Requirements For Conforming Loan:

A lot goes into getting qualified for a Conforming Loan and the actual guide issued by Fannie Mae is 1250 pages. We wont go into everything just the most important areas you should be aware of as of January 1, 2021:

- The minimum down payment for a purchase is 3% down or the minimum amount of equity in a home for a refinance is 3%.

- Generally speaking, you need above a 620 credit score to obtain a Conforming loan. And getting qualified for scores below 700 gets more difficult as you move further down.

- The debt-to-income ratio should be 50% or lower.

- Most Conforming loans do not need liquid asset reserves however some do. If you are purchasing a rental property youll need to show some liquid reserves. If you have a low credit score, a debt-to-income ratio above 45%, and are taking cash out youll need to show some liquid reserves.

Conventional Loans Vs Usda Loans

While conventional loans are available in all areas of the country, USDA loans can only be used to purchase properties in qualifying rural areas. Those who qualify for a USDA loan may find that its a very affordable loan compared to other loan options.

Theres no maximum income for a conventional loan, but USDA loans have income limits that vary based on the city and state where youre buying the home. When evaluating your eligibility for a USDA loan, your lender will consider the incomes of everyone in the household not just the people on the loan.

USDA loans dont require borrowers to pay private mortgage insurance , but they do require borrowers to pay a guarantee fee, which is similar to PMI. If you pay it upfront, the fee is 1% of the total loan amount. You also have the option to pay the guarantee fee as part of your monthly payment. The guarantee fee is usually more affordable than PMI.

Lenders Fight To Keep Homebuyers Competitive While Interest Rates Are Low

When UWM announced it would raise loan limits ahead of the FHFAs November announcement, the lender explained the move will allow mortgage brokers to get borrowers into higher loan amounts for better pricing as home prices surge.Other lenders expressed similar sentiments.

“By raising loan limits on conventional loans, we are able to further support our customers during a competitive housing market while rates are still low,” Caliber CEO Sanjiv Das said. “Jumbo loans are not feasible options for everyone, and higher conforming loan limits can help certain borrowers trying to purchase a home or access liquidity.”

To get a conventional loan, borrowers typically must have at least a 3% down payment for first-time homebuyers or 5% for other buyers with at least a 620 credit score for a single-family home. Conventional loans have more allowances compared to others, like FHA mortgages. For example, borrowers do not need to pay private mortgage insurance once they have at least 20% equity in the home.

If you are interested in taking out a mortgage as loan limits increase, visit Credible to compare multiple lenders at once and choose the option that is the best fit for you.

Recommended Reading: Usaa Car Loans Credit Score

How Conventional Loan Limits Work And How To Find Yours

Every November, the Federal Housing Finance Agency announces new loan limits for conventional loans for the following year. And each limit is usually higher than the last, in line with rising home prices.

So, in the early 1970s, the standard limit for single-family homes was $33,000. By 2019, it was $484,350. And now, in $2021, its 356,362.

But dont assume that rising loan limits are inevitable. When the FHFA announced 2020s caps, 43 counties had ones that remained unchanged.

Conforming Loan Limit To Increase By 18% To Match Home Price Increase

Each year, the FHFA adjusts the limit for conforming mortgage loans, as required by the Housing and Economic Recovery Act, to account for changes in the average home price in the U.S.

In 2021, Americans experienced a searing-hot housing market. According to the National Association of Realtors, the median sales price increased in 99% of housing markets across the country during the third quarter, and 78% experienced double-digit growth from the previous year.

Based on the nominal seasonally-adjusted, expanded-data FHFA House Price Index, house prices increased by an average of 18.05% in the third quarter, which resulted in the same increase to the conforming limit for conventional loans, from $548,250 to $647,200. In contrast, the increase from 2020 to 2021 was only 7.4%.

If you live in a high-cost area or certain states and territories, the conforming limit is 150% of the baseline ceiling. In 2022, that limit will be $970,800. This ceiling applies to residents of Alaska, Hawaii, Guam and the U.S. Virgin Islands, as well as areas in which 115% of the local median home value exceeds the baseline conforming loan limit.

Don’t Miss: Lightstream Rv Loans

Conforming Loan Limits Increase To $548250 For Most Areas

Conforming loan limits are on the rise.

Home buyers in most of the U.S. can now get a conforming loan up to $548,250 with just 3% down.

And the single-family loan limit is over $822,000 in high-cost areas.

Multifamily home buyers get a nice increase inbuying power, too, with limits for 2-4-unit properties topping $1 million insome areas.

On top of this, were seeing ultra-low interest rates carry over from 2020 into 2021.

Put all it together, and you get incrediblepurchase and refinance opportunities for home buyers and homeowners alike.

When Is A Loan Considered Jumbo In Your Area

A jumbo loan is a type of mortgage that is too high to be guaranteed by Fannie Mae or Freddie Mac, which are government-sponsored enterprises that set mortgage underwriting standards and purchase qualified loans from lenders. Loans that can be purchased by Fannie Mae or Freddie Mac also called conforming loans are considered safer investments for lenders than jumbo loans, and it can be easier for borrowers to meet their requirements.

With home prices rising in most areas of the United States, the FHFA has increased conforming loan limits for 2021. How large a loan you can get before its considered jumbo depends on where you live, as certain more expensive areas like Hawaii or San Francisco have higher limits. If youre concerned about meeting the more stringent lender criteria required for approval for a jumbo loan, these new limits could allow you to finance a high-priced home with a conventional loan instead.

For 2021, the maximum limits for conforming loans are:

-

$548,250 for a single-family home in most areas of the country.

-

Up to $822,375 for high-cost areas where single-family home prices tend to be above average. When setting conforming loan limits, the FHFA has defined high-cost areas as places where 115% of the local median home value is more than $548,250.

You can find the exact conforming loan limits for your area using the tool below.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Recommended Reading: Does Va Loan Work For Manufactured Homes

Conforming Loans To Purchase A Home:

The Conforming loan program offers some great opportunities for those looking to purchase a home. From First Time Home Buyers to seasoned investors conforming loans have low-interest rates at great terms.

You can put down as little as 3% and the loan process for a Conforming loan is very efficient as it allows for 2-3 weeks closing periods if the buyer and seller are in a rush to close quickly. Another great aspect of the Conforming loan program is that you might get an appraisal waiver which helps save on costs and if granted really speeds up the process.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

You May Like: Transfer Auto Loan To Another Bank

What Are Conventional Loan Limits

Most conventional mortgages come with caps on the possible loan amount. These are called conventional loan limits or sometimes conforming loan limits.

In most parts of the country, conventional loan limits top out at over $500,000. So most home buyers will be well under the limit.

However, if you want to buy where real estate is more expensive than average, your limit may be higher. Because these caps are tied to local home prices at a county level.

If you need to borrow more, you may be able to find a jumbo loan from a lender thats comfortable with the amount you need. Many will happily lend millions of dollars to the most creditworthy applicants.

Still unclear? Were about to dig into all the details you need to know.

Qualifying For A Jumbo Mortgage

The qualification process for a jumbo loan is similar to the conforming loan process. The lender will review your assets, income and credit score, but there are some differences. Jumbo loans typically have higher qualification standards than conforming loans since lenders take on extra risk with jumbo loans. Because of this, lenders are looking at several key factors to determine your risk level. Generally, this means higher credit, income and cash reserve requirements.

Here are some of the main qualification differences between jumbo and regular mortgages.

Recommended Reading: Va Manufactured Home Guidelines

Special Considerations For The Conforming Loan Limit

Fannie Mae and Freddie Mac are the principal market makers in mortgages banks and other lenders count on them to insure loans that they issue and to buy loans that they wish to sell. The conforming loan limits act as guidelines for the mortgages that most mainstream lenders offer. In fact, some financial institutions will only deal with conforming loans that meet the agencies criteria.

Traditional lenders widely prefer to work with mortgages that meet the conforming loan limits because they are insured and easier to sell.

Mortgages that exceed the conforming loan limit are known as nonconforming or jumbo mortgages. The interest rate on jumbo mortgages can be higher than the interest rate on conforming mortgages.

Because lenders prefer conforming mortgages, a borrower whose mortgage amount slightly exceeds the conforming loan limit should analyze the economics of reducing their loan size through a larger down payment or using secondary financing to qualify for a conforming mortgage.

The Bottom Line: Remember Loan Limits If Youre Purchasing A High

If you plan on purchasing your home with a mortgage and have a sizeable home buying budget, its important to understand what the maximum loan limits are in your county. While other loan types, such as jumbo loans, can remove the barrier of having to stay within a certain price limit, that means forgoing the benefits of getting a conforming loan.

If youre considering purchasing a home outside of the conforming loan limits, be sure you understand whether you can afford a nonconforming loan and what this type of loan would mean for your finances after all, the larger the loan, the higher the monthly payment.

This is especially important to consider in high-cost areas. Even with higher loan limits, much of the local inventory could still exceed the high-cost loan ceiling.

In San Francisco, for example, the maximum conforming loan limit is $822,375, but the median list price is over $1,000,000. High prices like this can make it difficult to purchase a home without having to get a jumbo loan.

What would a jumbo loan mean for your finances? The upfront cost alone can be prohibitive for many borrowers. While conforming loans allow down payments as low as 3%, most jumbo loan borrowers are required to put down a minimum of 20%. Theyll also need to have a credit score in the 700s and a DTI of 45% or lower to qualify.

If youre wondering what your own personal loan limit should be, check out our advice on how to determine how much house you can afford.

Get approved to buy a home.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

= Largest Dollar Increase On Record

2006 had been the record holder for largest dollar increase on record. That year the loan limit jumped $57,000, from $359,000 to $417,000. This new announcement of the 2022 increase of $76,750 beats the 2006 figure by about $20K. 2006 still holds the record for highest % increase at 15.95%.

Over the years, maximum conventional loan limits have climbed to the highest yet in 2021 at $548,250. The annual limit increase has varied depending on the economy and current home prices. Some years the increases were slight, or had no increase at all – most notably from 2006 to 2016. The maximum loan limit remained constant for 10 years straight, until 2017 saw around a 2% increase. 2018 and 2019 were around a 7% increase, 2020 dipped to 5% and then 2021 saw the largest percent increase to date at 7.4%. The loan limits over the last 20 years are shown below in Table 1.

For the 6th year in a row, the loan limit has increased quite significantly, which isn’t surprising based on today’s competitive housing market. Each year since 2008, the loan limit has been calculated based on the average home price increase from Q3 of the previous year to Q3 of the current year. For 2022, home prices are estimated to have respectively increased by 14% at the end of Q3, so the 2022 loan limit is also increasing by 14%.

Table 1. Historical Maximum Conforming Loan Limit data from 2000 to 2022.

Fannie Mae Homeready Loan

To be able to compete with FHA loans, which require just a 3.5% down. Fannie Mae created the HomeReady loan program for low-income first-time homebuyers, in which just a 3% down payment is needed with a 620 credit score.

HomeReady loans are strictly for low-to-median income home buyers. In order to qualify, your annual income cannot exceed 80% of the area median income .

HomeReady Loan Requirements

- PMI is canceled at 80% LTV

Also Check: Do Underwriters Verify Bank Statements

What Is A Conforming Loan

A Conforming loan is a mortgage loan that conforms to the underwriting standards of Fannie Mae or Freddie Mac. All Conforming loans go through an Automated Underwriting System prior to an actual underwriter reviewing the file.

Conforming loan limits in California are the maximum loan amount a lender can lend under current Conforming guidelines.

A Conforming loan is a Conventional Loan and a Conventional loan is any mortgage loan that is not backed by the U.S. Government. FHA home loans and VA home loans are backed by the U.S. government and are not Conforming nor are they Conventional loans.

Avoid Jumbo Loans With A Piggyback Loan

Some find it better to avoid jumbo loans by having two smaller ones: a conforming main mortgage and a piggyback loan. Thats a second mortgage that bridges the gap between the conventional loan limits and your purchase price.

For example, lets say you wanted to buy a $750,000 home where the local loan limit was $550,000. You have $100,000 for a down payment. If you got a $650,000 loan, you would be over the conforming limit for the area, and youd need a harder-to-get jumbo loan. Fortunately, thats not your only option.

You could structure it as follows:

- Primary loan of $550,000

- Second mortgage of $100,000

- Down payment of $100,000

You potentially qualify much more easily for the primary loan since its a conforming loan, not a jumbo.

This doesnt work for everyone. But its an idea worth exploring. All you can do is run the numbers. A mortgage calculator is a good place to start.

Read Also: How Do I Find Out My Auto Loan Account Number

Why Are There Conventional Loan Limits

Technically, Fannie and Freddie are government-sponsored enterprises . Their role is to channel credit to parts of the population where access to that credit creates a public good in this case, increased homeownership.

The degree of Fannie and Freddies independence from the government is debatable. Because theyre regulated by the FHFA, their autonomy is limited.

And, more importantly, the federal government is likely to be on the hook for any extended losses they make. Hence these loan limits. They put a brake on lending and so limit the taxpayers exposure to risk.

Differences Between Conforming And Fha Loans

Weve touched on the main difference between the two programs and here well touch on the differences between the two loan programs at the consumer level:

- Conforming loans are best for those with credit scores above 700

- Conforming loans can be used to purchase or refinance investment properties

- If you put down 20% or have 20% equity in your home then you will not have Mortgage Insurance with a Conforming loan

- FHA loans are great for people with credit scores below 700

- FHA loans help those with small down payments/little equity that might not get qualified under a Conforming loan program

- With FHA loans you do not need liquid assets

- FHA loans can only be used on primary homes you can not purchase a rental property with a FHA loan.

And just like Conforming loan limits in California FHA has its own loan limits.

Also Check: Va Loan For Modular Home

Minimum And Maximum Loan Amounts

If you are wondering whether youll need a jumbo loan, you need to consider the limits set for conforming loans and U.S. Federal Housing Administration loans. The agency-set maximum limits for these loans provide a baseline for jumbo loans.

Most parts of the country have one maximum loan amount for conforming loans. In some high-cost areas, such as Washington D.C. and certain California counties, the threshold for the maximum conforming loan is raised.

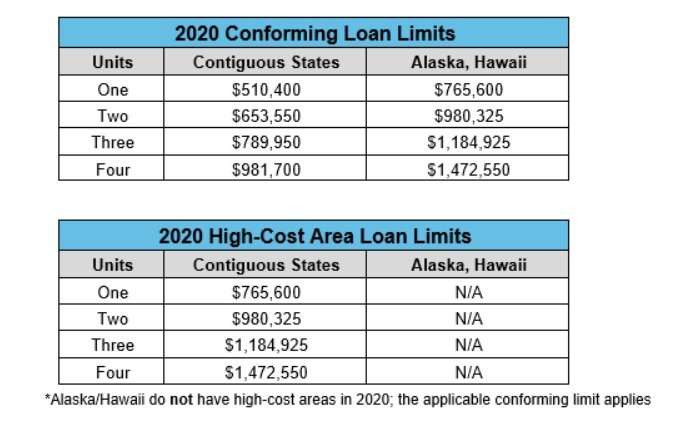

For 2021, the Federal Housing Finance Agency raised the maximum conforming loan limit for a single-family property from $510,400 to $548,250. In high-cost areas, the ceiling for conforming mortgage limits is 150% of that limit, or $822,375 for 2021.

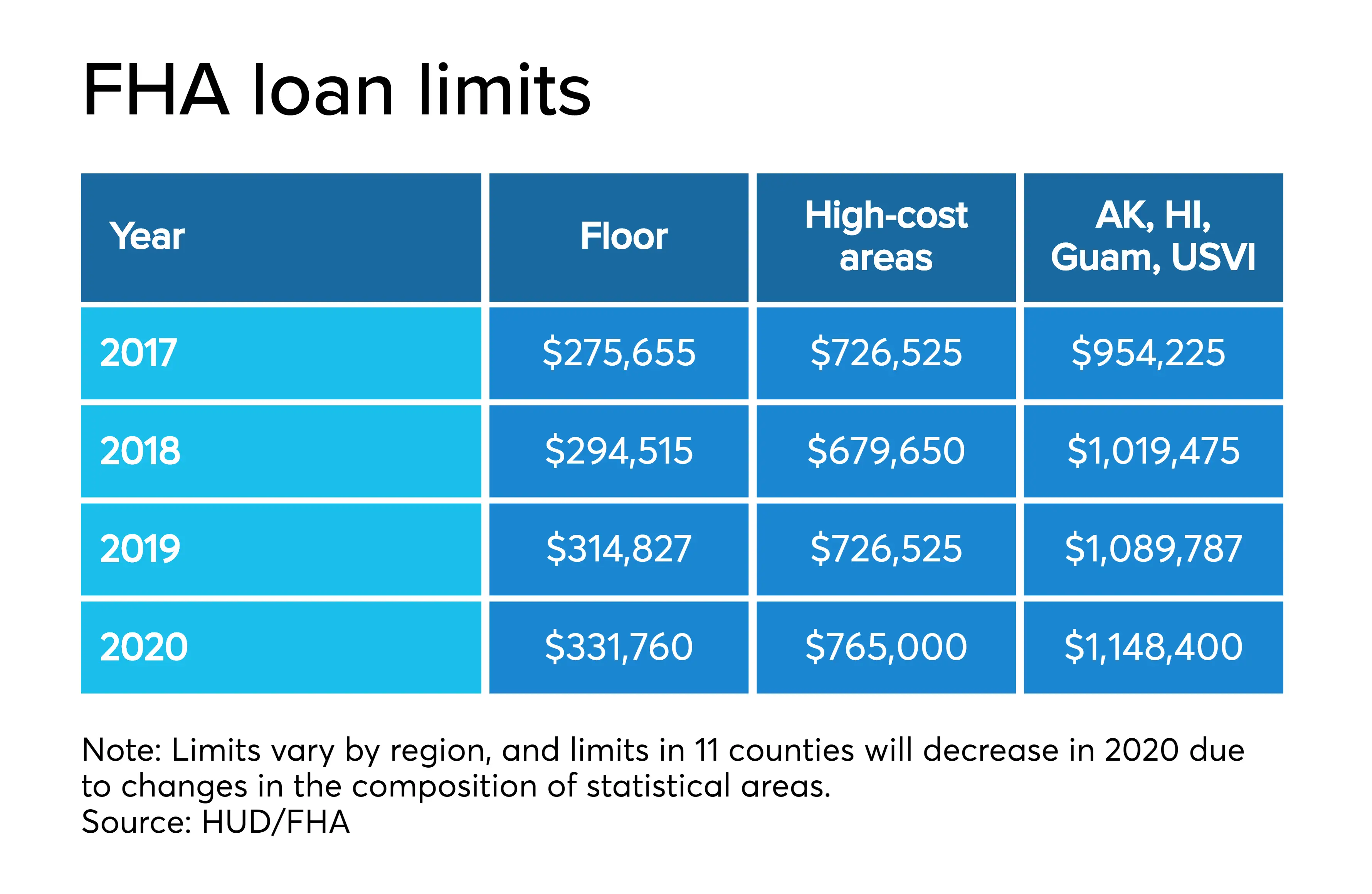

Those limits apply to conforming loans that follow Fannie Mae or Freddie Mac guidelines. A different loan limit kicks in if youre buying a home in 2021 using an FHA loan, which is backed by the Federal Housing Administration. The FHA loan floor for 2021 is $356,362, up from $331,760 in 2020. The maximum limit for approximately 70 high-cost counties has been raised to $822,375, up from $765,000 in 2020.

Keep in mind, the Federal Housing Finance Agency may increase conforming loan limits again for 2022. If you are planning on taking out a mortgage loan in 2022, check back here for updates on loan limits.