Paying Less Than The Scheduled Amount May Also Inflate Your Balance

Missing or deferring payments on loans will increase the balance, as will paying less than the scheduled monthly amount. Payments cover the interest and fees first before being applied to the principal. Therefore, by paying less, you’re reducing the principal by less while the interest grows.

Roughly 1/3 of all adults aged 25-34 have student loans. Its a crushing debt. Author Scott MacDonald offers solutions to this problem.Education Without Debt: Giving Back and Paying It Forward

What If You Default

You should try to avoid defaulting on your student loans. A default will negatively impact your credit score and your ability to obtain credit in the future. But if you are unable to avoid default, you may have options to help repair your credit and get you back on track. You can consider contacting your servicer to discuss your options and ask them to work with you toward a sensible solution.

While each person’s particular situation is different, below you will find some general information regarding default and your post-default options:

How To Avoid Having To Pay Capitalized Interest

What happens when the interest on your loan is capitalized? In general, it means that you must repay more, sometimes to the point where it becomes unsustainable. To keep capitalized interest from accruing on your loan, you must do two things:

Pay off interest before it is added to your balance by the lender. Also, start paying off your loan while youre still in school, if possible.

Paying off interest before it is added to your balance necessitates making larger monthly payments during the grace period. Increase your repayment amounts to offset any additional interest that may accrue.

Consider making early repayments to avoid accruing loan interest while studying. You can fund this through savings or by working a part-time job while studying. Learning what contributes to your total loan balance early on can save you a lot of money over the life of the loan.

Read Also: Usaa Loan Refinance

Loans With Variable Grace Period:

- PLUS loans

When it is time to begin repaying your student loans, you should explore your payment plan options and choose the one that best fits your needs. You should direct any student loan payments to your loan servicer, who will handle your loan while it is in repayment.

Tip: To find your federal student loan servicer, visit the National Student Loan Data System .

Try to stay current on your payments. If you have difficulty making your scheduled payments, you have other options to explore.

Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness.

Other Reasons A Student Loan Balance May Be Increasing

Other reasons a student loan balance may increase include:

Deferments and Forbearances Many lenders allow struggling borrowers to take a break during repayment. Most lenders also give students a six-month grace period after finishing school. Even though there is no bill due, the interest is still working for the lender and growing the balance.

Payments Requiring Less Than the Monthly Interest Accumulation Sometimes, private lenders allow borrowers to have a temporary reduction in the amount they are expected to pay each month. While this provides a break for borrowers, the interest usually continues to accumulate. Smaller payments help borrowers stay current, but they help the lenders make some extra money from the extra interest.

Extended Repayment Plans Some repayment plans are designed to take 20 years or more before the loan is paid off in full. This means early payments mostly pay down the interest. Borrowers on these plans are paying down their balance, but very slowly. When you add in the interest that grew during school, the total loan balance will often be larger than the original amount borrowed.

Calculation Errors Lenders arent perfect, and its possible that an error has been made. Where the lender made any manual adjustments to the balance, mistakes are especially common. Borrowers should keep copies of loan statements and documents so they can prove any errors. Sometimes filing a complaint with the Consumer Financial Protection Bureau may be necessary.

You May Like: Gustan Cho Mortgage Reviews

Changes To The Public Service Loan Forgiveness Program

On October 6, 2021, the Department of Education announced temporary changes to the Public Service Loan Forgiveness Program. The benefits from those changes are available until October 31, 2022 and include:

- A limited waiver that allows PSLF credit for all payments on federal loans made by student borrowers to count toward PSLF, regardless of the kind of federal loan, or payment plan you were on.

- For borrowers with at least one FFEL, Perkins, or non-Direct loan, you will need to consolidate your loans prior to October 31, 2022 for those previous payments to be counted.

- To find out more about loan consolidation please visit StudentAid.gov/Manage-Loans/Consolidation.

It is important to note that these benefits apply only to federal loans taken out by students , and you will still need to have worked or are working full time at a qualifying employer to be eligible for PSLF.

You may need to take action, such as consolidating your loans or applying for PSLF forgiveness or certified employment, prior to October 31, 2022. For more information, please visit StudentAid.gov/PSLFWaiver and the Student Aid Public Service Loan Forgiveness page.

If you are unsure what kind of federal loans you have, you can log into your account on StudentAid.gov.

Consider A Shorter Repayment Term

When youre choosing a repayment term, its important to consider how that will impact your total loan balance. A shorter repayment term typically comes with higher monthly payments, but youll limit the amount of interest you accumulate and pay down debt faster.

On the other hand, a longer-term repayment term usually requires lower monthly payments, but this also means accumulating more interest charges over time. So make sure to choose the option that works best for you and your financial situation.

Don’t Miss: The Mlo Endorsement To A License Is A Requirement Of

What Makes Your Loan Balance Ascend

As a rule of thumb, lenders plan the repayments so that, over time, the outstanding balance goes down. And how fast you repay the loan depends on the loan term. The standard term for federal student loans is 10 years and for private loans is 5-15 years.

Certain factors can defer the loan repayment progress, and these are as follows:

Pay Off Your Most Expensive Loans

When repaying a loan, always start with the most expensive one. That is most likely your student loan for the majority of people .

Remember that you cant get rid of student loans, even if you declare bankruptcy, so repaying them as soon as possible is a top priority for your financial security. In some cases, prioritizing your student debt over all other loans may be worthwhile.

One More Piece of Good News

When you dont know what increases your total loan balance, the majority of your payments will be used to pay interest, with only a small portion used to reduce the principal balance.

However, as the balance decreases, so does the monthly interest that accumulates. This means that with each passing month, the same student loan payment will go further toward paying off the principal balance.

Just as setbacks can cause a student loan balance to spiral out of control, so can positively progress.

Read Also: Chfa Loan Colorado

How To Avoid Paying Capitalized Interest

What happens when interest is capitalized on your loan? Generally, it means that you have to pay back more, sometimes to the point where it can become unsustainable.

There are two things you need to do to avoid capitalized interest from accruing on your loan:

Paying off interest before the lender adds it to your balance requires making higher monthly payments during the grace period.

If you increase your repayment amounts, you can offset the additional interest you might accrue.

To prevent loan interest from building up as you study, also consider making early repayments. You can do this either out of savings or by getting a side job while you study.

Learning what increases your total loan balance early on can wind up saving you large sums of money over the life of the loan.

Prioritize Federal Options For Student Loans

Federal student loan options often have lower rates and better protections than private loans, so they’re a good option to reduce overall loan costs. Federal student loan relief programs like Public Service Loan Forgiveness can help you get all of your loan debt forgiven if you work in the public sector and make qualifying monthly payments for 120 months.

To avoid student loans altogether, see what federal aid you qualify for in the form of grants, scholarships, and work-study, all of which don’t have to be repaid.

You May Like: Nslds Ed Gov Legit

Become A Repaye Plan Member

If youre on a federal income-driven plan, and your monthly payments are below the interest charged on your loan, sign up to the REPAYE plan.

This forgives 50% of the unpaid interest to be capitalized each month, making your loan more manageable. For instance, if the interest on your balance is $100 per month, this facility will lower it to $50.

What Causes Your Student Loan Balance To Increase

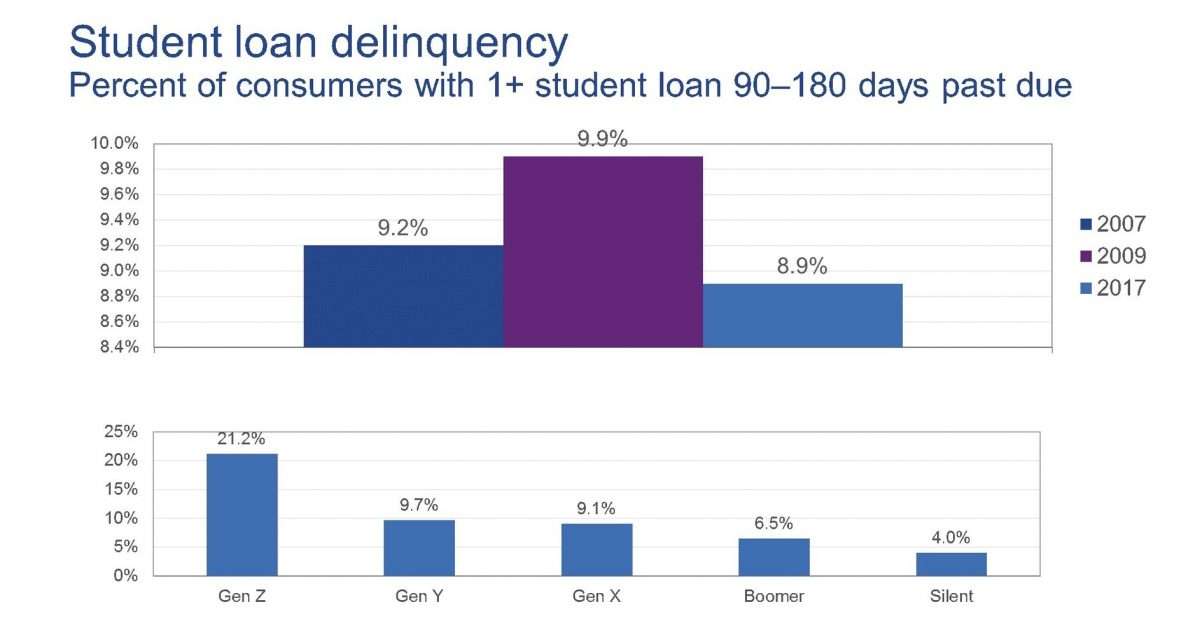

Federal and private student loans are like any debt you finance: the longer you take to pay, the more interest piles, and the more you eventually pay. But student loans also have unique qualities that make it more common for people to owe much more than they borrowed despite making payments for years.

Roughly 10% of all student loan borrowers saw their debt quadruple a decade after they left school, according to a recent analysis by economist Marshall Steinbaum. There are three reasons your student loan balance can increase despite making payments for years.

First, interest accrues daily, starting the day the loans are disbursed. If you have a subsidized loan, the federal government will pay your interest while your loans are deferred. But if you have an unsubsidized loan, you will be responsible for the interest over the life of the loan. Read more about subsidized vs. unsubsidized student loans.

Second, the unpaid interest is capitalized, which means itâs added to the principal amount when you pause monthly payments with deferment or forbearance, while your loans are in a grace period, or you switch plans. In other words, youâll pay interest on the accrued interest. Read more about capitalized interest on student loans.

Learn More:Why Are Student Loans So High?

You May Like: 600 Fico Score Auto Loan

Public Service Loan Forgiveness

If you work in public service, you may be able to have part of your federal student loan debt forgiven. Qualifying public-interest jobs include government service, military service, law enforcement, public health, and certain teaching positions.Public service loan forgiveness is not automatic. You must apply for loan forgiveness once you have made 120 qualifying payments. And To qualify you must:

- Have a Direct Subsidized or Unsubsidized, Direct PLUS, or Direct Consolidation Loan that is not in default.

- Make 120 monthly payments after October 1, 2007.

- Pay under the IBR, ICR, standard , or other qualifying plan.

- Be employed full-time in a public service job during the period in which you make each of the 120 payments.

Perkins and FFEL loans are not eligible for public service loan forgiveness. However, you can consolidate these loans into a Direct Consolidation Loan to take advantage of public service loan forgiveness. Payments made prior to consolidation do not count toward the 120 qualifying payments.Tip: Any amount forgiven under the public service loan forgiveness program is NOT taxable as income.

See StudentAid.gov for more details on whether you qualify for public service loan forgiveness

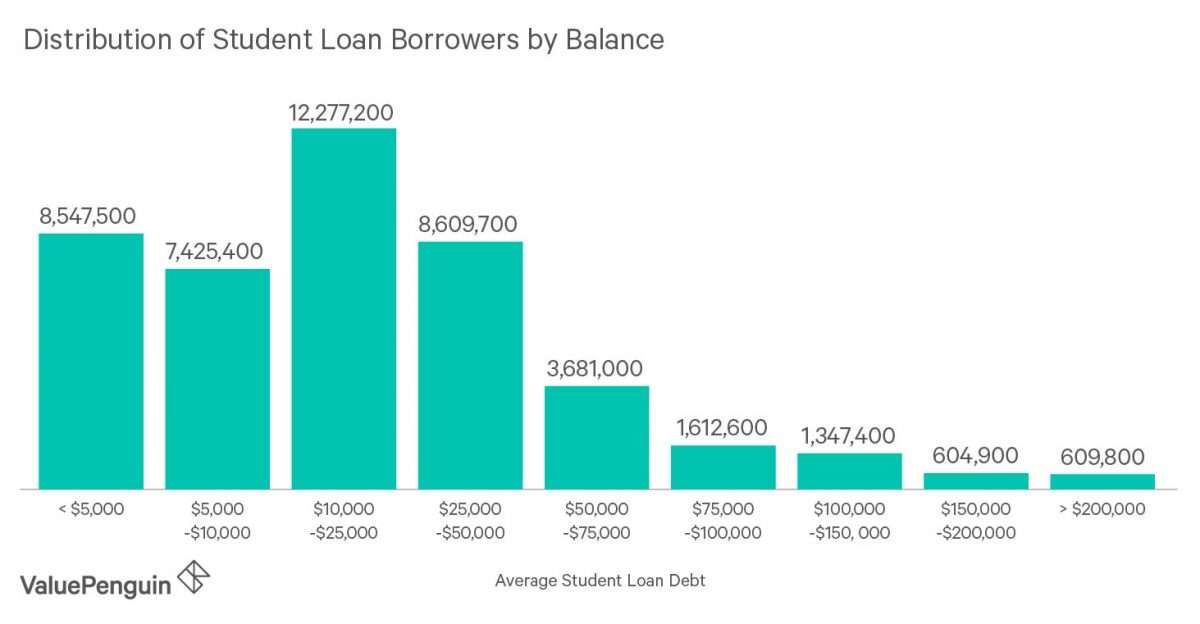

Average Debt Situation In Us

As of March 2020, the average American had $90,460 in personal debt, excluding mortgages. This includes debt from student loans, credit cards, car loans, and personal loans. The average debt per borrower has been rising steadily for the past few years and is now at its highest point ever. The average credit card debt per household is $8,398, while the average student loan debt is $48,172. Car loans and personal loans make up the rest of the average debt load.

While the total amount of debt has been rising steadily, the rate of growth has slowed in recent years. In 2010, the average American owed $53,000 in personal debt, which means that the total debt load has increased by almost 75% in just 10 years. The rapid increase in debt is likely due to a variety of factors, including rising tuition costs and a decline in incomes. As the cost of living continues to rise, its likely that the average American will continue to carry more debt.

Read Also: Can Mortgage Lenders Verify Bank Statements

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

Why Is My Student Loan Balance Increasing

There are several explanations for why a student loan balance would go up even though the borrower has made payments.

Increasing student loan balances are a very real and very frustrating problem.

We frequently receive emails from borrowers who have much larger balances on their debt than what they originally borrowed. This issue is so common that nearly half of all student loan borrowers have an increased balance after 5 years. In some cases, missed payments and late fees can explain the larger balances. In many cases, however, the borrower hasnt done anything wrong, yet the balance still increased.

Here, well look at ways a student loan balance can increase and review some strategies to prevent it from happening.

Recommended Reading: Co-applicant In Home Loan

Choosing A Payment Plan With A Longer Term

Loans with extended payment plans will last 20 years or more before being paid off in full. These typically reduce the loans size over time, but at a much slower rate.

When you pay over a longer period of time, you end up owing lenders a lot more interest. As a result, your monthly payments will be lower, giving you more disposable income today.

Again, if you fail to make payments on an extended plan, your total loan balance may increase. This is because, for the first few years, payments typically only cover interest plus a small amount extra.

Missing even one payment per year can put you back where you started.

What If My Grace Period Expires Before I Go On To Graduate School

When your grace period expires, payment is due. In order to suspend your payments, the school where you obtained your Perkins Loan, as well as the loan servicer of your Direct/Stafford Loan, must receive verification of your enrollment. Please see the Bruin Dollars and $ense How To File a Deferment page for more details. If in the mean time you are still unable to pay, please contact your servicer directly to inquire about deferment options.

Don’t Miss: Aiq Ellie Mae

What Increases Your Total Loan Balance As A Student

What Increases Your Total Loan Balance as a Student?, What Increases Your Total Loan Balance as a Student?

ADS! Download JAMB CBT Premium Past Questions and Answers here today

What Increases Your Total Loan Balance

The quest to find what increases your total loan balance is a crucial one. This article will help you pinpoint what youre doing wrong and thereby increasing your loan balance.

Standard Direct And Ffel Loan Repayment Plan

Applies to:

- Direct Subsidized and Unsubsidized Loans

- FFEL Stafford Subsidized and Unsubsidized Loans

- All PLUS Loans

- At least $50 per month

- Fixed amount

- Requires the highest monthly payments

- The borrower will pay less interest over time in comparison with other repayment plans

Some longer-term repayment plans such as the Extended Repayment Plan and the Graduated Repayment Plan allow you to make smaller monthly payments by extending your repayment term. Extending the repayment term generally increases the cost of the loan over time.

Don’t Miss: Golden1 Car Loan

Biden Administration Extends Student Loan Relief Through January 31 2022

President Biden has announced a final extension of the student loan relief covered by the federal CARES Act. Borrowers will receive notification about this final extension and information about how to plan as the end of the pause approaches and payments restart in February 2022.

You should take steps NOW to get the greatest benefit from the current relief and to prepare for repayment.

Continue

Benefits Of Paying A Student Loan With A Credit Card

When you make student loan payments with a credit card, you may:

- Enhance your payment history. If you make timely student loan payments with a credit card then pay off the card balance on time, you can get more positive payments on your credit history.

- Diversify your credit mix. A mix of loan types and credit is better for your credit score than a more homogenous borrowing portfolio.

- Potentially gain rewards through your credit card. If you have a rewards credit card, you may accrue rewards by adding student loan payments to your card balance. Be sure to verify with your credit card provider to make sure if you do pay off your student loans via the credit card, you earn points for this expense.

You May Like: How To Get Out Of Auto Loan