How An Unsubsidized Loan Works

The first step in applying for financial aid is filing a FAFSA form, which details your financial circumstances, including income and tax information. It is required by most colleges and universities if you are seeking financial aid.

There are no financial eligibility requirements for an unsubsidized loan, but youâll still need to fill out the form and meet other qualifications. Borrowers must be a U.S. citizen or permanent resident, enrolled in an accredited school at least half time, and pursuing a degree or certificate from the school. Additionally you must not be in default on other federal student loans or owe money for a federal grant.

When you borrow money for a federal student loan, the lender is the U.S. Department of Education. Billing and processing however will be outsourced to a third-party loan servicer. As soon as the federal loan funds are disbursed to the college, they begin to accumulate interest. If you donât pay the interest, it will capitalizeâ meaning it gets added to the principal loan amount, potentially causing you to repay much more â sometimes thousands of dollars more â over the course of your loan.

Get essential money news & money moves with the Easy Money newsletter.

Free in your inbox each Friday.

Sign up now

How To Apply For A Direct Unsubsidized Loan

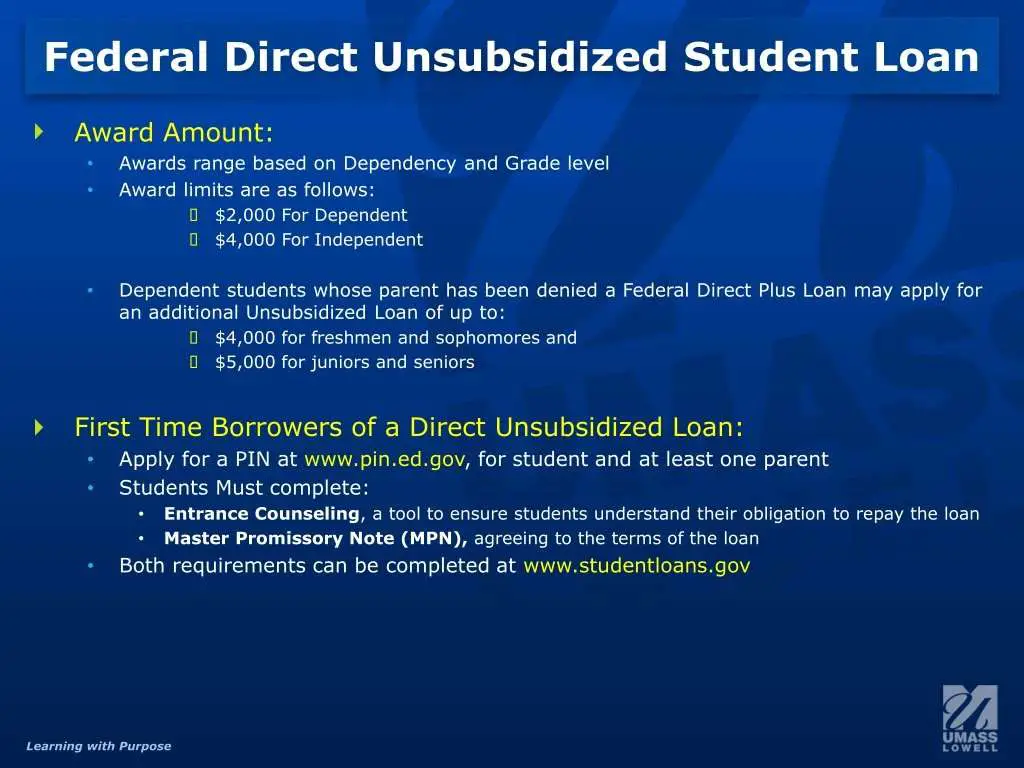

Elements Of A Federal Direct Unsubsidized Loan

The key elements of a Federal Direct Unsubsidized Loan are as follows:

- There is a fixed interest rate of 4.45% for undergraduate students and 6% for graduate students.

- You are not required to provide proof of financial need.

- There is a six-month grace period after you graduate, during which the same rules from your academic term apply.

- The interest is capitalized during your studies and the six-month grace period.

- There is a 1.069% loan origination fee taken out of each disbursement.

Unsubsidized loans act as a temporary solution to the immediate problem of high college fees. Today, most students tend to consolidate student loans with other loans to make the repayment process easier.

Also, there is a limit on the amount in subsidized and unsubsidized loans that you may be eligible to receive each academic year .

Dont Miss: Refinance Usaa Auto Loan

Recommended Reading: Reinstate Va Loan Eligibility

How To Calculate Apr

Now that we have the fees for each loan type, the next step to finding the APR is to estimate the monthly payment amount. Rather than breaking out the calculator or pen and paper, open excel or google sheets and type the following formula:

=PMT

Where:

- rate is the interest rate divided by 12

- nper is the number of payment periods, or months, you will make payments on the loan to repay it

- pv is the present value, or principal, of the loan

Now you can use that payment figure to calculate the APR in excel using the following:

=RATE

- nper is the same number of payment periods you used before

- pmt is sht monthly payment figure you calculated above

- pv is the principal amount

Fees For Federal Student Loans

Federal Student Loans also charge fees that are a percentage of the total loan amount. Similar to the fixed interest rate, these depend on the loan type and are set annually. The fee is deducted from each loan disbursement you receive while enrolled in school.

For example, a 4.228% fee means if you want your school to receive $10,000 in disbursement, you need to effectively borrow $10,441.5 ) in principal for that student loan to cover the fee, so that your school will receive $10,000. Or if you borrow for $10,000 in principal, your school will then only receive $9,577.2 ) actual disbursement.

Don’t Miss: Nslds Ed Gov Legit

What Can Disqualify You From Financial Aid

Incarceration, misdemeanors, arrests, and more serious crimes can all affect a students aid. Smaller offences wont necessarily cut off a student from all aid, but it will limit the programs they qualify for as well as the amount of aid they could receive. Larger offences can disqualify a student entirely.

How To Get Subsidized And Unsubsidized Loans

To get a federal loan, first submit the FAFSA. Youll get a report detailing how much federal aid youre entitled to. Be sure to first take all the grants and scholarships youre offered in the report, since its free money. Youll also want to accept any work-study youre offered before you take on loans. Each year youre enrolled, your school will determine the amount you can borrow as well as the loan types you qualify for: subsidized or unsubsidized.

Also Check: Apply Capital One Auto Loan

Federal Direct Graduate Plus Loan

Available to graduate and medical students enrolled at least half-time

- May be borrowed for up to the full cost of attendance, less other financial aid

- You must complete a Graduate PLUS Loan Credit Check Authorization Form which will be listed as a requirement through your myUVM portal once you accept the loan

What Is A Direct Unsubsidized Loan

Direct unsubsidized loans are loans that help cover the cost of higher education for both undergraduate and graduate or professional students at a four-year college or university, community college, or trade, career, or technical school.

Unlike subsidized loans, individuals who take out unsubsidized loans are responsible for paying interest during all periods of the loan.

Read Also: Usaa Car Loan Calculator

Financial Aid Warning Policy

If a student is not making Satisfactory Academic Progress they will be placed on Financial Aid

Warning status for the next payment period and continue to receive financial aid for that period.

Financial Aid is any financial assistance offered to the student for paying for their education, such as loans, scholarships, Federal Work-Study, Grants and stipends . Students who fail to make SAP by the end of that payment period lose financial aid eligibility.

It is the policy of the Financial Aid Office that once a student has been placed on academic probation for not meeting SAP standards as defined by the college, the Financial Aid Office will automatically place the student in a Financial Aid Warning status. During the next academic term if the student does not meet SAP standards and the college places the student on academic suspension the student will no longer be eligible for financial aid. If the student appeals the academic suspension and the appeal is approved, financial aid will be reinstated. If the student is directed to audit courses those courses will not be covered by financial aid. Students that are required to repeat coursework are encouraged to meet with a financial aid counselor with respect to their financial aid eligibility.

If you are considering taking a leave of absence or any time off from class, you should meet with a financial aid counselor first to find out how this may affect your financial aid.

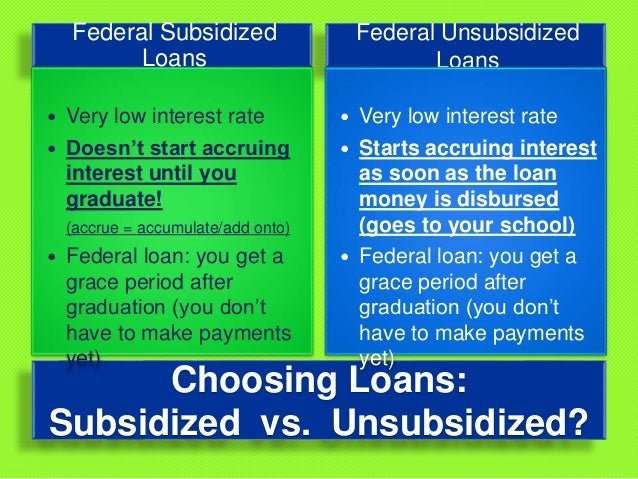

Interest On Subsidized Vs Unsubsidized Loans

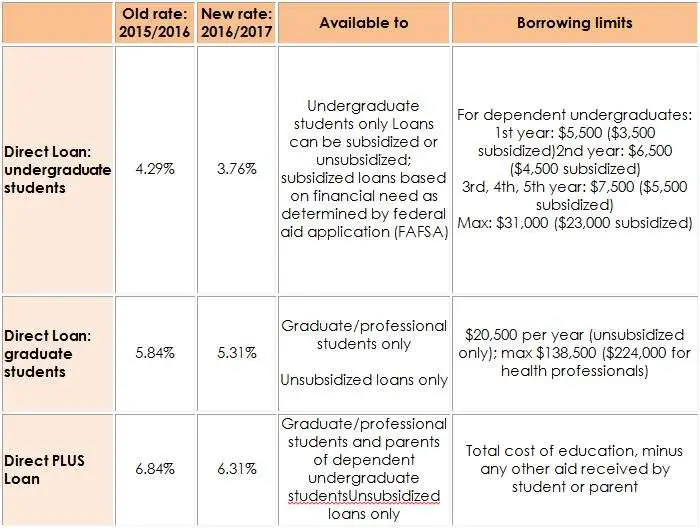

Interest rates on federal Direct Subsidized Loans and Direct Unsubsidized Loans are set by the government and change every year. For a given type of loan, the rate is the same for every borrower, regardless of the borrowers credit score, income, or other financial information. You can see the current rates for different types of federal student loans, as well as rates for previous years, on the Federal Student Aid website.

Although the interest rate is the same on subsidized and unsubsidized loans for undergraduate students, how interest accrues is quite different.

Also Check: 646 Credit Score Car Loan

Federal Direct Student Loans

Through the Federal Direct Stafford Loan program, students may apply for a maximum of $20,500 annually . Under current federal regulations, graduate students are only eligible for unsubsidized Stafford loans. 30% for the 2022-2023 academic year. Under current federal regulations from the US Department of Education, all Federal Direct Stafford loans are assessed a 1.057% origination fee, which is subtracted from each loan prior to disbursement. This fee will be adjusted on by the US Department of Education in accordance with federal budget sequestration formulas. Repayment of the Federal Direct Unsubsidized Stafford Loan begins six months after the borrower ceases to be enrolled payday loans NY or drops below half-time attendance. Payment of the Federal Direct Unsubsidized Stafford Loan may be deferred during the in-school deferment period and for six months after graduation or cessation of half-time enrollment. Repayment of the Stafford Loan is completed over a 10-year period, unless the borrower chooses to extend payments through a Federal Direct Consolidation Loan or other payment plan options with the Federal Loan Servicer after graduation.

How Is Interest Calculated For Federal Student Loans

A daily interest formula determines how much interest accrues on your federal student loans between each monthly payment.

The simple daily interest formula looks like this:

Outstanding Principal Balance x Interest Rate Factor = Daily Interest Amount

- Outstanding principal balance: The remaining amount of principal left on your loan

- Interest rate factor: Your loans interest rate divided by the number of days in the year

Sample Daily Interest Rate Calculation

Xavier has an outstanding principal balance of $11,500 for his Direct Grad Plus loan with a 5.30% interest rate.

Interest rate factor = .053 / 366 = 0.000145 or 0.0145%

Daily interest: $11,500 x 0.000145 = $1.67

Each day, Xaviers loan balance grows by $1.67. When Xavier makes his monthly student loan payment, it covers the portion of the principal he owes, as well as the $1.67 per day interest that accrued since his last payment.

Recommended Reading: Usaa Apply For Auto Loan

Federal Direct Subsidized & Unsubsidized Loans

Tulane participates in the Direct Loan Program. The federal government through the U.S. Department of Education is your lender for the Direct Loan Program. Federal Direct Subsidized and Unsubsidized Loans are offered to eligible students who are enrolled at least half-time and who meet all other eligibility criteria.

Eligible undergraduate students who have financial need may be offered a Direct Subsidized Loan, on which no interest will be charged before repayment begins or during authorized periods of deferment. Interest is charged during the repayment period on a Direct Subsidized Loan.

Regardless of financial need, eligible students may qualify for a Direct Unsubsidized Loan. Interest on the Direct Unsubsidized Stafford Loan will begin to accrue when the loan is disbursed and be capitalized to the principal balance when the repayment period begins.

Loan Funds Are Credited To Your Account In This Order:

If any loan funds remain in your account, the credit balance will be refunded to you by check, cash, debit card, orelectronic funds transfer to your bank account. Remember, the refund must be used to pay for your direct andindirect education expenses, such as textbooks, supplies, and equipment.

Read our blog on financial aid disbursementfor more details.

Also Check: Fha Limits In Texas

The Grad Plus Loan Will Be Awarded To Students With An Unmet Need To Fill The Gap In Their Budget

Packaging and Award Policy

Students at Western University of Health Sciences are packaged and awarded as independent graduate students. There are no Grants available to graduate students. Resources such as gift aid, scholarships, Military and the National Health Service Corps will be taken into consideration first when packaging and awarding students. All eligible students are then awarded in the unsubsidized loan and the balance in the Grad PLUS loan to meet the maximum of their budget.

Students are awarded the maximum allowable in the Federal Direct Loan programs as per their program and the Department of Education.

Award Notifications

Students will be notified via Western University email of their award letter notice. All subsequent awards or changes to the award will generate an additional or revised award letter notice.

Students may accept all or a partial amount of their award. When accepting your loans, students should always accept the loan with the lowest interest rate first and then the Grad PLUS Loan. Scholarships will always be taken into consideration first when awarding the student.

Western University is a graduate /professional university and is not eligible for Pell Grants.

Verification Requirements

Overawards

Students will be notified when they are overawarded and funds are being reduced or canceled to eliminate the overaward.

Official 3 Year Cohort Default Rate

Subsidized And Unsubsidized Loan Examples

Example 1:

Alberta Gator is a first year dependent undergraduate student. Her cost of attendance for Fall and Spring terms is $17,600. Albertas expected family contribution is $10,000 and her other financial aid totals $9,000.

Because Albertas EFC and other financial Aid exceed her Cost of Attendance, she is not eligible for need-based, Subsidized Loans. She is, however, eligible for an Unsubsidized Loan. The amount she would be awarded would be $5,500. Even though her cost of attendance minus other financial aid is $8,600, she can only receive up to her annual loan maximum .

You May Like: Usaa Car Loan Bad Credit

Examples Of Unsubsidized Student Loans

Unsubsidized loans include the unsubsidized Federal Stafford Loan, the Federal Grad PLUS Loan, the Federal Parent PLUS Loan, private parent loans and loans that consolidate and refinance these loans .

Private student loans and parent loans give borrowers more options than unsubsidized federal loans for making payments on the student loans during the in-school and grace periods. The most common of these are full deferment of principal and interest, interest-only payments and immediate repayment of principal and interest. Slightly more than a quarter of the private student loans offer fixed payments per loan per month, with $25 as the most common monthly payment amount.

Federal student loans provide for full deferment during the in-school and grace periods. Immediate repayment is an option on federal parent loans. There are no prepayment penalties on federal and private student loans, so nothing stops a borrower from making interest-only or fixed payments on unsubsidized loans that dont offer these options.

About four-fifths of all student loans are unsubsidized.

You May Like: Usaa Personal Loan Approval Odds

Why Am I Not Eligible For A Pell Grant

In general, you must maintain enrollment in an undergraduate course of study at a nonforeign school to receive a Federal Pell Grant. Once you have earned a baccalaureate degree or your first professional degree or have used up all 12 terms of your eligibility, you are no longer eligible to receive a Federal Pell Grant.

Recommended Reading: Loan Calculator Usaa

View Your Federal Aid

Head over to the U.S. Department of Education to view your federal aid. Log in using your federal FSA ID. Then, go to ‘My Aid’ and ‘View Details’ to see federal loan, outstanding balances, loan statuses, and disbursement info. If youve ever been awarded a Federal Pell Grant, you will see that here as well.

Contact

Private Student Loan Interest Rates

If youre looking for the best student loans to finance your college education, we always recommend that you start by looking at federal student loans first. Federal loan types offer the same fixed interest rate for every borrower and provide multiple repayment plans, which arent typically offered by private lenders. However, if youve already taken out federal student loans but are still falling short of affording your dream college, then it may make sense to look at private student loan lenders to supplement your federal loans.

With that in mind, interest rates on private student loans can vary widely from lender to lender and also fluctuate based on several other factors, such as your credit score. We looked at five different private lenders to give you an idea of what your average student loan interest rate range may be on a private loan. Unlike federal student loans that have fixed rates, private loan interest rates are set by the lender and can vary based on a number of factors, including if you have a cosigner and the amount borrowed.

Recommended Reading: Usaa Used Car Interest Rates

Take Out Federal Student Loans

If you need to borrow for school, its usually best to rely on federal student loans first. This is mainly because youll have access to federal student loan benefits such as income-driven repayment plans and student loan forgiveness programs.

Once you complete the FAFSA, your school will send you a financial aid award letter detailing the federal student loans, federal financial aid, and school-based scholarships you qualify for. You can then choose which aid youd like to accept. Heres an example of how an award letter might look:

Subsidized And Unsubsidized Loan Limits

The amount you can borrow through the Federal Direct Loan Program is determined by your dependency status and classification in college. The annual and aggregate loan limits are listed in the charts below.

| Undergraduate Annual Loan Limits |

|---|

| Health Professions* Aggregate Loan Limits | $224,000 |

* Some professional students may be eligible for increased unsubsidized loan limits. Contact your adviser to determine if you are eligible.

Recommended Reading: Fha Title 1 Loan

What To Do After Youve Exhausted Your Federal Loan Options

Depending on the cost of attendance of your chosen school, federal student loans may not cover all your expenses. If this is the case, you may turn to private student loans to fill in the gap. Private lenders including banks, credit unions, and online lenders offer private student loans.

You may need to meet credit score requirements or have a cosigner to help you qualify for these loans. Private student loans typically have less generous repayment plan options, though interest rates may be lower depending on your financial situation.

Credible makes it easy to compare private student loan rates from various lenders in minutes.