I Can Quickly Improve My Credit Score

Since you know that the absence of a credit history is actually a bad idea, you may be tempted to quickly apply for credit cards and small loans, to create a history. This would be a bad idea, because such attempts make it obvious to the credit institutions that you are trying to hurriedly create a credit history, to get a huge loan subsequently. This would also reflect poorly on your credit score.

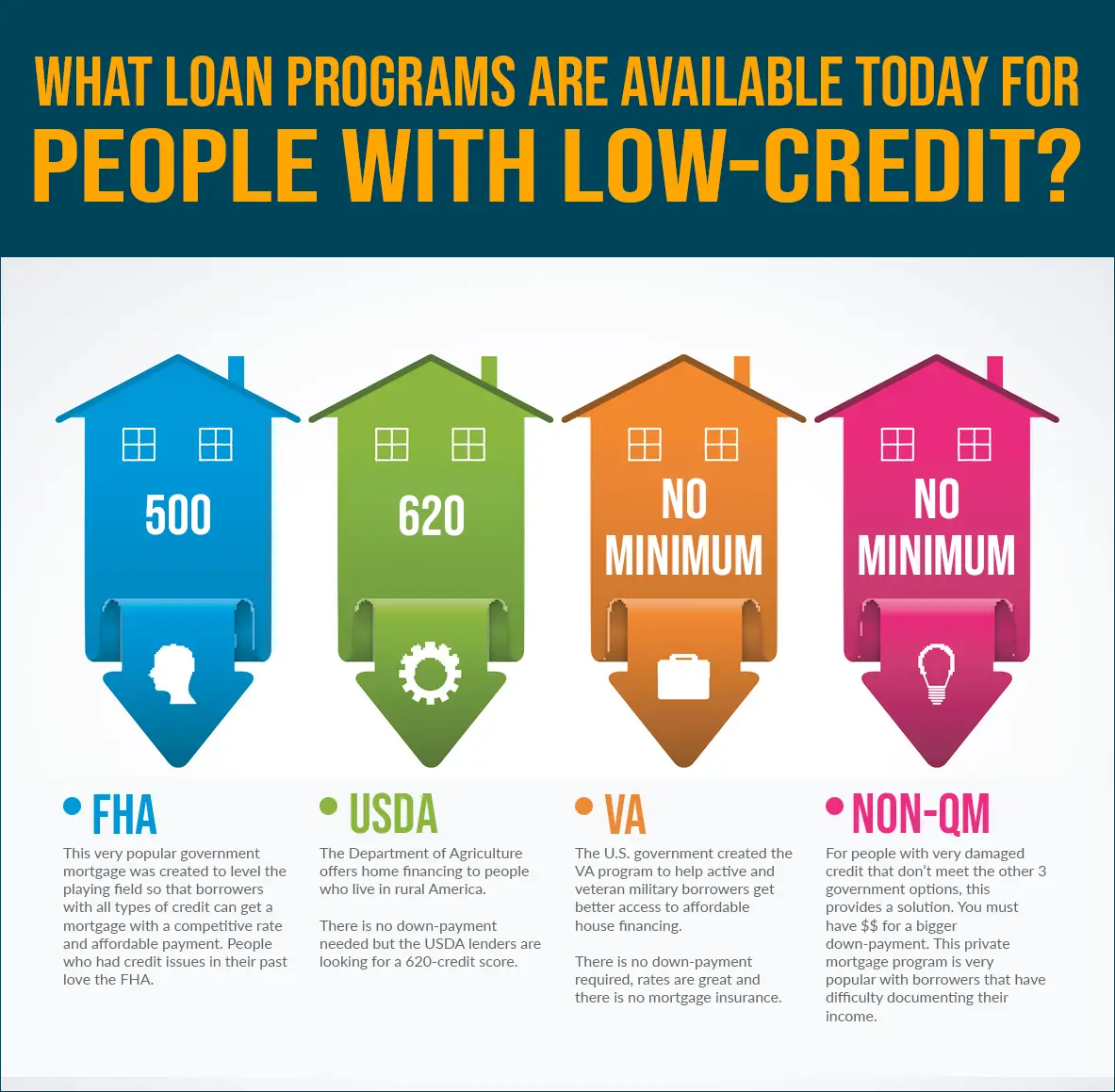

Fha Mortgage: Minimum Credit Score 500

FHA loans backed by the Federal Housing Administration have the lowest credit score requirements of any major home loan program.

Most lenders offer FHA loans starting at a 580 credit score. If your score is 580 or higher, you need to pay only 3.5% down.

Those with lower credit may still qualify for an FHA loan. But youd need to put at least 10% down, and it can be harder to find lenders that allow a 500 minimum credit score.

Another appealing quality of an FHA loan is that, unlike conventional loans, FHAbacked mortgages dont carry riskbased pricing. This is also known as loanlevel pricing adjustments .

Riskbased pricing is a fee assessed to loan applications with lower credit scores or other lessthanideal traits.

There may be some interest rate hits for lowercredit FHA borrowers, but they tend to be significantly less than the rate increases on conventional loans.

For FHAbacked loans, this means poor credit scores dont necessarily require higher interest rates.

Keep in mind, though, that FHA requires both an upfront and annual mortgage insurance premium which will add to the overall cost of your loan.

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Read Also: Apply Capital One Auto Loan

How Your Credit Score Affects Your Mortgage

Your credit score can have a positive or negative impact on your mortgage. A high credit score will work in your favour, while a low score or no credit history will work against you. This is because your credit determines how much of a risk you are for defaulting on your mortgage loan.

If your credit score indicates that you dont have a lot of debt and make regular, timely payments, youll have a higher credit score and will be seen as low-risk. If you have lots of debt and pay your bills late, youll have a lower score and will be seen as high-risk.

Understandably, banks dont want to lend lots of money to someone they deem as potentially unlikely to pay it back. If they do, it will be at a much higher interest rate that reflects that risk. Those higher interest rates mean higher mortgage payments and a larger cost over time.

How Credit Score Impacts Your Mortgage: Examples

Theres often a stark difference between mortgage interest rates at the highest and lowest ends of the credit score spectrum. And that equates to a big difference in monthly mortgage payments and longterm interest costs for homeowners.

Here are a few examples to show how your those differences in credit score can impact your mortgage costs.

Don’t Miss: Conventional 97 Loan Vs Fha

What Is A Good Credit Score In Canada

You may be wondering what’s considered a good credit score. In Canada, credit scores range between 300 and 900, although you’ll find very few people on the extreme ends of the spectrum. Most Canadian’s credit scores would fall between 600 and 800.

- A score of 800 or above is considered excellent.

- A score between 720 and 799 is considered very good.

- Between 650 and 719, you are considered to have a good credit score.

- 600 to 649 is considered fair.

- Anything under 600 is deemed to be a poor credit score.

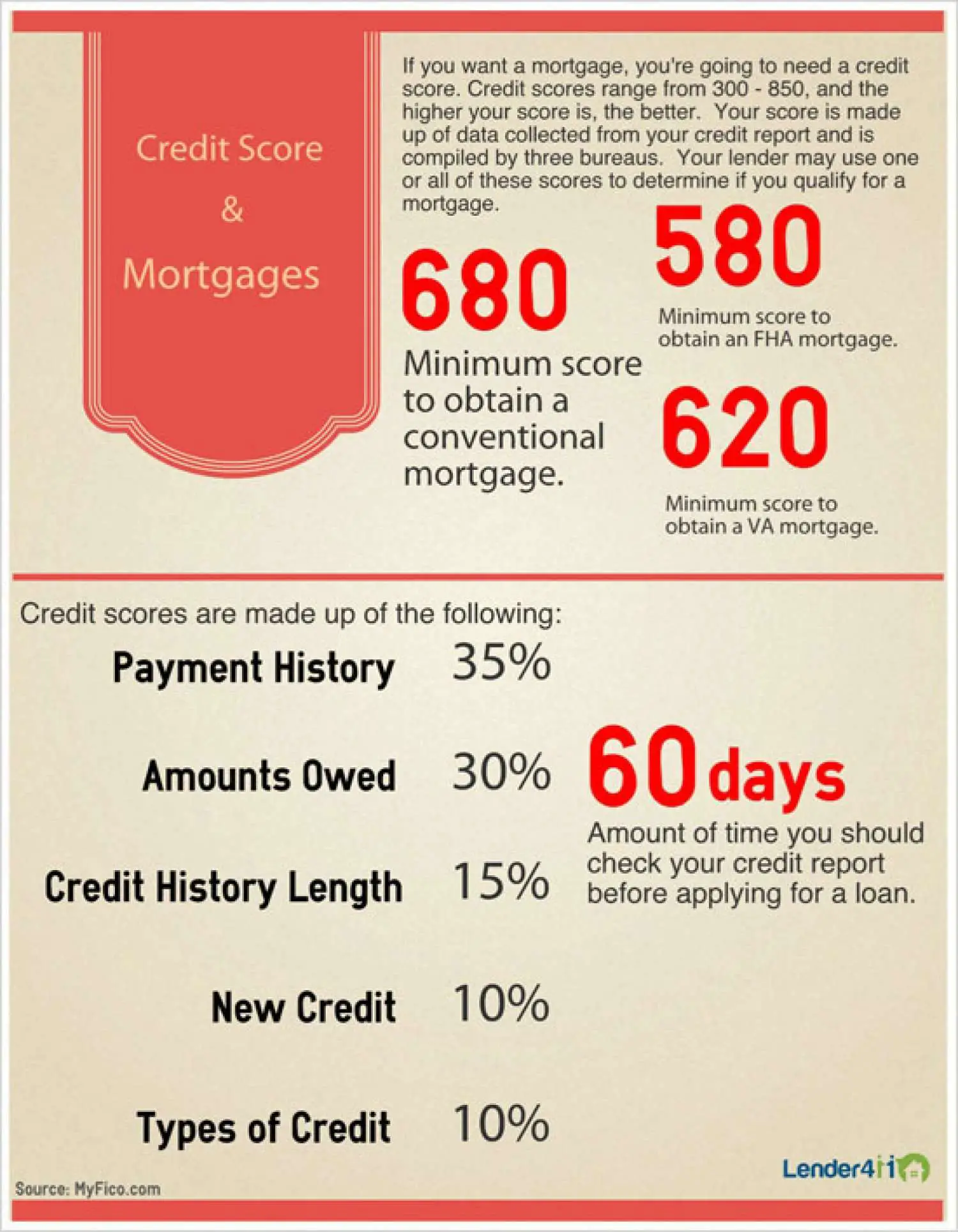

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

- New credit

Read Also: What Credit Bureau Does Usaa Use For Auto Loans

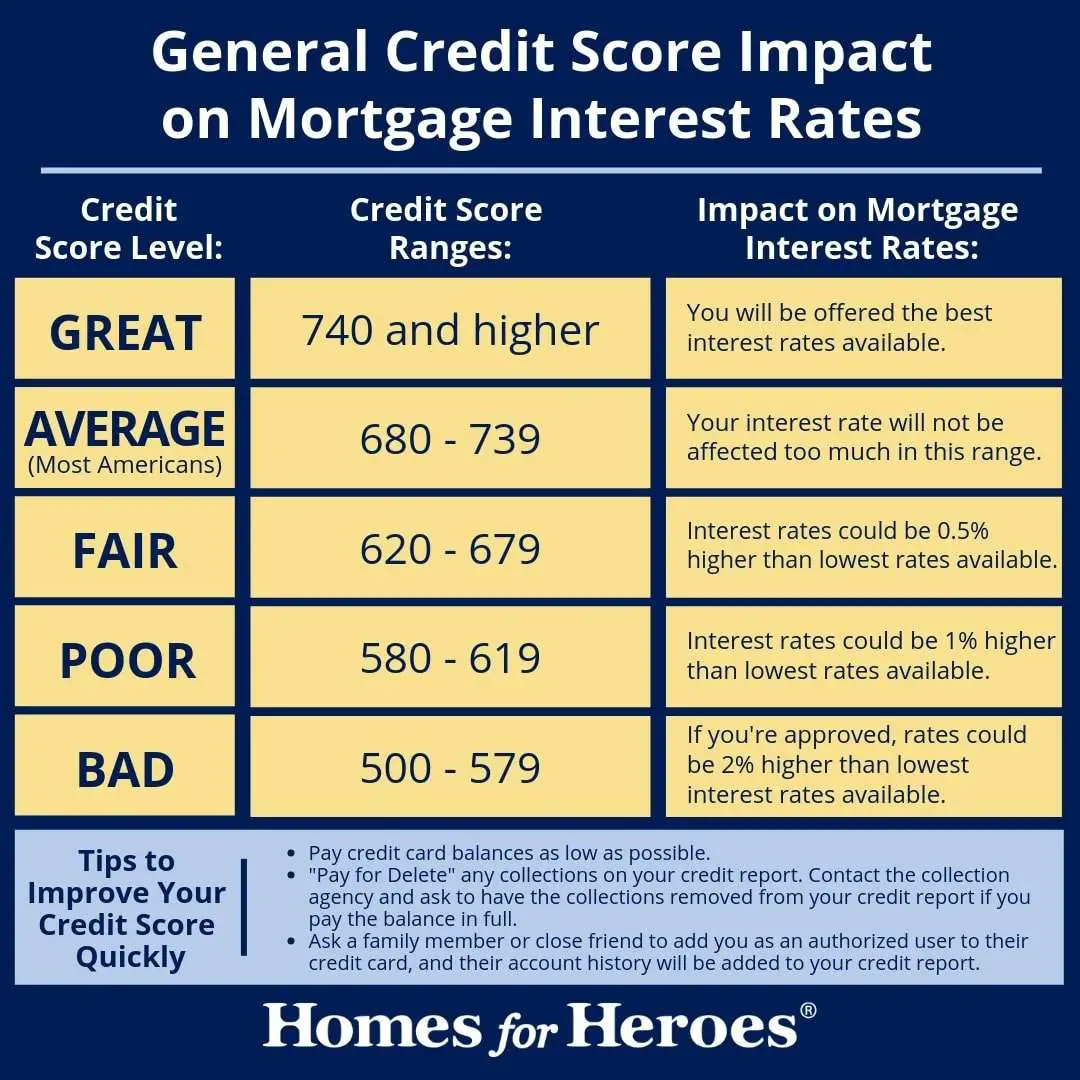

What Should My Credit Score Be To Get The Best Mortgage Rates

Hereâs a brief overview of what your credit score looks like to lenders and mortgage brokers. The higher your credit score, the better rates you can qualify for.

-

741 or more: Wow â your credit score is excellent! This is where the best mortgage rates live.

-

713 to 740: You have a good credit score. You should receive a very good interest rate on your mortgage and have plenty of options.

-

660 to 712: This is considered a fair credit score by lenders. However, once you get to 660, youâll be entering average credit score territory.

-

575 to 659: In the eyes of banks and lenders, this is a below-average credit score. If your credit score is below 640, you might have trouble getting a conventional mortgage from a bank or online lender. Consider working on improving your credit score before applying for a mortgage.

-

300 to 574: Your credit score is poor and needs improvement, but thatâs OK. As your credit stands right now, youâd be considered a high-risk borrower. Even if youâre approved for a mortgage, you would end up paying extremely high interest rates. You should make an effort to improve your credit score in order to access better mortgage rates in the future.

For every 20-point increment that your credit score drops, youâll likely see small changes in the interest rate youâre offered. Lenders typically adjust their offer rates each time your credit score moves up or down by 20 points.

It’s Not Just About Your Credit Score For A Mortgage

Your credit score for a home loan is certainly an important factor, but it is just one piece of the puzzle. In addition to your FICO® Score, your mortgage lender will consider:

- Your down payment: The minimum down payment for a conventional loan is 3% for first-time buyers. But higher down payments can increase your approval chances and also lower your interest rate. Plus, if your down payment is less than 20%, you’ll likely have to pay for PMI.

- Your income: Lenders want to know that you earn enough money to justify the loan. Generally speaking, lenders want to see that your new housing payment will make up less than 28% of your pre-tax income and that your total debts will be less than 45% of your income.

- Your assets: If you have substantial money in savings, lots of investments, or other assets, it can help bolster your mortgage application. In fact, lenders generally require that you have a certain number of mortgage payments in reserve.

- Your employment history: Not only does your lender want to see enough income to justify the loan, but it also wants to know that your income is likely to continue for the foreseeable future. As a general rule, lenders want to see at least two years of steady employment in the same industry, with no significant gaps.

- A total DTI ratio of 36% or less, and a down payment of at least 25% of the purchase price.

- A DTI of 45% or less, a down payment of at least 25%, and two months’ worth of mortgage payments in reserve.

Recommended Reading: Capitol One Car Loan

Whats The Minimum Credit Score To Buy A House

Home buyers are often surprised by the range of low credit home loans available today.

Many lenders will issue governmentbacked FHA loans and VA loans to borrowers with credit scores as low as 580. Some even start at 500 for FHA .

With a credit score above 600, your options open up even more. Lowrate conventional mortgages require only a 620 score to qualify. And with a credit score of 680 or higher, you could apply for just about any home loan.

So the question isnt always, Can I qualify for a mortgage?, but rather, Which one is best for me?

Dont Get Preapproved Too Far In Advance

When you receive your preapproval letter, itll probably say its good for 30 to 90 days. Since thats a relatively short period, youll probably want to wait to get preapproval letters until youre ready to start seriously shopping for a home. And remember, a preapproval is only a conditional approval. If you rack up more debt, change jobs or reduce your savings, you could get denied when you go to get final mortgage approval.

Don’t Miss: Cap One Auto Loan

Mortgage Rates By Credit Score

FICO, the biggest credit scoring company in America, has a handy online calculator that shows just how much mortgage rates vary by credit score.

As an example, heres how average annual percentage rates stacked up by credit score in early February 2022. Keep in mind that rates change constantly and will likely be different by the time you read this. These numbers are meant only as a sample to show you how much rates can vary.

| FICO Score |

| $2,239 | $382,876 |

*Payment examples and APRs sourced from myFICO.com on February 1, 2022. Payments based on a loan amount of $423,100 and a 30-year, fixed-rate mortgage loan. Your own interest rate and monthly payment will be different.

If you compare the highest and lowest credit score tiers, the borrower with better credit saves about $390 per month and $140,000 in total interest over the life of their mortgage loan.

Of course, most people fall somewhere in between those two extremes. But the point is, your credit can have a big impact on both your interest rate and the amount of interest youre paying to your mortgage lender.

If youre able to boost your score before applying for a home loan, it could lead to serious savings over the next few decades.

Better Credit Can Mean Better Interest Rates

Credit scores are a significant factor in determining the interest rate youll receive. Credit scores needed for a conventional loan are higher than those for FHA or even VA loans, which are government-backed by the U.S. Department of Veterans Affairs . Thats because lenders take on more risk.

To incentivize good credit, they offer more competitive rates to borrowers with higher credit scores, lower debts, and larger down payments.

Read Also: Flex Modification Calculator

How Do Lenders Make Use Of Cibil Scores

Previously, lenders had to make a partly subjective internal assessment and conduct background checks before sanctioning a loan. However, with the assistance of a credit score and a credit report, it is now very simple for the lender to obtain accurate, data-based credit information on the applicant.

CIBIL maintains a database of customer credit-related activity. This information is used to calculate their credit score.

- If your credit score is low , lenders may view you as a high-risk customer with a history of payment defaults and may be unwilling to approve your loan application.

- If you have a high score, lenders will see you as a low-risk customer with a low likelihood of default and will be willing to lend to you on favorable terms.

While there is no set minimum CIBIL score required to apply for a card, it is recommended that you have a score of at least 700 before applying for a home loan.

Understanding Your Credit Score

Your credit report is an essential part of getting your credit score, as it details your credit history. Any mistake on this document could lower your score. Its easy to check your credit score, and youre entitled to a free credit report from all three major credit reporting agencies once a year.

Its good practice to stay on top of your credit score and check it often for any errors to ensure youre in the best possible position. From there, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

Recommended Reading: Auto Loans For Self Employed

Down Payment And Closing Costs

It should come as no surprise that to buy a home, you need to have enough funds available to cover the down payment and closing costs However, you can’t just get these funds from any old source. Your lender will need to confirm that the down payment isn’t from borrowed funds and that you’ve had the money in your possession for at least 30 days.

Exceptions can be made, but don’t plan to use the income tax refund you expect to arrive in a couple of weeks to qualify for a mortgage you’re applying for tomorrow. Here is a list of acceptable sources of down payment.

Acceptable down payment sources

- RRSPs

- Other investments

- Equity from the sale of another property

- Gift from a parent or close relative

- Inheritance, employer bonus

Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You can qualify for a mortgage, youll just have to pay more for it.

Also Check: Usaa Auto Loan Credit Score

Keep A Check On Your Credit Report

When you apply for home loan, the housing finance companies will look for three main things viz a steady income, a down payment and a solid credit history. Hence, review your credit report i.e. check credit score regularly to see if there is any error that is hurting your credit score. If there is, then you can rectify the errors by contacting your lender.

Staying Off Credit Is Good

Thinking that banks will be impressed by the fact that you have never depended on credit to meet any of your financial needs, is ill-founded. In the total absence of a credit history, banks will have to go through a more rigorous scrutiny process, to figure out your credit-worthiness and repayment capacity. Hence, they will be more cautious, while examining your home loan application.

Read Also: Usaa Pre Approval Auto Loan

How To Improve Your Credit Score For A Home Loan

While scores of 700 and above are considered good enough for loan acceptance, there is also a range of CIBIL scores that are unacceptable for home loans. A score of 350 to 650 may not be ideal, but it may be adequate in some cases. A CIBIL score of less than 350, on the other hand, can be a major source of concern, not only for home loan acceptance but also as an overall representation of your repayment ability.

However, lower CIBIL scores are not set in stone. You can take proactive steps to avoid these numbers or even raise them over time to help you meet the CIBIL scorerequired for your home loan application.

What Are The Uses Of Cibil Score For Home Loans

Banks or financial institutions typically provide home loans, and as lenders, they must ensure that all relevant risks are minimized. This is where your CIBIL score comes into play.

Every month, TransUnion CIBIL Limited, a credit information company, generates reports on each individual and commercial organizations credit history. The CIBIL score is an essential component of this report.

By default, all banks and financial institutions are members of CIBIL and provide and receive information from them. When a person applies for a home loan, the lending financial institution looks at his or her CIBIL reports, particularly the CIBIL scores. They form a better judgment of ones history as a lender as a result of this and then decide whether the home loan application is accepted or rejected.

Also Read: CIBIL Score, Credit Score, Credit Rating and CIBIL Report Explained

Also Check: Usaa Classic Car Loan