Best Credit Union For Auto Loans: Consumers Credit Union

Consumers Credit Union

- As low as 2.49%

- Minimum loan amount: None

-

No minimum or maximum loan amount

-

Offers new, used, and refinance loans

-

Offers transparent rates and terms

-

Lowest rates require excellent credit

-

Membership in credit union is required

Consumers Credit Union offers auto loan rates to its members as low as 2.49% for new car loans up to 60 months. Like other credit unions, it requires membership, but it’s easy to join. You can become a member by paying a one-time $5 membership fee. There are no geographic or employer requirements.

CCU doesn’t have a minimum or maximum loan amount. Your loan is approved based on your credit score, credit report, and vehicle information. There’s also no minimum loan termyou submit a request based on what you need.

Generally, borrowers with excellent credit will qualify for the lowest rates from Consumers Credit Union. But even members who have less than excellent credit have access to discounts. There’s a 0.5% discount available for those who autopay from a CCU account. The discount falls to 0.25% for those who make automatic payments from an outside financial institution.

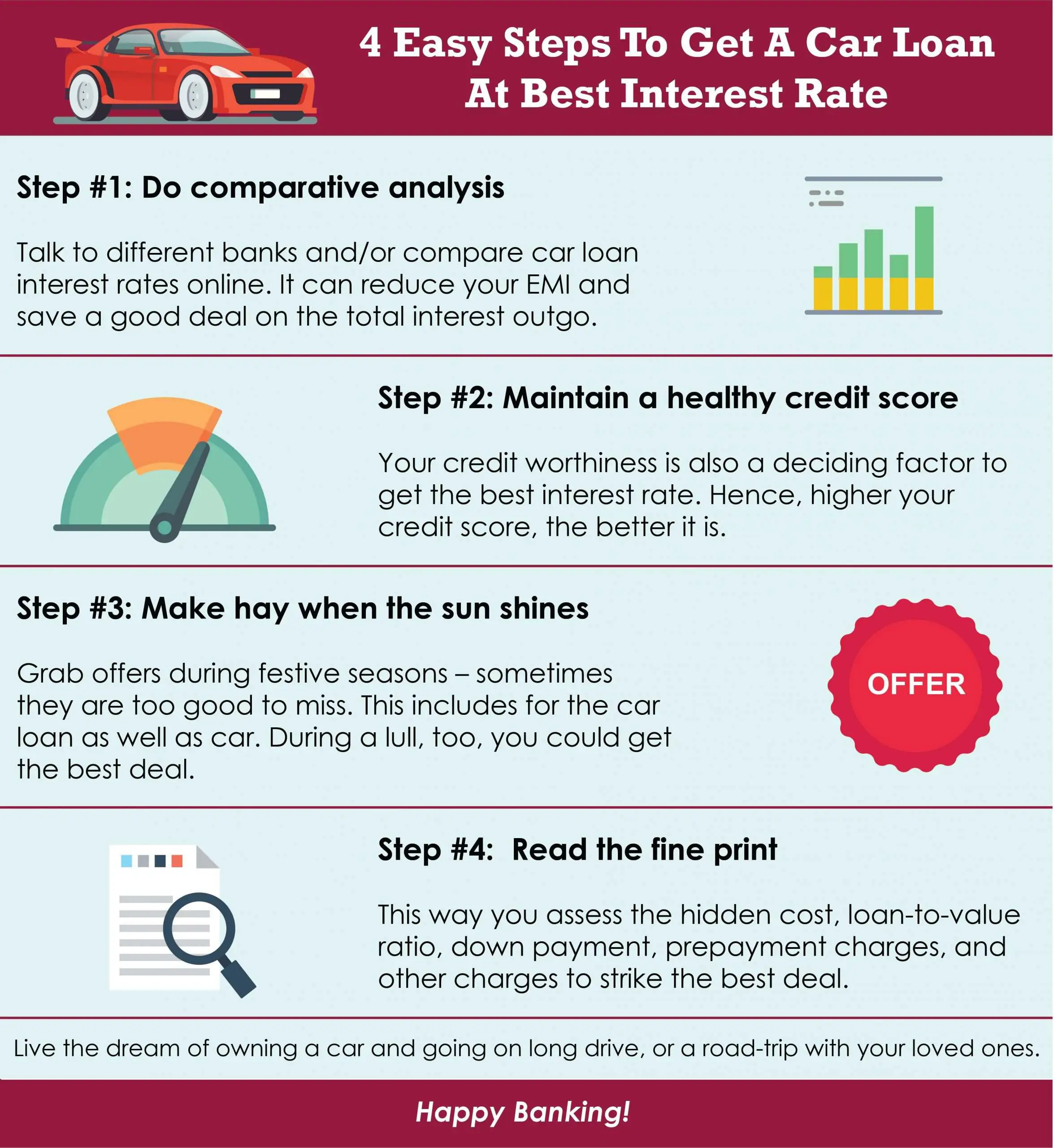

How To Get The Best Auto Loan Rates

There are a few different ways to save money and find the best auto loan rates. Below, well outline some simple ways to reduce your interest rate for a new car, a used vehicle, or a lease buyout.

Remember that you may pay a higher APR if youre looking to purchase a used car or if youre hoping to buy a vehicle from a private party. And before you go searching for the best auto loans, make sure that repayment is possible based on your current financial situation.

Best Overall: Penfed Credit Union

PenFed Credit Union

- As low as 4.44%

- Minimum loan amount: $500

PenFed Credit Union provides some of the best rates available. It also has flexible loan amounts and a number of auto loan options for members. Even though membership is required, a disadvantage for some, PenFed makes the requirements to join fairly straightforward.

-

Offers new, used, and refinance loans

-

Loan amounts from $500 to $100,000

-

Provides rate discounts for using its car buying service

-

Borrow up to 125% on new and used vehicles

-

High minimum loan amount for longer terms

-

Excellent credit history required for lowest rates

-

Membership in the credit union is required

Our top pick for auto loan rates, PenFed Credit Union, offers some of the lowest rates available.

At PenFed, rates for 36-month refinance loans start as low as 4.44%. Deep discounts are available for members who use the credit union’s car buying service, with rates starting as low as 6.04% annual percentage rate for a new car and 5.24% APR for a used vehicle.

You’ll have to become a member of the credit union, but the requirements to join are fairly easy to meet. Car loans from PenFed start as low as $500 and move up to $150,000, a wide range that beats out many of the lenders we surveyed.

Read Also: Payment On 20000 Car Loan

Average Auto Loan Rates By Credit Score

Consumers with high credit scores, 760 or above, are considered to be prime loan applicants and can be approved for interest rates as low as 3%, while those with lower scores are riskier investments for lenders and generally pay higher interest rates, as high as 20%. Scores below 580 are indicative of a consumers poor financial history, which can include late monthly payments, debt defaults, or bankruptcy.

Individuals in this “subprime” category can end up paying auto loan rates that are 5 or 10 times higher than what prime consumers receive, especially for used cars or longer term loans. Subprime loans are sometimes offered to people buying a car with no credit.

Consumers with excellent credit profiles typically pay interest rates below the 60 month average of 4.21%, while those with credit profiles in need of improvement should expect to pay much higher rates. The median credit score for consumers who obtain auto loans is 711. Consumers in this range should expect to pay rates close to the 5.27% mean.

When combined with other factors relevant to an applicants auto loan request, including liquid capital, the cost of the car, and the overall ability to repay the loan amount, credit scores indicate to lenders the riskiness of extending a loan to an applicant. Ranging from 300 to 850, FICO credit scores are computed by assessing credit payment history, outstanding debt, and the length of time which an individual has maintained a credit line.

How To Apply For An Auto Loan

Follow these general steps to apply for an auto loan:

Read Also: Who Qualifies For Loan Forgiveness

Choose A Refinancing Lender

You can choose to refinance with your current lender or shop around with different lenders to compare their fees, interest rates and special offers. You can often leverage the various offers you receive to get the best rate and terms from your preferred lender.

Related:Best Auto Loan Refinance Lenders

Consult An Auto Loan Refinance Calculator

A car loan calculator is a useful tool that can help you get a feel for what you can afford. To use one, you just need to input a few pieces of information to get an estimate of what your refinance budget is. You can also see what your monthly payments and total interest costs could look like with different loan terms.

You May Like: How Long Would It Take To Pay Off Student Loan

How Do You Calculate Interest On A Car Loan

When youre thinking about applying for a car loan, its a good idea to calculate how much youll likely pay each month with interest rates. Our Auto Loan calculator helps you easily calculate your monthly payment, total interest paid and how long youll make payments on your loan. The calculator is also helpful for making adjustments in your potential down payment, interest rate and loan term to help you budget.3

Make A Large Down Payment

The more you borrow on your car loan, the more the lender is at risk if you default on your payment. When you make a sizable down payment or trade in your vehicle, you lower your borrowing amount and may even qualify for a lower interest rate.

For example, if you put $6,000 down on an $18,000 car, you would have to borrow $12,000 and pay interest on that amount. If your loan carries an interest rate of 5% with a loan term of 60 months, your monthly payment would be $226.45, and you’d pay $1,587.29 in total interest.

Don’t Miss: How To Get Approved For Sallie Mae Loan

Car Loans For Bad Credit

Whether youre just starting out and have no credit history, or have simply made some credit mistakes along the way, its still possible to get an auto loan. Many lenders provide car loans for bad credit. If youd like to improve your chances of being approved or possibly get a lower rate now, consider adding a cosigner, making a large down payment or both.

A no-haggle, online experience could be extremely stress relieving. Read our full Carvana review.

WHERE IT MAY FALL SHORTYou cannot use a loan offer you got through Carvana to purchase a vehicle from any other seller.

Consumers Credit Union: Best Credit Union Used Car Loan Rates

- New Car Loan Starting APR: 2.74%

- Used Car Loan Starting APR: 2.99%

Consumers Credit Union is another great option for low rates on auto loans. Based out of Illinois, the credit union offers membership for anyone in the country who can pay a $5 fee and keep at least $5 in a savings account. The credit union has an A+ rating with accreditation from the BBB. Consumers Credit Unions auto loan products are available for people with good to excellent credit, meaning from the mid-600s and above.

Like PenFed Credit Union, Consumers Credit Union partners with TrueCar to help shoppers find vehicles from across the country. One difference is that buyers can still get the same interest rates whether they shop with TrueCar or not.

At this time, rates start at 2.74% for financing newer vehicles. Consumers Credit Union offers a 0.25% discount on this rate for using autopay and an extra 0.25% discount when that autopay is linked to a Consumers Credit Union account.

Consumers Credit Union Pros and Cons

Below are some of the benefits and downsides of opting for Consumers Credit Union:

| Consumers Credit Union Pros | |

|---|---|

| Starting APRs are relatively low | Requires good to excellent credit |

| Flexible loan terms and limits | Must become a member to get a loan |

| Generous autopay discount |

For more details on Consumers Credit Union, head to the companys website.

Don’t Miss: What Is Interest Rate On House Loan

What Is The Difference Between Apr And Interest Rate

While a loans interest rate and APR may look similar, there are some key differences you should understand before you finance a car. An interest rate is the percentage banks charge you for borrowing money. When you make monthly payments on a car loan, your payment will go toward both your principal balance and your interest charges.

When you finance a car, the annual percentage rate, or APR, is the total cost of interest, fees, and prepaid expenses expressed as an annual rate over the life of the loan. Because it includes the cost of certain prepaid charges youll pay, APR can give you a much better picture of how much youre actually paying for a car loan.

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what is known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Don’t Miss: What Loan Will I Qualify For

What Does This Mean For You

If you want to buy a used car and have the ability to hold out, it might be a good idea to wait. If youre thinking of selling your car, however, it might be a good time to do so.

Either way, the current takeaway is not that you should rush to a used car dealer. Prices arent declining at a rate fast enough to warrant urgent action. That being said, keep your eye on auto industry economic trends until 2023.

Refinance Auto Loans: Top Providers

We recommend getting multiple refinancing offers to determine the best option for your financial situation. In our industry-wide study, our team found that these providers offer the best combination of rates, reputation, and customer experience.

| Refinance Auto Loan Provider | |

| Varies | Best for Bad Credit |

*The overall ratings in this chart reflect the companys score in our industry-wide insurance study and are not specific to refinancing.

Recommended Reading: How Much Will The Va Home Loan Give Me

Tips For Car Buyers With Bad Credit Scores

Theres no getting around the fact that if you have less than perfect credit and need an auto loan, the cost of financing is going to be higher. Despite this drawback, you can use your car loan to help improve your credit score for the future all you have to do is make your payments on time each month.

Here are some tips you can use to help you save money on your bad credit auto loan:

These tips can give you an advantage if you need a bad credit auto loan, where your average interest rate typically reaches double digits if your credit score falls around 600 or below. If you apply these tips and use the loan to improve your credit score, you can put yourself in a much better situation the next time you need to finance a vehicle.

Best For New Cars: Pnc Bank

- From dealer: 2.14% to 14.54%, From private party: 4.64% to 21.04%, Lease buyout: 3.64% to 20.04%, Refinance: 2.64% to 19.04%

- Loan range: $5,000 to $100,000

- Loan length: 12 to 72 months

- Available in all 50 states

Read Insider’s full review of PNC Bank.

PNC offers great rates for borrowers who have good credit. The bank offers financing for cars model year 2014 or newer if you want to buy an older car, you won’t be able to get a loan through PNC.

Borrowers with a poorer credit history may find it hard to qualify at all or might be saddled with high interest rates.

Read Also: How To Get Out Of Underwater Car Loan

What Affects Auto Loan Interest Rates

The rates above are average APRs based on information reported to the NCUA. You may find different rates based on a number of factors, including:

- : A low score will require a higher interest rate, and vice versa. Credit score is perhaps the single most important factor that auto lenders use to determine rates.

- Loan term: Shorter terms typically have lower interest rates. Consider making higher monthly payments to get a shorter-term loan with a lower overall cost.

- : Lenders look at your entire credit report, so two people with the exact same score can find different rates based on how their score is calculated.

- Income: Lenders can have minimum income requirements for borrowers to qualify and also to secure the best auto loan rates.

- Down payment: A higher down payment not only reduces the total amount of the loan, but it shows that you are committed to purchasing the vehicle, and this can also reduce your interest rate.

- Interview process: If you impress a loan officer with professionalism and supporting documentation in discussing your financial situation, you may have a better chance of getting the best auto loan rates for your situation.

- Negotiation: If you get multiple prequalification offers, you can use those when negotiating interest rates from lenders.

- Autopay: Many lenders offer discounts for making automatic payments from your checking account. Credit unions can also offer a discount if you pay for the loan with an account at that same credit union.

Where To Find Refinance Auto Loans

Auto refinancing is a common lending product. As a result, you have plenty of options when it comes time to refinance.

Banks

Commercial banks typically offer many refinancing options. Brick-and-mortar locations can provide in-person service for customers who prefer it.

In addition, many larger institutions have user-friendly online banking services. People who have other accounts at a certain bank may find it convenient to manage their lending and other online banking services in one place.

Online Lending Providers

Its become increasingly common to find lenders that operate solely online without any physical branches. Some of these are direct lenders that serve as the online face of a larger bank.

However, youll also find auto lending marketplaces and auto loan brokers online. Rather than direct providers, these online services help line you up with lenders that offer competitive refinancing rates for your situation.

Dealerships

Its not nearly as common to get a refinancing loan at a car dealership as it is to get a purchase loan on a new car, but that doesnt mean its impossible. Since your car dealer regularly works with lenders, they may have access to refinancing options, too.

Don’t Miss: How To Not Pay Student Loan Debt

When You Should Refinance A Car Loan

Here are a few scenarios where it would make sense to refinance:

- Your credit has improved. You might be eligible for a better auto loan rate if your credit score has improved significantly since you first took out the loan. Or you can refinance using a co-signer with a strong credit history to improve your chances of getting a better rate.

- You want a lower monthly payment. Refinancing to get a lower payment can be a good option If youre struggling to keep up with debt payments, and need some extra room in your budget. Remember that if you choose a longer term to get that lower payment, youll pay more in interest over the length of the loan.

- Interest rates are lower. Another reason to refinance is if you have a high interest rate on your current car loan and interest rates are now lower.

Finance Your Next Car With Us

Rate Break ProgramHave less than perfect credit? You may qualify for Mission Feds Rate Break Program, which could help you save up to 3% off your rate while you build up your credit.

Autoland Car Buying ServiceLet the Autoland experts handle every step of the car buying process including contactless delivery of your car to your home or a Mission Fed branch.

Protect Your New InvestmentWeve partnered with LiveSmart Insurance Services, LLC to offer auto insurance to our Mission Fed members. With member pricing, you can feel confident in coverage options.1

Read Also: How To Compute Monthly Payment For Car Loan