Common Uses For Home Equity

Making the choice to access your homes equity is not a decision you can take lightly. The equity is yours to use, but remember that adding additional financing to your home increases your risk. If you default on a home equity loan or HELOC, you can be at risk of foreclosure.

This means you should only use this type of financing option if you have a clear, strategically viable reason to do so. You should also determine if taking out the loan or HELOC will increase your risk, and by how much.

Use #1: Renovation and remodeling projects

Home renovations and remodeling are one of the most common uses for this type of financing. You use the equity in your home to fund home improvement. This increases the value of the property, so its a little like spending equity to get more equity.

Always consult with an expert before making the decision to access your equity. If you want to use this option, we recommend a quick, confidential consultation with a counsellor to weigh your options. Call to request a HUD-approved free consultation.

Use #2: Invest the money you receive

It may seem strange, but you can use home equity loans to strategically invest your money. If the rate of return is higher than the interest rate on the loan, then it can be a smart choice. This only works when mortgage rates are low and the investment market is strong.

Use #3: Cover education costs

Use #4: Supplement an emergency fund

Use #5: Pay off credit card debt

How To Calculate Your Home Equity

Calculate your home equity with this equation:

The value of your property the balance remaining on your mortgage = home equity

For example, if your home is worth $500,000 and you owe $300,000 on your mortgage, your home equity is $200,000.

Maybe youve worked hard to pay your mortgage down early by making extra payments. Or maybe youve owned your home for several years and property values have increased in your area. These situations may mean youve built up a good amount of equity in your home.

What you might not realize is that you can tap into that equity to help you meet your other life goals, such as buying a cottage, paying for your kids post-secondary schooling, or renovating your home.

Most of the time, youll pay less to borrow against your home equity than you would if you got a regular unsecured loan or credit line.

When your home equity loan application gets approved, a lending limit of not more than 80% of the home value gets set. This means that you wont need to re-apply with a full credit application each time you want to access your home equity based on the appraised value of your home at the time of the application.

What You Need To Know About Home Equity Loans And Home Equity Line Of Credit

5 minute read

If you own your home, you may be able to borrow against your equity. On average, each American homeowner has around $216,000 in equity, a significant amount that can open doors to funding for home improvements, educational expenses, and more.

But before deciding to tap into your home equity, it’s important to understand how it works and what your options are for borrowing against it. It’s also vital to consider that since your home is on the line, you want to make sure the purpose for the loan is for something that is important to you. Then you can see if a home equity loan, a home equity line of credit or another product makes sense for your situation.

What is home equity

Home equity is the portion of your home’s value that you don’t have to pay back to a lender. If you take the amount your home is worth and subtract what you still owe on your mortgage or mortgages, the result is your home equity. For example, suppose the market value of your home is $200,000. If your mortgage balance is $120,000, then your home equity is $200,000 – $120,000 = $80,000.

You can use equity as collateral to borrow money. Borrowing against home equity is often less expensive than taking out an unsecured loan or putting purchases on a credit card.

Home equity loans

How a home equity loan compares to a cash-out refinance

Home equity lines of credit

Choosing a home equity loan vs. a HELOC

For more on personal finance topics

Also Check: Usaa Loan Credit Score Requirements

Make A Plan To Use Your Home Equity Line Of Credit

Establish a clear plan for how you’ll use a home equity line of credit. Consider a repayment schedule that includes more than just minimum monthly interest. Make a realistic budget for any projects you may want to do.

You may be able to borrow up to 65% of your homes purchase price or market value on a home equity line of credit. This doesnt mean you have to borrow the entire amount. You may find it easier to manage your debt if you borrow less money.

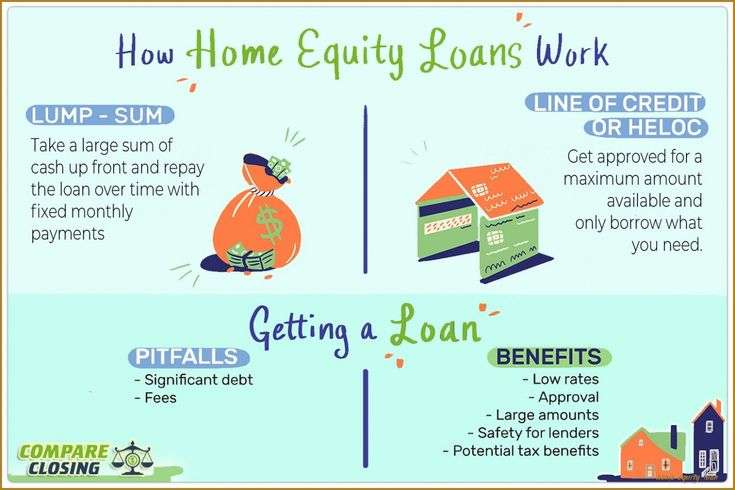

What Are The Different Types Of Home Equity Financing

Reading time: 3 minutes

Paying for college, financing home renovations and consolidating debt are just a few of the reasons that homeowners take out home equity loans or lines of credit. Whether you need a one-time lump sum of money or access to cash on an as-needed basis, these types of financing provide flexible and accessible options.

There are two main ways a homeowner can borrow against the equity in their home: a home equity loan and a home equity line of credit .

Don’t Miss: When Can You Refinance An Fha Loan

Learn How Home Equity Loans Work

A home equity loan lets you borrow money against the value of your homes equity to pay for things like home renovations and college educations, or to pay down higher interest debts. Freedom Mortgage offers cash out refinances to customers who want to tap the value of their homes equity. Read on to learn more about your home equity loan options.

What Can You Do

- You can use this money to make home improvements, but you arent limited to that. You can use this loan for other things, major expenses and consolidating higher-interest debt.

- You can often get lower rates on a home equity loan than other types of unsecured loans or borrowing on credit cards.

- You can use a home that you live in as your primary residence as collateral. This includes single-family homes, condominiums, town homes and Planned Unit Developments.

Also Check: Texas Fha Loan Limits

Which Home Equity Loan Is Better For You

The right home equity financing for you depends entirely on your situation. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. If you are trying to decide, think about the purpose of the loan. Are you borrowing so youll have funds available as spending needs arise over time or do you need a lump sum now to pay for something like a kitchen renovation?

A home equity loan offers borrowers a lump sum with an interest rate that is fixed but tends to be higher. HELOC, on the other hand, offers access to cash on an as-needed basis, but often comes with an interest rate that can fluctuate.

As a borrower, it pays to shop around and ask a lot of questions to ensure that you are getting the right financing for you at the best rate possible.

Drawbacks Of Using Home Equity

Using home equity doesnt work for everyone in every situation. Drawbacks include:

- Borrowing costs. Some lenders charge fees for home equity loans or HELOCs. As you shop lenders, pay attention to the annual percentage rate , which includes the interest rate plus other loan fees. If you roll these fees into your loan, youll likely pay a higher interest rate.

- Risk of losing your home. Home equity debt is secured by your home, so if you fail to make payments, your lender can foreclose on your home. If housing values drop, you could also wind up owing more on your home than its worth. That can make it more difficult to sell your home if you need to.

- Misusing the money. It is best to use home equity to finance expenses that will pay you back, like renovating a home to increase its value, paying for college, starting a business or consolidating high-interest debt. Stick to needs versus wants otherwise, youre perpetuating a cycle of living beyond your means.

Don’t Miss: Car Loans With A 600 Credit Score

Home Equity Line Of Credit Combined With A Mortgage

Most major financial institutions offer a home equity line of credit combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

It combines a revolving home equity line of credit and a fixed term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender will generally only require you to pay interest on the money you use.

The fixed term mortgage will have an amortization period. You have to make regular payments on the mortgage principal and interest based on a schedule.

The credit limit on a home equity line of credit combined with a mortgage can be a maximum of 65% of your homes purchase price or market value. The amount of credit available in the home equity line of credit will go up to that credit limit as you pay down the principal on your mortgage.

The following example is for illustration purposes only. Say youve purchased a home for $400,000 and made an $80,000 down payment. Your mortgage balance owing is $320,000. The credit limit of your home equity line of credit will be fixed at a maximum of 65% of the purchase price or $260,000.

This example assumes a 4% interest rate on your mortgage and a 25-year amortization period. Amounts are based on the end of each year.

Figure 1: Home equity line of credit combined with a mortgage

| $260,000 | $260,000 |

Buying a home with a home equity line of credit combined with a mortgage

- personal loans

- car loans

- business loans

Using Home Equity For Renovations

If youre wondering how to use home equity for renovations, you have a couple of choices, considering the scope and timeline of those projects.

Home renovation projects with long flexible timeline requiring many smaller building supply purchases could be funded through a home equity credit line. With a credit line, you only pay interest on the amount you borrow. Then as you pay it down you can reborrow back up to your set limit.

If, however, you need a larger lump sum to make one large supply purchase, a fixed-rate mortgage or loan component could be a better option due to lower interest rates and lower payments. Some construction companies require deposits and periodic payments as renovation projects progress, so ask about payment timelines when youre making a list of questions to ask when hiring a contractor.

You May Like: Auto Loan Self Employed

Home Equity Loan Interest Rates

When you apply for home equity financing, expect higher interest rates than youd get on a first mortgage due to the extra risk these loans pose for lenders.

Fixed home equity interest rates for borrowers with excellent credit are about 1.5% higher than current 15-year fixed mortgage rates.

Home equity interest rates vary more widely than mainstream first mortgage rates, and your credit score has more impact on the rate you pay. For example, an 80-point difference in FICO credit scores can create a 6% difference in home equity interest rates.

Home equity lines of credit have variable interest rates. This means your monthly payment depends on your loan balance and the current prime rate. Your payment and rate can change from month to month.

Home equity loans can have variable interest rates, but most of the time the rate and payment are fixed.

Home Equity: What Is Home Equity And How Do I Use It

When you take out a mortgage to buy a home, it might seem like youâve just taken on a huge amount of debt. While this is partly true, you also need to consider the value of your new home. Because your mortgage debt roughly equals your homeâs value, your overall wealth will not have changed by much.

To help measure the actual financial wealth that homeowners hold in their property, thereâs a useful concept called home equity. But what is home equity, and whatâs it useful for? Regardless of how you use your home equity, itâs an important concept for homeowners to understand.

Also Check: Drb Refinance Reviews

Get Money From Your Home Equity Line Of Credit

Your lender may give you a card to access the money in your home equity line of credit. You can use this access card to make purchases, get cash from ATMs and do online banking. You may also be given cheques.

These access cards don’t work like a credit card. Interest is calculated daily on your home equity line of credit withdrawals and purchases.

Your lender may issue you a credit card as a sub-account of your home equity line of credit combined with a mortgage. These credit cards may have a higher interest rate than your home equity line of credit but a lower interest rate than most credit cards.

Ask your lender for more details about how you can access your home equity line of credit.

Starting Your Own Business

Many people who want to start their own business may not have the funds to do so, which is why home equity loans may be an option to explore. Whether you want to start a company from scratch or open a franchise, home equity loans can help you access money that you may not have had in your personal savings account.

Don’t Miss: Usaa Auto Refinance Rates

Using Home Equity Lines Of Credit To Invest

Some people borrow money from a home equity line of credit to put into investments. Before investing this way, determine if you can tolerate the amount of risk.

The risks could include a rise in interest rates on your home equity line of credit and a decline in your investments. This could put pressure on your ability to repay the money you borrowed.

How Home Equity Works

If a portionor allof a home is purchased via a mortgage loan, the lending institution has an interest in the home until the loan obligation has been met. Home equity is the portion of a home’s current value that the owner possesses at any given time.

Equity in a house is initially acquired with the down payment you make when you buy the property. After that, more equity is achieved through your mortgage payments since a contracted portion of that payment will be assigned to bring down the outstanding principal you still owe.

You can also benefit from property value appreciation because it will cause your equity value to increase.

Home equity is an asset and it is considered a portion of an individual’s net worth, but it is not a liquid asset.

Don’t Miss: Carmax Loan Approval

A Home Equity Loan For Every Situation

Home equity loans can help you over all kinds of financial hurdles. Here are just some of the ways we can help:

- Access up to 85 percent of the equity built up in your home in urban areas.

- Fund home renovations.

- Extend cash reserves and build a backup fund for a rainy day.

- Repair your credit by paying off collections or judgements.

- Consolidate your debts into one easy monthly payment.

- Pay off personal or property taxes, or even mortgage arrears.

- Transform your homes equity into cash for any purpose.

- Purchase a vacation or investment property.

- Pay for education for your children.

- Invest in your business.

Throughout the application process, it is a good idea to partner with a trusted financial or loan advisor. Speaking with a professional and receiving informed advice ensures that the process goes as smoothly as possible for you and your family.

This also gives you the opportunity to put your financial needs and options into perspective and prepare yourself for the home equity loan application process. Take advantage of the time you spend with a loan advisor and ask any and all of the questions you have. It may also be helpful to do some research on your own so that youre as informed as possible going in.

Be Financially Ready To Buy

Getting ready to buy a home is more complicated than pulling up listings and figuring out whether you like the location of this one more than the deck on that one. It starts with determining if youre in the right financial position to buy, and how much you can afford.

Barrow suggests your first steps should be ensuring you have an emergency fund before you start thinking about how much house you can afford, and that you give yourself some cushion in your homebuying budget for things like unexpected maintenance. Then focus on clearing up your credit score, paying down credit cards or paying off other debts to get the best interest rate possible. Especially in an environment where the economy is not quite as sure-footed as it felt like it was maybe a year ago, its really important to look at that affordability first, she says.

Getting preapproved for a mortgage is essential, as is shopping around for that loan. When you do so, Hale suggests asking your lender what happens if mortgage rates move even higher. Then resist the temptation to go over what you plan to spend. Really pin down how much you want to spend on housing and stick to that budget, she says.

Don’t Miss: Capital One Car Note