What Are Va Home Loan Limits For Remaining Entitlement

In some cases, you may have a “remaining entitlement” you can use on a second VA loan. These cases can include having an active VA loan you are still paying back or having fully paid off a previous VA loan for a home you still own. When you have your remaining entitlement, your Certificate of Eligibility will say your basic entitlement is more than $0 but less than $36,000.

Loan limits often apply when you would like to get a VA loan using your remaining entitlement. These VA home loan limits are based on county loan limits published by the Federal Housing Finance Agency. You may also need to make a down payment when you are buying a home with your remaining entitlement. See the VA website for more information.

Va Loan Entitlement And Partial Eligibility

Learn how the VA calculates your remaining VA Loan Entitlement and how it impacts your VA loan benefit.

Every Veteran whos eligible for a VA mortgage enjoys a certain level of entitlement a dollar amount that the Department of Veterans Affairs is willing to repay a lender if you fail to make your payments.

Are you planning to buy a home or refinance with a VA loan? Heres how your entitlement could play a role.

What Is A Va Loan Entitlement

4.1/5VA loan entitlementVA Loan Entitlementloanloanloan

Herein, how do I find out my VA loan entitlement?

A Veterans United Home Loans specialist can help you determine your entitlement. Talk to a loan specialist at 855-870-8845 or start your home loan quote today.

One may also ask, what is the VA loan limit for 2020? Thelimit in 2020 is $510,400 in a typical U.S. county and higher in expensive housing markets, such as San Francisco County. If you’re subject to VA loan limits, the lender will require a down payment if the purchase price is above the loan limit.

Thereof, can you do a VA loan with no entitlement?

VA borrowers without sufficient entitlement may still be able to obtain a VA loan by making a down payment, often for less than what would be required for other types of financing. Plus, VA loans do not carry any type of mortgage insurance.

Will VA loan limits increase in 2020?

In most of the U.S., the 2020 maximum conforming loan limit for one-unit properties is $510,400, an increase from $484,350 in 2019. This represents a 5.38% increase. Loan limits still apply to veterans with more than one active VA loan, only partial entitlement available or those who have defaulted on a previous loan.

You May Like: Capital One Pre Approved Auto Loan Program

What Is A Va Loan

A VA loan is a type of loan backed by the U.S. Department of Veterans Affairs that helps veterans, service members and some eligible surviving spouses become homeowners. Although these loans are generally provided by private lenders like mortgage companies and banks, the VA guarantees a portion of the loan so that lenders can offer those who are eligible more favorable terms.

Table : Other Ways You May Be Eligible For Va Benefits

This table outlines some important exceptions, especially for spouses. For example, an unremarried spouse of a Veteran who died while in service or from a service-connected disability is eligible regardless of his or her late spouses time served.

The spouse of a service member whos been MIA or a POW for at least 90 days automatically gains entitlement.

| Other Eligible Persons |

| Veteran has been POW/MIA for 90 days |

Recommended Reading: Apply Capital One Auto Loan

What Is A Va Funding Fee And How Much Does It Cost

While you dont have to worry about PMI, you do have to pay a VA funding fee. Your VA funding fee depends on the size of your VA loan down payment, and whether its your first-time use of the benefit.

| Down payment | |

|---|---|

| 1.40% | 1.40% |

So, while a VA loan down payment isnt required, it can save you money to make a down payment.

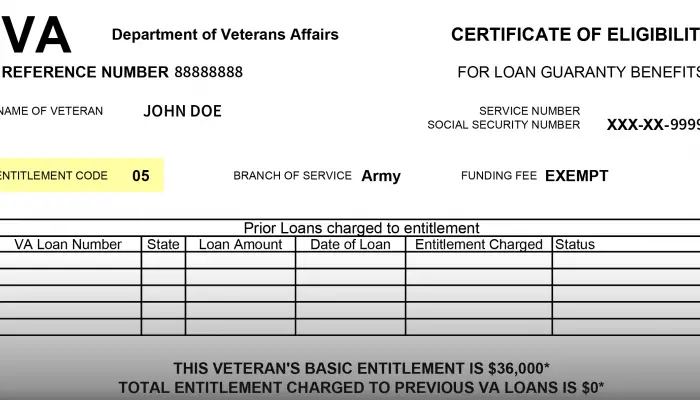

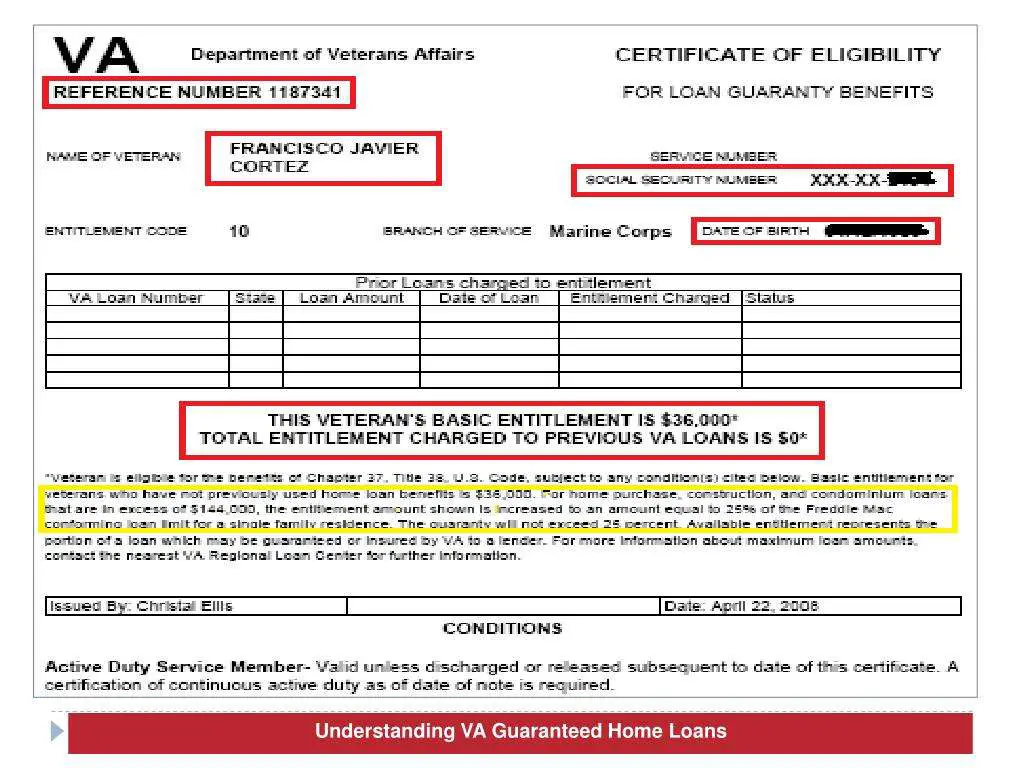

Obtain Your Va Certificate Of Eligibility

You need to show your mortgage lender your VA loan Certificate of Eligibility, or COE, as proof that you’re eligible for a VA loan. If your lender is VA-approved, it may be easier to ask them to obtain the COE for you. Else, you can apply for the document yourself.

If you are applying to get a COE, you’ll need to establish proof of service. The documents you need to submit as proof to obtain a COE vary based on your current status with the military whether you’re an active-duty military member, a veteran, or a surviving spouse.

-

Active-Duty Service Members, National Guards, and Reservists: You’ll need a statement of service signed by your superior officer or an adjunct or unit commander. The statement of service must include your:

- Full legal name

- The date you entered the service

- Information on any breaks or discharges you took from service and

- The name of the commander providing the information.

Veterans: You will need to submit DD Form 214. DD Form 214 is a certificate that verifies your military discharge. You can request your DD Form 214 online by using the eVetRecs filing system.

Discharged National Guard Members: Unlike service members, members of the National Guards unit belong to states, so you will need to contact the National Guard Adjutant General’s office in the state you served in to request documents you need to apply for a COE. These documents are as follows:

Also Check: Usaa Auto Loan Credit Score

Your First Choice Va Home Loans For Refi & Purchase

If you don’t need cash-out, consider refinancing with the VA’s Interest Rate Reduction Refinance Loan . Although you will still have a funding fee, you can’t beat VA loan rates. That is one of the most popular VA home loan programs with service members and veterans.

The other great thing about VA loans is there are no loan limits. So, if you want to buy a higher-priced home, you no longer need a jumbo loan. Now you can get a VA mortgage and take advantage of the less stringent guidelines and incredible rates.

Whether you’re purchasing or refinancing VA mortgages offer flexible guidelines and some of the lowest interest rates available.

To learn more about PenFed loans or what loan is right for you:

How To Calculate Your Entitlement

To figure out how much entitlement is available, follow the VAs instructions that I highlighted on the COE. …the entitlement amount is 25% of the VA loan limit for the county where the property is located.

The national VA loan limit for 2019 is $484,350. So multiply $484,350 by 25% to get your entitlement amount of $121,087.

Mason already used $75,000 of his $121,087 entitlement. To figure out how much he has left over for his next home purchase, subtract $75,000 from $121,087 to get $46,087.

For a thorough explanation and examples of VA entitlement, see How to use VA entitlement for one or more VA Loan.

Also Check: Using Va Home Loan For Investment Property

Are There Limits To How Much You Can Borrow With A Va Loan

In the recent past, full entitlement had limits on loans over $144,000. But as of 2020, if you have full VA entitlement, you wont have a VA loan limit.

A VA entitlement is simply the maximum amount that the government will pay to a lender if the borrower defaults on the loan. As a prospective homeowner, you can borrow as much money as your lender is willing to give you: the VA-backed home loans program doesnt limit how much can be borrowed to finance a home.

However, your situation may be different in that you may have to provide a down payment if you are looking to borrow more than four times your VA entitlement amount. Think of it this way: your VA entitlement plus any down payment you make, must equal at least 25% of the homes purchase price.

Va Loan Limit Example

Lets assume youre currently using $60,000 of your VA loan entitlement and want to purchase a new home in a standard cost county . Because the VA guarantees a quarter of the loan amount, the maximum entitlement in this county is currently $161,800.

Heres how the typical VA loan limit calculations look:

- $161,800 $60,000 in current entitlement = $101,800 remaining entitlement

- $101,800 remaining entitlement x 4 = $407,200

$407,200 represents how much you can borrow before needing a down payment.

In this example, you can purchase a home with $0 down up to $407,200. Anything above that mark would require a down payment equal to 25 percent of the difference between that ceiling and the purchase price.

Read Also: How To Get Approved For Capital One Auto Loan

Read Also: Does Carmax Pre Approval Affect Credit Score

Basic Restoration Of Entitlement

Michelles entitlement code is 05 – Entitlement Restored. Entitlement Restored means she already used her entitlement for a VA Loan, paid off the loan, and asked the VA to restore her entitlement.

You can reuse your VA entitlement indefinitely and buy as many homes as you want using VA mortgages. However, you must pay off the VA loans, sell the properties, and ask the VA to restore your entitlement before you can reuse it.

If you don’t, then you will eventually use up all your entitlement leaving you ineligible for a future VA loan unless you come up with a substantial down payment.

If you plan to use more than one VA Loan, dont let a code 05 limit your eligibility. Borrow a little strategy and know-how from a VA Loan Expert. Contact me for free advice.

How To Calculate The Va Loan Entitlement

So how can you know exactly how much your entitlement will be? First, determine whether you have full or reduced entitlement. If you have full entitlement, you wont need to worry about making entitlement calculations the VA will back however much your lender is willing to lend with no down payment.

If you have reduced entitlement, the VA will back 25% of your loan. To calculate your entitlement, use the following equation:

Loan amount × 0.25 = entitlement youve already used

Don’t Miss: Capital One Auto Loan Private Party

How Is Va Loan Entitlement Calculated

Remember, the VA promises to cover a quarter of the loan amount in most cases.

A quarter of $647,200 is $161,800. In order to meet that mark, the VA essentially created a secondary entitlement amount . That additional layer of entitlement comes into play anytime a Veteran purchases a home for more than $144,000.

» MORE: See if you qualify for a $0 down VA loan

Dont Meet Va Loan Requirements

Dont panic. If you dont meet the requirements for a VA loan, you still have options. Maybe an FHA loan is the right choice for you. Like VA loans, FHA loans have lower down payment requirements and lower interest rates than regular commercial loans. With an FHA loan, you wont be able to put 0% down like you could with a VA loan, but your down payment requirement will be well below what you would need for a conventional loan. Some banks also offer special perks to military customers for conventional loans.

Read Also: Usaa Car Loan Rate

How Much Entitlement Does The Va Provide

Entitlement can be confusing for even the most experienced mortgage professionals. But it really just involves a bit of math. In most areas of the country, basic entitlement is $36,000. Additionally, secondary entitlement is $70,025. Adding those together gives you a total of $106,024 for eligible veterans. In higher cost areas, it may be even more.Additionally, the VA insures a quarter of the loan amount for loans over $144,000. Therefore, you can multiply that entitlement amount, $106,024, by four for a maximum loan amount of $424,100. Thats the total amount qualified buyers could borrow before having to factor in a down payment.

More About Va Loan Entitlements

Since their creation in 1944, VA loans have been backed by the federal government which provides a financial guarantee on every single loan.

The guarantee is like a form of insurance where the VA pledges to repay a portion of the loan if the borrower defaults.

The guarantee is typically 25 percent of the loan and it is reflected in a dollar amount known as VA entitlement.

Your amount of VA home loan entitlement can vary depending on how you have used your home loan benefit.

There are two layers of entitlement, a basic entitlement level and the second tier of entitlement.

The VA loan basic entitlement is valued at $36,000 and the second-tier entitlement is linked to the confronting limits set in your particular county.

If you have never used the benefit before, or if you dont have an active VA loan right now, you are eligible to get a full entitlement.

With a full entitlement, there is no limit on how much you can borrow without a down payment.

The VA loan limits do not apply to the borrowers with their full VA loan entitlement.

This can mean that the borrower should make a down payment or what otherwise is a zero down loan program.

If you have an active VA loan or if you have lost one to foreclosure, you can still look to reuse the benefit this is known as reduced entitlement.

This is a very important point because many veterans think that this is a one-time benefit.

You May Like: Usaa Credit Score For Auto Loan

How To Buy A House That Costs More Than The Maximum Va Loan Guarantee

If you do not have your full entitlement and want to use the VA loan to buy a house that costs more than $144,000, you may need to put make a down payment on the loan. The amount of the down payment will depend on your lenders policies, the cost of your home, the amount you are borrowing, your income, credit profile, debt-to-income ratio and other factors.

If you want to buy a home that costs more than the loan guarantee, you need to make a down payment, usually 25% of the amount above the VA loan limit.

For example, if you want to buy a home that costs $747,200 in a county with a loan limit of $647,200, you would likely need to make a $25,000 down payment .

Larger down payment may be a good idea: You can always make a larger down payment if you have the available funds, and there are some benefits to doing so. For example, a larger down payment reduces your outstanding balance on your home, reduces your monthly payments and reduces the amount of interest you pay over the life of the loan.

Additional loan costs to consider: You still may need to come up with the VA loan funding fee, which the VA charges for guaranteeing your loan. However, the funding fee may be waived for some disabled veterans. Alternatively, you can often roll the funding fee into your loan.

You May Like: Bayview Home Loans

Down Payment Calculation When The Loan Exceeds The Va Limit

Scroll for more

- $800,000$46,937

Though a down payment of several thousand dollars isn’t insignificant, consider the benefit VA loans offer compared to conventional loan products. With conventional loans, borrowers often must make a down payment equal to 20 percent of the purchase price to secure competitive home loan terms and rates, and no mortgage insurance. In the scenario described above, you would be required to make a $100,000 down payment for a conventional loan compared to the $20,750 down payment of a VA loan.

Read Also: Car Refinance Rates Usaa

Whats My Va Loan Limit

That depends. VA loan limits vary by county. In fact, within a single state the limit could differ by as much as $500,000 between counties. Limits are higher in wealthier counties where the cost of living is higher. In most places around the country, the current limit is $424,100. That applies to loans closed on or after January 1, 2017. But limits can top a million dollars in the most expensive counties.

Whats A Va Loan Partial Entitlement

VA entitlement isnt a one-time benefit. If you havent used your full loan entitlement, you may be able to use the remaining portion for a second VA loan in the future. This is called a VA partial entitlement and can allow you to purchase another home without selling your first one. This is common with military members making a PCS.

An important thing to remember with partial entitlements is that theyre often not enough to cover a homes full price. When this is the case, your lender may require a down payment to offset this risk.

You should also prepare for a higher VA funding fee on your second loan. The exact amount will depend on your down payment size, but it will generally fall between 1.4% and 3.6% of the loan total.

You May Like: Upstart Vs Avant

What Is A Va Loan And Who Is Eligible

With the purpose of helping service members finance a home with favorable loan terms, a is a mortgage loan thats guaranteed by the U.S. Department of Veteran Affairs . The main perks of a VA loan is that zero down payment is required, and there is noprivate mortgage insurance).To qualify for a VA loan, you must have a valid Certificate of Eligibility , and you must meet certain income and credit requirements. Length of service, conduct, and duty status can also affect your eligibility.

You may be able to obtain a COE if you belong to any of the following categories: veteran, active duty service member, National Guard member, reserve member, or surviving spouse.