Essas Monitoring For Debit Card Fraud:

To protect your account, we monitor your debit card transactions for potentially fraudulent activity which may include a sudden change in locale , a sudden string of costly purchases, or any pattern associated with new fraud trends around the world. If we suspect fraudulent use, we will send a text notification to the cell phone on file for you to validate the transaction. If you do not respond to the text message, we may call you. Your participation in responding to our text or call is critical to prevent potential risk and avoid restrictions that we may place on the use of your card.

Our automated text or call will ask you to verify recent transaction activity on your card, which you will be able to do via your touch-tone keypad. If you prefer not to use the automated call system, take note of your case # and then call our fraud center at .

Additionally, foreign transactions may be restricted due to the high risk of potential fraud. Fraud risks are monitored on a daily basis and countries are blocked accordingly. Please contact your local branch or our customer support at for more information.

The Benefit Of An Online Payoff Calculator

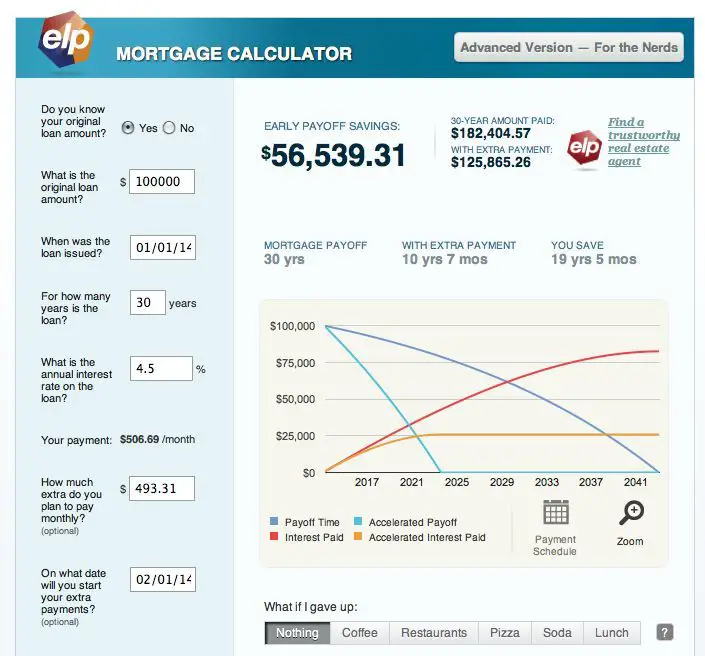

When youre ready to pay off your auto loan, one of the easiest ways to do it is by using an online payoff calculator. These calculators are easy to use and can give you an idea of different outcomes if you put in various entries. Plus, you dont have to worry about a dealership salesman bothering you when youre using an online payoff calculator to get the information you need.

To use an online auto loan payoff calculator, simply enter the amount of your loan, the interest rate, and the number of months you have left on the loan.

The calculator will then give you a payment amount that will pay off the loan in full. You can also use the calculator to see how much you can save by making extra payments each month. Just enter the amount of your extra payment, and the calculator will adjust the payment amount accordingly.

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

You May Like: What’s Required For Fha Loan

Should You Pay Off Your Car Loan Early

Whether you should pay off your car loan early depends on the contract you signed. Since lenders make their money on the amount of interest you pay, its possible there will be a repayment fee if you decide to pay it off early. What youll need to do before deciding to pay it off is calculate the amount of interest youd pay if you were to continue making monthly payments. Once youve done that, compare it to how much youd pay for the repayment fee then ask yourself if its worth the cost difference. If you do decide to pay it off early, remember that your could also drop for multiple reasons. These reasons include a decrease in the age of accountsthe number of months/years youve had the loan foror the number of installment loans also known as a loan where you borrow a certain amount of money at once and pay it off on a month-to-month basis.

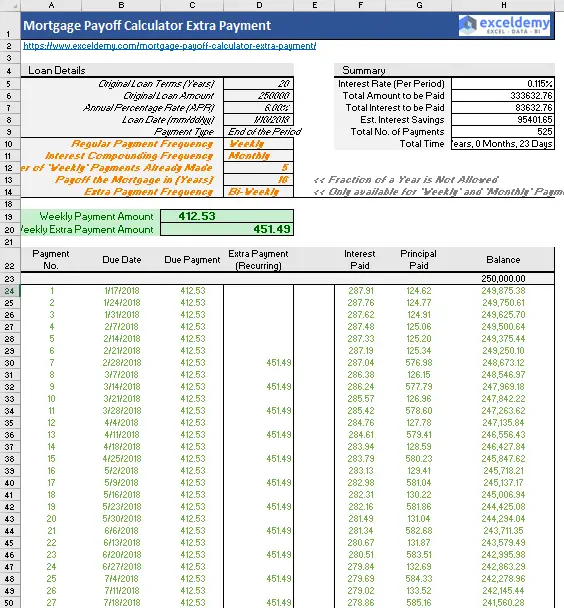

What The Mortgage Payoff Calculator Tells You

The Summary Results section has two subheadings:

How to reach your goal describes how much you would have to pay in principal and interest every month to meet the payoff goal. It lists the original principal-and-interest payment, and how much you would have to add to the minimum monthly payment to meet your goal.

Loan comparison summary describes the total cost of the mortgage in principal and interest payments, the original monthly principal-and-interest payment, the total cost in principal and interest if you pay it off early, and the new monthly principal-and-interest payment to reach your payoff goal.

New monthly P& I and Original monthly P& I comprise only the principal and interest portions of your monthly payments. Your full monthly payment will include principal and interest, plus the other monthly costs, such as taxes, homeowners insurance and mortgage insurance .

The early mortgage payoff calculator also lets you enter different numbers into the In how many years from now do you want to payoff your mortgage? box to see how those changes affect your total savings.

For more information about how the process of gradually paying off a mortgage works, see this explanation of mortgage amortization.

Also Check: Can I Use Capital One Auto Loan Anywhere

You May Like: How To Fill Out Schedule C For Ppp Loan

Auto Loan Early Payoff Calculator Definitions

- Annual interest rate

- Annual interest rate. Maximum interest rate is 20%.

- Number of months remaining

- Total number of months remaining on your original auto loan.

- Loan term

- Total length, or term, of your original auto loan in months.

- Auto loan amount

- The original amount financed with your auto loan, not to be confused with the remaining balance or principal balance.

- Additional monthly payment

- Your proposed extra payment per month. This payment will be used to reduce your principal balance.

- Current payment

- Monthly principal and interest payment based on your original loan amount, term and interest rate.

- Monthly prepayment amount

Should I Consider Paying My Car Loan Off Early

As you can see, there are potential benefits to paying off a car loan early but before you make any changes, consult your lender. Things may not be as straightforward as sending your bank a big check to call it a day. Some loan agreements have early payment penalties which would derail the whole purpose of paying off your loan early.

Dont Miss: How Much Do Mortgage Loan Officers Make

Read Also: Itt Tech Loan Forgiveness 2021 Application

How To Calculate Auto Loan Payoff

The price of your vehicle, down payment you make, length of the loan, and interest rate are all factors that determine how much you’ll pay for your car. Adding a bit more to your payments each month can help you pay off your car loan sooner and, ultimately, save you money. Use this calculator to see the impact of putting a bit more money toward your loan each month.

Enter the price of your vehicle as the Vehicle Price and adjust the sliders to match the details of your loan. Move the Added Monthly Amt slider to see the impact of paying more toward the loan.

Dont Forget The Origination Fees

Before applying for a new loan, theres one other factor you should be aware of: Some personal loan lenders charge origination fees equal to between 1% and 6% of the amount you borrow. That means you may pay between $100 and $600 on a $10,000 loan.

But an origination fee shouldnt automatically discourage you from considering a personal loan. For example, lets say you have $10,000 in credit card debt with an average interest rate of 23%. That means youre paying $2,300 per year in interest.

If you have an opportunity to get a personal refinancing loan at, say, 12% APR over 60 months with a 6% origination fee, then even though youll pay $600 for the origination fee, youll still save quite a bit of money compared to your current credit card debt.

The personal loan, with an interest rate of 12%, will cost you $3,346.4 in interest charges over the 60-month term. Even if you add the $600 origination fee to that, the combined cost is still dwarfed by the $6,914 youd pay in interest by keeping the balance on the credit card and gradually repaying it over the same 60-month period.

Translation: Dont let an origination fee scare you away from taking out a personal loan. Crunch the numbers, compare them with what youre paying on your current debt, and go forward if it will save you money.

You May Like: How To Remove Auto Loan Charge Off

Risks Of Paying Off Your Car Loan Early

There are also some risks to keep in mind when deciding whether or not to pay off your car loan early:

- Your lender might charge a prepayment penalty, so check with them before deciding to pay off the loan too soon so you donât owe more than planned.

- Your credit score could temporarily dip when the loan is closed out, which automatically happens when the loan is paid off. So, if you plan to take out another loan soon, like a mortgage, you might want to hold off on paying off the car loan until after youâve secured the new loan.

- You might have other debt with a higher interest rate that you should focus on paying down first.

What Factors Determine The Total Cost Of A Car

When youre choosing a loan, the length of the loan term and the APR you receive will determine how much you pay in total. So will the down payment you make, and any money you receive for trading in your previous car. Youll also need to pay for state taxes, title fees and potentially dealer-specific fees upon purchase, plus ongoing driving expenses.

Recommended Reading: How To Pay Off Student Loan

Car Dealership Payoff Calculators Can Be Inaccurate

Car dealerships often advertise payoff calculators on their websites, promising customers a quick and easy way to estimate how much it will cost to pay off their vehicle. However, these calculators can be inaccurate, and customers should be aware of the potential pitfalls before using them.

One problem is that the calculators typically assume that the customer will make regular monthly payments, when in reality many people choose to make bi-weekly or even weekly payments. This can lead to overestimating the amount of interest that will accrue over time.

Additionally, the calculators often do not take into account late fees or other charges that may apply if a payment is missed. As a result, customers should use caution when relying on payoff calculators, and should contact their lender directly to get an accurate estimate of their payoff amount.

Why Use The Early Loan Repayment Calculator

The early loan repayment calculator will help you to calculate the monthly interest repayments and compare how alterations to the loan payments can reduce the overall cost of the loan. With this calculator, you can also compare the loan repayments over different periods of time and opt for the most affordable option. The early repayment loan calculator provides interest repayment options over a variety of time periods starting from 1 year to 10 years. You can also compare them to monthly repayment periods of your choice.

It’s quite easy to use, you just need to input the current loan balance, annual interest rate, current monthly repayment and additional monthly repayment and the calculator will automatically show you the minimum and increased monthly payments itself. You can instantly learn about the interest paid, number of payments, etc. Using a calculator will help you discover various options and make informed financial decisions.

Regardless of your preference of loan repayment, it is important to ensure that you are capable of sustaining the income necessary so that you can afford the loan throughout it’s terms. Remember, the best loan is the one which is affordable and can be repaid quickly.

Don’t Miss: Can I Roll My Car Loan Into Another Car Loan

Calculating Your Businesss Monthly Principal Payments

If your business is dealing with loan repayments, understanding how to calculate your principal is likely to be beneficial. After all, according to a study we conducted, 21% of borrowers say that not knowing how much they need to pay is the most likely cause of their missed payments. So, how do you calculate your scheduled principal payments?

Theres a relatively complicated formula you can use, which is as follows:

a / / = p

Note: a = total loan amount, r = periodic interest rate, n = total number of payment periods, p = monthly payment).

If youre looking for an easier way to work out your principal payments, a principal payment calculator may be the way to go.

Read Also: Difference Between Lease And Loan

Amortization Table And Interest

- Expanding the “Auto Loan Balances and Interest” section below the Auto Loan Payoff Calculator will display a graph illustrating the rate you will pay down your loan with and without any additional payments, plus your accumulated interest charges over time.

For the full amortization schedule, choose whether you want to see monthly or annual amortization then click “View Report” at the top of the page. You’ll then see a page showing how much you’ll shorten your loan by, the graph illustrating your amortization, a summary of the loan and a line-by-line table showing the amortization of the loan over time and comparing regular vs. accelerated payments.

- FAQ: Great tool to make positive decisions on budget planning and goals

If you’re looking to trade in your car at some point in the future, the amortization schedule is useful in that it lets you know exactly how much you’ll still owe on the loan at any point in time. You can then use this information, combined with the vehicle’s depreciation, to estimate what your trade-in value would be.

Also Check: What Is The Fha Loan Credit Score Requirement

How Much Will You Save By Paying Off Your Car Loan Early

The amount youll save by paying off your car loan early depends on the terms established by the lender. Its not uncommon for a lender to have a repayment term/cost when you sign a contract. Lets say you take out a $20,000 loan with a 60-month repayment term and 5% interest rate, in the end, youll be paying $22,645the $20,00 principal and then an additional $2,645 in interest.

Can You Make Extra Payments On Your Car Loan

If you can, you should! Depending on whether your loan has a set interest amount already added to the final loan price, making extra payments could actually help you pay off your loan faster and ultimately pay less in interest. The Auto Loan Payoff Calculator can help you visualize the numbers and see how much each payment can impact the final cost.

You May Like: Lakeview Loan Servicing.myloancare Login

How To Use The Calculator:

Fill in the required fields and click on the Calculate button to see the results. Heres what each of the fields means:

- Current loan balance: the current amount left to pay on a loan.

- Annual interest rate: the amount you pay every year to borrow money, including fees, expressed as a percentage.

- Years of term remaining: the remaining length of your loan, expressed in years.

- Extra monthly payment: an additional payment that goes towards the principal part of a loan.

- Interest saved with extra payments: the amount saved in interest by making an extra payment each month.

- Monthly payment: the amount paid to your lender each month in order to repay a loan.

- Months to payoff: how many months are left until the loan is fully paid.

- Total payments: the total amount of money paid towards the loan.

- Total interest: the total amount of money paid in interest.

Our goal at FinMasters is to make every aspect of your financial life easier. We offer expert-driven advice and resources to help you earn, save and grow your money.

Tools & Resources

How To Estimate Interest Rates

If you know your credit score, you can estimate your interest rate based on average rates in 2020:

- 781-850: 3.65% APR for new, 4.29% APR for used

- 661-780: 4.68% APR for new, 6.04% APR for used

- 601-660: 7.65% APR for new, 11.26% APR for used

- 501-600: 11.92% APR for new, 17.74% APR for used

- 300-500: 14.39% APR for new, 20.45% APR for used

Recommended Reading: Which Bank Gives Low Interest Personal Loan

What Is An Online Auto Loan Payoff Calculator

An online auto loan payoff calculator is a tool that can help you determine how long it will take to pay off your car loan. To use the calculator, simply enter the loan amount, interest rate, and monthly payment. The calculator will then generate an estimated payoff date. Keep in mind that this is only an estimate your actual payoff date may vary depending on your personal circumstances.

The online auto loan payoff calculator can be a valuable tool if you are trying to pay off your car loan as quickly as possible. By entering different scenarios into the calculator, you can see how making extra payments or increasing your monthly payment can reduce the length of your loan.

You can also use the calculator to see how different interest rates will impact your payoff date. With this information, you can make informed decisions about how to manage your auto loan and get on the path to financial freedom.

Auto Loan: Accelerated Payoff

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Don’t Miss: How To Calculate Your Student Loan Payment