To Use As A Heloc Payment Calculator

Figuring out the payments for a HELOC is more complicated. For one thing, HELOCs are interest-only loans during the draw period you don’t have to repay any principle during that phase, but you must pay off any interest charges as they occur. HELOCs are also adjustable-rate loans during the draw, so you can’t pin them down to a single interest rate.

Because you’re also borrowing and possibly repaying, though that isn’t required various amounts of money during the draw, you may not have a set loan balance to calculate your payments against.

Once the draw ends, you don’t borrow any more money and begin repaying principle, usually at a fixed rate. So from that point on it works like a regular home equity loan.

This calculator lets you do several different types of calculations to help you figure out what your payments will be.

What If The Math Still Doesn’t Add Up

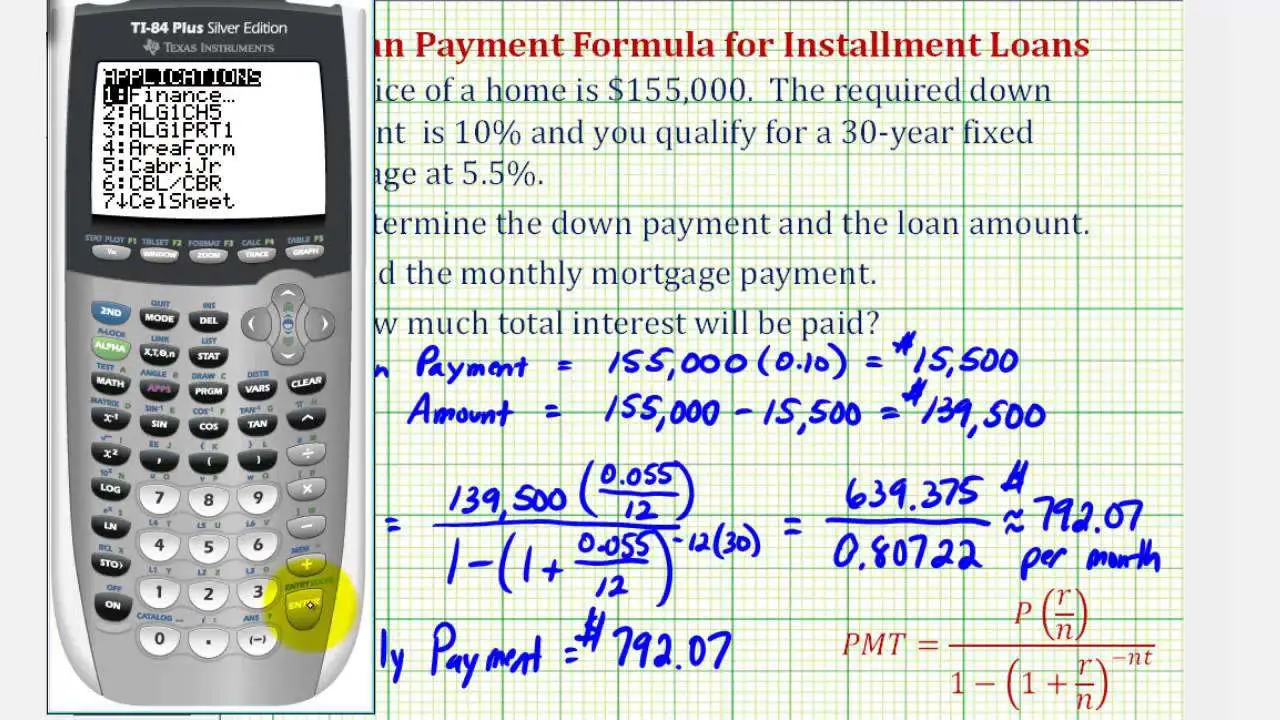

If these two steps made you break out in stress sweats, allow us to introduce to you our third and final step: use an online loanpayment calculator. You just need to make sure you’re plugging the right numbers into the right spots. The Balance offers for calculating amortized loans. This loan calculator from Calculator.net can do the heavy lifting for you or your calculator, but knowing how the math breaks down throughout your loan term makes you a more informed consumer.

Educational Loan Minimum Monthly Payments

Some educational loans have a minimum monthly payment. Please enter the appropriate figure in the minimum payment field. Enter a higher figure to see how much money you can save by paying off your debt faster. It will also show you how long it will take to pay off the loan at the higher monthly payment.

Recommended Reading: Loan Officer License Ca

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Personal Loan Calculator Results Explained

To use the personal loan calculator, enter a few details about the loan, including the:

- Loan amount: How much money you want to borrow.

- Loan term: How much time you’ll have to pay back the loan.

- Interest rate: How much money the lender will charge you to borrow the money, expressed as a percentage of the loan. If you don’t know the interest rate, enter your range to see an interest rate estimate.

Once you enter your loan details, the personal loan calculator displays three numbers, which you can use to evaluate and compare various loans. Here’s what the numbers mean:

- Total interest paid: The total interest you pay over the life of the loan. Borrowers with higher credit scores typically pay less interest overall than those with poor credit.

- Total paid: The total amount you pay to the lender, including the original amount you borrowedknown as the “principal”plus the interest. This amount doesn’t include any additional fees your lender may charge .

- Monthly payment: How much you can expect to pay each month for the duration of the loan term. Part of each payment is applied to interest, and part goes toward the principal, according to an amortization schedule.

If you choose a longer loan term, your monthly payment will be lower, and your total interest will be higher. With a shorter loan term, your monthly payment will be higher, but your total interest will be lower.

Aim for the shortest possible loan term that has payments you can still afford.

| Loan Term |

|---|

| $12,748.23 |

Also Check: Sss Loan Requirements

Qualifying For A Home Equity Loan Or Heloc

The main qualification for a home equity loan or HELOC is having home equity, described above. Credit requirements are somewhat stricter than on a mortgage to buy or refinance a home many lenders require a FICO score of 720 or higher, though some lenders will allow scores of 660 or below. Expect to pay higher rates and face tighter LTV limits on lower scores.

As for income, your monthly debt payments, mortgage and home equity loan/HELOC included, should total no more than 45 percent of your pretax income.

With most home equity loans and HELOCs, there are no restrictions on how you use the money. You don’t need to demonstrate a need for the money or justify it to the lender you just have to qualify for the loan. Some special loan programs for things like medical expenses or home improvements may be an exception, though.

Ready to start looking at lenders? Click the “Get FREE Quote” box above for fast, personalized rate quotes tailored specifically for you.

What Is A Loan Calculator

A loan calculator is an automated tool that helps you understand what monthly loan payments and the total cost of a loan might look like. You can find various types of loan calculators online, including ones for mortgages or other specific types of debt.

The loan calculator on this page is a simple interest loan calculator. It’s designed to estimate monthly payments for simple interest loans given certain terms and interest rates.

Also Check: Va Mpr Checklist

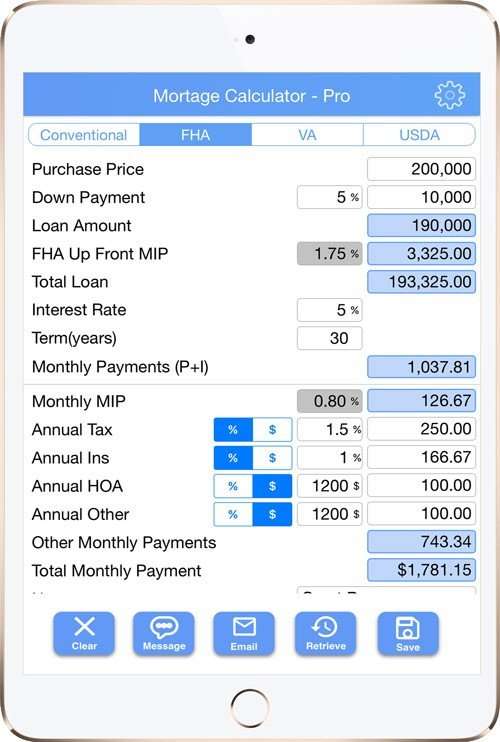

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

How To Calculate Loan Amount From The Payments

Additionally, you can use our loan calculator to compute the loan amount or total loan payment from the periodic installments.

Let’s presume that your monthly loan payment is 100 dollars with a 9 per cent annual rate with two years payment term.

- Periodic loan payment: $500

Periodic rate = Annual rate / Number of payments in a year = 0.09 / 12 = 0.0075 = 0.75%

Number of payments = Number of years * Number of payments in a year = 2 * 12 = 24

Loan amount = Periodic loan payment * ^ Number of payments) – 1) / ^ Number of payments)) = 500 * ^ 24) – 1) / ^ 24)) = $10,944.5

Total loan payment = Number of payment * Periodic loan payment = 24 * 500 = $12,000

You May Like: Current Usaa Car Loan Rates

Home Equity Loan & Heloc Payment Calculator

Home equity loans and HELOCs are two versions of the same type of loan but with some major differences. Both are secured by the equity in your home, but the way you borrow money and calculate your loan payments are completely different. This Home Equity Loan and HELOC payment calculator is versatile enough to calculate payments for both types of loans. It can also calculate your total payments over the life of the loan, the total amount of interest you’ll pay, your loan balance at any point in time and provides an amortization schedule for paying off the loan.

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Recommended Reading: Usaa Rv Loan Calculator

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Definition And Examples Of Monthly Loan Payments

When you receive a loan from a lender, you receive an amount called the principal, and the lender tacks on interest. You pay back the loan over a set number of months or years, and the interest makes the total amount of money you owe larger. Your monthly loan payments will typically be broken into equal payments over the term of the loan.

How you calculate your payments depends on the type of loan. Here are three types of loans you’ll run into the most, each of which is calculated differently:

- Interest-only loans: You dont pay down any principal in the early yearsonly interest.

- Amortizing loans: You’re paying toward both principal and interest over a set period. For instance, a five-year auto loan might begin with 75% of your monthly payments focused on paying off interest, and 25% paying toward the principal amount. The amount you pay on interest and principal changes over the loan term, but your monthly payment amount does not.

- A credit card gives you a line of credit that acts as a reusable loan as long as you pay it off in time. If you’re late making monthly payments and carry your balance to the next month, you’ll likely be charged interest.

Read Also: Specialized Loan Servicing Lawsuit

Consider All Aspects Of The Loan

The monthly payment is the best indicator of how the car loan will impact your budget. It can give you a reality check on whether you can afford the vehicle. And though this figure is the easiest to understand, it isn’t the only number to be aware of.

It is also important to be aware of how much the loan will total, how much of a down payment you’re making, and how long the loan will be. The general rule for each of these is as follows:

Your loan payment should be no more than 15% of your take-home pay. The loan term should ideally be less than 72 months, and you should aim for a down payment of at least 10% or consider GAP insurance.

Keep in mind that everyone’s situation will be different, so these recommendations are not set in stone. Furthermore, these figures will differ for those who lease, so take a look at our articles for information specific to that scenario.

When you obtain a monthly payment, be it from a price quote, negotiation or advertised special, make sure you are aware of all the numbers behind it. What good is a low payment if it takes you 84 months to pay off the loan? Is the selling price for the car a good deal? What about the trade-in amount the dealership is offering for your car? Ask for the “out-the-door” figures from your salesperson and review them before making a decision.

How Do I Calculate A Home Equity Loan Payoff +

Using our calculator to do your home equity loan payment calculations is pretty easy. The home equity loan has a fixed interest rate, so all you need to know is your loan amount, the fixed interest rate, and the loan term. Input these values into the loan calculator and it will provide your monthly home equity loan payments.

Don’t Miss: Usaa Auto Loan Rates Used Cars

Simple Loan Payment Calculator

Before you get a loan, its important to know just how much debt you can afford. Our simplified loan payment calculator does all the heavy lifting to help you discover what your monthly payment could be. Just input the principal balance of your loan, the interest rate, and the number of years.Having an idea of your monthly payment can help when youre putting together a budget. You might find that you have enough money left over to make extra payments. In the end, you might even be able to develop a plan to get ahead of your debt.

Having an idea of your monthly payment can help when youre putting together a budget. You might find that you have enough money left over to make extra payments. In the end, you might even be able to develop a plan to get ahead of your debt.

What Will My Monthly Mortgage Payment Be

Accurately calculating your monthly mortgage payment can be a critical first step when determining your budget. Enter your details below to figure out what you might pay each month.

Why use this calculator?

Looking to buy a home? Its important to take out a mortgage that you can reasonably afford. A mortgage is a home loan that is usually paid back in fixed amounts over a period of time typically 15 or 30 years. Each payment includes a portion that goes toward the mortgage principle, and another portion that goes toward interest charged by the lender. Most experts recommend that your monthly mortgage payment should not exceed 35% of your gross income. But that is the upper end. Other models are more conservative and suggest 25%, in order to keep your debt-to-income ratio lower. A middle-ground recommendation says you shouldnt put more than 28% of your monthly gross income toward your mortgage payment. And dont forget to consider additional costs associated with owning a home, such as utilities, taxes, maintenance, which will add to your monthly costs. This calculator can help you determine what your monthly payments will be, based on how much money you plan to borrow for your home purchase.

You May Like: What Car Can I Afford Based On Salary

See How A Discover Personal Loan Can Help You Lower Your Monthly Payments

Lock in a Fixed Rate

We offer competitive fixed rates from 5.99% to 24.99% APR.

Choose Your Monthly Payment

$0 Fees

We offer competitive fixed rates from 5.99% to 24.99% APR.

With a Discover personal loan, you get a fixed rate. That means you’ll lock in your interest rate, so your monthly payments will remain the same for the duration of your loan. This is typically the key difference between a line of credit and a personal loan.

In the most general terms, the higher your credit score is, the lower your interest rate and monthly payments may be. Your interest rate is determined at the time of application based on the information you provide. Learn more about factors that impact your credit score.

Calculate A Payment Estimate

The selling price of the new or used vehicle for monthly loan payment calculation.Estimated sales tax rate for the selected zip code applied to the sales price.Add title and registration here to include them in your estimated monthly payment.Available incentives and rebates included in the monthly payment estimate.The value of your currently owned vehicle credited towards the purchase or lease of the vehicle you are acquiring. If you select a vehicle using the “Value your trade-in” button, the value displayed in the calculator will be the Edmunds.com True Market Value trade-in price for a typically-equipped vehicle, assuming accumulated mileage of 15,000 miles per year.The remaining balance on a loan for your trade-in will be deducted from the trade-in value.The cash down payment will reduce the financed loan amount.Generally available financing interest rate for the estimated loan payment.Your approximate credit score is used to personalize your payment. A good credit score is typically between 700 and 750, and an excellent credit score is typically above 750.

Also Check: California Loan Officer License

Should I Take Out A Loan To Pay Off My Credit Card

Using a loan to pay off a credit card that has a higher interest rate or larger repayments can be helpful if you are struggling to meet your debts. A debt consolidation loan can also enable you to combine two or more other debts such as credit cards into a single monthly repayment.

When taking out any loan, be sure that the interest rate you will be paying is less than the interest rate on your debts its of little use to pay off one lender only to end up paying more through another. If you are struggling with maintaining your debt repayments, a useful idea is to take out the loan over a longer period thus reducing the size of your repayments to a more manageable level.