Refinancing Options Available At Resource One Credit Union

At Resource One Credit Union, we are happy to speak with you at any time about your options for refinancing an existing auto loan. Whether your current loan is with us or another bank or credit union, you can trust us to provide a fair and honest loan offer with a competitive interest rate. If you need help deciding which loan term is right for you or other loan specifics, we can lend a hand. Contact us today to start a conversation about auto loans and unlock the extra financial comfort and freedom that a well-timed refinance can bring.

Youre Having Trouble Keeping Up With Bills Each Month

Even if youre not able to secure a lower interest rate, it may still be worth trying to find a loan with a longer repayment period in order to reduce your monthly car payments.

If you cant find a suitable loan, you may also be able to renegotiate the repayment period on your current loan. But keep in mind that more time spent paying back your loan is also more time spent paying interest. In general, youll pay more interest overall if you have a loan with a longer term.

How Does Auto Refinancing Affect Your Credit Score

There are three major areas refinancing will affect when it comes to credit.

You can help minimize the impact by researching financial institutions before you apply, and determining which lenders are offering the best interest rate and loan term for your needs. If you know your credit score, you can ask a potential lender what rates they believe they could provide. Its fine to send loan applications out to multiple auto lenders, but if you go that route, its best to submit all the loan applications within a 14-day window. These inquiries will typically be grouped into one hard pull.”

Change in credit utilization. Credit utilization is the percentage of your credit that you have currently spent. For example: If you have a $100 credit card limit, and you buy something that costs $30, youre utilizing 30% of your credit. A general rule of thumb for creating a good credit score is to not use more than 30% of your credit. Refinancing your auto loan can change the percent of credit that you are utilizing, which could result in a lowered score.

You May Like: Va Loan Mobile Home Requirements

Pros & Cons Of Refinancing Your Auto Loan

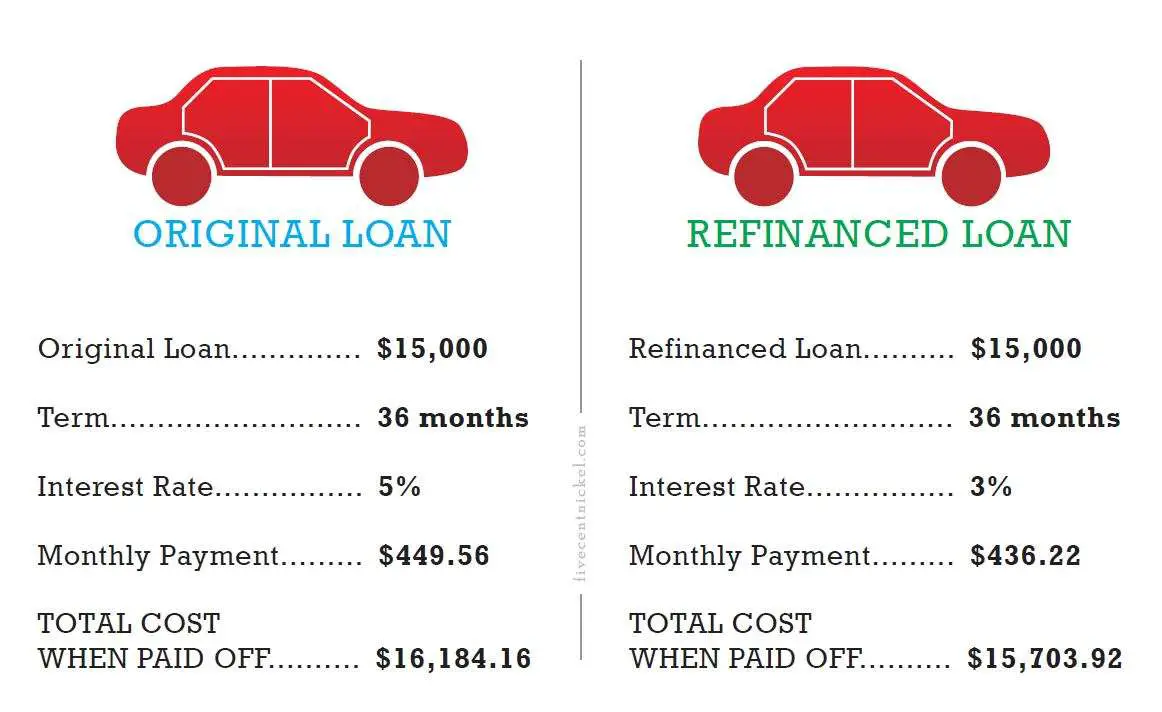

When buying a car, many buyers accept the loan package they are offered at the dealership. Though convenient at the time, you may later come to regret the conditions of your auto loan once youve started making payments. Refinancing your auto loan is one way to get better terms and potentially reduce your interest rate and monthly payments, helping you save more money. An auto loan refinance involves taking out a new loan to pay off the balance of your existing loan, and transferring the title to the new lender. While refinancing your auto loan can improve your overall finances, it may not always be the right choice for you. There are a few things to consider before applying for an auto loan refinance.

Your Credit Has Improved

One of the biggest pain points of getting the best interest rate is based on your credit score.

There are 3 top credit reporting agencies that youll want to check your scores with 1) Equifax 2) Experian, and 3) TransUnion.

Depending on your lender, they may use a different version when you complete your auto loan application.

My favorite company that offers free credit reports and scores is .

My credit score jumped from a 715 to a 790 from the time I purchased my vehicle, so when weighing out the pros and cons of refinancing, the decision was clear.

The best credit score to refinance a car is when your score is in the Excellent Range, 720 850.

Nerd Wallet has an excellent article that helps explain What Is a Credit Score, and What Are the Credit Score Ranges?

I started on my auto loan with a credit score of 715 with 3.99% APR and a monthly payment of $400.46 to a credit score of 790 with a 2.49% APR auto loan and monthly payments of $350.30.

Unfortunately, some people get locked into unreasonable rates due to a lack of knowledge and poor credit scores. But the moment that improves, its best to look into refinancing high-interest car loans.

You May Like: Alliant Credit Union Rv Loan Review

Interest Rates Have Dropped

Interest rates fluctuate periodically based on the economy. And right NOW were seeing interest rates drop like flys.

Interest rates are now historically LOW!

One of the best reasons to refinance a car loan is if you have an opportunity to reduce your interest rate. If you previously had no credit or bad credit, it is worth checking into refinancing your car loan after a couple of years to see if you receive better offers. Your credit score may have improved enough to qualify you for a lower interest rate.

With a lower interest rate, you will be able to pay off your car loan faster or lower your monthly payment while paying it off at the same pace.

In either case, youll pay less over the life of the loan.

When Should You Refinance Your Car Loan

First, its important to evaluate your current financial needs and determine whether anything has changed that could get you a lower interest rate, shorter loan term or a lower monthly payment this time around.

Lets take a look at some reasons why you should consider an auto loan refinance, and determine if its the right time for you to refinance.

Also Check: How To Transfer Car Loan To Another Person

Should You Refinance For A Longer Or Shorter Term

In order to decide how to approach your refinancing, there are some key things to consider. A key aspect is the duration of the new loan. The term of the agreement dictates what it will cost you in the long run. Loans with a shorter term will cost more on a monthly basis, though will end sooner. This results in less interest payments over time.

Conversely, longer-term agreements have smaller monthly payments. However, that does not mean you will ultimately pay less. Long-term loans have more time to compound the interest. It results in your paying a significantly higher price for the vehicle than you would with a shorter term.

In order to understand how the term of the loan will play into your households larger financial picture, there are other details to consider.

Financial Situation

Consider your ability to make payments and how much you can afford. Weigh this against your willingness to pay out the loan faster, even if it means some frugality. Additionally, consider whether you will qualify for a better rate. If your credit is better than when you initially entered into the agreement, you should be fine to proceed.

New Loan Term

When you pay out a loan over a longer term, you are eventually spending more in interest. Depending on how well you are able to make your existing regular payments, it may be worth discharging the loan faster. Conversely, if youre struggling and dont have a long-term solution yet, refinancing is a reasonable option.

Monthly Payments

Lowering Your Monthly Payment

For many of us, Life Happens and we have expensive unexpected responsibilities like having a baby, dentist bills, and other unexpected medical bills, or maybe even a natural disaster can put you in a situation where youll want or need to reduce your monthly bills and expenditures.

Refinancing your auto loan could help you to significantly reduce your monthly bill.

For instance, if you owe two more years on your current loan, it may be possible to refinance and extend the term to four years.

Although the drawback is you would be paying for two additional years, youd free up more cash on hand monthly to boost your savingsand other personal/household needs.

If you can, its smart to pay a little more on your monthly to pay more on the principle and less in interest.

Read Also: How Many Times Can You Refinance A Car Loan

Is There A Need To Refinance Your Car

The decision to refinance a car solely depends on your needs. You should consider financial factors such as your current financial status, the purpose of the refinance, your monthly cash flow, among others.

You may also want to consider the following before deciding to refinance your car loan.

Typically, fluctuations of interest rates depend entirely on the current economic situation. Even if the interest rate decreases between two and three percent, you would definitely save a lot on your loan. For example, if your original loan is RM103,337.50 with an interest rate of seven percent and a loan term of 60 months, the total loan amount you would be paying is RM122,773.22.

After a year, your loan balance should be around RM86,803.50. If you decide to refinance, you can get a new loan with a lower interest rate and a shorter repayment period. This means you will pay off the new refinancing debt at a lower monthly amount, which saves you much more in the long run.

- Current Financial Status

Financial institutions usually consider a number of other factors including your credit score for the past 12 months, and your debt-to-income ratio . The DTI ratio is usually calculated by dividing your total monthly income by your existing monthly commitment.

- Delay in Repayment

Things To Watch Out For When Refinancing A Car Loan

Just like with any financial arrangement, it is important to keep your eyes out for red flags. Ensure that the lending agency is reputable and offers a reasonable interest rate. Make sure that you are dealing with a proven institution and be sure to read all the fine print. If you are unsure as to the meaning of a phrase, it is better to ask.

Take a look at the cost of refinancing the vehicle. Are there any upfront expenses? Are you going to be paying more down the line? If so, how much more? Make sure that you have all of the information above before making your decision. As always, avoid deals that seem too good to be true. Understand your rights and the responsibilities of the lender. Be certain that you are comfortable with the arrangement and that it is in your best financial interests.

Don’t Miss: Usaa Auto Loan Pre Approval

Pros Of A Car Refinance

There are some benefits to refinancing. The process does not take long, and you can obtain a free quote to determine if these benefits apply to your case.

Here are several advantages of refinancing your car loan.

A Lower Interest Rate

If you had a poor credit score when you first purchased the car, your interest rate may be significantly lower than it is right now.

In addition, an individual who refinanced several years ago may also qualify for a lower rate because interest rates have fallen since they purchased the loan.

If the current interest rate you could obtain is one or more percent lower than what you are paying, consider refinancing. You will spend less overall to buy your car.

You Want to Consolidate Debt

Your vehicle is a valuable asset. As a result, it is possible to borrow against the value of it.

For example, if you own a car worth $12,000 but you only owe $8,000 on it, you may be able to borrow against that $4,000 value. You could use these funds to help you pay off debt or handle other financial needs.

In some situations, you can use this equity in your vehicle to pay off all of your credit cards . This, too, can save you money.

You Want a Lower Monthly Payment

There are several ways you could obtain a lower monthly payment on the loan.

First, if you secure a lower interest rate, the monthly payment will be lower as well. This could help make your budget a bit easier to manage. How much lower depends on the debt you owe, the interest rate, and the term.

What Fees Are Associated With Auto Refinancing

- Prepayment Penalties. Your existing lender might have prepayment fees. This is a penalty for paying off your loan early. Many lenders dont charge these, but if yours does, calculate whether those fees will cost you more than youd save with a new loan.

- Application Fees. Your new lender might charge you an application fee for filing the papers. Dont be shy about asking the lender to waive the application fee. Afterall, its the honeymoon stage, so it might be generous.

- Transaction Fees. There could also be a transaction fee, an administrative or processing fee charged when you terminate your loan.

Recommended Reading: Usaa Pre Approval Auto Loan

Determine If You Qualify For Refinancing

Find out whether youd meet a lenders requirement for a refinancing. Capital One, for example, wont refinance loans for cars that are more than seven years old, and the payoff amount on your current loan must be between $7,500 and $50,000. Like many lenders, it also wont refinance a loan that it issued in the first place.

Next Steps: How To Refinance A Car Loan

When it comes time to actually refinance your loan, there are some steps youll need to take. These include gathering your documentation, doing some comparison loan shopping, choosing a lender, applying, then paying off your old loan and making payments to your new lender. Here are six steps you can take to refinance your car.

When youre shopping around, make sure you dont go with the first offer youre presented with, either. Take your time and request quotes from multiple lenders. Compare the APR, term, payment amount, fees and penalties from each lender to find the best offer. Once you make a choice, the lender will guide you through the exact process and what comes next.

Recommended Reading: Can You Use Fha Loan If You Already Own House

Which Is The Stylish Lender To Refinance With

The advanced your credit scores and the stronger your finances, the further choices you ll have. Apply to multiple lenders to see what new interest rate you can qualify for. Comparing several offers gives you the stylish chance of chancing the smallest rate.

Keep in mind that rate shopping can also lead to being communicated by multiple lenders, especially if you use a service that compares offers for you. Consider opening a new dispatch account and getting a free Google Voice phone number that you can check independently.

Utmost lenders use what’s known as a soft credit check that gives you a rate estimate but doesn’t hurt your credit score. However, credit scoring formulas tend to treat multiple inquiries in a short time period as a single event, If you apply to further than one lender that requires a full operation and hard credit check. For utmost FICO formulas, for illustration, that period is 45 days.

Best Bank For Auto Refinance: Bank Of America

Bank of America

- Minimum credit score: Not stated

- Loan terms : 48 to 72 months

If youre looking to refinance your auto loan at a big bank, Bank of America is a good option. The lender features multiple refinance options and an easy online application process.

-

Transparent rates and terms online

-

Established financial institution

-

Minimum finance amount of $7,500

-

Must have fewer than 125,000 miles

-

Car can’t be valued at less than $6,000

Among big banks, Bank of America offers competitive refinance rates and an easy overall process. It’s open to borrowers throughout the nation and scored exactly the average in J.D. Power’s 2020 U.S. Consumer Financing Satisfaction Survey.

Read Also: Usaa Car Loans Review

When Is The Best Time To Refinance A Car Loan

The best time to refinance a car loan is right now! If it makes sense for you.

Interest rates are incredibly low right now, and you dont want to miss this wave.

Are you going to refinance your auto loan?

Let me know in the comment section below, Id love to hear how much youre saving!

If you liked this article, theres more! Im working on some more ways to save, so subscribe to my mailing list to stay up-to-date. Click here to .

When Refinancing Your Car Loan Makes Sense

Refinancing your auto loan could be the right move for reasons other than your improved credit. Even if youre satisfied with your current loan, it doesnt hurt to see if you can save money on interest. It makes sense if:

Interest rates have dropped. Interest rates fall for a variety of reasons: a changing economic climate, increased competition in the banking industry, even regulatory changes. If interest rates are lower now than when you first got your car loan, refinancing is likely to lower your rate and could help you pay the loan off sooner. Or, it could save you money on interest. It only takes a few minutes to apply for refinancing and see if a new lender a bank, credit union or online lender will offer you a lower interest rate.

A car dealer marked up your interest rate. When you got your existing loan, the car dealer might have charged you a higher interest rate than you could have qualified for somewhere else. This often happens to shoppers who dont check their credit score before buying a car. They are persuaded to take the dealerships loan because they didnt shop around for the best interest rates. But you can undo the damage by refinancing and getting a new loan at a lower interest rate.

If it looks like refinancing could make sense for your situation, you can run the numbers on an auto loan calculator and consider the pros and cons of refinancing your car before applying.

Read Also: Typical Origination Fee