How Are Mortgage Rates Set

Several economic factors influence rates, from inflation to monetary policy. Likewise, different lenders charge different mortgage rates for a variety of reasons, including varying operating costs, risk tolerance and even how much they want new business. Your personal financial informationincluding credit score, debt-to-income ratio and income historyalso have a significant impact on interest rates.

Refinances Are Still A Pretty Good Deal At These Rates

Rates remain a bit above the record lows reached earlier this year, but refinancing remains a historically excellent deal. The rate on 10-year bonds issued by the U.S. government moved to 1.46 percent this week. The 10-year Treasury is closely tied to 30-year mortgage rates.

Economists generally expect rates to rise by the end of 2022. As mortgage rates make a predicted slow climb to the 3.5 percent range, decreased purchasing power might ease some of the pressure on home prices.

But competition will remain intense among those who can still afford to buy. Those looking to refinance should be able to find good deals, though at rates a bit higher than the current level.

The bottom line: If you see a rate that fits your needs and budget, the time to do that refinance could be now. In fact, many homeowners with a mortgage havent taken advantage of the low rate environment. Among homeowners with a mortgage theyve had since before the pandemic, 74 percent have not refinanced, according to a recent Bankrate survey.

The overwhelming majority of mortgage borrowers have not yet refinanced, despite record-low rates over the past year, says Greg McBride, Bankrates chief financial analyst. Cutting the monthly mortgage payment by $150 or $250, possibly more, can create valuable breathing room in the household budget at a time when so many other costs are on the rise.

What Are Current Fha Loan Rates

Youve probably heard that mortgage rates are going up this year. Youre wondering just how high they are and whether you should buy a home before they go even higher.

But tracking FHA loan rates today, or any mortgage rates for that matter, may be less informative than you think.

The rates you see can give you insights into the market, and rates are up from where they were at the height of the Covid-19 pandemic in 2020. But rates may stay low throughout 2021.

And if youre wondering whether to buy, the first place you should look isnt daily rates. Its at your own creditworthiness.

Because that can have a big effect on your interest rate.

Also Check: Does Usaa Refinance Auto Loans

Historical Mortgage Rates And Refinancing

Refinancing is the process of swapping your old loan for a new loan. Homeowners can take advantage of lower rates to decrease their monthly payment. This extra money could go toward the principal, paying other debts or building up your savings.

A cash-out refinance is a refinancing option if you have enough equity in your home. The way a cash-out refinance works is you take out a loan for more than you owe on the home. You can use the extra to pay off other debts or make home renovations. If rates are lower than when you took out your first mortgage, your payment may not change much.

Current Jumbo Mortgage Rate Trends Down

The current average rate youll pay for jumbo mortgages is 4.54 percent, down 4 basis points from a week ago. This time a month ago, jumbo mortgages average rate was lower, at 4.26 percent.

At todays average rate, youll pay principal and interest of $503.13 for every $100k you borrow. Thats lower by $7.13 than it would have been last week.

Read Also: Fha Title 1 Loans

How Mortgage Rates Have Changed Over Time

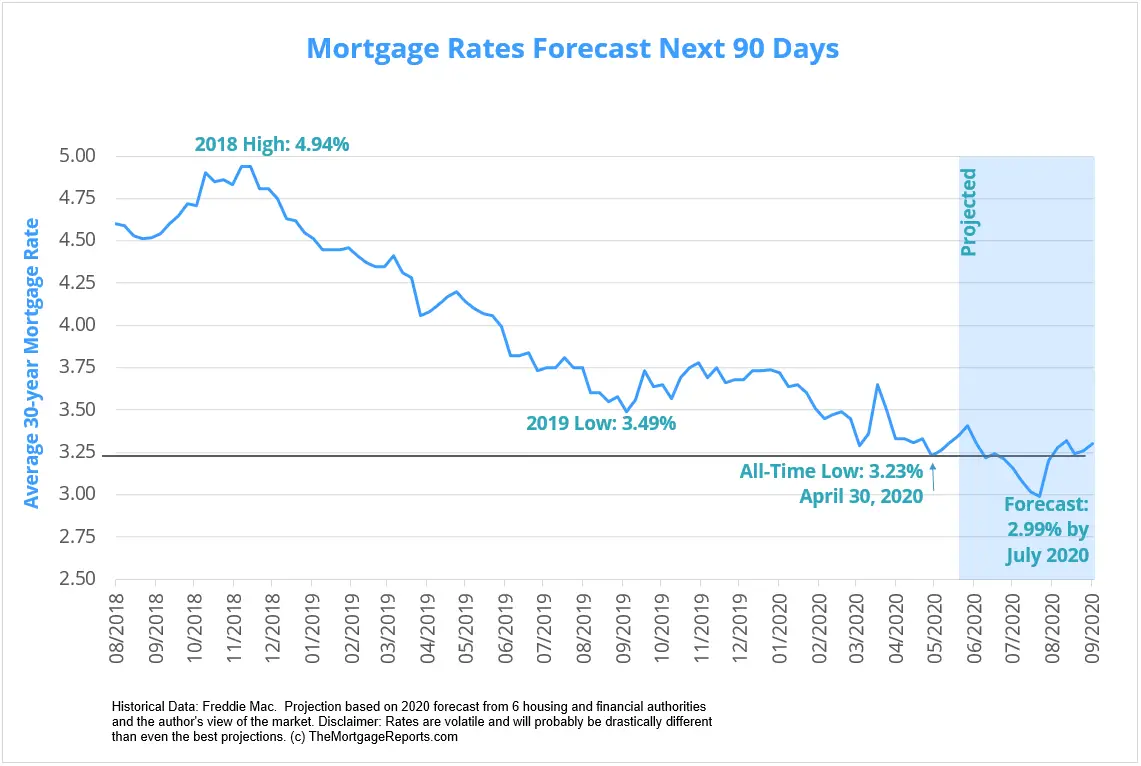

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of todays lower interest rates. When considering a mortgage or refinance, its important to take into account closing costs such as appraisal, application, origination and attorneys fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

Are you looking to buy a home? Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Use Credibles online tools to compare rates and get prequalified today.

Thousands of Trustpilot reviewers rate Credible “excellent.”

What Do The Latest Rates Mean For Existing Homeowners

While experts have said the rising rates have cut down the number of homeowners who can save money by refinancing at a lower rate, whether it makes sense depends entirely on your personal financial situation. Generally, if you can refinance at a rate at least 0.75% lower than your existing rate, it makes sense. If you can lower your rate, regardless of whats going on in the market, and its going to save you money, cool, Beeston says.

Another option is a cash-out refinance, which is less based on lowering your interest rate and instead allows you to tap into some of the equity of your home like from those rising home prices to take out cash for another purpose. That might be for a major home improvement to further boost the equity, or for debt consolidation. Beeston says debt consolidation is typically a good reason to refinance, especially because rising interest rates will affect not just mortgage rates but all consumer debt, including credit cards.

If youre considering a cash-out refinance to take out a relatively small amount of money, however, Beeston recommends taking a close look at whether its worth doing so if youre raising the interest rate on the rest of your mortgage. If you have a mortgage of, say, $500,000, and you want to do a cash-out refi to take out $10,000, crunch the numbers to see if itll cost you more in the long run. Make sure youre doing the math, Beeston says. Dont just trust the lender to do the math for you.

Recommended Reading: Usaa Credit Score For Auto Loan

What Is A Discount Point

A discount point also called a mortgage point is an upfront fee paid at closing to reduce your mortgage rate. One point is equal to 1% of your loan amount. So if youre borrowing $300,000 for example, one point would cost you $3,000.

Each mortgage point can lower your rate 12.5 to 25 basis points, which equals 0.125% to 0.25%.

What If You Dont Want To Stay In The Home Forever

Maybe youre planning to buy a starter home now, knowing youll want to move in a few years. Perhaps youre doing a medical residency, and you expect to relocate for a new job opportunity.

In other words, youre not so concerned about finding a forever home but you still want a good rate.

Now is still a good time to buy, even under those circumstances. Lets say you buy a house now at a comparatively good rate, with the intention to move a few years down the road. The rate you get on this property is what Id call a transitory rate, because youll transition to another property and loan at some point.

But by buying a house in the current market with a good mortgage rate now, youve:

- Bought a property in which youll gain equity while you live in it, and you can use that equity to purchase another home once youre ready

- Stabilized your housing payment for the time youre living in the home, avoiding higher interest rates or rent hikes

Also Check: Why Is My Car Loan Not On My Credit Report

Avoid Higher Rates With A Short

In a rising mortgage rate environment, there are certain strategies you can use to secure a lower interest rate. One is choosing a shorter loan term.

Homeowners who refinance from a 30-year mortgage into a 15-year mortgage often secure far lower interest rates. Just look at Freddie Macs survey as an example:

On November 18, 2021, 30-year fixed rates were averaging 3.10%. But 15-year fixed rates were averaging just 2.39% more than 50 basis points lower than a 30-year loan term.

And thats not unusual.

15-year fixed rates are almost always significantly lower than 30-year rates.

That represents a huge savings opportunity for homeowners who refinance into a 15-year mortgage. Doing so could easily save you thousands over the life of the loan.

Just keep in mind that 15-year loan terms come with higher payments. So youll need to compare your options and choose the loan type that makes the most sense for your monthly budget.

What Does That Mean For You As A Borrower

It means you should take low rates as they come. Whether youre buying a home or refinancing, todays lowest rates represent a great deal one not worth passing up in hopes of slightly lower rates later on.

And borrowers shouldnt try too hard to time the market.

Mortgage rates are unpredictable right now. So keep a laser focus on your own personal goals, and lock a mortgage rate when the time is right for you regardless of what the market might do.

Don’t Miss: Loan Officer Commission Percentage

What Are Todays Mortgage Rates

Low mortgage rates are still available. Connect with a mortgage lender to find out exactly what rate you qualify for.

1Todays mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

Popular Articles

Resources

Mortgage Rate Trends By Loan Type

Many mortgage shoppers dont realize there are different types of rates in todays mortgage market.

But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are 3-month mortgage rate trends for the most popular types of home loans: conventional, FHA, VA, and jumbo.

Recommended Reading: Max Fha Loan Amount Texas 2020

The Rules That Could Stop You Remortgaging

The ability to remortgage and/or fix your mortgage has become a bit more difficult over recent years as the rules surrounding the affordability tests when applying for a mortgage were tightened slightly. Lenders always had to make sure borrowers could still afford to pay the mortgage if interest rates went up.

However, if you were simply remortgaging, lenders didn’t have to apply the more stringent affordability tests. Some lenders did just that which made remortgaging a bit easier. But new rules removed this option for lenders which could end up leaving some borrowers stranded on their existing deals which is why it’s important to calculate the impact of an interest rate rise and seek advice from a mortgage expert by following the steps below. It will take you a few seconds but could prevent your mortgage repayments crippling your finances in the future and help you lock into low rates while they are still available.

If you are planning on fixing your mortgage rate when interest rates do start going up, mortgage rules may prevent you â leaving you stranded on your existing deal with your mortgage repayments rising in line with the bank base rate or your lender’s whim.

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 3.6% right now.

Read Also: Fha Refinance Mortgage Insurance

Homeowners Generally End Up With More Wealth

Data from the U.S. Census shows one of the key reasons why buying a home is a good financial choice for most people, even if they can’t qualify for rock-bottom mortgage rates. According to the Census, the median net worth of homeowners is 80 times the median net worth of renters.

Some of that is explained by the fact that people with more wealth in the first place are in a better position to purchase a home than those who are facing factors that cause them to struggle to become a homeowner . But, when you own a home, the house helps you to grow your net worth in most situations.

Each month when you pay down your mortgage loan, you acquire more equity in your home. Eventually, over time, you come to own a valuable asset that is worth hundreds of thousands of dollars — or even millions of dollars. That’s not the case for renters when they pay rent.

Homes also tend to increase in value over the long term, so you acquire more equity as your property value rises. If you can make tens of thousands of dollars or hundreds of thousands of dollars of profit on the property you’re living in, this will naturally leave you better off.

Timing The Market: Waiting Out Home Prices Going Down

Instead of trying to time the market, consider basing your homebuying decision on your personal timeline.

My advice when the homes are in short supply, is if you think youre ready financially and emotionally to commit to being in one place for a long time, thats when it makes sense to buy a home, says Hale. And if youre ready, and you start shopping, you should buy when you find a home that works for you, meets your needs, and fits your budget.

She also advises prospective homebuyers to think long term, especially if theyll be committing to a 30-year mortgage.

Your best bet is to think very long term, says Hale. You want to think about the next five to seven years, but not necessarily about very short-term fluctuations.

Also Check: Firstloan Com Legit

Understand Inflation In The Us

- Inflation 101: What is inflation, why is it up and whom does it hurt? Our guide explains it all.

- Your Questions, Answered: We asked readers to send questions about inflation. Top experts and economists weighed in.

- Whats to Blame: Did the stimulus cause prices to rise? Or did pandemic lockdowns and shortages lead to inflation? A debate is heating up in Washington.

- Supply Chains Role: A key factor in rising inflation is the continuing turmoil in the global supply chain. Heres how the crisis unfolded.

Rates are rising as strong demand for homes, along with a tight supply of properties for sale, has pushed up home prices. The typical sale price of a previously owned home in 2021 was just under $347,000, according to the National Association of Realtors an increase of nearly 17 percent from 2020.

Shoppers should still expect a competitive spring housing market, Ms. Hale said. Some potential buyers who have been on the fence may move quickly to lock in mortgage rates before they rise further. It gives shoppers some urgency to close sooner rather than later, she said.

But some shoppers particularly first-time buyers may decide to wait until even higher rates help cool off prices later in the year. The largest share of home buyers are millennials ages 21 to 40, many of whom are first-time buyers, according to the National Association of Realtors.

The spring season will be very interesting, said Lawrence Yun, the chief economist with the Realtors association.

What Happened In November

As November dawned, I predicted that inflation would push mortgage rates higher but they wouldn’t rise steeply.

But instead of the slow rise that I expected, mortgage rates meandered up and down most of November. The average rate on the 30-year fixed-rate mortgage was almost the same as October’s despite inflation rising to 6.2%, according to the Consumer Price Index.

About the author:Holden Lewis is NerdWallet’s authority on mortgages and real estate. He has reported on mortgages since 2001, winning multiple awards.Read more

Read Also: Refinance Usaa Car Loan