File A Consumer Proposal

Through a Bankruptcy Trustee

Most people know about bankruptcy, but not as many know about a consumer proposal. Its a legal agreement between you and your creditors arranged and administered by a bankruptcy trustee, to repay your debt with monthly payments that can stretch to almost 5 years. Instead of consolidating your debts into one loan, it consolidates your debt payments. Your debts will still be with your creditors, but the amount you pay your trustee each month is disbursed to your creditors after their fee is deducted.

Read Also: Which Bank Is Best For Construction Loan

How To Get A Debt Consolidation Loan With Bad Credit

Whether you have bad credit or good credit, the basic loan shopping process is similar.

- Start with a credit review. A lender will most likely review one of your credit reports and credit scores when you apply for a debt consolidation loan. So, you should check your credit from all three Equifax, Experian and TransUnionto understand where you stand before filling out loan applications.

- Search for lenders that are a good fit. Lets say your FICO credit score is 580. In this scenario, a lender that requires a credit score of 660 wont work for you. But a lender with a minimum credit score requirement of 560 could make it onto your list of borrowing possibilities.

- Compare loan options. Some lenders allow you to prequalify and discover the interest rate they might offer you with a soft credit inquiry. Once you find loan options that might work for you, you can narrow them down to the best deal.

- Submit an application. The final step to getting a debt consolidation loan is to fill out a lenders official loan application. Provide the lender with any documents or information it requests right away to avoid potential problems.

How Do No Income Loans Work

When these loans get serious, they dont really differ from the standard loan types. The vital part of the application is to prove that youll be able to repay the loan in due time, and thats established by verifying your assets, for the most part.

Its also worth mentioning that the approval process doesnt only include ensuring that the loans principal amount will be repaid it also involves assessing whether youll be able to pay back the interest too. Many people tend to neglect this point and only factor in the principal amount while providing proof of their assets or collateral, leading to the applications rejection.

Remember, at the end of the day, lenders only need to see that they wont need to pay an extra penny out of their pockets after the loan term is over. With that in mind, theyll also want to check your credit history, bank accounts and transactions, and general financial stability. The more youre able to prove that stability, the higher your chances of getting the loan approved.

You May Like: How Do I Refinance An Auto Loan

Recommended Reading: Which Bank Has Lowest Interest Rate On Personal Loan

Judgment And Discipline Are Key

It is imperative to remember that consolidating debt does not eradicate debt. You still owe the money. Meanwhile, all the credit cards from which the debt was transferred will have zero balances. Strong is the consumer who can resist that siren call when the urge to shop hits.

Thing is, give in to it and youll be burrowing yourself even farther into a warren of debt. Except, this time, you wont have consolidation as a position to which you can retreat.

The right way to consolidate credit card debt is to figure out what happened to land you so deeply in debt and take steps to ensure it doesnt happen again. Then, consider the upsides and downsides of each approach to figure out which one you can handle as easily as possible.

Once youve decided, follow through with it until the consolidation debt is paid offwithout incurring additional debt while youre doing so.

Recommended Reading: Which Bank Offers The Lowest Auto Loan Rates

% Apr Offers On Credit Cards

Many credit cards offer an introductory offer of 0% APR on balance transfers for a limited amount of time after opening the card. While they still may be subject to balance transfer fees , they often offer 0% introductory periods between twelve and eighteen months to not worry about the balance accruing any additional interest.

The Citi® Diamond Preferred® Card, for example, is an excellent option for those considering taking this route. It comes with a $0 annual fee and a respectable 0% intro APR for 21 months on eligible balance transfers from date of first transfer and 0% intro APR for 12 months on purchases from date of account opening. After that, the variable APR will be 15.99% – 25.99%. Balance transfers must be completed within 4 months of account opening. A balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater, applies.

The downsides to balance transfer credit cards are the credit limit given and being limited to only the intro period before interest starts to accrue. For some people, spreading payments over a longer time period may be more beneficial, even if it requires paying some interest. Its recommended that you have good to excellent credit if youre considering applying for a credit card that offers a 0% introductory period.

You May Like: How To Apply For Student Loan Forgiveness Due To Disability

What Do I Need To Know If Im Thinking About Consolidating My Credit Card Debt

When you consolidate your credit card debt, you aretaking out a new loan. You have to repaythe new loan just like any other loan. If you get a consolidation loan and keep making more purchases withcredit, you probably wont succeed in paying down your debt. If youre havingtrouble with credit, consider contacting a credit counselor first.

Consolidation means that your various debts, whether they arecredit card bills or loan payments, are rolled into one monthly payment. If youhave multiple credit card accounts or loans, consolidation may be a way tosimplify or lower payments. But, a debtconsolidation loan does not erase your debt. You might also end up paying moreby consolidating debt into another type of loan.

Before you use a consolidation loan:

- Take a look at your spending. Its important to understandwhy you are in debt. If you have accrued a lot of debt because you are spendingmore than you are earning, a debt consolidation loan probably wont help you getout of debt unless you reduce your spending or increase your income.

- Make a budget. Figure out if you can payoff your existing debt by adjusting the way you spend for a period of time.

- Try reaching out to your individualcreditors to see if they will agree to lower your payments. Some creditors might be willing to accept lower minimum monthlypayments, waive certain fees ,reduce your interest rate, or change your monthlydue date to match up better to when you get paid, to help you pay back yourdebt.

Home equity loan

Debt Consolidation Loans That Dont Put Your Home At Risk

A better option might be a 0% or low-interest balance transfer card. But you’ll need to consider if a fee will be applied to the balance transferred.

This can be the cheapest way provided you repay the money within the interest-free or low-interest period.

Keep in mind that youre likely to need a good credit rating to get one of these cards and might have to pay a balance transfer fee.

You might also consolidate your debts into an unsecured personal loan, but again, youll need a good credit rating to get the best deals.

Find out more in our guides:

Read Also: What Is Auto Loan Interest Rate

Should I Get A Personal Loan To Pay Off Debt

Falling behind on debt payments can have a damaging effect on your credit score and may ultimately result in repossession of collateral or accounts being sent to collections. If youre struggling to make payments on all of your individual debts, consider taking out a personal loan to streamline your payments and increase the repayment termthereby reducing your monthly payment.

A debt consolidation loan also may be a good option if your credit score has improved since you applied for your loans. By qualifying for a lower interest rate on a debt consolidation loan, youll be able to reduce how much you pay over the life of your loans.

Does The Downturn Affect Consolidation With A Debt Management Plan

The good news is that the rising interest rates that are making do-it-yourself debt consolidation less beneficial dont affect a debt management program, Herman says. We work with creditors to reduce or eliminate interest applied to your account. That rate reduction isnt tied to the economy. So, we can still help you get rates as low as 0% in some cases..

This means that people who want to consolidate still have a way to do so even if they cant qualify for the do-it-yourself options at the low rate they need.

Credit card companies want to work with people, Herman encourages. Working with a credit counseling organization like Consolidated Credit shows them that youre serious about paying back everything you charged on your credit cards. So, we can work with them to reduce or eliminate the interest charges applied to your balance and find a monthly payment that you can afford. Its a great way to consolidate for those who cant successfully consolidate on their own.

Also Check: How To Calculate Dti For Conventional Loan

How Debt Consolidation Loans Work

To start consolidating debt, apply for a personal loan through your bank or another lender. Once your lender approves you for a debt consolidation loan, it may offer to pay off your other debts automaticallyor you will take the cash and pay them off yourself.

After your pre-existing debts are repaid with your new debt consolidation loan funds, youll make a single payment on your new loan every month. While debt consolidation often reduces your monthly payment, it accomplishes this by extending the loan period of the consolidated loans. Debt consolidation also streamlines payments and makes it easier to manage finances, like having a single monthly payment due date.

Balance Transfer Credit Card

With a balance transfer card, you shift your credit card debt to a new credit card with a 0 percent introductory rate. The goal with a balance transfer card is to pay off the balance before the introductory rate expires so that you save money on interest. When you calculate potential savings, make sure you factor in balance transfer fees.

Keep in mind that paying off existing credit card debt with a balance transfer to another credit card isn’t likely to lower your credit utilization ratio like a debt consolidation loan would.

A debt consolidation loan also is going to offer higher borrowing limits, enabling you to pay off more debt, as well as fixed monthly payments, which make it easier to budget and stay disciplined with paying off debt.

Who this is best for: Borrowers who can pay off existing debt quickly.

Balance transfer credit card vs. debt consolidation loan: Often, balance transfer cards are the best choice for borrowers who have the means to pay off their debt within 18 months, which is a standard 0 percent APR period. If you need longer to pay off your debt, or if you have a lot of debt, a debt consolidation loan is a better choice.

Also Check: Can You Buy An Investment Property With An Fha Loan

Take The Guesswork Out Of Applying For This Offer

See offers Matched for You instantly.Create your free Experian CreditWorksSM account now.How do you match me?

Weâve done the research so you donât have to. Our technology works directly with financial institutions to match you to the offers from our partners that are right for you, which means you are more likely to qualify for the products that are Matched for You. Our list is more personalized than other sites because we review lender requirements before showing you offers. We find your best matches using things like your credit profile and your spending habits.

How To Consolidate Credit Cards With A Balance Transfer

Balance transfers are the best option for credit consolidation when you have excellent credit and a limited amount of debt. Balance transfer cards offer 0% APR for a limited time after you open the account. The higher your score, the longer the 0% APR period.

The goal is to pay off your balance before the 0% APR period ends. Thats because once the 0% APR period ends, the regular APR for balance transfers will apply. Depending on the terms of your card, the rate could be right back up where you started.

Recommended Reading: Should You Refinance Your Auto Loan

Does Debt Consolidation Give You Bad Credit

Consolidating your debt has the potential to impact your credit score in positive and negative ways. Applying for a loan and adding a new tradeline to your credit report are both actions with the potential to damage your credit score.

On the other hand, debt consolidation should help you pay down your debt faster, reducing the number of accounts with balances on your credit report. This could give your credit score a boost.

Debt Consolidation Loan In Canada

A debt consolidation loan is when you borrow money to pay off other debt. The money from the new loan pays off the other debts, the accounts are often closed, and then you only make payments on this one new loan. A debt consolidation loan will often have a lower interest rate than what your other debts are charging you.

There might also be better terms and conditions, but each lender is different. When you apply for a consolidation loan, getting approved can become more difficult if youre behind on your payments, or it could put assets like your home at risk if you use them as collateral. But the biggest danger with these loans is that you can end up doubling your debt if you dont carefully live with a budget while youre paying off the loan, thats the reason you can consider getting professional help with debt consolidation loans.

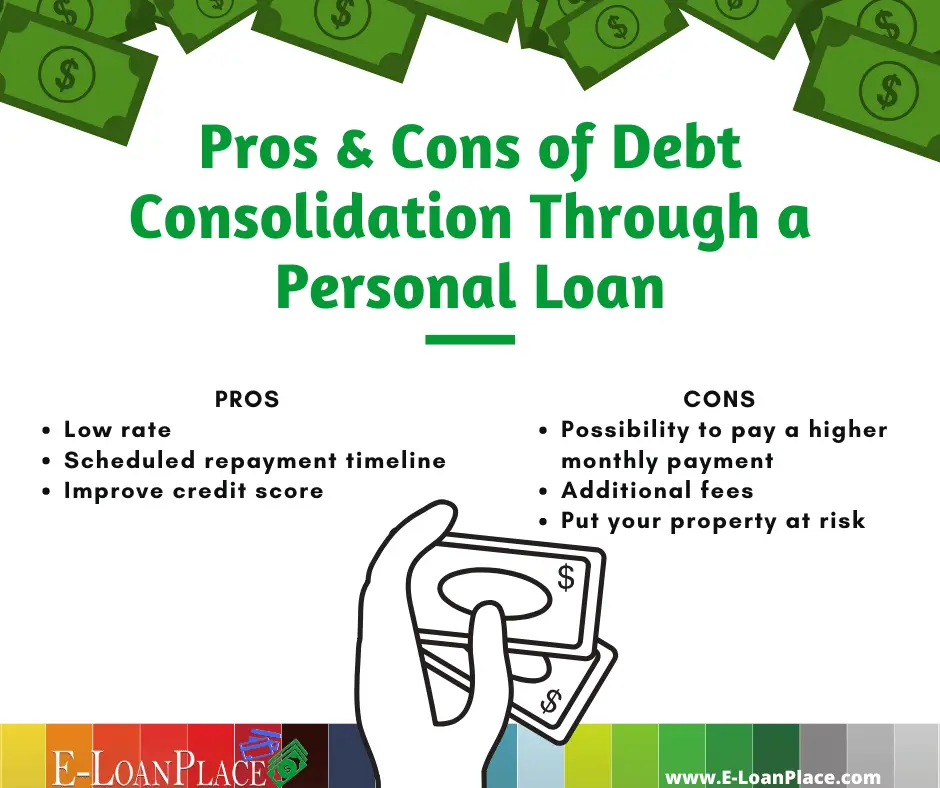

Pros:

Read Also: How Much Is The Average Student Loan Monthly Payment

When Getting A Debt Consolidation Loan Doesnt Make Sense

A debt consolidation loan definitely doesnt make sense if:

- you cant afford the new loan payments

- you dont clear all your other credit commitments or debts with the loan

- you end up paying more overall , or

- you need help sorting out your debts rather than a new loan a debt adviser might be able to negotiate with your creditors and arrange a repayment plan.

How A Personal Loan From A Credit Union Can Affect Your Credit

As with online lenders and banks, credit unions offer large personal loans you can use to consolidate multiple payday loans. Just about any personal loan is a long-term positive if you use the money to escape from expensive payday loan debt.

Obtaining a personal loan can help diversify your credit mix and build your payment history, which is the largest credit scoring factor.

But if you dont repay the loan as agreed, a single late payment can harm your credit score by 100 points or more. The better your credit score before the late payment, the worse the damage.

You May Like: Will Ally Refinance My Auto Loan

A Credit Card Consolidation Loan Can Help You Manage High

Want to manage your credit card debt? Learn how credit card consolidation loans can help you reach your financial goals

If youre trying to keep track of multiple due dates for your credit cards, a credit card consolidation loan can allow you to pay off your high-interest credit cards and leave you with a single monthly payment. You might even be able to lower your interest costs.

If youre considering a credit card consolidation loan, its important to shop around to save on interest and find a repayment term that works for your financial situation.

If you want to consolidate credit card debt, Credible lets you easily compare personal loan rates from various lenders in minutes.

Know Your Budget: Track Your Income And Bills

Next, collect recent pay-stubs to understand your typical monthly income .

Now, on the debt side, add to your list of credit card balances a collection of your recent monthly and annual bills. That’ll likely include things like:

- Rent, mortgage and other housing costs

- Utilities, like water, gas, heating and electricity, broken down by average monthly balances.

- Loans and insurance: Car loan and insurance, student debt payments and other personal loan or insurance costs

- Subscription service payment

- Grocery and commuting bills

- Education and child-care costs

- And anything else that’s a regular monthly payment, like gym memberships and public transport costs.

You can also load this information into an online budgeting tool, such as Chase’s Budget Builder, to keep on hand for future reference. There are also plenty of budget apps online that are free and easy to use.

Once you have all of this, you’ll have a clearer understanding of your total expenses and income, and how much credit card debt adds to monthly costs.

Don’t Miss: How To Calculate Loan Installment