How Does A Home Equity Loan Work

Home equity loans are a type of loan that uses your home as collateral and allows you to borrow against that equity. They are considered a second mortgage.

Borrowers will receive their loan in one lump sum. The repayment timeline can range from five years to 30 years, depending on the terms of your loan. The longer you take to pay it off, the more interest youll end up paying. Interest rates on home equity loans are fixed and generally lower than rates for credit cards or personal loans.

Home Equity Line Of Credit

A HELOC is a revolving credit line. It allows the borrower to take out money against the credit line up to a preset limit, make payments, and then take out money again.

With a home equity loan, the borrower receives the loan proceeds all at once, while a HELOC allows a borrower to tap into the line as needed. The line of credit remains open until its term ends. Because the amount borrowed can change , the borrowers minimum payments can also change, depending on the credit lines usage.

Wells Fargo May Have Wrongly Corrected Loan Dates On Thousands Of Mortgages Did This Happen To You

for help.

After realizing it had made a significant error in failing to set customers second mortgages to end after the final maturity date , Wells Fargo allegedly changed the maturity dates on thousands of mortgages that secured home equity loans without informing its customers. Instead, it filed documents referred to as affidavits of correction in the counties in which the borrowers live. These documents allegedly corrected the final payment dates on the mortgages so that they matched those for the home equity loans.

Not only did the bank allegedly file these documents without their customers consent, but the banks actions could also invalidate the property titles and damage the value and marketability of customers homes.

If you hold a home equity loan with Wells Fargo, Keller Rohrback wants to hear from you. Please contact us at , , or using the secure form on this page to learn more about your legal rights.

About Keller Rohrback L.L.P.

Attorney Advertising. Prior results do not guarantee a similar outcome. Not licensed to practice law in all states. Please refer to krcomplexlit.com for details.

CONTACT US:

Don’t Miss: How Do I Pay My Chase Auto Loan Online

How Can I Pay Down Or Pay Off My Account

Paying down your home equity line of credit doesn’t mean you have to close your account. In fact, there are significant long-term benefits to keeping your line of credit open, even at a zero balance. Youll:

- Retain quick access to available credit for unexpected expenses or major purchases.

- Spare yourself the need to reapply and be approved again in the future.

Of course, you may arrange to pay off and close your entire line of credit at any time. Please call us at 1-866-404-3149 to discuss your options.

Best Uses For A Home Equity Loan

While home equity loans can be used for almost anything, taking out a loan for something you can pay for another way or don’t need can be expensive in the long run. For that reason, financial experts generally advise being careful with what you use loan money for.

Some of the best uses to make the most of your loan include:

- Home improvements: Because these can often add value over time, using your home’s value to increase the value can be helpful.

- Education: Home equity loans generally have a lower interest rate than student loans.

- Debt consolidation: Using home equity to help with debt consolidation may give you better interest rates so you can get your finances on track.

- Emergency expenses: If you don’t have the funds for an immediate need, home equity loans can give you money with much more favorable interest rates than something like a payday loan.

- Investments: Although risky, using home equity on investments may benefit your financial portfolio over time.

Also Check: How Much Can I Loan

What Can A Heloc Help You Do

In life, you often face major home improvement projects,

unexpected costs, education expenses, or the need to consolidate debt.

A home equity line of credit, or HELOC,

could help you achieve your life priorities.

At Bank of America,

we want to help you understand

how you might put a HELOC to work for you.

A HELOC is a line of credit borrowed against

the available equity of your home.

Your home’s equity is the difference between

the appraised value of your home

and your current mortgage balance.

Through Bank of America,

you can generally borrow up to 85%

of the value of your home

MINUS the amount you still owe.

For example,

say your homes appraised value is $200,000.

85% of that is $170,000.

If you still owe $120,000 on your mortgage,

youll subtract that, leaving you with the maximum

home equity line of credit

you could receive as $50,000.

Much like a credit card,

a HELOC is a revolving credit line that you pay down,

and you only pay interest on the portion of the line you use.

With a Bank of America HELOC,

there are no closing costs,

no application fees, no annual fees,

and no fees to use the funds!

Plus, Bank of America offers rate discounts

when you sign up for automatic payments,

as well as discounts

based on the funds you initially use when opening the HELOC.

AND there’s Preferred Rewards,

which extends benefits to you

as your qualifying Bank of America balances grow.

The interest rate is often lower

than other forms of credit,

but you should consult a tax advisor.

Calculating Your Home’s Equity

You can calculate how much equity you may be able to borrow by dividing the amount you owe by the value of your home.

For example, say you owe $200,000 on a home worth $400,000. Thats $200,000 / $400,000 = 0.50, or 50 percent loan-to-value ratio. This means that you have 50 percent equity in your home. Compare that number to your lenders maximum LTV ratio to see if you might qualify for a home equity loan.

Next, calculate how much you may borrow by multiplying your home’s value by the lender’s maximum LTV ratio and subtracting your mortgage balance.

Say your lender allows you to borrow up to 85 percent of your home’s value. In this example, that would be $400,000 x 0.85 = $340,000. From there, you would subtract your mortgage balance: $340,000 – $200,000 = $140,000 as the maximum amount you may be eligible to borrow.

You May Like: Is Home Equity Loan Good Idea

Reasons To Avoid Helocs

The chance that you might lose your home if you cant make HELOC payments on time is a major risk. Unlike personal debt, which is unsecured, HELOCs use your home as collateral. If you lose a job or become seriously ill and cant make payments on time, the lender is entitled to foreclose.

HELOCs are credit, not free money. Some people treat HELOCs like a savings account available for major purchases, vacations or home remodeling. Though HELOCs carry lower interest rates than credit cards, they are still borrowed money. You eventually must repay the HELOC, and the more you borrowed and used, the larger your payments will be. If you dont, the lender will foreclose.

Using a HELOC might throw your retirement plans into disarray. Many people try to pay off a mortgage before leaving the workforce, but they might forget the HELOC. Instead of having one mortgage to pay off, they have two. Home equity is the biggest asset many retirees have, but if its depleted by a HELOC, it might not be nearly a great as it could be.

What Is A Heloc

A HELOC resembles a second mortgage but functions like a credit card. HELOC funds can be drawn when you need the money instead of taken in a lump sum, as is common with second mortgages, which also are called home equity loans. You can access HELOC funds when you want but cannot exceed the amount set when you signed for the credit line.

If you have a $100,000 HELOC, for example, you can borrow up to that amount at an adjustable interest rate. If you never use more than $20,000 of the HELOC line, you will only pay interest on the $20,000 you used, not the $100,000 that is the maximum value of the line.

Some people mix up HELOCs with mortgage loans. Lets clear up the confusion. A mortgage is used for one purpose: to fund the purchase of a home. You never see the money it goes straight to the seller, and for the most part you stick to a repayment schedule that stretches from 15 to 30 years.

HELOCs, by contrast, are revolving credit lines that use your home as collateral. You dont necessarily have to use the money on your home or any type of real estate. Since the credit line is secured by a dwelling, the interest charged on what you borrow is lower than what you would pay on an unsecured credit card. The catch, of course, is that the house secures the HELOC. If you default, the lender can foreclose on your home.

Also Check: How To Get An Sba Loan

Dream Big Finance Smart

Receive anintroductory low rate of 6.75% APR for the first 24 months.* Pay no application fees and generally no closing costs.

A Home Equity Line of Credit is money you can use wherever and whenever you want. Use it for home improvements or that long awaited vacation. You can even pay off your credit card debt.

As a community bank chartered in 1851, BayCoast Bank is proud to provide financial products and services to the people and businesses of southeastern Massachusetts and Rhode Island. Through all phases of your life from personal banking to business services, BayCoast Bank has you covered.

What Are The Requirements For A Heloc Or A Home Equity Loan

Generally, borrowers for either a HELOC or a home equity loan need:

- More than 20% equity in their home

- A credit score greater than 600

- Stable, verifiable income history for two-plus years

It is possible to get approved without meeting these requirements by going through lenders that specialize in high-risk borrowers, but expect to pay much higher interest rates. If you are a high-risk borrower, it may be a good idea to seek out a service for advice and assistance before signing up for a high-interest HELOC or home equity loan.

You May Like: Personal Loans For Credit Card Debt

Common Uses For Home Equity Lines Of Credit

There are no restrictions on how you can use your HELOC. You can spend it all on vacation if you want, but we recommend using it in a way you wont regret later on. Your home is too valuable to put on the line without first having a clear plan of action for your funds.

If youre not sure what you could use a HELOC for, check out some of these recommendations:

- Home improvements: Replacing the garage door or remodeling the kitchen or bathroom could increase your homes value. Or you could use a HELOC to repair damage to your home, especially damage not covered by insurance.

- Education: You can use a HELOC to pay for school or pay off student loans, which may come with higher interest rates.

- Debt consolidation: Using a HELOC to consolidate your debts could simplify your life by reducing your monthly payments and lowering the amount you lose on interest.

- Start a business: Dont let a lack of capital be the reason you never got your business off the ground. If you have a solid idea for a business, you can use a HELOC to get things rolling.

- Medical expenses: You can use a HELOC to pay for an expensive medical procedure or to pay off medical debt that could be cramping your credit score.

Is It Worth Getting A Heloc

A HELOC could be a worthwhile borrowing vehicle when you use it for certain things. For example, using a HELOC on home improvements that also improve the value of your home should see a return on investment later if you sell. The biggest pitfall of a HELOC is using it for frivolous things, such as vacations or weddings. Overall, its best to refrain from taking on more debt if you cant afford the payments.

Also Check: Can Daca Apply For Fha Loan

Bankrate Guide To Choosing The Best Home Equity Loan

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure our content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Bankrate analyzes loans to compare interest rates, fees, accessibility, online tools, repayment terms and funding speed to help readers feel confident in their financial decisions. Our meticulous research done by loan experts identifies both advantages and disadvantages to the best lenders.

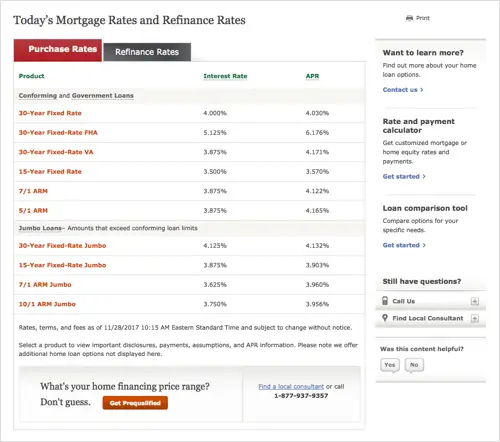

When shopping for a home equity loan, look for a competitive interest rate, repayment terms that meet your needs and minimal fees. Loan details presented here are current as of the publication date. Check the lenders websites to see if there is more recent information. The top lenders listed below are selected based on factors such as APR, loan amounts, fees, credit requirements and broad availability.

How To Get A Low Interest Rate

Follow these steps to get the best interest rate on a HELOC:

You May Like: What Does It Mean To Refinance Your Car Loan

Home Equity Loan Vs Heloc

Home equity loans and home equity lines of credit are both loans backed by the equity in your home. However, while a home equity loan has a fixed interest rate and disburses funds in a lump sum, a HELOC allows you to make draws with variable interest rates, like a credit card.

Generally speaking, if you’re planning on doing multiple home improvement projects over an extended period of time, a HELOC may be the better option for you. If you’re thinking about consolidating high-interest credit card debt or doing a larger home improvement project that would require all of the funds upfront, a home equity loan may be the best option.

| HOME EQUITY LOANS | |

|---|---|

| Debt consolidation, large home improvement projects, major purchases | Ongoing home improvement projects, college tuition payments, medical expenses |

Alternatives To Wells Fargo Home Equity Products

If youre interested in a new home equity product, many other big-name banks still offer loans and lines of credit.

Depending on where you live, the equity youve established in your home, and how much you want to borrow, you may be able to lock in competitive home equity terms and get the money you need.

Weve researched three alternatives to Wells Fargo home equity products. Keep reading to find out what they offer and how they measure up.

Don’t Miss: Same Day Pay Day Loans

Wells Fargo Home Equity Review

Wells Fargo paused new home equity lines of credit in May 2020. Here are other options for borrowers to tap into their homes current value.

Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site.

One of the largest banks in the U.S., Wells Fargo has a presence in nearly every state. Its products and services include the following:

- Checking and savings accounts

Until early 2020, Wells Fargo also offered home equity lines of credit .

As of April 30, 2020, Wells Fargo is denying all new home equity applications and has suspended issuing new HELOCs. This has left borrowers looking for other lenders to tap into their homes equity while they own the property.

Heres why Wells Fargo stopped issuing home equity productsand how to find an alternative.

In this review:

What Are Some Options That I May Have To Pay Off My Line Of Credit

Each persons situation is unique, and lines of credit vary. Some of these options may not be available to you.

For home equity lines of credit at end of draw or end of term:

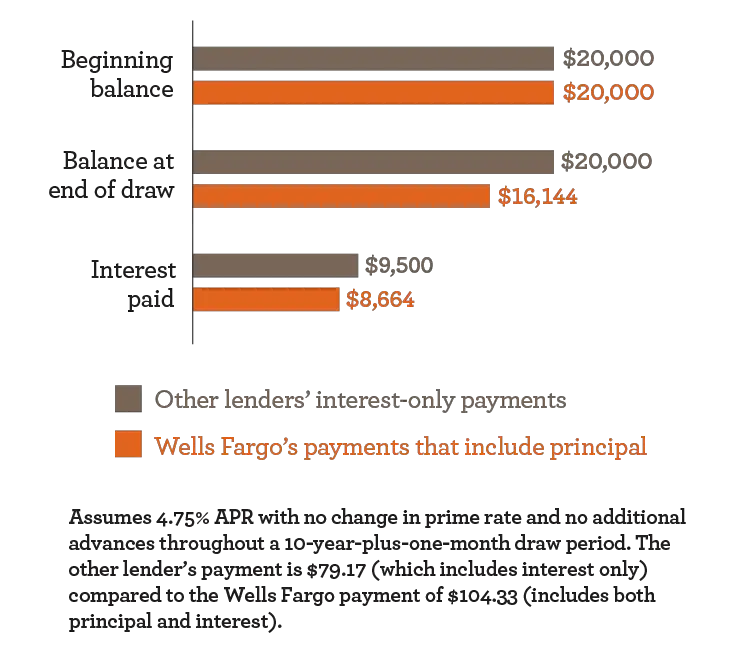

- Use our Early Paydown ProgramSM, which gives qualified borrowers the ability to convert your variable-rate home equity line of credit balance into a fixed rate and fixed term before the end of draw date. The monthly payments are designed to pay off the balance by the end of the new term. This program transfers the entire outstanding balance into its repayment phase early, and ends access to new home equity funds.

- Refinance to a new first mortgage with Wells Fargo, which lets you refinance your home equity line of credit into a new Wells Fargo home mortgage.

Considerations

- Refinancing may not be right for your situation. Talk with a home equity specialist to learn more.

- Different options may help you lower your interest rate, lower your monthly payment, or pay off your outstanding balance.

- If youre experiencing financial challenges, you may qualify for a modification with new terms and a possible interest rate reduction.

Talk with a home equity specialist at 1-855-877-6661 for more information.

Also Check: Can You Get Car Loan Without Job