Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

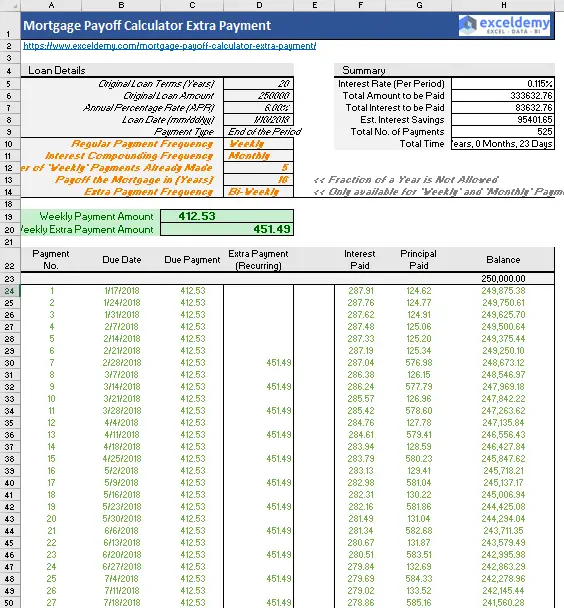

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

How Much Faster Will I Get Out Of Debt By Making Extra Payments

This debt repayment calculator figures how much faster you will get out of debt and how how much interest you will save by adding an additional principal repayment to your next regularly scheduled payment.

If you have multiple debts to repay then try this Debt Snowball Calculator to repay faster using the rollover method. In addition, there are 10 other to choose from. One will certainly fit your debt repayment needs perfectly.

Dont Miss: Can You Loan Audible Books

How Long Does It Take To Write Off A Student Loan

Depending on the year in which you took out your loan, it will simply be written off after 25 years, 30 years, or when you turn 65. Phew. For this reason, repaying a student loan in the UK can be considered to work a bit like a graduate tax, applied in a similar way as income tax or national insurance.

You May Like: Va Loan With 500 Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

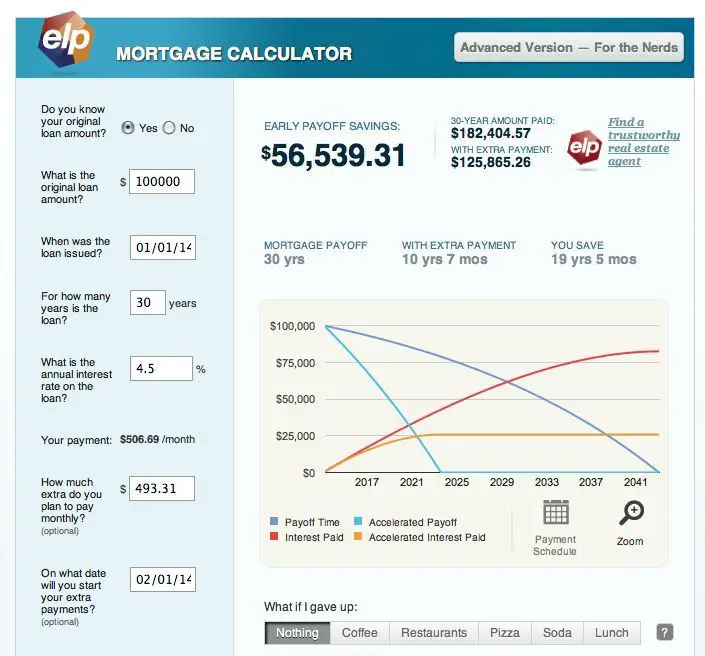

What The Mortgage Payoff Calculator Tells You

The Summary Results section has two subheadings:

How to reach your goal describes how much you would have to pay in principal and interest every month to meet the payoff goal. It lists the original principal-and-interest payment, and how much you would have to add to the minimum monthly payment to meet your goal.

Loan comparison summary describes the total cost of the mortgage in principal and interest payments, the original monthly principal-and-interest payment, the total cost in principal and interest if you pay it off early, and the new monthly principal-and-interest payment to reach your payoff goal.

“New monthly P& I” and “Original monthly P& I” comprise only the principal and interest portions of your monthly payments. Your full monthly payment will include principal and interest, plus the other monthly costs, such as taxes, homeowners insurance and mortgage insurance .

The early mortgage payoff calculator also lets you enter different numbers into the “In how many years from now do you want to payoff your mortgage?” box to see how those changes affect your total savings.

For more information about how the process of gradually paying off a mortgage works, see this explanation of mortgage amortization.

Also Check: Can I Use Capital One Auto Loan Anywhere

The Loan Payoff Formula

You may feel comfortable doing this exercise with the loan payoff formula if youâre savvy with numbers. You can use a calculator or set up the equation in a spreadsheet to calculate how long it will take you to pay off the loan based on what changes to your payments you want to make.

The Loan Payoff Formula: N = -)/ In

If your brain is shutting down just looking at that â no sweat â keep scrolling. We have more tools that can help you. If youâre up for the challenge, itâs time to break down how to fill in the formula with your loan information.

Start with identifying the four variables:

In stands for the natural logarithm, the math function used to calculate exponents.

If you have a fixed interest rate, using this formula will be easier. If you have a variable interest rate, just use the current rate.

When using this formula, you can adjust the monthly payment amount to see how the number of months remaining may vary. Hereâs a helpful guide on how to use the formula.

Here are a few ways you can change the calculations to try out different scenarios:

- Use the formula to calculate how many months will be remaining if you paid the minimum amount required each month. Use this as a baseline.

- Calculate different scenarios where you pay a little more each month.

- If you have a specific timeline in mind, figure out how much youâd need to pay per month to achieve that timeline.

Should I Consider Paying My Car Loan Off Early

As you can see, there are potential benefits to paying off a car loan early but before you make any changes, consult your lender. Things may not be as straightforward as sending your bank a big check to call it a day. Some loan agreements have early payment penalties which would derail the whole purpose of paying off your loan early.

Don’t Miss: How Much Do Mortgage Loan Officers Make

How To Calculate Auto Loan Payoff

The price of your vehicle, down payment you make, length of the loan, and interest rate are all factors that determine how much youll pay for your car. Adding a bit more to your payments each month can help you pay off your car loan sooner and, ultimately, save you money. Use this calculator to see the impact of putting a bit more money toward your loan each month.

Enter the price of your vehicle as the Vehicle Price and adjust the sliders to match the details of your loan. Move the Added Monthly Amt slider to see the impact of paying more toward the loan.

How Long Will It Take Me To Pay Off My Student Loan: Usa

In the US, a student loan is treated more like a traditional bank loan. It requires regular repayments, whatever the circumstances. It will not be written off after a certain amount of time, so small repayments can feel stressful for the borrower, who is aware that the interest is constantly growing.

You May Like: Home Equity Line Of Credit Vs Home Equity Loan

How Do You Calculate Amortization

An amortization schedule calculator shows:

This means you can use the mortgage amortization calculator to:

To use the calculator, input your mortgage amount, your mortgage term , and your interest rate. You can also add extra monthly payments if you anticipate adding extra payments during the life of the loan. The calculator will tell you what your monthly payment will be and how much youll pay in interest over the life of the loan. In addition, youll receive an in-depth schedule that describes how much youll pay towards principal and interest each month and how much outstanding principal balance youll have each month during the life of the loan.

Auto Loan Early Payoff Calculator

. Early Payoff Auto Loan Calculator. This financial calculator helps you find out. View the report to see a complete.

Current Interest Rate Remaining Terms Months Payment Frequency. The average interest rate lenders charge. How much interest can you save by increasing your auto loan payment.

From there the car loan calculator with extra payments will calculate how much you would normally have to pay versus the adjusted monthly amount. Enter the original dollar amount of the car loan but without the dollar sign principal. Auto Loan Early Payoff Calculator.

Current Loan Balance. Colorful interactive simply The Best Financial Calculators. Ad Get Helpful Support and Take Control of Your Unexpected Auto Expenses.

The amount of money you will pay each year for this loan. View the calculators report to see a. Calculate your early car loan payoff savings in both time and interest.

Enter your loan details into the auto payoff calculator to estimate. This financial calculator helps you find out. The number of payments you will make to pay off the loan.

401k Spend It or Save It Calculator. When checked a section will appear below the calculator showing the. How much interest can you save by increasing your auto loan payment.

Auto Loan Payoff Calculator. Now you can compare side by side. Auto Loan Early Payoff Calculator How much interest can you save by increasing your auto loan payment.

Increase monthly payment. Auto Loan Early Payoff Calculator. Add this calculator to your.

Read Also: Is The Loan Forgiveness Program Worth It

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Use A Lump Sum To Pay Off Your Loan Faster

Tax refund, bonus, commission, inheritance, yard sale, gift or lottery win? Whatever it may be, an unexpected windfall can be used to pay off a chunk of the principal in one fell swoop.

So there you have it. Check out our loan payoff calculator to see how overpayments can help you save money in the long run.

Finance features

Also Check: Quick Loan For Bad Credit

Can You Payoff Your Mortgage Early

This mortgage payoff calculator figures the extra payment necessary to…show instructions

Please Note: You should only enter the principal and interest portion of your regular monthly payment. Do not include tax and insurance escrow accounts.

You can also compare 4 payoff strategies monthly, bi-weekly, extra payment, and bi-weekly with extra payment using this mortgage calculator plus it includes amortization schedules as well.

In other words, use this calculator to define time period and payment amount, and use the other calculator to define optimum early payoff strategy.

Once you’ve figured out your mortgage payoff strategy then learn how to further accelerate your wealth with this free 5 video course, 5 Rookie Financial Planning Mistakes That Cost You Big-Time

How To Use The Early Mortgage Payoff Calculator

To fill in the calculator’s boxes accurately, consult a recent monthly statement or the first page of the Closing Disclosure that you received when you closed on your mortgage.

-

Under Loan term , enter the number of years for which your home is financed.

-

Under What was your mortgage amount?, fill in the loan amount. In the Closing Disclosure, you can find this on the first line of the Loan Terms section.

-

Under Interest rate, enter the percentage.

-

Under How many years are left on your mortgage?, you’ll need to enter a whole number, so round up or down.

-

Likewise, under In how many years do you want to pay off your mortgage?, you’ll have to enter a whole number, rounding up or down.

-

Under How much do you still owe ?, look for this figure in a recent monthly statement, or contact the mortgage servicer. Or you can use NerdWallet’s mortgage amortization calculator and drag the slider to find out how much you still owe.

Don’t Miss: What Are The Qualifications For First Time Home Buyers Loan

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

How Do You Calculate A Credit Card Payment

Your credit card issuer will require you to make the minimum payment each month. Whileeach issuer may have a slightly different policy, the common practice is to charge the greater of a certain amount , or

- 1% of your current balance, plus

- Any new interest charges, plus

- Any late fees or past due amounts if you previously missed a payment

You may also choose to pay your statement balance or current balance. The statement balance is your entire balance as measured at the end of your last billing period. After you receive your credit card bill, you usually have a few weeks to pay before its due. During this time, any additional purchases you make will be added to your current outstanding balance, which is the total amount you owe right now.

You can avoid interest charges by paying off either the statement balance or current balance by the due date.

Also Check: How To Take Personal Loan From Bank

Calculate How Long To Pay Off Your Loan

When it comes to managing your money responsibly, itâs a good idea to check in with your finances from time to time. This practice can help ensure youâre sticking to your financial plans and doing so efficiently. A lot of things can change in the course of a few months.

For example, maybe you got a raise last quarter, and you havenât revisited your budget yet. You might have more money in your budget and want to recalculate how long it would take to pay off your loan.

Why would you want to pay off your loan early? Lowering your debt-to-income ratio can increase your net worth. This is an important step toward achieving financial health and building wealth.

While many have found themselves tightening their belts as a result of the COVID-19 pandemic, other groups are feeling more confident in their ability to manage as a result of stimulus checks and lower life spending in general.

If youâve found yourself with a little more financial flexibility, a few simple calculations can give you a clear picture of what it will take to pay off your loan faster. With a few quick exercises, you can calculate your loan repayment timeline, make adjustments to your cash flow, and get out of debt faster!

Calculating Your Businesss Monthly Principal Payments

If your business is dealing with loan repayments, understanding how to calculate your principal is likely to be beneficial. After all, according to a study we conducted, 21% of borrowers say that not knowing how much they need to pay is the most likely cause of their missed payments. So, how do you calculate your scheduled principal payments?

Theres a relatively complicated formula you can use, which is as follows:

a / / = p

Note: a = total loan amount, r = periodic interest rate, n = total number of payment periods, p = monthly payment).

If youre looking for an easier way to work out your principal payments, a principal payment calculator may be the way to go.

You May Like: How Is Home Mortgage Interest Calculated

Read Also: Difference Between Lease And Loan

Dont Forget The Origination Fees

Before applying for a new loan, theres one other factor you should be aware of: Some personal loan lenders charge origination fees equal to between 1% and 6% of the amount you borrow. That means you may pay between $100 and $600 on a $10,000 loan.

But an origination fee shouldnt automatically discourage you from considering a personal loan. For example, lets say you have $10,000 in credit card debt with an average interest rate of 23%. That means youre paying $2,300 per year in interest.

If you have an opportunity to get a personal refinancing loan at, say, 12% APR over 60 months with a 6% origination fee, then even though youll pay $600 for the origination fee, youll still save quite a bit of money compared to your current credit card debt.

The personal loan, with an interest rate of 12%, will cost you $3,346.4 in interest charges over the 60-month term. Even if you add the $600 origination fee to that, the combined cost is still dwarfed by the $6,914 youd pay in interest by keeping the balance on the credit card and gradually repaying it over the same 60-month period.

Translation: Dont let an origination fee scare you away from taking out a personal loan. Crunch the numbers, compare them with what youre paying on your current debt, and go forward if it will save you money.