Qualifying For A Conventional Loan

Your creditworthiness or ability to repay your loan is factored in determining the interest rate. This is the reason why your credit score and history must uphold satisfactory records: it reflects low risk of defaulting on a loan. Lower credit scores, on the other hand, are assigned higher rates because they pose greater risk to lending institutions.

Generally, you may have difficulty qualifying for a conforming conventional loan if your financial records reveal the following issues:

- If you’ve experienced foreclosure or bankruptcy in the last 7 years

- Having less than 10% down payment

- Back end debt-to-income ratio over 43%

There are two important DTI ratios:

Front-end ratio

The percentage of your monthly income that go toward housing costs . Historically a ratio below 28 percent has been considered great.

Back-end ratio

The percentage of your earnings that go toward your home related expenses along with paying off all your other debt payments . Historically a ratio below 36 percent has been considered great.

Your back end debt-to-income ratio is estimated by dividing all your monthly debt payments and home-related expenses by your gross monthly income. The result is the percentage of your income that goes to paying debts. The lower your DTI, the higher your chances of securing a mortgage.

The table below summarizes requirements you’ll need to meet to qualify for a conforming conventional loan:

I Live Outside The Continental Us Is My Loan Limit The Same

No, your maximum conventional loan amount isnt the same. Alaska, Hawaii, Guam, and the U.S. Virgin Islands are designated high-limit areas, and therefore have limits 50% higher than the nationwide baseline limit of $647,200:

- Single-family home: $970,800

Pros Of A Collateral Mortgage

- Easy To Borrow Money The main advantage of a collateral mortgage is that it will likely be easier and more affordable to borrow money in the future from your current lender.

- Avoid Fees Because you dont have to refinance the mortgage, you wont have to pay any fees associated with paying a real estate lawyer that would be required if you had to refinance your mortgage.

For some ways of making money with real estate, check this out.

Read Also: Car Loan Interest Rates Credit Score 650

What Do These Changes Mean For Prospective Homebuyers

If youre planning on purchasing a home priced below half a million dollars, conforming loan limits have no impact on your life. However, if you have your eye on a property above the previous limit, you will now be able to purchase the home with a conventional mortgage, as opposed to a jumbo mortgage.

This is great news for anyone who wants to purchase a highly-priced home but doesnt want to jump through the extra hoops required to secure a jumbo mortgage. A conventional mortgage will almost certainly come with a lower interest rate and require smaller down payments than a jumbo mortgage because conventional mortgages are considered less risky investments by lenders. With these new limits in place, it could be easier than ever to secure the home of your dreams.

You May Like: What To Do If Lender Rejects Your Loan Application

How Do Conventional And Collateral Mortgages Compare

The biggest difference between a collateral mortgage and a conventional mortgage is in the terms and conditions. Essentially, lenders are able to write in a higher interest rate with a collateral mortgage compared to what was initially offered to borrowers.

With a conventional charge, only the amount of the home loan is registered against the property. If you borrow $400,000, for instance, your lender would register $400,000 as a liability on your home. With a collateral charge, on the other hand, an amount higher than the home loan can be registered against the property.

Want to know what a Cash Back Mortgage is? Look here.

Read Also: Sss Loan Requirements

Conventional Loans Vs Government Loans

To decide whether conventional loans are suitable for you, you should also consider whats on the other side of the table government-backed loans.

Government-backed home loans are offered and guaranteed by the federal government, specifically the Federal Housing Administration and the Department of Veterans Affairs .

The most significant difference between conventional and government-backed loan types boils down to who assumes the risk. With conventional loans, the lender assumes the risk in case youre unable to pay. Thats why theyre motivated to make sure that youre financially stable, or at the very least, have some collateral in case you default.

In contrast, if you default on a government-backed mortgage, the federal agency that offered the loan will pay the lender on your behalf.

The other advantage of government-backed loans is that they have less strict requirements. They often do not have credit history checks, so individuals who may be barred from getting a conventional loan may get approved for a federal-backed loan. Government loans also have attractive features like flexible payment plans and lower interest rates.

However, because of these advantages, it can be much more challenging to get a government-backed mortgage. They offer fantastic deals, so the competition for government loans is fierce and the application process long. There are also other eligibility rules in play for which you may not qualify.

More Money Down Can Improve Interest Rates

If a friend asked you to borrow money so they could buy a $1,000 new iPhone, would you feel better knowing your friend had saved $400 to put toward the purchase? That way, theyd be investing some of their own money and wouldnt be asking you to front the entire cost of the phone.

Mortgage lenders tend to approach home loans in a similar way. They know homebuyers who put down 10% are less likely to fall behind on payments.

Lower risk to the lender can translate into lower interest rates for you. And even a slightly lower rate can save you thousands of dollars over the life of the loan.

You May Like: Fha Loan Refinance

How To Get A Jumbo Loan

Many lenders have suspended their jumbo loan program during the COVID-19 pandemic.

Mortgage companies put more on the line with these loans than with other sorts and many lenders are more risk-averse during uncertain times.

But dont let that put you off. If youre a reasonably strong borrower, you still stand a good chance of getting your application approved. You just have to search farther afield to find the lenders still offering jumbo loans.

While youre shopping around for your jumbo loan, be aware that the variations between different lender mortgage rates can be wider for jumbo loans than for other types of mortgages. So be sure to explore the market widely to find your best deal.

Peter Warden

MyMortgageInsider.com Contributor

Many Lenders Have Announced Increases In Their 2022 Conforming Loan Limits For California

Increased home prices and higher demand for more homes fueled a major surge in not only home values but also conforming loan limits. Government regulators realized the changes that were necessary to make homeownership possible for more borrowers. As a result, California 2022 conforming loan limits are increasing as much as $75,000, bringing the maximum loan limit to $625,000.

| 1 Unit | |

| 2021 Baseline National Conforming Loan Limit | $548,250 |

| $1,202,000 |

With the recent run-up in-home price appreciation affecting many markets throughout the country, we wanted to step in and provide support for borrowers, said Kimberly Nichols, Senior Managing Director of Broker Direct Lending at PennyMac. This will specifically help those trying to purchase a home or access equity in their property while rates are relatively low.

The industry is also predicting an increase for high-cost areas such as LA County and Orange County in California to be raised from $822,375 to $937,500 in 2022.

Even though the increase isnt official yet, several lenders have jumped the gun and are already writing loans exceeding the 2021 conforming loan limit of $548,250.

Higher conventional loan limits are on the horizon, and we may even be able to find you a lender that is already using the 2022 conforming loan limits.

We will continue to update this page as more information comes out on the 2022 California conforming loan limits.

Read Also: Apply For Avant Loan

Read Also: Auto Loan 650 Credit Score

Conventional Loan Limits Explained

Most conventional loans are conforming loans, meaning they conform to certain requirements set by the Federal Housing Finance Agency .

Among those requirements are loan limits, or the maximum amount for which a lender can approve a borrower in a given area.*

The FHFA sets limits according to the median home price in an area, so you can actually see serious differences even within the same state.

The FHFA sets limits according to the median home price in an area, so you can actually see serious differences even within the same state.

For instance, a home near Los Angeles is eligible for a higher conventional loan than in northern Californias Humboldt County. Thats because home prices are different in these areas.

Any time youre buying in an expensive market, such as Los Angeles, San Francisco, Denver, or other major metropolitan areas, loan limits could be higher.

The FHFA sets loan limits annually, which means that if home prices go up, so will the limits.

And in 2022, loan limits went up more than they have in any time in history. Read on to find out more.

Conventional Loans And Mortgage Insurance

Private mortgage insurance is a type of mortgage insurance unique to conventional loans. Like mortgage insurance premiums do for FHA loans, PMI protects the lender if the borrower defaults on the loan

Youll have to pay PMI as part of your mortgage payment if your down payment was less than 20% of the homes value. However, you can request to remove PMI when you have 20% equity in the home. Once youve reached 22% home equity, PMI is often removed from your mortgage payment automatically.

Unlike mortgage insurance for FHA loans, PMI offers different payment options. Borrower-paid PMI, or BPMI, does not require an upfront cost. Depending on the lender, you can request to have it canceled once youve reached 20% equity in your home. In most cases, its automatically removed once you reach 22% equity.

Lender-paid PMI, or LPMI, is paid for you by your lender. The lender will raise your mortgage interest rate to incorporate the insurance payment they make on your behalf. This option may result in lower payments, but its typically not cheaper over the life of the loan. LPMI cant be canceled because its built into your interest rate.

Read Also: Does Upstart Require Collateral

More Money Down Can Make Qualifying Easier

With so much demand for mortgages in todays market, lenders and the GSEs can tighten their qualifying ratios, making it harder to qualify for a conventional loan if you meet only the minimum requirements.

With so much demand for mortgages in todays market, lenders and the GSEs can tighten their qualifying ratios, making it harder to qualify for a conventional loan if you meet only the minimum requirements.

Benefits Of Staying Within The Conforming Loan Limits

- Lower APR: The primary advantage of a conforming loan is the lower Annual Percentage Rating . The APR on a loan indicates how much a loan will cost you and includes the fees that lenders will charge you to originate your loan. Therefore, a lower APR will affect the fees and interest that youll pay on your loan, thus resulting in lower monthly payments and less money spent over the life of the loan.

- Lender preference: In addition to saving money, traditional lenders prefer to work with mortgages that fall within the conforming loan limits. Fannie Mae and Freddie Mac insure these loans, so theyre safer for the lender to sell. Theyre also easier for lenders to sell because they follow so many regulations.

- No residency restrictions: Conforming loans through Fannie Mae and Freddie Mac arent restricted to primary residences. This means that if youre in the market for a second home or investment property, you may be able to take out a conforming loan permitting that you meet the necessary qualifications.

You May Like: Www.lowermycarloan.com

What Are Conventional Loans

Conventional loans are not guaranteed or insured by the Veteran’s Administration or Federal Housing Administration . The majority of conforming conventional loans abide by the mortgage guidelines established by the government-sponsored entities known as Fannie Mae and Freddie Mac .

Conventional mortgages with less than 20% down require private mortgage insurance. Since conventional loans are not insured by the federal government, there is no guarantee for the lender should the borrower default. These loans are considered higher risk for lenders and generally have more restrictive underwriting guidelines.

Conforming conventional loans:

- Loan amounts up to $647,200

- No mortgage insurance required with 20% or more down payment

- Can put down as low as 3%

- Guidelines differ slightly between Fannie Mae and Freddie Mac

Jumbo loans:

- Loan amounts greater than $647,200 and up

- Jumbo guidelines vary from Fannie Mae & Freddie Mac and are typically stricter

- Can require more documentation

- As low as 20% down

- Most require a manual underwrite which is the strictest underwriting approach today

A few benefits of a conventional mortgage:

Resources

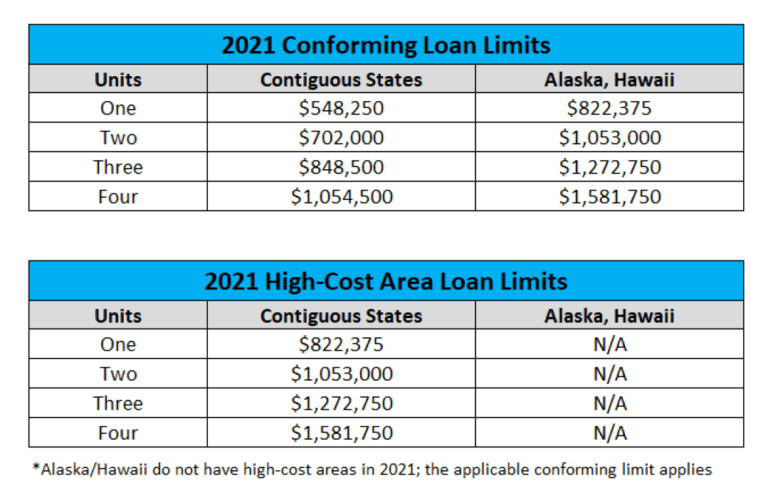

Conforming Loan Limits For 2021 Explained

When buying a house, a conforming loan can be advantageous because it meets specific criteria and will have lower interest rates than nonconforming loans. However, conforming loans must meet several requirements, the most important being the conforming loan limit.

In this article, well discuss conforming loan limits, how they work and the 2021 conforming loan limits.

Read Also: Fha Title 1 Loan Lender

Jumbo Vs Conforming Loan: What’s The Difference

From big and small to high-interest and low-interest, mortgages come in all shapes and sizes. The two most common types are jumbo, or non-conforming, and conforming. To understand the difference between the two, let’s touch on federal loan limits.

The Federal Housing Finance Agency sets conforming loan limits annually. Loan limits determine whether mortgages are eligible for purchase by Fannie Mae and Freddie Mac. Mortgages that fall within these limits are considered conforming. Mortgages that fall outside these limits are considered non-conforming.

The government uses two businesses Fannie Mae and Freddie Mac to purchase conforming mortgages. That makes regular mortgages less risky for lenders to issue. But what happens when you need a house that costs more than the limit?

Some lenders will let you take out a jumbo mortgage. These are non-conforming mortgages used to finance mortgages over the FHFA loan limit. These mortgages are typically kept by the lender and are not guaranteed or insured, which makes them riskier. Every jumbo lender will have its own standards for making these loans.

New 2022 Conventional Loan Limits

New 2022 conventional loan limits wont be released until January but were honoring them now so you can start taking advantage!

- $647,200 for regular one-unit conventional loans

What Are the Advantages of Conventional Loan Financing?

There are several benefits of conventional financing, including the following:

- You can buy a primary home residence, second home, or rental property with most conventional loans. Government Loans do not allow this

- You have the choice of fixed rates, adjustable rates , and loan-term options from 10-30 years

- Down payments as low as 3% with our traditional conventional options, 97% loan-to-value

- You pay no monthly mortgage insurance with a down payment of 20% or more

- Mortgage insurance may be cancelled when your home equity reaches 20% of the original appraised value

Fannie Mae and Freddie Mac guidelines establish the maximum loan amount, borrower credit and income requirements, down payment, and suitable properties. Fannie Mae and Freddie Mac announces new loan limits every year.

10 Year and 15 Year Loan OptionsA great loan term to payoff your mortgage quickly! These loans accumulate equity very fast but, come with a higher payment. The main advantage of these terms is the lower interest rate. The offer the lowest of any mortgage and are ideal if you can afford the monthly payments. If you are looking to own your home and payoff the debt quickly a 10 year or 15 year mortgage is the best option.

Recommended Reading: Usaa Credit Score For Mortgage

Benefits And Drawbacks Of A Conventional Mortgage

The most significant benefit to buyers with a conventional mortgage is the fact that they have more equity in the home right away because of the larger down payment. This equity gives homeowners greater access to useful financing tools, such as HELOCs.

Homeowners indeed save money on the insurance payments necessary for a high-ratio mortgage however may lose out in other ways. Although the higher the down payment a buyer pays, the more equity the lender has access to in the event of a default, lenders typically do not benefit from insurance with conventional mortgages.

In this sense, some borrowers can obtain a lower interest rate with a high-ratio mortgage than a conventional one given that lenders see the added insurance as reducing overall risk. This is why its extremely important you speak with a mortgage professional about your specific situation before making a decision.

As high-ratio insurance companies have an important say on any mortgage loans approved above 80 percent, conventional mortgages can sometimes be arranged for those with less than perfect credit or income situations. CMIs mortgage brokers have increased negotiating power in situations where at least 20 percent equity is available.

Despite the various ways that you can benefit from a conventional mortgage, there are certain things you will need to consider. Coming up with 20 percent of a homes value for a down payment is sometimes not feasible for prospective homebuyers.

How Conventional Loan Rates Compare

While conventional mortgage rates are relatively low compared to alternative home loans, they typically arent as low as some government-backed mortgages.

Whats more, conventional mortgages may be more expensive than government-backed loans for borrowers who arent able to put 20% down because theyre required to buy private mortgage insurance. This insurance typically adds 0.5% to 1% to the cost of the loan every year, which is higher than mortgage insurance required by FHA and USDA home loan programs.

If you have a credit score of 700 or higher, a debt-to-income ratio of 35% or lower, and a 20% down payment for your loan, a conventional mortgage may be your best bet. If your credit score is lower than 640 or you cant put 20% down, you may want to consider an FHA or USDA loan instead.

Recommended Reading: Usaa Proof Of Residency Request Form