Current Federal Student Loan Rates

Currently, all federal student loans have a temporary 0% interest rate, as part of the U.S. governments COVID-19 relief effort. However, this relief period is scheduled to end on January 31, 2022.

Federal student loan rates reset on July 1, 2021, and apply to all new loans disbursed between July 1, 2020 and June 30, 2021. New federal interest rates are introduced based on the high yield of the most recent 10-year Treasury Note auction. These auctions occur every May.

In the latest 10-year Treasury Note auction on May 12, 2021, there was a high yield of 1.684%, up from 0.70% in 2020. As a result, federal rates increased for the 2021-2022 academic year are:

- 3.73% for undergraduate Federal Direct Stafford loans, up from 2.75%

- 5.28% for graduate Federal Direct Stafford loans, up from 4.30%

- 6.28% for Federal Direct PLUS loans , up from 5.30%

The rate increase does not affect existing federal loans. Only new loans disbursed between July 1, 2021 and June 30, 2022 will have the current interest rates.

The interest rate on your federal student loan is fixed, which means it will remain the same until youve finished repaying the loan in full, or you choose to refinance or consolidate your loan

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Should You Take Out A Discover Student Loan

As an independent, transparent marketplace for student loans, Credible will be producing a series of articles profiling lenders in the student loan space.

Discover Student Loans is a part of Discover Bank, a trusted U.S banking institution in existence for over 100 years. Discovers private student loans are offered at fixed and variable rates, for undergraduate and graduate students who need additional education financing.

- low private student loan rates

- great incentives for good grades and upon graduation

- scholarship sweepstakes

Overview:

Discovers student loans offer an array of private undergraduate and graduate loans at both fixed and variable rates, while also servicing loans of other lenders, starting at a 5.99% fixed interest rate and have no fees whatsoever. Discover provides in school, military, public service, and residency deferment options. One drawback, however, is that Discover does not offer loan consolidation if a borrower ends up with more than one loan.

Rates*:

*Interest rates include auto-debit reduction and reflect APR on a deferred payment plan over the life of the loan. See additional details on Discover.

Discover Benefits:

Scholarships:

Who should explore Discover Student Loans?

To learn more about your private student loan options visit, Credible.

Credible enables college students and graduates to compare personalized student loan offers from numerous lenders in one place.

Don’t Miss: Does Va Loan Work For Manufactured Homes

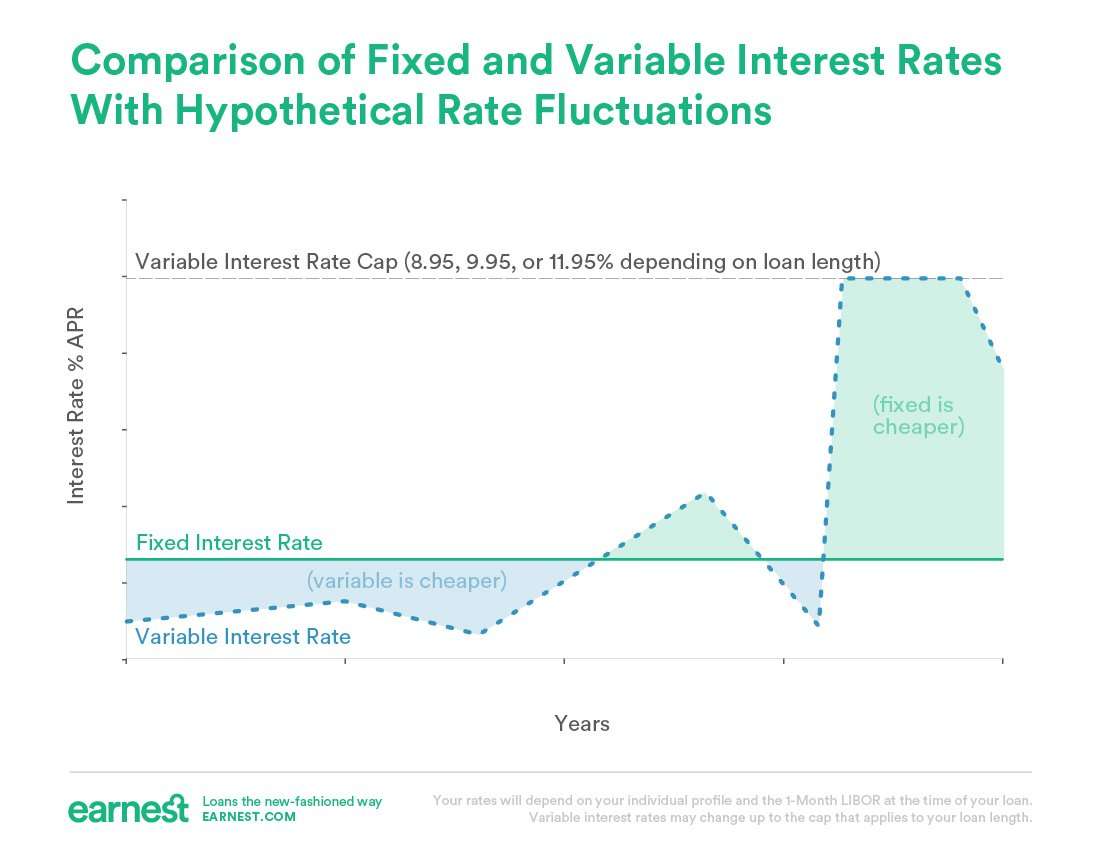

Choosing Between A Fixed And Variable Rate Loan

Before taking out a loan, it’s most important to consider your personal financial situation and the specifics of each loan. Looking at these factors first can help you decide whether to choose a fixed or variable rate option. You should also remember that interest rate is only one part of the total cost of a loan. Other factors like term length, lender fees and servicing costs will also contribute to the overall expense.

The Ascents Best Personal Loans For 2021

The Ascent team vetted the market to bring you a shortlist of the best personal loan providers. Whether youre looking to pay off debt faster by slashing your interest rate or needing some extra money to tackle a big purchase, these best-in-class picks can help you reach your financial goals. on The Ascents top picks.

Read Also: When Can I Apply For Second Ppp Loan

Don’t Miss: Does Fha Loan On Manufactured Homes

Choosing A Student Loan That Works For You

The final decision depends on your unique situation, of course. If you plan to pay off your loan relatively quickly , a variable-rate student loan may help you spend less in interest.

However, be aware that the longer it takes you to pay off the loan, the more opportunity there is for interest rates to rise. You can help mitigate your risk by choosing a lender that caps its variable rates, but they will still fluctuate.

For borrowers who anticipate repaying student loans over a longer time period, or those whose future income level is uncertain, or those who are simply uncomfortable taking on extra risk, a fixed rate student loan may make more sense.

Are There Ways To Reduce My Interest Rate On My Student Loans Other Than Refinancing

If you have federal student loans and want to keep their protections, you may have options other than refinancing to lower your interest rates, so explore those first. Many servicers will reduce your rate if you enroll in automatic payments.

They also may do the same if you make a set number of on-time payments in a row. Call your servicer, and ask it they offer these benefits or others.

In addition, consider paying extra every month. There is no penalty for prepayment with federal student loans, and paying off your loans faster can reduce the amount of interest you pay overall, even if your rate stays the same.

Ultimately, these reductions may not subtract as much from your monthly payments as refinancing would. Still, add these benefits to those from keeping your loans in the federal student loan program. The result may end up making more sense for you overall.

Don’t Miss: What Is Chfa Loan Colorado

Variable Vs Fixed Interest Rates: What’s The Difference

After you submit an application and receive approval for a private student loan, you typically will be presented with the option to select a variable or fixed interest rate on your loan. The interest rate is the price you pay the lender in return for borrowing the money, so its important to understand what youre choosing and why.

Variable Student Loan Rates Are A Gamble

Variable rates are subject to change throughout the life of the loan. Student loan lenders typically set variable rates based on an economic indicator known as the London Interbank Offered Rate, or Libor. Lenders determine variable rates by adding the Libor rate to a base rate. If the Libor goes up, your rate goes up exactly that much.

» MORE:Even near 1%, are variable rate student loans worth the risk?

Before getting a variable-rate student loan, ask lenders how often the rate is subject to change. Some adjust variable rates monthly, while others adjust every three months. Also, find out about the overall rate cap. Variable rates are often capped, but the caps can be as high as 25%.

Pros

-

Rates typically start out lower than fixed rates.

-

You could save on interest if variable rates dont rise by too much.

Cons

Don’t Miss: How Can I Get An Rv Loan With Bad Credit

Which Is Better: Fixed Or Variable Interest Rate

Whats the best option for you? Assessing which interest rate option is better is a personal decision.

A fixed interest rate loan has the same interest rate for the life of the loan whereas, a variable interest rate loan changes based on changes to the index . With a variable interest rate loan, you benefit if the interest rate index remains the same or decreases. With a fixed interest rate loan, you dont benefit from decreases in the interest rate index, but you would also never face an increase in rate.

You should carefully consider your options and determine which rate is more appropriate for your situation.

Best viewed in landscape mode

What Is A Fixed

A fixed-rate loan means that your minimum payment will never change over the life of the loanyou lock in your terms when you sign the agreement, and even if interest rates go up, your APR does not.

One reason borrowers, especially those with long-term loans, like fixed rate loans is that they provide a kind of interest rate insurancethey cost a little more, but that premium protects you against price changes down the road.

Read Also: How To Get Loan Originator License

What If My Grants And Federal Loans Dont Cover The Cost Of Attendance

If your grants and federal loans are not enough to cover the cost of your education, you should consider the following options:

- and scholarships using one of the many free scholarship search options available. Servicemembers, veterans, and their families may be eligible for GI Bill benefits and/or military tuition assistance.

- Cut costs. Consider getting one or more roommates or a part-time job, possibly through Federal Work-Study.

- See what your family can contribute. Your parents may be able to get tax credits for their contributions. Parents can also explore the federal Direct PLUS Loan program.

- Shop around for a private loan. Remember that these loans generally have higher interest rates and less repayment flexibility compared to federal student loans. You generally should turn to private loans only after you have explored all other grant, scholarship, and federal loan options. If you can show you have a very high credit rating, you may find an affordable private student loan, though you will likely need a co-signer, who will be legally obligated to repay the loan if you cant or dont. Look for the one with the lowest interest rate and flexible repayment options.

You May Like: Is It Easy To Get Approved For Fha Loan

Choosing Between Variable And Fixed Rate Student Loans

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

So, youve realized that you need to take out student loans to help finance your education. Or maybe youve settled on student loan refinancing as a strategy to repay existing student loans.

Either way in this hypothetical, youve filled out the application, gotten approved , and now youre faced with loan optionsincluding the choice between a fixed vs. variable rate.

Even if youre already familiar with both, factors like changing interest rates and personal financial situations may have a bearing on which type of loan is the right choice.

What factors are worth considering before deciding between a fixed- or variable-rate student loan? Heres the scoop on ways these two student loan options differ:

You May Like: Usaa Car Loans Review

Are Variable Rate Student Loans Right For You

So should you choose a fixed rate or variable rate student loan when you get a new or refinanced student loan?

First, you should do the math to see what youd actually be saving on interest. Use one of our student loan calculators to estimate your monthly payments and compare interest rates on multiple loan offers.

Besides doing the math, ask yourself how comfortable you are with the risk of a rate increase, along with how many years you expect it will take you to pay off your debt.

Variable rate student loans arent for everybody, but they can be a big money-saver for some. Depending on your circumstances, variable rate student loans could help you save on interest, lower your monthly payments and even pay off your education debt ahead of schedule.

Rebecca Safier contributed to the reporting of this article.

Fixed Or Variable Mortgage: How To Minimize The Risk Associated With A Variable Mortgage

Here we revisit the fundamental question of why we are even taking the time to a fixed or variable mortgage. The answer for most is to save more money on their mortgage, in one way or another.

The strategy here will show you how to lower your risk on a variable mortgage while also setting you up to save substantially on interest over time.

I call this more specifically, variable rate risk mitigation and it involves using the extra payment/ prepayment privileges found in the mortgage fine print terms to increase your variable mortgage payment to the same payment that you would be making at a higher rate 5 year fixed rate mortgage.

For example:

25 YR Amortization

Payment: $1,270

Then using prepayments, boost the variable payment by $72 per month to $1,342 the same payment as you would have been making on the fixed rate.

Recommended Reading: Genisys Credit Union Auto Loan Calculator

Get The Most Effective Deal In Your Student Loans

Now that youve a greater understanding of how to decide on between fastened and variable rates of interest, its time to search out the lender that may give you the most effective deal.

A useful bonus is that almost all lenders let you apply on-line with out hurting your credit rating. To get began, head over to the Student Loans Review Page and evaluate a listing of prime lenders.

Jessica Walrack is a private finance author at SuperMoney, The Simple Dollar, Interest.com, Commonbond, Bankrate, NextAdvisor, Guardian, Personalloans.org and lots of others. She focuses on taking private finance matters like loans, credit playing cards, and budgeting, and making them accessible and enjoyable.

No related posts.

Comparing Fixed And Variable Interest Rates

Generally, a fixed interest rate will be higher than the correspondingvariable interest rate in a rising interest rateenvironment. Borrowers sometimes get confused about the difference inthe current interest rates, picking the variable-rate loan because thecurrent interest rate is lower. In effect, they treat the variableinterest rate as though it were a fixed interest rate. But, lendersprice fixed and variable-rate loans to yield the same income to thelender, based on models that predict a range of future changes ininterest rates.

Assuming a rising interest rate environment, a fixed interest rate ona new loan with a 10-year repayment term will generally be 3 or 4percentage points higher than the current variable interest rate.

There are two scenarios in which a variable interest rate is better than a fixed interest rate.

You May Like: Can I Refinance My Sofi Personal Loan

Fixed Vs Variable Student Loan Rates: Why It Matters

- Fixed vs. Variable Student Loan Rates: Why It Matters

According to CollegeBoard estimates, the average amount borrowed by 2017-2018 academic year Bachelors Degree recipients was $29,000. While paying off the initial balance is already an intimidating task, interest rates increase the total payoff significantly. Fortunately, borrowers have the choice between fixed and variable interest rates, with each impacting the overall cost differently.

Both forms of these interest rates will vary by lender, as well as the borrowers credit history. However, both bode their own unique advantages, drawbacks, and financial ramifications. Evaluate them carefully with the help of our guide below.

What Is The Difference Between Variable And Fixed Rate Student Loans

As with other types of loans, the main difference between variable and fixed rate student loans is how the rate of interest applied to the loan is set. Fixed rate student loans are offered by both federal and private lenders to those who are borrowing for the first time or looking to refinance their existing student loans.

The main benefits of fixed rate student loans are that the monthly payments are the same. This makes them a great option for those who cant pay off their loan quickly or who are uncertain if theyll get a stable job once they leave college. Its also a preferable choice if market interest rates are set to rise.

However, if market interest rates are falling or youre looking to pay off your student loan quickly after college, then variable rate loans may be a great option for you. Offered by only private lenders and with interest rates based on the London Interbank Offered Rate , rates often start out lower than those for fixed loans and will change over the term of the loan.

If youre considering a variable student loan, its important to understand if the lender will adjust the rate monthly or quarterly and if they apply a cap to the interest rate. This will help you to determine how often the monthly payment will change and if youll always be able to afford it.

We can help

GoCardless is used by over 60,000 businesses around the world. Learn more about how you can improve payment processing at your business today.

Also Check: What Happens If You Default On Sba Loan

You Can Qualify For The Lowest Rate

Students should max out federal loans before turning to private options. Interest rates on federal loans are fixed and as low as 2.75% for the upcoming school year.

All eligible federal borrowers get the same rate, whereas private lenders base rates on credit and other factors. That means you may not actually qualify for 1% interest.

For example, College Aves lowest rates are for borrowers who have excellent credit, choose the shortest repayment term and make full payments immediately, according to DePaulo.

He says 40% of the lenders borrowers defer payments, making them ineligible for the lowest advertised rate.

Compare offers from multiple lenders before applying to find the lowest rate you can get. Pre-qualifying with lenders wont affect your credit.