For You

Home equity loans and home equity lines of credit can both be great options, but in most situations, home equity lines of credit are the best overall. As you research, youll find home equity lines of credit offer the most competitive interest rates, the least amount of fees, and the best loan terms.

A home equity line of credit gives you the ability to borrow as little or as much as you want when you want. If you have upcoming expenses such as college tuition, a wedding, or family vacation, these loans give you the flexibility so you dont have to borrow until youre ready.

What To Know About Home Equity Loans

Whether you decide to access your home equity through a loan or a home equity line of credit , youll need to keep in mind the general regulations that govern how they can be issued in Canada. Alongside these legal conditions, theres plenty that any first-time homeowner in Vancouver should consider before approaching a lender. Heres what to know about home equity loans in Vancouver.

You May Like: How Long For Sba Loan Approval

What Is A Home Equity Loan And A Home Equity Line Of Credit

Even though both are similar, there are some differences. Do keep in mind that both can leave you at risk of foreclosure if you fail to pay back your lender.

Home equity loans are distributed as a single lump sum that you pay back to the lender with interest in fixed monthly payments. Think of it like a second mortgage on your home. Home equity loans have fixed interest rates, which means the rate doesnt change. They can also be tax-deductible, depending on how you use them.

A HELOC acts like a credit card, so you can tap into the funds whenever needed. As you pay the balance back, the available balance is replenished. There is a draw period where you can withdraw funds, followed by a repayment period where you no longer have access to the funds.

Tips Before You Get A Home Equity Line Of Credit

- Determine whether you need extra credit to achieve your goals or could you build and use savings instead

- If you decide you need credit, consider things like flexibility, fees, interest rates and terms and conditions

- Make a clear plan of how you’ll use the money you borrow

- Create a realistic budget for your projects

- Determine the credit limit you need

- Shop around and negotiate with different lenders

- Create a repayment schedule and stick to it

- What do they require for you to qualify

- Whats the best interest rate they can offer you

- How much notice will you be given before an interest rate increase

- What fees apply

Don’t Miss: Bayview Loan Servicing Tucson Az

What Is The Difference Between A Heloc And A Mortgage

A mortgage is a one-time loan where the entire amount is loaned upfront and then repaid over a period, with payments going to both the principal and interest.

In the case of a TD Home Equity FlexLine, you get a revolving credit amount which lets you make withdrawals as needed and then pay it back at your own pace with a minimum monthly interest payment. You can also add an optional Term Portion which acts more like a traditional mortgage loan.

How To Find The Best Home Equity Loan

Lenders have varying borrowing standards and rates for home equity products, so youll want to shop around for the best deal. Most lenders are looking for a few basic minimum requirements:

- A credit score of 620 or higher. A score of 700 and above will most likely qualify for the best rates.

- A maximum loan-to-value ratio of 80 percent or 20 percent equity in your home.

- A debt-to-income ratio no higher than 43 percent.

- A documented ability to repay your loan.

Don’t Miss: Usaa Personal Loan Approval Odds

Backing Out Of A Loan

To avoid serious heartache later on, be sure to look over all the loan documents carefully before signing on the dotted line. You do have some recourse if you realize youve made a mistake, as long as you act quickly. Theres a federally mandated three-day cancellation rule that applies to both home equity loans and HELOCs, but you have to notify the lender in writing. That notice has to be mailed or filed electronically by midnight of the third day , or its void.

Check Your Credit Score

Borrowers need to prove that they have income, so people who have been laid off or furloughed will not qualify for a home equity loan or line of credit. Lenders also generally wont provide home equity debt if your credit score is below the mid-600s. During the coronavirus pandemic many lenders have raised the requirement to somewhere in the 700s, and some temporarily stopped accepting applications in the early months of the crisis.

Also Check: How Long Does Sba Loan Take To Get Approved

Equity Loan Tax Deductions

Tapping your equity for home renovation projects has another advantage. The Internal Revenue Service lets you write off some of the interest on home equity credit as long as you itemize deductions.

Before the Tax Cuts and Jobs Act of 2017 , taxpayers were able to deduct interest on up to $1 million of mortgage debt, and there were no restrictions on the usage for deductions. The TCJA instituted new limits and restrictions, which run through the end of 2025.

As of 2020, couples can deduct the interest on up to $750,000 of eligible mortgage debt if the debt is used on the home. The deductions can be applied for first mortgages, second mortgages, home equity loans, and home equity lines of credit if the debt is used to buy, build, or substantially improve the home against which it was secured.

Tax Benefits To Home Equity Loans And Helocs

A final benefit to using a home equity loan or HELOC to improve your home is that the interest can be tax deductible, just as it is on a primary mortgage. However, the Tax Cuts and Jobs Act , the massive tax reform law that went into effect in 2018, placed new restrictions on this deduction.

Before 2018, you could deduct the interest on up to $100,000 in home equity loans or HELOCs. You could use the money for any purpose and still get the deductionâfor example, homeowners could deduct the interest on home equity loans used to pay off their credit cards or help pay for their children’s college education. The TCJA eliminated this special $100,000 home equity loan deduction for 2018 through 2025.

However, the interest you pay on a home equity loan or HELOC used to purchase, build, or improve your main or second home remains deductible. The loan must be secured by your main home or second home. Thus, for example, you can deduct the interest on a home equity loan you use to add a room to your home or make other improvements.

Recommended Reading: Usaa Prequalify Auto Loan

Getting A Second Mortgage

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.

If you cant make your payments and your loan goes into default, you may lose your home. If thats the case, your home will be sold to pay off both your first and second mortgages. Your first mortgage lender would be paid first.

Home Equity Loan Qualification

Home equity loans operate much like a mortgage or auto loan. The borrower receives a lump sum of money that is paid back over a fixed time with a fixed interest rate. In 2019, the rates were averaging about 6% with some available for a lower rate and great credit score.

The terms are pretty standard, ranging from 5-to-15 years, though some can be as long as 20. Approval, by the way, is not guaranteed.

Banks are much more careful after the 2008 housing crisis, when it was more of a rubber-stamp operation. Lenders evaluate your application and generally make sure the 80% loan-to-value ratio isnt surpassed.

Basically, like most loans, home equity approval moves forward if you demonstrate the ability to repay. The ability to repay is an amazing thing. Lenders go through credit reports to verify your finances. You need to provide proof of income with pay stubs, tax returns, investments, etc. Your credit will be checked carefully. An appraisal will be required. The whole process will take several weeks before any money is released.

Its similar to applying for a home purchase loan. Another similarity: You should shop around with banks, credit unions and online lenders because interest rates can vary.

If you are hesitant because of volatility in the real-estate market, it could be very difficult to sell your home. You might investigate other options, such as mortgage modifications.

You May Like: Which Of These Loan Options Is Strongly Recommended For First-time Buyers