What Documents Need To Be Notarized

All the documents that require a notary stamp are legally binding. A few of these documents that necessitate notary intervention include, but are not limited to, business documents, sales documents, and financial and medical forms, among others. Here are some of the most common legal documents youll need to seek notarization for.

Mobile Notary Vs Signing Agent

The main difference between a mobile notary and a notary signing agent is their specific expertise and certifications related to real estate. Mobile notaries work on a variety of documents that require their attention and signatures while notary signing agents specifically handle home loan documents. Both must have a notary commission, but the notary signing agent must also be background screened and certified to meet compliance requirements for companies they perform assignments for.

Other Locations That Notarize Documents For Free

Other financial services firms, such as , thrifts, real estate firms, tax preparation firms or insurance company offices also commonly have notaries available and provide that service to clients at no charge. Additional places that commonly have a notary on staff include law offices, local clerk of courts offices, and some public libraries. Pharmacies or doctors offices may also offer free notary service for medical records.

If all else fails, UPS stores and your local AAA office often perform notary services for a nominal fee. If you do get something notarized for free, its appropriate to tip the notary a couple of dollars for providing the service.

You May Like: Usaa Auto Loan Reviews

Real Estate Title Documents

Just when you think you are finished reviewing and signing documents, the title company and escrowee will give you their documents.

The main title document is the title insurance commitment showing the party in title , hopefully the seller. It will also show all of the liens or other clouds on title. Your attorney will review the Commitment to make sure that title is in the condition promised in the contract and otherwise acceptable under local law and custom. If you are relying on an escrow company, it will review the Commitment to make sure title complies with the conditions stated in the escrow instructions created to satisfy the lender’s requirements. If title is not acceptable, the seller might have to pay off additional liens, or obtain additional signatures. Unexpected title issues could halt or delay your closing.

CAUTION: Some title issues can be very complex. If the seller does not have an attorney, or if local custom dictates, you might have to do more to ensure title will be good in time for the closing. In areas where it’s common for neither party to work with an attorney, the title company often is the closer, and you’ll likely have already been alerted if there is a problem with the title that could delay closing. Even when it’s not customary to work with an attorney, if you have any questions or concerns about closing or title, consider hiring a local real estate attorney to review the Commitment and other title documents.

Equity Loans And Lines Of Credit

Most states notaries love equity loans. In my experience, these loan types seem to run from 125 150 pages with 15 20 notarial acts on average.

However, when I signed an equity loan on my own home a couple of years ago, I was surprised to see that the package was 46 pages long, there was no title company involvedonly a quick title search done to ensure the title was clear, and there were not many documents to be notarized. The banker worked for a homegrown Texas bank, and I signed the documents at his office. 46 pages is unusual, but the amount I borrowed was only about 10% of the equity, so it was virtually no risk for the lender.

Scanning back multiple documents is common.

Texas only when the collateral for an equity loan is a Texas homestead, things get a bit confusing. By law, a Texas home equity loan must be signed in one of three places and never in the borrowers home.

These locations are

- Attorneys Office

- Lenders Branch Location.

The notary will need to pay to use a conference room in one of these offices and should quote the hiring party $35 $55 over her notary fee. Hiring parties are usually well aware of this fee increase.

Also Check: Usaa Auto Loan Application

Typical Notary Signing Agent Document Packages

If you are new to the notary business, you may feel like receiving the documents for your assignment is like opening up a box of Cracker Jacks and digging out a prize.

Are there 200 pages in that file or 20? 500 or 50?

Will I need to notarize something? How many documents need notarization?

The guessing game can be fun for about three minutes, but then you need facts. Todays article may help you better know what to expect when you receive an assignment. We will analyze assignments in this article based on the following variables:

- Size of the package

- Number of notarizations

- Other nuances of the deal

This article cant cover ALL the different types of lending or real estate packages, but we will hit the most common types. Please note that some states loan packages may require more notarial acts and pages than other states.

The information reported within this document is my experience. It may not be exactly what your state will see in the same assignment types, but at least youll know to ask around about them in your own state so you will know what to expect.

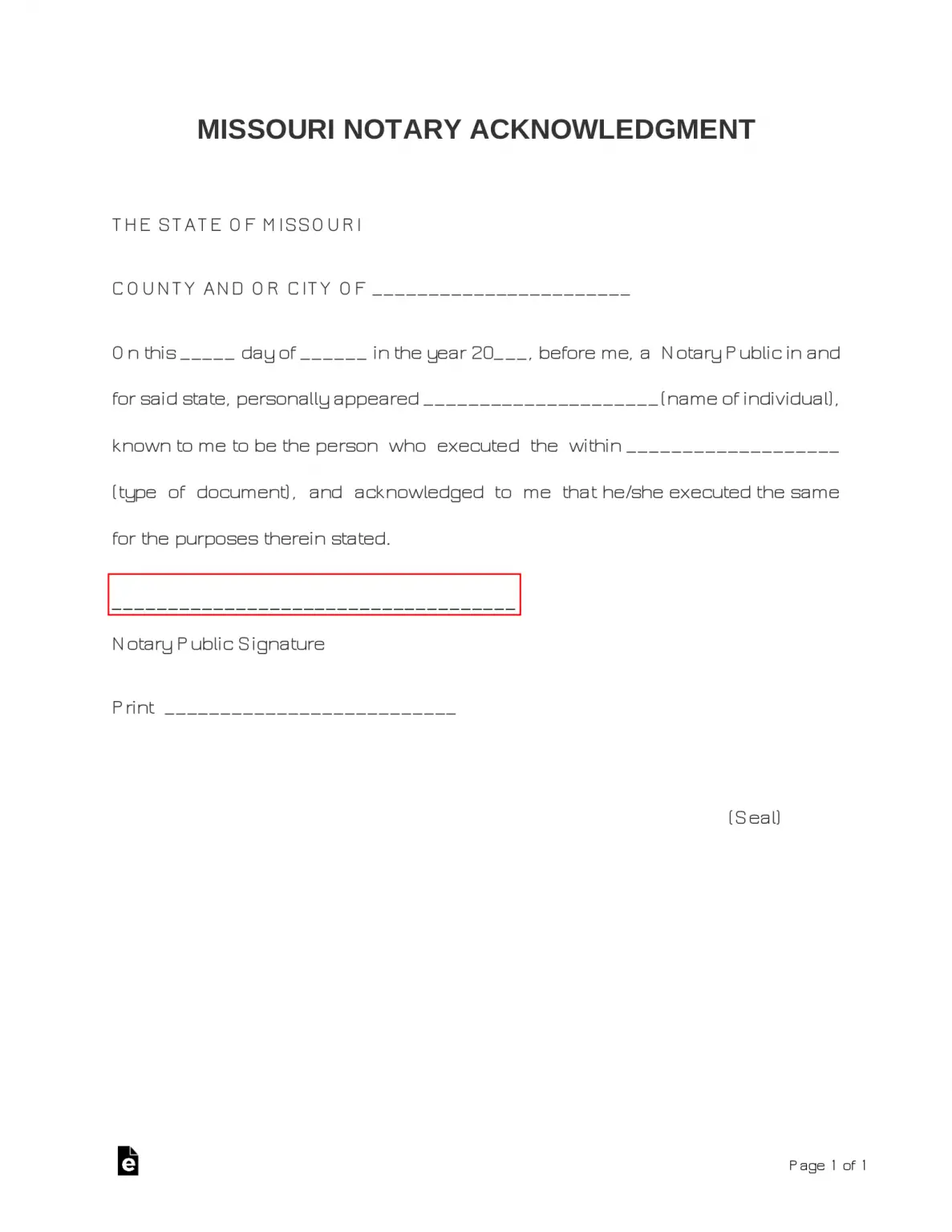

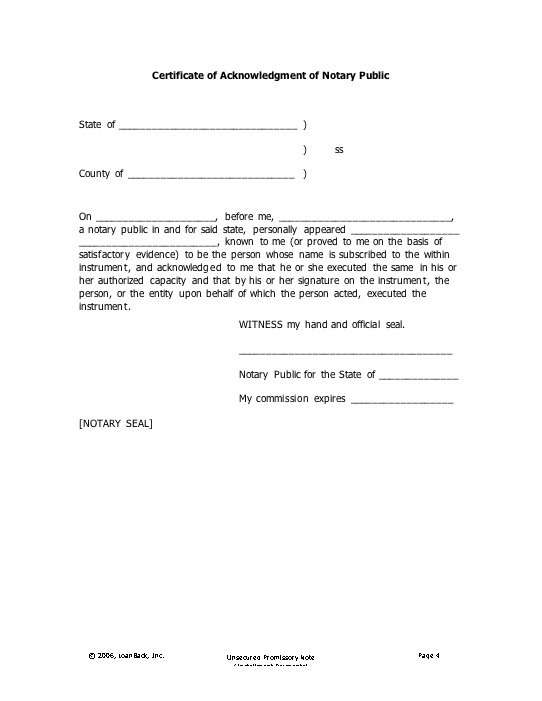

The Importance Of The Notary Witnessing Your Signature

When you have a document notarized, the notary certifies your identity and that you are the person signing the document being notarized. For this reason, the notary must witness you signing the document. That means you should not sign it before seeing the notary. Notaries take a legal oath that they will not notarize any document unless they have witnessed it being signed by the appropriate party.

If you mistakenly sign a document ahead of time, you may need to return with an unsigned copy of the document. After witnessing you sign the copy, the notary will compare that signature to the one you made on the original. If the signatures appear to match, the notary will notarize the original document for you. In some cases, the notary can notarize the copy and will not need to notarize the original document.

You May Like: Reloc Line Of Credit

What Documents Need To Be Notarized Read To Know

Did you know that

Notaries used to travel with Spanish explorers to make sure that they could keep a record of the discovery of all the treasures? For that very reason, even Christopher Columbus had notaries with him to account for all his discoveries!

Interesting, right?

See! Even matters like these needed the assistance of notaries to avoid any future conflicts! You also must have found yourself in a situation where someone told you to notarize your documents. Trust us you might require the help of the notary public in those matters you cannot even think about! Keeping it concise, a document that demands ensuring the authenticity of all the parties connected to that document might require notarization.

If you specifically want to know what documents need to be notarized?

Keep reading to get your answers!

Choosing A Notary For Notarizing Loan Documents

Closing on a new home is a hectic, stressful process for everyone involved. When a buyer sits down to finalize the purchase of a home, he or she must go through and sign dozens of documents, some of which may require notarization from a commissioned notary public. If the notary public makes a mistake, it could result in the purchase being delayed.

Read Also: Used Car Loan Usaa

Banks Can Notarize Your Documents For Free

If you need to get a document notarized, a simple free solution can often be found at the nearest branch of your bank. A document is notarized when a third party, known as a notary public, verifies your identity, witnesses you signing the document and, in some cases, requires you to swear or affirm that the facts in the document are true. Notarization covers almost every kind of legal document, including letters of indemnity.

Since banks handle a lot of documents that must be notarized, its common for some bank employees to be notaries and for the bank to offer free notary services to its customers. If you are not a customer, you may be charged a fee or advised to go to your own bank.

What Notary Signing Agents Must Do:

- Verify the identity of the person signing the loan

- Ensure that all documents are in English and can be read and understood by the signer or can be sufficiently translated or explained to the signer by a third party

- Make sure that all documents are signed and initialed in all the necessary places

- Notarize the document

- Make sure the notarized documents are returned to the mortgage company or proper organization

Recommended Reading: What Is The Fha Loan Limit In Texas

Become A Notary With Florida Notary Association

At Florida Notary Association, we make sure you have the resources and tools you need to do your job as a public notary. We even help you submit your notary application or renew your commission if you already are one.

If youre interested in becoming a notary in the state of Florida, we are here to help you through the steps of notary certification. Contact us today to find out how we can answer any questions you might have. If youre a notary looking for supplies, check out The Dotted Line where you will find all the accessories you need.

Certified Copies Or Duplicates

Sometimes, youll need certified copies or duplicates of official forms you had notarized previously. For example, youll need a certified copy of your marriage license to change your name. Or, if you lost the title to your property, youll need a notarized application if you want to get a duplicate.

Also Check: Refinancing Fha Loan

From Where To Get Documents Notarized

To notarize a document, you can visit any notary office in your city. However, it is time-consuming. First, you need to take out time from your busy schedule to visit the notary office, and still, there is no guarantee that they will be available there, plus they will or will not notarize your documents on the same day.

We get it! It is a little vexatious. Well, after the legalisation of remote online notarization, you can notarize documents from the comfort of your home. You dont need to go anywhere. A notary public will contact you on your preferable day and your preferable time. Many platforms provide remote online notary services like Lottalegal. Our process to notarize documents is simple and easy! It goes as:

Upload Document that you want to get notarized

Visit our portal and fill up a simple form mentioning your essential details like name, contact number, residency, and type of documents you want to notarize. After that, you have to upload a soft file of all the documents that need to be notarized.

You can make a soft copy by taking pictures of all the documents and making a pdf file. Once you do that, upload this file to our portal.

Connect with Legal Notary and Notarize Your Documents

After you upload the documents and submit them along with the form, a Notary will contact you to conduct audio-video conferencing. During the call, the notary will confirm your identity via KBN and check whether the provided information is correct or not.

Personal Bias Or Beliefs

As a public official, a notary should never refuse due to a signers nationality, religion, race, age, lifestyle, gender, or disabilities. There are times when a notary might be responsible for notarizing a controversial document related to such topics as same-sex unions, assisted suicide, the use of medical marijuana, or abortion. Even if a documents contents violate your personal beliefs, this is not enough to refuse a notarization.

Notarizing a document does not mean you personally agree with or condone the contents of the document. A notary is only an impartial, third-party witness that verifies the identity of the signer.

Don’t Miss: Genisys Auto Loan Calculator

What Is A Notary Signing Agent

Notary signing agents begin their careers as notaries public, and then complete additional certification requirements and submit to a background check to become a licensed notary signing agent. They also complete educational requirements that focus on the proper handling of loan documents. Exact requirements vary from state to state, but most require applicants to pass a test and have a clean criminal record.

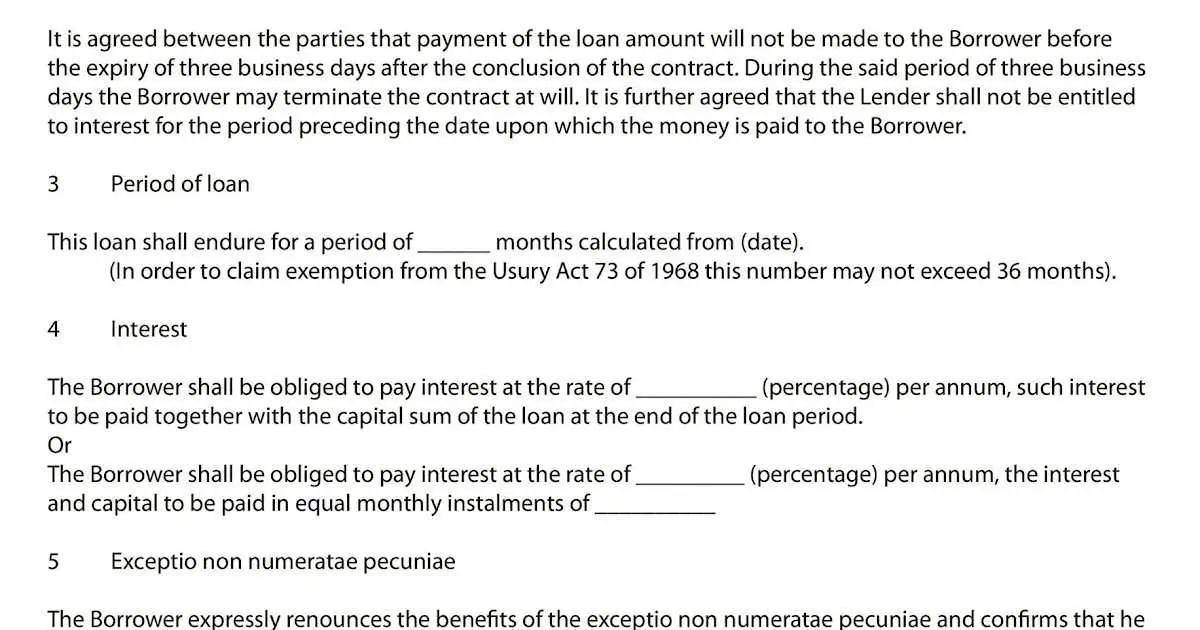

What Type Of Loan Is It

The wording of your promissory note will depend on the type of loan it is. Is it secured or unsecured?

Secured loan: A secured loan uses the borrowers property as collateral. In a real estate loan, for instance, the house is the collateral. If you default on the loan, the lender can take back the house. Automobile loans work the same way.

A title loan is a different type of secured loan. In this loan, a borrower uses their car title as collateral. If the borrower defaults, the lender keeps the car. Pawn loans are another type of title loan.

Secured loans and title loans are suitable for large, expensive items. They may be the only choice for borrowers with weak credit.

Unsecured: An unsecured loan does not involve any collateral. Most unsecured loans require good credit because the loan relies on nothing but the borrowers promise to pay. Personal loans, lines of credit, and credit cards are all types of unsecured loans.

Don’t Miss: Loan Signing Officer

Keep Copies Of Your Closing Paperwork

Conveniently, most closing agents provide digital copies of your entire closing packet. You’ll also want to keep the original documents in a safe place, as you might need to provide them when you later sell the house, have to make an insurance claim, or are in another situation where you need to prove ownership. The most important originals are the purchase agreement, deed, and deed of trust or mortgage. In the event originals are destroyed, you might be able to get certified copies of these documents from the lender or closing company, but you don’t want to rely on others’ recordkeeping systems unless you have to.

How To Find A Notary For Your Promissory Note

The fastest, most convenient way is to use a platform like OneNotary. The notaries on this platform are background checked and in good standing with their state licensing boards.

The platform uses high-level security protocols to protect your personal information. In just 20 minutes, you can have a fully notarized note.

Don’t Miss: How Long Does Pmi Stay On Fha Loan

Presenting The Closing Documents

Non-attorney notaries have to be careful about what information they give to signers during a real estate closing. In the Notary Signing Code of Conduct, Guiding Principle 4 lays out how notaries are to present closing documents:

4.4. Presentation of Documents:The Notary Signing Agent will present each closing document to a signer in conformance with a signing presentation guidelines authorized by the contracting company, and by naming and stating the general purpose of the document, specifying the number of pages and indicating where signatures, dates, or initials are to be placed.

Essentially, you may describe the documents, but you cant interpret or explain beyond what is present in the document. Notaries should remain impartial and patient with signers as they review each document. The notary may provide the signer with the contact information of the lenders representative or closing agent to answer any question about the loan, explain the terms of the loan, or other fees listed in the documents.

Notarized Documents Explained In Less Than 5 Minutes

Notarized documents are documents that have been certified by a notary public to verify their authenticity. Notarization includes the witness and record of the signing of documents to make sure the process is not fraudulent, and to assure that the documents can be trusted by the authorities who requested them.

Important documents often need to be notarized, but how can you accomplish this? While it may sound intimidating, the process is often as easy as a trip to your local bank, credit union, or shipping center.

You May Like: Usaa Auto Loan

Common Documents You Can And Cannot Notarize

So you have just completed the course and filed your oath and bond, and you promptly forgot what you are supposed to do next. Maybe you have been a Notary for ages and you have gotten used to the same old documents but someone just brought you immigration forms and you have no idea what to do. Well the good news is, with few exceptions, there are not many documents you cant notarize. The even better news is that the exceptions usually have something to do with caveats to an individual document and not the type of document.Lets go over the most commonly asked questions about types of documents:

Real Estate Documents While you do not need any additional training to notarize real estate documents like deeds, you do need additional certification to act as a Notary Signing Agent because there is a lot more involvement than just performing notarizations. You make more money as a Signing Agent, so you might consider taking one of our classes and obtaining the proper amount of E& O coverage.

Wills As a matter of practice, wills are generally not notarized they are witnessed. There are very few circumstances where wills can be notarized, but you usually need special instructions from an attorney.

Wow! That was helpful. Thanks, Leah. Remember members, if you have questions about a particular notarization, you can always call or email for help. Not a member? Consider joining. !