Fha Loan Down Payments

Your down payment is a percentage of the purchase price of a home and is the upfront amount you put down for that home. The minimum down payment youre able to make on an FHA loan is directly linked to your credit score. Your credit score is a number that ranges from 300 850 and is used to indicate your creditworthiness.

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans. A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them.

Note that cash down payments can be made with gift assistance for an FHA loan, but they must be well-documented to ensure that the gift assistance is in fact a gift and not a loan in disguise.

Quicken Loans Best For Customer Satisfaction

For 10 years running, Quicken Loans has earned the distinction of the top Primary Mortgage Origination company in customer satisfaction from J.D. Power. Homebuyers can apply for an FHA loan through the company completely online or over the phone with an expert loan officer. Quicken also offers no down payment loan options in case youre not completely sure if an FHA loan is the right fit for you.

How Low Arefha Mortgage Rates

FHA loans havevery competitive rates, at least on the surface.

Looking atloan options side by side, you might note that FHA mortgage rates are close toconventional rates. Usually theyre even lower.

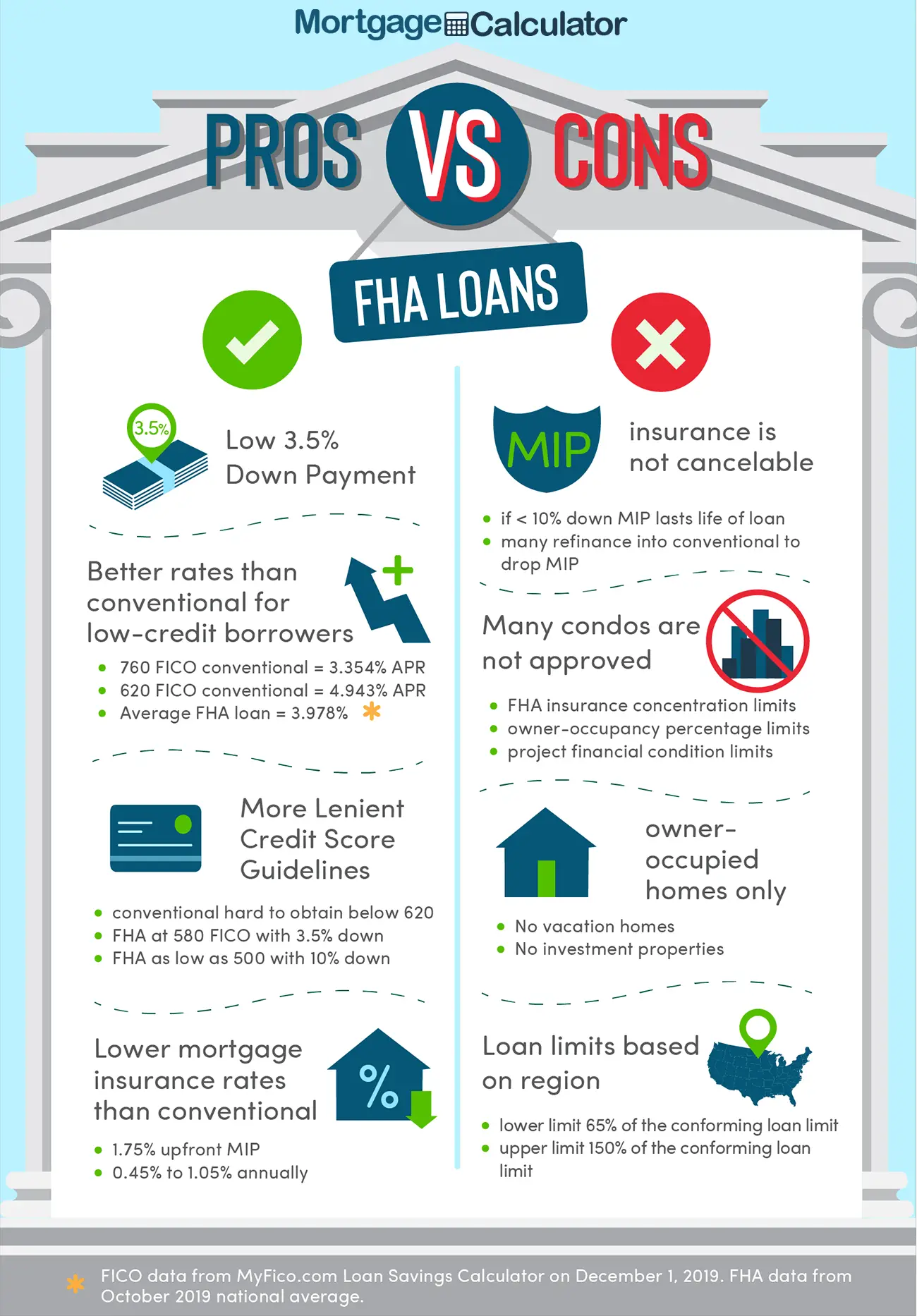

However,theres a big caveat to those low FHA interest rates. And thats mortgageinsurance.

Mortgage insurance premium or MIP is required on all FHA loans. It costs 1.75% of the loan amount upfront and 0.85% per year . This effectively increases the rate youre paying by nearly a full percentage point.

Mortgageinsurance isnt the same as interest, of course. But it affects the overallcost of your loan.

Dont think FHA borrowers are being singled out. Nearlyeveryone with a down payment smaller than 20% has to pay some form of mortgageinsurance, though its called private mortgage insurance on conforming loansfrom Fannie Mae and Freddie Mac.

When youre shopping for rates, you should explore all youroptions and pay attention to the cost of mortgage insurance as well as your mortgagerate.

If you have a higher credit score with less than 20% down, youre may find conventional PMI much cheaper. But if your score is in the 580 to 620 range, an FHA loan is likely your best option.

Read Also: How To Qualify For Loan Modification

Conventional Loan Interest Rates

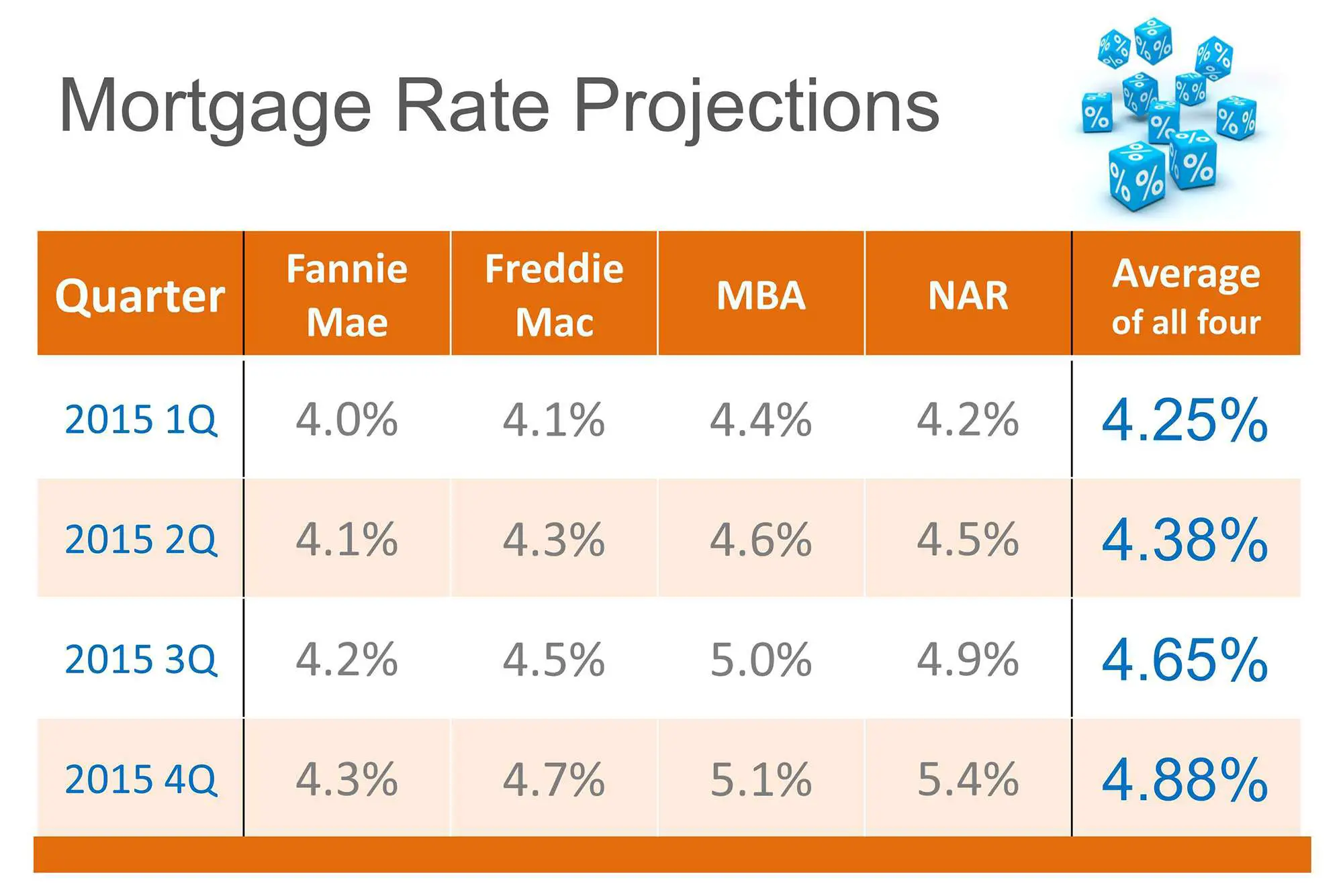

Conventional rates usually beat FHA loan interest rates by a small amount. Like FHA loans, your rate depends on your qualifying factors. The more positive factors you present, the lower the interest rate youll get.

Its always best to shop around to find the best interest rate. Getting at least three quotes should help you secure the right rate.

What Is A Rate Lock

Since FHA mortgage rates fluctuate often, it’s not uncommon for the rate you’re quoted to change by the time you close on the home. A rate lock prevents this by freezing the interest rate you’ve been offered for a set period of time, so you can find a home and close on the property.

Rate lock-in offers vary by lender, but they generally come in 30-, 45-, 60- or even 90-day periods. This number represents how long your rate is locked in and guaranteed for. Some lenders offer free rate locks, while others charge a fee. Fees are generally higher the longer the rate lock period lasts.

It’s usually best not to lock your rate until you’ve found a property . If you lock too early and are unable to close on your home, you may have to pay expensive extension fees or, worse, re-apply for the loan altogether.

Read Also: How To Find Student Loan Number

What Are Fha Mortgage Insurance Premiums

FHA loans are guaranteed by the Federal Housing Administration which reduces the risk for mortgage lenders allowing them to lower their credit score and down payment requirements. The FHA program is funded by mortgage insurance premiums.

|

⢠Down payment of 10% or more MIP duration is 11 years |

|

⢠Down payment of less than 10% MIP is required for the life of the loan |

The MIP rate depends on the down payment, loan amount, and loan term. For most FHA borrowers with 3.5% down the MIP rate is 0.85%.

A Credit Score Of 500 Or Above

A credit score of 580 and above will allow for aminimum down paymentof 3.5%.

A credit score between 500 and 579 will require a minimum down payment of 10%

FHA loans are one of the few mortgage loans that allow for such low credit scores making them the only alternative available for some borrowers. It is also important to note that with a lower credit score, there will be less negotiating power when the interest rate is being determined by the lender of the FHA-insured loan.

* * A credit score is a number between 300850 that depicts a borrower’s creditworthiness. A higher score signifies a better ability to repay lenders and debtors in a timely manner. A credit score is based on several factors such as the number of open accounts, total levels of debt, and repayment history, etc. The most common credit score in the US is the FICO credit score.

Also Check: Can I Refinance My Sofi Personal Loan

When A Conventional Loan Makes Sense

Each situation is flexible, but your qualifications or preferences should be close to these if you want to try for a conventional loan:

- Your credit score is at least 620.

- You have a down payment equal to at least 3%, or 20% if you want to avoid PMI.

- You have a low debt-to-income ratio, or DTI, which compares your monthly debt payments to your monthly gross income.

- You want flexible repayment terms.

Fha Loans Vs Conventional Loans

*The percentages show the market shares of each home financing option. Cash purchases of homes are responsible for 11% of the overall home financing. The diagram uses data from 2019.*

FHA loans are provided from institutions which have been approved by the FHA and are guaranteed by the Federal Housing Administration whereas conventional loans are provided by private institutions.

Conventional loan interest ratesare typically a little higher than FHA mortgage rates.Thats because FHA loans are backed by the Federal Housing Administration, which makes them less risky for lenders and allows for lower rates. Todays average FHA rates are as low as 2.25%, while conventional rates are as low as 2.875%. However, if you have a great credit score you might qualify for a lower conventional rate.You also have to consider the annual mortgage insurance rate with each loan.Depending on your credit score and down payment, conventional mortgage insurance rates could be higher or lower than FHA insurance rates. This will affect which loan is cheaper overall.

Check out ourConventional vs FHA Loanspage for more information.

The following table highlights the key differences between FHA loans and conventional loans.

| FHA Loan |

|---|

There are advantages and disadvantages to both loans as shown in the table.

Also Check: Va Manufactured Home 1976

Today’s National Fha Mortgage Rate Trends

For today, Sunday, September 12, 2021, the national average 30-year FHA mortgage APR is 3.640%, down compared to last weeks of 3.710%. The national average 30-year FHA refinance APR is 3.660%, down compared to last weeks of 3.720%.

Whether you’re buying or refinancing, Bankrate often has offers well below the national average to help you finance your home for less. Compare rates here, then click “Next” to get started in finding your personalized quotes.

Weve determined the national averages for mortgage and refinance rates from our most recent survey of the nations largest refinance lenders. Our own mortgage and refinance rates are calculated at the close of the business day, and include annual percentage rates and/or annual percentage yields. The rate averages tend to be volatile, and are intended to help consumers identify day-to-day movement.

Availability of Advertised Terms: Each Advertiser is responsible for the accuracy and availability of its own advertised terms. Bankrate cannot guaranty the accuracy or availability of any loan term shown above. However, Bankrate attempts to verify the accuracy and availability of the advertised terms through its quality assurance process and requires Advertisers to agree to our Terms and Conditions and to adhere to our Quality Control Program.

Current Fha Mortgage Rates

FHA mortgage rates have remained low for the last several months, which is no surprise considering that mortgage interest rates recently reached record-breaking loans for almost every loan type. The average rate for a 30-year fixed mortgage is 3.090% as of September 27, 2020 well below what rates were for this type of mortgage even one week ago. While mortgage rates constantly fluctuate, experts expect FHA loan rates to remain low in the near future due to the economic hits the nation sustained from COVID-19.

Read Also: Can I Refinance My Car Loan With The Same Lender

I Want To Check Todays Fha Mortgage Rates

Before you start looking at homes , consider getting prequalified for an FHA loan with an FHA-approved lender. A prequalification shows you how much you may be able to borrow, so you can look for homes in your price range.

Once you find a home, you can lock in an FHA loan rate. Until then, you can watch rates and perhaps get an estimate of what your rate would be today if you found a home.

Fha Vs Conventional Loans: What’s The Difference

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

How Do I Apply

3 Easy Steps to Apply

Con: Looks Bad In Bidding Wars

Because FHA loans dont require high credit scores, some sellers look down upon them. They may think of selling to a buyer with an FHA loan as a last resort or they may choose to sell to the highest bidder with a conventional loanor none at all.

FHA loans also have strict requirements for appraisals and inspections, which could mean that financing falls through if a property doesnt meet their requirements. Buying a home with an FHA loan can look like a risk instead of a sure thing.

While FHA loans are not without their downsides, they still present a great opportunityparticularly for new investors. Anyone with a job who is looking to get into real estate and doesnt have a lot of capital to begin with should seriously consider using an FHA loan to get started.

Recommended Reading: What Is An Rv Loan

What Are The Requirements For An Fha Loan

To qualify for an FHA mortgage loan, the FHA guidelines state that applicants must meet the following requirements.

Summary Of Best Lenders For Fha Loans In September 2021

| Lender | NerdWallet Rating

NerdWallet’s ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. |

Min. Credit Score

Minimum credit score on top loans other loan types or factors may selectively influence minimum credit score standards |

Min. Down Payment |

|---|---|---|---|

|

Best for lower credit score borrowers |

600 | ||

|

Best for online FHA loan experience |

580 | 3.5% | |

|

Best for nontraditional credit histories |

500 | ||

|

Best for veterans seeking FHA loans |

580 | ||

|

Best for overall FHA loan experience |

|||

|

Best for overall FHA loan experience |

580 | ||

|

Best for FHA 203k renovation loans |

580 | ||

|

Best for lower credit score borrowers |

580 | ||

|

Best for veterans seeking FHA loans |

500 |

Min. Credit Score

On conventional loans, Quicken offers down payments as low as 3%.

View details

View details

Why we like it

Good for: borrowers looking for just about all of the services your neighborhood lender offers with online convenience.

Pros

-

Quicken Loans couples a fully online application with available mortgage advisors for those who want a human touch.

-

Instantly verifies employment and income for many working Americans.

-

Offers custom fixed-rate loan terms that are between eight and 30 years.

-

Provides a wide variety of loan types, including renovation loans and all government-backed mortgage products.

Cons

Min. Credit Score

AmeriSave offers conventional loans for as little as 3% down.

View details

View details

Pros

Pros

You May Like: Usaa Refinance Auto Loan

Applications And Underwriting Process

Pre-approval is necessary for both loans, as it signifies you are a serious buyer and can be approved for a mortgage.

A preapprovalis a notch better this allows the mortgage lender to run your credit and check your income and tax documentation to determine the loan amount you can be approved for. This starts the underwriting process.

Getting a USDA loan takes a bit longer than an FHA, mainly because USDA loans go through underwriting twice, first by the lender than by the USDA.

To get your loan application to go through underwriting automatically, youll need a credit score of 640 or more.

If your credit score is under 640, you will need manual underwriting, which adds significant time to your loan process. You can expect a USDA loan to close between 30-45 days.

An FHA loan requires 1 to 5 business days for the application and origination part of the loan process.

The next underwriting step depends on how quickly you can submit the required documentation, such as income and taxes.

The mortgage broker you choose will move and close faster if they are an FHA-approved lender. FHA loans can expect to close in 30-45 days, as well.

Fha Vs Conventional Loans

Unlike FHA loans, conventional loans are not insured by the government. Qualifying for a conventional mortgage requires a higher credit score, solid income and a down payment of at least 3 percent for certain loan programs. Heres a side-by-side comparison of the two types of loans.

FHA loans vs. conventional mortgages| Conventional loan |

|---|

Recommended Reading: Refinance My Avant Loan

Paying More For Mortgage Insurance

FHA mortgage insurance premiums are expensive, and add to an already hefty monthly payment. Not only is this coverage expensive, but taking out an FHA loan with a minimum down payment will keep mortgage insurance on your bill through the loans full term.

If you arent able to afford the cost of monthly mortgage insurance on top of your existing bills, then saving for a higher down payment might be a better option.

You May Like: What Do I Need To Become A Mortgage Broker

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

BEST OF

Also Check: What Credit Score Is Needed For Usaa Auto Loan

What Is The Interest Rate For Fha Refinance Loans

What is the interest rate for FHA refinance loans? This is an important question since your interest rate will affect the overall cost of your refi loan over time, and its good to know how rates work before you apply for a new home loan.

FHA mortgage loan and refinance loan interest rates have a variety of factors that affect how they are determined for your loan. There is no single determining factor that allows a lender to give a single rate to all applicants-your interest rate is determined based on application data, market forces, and other factors.

Does The FHA Set Interest Rates On FHA Refinance Loans?

The FHA and HUD do not set or regulate FHA mortgage loan and refinance loan interest rates, except to require that the rates offered by participating lenders are reasonable and customary for similar home loans. You will negotiate the interest rate with the participating lender.

Are FHA Refinance Loan Interest Rates The Same Every Day?

No. Mortgage loan interest rates can and do change daily. Sometimes the rates themselves do not change, but closing costs change instead. This is a common practice.

Some borrowers are confused when it is suggested that a higher on paper interest rate is offered as an advantage over a lower rate this IS advantageous when the borrower wants to save money up front on the transaction and pay less in closing costs in cash.

Are FHA Refinance Loan Interest Rates Affected By My Application Data?