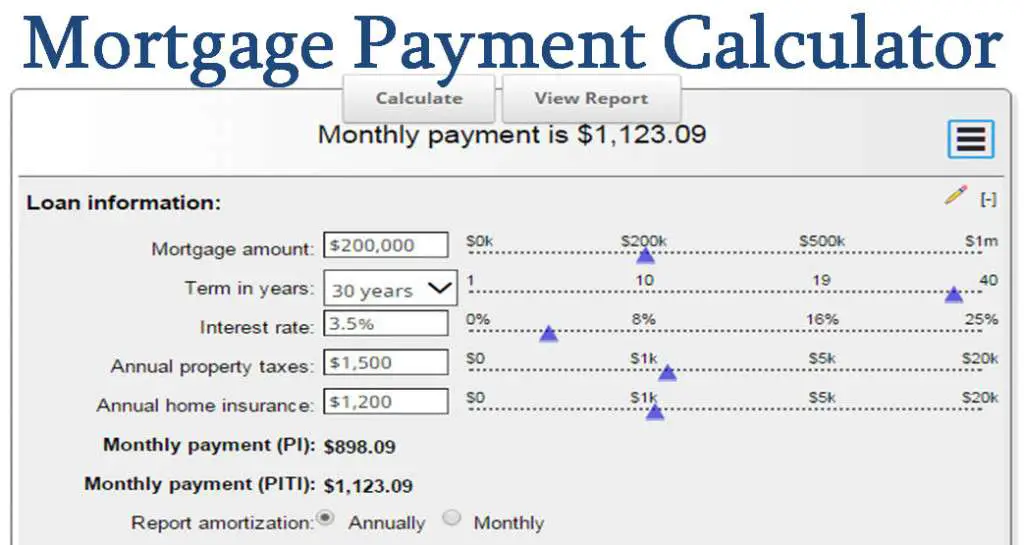

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

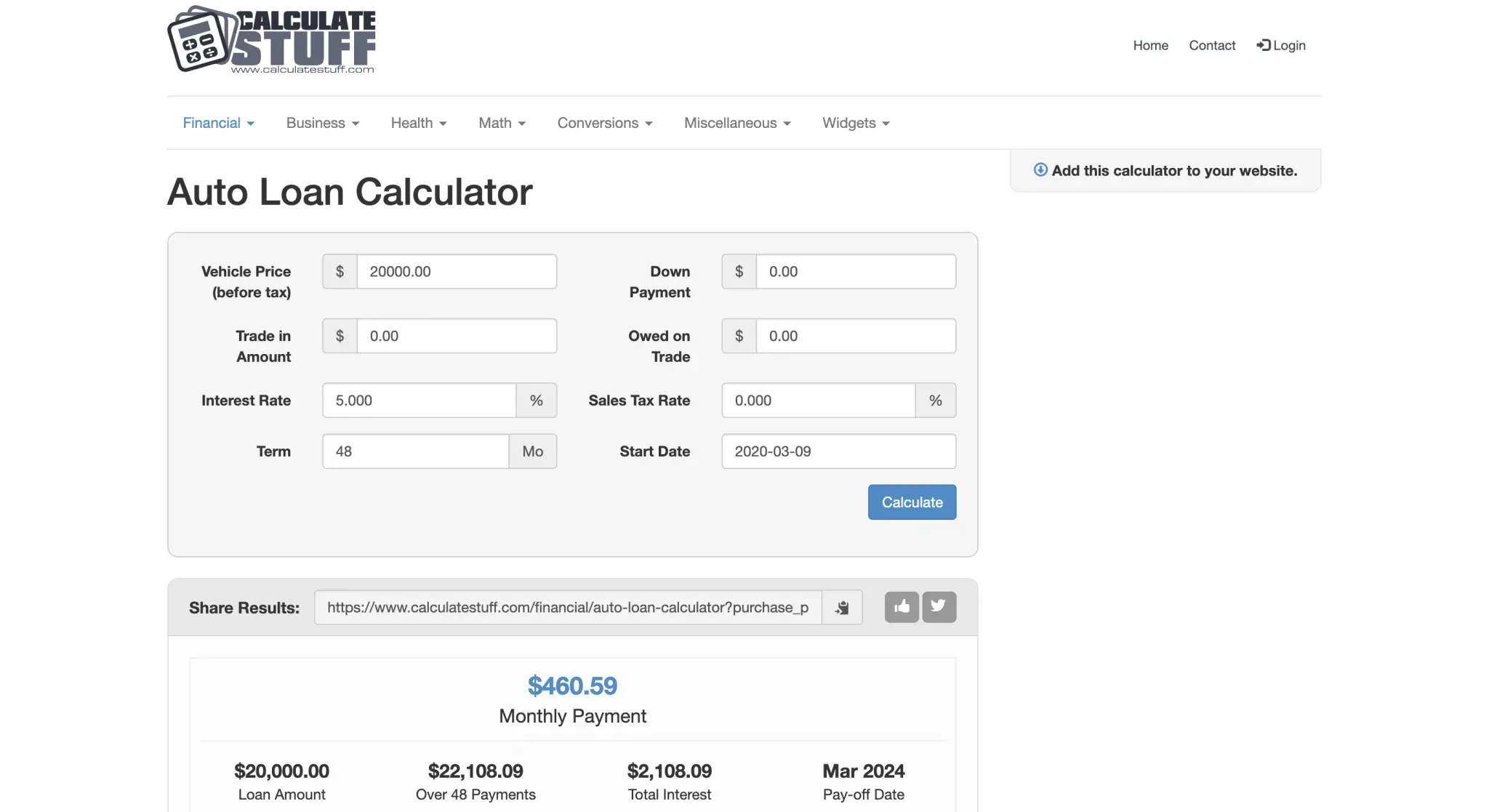

Why An Auto Loan Calculator Is Important

If youre planning on financing your new vehicle purchase, the overall price of the vehicle isnt really the number you need to pay attention to. The most important number, for you, is the payment. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less youll pay each month, because youre spreading out the loan amount over a greater number of months. However, due to the interest youll be paying on your loan, youll actually end up spending more for your vehicle by the time your payments are over. Why? Because the more time you spend paying off your loan, the more times you will be charged interest.

Speaking of interest, the interest rate is the second most important number to consider when structuring a car loan. The interest rate is the percentage of your purchase that is added to the cost of your vehicle annually. So, if you buy a vehicle with 4.99% financing, then youre paying roughly 5% of your vehicles overall price in added interest every year.

Next, consider how much your vehicle is worth if youre trading it in. If youre trading in a vehicle thats worth $7000 and youre buying a vehicle thats worth $22,000, then you will only have to take an auto loan out for $15,000 .

What Are Coronavirus Hardship Loans

Coronavirus hardship loans are short-term personal loans designed by lenders specifically to help people affected by the coronavirus pandemic. These loans are typically less than $5,000 and may have to be repaid within three years or less. Coronavirus hardship loans are popular among credit unions, in particular if you need short-term relief, ask your local credit union about its offerings.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Why Use A Simple Loan Calculator

A loan calculator isn’t an agreement or binding tool. In fact, usually when you use a loan calculator, it’s not associated with a specific loan at all. That means that the information you gather using a loan calculator is only an estimate.

However, that estimate can be helpful when you’re planning on applying for a loan. A calculator lets you look at what the monthly payment might be given various scenarios.

That helps you understand if you can afford a loanyou can see if the monthly payment amount would even fit in your personal budget.

You can also test different interest rate and loan term combinations to understand what might work for you. For example, you might find out using the calculator that you can’t afford a loan with a 12-month term. But maybe you could afford the same amount at the same interest rate over a longer period of timesince that would mean lower monthly payments.

Start With The Interest Rate

The higher your credit score, the lower the interest rate you will likely qualify for on a personal loan. If you think you might be in the market for a personal loan in the future, its a good idea to get to work building up your credit score. Contest any errors in your credit report, pay your bills on time and keep your credit utilization ratio below 30%.

Once you’re ready to shop for a personal loan, don’t just look at one source. Compare the rates you can get from credit unions, traditional banks, online-only lenders and peer-to-peer lending sites.

When you’ve found the best interest rates, take a look at the other terms of the loans on offer. For example, its generally a good idea to steer clear of installment loans that come with pricey credit life and credit disability insurance policies. These policies should be voluntary but employees of lending companies often pitch them as mandatory for anyone who wants a loan. Some applicants will be told they can simply roll the cost of the insurance policies into their personal loan, financing the add-ons with borrowed money.

This makes these already high-interest loans even more expensive because it raises the effective interest rate of the loan. A small short-term loan is not worth getting into long-term debt that you can’t pay off.

Read Also: What Car Loan Can I Afford Calculator

Your Down Payment Influences The Home Price You Can Afford

Because the minimum down payment in Canada is 5%, this benchmark is used to determine your maximum affordability. Ignoring your income and debt levels, you can infer your maximum purchase price based on the size of your down payment. Because the minimum down payment is a sliding scale, the calculation depends on whether your down payment is more or less than $25,000.

If your down payment is $25,000 or less, your maximum home price would be: down payment amount / 5%. For example, if you have saved $25,000 for your down payment, the maximum home price you could afford would be $25,000 / 5% = $500,000.

If your down payment is $25,001 or more, the calculation is a bit more complex. You can find your maximum purchase price using: down payment amount – $25,000 / 10% + $500,000. For example, if you have saved $40,000 for your down payment, the maximum home price you could afford would be $40,000 – $25,000 = $15,000 / 10% = $150,000 + $500,000 = $650,000.

Naturally, as your affordability is also a function of your income and debt levels, you should visit our mortgage affordability calculator for a more detailed analysis.

What Is The Minimum Down Payment Required In Canada

The minimum down payment in Canada depends on the purchase price of the home:

- If the purchase price is less than $500,000, the minimum down payment is 5%.

- If the purchase price is between $500,000 and $999,999, the minimum down payment is 5% of the first $500,000, and 10% of any amount over $500,000.

- If the purchase price is $1,000,000 or more, the minimum down payment is 20%.

Mortgage default insurance, commonly referred to as CMHC insurance, protects the lender in the event the borrower defaults on the mortgage. It is required on all mortgages with down payments of less than 20%, which are known as high-ratio mortgages. A conventional mortgage, on the other hand, is one where the down payment is 20% or higher.

According to a recent TD Canada Trust Home Buyers Report1, 30% of homebuyers plan to or have at least a 20% down payment, the point at which mortgage default insurance is no longer required.

You May Like: Genisys Loan Calculator

Amortized Loan Payment Formula

Calculate your monthly payment using your principal balance or total loan amount , periodic interest rate , which is your annual rate divided by the number of payment periods, and your total number of payment periods :

Assume you borrow $100,000 at 6% for 30 years to be repaid monthly. To calculate the monthly payment, convert percentages to decimal format, then follow the formula:

- a: 100,000, the amount of the loan

- r: 0.005

- n: 360

- Calculation: 100,000//=599.55, or 100,000/166.7916=599.55

The monthly payment is $599.55. Check your math with an online loan calculator.

Bond: Predetermined Lump Sum Paid At Loan Maturity

This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value of a bond, is the amount paid by the issuer when the bond matures, assuming the borrower doesn’t default. Face value denotes the amount received at maturity.

Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds.

After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond’s value at maturity, a bond’s market price can still vary during its lifetime.

Read Also: What Percentage Does A Loan Officer Make

Secured Vs Unsecured Loans

Mortgages and car loans are offered at lower interest rates than personal loans because they are secured by the collateral of the house or car from which you are borrowing money to buy. A personal loan with no collateral against it will cost you more in interest because if you default, then the bank will have nothing tangible to foreclose on or repossess to cover your debt.

Types Of Personal Loans And Their Uses

With the exception of loans from a few niche lenders, like Payoff, most personal loans can be used for any purpose. The most common types of personal loans are:

- Debt consolidation: If you have multiple lines of credit card debt, for instance, you can pay them off with a personal loan and repay the loan over time, often with a better interest rate.

- Emergency expenses: Unexpected expenses like a car repair or hospital bill can throw off your monthly budget, and a small personal loan can alleviate the immediate cost.

- Home renovations: A personal loan is a great way to pay for a large home renovation project and boost the equity in your home.

- Major purchase or event. Personal loans are often used to cover major expenses, such as a wedding or vacation.

To learn more, read our article on the top nine reasons to apply for a personal loan.

Recommended Reading: Usaa Bad Credit Auto Loans

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Also Check: Usaa Auto Loan Application

About The Loan Origination Date And First Payment Date

Important – The first loan payment period is seldom equal to the frequency of other schedule payments. That is, if a loan’s payment schedule is monthly, the time from when the loan originates until the day the first payment is due will likely not equal one month. The first period will typically be either longer or short than a month.

A longer or shorter first period impacts the interest calculation.

Very few online calculators can correctly handle this detail. But if you want accurate interest and payment calculations, you need to be able to independently set the loan origination date and the first payment due date. You can do that on the “Options” tab of this calculator.

Warning – Selecting dates will result in payment amounts as well as interest charges that do not match other calculators.

That’s the point!

If you want to match other calculators, then set the “Loan Date” and “First Payment Due” so that the time between them equals one full period as set in “Payment Frequency.” Example: If the “Loan Date” is May 15th and the “Payment Frequency” is “Monthly,” then the “First Payment Due” should be set to June 15th, that is IF you want a conventional interest calculation.

See “Long Period Options” and “Short Period Options” below for additional details about payment amounts and interest calculations.

Yet keeping it simple – if you only need estimates and not absolute accuracy, you can always leave the dates set as they are when the calculator loads.

Deferred Payment Loan: Single Lump Sum Due At Loan Maturity

Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

You May Like: Does Va Loan Work For Manufactured Homes

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Loan Payment Calculations Explained

The Balance / Julie Bang

Loan payment calculations, or monthly payment formulas, provide the answers you need when deciding whether or not you can afford to borrow money. Typically, these calculations show you how much you need to pay each month on the loanand whether it’ll be affordable for you based on your income and other monthly expenses.

Read Also: How To Refinance An Avant Loan

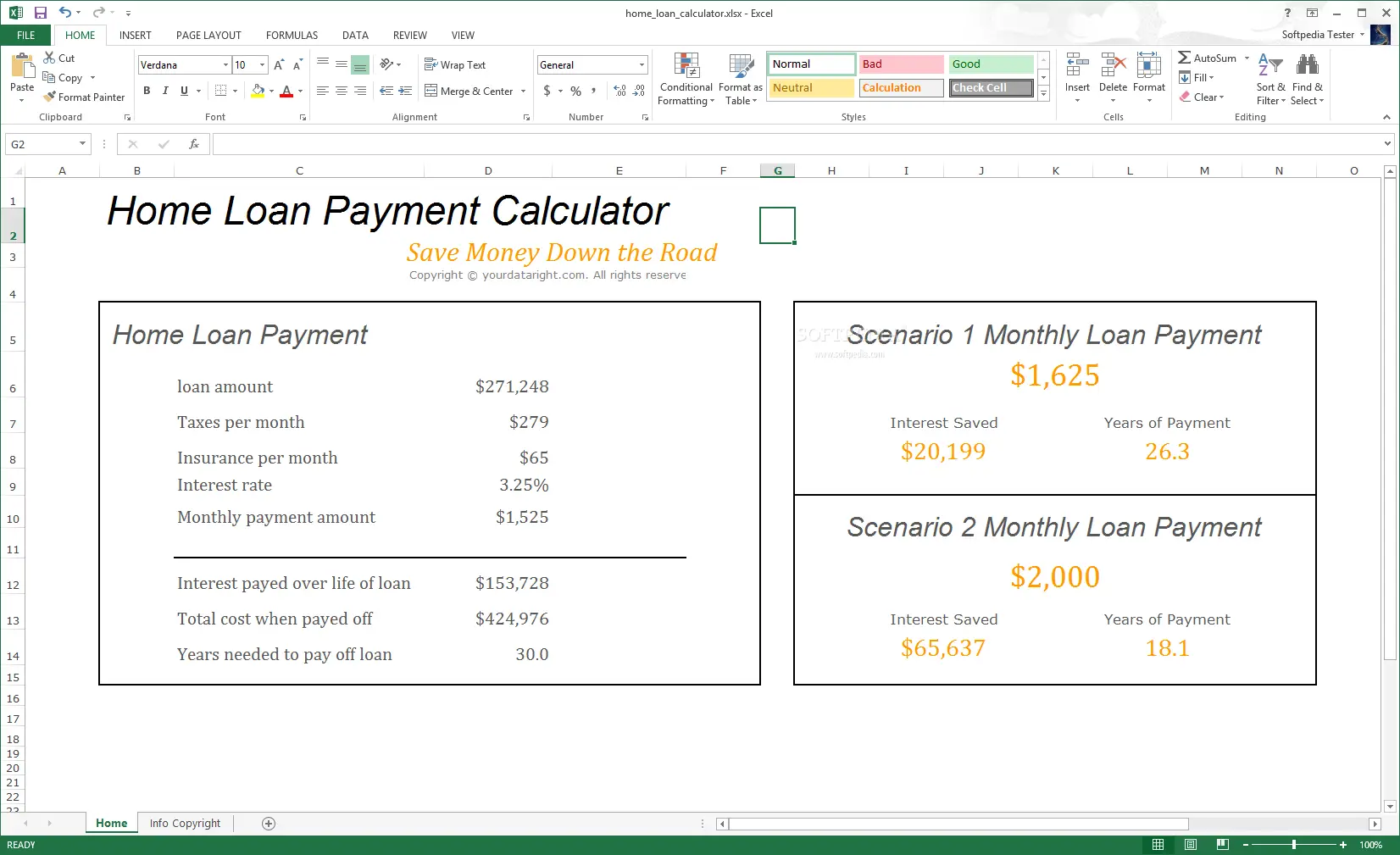

How Much Will The Total Loan Cost

It can be difficult to understand exactly how much you’ll pay when you have several competing loan offers. One might have a lower interest rate, while another offers lower fees. Figuring out which offer to choose means you’ll need to calculate the total cost of the loan including interest and fees. Calculators help with apples-to-apples comparisons. For example, some amortization calculators show you lifetime interest which you can use to compare interest costs from loan to loan.

Consider more than just your monthly payment amount when reviewing the terms of a loan.

In addition to your monthly payment, its crucial to focus on the purchase price, lifetime interest, and any fees.

APR is another useful tool for comparing loan costs. On mortgages, some APRs account for upfront costs in addition to the interest rate you pay on your loan balance. But the lowest APR isnt always the best loan. You might not even qualify for the lowest advertised APR. If the APR is low but closing costs and fees are high, and you don’t keep your loan for very long, you won’t see the benefits of that low APR.

With mortgages, you’ll also want to take into account other costs, such as property taxes, homeowners insurance and homeowners association fees. A good mortgage calculator can help you account for all of those costs to get the true cost of the house.

Fixed Monthly Payment Amount

This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Simply add the extra into the “Monthly Pay” section of the calculator.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that interest will accrue at such a pace that repayment of the loan at the given “Monthly Pay” cannot keep up. If so, simply adjust one of the three inputs until a viable result is calculated. Either “Loan Amount” needs to be lower, “Monthly Pay” needs to be higher, or “Interest Rate” needs to be lower.

Also Check: Usaa Auto Loan Rates Used Cars

What Are Current Personal Loan Interest Rates

Personal loan interest rates currently range from about 3 percent to 36 percent, depending on your . As of July 7, 2021, the average personal loan interest rate is 10.49 percent.

The better your credit score, the more likely you are to qualify for a personal loan with the lowest interest rate available. Compare personal loan offers to see what you are eligible for before applying for a personal loan.

What Is My Loan Payment Formula

Now that you have identified the type of loan you have, the second step is plugging numbers into a loan payment formula based on your loan type.

If you have an amortized loan, calculating your loan payment can get a little hairy and potentially bring back not-so-fond memories of high school math, but stick with us and we’ll help you with the numbers.

Here’s an example: let’s say you get an auto loan for $10,000 at a 7.5% annual interest rate for 5 years after making a $1,000 down payment. To solve the equation, you’ll need to find the numbers for these values:

-

A = Payment amount per period

-

P = Initial principal or loan amount

-

r = Interest rate per period

-

n = Total number of payments or periods

The formula for calculating your monthly payment is:

A = P ^n) / ^n -1 )

When you plug in your numbers, it would shake out as this:

-

P = $10,000

-

r = 7.5% per year / 12 months = 0.625% per period

-

n = 5 years x 12 months = 60 total periods

So, when we follow through on the arithmetic you find your monthly payment:

10,000 / – 1)

10,000 /

10,000

10,000 = $200.38

In this case, your monthly payment for your cars loan term would be $200.38.

If you have an interest-only loan, calculating the monthly payment is exponentially easier . Here is the formula the lender uses to calculate your monthly payment:

loan payment = loan balance x

In this case, your monthly interest-only payment for the loan above would be $62.50.

Read Also: Refinancing Car Loan Usaa