Why Apr Is Important

Annual percentage rate, or APR, takes into account interest, fees and time. Its the total cost of your loan and includes both the loans interest rate and its finance charges.

Since APR includes both the interest rate and certain fees associated with a home loan, APR can help you understand the total cost of a mortgage if you keep it for the entire term. The APR will usually be higher than the interest rate, but there are exceptions.

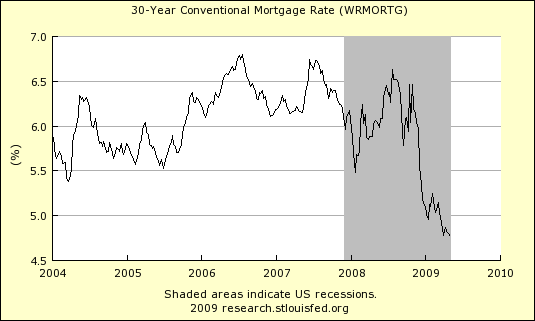

How Rates Have Changed For 30

Historically speaking, mortgage rates for 30-year fixed loans have been gradually declining. If we take a look at average rates from 2000 to 2020, it shows points were average rates have significantly decreased. The graph below is taken from the Federal Reserve Bank of St. Louis. We also compiled a table showing average rates from January 2000 to January 2020.

Based on the FRED graph, the 30-year fixed mortgage started with an average rate of 8.15 percent in January 2020. Over the next couple of years between 2001 to 2008, it fluctuates between 7.07 percent and 5.85 percent.

| 3.72% |

By January 2008, youll notice a substantial drop down to 5.01 percent. During this period, the effects of the subprime mortgage crisis gravely affected consumers and lending institutions. According to historical accounts, the mortgage crisis aggravated the U.S. recession in December 2007 to June 2009.

In January 2009, the average 30-year fixed mortgage rate dropped by 1.06 percentage points from 2008. It increased to 5.09 percent in 2010, but went down to 4.77 percent in 2011. Between January 2012 to 2017, the average rate ranged between 3.34 percent to 4.53 percent. In 2017, it reaches 4.20 percent, but continues to fluctuate downward to 3.95 percent in January 2018.

What’s The Difference Between A Mortgage Interest Rate And Apr

When searching for rates, you’ll probably see two percentages pop up: interest rate percentage and annual percentage rate .

The interest rate is the rate the lender charges you for taking out a mortgage.

The APR takes the rest of your house payments into consideration, such as private mortgage insurance, homeowners insurance, and property taxes.

The APR gives you a better idea of how much you’ll actually pay on your home.

Recommended Reading: Usaa Auto Refi Rates

Much More Than The Amount Of Monthly Payments

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Flex Modification Calculator

Tips For Getting The Lowest Mortgage Rate Possible

There is no universal mortgage rate that all borrowers receive. Qualifying for the lowest mortgage rates takes a little bit of work and will depend on both personal financial factors and market conditions.

Check your credit score and credit report. Errors or other red flags may be dragging your credit score down. Borrowers with the highest credit scores are the ones who will get the best rates, so checking your credit report before you start the house-hunting process is key. Taking steps to fix errors will help you raise your score. If you have high credit card balances, paying them down can also provide a quick boost.

Save up money for a sizeable down payment. This will lower your loan-to-value ratio, which means how much of the homes price the lender has to finance. A lower LTV usually translates to a lower mortgage rate. Lenders also like to see money that has been saved in an account for at least 60 days. It tells the lender you have the money to finance the home purchase.

Shop around for the best rate. Dont settle for the first interest rate that a lender offers you. Check with at least three different lenders to see who offers the lowest interest. Also consider different types of lenders, such as credit unions and online lenders in addition to traditional banks.

Finally, lock in your rate. Locking your rate once youve found the right rate, loan product and lender will help guarantee your mortgage rate wont increase before you close on the loan.

Im Ready To Apply For A Conventional Loan

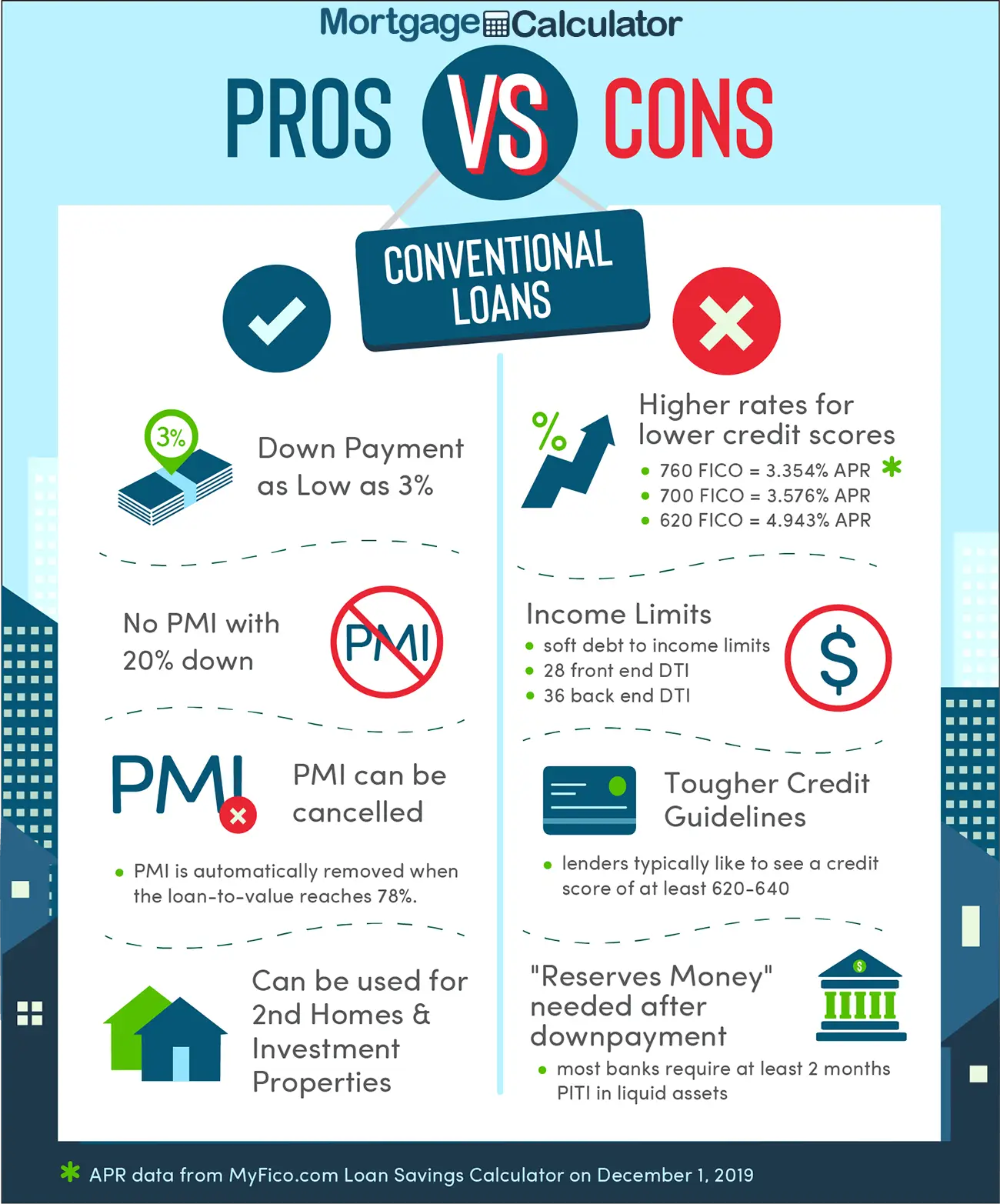

Conventional loans are a great mortgage option for qualifying homebuyers. Depending on your financial situation, its likely a conventional loan will offer lower rates than other types of mortgages. Down payment requirements are as low as 3%, and the private mortgage insurance is cancelable when home equity reaches 20%.

Tim Lucas

Editor

Don’t Miss: My Car Loan Is Not On My Credit Report

Can You Pay Off A 30

Thirty years seems like a long time. If you buy a house when youre 35-years-old and get a 30-year mortgage, your last payment will be scheduled for right around the time you reach the retirement age of 65. One thing worth knowing about a 30-year mortgage is that just because you can take 30 years to pay it off doesnt mean you are obligated to do so. Many lenders may let you pay off your loan early. Some do charge a pre-payment or early payment penalty. Before you pay extra on your mortgage, double-check to confirm that your lender wont penalize you for doing so.

If you are interested in paying off your mortgage early, there are multiple ways to do so. If you get paid biweekly, you can try making biweekly payments on your mortgage, instead of monthly. Divide your monthly payment in half and pay one half when you get your first paycheck of the month and the second when you get paid the second time. Since there are 26 biweekly pay periods in a year, youll end up paying 13 months worth of your mortgage, rather than 12.

Another option is to add on an additional amount when you schedule your monthly payment. Even paying an extra $100 or $200 per month consistently can shave years off your mortgage.

How To Qualify For A Conventional Loan

Some people mistakenly believe that conventional loans are incredibly hard to qualify for. In reality, besides the higher credit requirement, they arent any more difficult to qualify for than government-backed loans, like FHA or VA.

Like with any type of mortgage, you need to be able to prove you are capable to make the monthly payments. Lenders will look at a variety of factors to determine whether or not a borrower qualifies.

Also Check: Leads For Loan Officers

Experimenting With Loan Terms Is A Good Strategy

Running the numbers on a mortgage comparison calculator is a good start to figuring out what the right loan term might be for you.

The next step is a mortgage pre-approval, which tells you how much money youll likely be able to borrow based on your finances. The whole idea will become less hypothetical once you start seeing the numbers on a page.

And having a pre-approval in hand shows home sellers youre a serious buyer. It shows that a mortgage lender is willing to back your home purchase for 15 or 30 years.

Dos And Donts When Looking For A Mortgage

Homeownership is a big responsibility, and you will want to make sure you are prepared to take on such a large debt. While youre filling out the columns, consider these recommendations.

Dos When Looking for a Mortgage:

- Start by calculating how much you can afford each month.

- Consider how long you plan to stay in the house. You might have a job that requires you to move frequently.

- Do you plan to start a family? You should anticipate how much space youll need.

- Is the house near good schools?

- Can you reasonably expect the house to improve in value?

Donts When Looking for a Mortgage:

- Dont borrow your limit on a 30-year mortgage. You might love the backyard or the walk-in closet, but that money could be used elsewhere. Youll need to build an emergency fund should something bad happen. If the refrigerator breaks or you need to repair the roof, you need to have cash on hand to handle these kinds of problems. You should also have money to set aside for retirement savings.

- Dont put less than 20% down. Otherwise, youll need private mortgage insurance to protect the lender in a foreclosure. Plus, a 20% down payment keeps your monthly payments affordable.

The word mortgage literally translates to death pledge. Seems like a rather ominous word to associate with something youll live in, but no, that isnt referring to mortgages as a suicide mission.

About The Author

Also Check: Usaa Auto Loan Bad Credit

Minimum Down Payment For A Conventional Loan

Its a common myth that you need a 20% down payment for a conventional loan you can actually get one with as little as 3% down.

All told, there are sixmajor mortgage options for conventionalloan down payment requirements, ranging from 3% to 20%.

These types of conventionalloans include:

- Conventional 97 loan 3% down

- Fannie Mae HomeReady loan 3% down

- Freddie Mac Home Possible loan 3% down

- Conventional loan with PMI 5% down

- Piggyback loan 10% down

- Conventional loan without PMI 20% down

From the 10% down piggyback loan to 3% down HomeReady and Conventional 97 loans, low-down-payment options not only exist but are extremely popular with todays conventional loan borrowers.

So, how do you qualify for aconventional loan? Simply by matching requirements set out by Fannie Mae andFreddie Mac.

Once you do that, you can join the club of conventionalloan homeowners who make up about 69% of the market.

The20% down payment myth

Where does the myth about the20% down payment requirement come from? Probably from shoppers who want toavoid paying private mortgage insurance premiums.

When you put less than 20%down on a conventional loan, your lender will require private mortgageinsurance . This coverage helps protect the lender if you default on theloan.

PMI does increase monthly mortgage payments. But thats OK if it allows you to get a conventional loan with a down payment you can afford.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Don’t Miss: 84 Month Auto Loan Usaa

Where Are Mortgage Rates Heading This Year

Mortgage rates sank through 2020. Millions of homeowners responded to low mortgage rates by refinancing existing loans and taking out new ones. Many people bought homes they may not have been able to afford if rates were higher. In January 2021, rates briefly dropped to the lowest levels on record, but trended slightly higher through the rest of the year.

Looking ahead, experts believe interest rates will rise more in 2022, but also modestly. Factors that could influence rates include continued economic improvement and more gains in the labor market. The Federal Reserve has also begun tapering its purchase of mortgage-backed securities and said it anticipates raising the federal funds rate three times in 2022 to combat rising inflation beginning as soon as March.

While mortgage rates are likely to rise, experts say the increase wont happen overnight and it wont be a dramatic jump. Rates should stay near historically low levels through the first half of the year, rising slightly later in the year. Even with rising rates, it will still be a favorable time to finance a new home or refinance a mortgage.

Factors that influence mortgage rates include:

Features Of An Adjustable Conventional Loan

Many borrowers shy away from adjustable rate conventional loans. Instead, they prefer to stick with traditional amortized loans, so there are no surprises concerning mortgage payments due down the road. But an adjustable-rate mortgage might be just the ticket to help with the early years of payments for borrowers whose incomes are expected to increase.

The initial interest rate is typically lower than the rate for a fixed-rate loan, and there’s usually a maximum, known as a cap rate, on how much the loan can adjust over its lifetime. The interest rate is determined by adding a margin rate to the index rate. Adjustment periods can be monthly, quarterly, every six months, or yearly.

Recommended Reading: Usaa Refinance Auto Loan Rates

How To Get A Good 30

Lenders take your financial profile into consideration when determining an interest rate. The better your finances are, the lower your rate will be.

Lenders look at three main factors: down payment, credit score, and debt-to-income ratio.

- Down payment: Depending on which type of mortgage you take out, a lender might require anywhere from 0% to 20% for a down payment. But the higher your down payment is, the lower your rate will likely be. If you can provide more than the minimum, you could score a better rate.

- : Most mortgages require a minimum 620 credit score, and an FHA loan lets you get a mortgage with a 580 score. But the higher your score is, the better. If you can get your credit score above the minimum requirement, then you could snag a lower rate. To improve your score, try making payments on time, paying down debts, and letting your credit age.

- Debt-to-income ratio: Your DTI is the amount you pay toward debts each month in relation to your monthly income. Most lenders want to see a minimum DTI ratio of 36%, but you can land a lower rate with a lower DTI ratio. To decrease your DTI ratio, you either need to pay down debts or earn more money.

If you have a large down payment, excellent credit score, and low DTI ratio, then you should be able to get a low 30-year fixed rate.

Mortgage Comparison Calculator: Is A 15

What difference does a loan repayment term make to how much youll pay for a home? Quite a bit.

For starters, your monthly payment could be drastically different because of your loan term the length of your loan even though youre paying the same purchase price.

And, your loan term can add tens of thousands of dollars in total interest paid again, even though youre paying the same principal amount.

It can even affect the interest rate itself.

Experimenting with our mortgage comparison calculator can help you see your loan lengths effect on your homebuying budget.

You May Like: Does A Loan Processor Have To Be Licensed In California

Managing Your Mortgage Payments

Purchasing a 30-year fixed loan means making consistent payments for three decades. Thats a long time, so you must stay on top of your payments. This is why its important to secure a stable career and build savings. You must keep paying your loan even during emergencies. The same goes even when youre retired and not yet fully paid on your loan.

Before you agree to any real estate deal, you should understand how mortgage payments work. One important document you should use is the amortization schedule. This breaks down your monthly payments so you know how much goes toward your interest charges and principal loan.

- Principal This is the amount you borrowed from your lender. It also indicated the outstanding balance you still owe after making several payments.

- Interest This is the payment lenders charge to service your loan. Interest costs are higher when your principal is large. Likewise, interest increases the longer it takes to pay down a loan.

Calculate Your PITI Costs

Mortgage payments are not just comprised of interest and principal payments. You must also pay for real estate taxes and homeowners insurance. When taken together, this is called PITI costs or Principal, Interest, Taxes, and Insurance. If you check your PITI expense, you can calculate the total cost of your monthly payments. Finally, while principal and interest payments remain the same, your insurance and property taxes may change over the years.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Also Check: Usaa Auto Loans Bad Credit