Can I Go Abroad To Take A Loan

There are many examples of going abroad even in the event of non-payment of the loan there are many persons, for example, Vijay Malya and Nirav Modi in our country, who have run away with a large amount of loan from the bank.

But running away with a loan is a problem in itself. Therefore, repaying the loan taken at the right time is not beneficial for itself, the bank, and the country.

Revolving Vs Term Loan

Loans can also be described as revolving or term. A revolving loan can be spent, repaid, and spent again, while a term loan refers to a loan paid off in equal monthly installments over a set period. A credit card is an unsecured, revolving loan, while a home equity line of credit is a secured, revolving loan. In contrast, a car loan is a secured, term loan, and a signature loan is an unsecured, term loan.

Electronic Bank Statement Configuration

Along with all the settings for manual Bank statement configuration, add the following settings:

SPRO => Financial Accounting => Bank Accounting => Business Transaction => Payment Transaction => Electronic Bank Statement => Make Global Settings for Electronic Bank Statement .

Recommended Reading: Usaa Boat Loan Credit Score

How Do You Record A Loan Receivable In Accounting

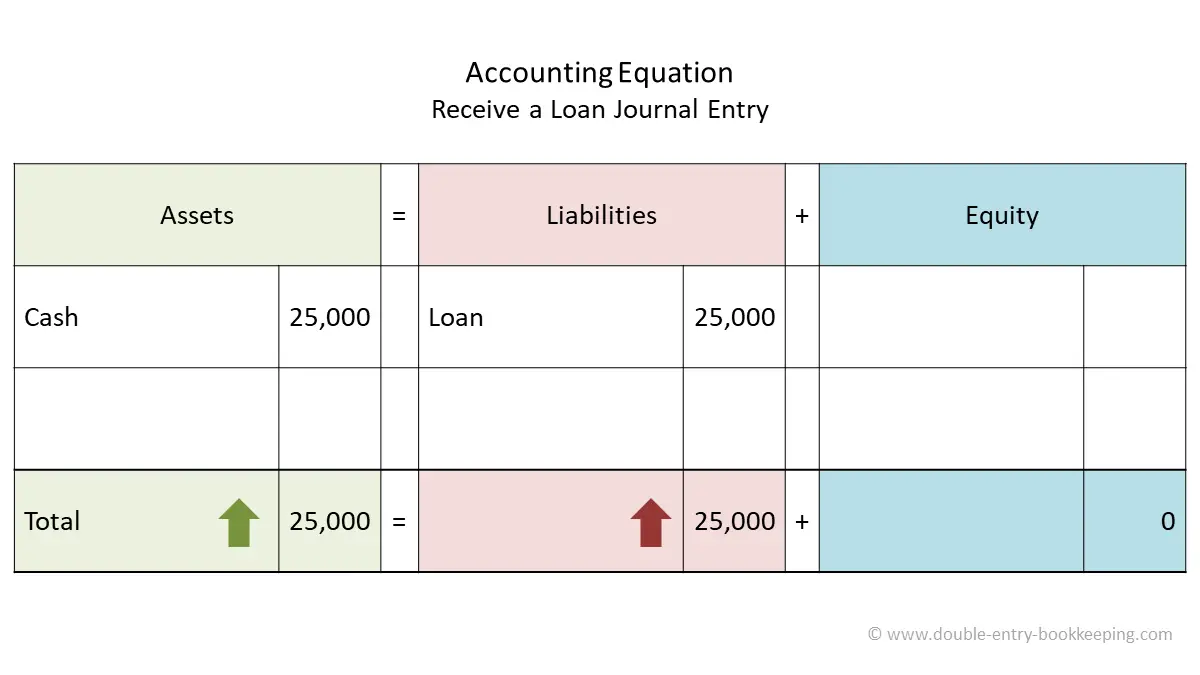

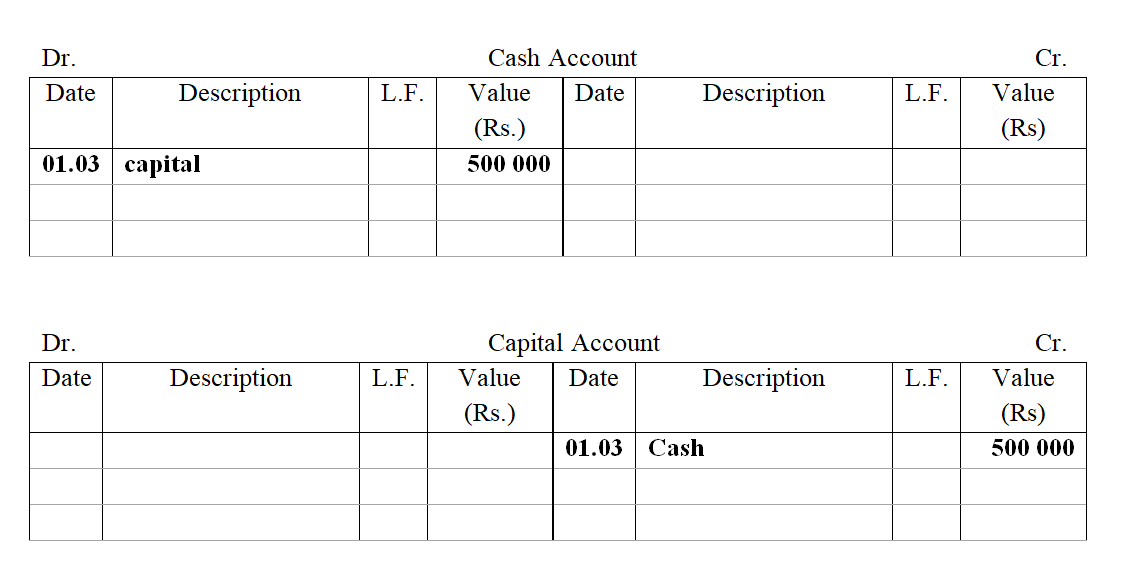

Like most businesses, a bank would use what is called a Double Entry system of accounting for all its transactions, including loan receivables. A double entry system requires a much more detailed bookkeeping process, where every entry has an additional corresponding entry to a different account. For every debit, a matching credit must be recorded, and vice-versa. The two totals for each must balance, otherwise a mistake has been made.

A double entry system provides better accuracy and is more effective in preventing fraud or mismanagement of funds.

Lets give an example of how accounting for a loans receivable transaction would be recorded.

Lets say you are a small business owner and you would like a $15000 loan to get your bike company off the ground. Youve done your due diligence, the bike industry is booming in your area, and you feel the debt incurred will be a small risk. You expect moderate revenues in your first year but your business plan shows steady growth.

You go to your local bank branch, fill out the loan form and answer some questions. The manager does his analysis of your credentials and financials and approves the loan, with a repayment schedule in monthly installments based upon a reasonable interest rate. You are required to pay the full loan back in two years. You walk out of the bank with the money having been deposited directly into your checking account.

Variants For Manual Bank Statement

To start processing a manual bank statement, you require an account assignment variant, which you can configure using the menu path:

SPRO => Financial Accounting => Bank Accounting => Business Transaction => Payment Transaction => Manual Bank statement => Define Variant for Manual Bank Statement TCode- OT43.

You May Like: Do Loan Originators Make Commission

Different Costs Of Borrowings

Most bank loans include five direct costs that are capitalized if material. Following are the types of direct costs:

- Arrangement fees

- Covenant compliance costs

- Professional consultancy

The primary cost of the bank loan is interest that is periodically paid for the owed amount. Arrangement fees are administration charges paid by the borrower to the lender for fund reserves and loan opening costs. The amount of arrangement fees varies according to business type, nature of the loan, amount of loan, etc. Insurance costs are incurred as a preliminary requirement by the bank loans. There are other professional costs like legal fees, financial consultancy fees, etc.

Home Equity Line Of Credit

A line of credit secured by the equity in a consumer’s home. It can be used for home improvements, debt consolidation, and other major purchases. Interest paid on the loan is generally tax deductible . The funds may be accessed by writing checks against the line of credit or by getting a cash advance. See related questions about Home Equity Loans & Lines of Credit.

Recommended Reading: Fha Loan Maximum Texas

Bank Loan Account Is A : A Real Accountb Nominal Accountc Personal Account D Current Account

A) Real Account

Because asset, liability, reserve, and capital accounts that appear on a balance sheet are real accounts.

The balances of real accounts are not cancelled out at the end of an accounting period but are carried over to the next period. Also called permanent accounts. See also nominal accounts.

From the fundamentals of accountancy: Bank loan accounts for customer is personal account and for banks it is a Real account

Accounting equation is Capital+Liabilities=Assets

Capital is represent the owners of the business therefore is a personal account.

Liabilities imply the amounts owe to others and thus are personal account.

All Assets are real account.

The Bank loan account is Real account since this will be reflected in the balance sheet and never be a Nominal account since nominal account refers to the account that is being closed after the accounting cycle and maybe a Personal account and Current account since it could be avail by any entity and could be current or non-current. So the answer woild be letter A. Real Account.

What Is The Difference Between A Bank Loan And A Bank Overdraft

Bank overdraft definition: Bank overdraft is an arrangement by a bank to provide finance for their customers short-term needs, under which the bank agrees to pay the customers checks against insufficient funds in his account. In other words overdraft facility is a loan from bank for short-term. This facility is provided by bank to their customer to meet short-term financial needs. A bank overdraft differs from a normal bank loan because the borrower does not have to repay the overdraft immediately. Bank overdraft can be explained as an advance from a bank against an account maintained by the borrower. It is a short term form of credit from bank, to which is agreed by both bank and borrower at the time of advance.

Don’t Miss: Refinance Car With Usaa

Accounting Entries Of Loan

Finance is one of the important and integral parts of business, and it plays a major role in every part of the business activities. It is used in all the area of the activities under the different names. However, a company may arrange the necessary finance from two major sources, such as:

- Equity Capital

- Debt Capital

Loans are provided the major portion of financial requirements because the cost of the loan is comparatively cheaper than Equity capital. Cost of the loan is cheaper because it gives more tax benefits than any other finance i.e Interest on Loan is an allowable expenditure but dividends are subject to tax. Hence, Loan is preferable financing tools for the business owner.

However, now we will discuss the accounting treatment of Loan. The journal entries of this loan are as follows:

Allowance For Loan Losses

The Federal Reserve offers lending facilities to help provide liquidity and funding to the financial markets.1 Under each facility, including primary, secondary, and seasonal credit, a Federal Reserve Bank provides collateralized credit to eligible borrowers.

Loans extended by the Reserve Banks to consolidated limited liability companies are not considered in the following paragraphs because the loans are eliminated in consolidation. In addition, loans extended to consolidated LLCs that are recorded at fair value do not require an allowance for loan loss.

In accordance with FAM 3.10, Reserve Banks are required to accrue a loss on a loan when it is probable that the loan will be not be collected in full and when the amount of loss is reasonably estimable. The following paragraphs discuss key considerations for accounting for loan losses: recognizing an allowance for loan losses, measuring loan losses, recording loan losses, interest income recognition, and disclosure.

You May Like: Usaa Auto Refinance Reviews

The Process To Define Posting Keys And Posting Rules For Manual Bank Statement

SPRO => Financial Accounting => Bank Accounting => Business Transaction => Payment Transaction => Manual Bank Statement => Define Posting keys and Posting Rules

There are multiple sub-activities in this step:

3. With the account symbols and G/L accounts assigned, the next step is to define the posting rules that you may need for your bank statement entry. Denote each posting rule with a posting rule key. Example Z07 Bank charges for which you later define the posting rules for G/L and sub-ledger accounting.

4. The final step for each of the posting rule keys is to define the posting rules. These include the affected posting area posting keys compressing the line items before posting etc. Double click the Define posting rule in the left dialogue pane and enter the details.

You may be interested in: Career in SAP FICO

Exposure To Risky Sectors

While this fragility of the banking system was not reflected in profitability indicators, it was reflected on the asset side of banks’ balance sheets in terms of exposure to risky sectors. In particular, there was a rapid increase in real estate lending in several countries. Real estate lending was higher and the banking sector exposure to real estate was greater in countries where the growth of credit was larger than proportional to GDP growth .2 Nonetheless, there were significant differences among countries. Korean banks, for example, did not have large property exposure. However, Korean banks did increase the share of bonds and other securities in their portfolios to almost 20% . Except for the Philippines, all the other countries had exposure to bonds and other securities .

Figure 44.5. Banks’ exposure to real estate.

Figure 44.6. Banks’ holdings of securities and bonds.

Loretta J. Mester, in, 2008

Also Check: How Much Commission Does A Mortgage Loan Officer Make

What Is A Personal Loan And How Much Can I Get

A loan taken by a person from any bank or financial institution to fulfill personal wishes is called a personal loan. A person can use the money brought in as a personal loan for any work per his wish.

Banks or financial institutions offer their customers personal loans ranging from 50000 to 20 lakhs. If you, too, have ever taken a personal loan or you have taken it in the future, what if you cannot repay it.

Calculation Of Bank Loans

For calculating bank loans, most companies develop an amortization schedule for individual loans with different lenders. We will understand the calculation of bank loans with the help of an example.

An amortization schedule is a complete plan of periodic payments of outstanding debt and loans. Each installment consists of a part of the principal amount and interest due for the current financial period. The tenure of the amortization schedule is the same as the tenure of a bank loan.

Lets take an example of ABC Corporation that owes $300,000, 30-year fixed-rate mortgage with Alfredo Bank. 5% is the fixed interest rate for the tenure of the loan. What will be the periodic payment?

Interest rate = 5% per annum

Interest rate per month = 5 X 1/12 = 0.416%

Monthly payment = $1500

| 298,389.66 | 298,064.18 |

For the monthly payments, multiply the total debt with the interest rate and divide the answer by 12. However, you can also convert per annum interest rate into per month rate as done in the above example.

For the calculation of principal payment, the following formula is used:

Principal payment = Total payment per month [Oustanding loan balance X Interest rate per month)

Principal payment = Total payment per month [Oustanding loan balance X Annual Interest rate/ 12)

Recommended Reading: Can You Do A Va Loan On A Second Home

How Does The Lockbox Help

The clearing account has a non-zero balance . However, the bank account shows the correct balance. You post the collected amounts to respective bank accounts in addition to clearing the appropriate A/R open items of the customers. Now here, if the payment is not sufficient to fully clear an open item, the lockbox processing creates payment advice that is post-processed.

Use TCode- FLB1 to create partial or residual items. Run a batch input to update master records.

Is Loan Repayment Included In An Income Statement

Only the interest portion of a loan payment will appear on your income statement as an Interest Expense. The principal payment of your loan will not be included in your business income statement.

This payment is a reduction of your liability, such as Loans Payable or Notes Payable, which is reported on your business balance sheet. The principal payment is also reported as a cash outflow on the Statement of Cash Flows.

RELATED ARTICLES

Read Also: Drb Refinance Reviews

What Are Bank Loans

When a business entity wants to raise capital for its different capital expenditures, taking a loan from financial institutions against a mortgage is common practice. We can define bank loans as,

Bank loans are contractual obligations of the borrower that he will pay the amount taken from the bank. The agreement takes place when the bank or another financial institution issues finance to the business entity or individual. A bank loan comprises principal amount and interest payment. Interest is a type of fee or compensation for borrowing money from lenders.

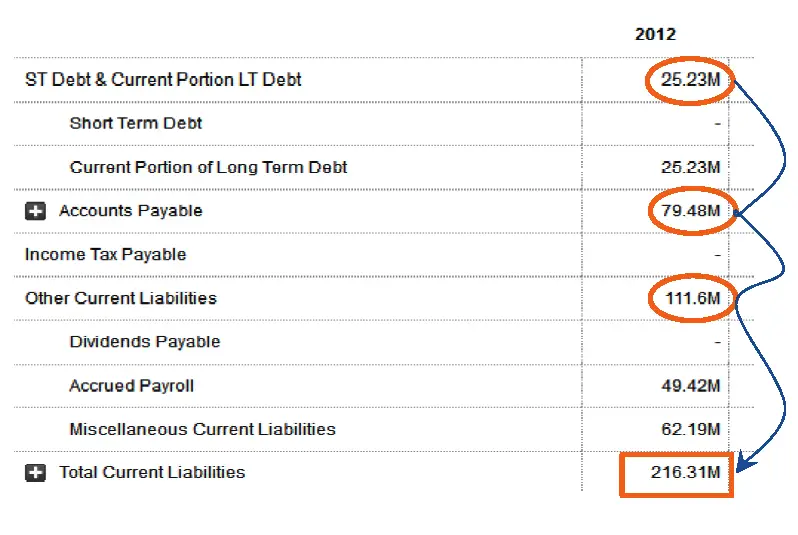

The bank loans are current as well as non-current. The short-term bank loans are often not backed with a mortgage and recorded as current liabilities. Another specification of short-term loans is that they are recorded as the line of credits or bank overdrafts.

In this article, we will talk about bank loans that are long-term liabilities of the companies.

Evaluating Assets And Liabilities Under Relevant Accounting Standards

Financial assets may include commercial paper, mortgage-backed securities, collateralized debt obligations, commercial and residential mortgages, derivative financial instruments, other asset-backed securities, preferred securities, and similar securities. Financial liabilities may include obligations arising under derivative financial instruments and obligations due third-party SPE financial interest holders.17 The Bank must carefully consider the nature of the financial instrument and the intent of the Bank in holding the instrument to determine the appropriate valuation approach. There are three primary GAAP requirements under which these assets and liabilities should be valued:

FASB ASC Topic 320-10 formerly SFAS No. 115, provides general guidance on the valuation of all debt securities and equity securities that have readily determinable fair values. Under FASB ASC Topic 320-10 formerly SFAS No. 115, the debt and equity securities are classified into three categories:

The fair value option can be elected for the following items:

Recommended Reading: Credit Score For Usaa Personal Loan

Empirical Tests Of Bank

Theories of the existence of bank-like financial intermediaries link banks activities on the asset side of their balance sheets with the unique liabilities that banks issue on the liability side of their balance sheets. Such a link is important for establishing what it is that banks do that cannot be replicated in capital markets. As we have seen, these arguments take two linked forms. First, the banks balance sheet structure may ensure that the bank has incentive to act as delegated monitor or information producer. Second, by virtue of holding a diversified portfolio of loans, banks are in the best position to create riskless trading securities, namely, demand deposits.

Two papers, in particular, construct empirical tests of hypotheses about links between the two sides of bank balance sheets. Berlin and Mester look for a link between bank market power in deposits markets and the types of loan contracts that the bank enters into with borrowers.7 Core deposits are those deposits, demand deposits and savings deposits, which are mostly interest rate inelastic. To the extent that a bank has such core deposits, it can safely engage in long-term contracts with borrowers in particular, it can smooth loan rates. Using a large sample of loans from the Federal Reserves Survey of Terms of Bank Lending to Business, they find that banks that are more heavily funded through core deposits do provide borrowers with smoother loan rates in response to aggregate shocks.

How Do You Record A Loan In Accounting

Businesses often need some type of financing in their lifecycle. This financing often comes in the form of a loan from a commercial bank.

These loans can be short-term, where the loan repayment is processed in less than a year or a long-term loan which can be paid back in over a years time. On your business balance sheet your loan will be classified as a short-term or long-term liability.

Here are four steps to record loan and loan repayment in your accounts:

You May Like: Can You Refinance Sallie Mae Student Loans