What Is An Unsecured Car Loan

Some lenders offer unsecured car loans. These are mainly available for used cars and are not secured by any property. Unsecured car loans typically have higher interest rates than secured car loans. This is because there is a greater risk to the lender. If you fail to make repayments, there is no particular asset tied to the loan for them to repossess. Instead, a lender may choose to take a borrower to court if their repayments are not met.

You can consider different types of car loans using the comparison selector tool at the top of this page.

How Do I Choose The Best Auto Loan

First, you have to decide what constitutes the best auto loan. Is it the one with the lowest APR, the smallest monthly payment, the fewest fees, the longest term, or the widest selection of vehicles in your price range?

Whatever your criteria, a great place to start your search is by reading third-party reviews like this one. You can click on the APPLY HERE links in the summary boxes to get additional information about each loan and, if you like what you see, fill out the form to request an auto loan.

If approved, you can then shop for a car that fits your budget and meets your needs. In some cases, you can shop online and even have the car delivered to your front door, for example, with Vroom.

Its important you deal with a reputable auto lender. To ensure this happens, practice due diligence by checking the following:

In general, its a good idea to stick with well-known players in the auto loan market who have received recommendations from customers and independent third parties.

How Do Lenders Come Up With Car Loan Interest Rates

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower car loan rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

- Type of interest rate. Banks and credit unions can offer fixed and variable interest rates on a car loan. Generally, variable-rate car loans have lower starting rates than fixed-rate car loans.

Also Check: Car Loans Usaa

Best For Shopping Around: Lendingtree

LendingTree

- As low as 0.99%

- Minimum loan amount: Varies by lender

- Repayment terms: Varies by lender

LendingTree makes it easy to compare rates from dozens of lenders and offers a variety of helpful financial calculators, placing it in our top spot as the best for comparing rates.

-

Compare auto loans from multiple lenders

-

Search by new, used, refinance, or lease-buyout options

-

Loan-payment and credit-score tools

-

Search process requires personal and financial details

If you are tossing around the idea of getting a new car but are not sure if it will fit in your budget, stop by LendingTree first. Without affecting your credit, you can shop from a variety of lenders. You can use this feature for refinancing, new cars, used cars, or lease buyouts. Just enter your desired loan type, down payment, financial status, and the vehicle you want. Then, LendingTree will match you with lenders.

You can compare the offers to find the best rates and terms for your life. If you decide to apply, the lender will require a full application. LendingTree can also help with a loan-payment calculator, free , and other tools.

Best For Refinance: Autopay

- As low as 1.99%

- Minimum loan amount: $2,500

AUTOPAY offers several different refinance options, competitive rates, and has flexible credit requirements. Borrowers can easily compare offers from different lenders on AUTOPAY’s site and choose the best deal.

-

Considers all credit profiles

-

Excellent credit required for the best rates

While AUTOPAY’s rates start at 1.99%, only those with excellent credit will qualify. According to AUTOPAY, they can, on average, cut your rate in half on a refinance.

AUTOPAY offers more refinance options than many lenders. In addition to traditional auto refinancing, borrowers can choose cash-back refinancing and lease payoff refinancing.

AUTOPAY is a marketplace that makes it easy to shop around for the best deal. It caters to individuals who are rebuilding credit or improving their credit.

Read Also: Nerdwallet Loans

Banks And Credit Unions

When a Canadian bank or credit union approves an auto loan they typically deposit the loan amount directly into the borrowers bank account. The borrower can then use the funds to pay the car dealership for the vehicle theyd like to purchase. This is often referred to as direct lending, since the car loan comes directly from a bank or credit union.

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you’re having trouble getting approved or finding acceptable rates, try taking these steps:

- Improve your credit: Before applying for an auto loan, pay down as much debt as you can and avoid opening new accounts, like credit cards.

- Make a large down payment: Making a larger down payment will lower your monthly payment, but it could also help you qualify for better rates.

- Consider a co-signer: A co-signer with good credit will take on some responsibility for your loan if you default, but they can also help you qualify.

You May Like: Usaa Current Used Car Loan Rates

What Is A Good Interest Rate For A Car Loan

The average APR for an auto loan was 9.46% in 2020, but its possible to get a lower rate, especially if your credit is strong. tend to offer some of the lowest starting rates weve seen if you meet their membership requirements, which may be easier than you think. Car manufacturers offer 0% financing, but those deals require high credit scores and only apply to certain models. Used car loans tend to have higher starting rates than new, but manufacturers do offer APR deals on certified pre-owned cars.

Lenders With The Best Auto Loan Rates

5 Lenders with the Best Auto Loan Rates

Lenders compete with one another by offering low interest rates to what they consider dependable borrowers. Currently, the best auto loan rates for new vehicles are about 2.5% and under. Many providers offer rates like this, including credit unions, banks, and online lenders.

In this article, well talk about the five best providers for low auto loan rates and go over how you can find good financing terms. When shopping around for auto loans, its a good idea to compare pre-qualification offers from several top lenders.

Recommended Reading: Stilt Personal Loans

Features And Benefits Of Car Loan

When it comes to car loans in India, in general, the following features and benefits are offered. Note that, the following is a generalized look at the advantages offered by car loans. Individually, car loan lenders may have highly customized and specialized offerings for their customer base.

- It helps you purchase a car even if you dont have all the money for it right now.

- Most car loans will finance the on-road price of the car.

- Some car loans will even finance 100% of the on-road price. This means no down payments.

- With some banks offering financing in the crores, you are not limited in your choice of cars

- Most car loan offerings in India are secured loans. This implies that the car serves as the security/collateral for the loan.

- Procuring a car loan is usually simple when compared to other loan products. Individuals with slightly unsavoury credit scores can also hope to procure one. However, this option differs from bank to bank.

- Car loans in India often offer fixed interest rate options. This means, you are always assured of a fixed amount that needs to be repaid monthly.

- Many lenders will offer interest rates based on your credit score so a high score to get you a cheaper loan.

- Car loans are not meant for just new cars. A used car loan can help you buy a pre-owned car.

How Can I Get The Best Car Loan Interest Rate

Video: Rising mortgage rates hit housing affordability

Borrowers with a lower credit score may see higher auto interest rates. If your credit score is on the lower end , some lenders may offer higher interest rates. Taking steps to improve your credit score can go a long way toward getting a better interest rate.

You May Like: What Does Unsubsidized Loan Mean

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

Best Big Bank Lender: Capital One

Capital One

Capital One gives car shoppers the peace of mind of working with a major secure lender, placing it in the top spot as the best big bank lender.

-

Pre-qualify with a soft credit check

-

Big bank lender provides security

-

Must contact dealer directly to confirm vehicle is in stock

-

Loans only available through the lenders network of dealers

Understandably, some people aren’t as comfortable using lesser-known or niche lenders for something as crucial as an auto loan. If you want the backing of a major financial institution with a household name, Capital One may be your best bet. If you’re in the market for a new or used car, you can submit a request to get pre-qualified for auto financing through the bank’s Auto Navigator program. This early step does not affect your credit since it is a soft pull.

The pre-qualification is then valid at more than 12,000 dealers throughout the nation, each of which you can find on Capital One’s website. Just present the qualification note at a participating dealership and begin the full application process once you find the perfect ride.

Read Also: Refinance Conventional Loan

Auto Approve: Best For Refinance Car Loans

on LendingTrees secure website

Auto Approve offers refinancing and lease buyouts for cars, trucks, SUVs, motorcycles, boats, RVs and ATVs. When you apply, youll see potential car refinance offers from multiple lenders without impacting your credit. Once you choose, the lender will do a hard credit pull and give you an official offer for you to accept or reject.

Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |

Don’t Miss: Usaa Auto Loan Payment Calculator

What Is A Good Used Car Loan Rate

Loan rates for used cars are higher than rates for new cars. For a 48-month term, a good used auto loan rate from a bank is 5.16% or lower. A good used car rate from a credit union is 3.16% or lower.

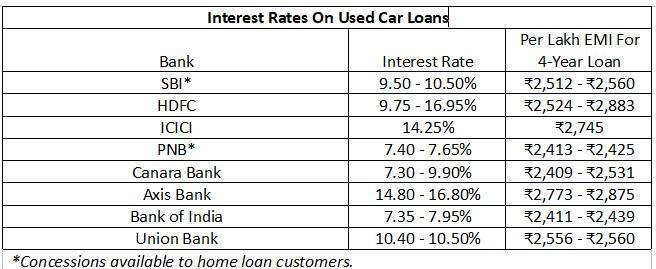

Below is a chart with NCUA data for average credit union and bank rates for both new and used vehicles.

| New or Used Vehicle Loan | Loan Term |

|---|---|

| 5.16% |

What Credit Score Do You Need For Ford Credit

What do you need to qualify for Ford Credit? Applicants with a credit score of at least 650 and up to 850 may be eligible for Ford Credit. The minimum age to be eligible is 18 or the state minimum, whichever is higher. Ford Credit does not have or does not disclose a minimum annual income eligibility requirement.

Don’t Miss: Usaa Auto Loan Refinance Calculator

What Is A Car Loan

Auto loan is one of the most sought after financial products in the market right now. Transportation has grown to be more of a necessity rather than a luxury in the Philippines mainly due to substandard transportation system and the heavy traffic around the metro. Whether its for a used or brand new car, auto loan gives the opportunity for Filipino families, especially the growing middle class, the chance to purchase their own car.

Read Also: What Car Loan Can I Afford Calculator

Best For Shopping Around For Refinancing: Lendingclub

LendingClub

- 2.99% to 24.99%

- Minimum loan amount: $4,000

Using a soft pull on your credit, LendingClub allows borrowers to compare refinancing options instantly.

-

Easily compare refinance rates online

-

Pre-qualify with a soft credit check

-

No origination fees or prepayment penalties

-

Not available in all states

-

Some vehicle restrictions

Although LendingClub made a name for itself with peer-to-peer personal loans, the online lender now offers auto-loan refinancing. If you’re looking for ways to lower your monthly bills, LendingClub can help by showing you your refinancing options.

First, complete the initial application and get instant offers. This step is a soft pull on your credit that won’t change your score. Then you can compare the details of each proposal to see which best fits your needs. Whether you need to lower your interest rate, increase the length of your loan, or both, you can find the right lender.

Once you decide on an offer, you can finish the official application. The process is entirely online and easy, and you won’t pay an origination fee for your loan. Sit back and enjoy a smaller monthly payment. Rates start at 2.99%. Whether you’re sure you want to refinance or just seeing what’s out there, LendingClub is a great option.

Also Check: Capital One Car Loan Pre Approval Letter

Auto Credit Express: Best For Bad Credit

Auto Credit Express specializes in loans for customers with poor credit. The company even has representatives that can help loan seekers build their credit scores through their loan repayments.

Customer experiences with Auto Credit Express vary, but few loan providers look to work with customers who have especially bad credit. If you need a vehicle and are having difficulty securing a loan because of poor credit, Auto Credit Express can help. Even drivers going through a bankruptcy or repossession may be able to secure an auto loan from Auto Credit Express.

| Auto Credit Express Pros | |

|---|---|

| Offers special rates for military members |

To learn more about this provider, read our full Auto Credit Express review, and visit AutoCreditExpress.com to compare rates between multiple lenders.

Foreclosing A Car Loan

When you take a car loan, you can repay it in equated monthly instalments till the end of the repayment tenure. However, if you decide to pay off the outstanding loan amount before your tenure ends, you will be foreclosing or prepaying your loan. The foreclosure/prepayment facility is offered by most lenders for a penalty fee though some lenders may allow you to foreclose/prepay your car loan without charging you any penalty.

You can foreclose your car loan if your income has increased and you wish to clear off your liability. It also takes away your burden of having to make monthly EMI payments. Foreclosing a car loan will release the hypothecation on the car and give you full ownership.

As stated above, some lenders may charge you a penalty on loan foreclosure. Hence, before you decide to foreclose a loan, it is a good idea to go through the clauses associated with it carefully.

Read Also: Usaa Preferred Dealerships

What Are Other Important Car Ownership Costs To Consider

Beyond the cost of monthly car loan payments, car insurance can be a significant expense. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs.

Estimate your monthly payments with our handy Auto Loan Calculator.

You May Like: Usaa Loans For Bad Credit